Ceramic Attenuators Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436572 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Ceramic Attenuators Market Size

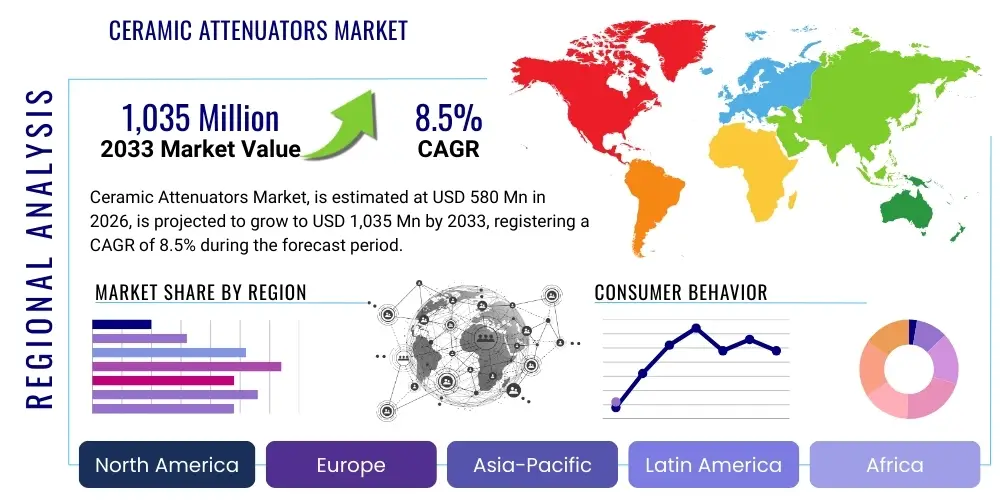

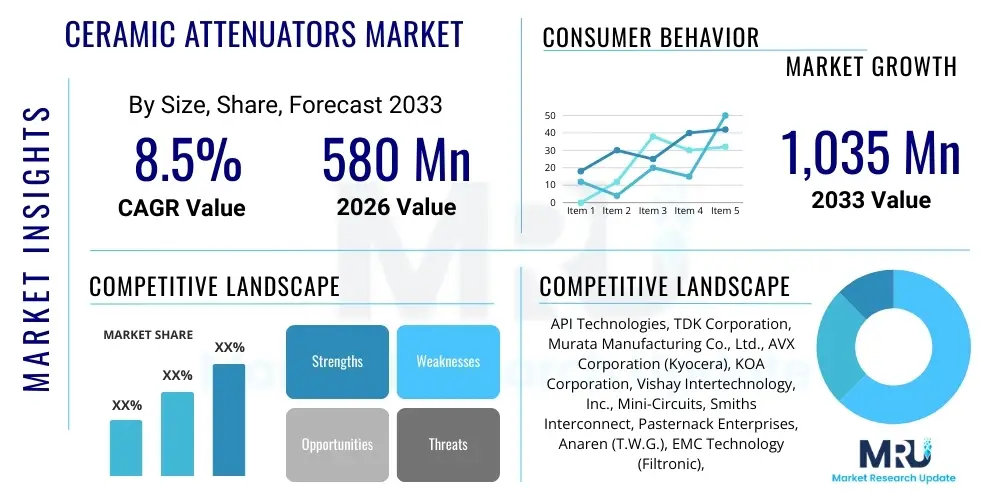

The Ceramic Attenuators Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at $580 Million in 2026 and is projected to reach $1,035 Million by the end of the forecast period in 2033.

Ceramic Attenuators Market introduction

The Ceramic Attenuators Market encompasses the design, manufacturing, and distribution of passive electronic components used primarily to reduce the power level of a radio frequency (RF) or microwave signal without introducing significant distortion or impedance mismatch. These devices leverage specialized ceramic substrates, often utilizing materials like alumina or beryllium oxide, doped with resistive elements to dissipate excess signal energy as heat. Their compact size, superior thermal stability, high frequency performance, and robust reliability make them indispensable components in modern wireless communication and radar systems.

Ceramic attenuators are favored over thin-film or thick-film alternatives in demanding environments due to their exceptional power handling capabilities and low temperature coefficient of resistance (TCR). Major applications span across high-reliability sectors such as telecommunications infrastructure (including 5G base stations), satellite communication systems, military electronic warfare (EW), and complex testing and measurement equipment. The inherent stability of ceramic materials ensures consistent attenuation levels even under wide temperature variations, which is a critical performance metric for precision RF systems. The ongoing global rollout of high-frequency wireless networks and the increasing density of RF modules in consumer and industrial products are primary drivers fueling demand.

The core benefits derived from utilizing ceramic attenuators include enhanced system linearity, improved impedance matching, and protection of sensitive receiver circuits from overpowering input signals. Driving factors for market expansion include the exponential growth in data traffic necessitating higher operating frequencies (mmWave and sub-6 GHz), increased deployment of radar systems in automotive and defense sectors, and the miniaturization trend in electronic devices which demands components with high integration capabilities and superior thermal management in smaller footprints. Furthermore, the stringent quality requirements in aerospace and defense applications heavily favor the proven durability and performance stability offered by ceramic components.

Ceramic Attenuators Market Executive Summary

The Ceramic Attenuators Market is poised for substantial growth, driven primarily by the global adoption of 5G and future 6G communication technologies, which necessitate high-performance, high-frequency components capable of managing increasing power levels and operating in complex signal environments. Business trends indicate a shift towards customized, highly integrated surface-mount device (SMD) ceramic attenuators, particularly those optimized for millimeter-wave (mmWave) applications above 24 GHz. Key industry players are focusing heavily on material science innovation to enhance thermal dissipation properties and reduce insertion loss, thereby addressing the crucial challenges associated with high-density packaging and thermal management in advanced electronic systems. Strategic mergers, acquisitions, and long-term supply agreements with major telecommunications equipment manufacturers are defining the competitive landscape.

Regional trends highlight Asia Pacific (APAC) as the dominant and fastest-growing region, fueled by massive infrastructure investments in China, South Korea, and Japan aimed at 5G deployment, alongside significant growth in consumer electronics manufacturing. North America and Europe maintain a strong market share, primarily due to high defense spending, advanced aerospace programs, and established industrial automation sectors requiring high-precision RF components. The increasing demand for low earth orbit (LEO) satellite constellations is also generating substantial opportunities, particularly in regions where terrestrial infrastructure is underdeveloped.

Segmentation trends confirm that the Fixed Attenuators segment commands the largest market share due to their widespread use in standard power leveling and impedance matching applications within transceiver circuits. However, the Variable Attenuators segment is projected to exhibit the highest CAGR, propelled by the growing requirement for dynamic range control in complex phased-array radar systems and automated test equipment (ATE). Application-wise, the Telecommunications segment remains the largest consumer, while the Automotive segment, driven by the integration of advanced driver-assistance systems (ADAS) and radar sensors, is experiencing the most accelerated adoption rate for high-reliability ceramic attenuators.

AI Impact Analysis on Ceramic Attenuators Market

User inquiries regarding the influence of Artificial Intelligence (AI) on the Ceramic Attenuators Market typically center on how AI-driven design tools and autonomous network management systems affect component requirements and operational lifetimes. Users frequently ask about the role of machine learning (ML) in optimizing attenuator performance parameters, predicting component failure rates, and facilitating the rapid development of custom, high-frequency components. Furthermore, a major theme is the expectation that AI-enabled systems, such as cognitive radio or dynamic spectrum access (DSA), will require attenuators that can be tuned dynamically and precisely, often leading to increased demand for high-speed, digitally controlled variable ceramic attenuators (DCVAs). The underlying concern is whether current manufacturing processes can keep pace with AI-driven optimization requirements for performance and integration.

The primary impact of AI is not in the manufacturing process of the attenuators themselves, but in the systems they enable and the design cycle efficiency. AI accelerates the design and simulation of complex RF circuits, allowing engineers to rapidly iterate designs incorporating ceramic attenuators, optimizing parameters like thermal budget and power dissipation before physical prototyping. This reduces time-to-market for new electronic devices utilizing ceramic components. Moreover, the massive data throughput generated by AI-powered telecommunications networks (e.g., beamforming in 5G) necessitates enhanced signal integrity and robust power control, tasks where ceramic attenuators excel due to their stability and linearity. The stability required for reliable AI operation in extreme environmental conditions, such as those found in defense or space applications, further solidifies the preference for ceramic-based components over less robust alternatives.

The integration of ML algorithms into network infrastructure equipment allows for predictive maintenance and dynamic power allocation, requiring highly reliable components that can withstand constant adjustments and stress. This demand pushes manufacturers toward even higher quality control and stricter material tolerances, favoring advanced ceramic compositions. AI-driven test platforms also necessitate extremely precise and repeatable attenuation levels for calibration, directly increasing the market for high-precision ceramic attenuators. Ultimately, AI acts as a significant demand driver, pushing the envelope for component reliability, precision, and the ability to operate across ultra-wide bandwidths necessary for advanced data processing and communication.

- AI accelerates RF system design optimization incorporating ceramic attenuators, reducing development cycles.

- AI-enabled massive data throughput demands high linearity and stability, boosting ceramic component preference.

- Predictive maintenance systems utilize ML, necessitating extremely high component reliability and longevity, favoring specialized ceramics.

- Cognitive radio applications require high-speed, digitally controlled variable attenuators (DCVAs) for dynamic spectrum management.

- AI-driven test and measurement equipment requires ultra-precise ceramic attenuators for accurate calibration and performance validation.

- AI indirectly drives miniaturization needs, as complex algorithms must be housed in small, thermally efficient modules, requiring high power-handling SMD ceramics.

DRO & Impact Forces Of Ceramic Attenuators Market

The Ceramic Attenuators Market is heavily influenced by a confluence of technological drivers, structural restraints, and emerging opportunities, collectively defining the market trajectory. The primary driver is the accelerating deployment of 5G and ongoing research into 6G networks worldwide, requiring massive amounts of high-frequency components that can handle greater power densities and operate reliably across wide bandwidths. Furthermore, the increasing complexity and volume of defense electronics, including electronic warfare systems and high-resolution radar, mandate the use of rugged, temperature-stable ceramic components. Restraints primarily involve the high upfront material costs associated with specialized high-purity ceramic substrates (like Beryllium Oxide, although usage is restricted in some regions due to toxicity concerns, alternatives like Alumina are common) and the inherent limitations in achieving ultra-low insertion loss compared to certain integrated circuit solutions at lower frequencies. The market also faces technical challenges related to manufacturing precision required for mmWave performance and minimizing parasitic effects.

Opportunities are emerging rapidly, particularly in the space sector due to the proliferation of Low Earth Orbit (LEO) and Medium Earth Orbit (MEO) satellite constellations, which require radiation-hardened and extremely reliable RF components. The automotive sector presents a significant growth avenue, driven by the expansion of radar modules (24 GHz, 77 GHz) in ADAS and autonomous vehicles, where environmental stability is paramount. Furthermore, the development of sophisticated IoT and industrial sensor networks operating at higher frequencies provides new niches for miniaturized, high-performance ceramic attenuators. The increasing demand for precise power control in complex medical imaging equipment, such as MRI and specialized diagnostic devices, also represents a critical, high-value opportunity.

The primary impact forces shaping this market include technological substitution pressure from monolithic microwave integrated circuits (MMICs) and the strict regulatory standards governing component reliability and material usage, particularly related to hazardous substances (like REACH and RoHS directives). Supply chain resilience, particularly the availability and price volatility of high-purity ceramic powders and resistive materials (e.g., Ruthenium Oxide), also exerts significant force. Customer purchasing decisions are heavily influenced by the vendor's ability to demonstrate superior thermal management, high frequency accuracy, and long-term durability, especially in mission-critical applications where component failure is unacceptable. The shift toward higher integration and multifunctionality in RF modules demands ceramic components that seamlessly integrate with other passive and active devices.

Segmentation Analysis

The Ceramic Attenuators Market is comprehensively segmented based on Type, Application, Frequency Range, and End-User, allowing for a detailed analysis of market dynamics and targeted growth opportunities. Segmentation by type differentiates fixed, variable, and step attenuators, reflecting varying requirements for signal conditioning—from permanent power leveling (fixed) to dynamic signal adjustment (variable). Application segmentation identifies the key consumption verticals, with Telecommunications dominating, but with rapid growth observed in high-tech sectors like Aerospace & Defense and Automotive. Frequency segmentation is crucial, as the performance requirements and manufacturing techniques differ significantly between components optimized for sub-6 GHz, Ku/Ka band, and the higher mmWave spectrums (above 24 GHz).

Understanding these segments is vital for manufacturers to tailor their product offerings and R&D efforts. For instance, the demand for fixed attenuators is high volume but moderately priced, serving general-purpose RF chains, whereas variable and step attenuators are higher value, lower volume products critical for precision instrumentation and dynamic beamforming arrays. The end-user perspective separates commercial enterprises (consumer electronics, telecom) from high-reliability governmental/military applications, reflecting vastly different requirements regarding qualification standards, operating temperature ranges, and longevity expectations.

The highest growth is anticipated in the frequency segment operating above 18 GHz, driven by the global push into 5G mmWave services and next-generation satellite communications. In terms of end-users, the industrial segment is also seeing increased consumption due to the rise of Industry 4.0 initiatives and the widespread adoption of robust wireless solutions for factory automation, which demand components resistant to harsh industrial environments. Geographical analysis further refines the market view, highlighting regional specialization in manufacturing capabilities and consumption patterns based on local technological priorities (e.g., defense spending vs. telecom infrastructure build-out).

- By Type:

- Fixed Ceramic Attenuators

- Variable Ceramic Attenuators (Digital and Analog Controlled)

- Step Ceramic Attenuators

- By Application:

- Telecommunications & 5G Infrastructure

- Aerospace & Defense (Radar, Electronic Warfare)

- Consumer Electronics (Wi-Fi, IoT)

- Automotive (ADAS, V2X Communication)

- Medical Devices (MRI, Diagnostic Equipment)

- Test and Measurement Instruments

- By Frequency Range:

- DC to 6 GHz (Sub-6 GHz)

- 6 GHz to 18 GHz (C, X, Ku Bands)

- Above 18 GHz (Ka, V, W, mmWave Bands)

- By End-User:

- Commercial

- Government/Military

- Industrial

Value Chain Analysis For Ceramic Attenuators Market

The value chain for the Ceramic Attenuators Market begins with the highly specialized upstream analysis, focusing on the sourcing and processing of raw materials. This stage involves the procurement of high-purity ceramic powders, such as alumina (Al2O3), aluminum nitride (AlN), or potentially beryllia (BeO) for ultra-high power applications, along with resistive paste materials like ruthenium dioxide (RuO2). Suppliers in this upstream segment must adhere to strict quality controls to ensure the compositional homogeneity and particle size distribution critical for achieving precise resistive values and thermal performance in the final component. The complexity and proprietary nature of ceramic substrate manufacturing techniques, including tape casting and sintering, create significant barriers to entry and necessitate strategic partnerships between material suppliers and core manufacturers.

The core manufacturing stage involves the deposition of resistive films (thick or thin film technology) onto the ceramic substrate, followed by laser trimming for precise attenuation adjustment, metallization, and robust packaging (often in SMD form). Distribution channels are bifurcated into direct sales to major Original Equipment Manufacturers (OEMs), particularly those in the Aerospace & Defense and high-volume Telecommunications sectors, and indirect sales conducted through a network of specialized electronic component distributors. These distributors play a crucial role in providing technical support, inventory management, and servicing smaller to medium-sized enterprises (SMEs) and R&D labs globally. The effectiveness of the indirect channel is often determined by the distributor's regional reach and technical proficiency in handling specialized RF components.

Downstream analysis focuses on integration into end-user systems. In the telecommunications sector, this involves integration into power amplifiers, filters, and base station transceivers. In the defense sector, ceramic attenuators are integrated into radar systems, missile guidance, and electronic countermeasures equipment, demanding stringent testing and qualification processes. The high reliability and robust packaging of ceramic attenuators minimize post-sale failures and reduce total cost of ownership for end-users. The trend toward system-in-package (SiP) solutions further emphasizes the need for streamlined downstream logistics and close collaboration between component manufacturers and system integrators to ensure optimal thermal and electrical performance within dense modules.

Ceramic Attenuators Market Potential Customers

The potential customer base for ceramic attenuators is broad, primarily comprising entities involved in high-frequency signal transmission, reception, and processing where signal integrity and power management are critical. The largest segment of end-users are major telecommunications infrastructure providers and equipment manufacturers (e.g., Ericsson, Nokia, Huawei, Samsung Networks) who require fixed and variable attenuators for power leveling in massive MIMO arrays, small cells, and core network equipment supporting 5G and 6G deployment. These buyers prioritize high linearity, low intermodulation distortion, and exceptional thermal stability to ensure network reliability under continuous heavy load.

The second major group includes defense contractors and government agencies (e.g., Lockheed Martin, Raytheon, Northrop Grumman) that utilize these components in mission-critical applications such as airborne and naval radar systems, sophisticated electronic intelligence (ELINT) gathering, and satellite communication payloads. These customers require components certified to military standards (MIL-SPEC) and often demand unique packaging solutions that can withstand extreme shock, vibration, and temperature fluctuations, sometimes including radiation hardening for space applications.

Further potential buyers include automotive Tier 1 suppliers developing ADAS modules, specialized medical device manufacturers creating advanced diagnostic and therapeutic equipment, and companies focusing on high-end test and measurement equipment (e.g., Keysight, Rohde & Schwarz). These diverse customers share the common need for components offering high precision and repeatability over long operational lifetimes, making the stability inherent to ceramic technology a primary purchasing criterion. The growing Industrial IoT sector, requiring reliable wireless connectivity in harsh factory settings, is also rapidly emerging as a significant customer segment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $580 Million |

| Market Forecast in 2033 | $1,035 Million |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | API Technologies, TDK Corporation, Murata Manufacturing Co., Ltd., AVX Corporation (Kyocera), KOA Corporation, Vishay Intertechnology, Inc., Mini-Circuits, Smiths Interconnect, Pasternack Enterprises, Anaren (T.W.G.), EMC Technology (Filtronic), Qorvo, Skyworks Solutions, Inc., Microsemi (Microchip), KDI Integrated Circuits, RF-Lambda, Fairview Microwave, Cinch Connectivity Solutions, Johanson Technology, Tecdia. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ceramic Attenuators Market Key Technology Landscape

The technology landscape for ceramic attenuators is characterized by continuous material science refinement and advanced packaging techniques aimed at maximizing performance at increasingly high frequencies and power levels. A critical technology involves the utilization of high-dielectric constant (high-k) ceramic substrates, predominantly alumina and aluminum nitride (AlN), the latter being crucial for components requiring superior thermal conductivity to dissipate heat efficiently in high-power environments. The choice of ceramic material directly impacts the thermal coefficient of resistance (TCR), a key metric defining the component's stability across temperature variations. Furthermore, the shift towards ultra-thin film deposition (e.g., sputtered Tantalum Nitride or Nickel Chromium) for the resistive element allows for enhanced precision and stability compared to traditional thick-film technologies, crucial for high-linearity applications in 5G radio heads.

Packaging technology, particularly the use of surface-mount device (SMD) and chip-style packages, is central to market evolution. Advanced ceramic packaging ensures hermetic sealing and low parasitic inductance, allowing the attenuators to maintain specified performance well into the millimeter-wave spectrum (e.g., up to 67 GHz or higher). Flip-chip bonding and wafer-level packaging (WLP) techniques are becoming standard to minimize connection losses and optimize integration density within Multi-Chip Modules (MCMs) and System-in-Package (SiP) solutions. These techniques are essential for meeting the stringent size, weight, and power (SWaP) constraints imposed by modern portable and satellite communication systems. Laser trimming technology remains vital in the manufacturing process, allowing manufacturers to precisely adjust the resistive trace geometry to achieve highly accurate attenuation values with tight tolerances, often down to ±0.1 dB.

Emerging technologies focus on integrating smart features, such as temperature sensing capabilities directly into the ceramic substrate to allow system monitoring and adaptive power control. Moreover, the development of specialized ceramic-metal (cermet) compositions is ongoing to provide a better balance between high resistivity and temperature stability for next-generation systems. As signal frequencies move into the terahertz (THz) range for future 6G concepts, R&D is increasingly concentrating on minimizing reactive components and enhancing broadband performance across octave bandwidths, requiring novel ceramic structures, including integrated waveguides and low-loss substrates. The intersection of ceramic attenuator technology with microwave photonic integration also represents a burgeoning area of research, although this remains nascent compared to established RF solutions.

Regional Highlights

- Asia Pacific (APAC): APAC represents the dominant and fastest-growing market for ceramic attenuators, primarily due to the rapid and large-scale deployment of 5G infrastructure across China, South Korea, and Japan. Massive governmental investments in digital infrastructure, coupled with the region's position as a global manufacturing hub for consumer electronics and automotive radar systems, drive substantial demand. The industrial sector in countries like India and Southeast Asia is also accelerating its adoption of high-reliability components for factory automation and smart grid applications. The presence of major semiconductor and electronics manufacturing companies in Taiwan and South Korea further solidifies APAC's leading role in the supply and consumption chain.

- North America: North America holds a significant market share, driven primarily by robust defense and aerospace spending, leading to high demand for specialized, high-reliability, and often custom-designed ceramic attenuators for radar, electronic warfare, and sophisticated communication systems. The region is also at the forefront of LEO satellite constellation deployment (e.g., SpaceX, Amazon), requiring space-qualified components. Furthermore, the presence of major telecommunications technology innovators and advanced R&D centers ensures sustained demand for cutting-edge, mmWave-capable attenuators used in advanced test equipment and infrastructure trials.

- Europe: Europe is a mature market characterized by strong focus on high-precision industrial applications, automotive radar (driven by stringent safety regulations), and established defense programs. Germany, France, and the UK are key consumers, particularly in the fields of automated manufacturing (Industry 4.0) and scientific instrumentation. Regulatory compliance, such as REACH, heavily influences material selection and manufacturing processes within the European market. The region’s strength in high-end automotive electronics, particularly ADAS technology operating at 77 GHz, necessitates high volumes of stable, miniaturized ceramic attenuators.

- Latin America (LATAM): The LATAM market is emerging, with growth tied mainly to the gradual expansion of 4G and 5G networks in major economies like Brazil and Mexico. Demand is generally focused on cost-effective solutions for commercial telecommunications infrastructure. The pace of adoption is slower compared to APAC or North America, but increasing urbanization and mobile data consumption suggest a steady, albeit moderate, growth trajectory for standard-frequency ceramic attenuators.

- Middle East and Africa (MEA): The MEA market is seeing high investment in telecommunications in the Gulf Cooperation Council (GCC) countries, driven by government initiatives for economic diversification and smart city development. Defense spending in nations like Saudi Arabia and UAE also contributes significantly to the demand for high-performance military-grade ceramic components. The African segment remains nascent, primarily centered on basic wireless infrastructure upgrades and localized industrial projects.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ceramic Attenuators Market.- API Technologies

- TDK Corporation

- Murata Manufacturing Co., Ltd.

- AVX Corporation (Kyocera)

- KOA Corporation

- Vishay Intertechnology, Inc.

- Mini-Circuits

- Smiths Interconnect

- Pasternack Enterprises

- Anaren (T.W.G.)

- EMC Technology (Filtronic)

- Qorvo

- Skyworks Solutions, Inc.

- Microsemi (Microchip)

- KDI Integrated Circuits

- RF-Lambda

- Fairview Microwave

- Cinch Connectivity Solutions

- Johanson Technology

- Tecdia

Frequently Asked Questions

What is the primary function of a ceramic attenuator in modern RF systems?

The primary function of a ceramic attenuator is to precisely reduce the power level of an RF signal while maintaining signal integrity, preventing distortion, and ensuring proper impedance matching between different stages of a communication or radar system. Ceramic attenuators are valued for their superior thermal stability and high-power handling capabilities compared to non-ceramic alternatives, making them ideal for high-frequency applications like 5G infrastructure and aerospace electronics.

Why are ceramic materials preferred over other substrates for high-power attenuation?

Ceramic materials, particularly alumina and aluminum nitride, are preferred for high-power attenuation due to their excellent thermal conductivity and low temperature coefficient of resistance (TCR). This allows the component to dissipate significant thermal energy effectively and maintain a highly stable attenuation value across wide operating temperature ranges, which is critical for system reliability in challenging environmental conditions such as military or space applications.

Which application segment is driving the highest growth rate for ceramic attenuators?

The Telecommunications segment, driven specifically by the global rollout and densification of 5G and ongoing preparations for 6G networks, is currently driving the highest volume and growth rate. This infrastructure expansion necessitates vast quantities of highly reliable, stable, and high-frequency fixed and variable ceramic attenuators for signal conditioning within base station radios and massive MIMO systems operating in sub-6 GHz and millimeter-wave bands.

How does the miniaturization trend affect the design requirements for ceramic attenuators?

Miniaturization demands the use of high-power handling, surface-mount device (SMD) ceramic attenuators that occupy minimal board space. Designers must achieve high attenuation performance and excellent thermal dissipation within a smaller footprint, pushing manufacturers towards advanced techniques such as thin-film deposition, flip-chip integration, and the use of high-thermal-conductivity ceramic substrates to manage increased power density.

What are the key technical challenges facing the ceramic attenuators market above 18 GHz?

Key technical challenges above 18 GHz (mmWave) include minimizing insertion loss and parasitic effects, achieving ultra-precise resistance matching for broadband operation, and managing manufacturing tolerances down to micron levels. Components must be carefully designed and packaged (e.g., using WLP) to ensure stability and accuracy across the entire high-frequency spectrum without introducing unacceptable reflections or signal degradation, demanding significant investment in advanced lithography and measurement equipment.

The Ceramic Attenuators Market is fundamentally intertwined with the evolution of wireless technology and high-reliability electronics, demonstrating sustained growth potential through 2033. The convergence of high-speed data transmission requirements, the proliferation of radar systems, and the crucial need for components capable of operating reliably in harsh environments solidifies the strategic importance of ceramic attenuators in the global electronic component supply chain. Manufacturers are continuously innovating, particularly in material science and high-frequency packaging, to meet the stringent performance metrics demanded by 5G, satellite communications, and autonomous vehicle technologies. The market outlook is robust, contingent upon continued infrastructural investment across key geographical regions, particularly in Asia Pacific, and sustained technological advancements that address the complex thermal and electrical constraints of millimeter-wave applications. Strategic focus on variable attenuators and components designed for the highest frequency bands will be crucial for competitive advantage in the coming years, ensuring that the market capitalization continues its upward trajectory as projected.

Further analysis of the competitive landscape reveals that key players are increasingly differentiating themselves not merely on price, but on technical service, customization capability, and guaranteed reliability, especially in military and space-grade offerings. The increasing scrutiny on supply chain resilience globally following recent disruptions has also elevated the importance of geographically diversified manufacturing capabilities and robust quality control procedures among top-tier suppliers. The intellectual property landscape, particularly concerning proprietary ceramic compositions and thin-film deposition techniques, remains a significant barrier to entry, favoring established companies with deep R&D budgets. The integration of advanced testing methodologies, including automated high-frequency network analysis and environmental stress screening, is now standard practice, ensuring that ceramic attenuators maintain performance specifications throughout their expected lifecycle, aligning perfectly with the high-stakes applications they serve.

Looking ahead, the potential impact of nascent technologies, such as quantum computing and advanced photonics, on the demand for ultra-stable components cannot be overstated. While still futuristic, these fields represent potential high-value niche markets where extreme stability and minimal noise introduction are paramount, requirements that ceramic attenuators are uniquely positioned to fulfill. Companies that invest today in highly specialized production lines capable of supporting ultra-high vacuum and controlled atmosphere processing for these niche, high-precision applications are likely to capture significant long-term value. The overarching market narrative is defined by the reliable management of increasing power and frequency, a technical challenge that ceramic technology is consistently proving capable of addressing through incremental and disruptive material innovation.

The strategic recommendations for market participants center on vertical integration within the value chain, securing long-term contracts for raw material supply, and aggressively pursuing intellectual property related to high-temperature co-fired ceramic (HTCC) technology and low-temperature co-fired ceramic (LTCC) integration for complex RF modules. Furthermore, expanding certification processes to meet diverse regional military and automotive standards (e.g., AEC-Q200 for automotive) will unlock significant revenue streams. The emphasis must remain on providing components that offer guaranteed performance stability under extreme operational parameters, thereby mitigating system failure risk for high-tier customers in mission-critical industries.

The shift towards environmentally sustainable manufacturing practices is also becoming a critical factor, especially concerning materials like beryllium oxide (BeO), which, despite its superior thermal properties, faces increasing restrictions due to toxicity. Manufacturers are heavily investing in high-performance alternatives, such as advanced aluminum nitride composites, that offer near-comparable thermal performance while complying with stringent environmental and workplace safety regulations. This material transition presents both a challenge and an opportunity to redefine the performance benchmarks within the market. Success in the competitive environment will ultimately be determined by the ability to offer miniaturized, highly accurate, and thermally robust solutions that seamlessly integrate into the next generation of high-speed, high-density electronic systems, while maintaining cost-effectiveness and adherence to global regulatory frameworks.

In conclusion, the Ceramic Attenuators Market is undergoing a transformation fueled by technological convergence and unprecedented demand for high-speed connectivity. The reliance of defense, space, and telecommunications sectors on the unique thermal and electrical stability properties of ceramic components guarantees a sustained, high-value market. Continuous innovation in material science, focusing on enhanced thermal conductivity and reduced insertion loss at mmWave frequencies, will be the key differentiator for market leaders, ensuring that ceramic attenuators remain essential building blocks for the future digital infrastructure. The projected growth trajectory reflects not only the volume expansion of electronic systems but also the increasing complexity and performance demands placed upon every passive component within the signal chain.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager