Ceramic Ball Valve Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433798 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Ceramic Ball Valve Market Size

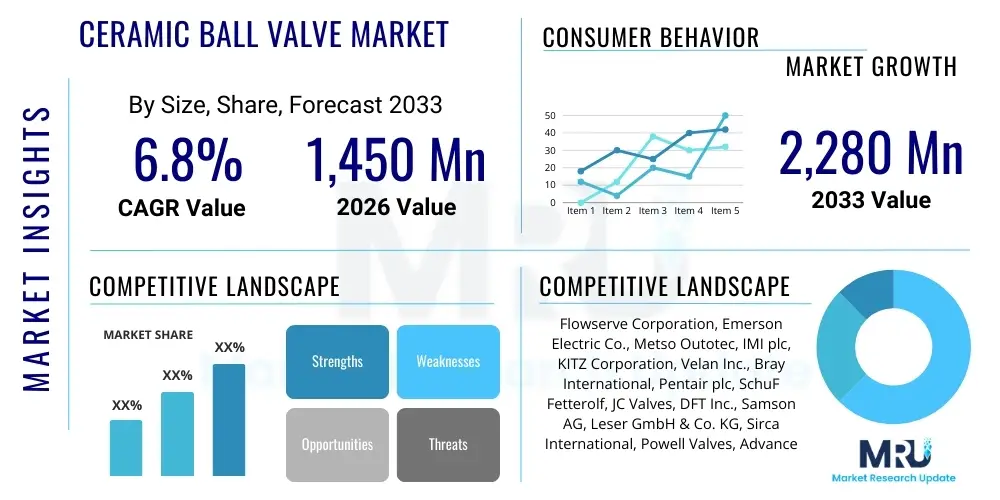

The Ceramic Ball Valve Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1,450 Million in 2026 and is projected to reach USD 2,280 Million by the end of the forecast period in 2033.

This robust growth trajectory is primarily underpinned by the increasing demand from industries characterized by severe operating conditions, such as chemical processing, power generation, and mining. Ceramic ball valves offer unparalleled resistance to abrasion, erosion, high temperatures, and chemical attack, making them the preferred choice over traditional metallic valves in handling highly corrosive slurries, powders, and viscous fluids. The operational longevity and minimal maintenance requirements associated with ceramic valves translate directly into lower total cost of ownership (TCO) for end-users, thereby accelerating their adoption across critical industrial applications globally.

Furthermore, stringent regulatory frameworks concerning environmental protection and industrial safety are compelling manufacturers to adopt zero-leakage valve solutions. Ceramic ball valves inherently provide superior sealing capabilities and maintain tight shut-off even after prolonged exposure to harsh media, effectively minimizing leakage and ensuring compliance. The expansion of infrastructure projects and the rising global energy demand, particularly in the Asia Pacific region, are creating significant opportunities for market participants specializing in high-performance fluid control mechanisms, positioning the ceramic ball valve segment for sustained and substantial market expansion through the forecast period.

Ceramic Ball Valve Market introduction

The Ceramic Ball Valve Market encompasses the production, distribution, and utilization of valves constructed with ceramic components, typically alumina, zirconia, or silicon nitride, designed for precise flow control in demanding industrial environments. These valves are highly regarded for their exceptional hardness, chemical inertness, and ability to withstand high temperatures and pressures, significantly outperforming conventional metal alloys in applications involving abrasive slurries, highly corrosive chemicals, and high-purity media. Major applications span chemical processing, where they manage aggressive acids and solvents, power generation, particularly in ash handling systems, and the mining sector, crucial for controlling mineral slurries. Key benefits include extended service life, reduced downtime, zero leakage sealing, and superior corrosion resistance. The market growth is principally driven by the global trend toward industrial process optimization, increased capital expenditure in chemical and petrochemical facilities, and the necessity for durable, low-maintenance flow control solutions across heavy industries.

Ceramic Ball Valve Market Executive Summary

The Ceramic Ball Valve Market is experiencing dynamic growth, driven by technological advancements in material science and increasing industrial requirements for longevity and performance under extreme conditions. Current business trends indicate a strong focus on developing specialized ceramic composites, such as nano-ceramic materials, to further enhance thermal shock resistance and mitigate the inherent brittleness of traditional ceramics, thus broadening the scope of application. Regionally, the Asia Pacific (APAC) stands out as the primary growth engine, fueled by rapid industrialization, especially in China and India, alongside significant investments in chemical plants and mineral processing facilities. North America and Europe maintain a mature market share, focusing on replacement demand and specialized high-ppurity applications in pharmaceuticals and semiconductors. Segment-wise, the Trunnion Ceramic Ball Valve segment dominates revenue due to its robust support structure suitable for high-pressure industrial lines, while the chemical processing application segment consistently leads in consumption volume, reflecting the critical need for chemically inert valve solutions in this sector.

AI Impact Analysis on Ceramic Ball Valve Market

Analysis of common user queries related to AI in the ceramic ball valve sector reveals key themes centered on manufacturing precision, predictive maintenance, and optimized material design. Users frequently ask how AI can reduce ceramic component defects, whether machine learning models can accurately predict the remaining useful life (RUL) of a valve operating in slurry service, and if AI-driven simulations can hasten the development of new, tougher ceramic formulations. These concerns highlight a collective expectation that AI should address the primary challenges associated with ceramic valves: managing brittleness, ensuring manufacturing consistency, and minimizing unexpected field failures in critical applications. The consensus points towards AI being a disruptive tool primarily focusing on quality control and lifecycle management.

The integration of Artificial Intelligence and Machine Learning (ML) is fundamentally transforming the manufacturing landscape for ceramic ball valves, moving from traditional inspection methods to predictive quality assurance. AI algorithms, applied through machine vision systems, are now deployed on production lines to analyze high-resolution images of ceramic components, detecting micro-cracks or surface imperfections invisible to the human eye, thereby dramatically reducing component defect rates and ensuring higher product consistency. Furthermore, AI is utilized in optimizing the sintering and firing processes, analyzing real-time temperature, pressure, and duration data to adjust parameters dynamically, which results in ceramics with improved density and mechanical properties, directly enhancing the valve's performance and structural integrity in demanding operational scenarios.

Beyond manufacturing, AI-powered predictive maintenance (PdM) systems are revolutionizing the lifecycle management of installed ceramic valves. By collecting and analyzing sensor data—such as vibration patterns, flow rates, and differential pressure—ML models can detect subtle deviations indicative of potential wear or failure long before catastrophic damage occurs. This capability allows industrial operators to schedule proactive maintenance, maximizing uptime and avoiding the extremely high costs associated with sudden valve failure in continuous process plants. Moreover, AI aids in demand forecasting and supply chain optimization for ceramic materials, ensuring efficient inventory management and responsive manufacturing capabilities tailored to fluctuating market demands.

- AI-driven machine vision enhances ceramic quality control, detecting micro-defects during manufacturing.

- Machine learning models optimize sintering processes, improving ceramic material density and toughness.

- Predictive maintenance (PdM) utilizes sensor data to forecast valve wear and remaining useful life (RUL).

- AI simulation accelerates the development and testing of novel ceramic composite materials.

- Automated robotic polishing guided by AI ensures precise spherical geometry for superior sealing capabilities.

- Supply chain resilience and demand forecasting are improved through AI-based data analytics.

DRO & Impact Forces Of Ceramic Ball Valve Market

The market dynamics for ceramic ball valves are shaped by a complex interplay of drivers, restraints, opportunities, and inherent market forces. The primary drivers revolve around the indispensable need for fluid control components capable of surviving severe service conditions, where conventional metallic valves fail rapidly, specifically in environments involving highly abrasive slurries or extremely corrosive media prevalent in sectors like mining, chemical processing, and specialized metallurgy. This demand is further amplified by industry mandates for increased operational efficiency and reduced maintenance downtime, which ceramic valves, due to their hardness and longevity, reliably deliver. The key restraints, however, often include the significantly higher initial capital expenditure compared to metal valves, coupled with the material's susceptibility to catastrophic failure under severe mechanical shock or rapid temperature cycling (thermal shock), necessitating careful handling and application engineering. Opportunities lie in penetrating emerging industrial sectors such as hydrogen production and carbon capture, which require inert and ultra-reliable valves, and expanding into developing economies that are rapidly scaling up their heavy industries.

Impact forces within this market structure are characterized primarily by intense technological rivalry among manufacturers focusing on material science innovation. The power of buyers is moderate; while high-volume users in large process industries possess strong negotiation leverage, the specialized nature and mission-critical function of these valves limit the willingness of buyers to compromise on quality or performance. The threat of substitutes is relatively low for severe service applications, as few materials match the combined abrasion and corrosion resistance of advanced ceramics; however, specialized high-alloy steels or polymer-lined valves offer competition in less severe peripheral applications. Supplier power is high for primary ceramic raw materials (alumina, zirconia), dictating input costs, but the market entry barrier is substantial due to the need for specialized manufacturing facilities, precision grinding capabilities, and extensive application knowledge necessary for ceramic component integration.

The market is continually influenced by global economic cycles, particularly capital expenditure cycles in the energy and chemical sectors, which directly affect large-scale project investments where ceramic valves are specified. Regulatory shifts towards tighter environmental controls, especially concerning process fugitive emissions and industrial waste handling, significantly boost the adoption of zero-leakage ceramic solutions. Furthermore, continuous material research aiming to reduce brittleness and improve thermal shock performance is a critical internal force driving market evolution, allowing ceramic valves to address a broader spectrum of high-temperature and fluctuating-pressure applications previously inaccessible due to material limitations.

Segmentation Analysis

The Ceramic Ball Valve Market is segmented based on critical characteristics including the valve Type, the ceramic Material used, the Application industry, and the End-User sector. This multi-dimensional segmentation allows for precise market sizing and strategic targeting, reflecting the varied performance requirements across different industrial settings. The Type segmentation primarily distinguishes between Floating, Trunnion, and V-port designs, each offering unique flow characteristics and pressure handling capabilities suited to specific process control needs. The Material segment, covering Alumina, Zirconia, and Silicon Nitride, highlights the varying degrees of hardness, chemical resistance, and cost profiles available to manufacturers and end-users, directly impacting performance in ultra-severe services. Application-based segmentation reveals the highest demand originating from chemical processing and mining, due to their inherent need for superior resistance to highly abrasive and corrosive media, while End-User classification separates industrial consumers from specialized commercial or utility users.

The dominance of the Trunnion-mounted valve type in high-pressure, large-diameter applications is a key trend within the Type segmentation, driven by its superior mechanical stability and ability to handle high differential pressures effectively, crucial in oil and gas or power generation settings. Conversely, V-port valves are gaining traction where precise throttling and flow modulation are paramount, particularly in dosage control systems within the chemical and pharmaceutical industries. Analyzing the Material segmentation reveals a shift towards Zirconia ceramics and Silicon Nitride, which, while generally higher in cost than standard Alumina, offer enhanced fracture toughness and thermal stability, enabling the valves to perform reliably in more thermally volatile environments or under conditions where mechanical stresses are high, validating their growing adoption in specialized high-performance niche markets.

- Type: Floating Ceramic Ball Valve, Trunnion Ceramic Ball Valve, V-port Ceramic Ball Valve.

- Material: Alumina Ceramics (most common), Zirconia Ceramics (higher toughness), Silicon Nitride Ceramics (superior thermal shock resistance).

- Application: Chemical Processing, Oil & Gas (downstream only), Power Generation (ash/slurry handling), Metallurgy & Smelting, Mining & Mineral Processing, Pulp & Paper, Pharmaceuticals & Food Processing.

- End-User: Industrial Sector (Heavy Manufacturing), Commercial Utilities, Municipal Water Treatment.

Value Chain Analysis For Ceramic Ball Valve Market

The value chain for the Ceramic Ball Valve Market begins with the highly specialized upstream procurement and processing of raw ceramic powders, primarily high-purity alumina and zirconia. Suppliers in this segment hold significant leverage due to the strict quality requirements and the energy-intensive nature of powder synthesis, which dictates the fundamental mechanical properties of the final component. This is followed by the intricate manufacturing process, involving precision forming, high-temperature sintering, and critically, precision grinding and polishing of the ceramic balls and seats. This manufacturing stage represents the highest value addition, as the quality of the surface finish (which determines sealing integrity) requires specialized machinery and expertise, creating substantial barriers to entry for new market participants. Companies often integrate vertically into the grinding phase to maintain strict control over tolerance specifications, which is vital for the zero-leakage performance claim of these valves.

Downstream activities involve specialized assembly, rigorous testing (including pressure and leak tests), and subsequent distribution. The distribution channel is often hybrid, utilizing both direct sales models for major, custom-engineered projects in sectors like mining or large chemical complexes, and indirect channels relying on specialized distributors or agents who possess specific application knowledge. Direct sales are preferred for complex, high-value orders as they allow for close collaboration between the manufacturer's engineers and the end-user's process design teams. Indirect distribution via technical channel partners allows for broader market penetration into smaller industrial users and provides localized after-sales support and inventory holding, which is essential for maintenance, repair, and overhaul (MRO) demand.

The effectiveness of the value chain is highly dependent on logistics, as ceramic components are inherently fragile and require careful handling during transport and installation. Furthermore, the downstream portion includes vital aftermarket services, such as specialized repair and replacement parts, given the long service life expectation of these valves. Manufacturers who offer comprehensive installation supervision, operator training, and reliable technical support throughout the valve's lifecycle gain a competitive edge. This full-service model ensures that end-users derive maximum benefit from their investment by minimizing potential damage during installation or operation, thereby reinforcing the overall value proposition of high-performance ceramic flow control solutions.

Ceramic Ball Valve Market Potential Customers

The primary customers for ceramic ball valves are industrial entities operating processes that subject fluid control equipment to severe conditions involving high abrasion, high corrosion, or high temperatures, where standard metal valves experience rapid failure or excessive wear. Key end-users include major chemical and petrochemical companies requiring inert valves for handling concentrated acids, bases, and abrasive catalyst slurries. Mining and mineral processing firms constitute a significant customer base, relying heavily on ceramic valves to manage dense, high-velocity mineral slurries and tailings, seeking solutions that guarantee minimal unscheduled downtime. Furthermore, the power generation sector, particularly coal-fired and biomass plants, uses these valves extensively for ash handling, fly ash pneumatic conveying systems, and flue gas desulfurization (FGD) systems, where particulate erosion is extremely aggressive. These customers prioritize product reliability, extended Mean Time Between Failures (MTBF), and superior sealing capability over initial cost, driven by the desire to minimize operational expenditure and maintain continuous production schedules.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1,450 Million |

| Market Forecast in 2033 | USD 2,280 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Flowserve Corporation, Emerson Electric Co., Metso Outotec, IMI plc, KITZ Corporation, Velan Inc., Bray International, Pentair plc, SchuF Fetterolf, JC Valves, DFT Inc., Samson AG, Leser GmbH & Co. KG, Sirca International, Powell Valves, Advanced Valve Technology, Xiamen Fujian Pressure Valve, MOGAS Industries, Inc., AZ Armaturen GmbH, Yantai Huacheng Valve Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ceramic Ball Valve Market Key Technology Landscape

The technological landscape of the Ceramic Ball Valve Market is rapidly evolving, driven primarily by advancements in material science and precision manufacturing techniques aimed at enhancing durability and performance. A core technological focus is the development of advanced ceramic composites, which integrate ultra-fine ceramic powders (often combined with stabilizing agents or reinforcing elements) to increase fracture toughness and resistance to thermal shock, mitigating the traditional drawback of ceramic brittleness. This material innovation is essential for expanding the application range into processes involving rapid temperature fluctuations or high mechanical stress. Furthermore, specialized thermal spraying techniques are being employed to apply thin, dense ceramic layers onto metallic substrates in hybrid valve designs, offering cost-effective solutions that combine the strength of metal bodies with the superior surface resistance of ceramics.

Manufacturing technology plays an equally critical role, with Additive Manufacturing (3D printing) gaining traction for prototyping and producing complex ceramic geometries, such as V-port throttling components, with greater customization and efficiency than traditional pressing and sintering methods. However, the most vital technology remains ultra-precision grinding and lapping. Achieving the requisite surface finish (often sub-micron level roughness) and dimensional tolerance on the ceramic ball and seat is paramount for ensuring bubble-tight sealing over millions of cycles. Manufacturers are investing heavily in CNC grinding machines equipped with diamond tooling and sophisticated in-process measurement systems to maintain these extremely tight tolerances, guaranteeing zero-leakage performance even in high-pressure gas applications. The efficiency and consistency of this precision finishing directly determine the market competitiveness of the final product.

Further technological advancements include the integration of sensor technology and IoT capabilities into the valve assembly. Smart ceramic ball valves are increasingly equipped with embedded sensors for monitoring temperature, vibration, and actuator performance, allowing for real-time process control feedback and integration into plant-wide digital control systems. This adoption of Industrial IoT (IIoT) facilitates remote monitoring and enables the predictive maintenance strategies discussed previously, significantly contributing to operational efficiency and safety. The combination of tougher ceramic materials, precise manufacturing, and digital integration establishes the current technological frontier, setting higher standards for reliability and control in critical industrial infrastructure across the globe.

Regional Highlights

The global ceramic ball valve market demonstrates distinct regional dynamics heavily influenced by industrial output, regulatory frameworks, and capital expenditure cycles in the energy and raw materials sectors. Asia Pacific (APAC) currently dominates the market, exhibiting the highest growth rate and volume consumption. This leadership is attributed to massive investments in infrastructure development, rapid expansion of chemical manufacturing facilities in countries like China, India, and Southeast Asia, and robust activity in the mining and metallurgy sectors which rely heavily on ceramic solutions for slurry handling and high-temperature processing. The competitive advantage in APAC is often balanced between large domestic manufacturers focusing on cost-effective production and international players providing high-specification, specialized valves.

North America and Europe represent mature markets characterized by stringent regulatory environments and a strong emphasis on operational safety and environmental protection. While the growth rate is generally lower than in APAC, demand is stable, driven primarily by replacement cycles, modernization of aging infrastructure, and specialized high-value applications in pharmaceutical, semiconductor, and ultra-pure chemical production where zero contamination and superior reliability are essential. European manufacturers particularly focus on developing advanced material compositions and integrating smart technology into valve systems to meet rigorous EU standards for emissions control and energy efficiency in industrial processes.

Latin America, the Middle East, and Africa (MEA) collectively represent high-potential emerging markets. MEA growth is closely tied to the upstream and downstream expansion of the oil and gas industry, where ceramic components are increasingly specified for challenging services such as high-pressure acid gas treatment and abrasive flow control. Latin America's demand is spurred by the extensive mining industry, especially in countries like Chile and Peru, which requires extremely durable valves to manage copper and iron ore slurries. However, market penetration in these regions often faces challenges related to infrastructure investment volatility and reliance on imported technology and specialized expertise.

- APAC (Asia Pacific): Dominates in market share and growth rate due to rapid industrialization, mining activities, and chemical plant capacity expansion. Key markets are China, India, and South Korea.

- North America: Focuses on replacement demand, stringent environmental compliance, and specialized high-purity applications (e.g., semiconductors, pharmaceuticals).

- Europe: Characterized by strong adoption of advanced and smart valve technologies, driven by demanding safety and environmental regulations in the chemical and power sectors.

- MEA & Latin America: High growth potential driven by mining operations and significant investments in oil and gas processing infrastructure requiring severe service valves.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ceramic Ball Valve Market.- Flowserve Corporation

- Emerson Electric Co.

- Metso Outotec

- IMI plc

- KITZ Corporation

- Velan Inc.

- Bray International

- Pentair plc

- SchuF Fetterolf

- JC Valves

- DFT Inc.

- Samson AG

- Leser GmbH & Co. KG

- Sirca International

- Powell Valves

- Advanced Valve Technology

- Xiamen Fujian Pressure Valve

- MOGAS Industries, Inc.

- AZ Armaturen GmbH

- Yantai Huacheng Valve Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Ceramic Ball Valve market and generate a concise list of summarized FAQs reflecting key topics and concerns.What advantages do ceramic ball valves offer over traditional metal valves?

Ceramic ball valves offer superior resistance to abrasion, erosion, and chemical corrosion compared to metallic valves, providing significantly extended service life and maintaining bubble-tight sealing capabilities, even when handling aggressive, high-particulate media like slurries and catalysts.

In which industries are ceramic ball valves most commonly used?

They are predominantly utilized in severe service applications across the Chemical Processing, Mining and Mineral Processing, Power Generation (ash handling), and Metallurgy sectors, where operating conditions involve high temperatures, high pressures, and highly abrasive or corrosive fluids.

What are the key limitations or disadvantages associated with ceramic ball valves?

The primary limitations include a higher initial capital cost compared to standard metal valves and the material's inherent brittleness, making them susceptible to failure under severe mechanical shock or rapid, uncontrolled thermal cycling if not properly selected and installed.

How does AI technology impact the performance and maintenance of ceramic ball valves?

AI improves valve performance by optimizing manufacturing processes (e.g., sintering and precision grinding) to reduce defects. It enhances maintenance through predictive maintenance (PdM) systems that analyze operational data to forecast wear and prevent unscheduled downtime in critical applications.

Which regional market is projected to lead the growth in the ceramic ball valve market?

The Asia Pacific (APAC) region is projected to be the leading market for ceramic ball valves due to high rates of industrialization, continuous expansion of mining activities, and substantial government and private sector investment in chemical and petrochemical manufacturing infrastructure.

What materials are commonly used in the construction of ceramic ball valves?

Common materials include high-purity Alumina (known for excellent chemical resistance), Zirconia (offering enhanced toughness and strength), and Silicon Nitride (valued for superior thermal shock resistance and high-temperature stability in specialized applications).

Are ceramic ball valves suitable for high-purity applications, such as semiconductor manufacturing?

Yes, ceramic ball valves are highly suitable for high-purity applications because ceramics are chemically inert and do not contaminate the media, making them ideal for handling ultra-pure chemicals, high-purity water, and critical gases used in semiconductor and pharmaceutical production processes.

What is the primary driver influencing the demand for Trunnion-mounted ceramic ball valves?

The primary driver is the need for reliable flow control in large diameter and high-pressure industrial lines. Trunnion mounting provides mechanical support to the ball, reducing friction and torque requirements, which is crucial for safety and operational longevity in heavy-duty applications.

How significant is the role of precision grinding in the ceramic valve value chain?

Precision grinding and lapping are perhaps the most critical steps, as they achieve the necessary sub-micron surface finish and exact sphericity of the ceramic ball and seat. This precision is directly responsible for ensuring the valve achieves and maintains its promised zero-leakage, bubble-tight shut-off capability.

What emerging technological trend is expected to further boost the ceramic ball valve market?

The development of advanced nano-ceramic composites and the increased adoption of Additive Manufacturing (3D printing) for creating complex, customized valve geometries are key trends expected to boost performance, reduce manufacturing lead times, and enhance the overall market adoption rate.

Do ceramic valves require specialized actuators or control systems compared to standard valves?

While standard actuators can often be used, ceramic valves frequently operate in severe service or high-precision throttling conditions. Therefore, they often benefit from high-torque, precise electric or pneumatic actuators and sophisticated positioners to manage the higher friction of ceramic surfaces and ensure accurate flow modulation.

What is the expected Compound Annual Growth Rate (CAGR) for the Ceramic Ball Valve Market between 2026 and 2033?

The Ceramic Ball Valve Market is projected to grow at a steady Compound Annual Growth Rate (CAGR) of 6.8% throughout the forecast period, reflecting strong demand from replacement cycles and new capital projects in severe service industries worldwide.

How do environmental regulations impact the adoption rate of ceramic ball valves?

Stringent environmental regulations demanding minimal fugitive emissions strongly favor ceramic ball valves, as their robust design and superior sealing mechanism minimize leakage of process fluids and gases, helping industrial facilities comply with increasingly strict international emission standards.

What differentiates a V-port ceramic ball valve from a Floating or Trunnion design?

The V-port design incorporates a contoured opening in the ball, which provides highly characterized, fine throttling control capabilities, making it ideal for regulating flow precisely, unlike the standard Floating or Trunnion designs which are optimized primarily for on-off shutoff and flow isolation.

What market segment contributes the most to the revenue of ceramic ball valves by application?

The Chemical Processing segment consistently contributes the most substantial revenue, driven by the critical and non-negotiable requirement for valves that can safely and reliably handle extremely corrosive media over long periods without failure or chemical interaction.

What are the primary upstream components influencing the cost structure of ceramic ball valves?

The primary upstream components are the specialized, high-purity ceramic powders (Alumina, Zirconia) and the high-energy processes (sintering) required to consolidate the powders, both of which are high-cost inputs significantly influencing the final manufacturing cost.

How does the total cost of ownership (TCO) compare between ceramic and metal valves in severe service?

While ceramic valves have a higher initial purchasing cost, their exceptional longevity, minimal maintenance requirements, and avoidance of costly unscheduled downtime result in a significantly lower Total Cost of Ownership (TCO) compared to metal valves that fail frequently in severe abrasive or corrosive environments.

Is there significant competition from substitute materials in the severe service valve market?

Competition from substitute materials is low in the most severe service niches (combining high abrasion and corrosion). While specialized alloys and polymer-lined valves exist, they generally cannot match the combined durability, temperature resistance, and hardness offered by industrial ceramics.

What role does the metallurgy segment play in the demand for ceramic ball valves?

The metallurgy segment requires ceramic valves for controlling high-temperature, abrasive media involved in smelting and processing metals, such as molten salts, hot flue dust, and highly erosive powders used in various refining steps, ensuring continuous flow control under extreme thermal load.

What are the main drivers for adopting IIoT technology in ceramic valve systems?

The main drivers for IIoT adoption are enabling remote monitoring, capturing real-time operational data for advanced analytics, and facilitating the implementation of AI-driven predictive maintenance strategies, thereby maximizing uptime and optimizing operational expenditure across large process facilities.

How does the high hardness of ceramics benefit valve performance?

The extreme hardness of industrial ceramics (approaching that of diamonds) provides unparalleled resistance to erosion and abrasion, making the internal components highly durable against continuous impact from solid particles in slurries and powders, significantly extending the valve’s operational lifespan.

Why is the mining industry a critical customer segment for ceramic ball valves?

The mining industry is critical because it relies heavily on ceramic valves to manage highly dense and extremely abrasive mineral slurries (such as copper or iron ore concentrates) that rapidly destroy conventional metallic valves, necessitating the superior wear resistance of ceramic components to maintain continuous operations.

What factors contribute to the high barrier to entry in the ceramic ball valve manufacturing market?

High barriers include the requirement for highly specialized manufacturing expertise, substantial capital investment in ultra-precision grinding equipment, access to reliable high-purity raw ceramic powders, and the need for rigorous quality control and application engineering knowledge.

Are ceramic valves suitable for pneumatic conveying systems?

Yes, ceramic ball valves are highly suitable and often essential for pneumatic conveying systems handling abrasive dry bulk solids and powders (like fly ash, cement, or fine minerals) because their superior hardness prevents rapid erosion of the sealing and flow path components caused by high-velocity particulates.

How is the market addressing the constraint of ceramic brittleness?

The market is addressing brittleness through ongoing material science research focusing on developing advanced ceramic composites, utilizing nanotechnology to achieve finer grain structures, and improving manufacturing processes like hot isostatic pressing (HIP) to reduce porosity and increase fracture toughness.

What is the typical expectation for the service life of a ceramic ball valve compared to an alloy valve in slurry service?

In severe slurry service, a properly specified ceramic ball valve can often achieve a service life five to ten times longer than that of a high-performance alloy metal valve, significantly extending the Mean Time Between Failure (MTBF) and reducing maintenance frequency.

What is the impact of global energy transition on the ceramic ball valve market?

The energy transition creates opportunities, particularly in emerging sectors like green hydrogen production, carbon capture and storage (CCS), and advanced biofuels, all of which often require ultra-reliable, chemically inert valves to handle corrosive intermediates and high-pressure gases, boosting demand for ceramic solutions.

Why is customization important in the ceramic ball valve market?

Customization is important because severe service applications often have unique operating conditions regarding temperature, pressure, media composition, and particle size distribution. Customization ensures the ceramic material composition and valve design are precisely tailored to maximize performance and guarantee reliability in those specific, demanding processes.

What is meant by ‘zero leakage’ in the context of ceramic ball valves?

Zero leakage refers to the ability of the valve to achieve a Class VI shut-off rating, meaning the valve provides a bubble-tight seal under test conditions. This capability is maintained over the valve's service life due to the hardness and precision fit of the ceramic ball and seat, preventing costly and hazardous fugitive emissions.

Which forecast year value represents the projected size of the ceramic ball valve market?

The Ceramic Ball Valve Market is projected to reach an estimated value of USD 2,280 Million by the end of the forecast period in 2033, indicating sustained and substantial market expansion driven by industrial infrastructure growth.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager