Centrifugal Pump & Positive Displacement Pump Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434834 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Centrifugal Pump & Positive Displacement Pump Market Size

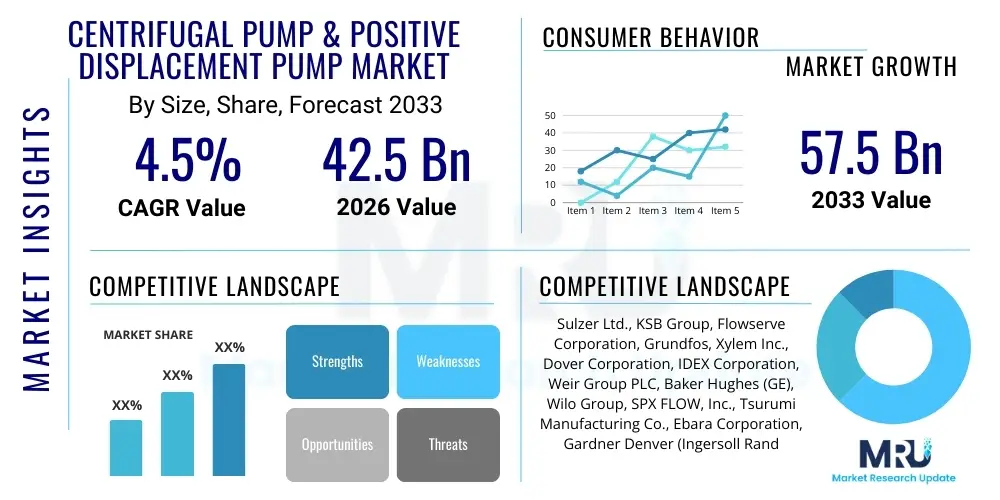

The Centrifugal Pump & Positive Displacement Pump Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at $42.5 Billion in 2026 and is projected to reach $57.5 Billion by the end of the forecast period in 2033.

Centrifugal Pump & Positive Displacement Pump Market introduction

The global Centrifugal Pump & Positive Displacement Pump Market represents a foundational element of industrial infrastructure, driving fluid mechanics across virtually every sector from municipal utilities to advanced chemical processing. Centrifugal pumps, utilizing the principle of rotational kinetic energy transfer, are the workhorses of high-volume transfer, adept at handling low-viscosity liquids, dominating applications such as water circulation, drainage, and massive cooling systems in power plants. Their robust construction and relatively simple maintenance profile make them the default choice for large-scale, continuous flow operations globally. Continuous innovation in hydraulic design, focused on improving impeller geometry and minimizing internal leakage, ensures their continued relevance amid rising energy efficiency demands. The versatility across varying flow rates, pressures, and temperatures, especially through the implementation of multi-stage designs and sophisticated sealing systems, underpins the centrifugal segment's extensive market penetration and high revenue generation capacity.

Conversely, positive displacement (PD) pumps, which rely on trapping a fixed volume of fluid and forcing it out, excel in applications requiring high pressures, precise metering, and the handling of viscous or non-Newtonian fluids. Types such as gear, screw, lobe, and diaphragm pumps offer inherently predictable flow rates independent of system backpressure, which is critical for chemical dosing, pharmaceutical synthesis, and specialized lubricant delivery. The demand for PD pumps is specifically intensified by the growth of niche industrial segments that prioritize volumetric accuracy and low shear handling, such as polymer production and high-purity media transfer in electronics manufacturing. Both pump types are witnessing technological convergence through smart integration, enabling real-time performance monitoring and optimized control strategies, thereby extending their operational envelopes and increasing overall system reliability.

The market expansion is fundamentally propelled by several macro-economic and regulatory factors. Globally, the accelerating pace of urbanization necessitates substantial investment in municipal water infrastructure, wastewater treatment, and sewage systems, all heavily reliant on industrial pumps. Furthermore, the resurgence in global oil and gas exploration, along with the continuous expansion of refining capacity, mandates the deployment of specialized, API 610 compliant pumps capable of operating under extreme conditions. Key benefits delivered by modern pumping systems include drastically improved Mean Time Between Failures (MTBF), lower Total Cost of Ownership (TCO) through reduced energy consumption via intelligent controls, and enhanced compliance with increasingly stringent environmental regulations regarding leakage and noise pollution. These driving factors, combined with technological shifts towards digitalization, cement the essential and growing role of these critical components in the global industrial ecosystem.

Centrifugal Pump & Positive Displacement Pump Market Executive Summary

The global market for fluid transfer solutions, comprising both centrifugal and positive displacement technologies, is poised for steady expansion driven by resilient industrial capital expenditure and a global mandate for operational efficiency. Strategic business trends highlight a concerted effort among market leaders to pivot from being mere hardware suppliers to providing comprehensive solutions platforms, incorporating advanced analytics, service contracts, and remote diagnostic capabilities. Mergers and acquisitions remain a vital strategy for expanding geographic reach and acquiring specialized technology portfolios, particularly in highly regulated segments such as high-pressure diaphragm pumps or sealless magnetic drive systems. Furthermore, manufacturers are increasingly leveraging lightweight, corrosion-resistant composite materials to address demanding applications in marine and aggressive chemical environments, focusing on minimizing lifecycle maintenance requirements.

Regionally, Asia Pacific (APAC) stands out as the primary engine of market growth, attributed to expansive industrial facility construction, particularly in the chemicals, textiles, and electronics sectors across Southeast Asia and the greater China region. The massive scale of planned hydraulic projects in India and the necessary infrastructure upgrades for urban centers continue to drive robust volume demand for centrifugal pumps. Conversely, mature markets in North America and Europe are characterized by a focus on high-value replacement cycles, where the emphasis is on maximizing energy savings through retrofit projects involving intelligent VSDs and high-efficiency motors. Regulatory mandates, such as the European Union’s requirements for industrial equipment efficiency, actively stimulate the adoption of premium, compliant pumping units, translating into higher average selling prices in these developed regions.

Segmentation analysis reveals nuanced shifts in demand patterns. While centrifugal pumps retain the largest market share owing to their ubiquitous use in water and general industry, the positive displacement segment is gaining momentum due to escalating demand from specialized process industries. Specifically, the pharmaceutical and food processing segments are driving rapid growth in rotary positive displacement types (like lobe and circumferential piston pumps) that ensure hygienic standards and product integrity. Technology-wise, the adoption of smart pumps, equipped with sensors for vibration, temperature, and pressure, is transitioning from a niche offering to a standard expectation across all high-value segments. This trend underscores a broader market movement towards proactive asset management, where pump reliability directly translates into competitive advantage for the end-user, further supporting the higher capitalization on digitally integrated pumping solutions.

AI Impact Analysis on Centrifugal Pump & Positive Displacement Pump Market

Industry stakeholders and end-users are intensely focused on quantifying the tangible economic benefits delivered by AI integration in pumping systems, particularly concerning the accuracy of failure prediction and the optimization of energy consumption under dynamic loads. Common inquiries revolve around the minimum data requirements necessary for AI models to reliably predict failure in varied pump types (centrifugal vs. PD) and the interoperability challenges when integrating new AI platforms with decades-old legacy control systems (SCADA/DCS). There is a critical requirement for transparency regarding algorithm performance, especially concerning false positives in failure alerts, which can lead to unnecessary intervention costs. Furthermore, the skilled labor shortage in maintenance and engineering fields amplifies the perceived value of AI-driven systems that can automate complex diagnostic tasks and provide prescriptive guidance, making the technology a key strategy for addressing operational resilience and maintenance efficiency gaps across industrial installations.

- AI-Powered Real-Time Condition Monitoring: Deployment of Deep Learning neural networks to accurately interpret complex vibration spectra and acoustic signals, differentiating ambient noise from incipient fault signatures in bearings, shafts, and impellers.

- Prescriptive Maintenance Planning: Algorithms not only predict failure but also recommend the optimal timing and scope of repair, factoring in operational costs, remaining useful life, and spare parts availability.

- Dynamic Energy Footprint Reduction: Utilizing Reinforcement Learning to continuously fine-tune VFD operational settings in response to variable demand curves, ensuring the pump operates only at its Best Efficiency Point (BEP).

- Digital Twin Creation and Simulation: Developing virtual representations of high-value pump assets, allowing engineers to simulate operational stresses, test control strategies, and train AI models without risk to physical infrastructure.

- Fluid Dynamics Optimization: Machine learning expediting the design phase by generating and evaluating thousands of hydraulic configurations, optimizing designs for specific fluid viscosity, temperature, and abrasiveness characteristics.

- Automated Leak Detection and Sealing Integrity Analysis: Employing AI to analyze subtle pressure drops and seal temperature variations to immediately identify and pinpoint micro-leakages in hazardous or critical fluid transfer lines.

DRO & Impact Forces Of Centrifugal Pump & Positive Displacement Pump Market

The market trajectory is significantly bolstered by critical global drivers, foremost among them being the severe strain on existing water infrastructure due to rapid population growth and climate change effects, necessitating large-scale water transfer and treatment projects demanding highly durable and specialized pumps. Furthermore, the rigorous standardization and growth of high-purity industries, such as pharmaceuticals, semiconductors, and specialized chemical production, necessitates the use of zero-leakage and precise metering pumps, driving significant investment in advanced positive displacement technologies. The global push for carbon neutrality and energy efficiency acts as a powerful catalyst, compelling industries to decommission older, inefficient systems in favor of pumps rated with premium efficiency standards (IE3/IE4 motors) integrated with sophisticated flow control mechanisms. This regulatory alignment with technological capability ensures continuous market churn and demand for modern equipment.

Restraints, however, pose challenges to widespread adoption. The substantial initial capital expenditure required for high-end, digitally integrated pumping systems often presents a barrier, particularly for small to medium-sized enterprises (SMEs) or public utilities operating under tight budget constraints. Secondly, the market faces significant price erosion pressure from aggressive, often subsidized, manufacturers in emerging markets, leading to compromised profit margins for established high-quality brands that adhere to stringent international manufacturing standards. Technical complexity, specifically the need for specialized engineering talent to install, configure, and maintain advanced VFDs and integrated smart systems, also acts as a bottleneck, particularly in regions lacking robust technical vocational training infrastructures, slowing the adoption of highly complex pump configurations.

Abundant opportunities lie in leveraging the expanding global energy transition and the burgeoning retrofit market. The development of renewable energy infrastructure, particularly large-scale pumped hydro storage and geothermal plants, requires new specifications for extremely high-head, high-power pump applications. The retrofit market, fueled by millions of older pumps worldwide, presents a substantial chance for manufacturers to offer modular IoT and VSD packages that upgrade existing installations to current energy standards without requiring a full system replacement. Moreover, the exploration of unconventional resources (e.g., high-viscosity crude, shale gas) drives highly specific demand for specialized reciprocating and multiphase positive displacement pumps, opening up high-margin segments that are less sensitive to generalized commodity price fluctuations and more reliant on specialized engineering expertise.

Segmentation Analysis

Detailed segmentation provides a clear map of market dynamics, revealing where specific technological advancements and regional demands intersect. The segmentation by product type is foundational, distinguishing between the high kinetic energy output of centrifugal variants, which account for the vast majority of volume sold, and the predictable volumetric delivery of positive displacement variants, which command a higher average unit price due to complexity and application criticality. Segmentation by end-user illustrates the concentration of capital spending; for example, the oil and gas sector demands robustness and API compliance, while the water sector focuses on life-cycle cost and efficiency. Material segmentation reflects the ongoing technological battle against corrosion and abrasion, with growing market preference for non-metallic or advanced alloy pumps in highly aggressive chemical applications, enhancing pump longevity and reducing hazardous leakage risks.

- By Product Type:

- Centrifugal Pumps

- Overhung Impeller Pumps (End Suction, Inline) – Used predominantly in general industrial and utility applications.

- Between Bearing Pumps (Single Stage, Multistage) – Critical for high-pressure, high-flow applications like pipeline transfer and boiler feed.

- Vertical Pumps (Sump, API Type VS) – Essential for pit drainage, sewage, and deep-well applications, conserving floor space.

- Submersible Pumps – Widely used in water wells, boreholes, and deep-sea environments, characterized by sealed motor integration.

- Sealless Pumps (Magnetic Drive, Canned Motor) – Preferred for handling toxic, corrosive, or flammable fluids, ensuring zero-leakage operation.

- Positive Displacement Pumps

- Rotary Pumps (Gear, Screw, Lobe, Vane, Peristaltic) – High-accuracy flow delivery for viscous liquids, dominating lubrication and metering tasks.

- Reciprocating Pumps (Piston, Plunger, Diaphragm) – Capable of generating extremely high pressures, necessary for injection, hydraulic control, and heavy-duty slurry pumping.

- Hydraulic Pumps – Convert mechanical power into hydraulic energy, primarily used in hydraulic presses and heavy equipment operation, often utilizing piston or gear mechanisms.

- By End-User Industry:

- Oil and Gas (Upstream, Midstream, Downstream)

- Water and Wastewater Treatment

- Chemical and Petrochemical

- Power Generation (Thermal, Nuclear, Renewable)

- Pharmaceuticals and Biotechnology

- Food and Beverage

- Mining and Metals

- General Manufacturing

- By Material:

- Cast Iron

- Stainless Steel

- Alloys (Duplex, Super Duplex)

- Plastics and Polymers

- Non-Metallic Composites

- By Pumping Stage:

- Single Stage

- Multistage

Value Chain Analysis For Centrifugal Pump & Positive Displacement Pump Market

The commencement of the pump value chain resides in the highly specialized procurement and manufacturing of foundational components. Upstream activities involve secure sourcing of critical raw materials, including high-grade alloys (e.g., Monel, Hastelloy) and advanced engineered plastics, which are essential for producing corrosion-resistant casings, impellers, and precision-machined shafts. Key suppliers include specialized metallurgical foundries and providers of sophisticated sealing technology, such as mechanical seals and magnetic coupling components. Efficiency in this phase is paramount, as fluctuations in global commodity prices directly impact the final product cost. Furthermore, managing the complexity of diverse material specifications required for API, hygienic, or slurry applications necessitates tight vertical integration or highly reliable external partnerships to ensure material quality and traceability, mitigating risks associated with component failure in demanding industrial settings.

The central phase involves advanced pump manufacturing and assembly, where core competencies in hydraulic engineering and mechanical design are critical. Manufacturers engage in complex processes like precision CNC machining of impellers to achieve optimal hydraulic balance and efficiency, integration of high-efficiency motors (IE3/IE4), and thorough pressure testing. Modern manufacturing increasingly utilizes modular design principles to streamline production across different pump models and integrate smart technologies, such as embedded IoT sensors and communication modules, directly onto the pump unit. Quality assurance processes are extensive, adhering to strict industry standards (e.g., ISO 9001, API 675/610), ensuring that the finished product meets the stringent performance and reliability demands of critical industries before entering the distribution phase.

Downstream market operations are centered on delivery, installation, and long-term service provision, which frequently constitutes a significant revenue stream. Distribution channels employ a hybrid model: direct sales teams manage large turnkey projects and highly specialized pump installations requiring intensive engineering support and consultation (common in oil and nuclear power). Conversely, indirect channels, consisting of established distributors, MRO (Maintenance, Repair, and Overhaul) specialists, and localized technical sales representatives, handle standard pump sales, spare parts, and immediate service needs. The increasing reliance on predictive maintenance has elevated the importance of the service segment, where manufacturers offer subscription-based monitoring, technical diagnostics, and rapid field service response, essentially transforming the transactional relationship into a long-term partnership focused on maximizing end-user asset uptime and performance.

Centrifugal Pump & Positive Displacement Pump Market Potential Customers

Potential customers for centrifugal and positive displacement pumps represent a wide spectrum of heavy and critical industries globally, characterized by demanding fluid transfer requirements essential for their core production processes. The largest end-users are typically governmental and municipal authorities responsible for vast infrastructure networks, specifically water supply, drainage, and wastewater treatment plants, which demand reliable, high-volume centrifugal pumps capable of continuous operation. The oil, gas, and petrochemical sectors constitute another core customer base, requiring specialized, often API-compliant, high-pressure pumps (both centrifugal and reciprocating) for extraction, refining, and pipeline transportation of volatile and corrosive media under extreme temperature conditions.

The second tier of potential customers includes manufacturing and processing industries, where precision and material compatibility are paramount. This encompasses the chemical manufacturing industry, which heavily relies on positive displacement pumps (like metering and diaphragm pumps) for accurate dosing and transfer of aggressive chemicals, and the pharmaceutical and biotechnology sectors, which require ultra-hygienic, sealless pumps (such as peristaltic or lobe pumps) capable of handling sensitive, high-value biological fluids while maintaining strict sterility protocols. These sectors prioritize customization, material traceability, and pumps designed for clean-in-place (CIP) and sterilize-in-place (SIP) processes.

Additionally, the power generation industry, including nuclear, thermal, and emerging renewable energy plants (like concentrating solar power), represents significant potential customers, requiring robust boiler feed pumps, condensate extraction pumps, and cooling water circulating pumps that can withstand high temperatures and pressures over decades of operation. Furthermore, the food and beverage industry demands specialized positive displacement pumps (lobe and circumferential piston pumps) that ensure product integrity, minimize shear damage to viscous food products, and meet stringent sanitary design standards, ensuring high throughput while complying with global food safety regulations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $42.5 Billion |

| Market Forecast in 2033 | $57.5 Billion |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sulzer Ltd., KSB Group, Flowserve Corporation, Grundfos, Xylem Inc., Dover Corporation, IDEX Corporation, Weir Group PLC, Baker Hughes (GE), Wilo Group, SPX FLOW, Inc., Tsurumi Manufacturing Co., Ebara Corporation, Gardner Denver (Ingersoll Rand), Pentair, Atlas Copco, Seepex GmbH, Netzsch Group, ITT Inc., Kirloskar Brothers Ltd., Colfax Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Centrifugal Pump & Positive Displacement Pump Market Key Technology Landscape

The contemporary technology landscape for industrial pumps is defined by the integration of mechanical excellence with digital intelligence to achieve optimal fluid handling performance. Energy conservation technology remains paramount, driven by the global adoption of IE3 and IE4 efficiency standards for electric motors, complemented by increasingly sophisticated Variable Speed Drive (VSD) systems. These VSDs leverage precise control algorithms to match pump output directly to instantaneous demand, preventing energy wastage associated with throttling or bypass operations. Furthermore, manufacturers are investing heavily in Computational Fluid Dynamics (CFD) simulation tools to refine hydraulic designs, maximizing the efficiency curve and minimizing the required power input for a given head and flow rate, particularly in complex multi-stage or high-solids handling applications.

Material innovation is a parallel critical technological area, specifically focused on extending pump lifespan in corrosive and abrasive environments. Advances in metallurgy include the widespread use of high-chromium white irons and ceramic-reinforced composites for slurry pumps in mining and dredging. For chemical processing, the shift towards modular, non-metallic pumps constructed from PVDF (polyvinylidene fluoride) and PFA (perfluoroalkoxy) allows for the safe and durable handling of aggressive acids and solvents, offering a cost-effective alternative to exotic metal alloys. Moreover, sealing technology has seen immense refinement, with double mechanical seals incorporating advanced barrier fluid systems, and the rising popularity of magnetic coupling systems effectively eliminating the risk of shaft leakage, thereby meeting stringent environmental safety mandates and reducing operational hazard exposure.

Digitalization forms the third pillar of the technological landscape, fundamentally altering maintenance and operational protocols. Smart pumps are equipped with advanced Industrial Internet of Things (IIoT) sensors monitoring vibration, pressure pulsations, and bearing temperatures, providing a continuous stream of diagnostic data. This data is processed by edge computing devices and cloud-based Asset Performance Management (APM) platforms utilizing AI/ML models to generate highly accurate predictive maintenance alerts. The implementation of robust, standardized communication protocols, such as OPC UA, ensures seamless integration of these smart assets into existing plant-wide control systems, enabling remote monitoring, performance benchmarking, and automated reporting. This technological convergence ensures that modern pumping solutions deliver not just flow, but comprehensive reliability intelligence, crucial for high-uptime critical infrastructure.

Regional Highlights

- Asia Pacific (APAC): Characterized by dynamic growth fueled by massive governmental investment in infrastructural expansion, particularly in centralized water distribution systems and wastewater treatment facilities across countries like India, Vietnam, and Indonesia. The region is also the global hub for chemical and petrochemical facility construction, creating immense demand for both standardized centrifugal pumps and specialized PD units. Market growth often emphasizes volume and localized production capabilities.

- North America: A mature market defined by high technological adoption and a focus on efficiency retrofitting. Key drivers include stringent regulatory pressure (e.g., California’s energy standards) and the robust demand from the technologically advanced oil and gas sector (shale operations), requiring specialized high-pressure reciprocating and centrifugal pumps. Investment is concentrated on smart pump integration and service contracts utilizing predictive analytics.

- Europe: Leads in the adoption of premium, high-efficiency pumping solutions and niche hygienic applications. The market is highly regulated by environmental and efficiency directives (e.g., Ecodesign directive), pushing manufacturers toward sealless designs and IE4 motor integration. The strong presence of pharmaceutical and high-tech manufacturing industries drives consistent demand for precise positive displacement metering and transfer pumps.

- Middle East and Africa (MEA): Growth is intrinsically linked to energy sector investment and critical water security projects. Large-scale seawater desalination plants in the Gulf Cooperation Council (GCC) countries mandate high-capacity, corrosion-resistant centrifugal pumps (often using super duplex materials). Africa’s developing infrastructure and mining operations provide a steady, albeit cyclical, demand for robust slurry and water pumps.

- Latin America: Market demand is highly correlated with commodity prices, impacting the mining sector (e.g., Chile, Peru) and the oil industry (Brazil, Mexico). While facing economic volatility, there is persistent long-term demand for modernizing aging industrial plants and improving urban water infrastructure, often favoring suppliers who offer competitive pricing alongside established global quality standards and local service support.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Centrifugal Pump & Positive Displacement Pump Market.- Sulzer Ltd.

- KSB Group

- Flowserve Corporation

- Grundfos

- Xylem Inc.

- Dover Corporation

- IDEX Corporation

- Weir Group PLC

- Baker Hughes (GE)

- Wilo Group

- SPX FLOW, Inc.

- Tsurumi Manufacturing Co.

- Ebara Corporation

- Gardner Denver (Ingersoll Rand)

- Pentair

- Atlas Copco

- Seepex GmbH

- Netzsch Group

- ITT Inc.

- Kirloskar Brothers Ltd.

- Colfax Corporation

- Dab PUMPS

- Watson-Marlow Fluid Technology Solutions

- Bosch Rexroth AG

Frequently Asked Questions

Analyze common user questions about the Centrifugal Pump & Positive Displacement Pump market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Centrifugal Pump & Positive Displacement Pump Market?

Market growth is predominantly driven by increasing global infrastructure spending, particularly in water and wastewater management, rapid industrialization in emerging economies (APAC), and mandatory adoption of energy-efficient pumping systems mandated by global environmental regulations and rising energy costs, coupled with pervasive digitalization.

How does AI technology impact the maintenance and efficiency of industrial pumps?

AI significantly enhances operational efficiency by enabling advanced predictive maintenance. Machine learning algorithms analyze operational data (vibration, flow, power consumption) to forecast potential component failures, thereby minimizing unscheduled downtime and optimizing pump performance through dynamic speed adjustments (VSD control) to maximize the Best Efficiency Point (BEP).

What is the key differentiator between centrifugal and positive displacement pumps regarding application?

Centrifugal pumps are optimized for high-volume, continuous flow applications using low-viscosity fluids (e.g., water transfer). Positive displacement (PD) pumps are utilized when high pressure, precise volumetric dosing, high viscosity, or the handling of shear-sensitive or hazardous fluids is required, offering flow independent of discharge pressure.

Which specialized material segment is showing the fastest growth and why?

The specialized alloys (e.g., Duplex, Super Duplex stainless steel) and engineered plastics/composites segment is growing rapidly. This is due to the escalating demand from critical industries like chemical processing and desalination plants that require superior corrosion and abrasion resistance to extend Mean Time Between Failures (MTBF) in extremely harsh operating environments.

How do global sustainability trends influence modern pump design and technology?

Sustainability mandates a focus on energy efficiency (IE3/IE4 motors), reduced noise pollution, and zero-leakage systems (magnetic drive or canned motor pumps). Manufacturers are prioritizing VSD integration and hydraulic optimization to lower the environmental footprint and Total Cost of Ownership (TCO) over the pump's entire operational life.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager