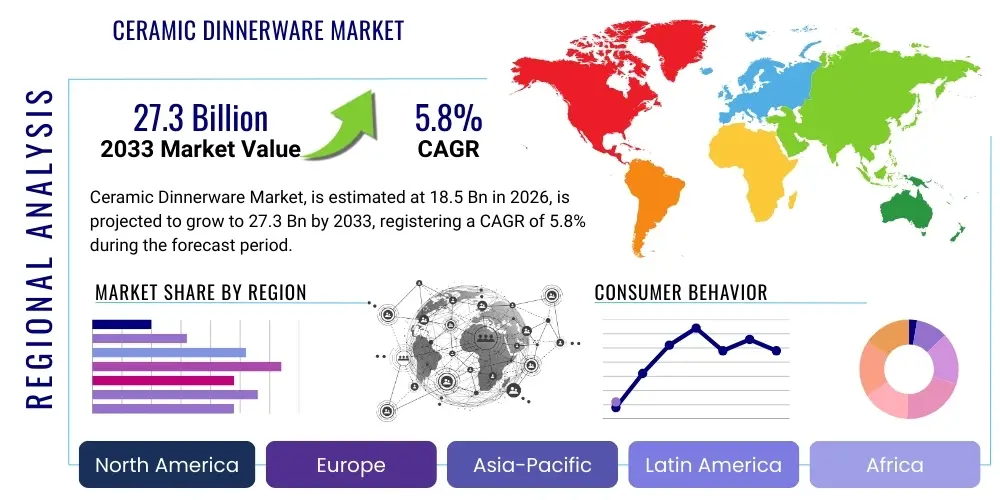

Ceramic Dinnerware Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440046 | Date : Jan, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Ceramic Dinnerware Market Size

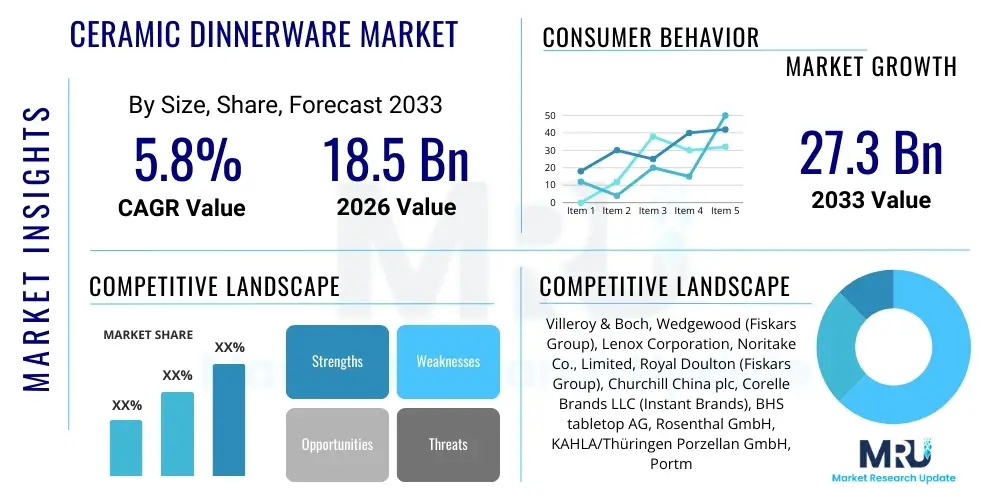

The Ceramic Dinnerware Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 18.5 Billion in 2026 and is projected to reach USD 27.3 Billion by the end of the forecast period in 2033. This robust expansion is primarily underpinned by a confluence of escalating global urbanization trends, which invariably lead to increased household formation and a greater demand for home essentials, including aesthetic and functional dinnerware. Furthermore, the steady rise in disposable incomes across key emerging economies empowers consumers to invest in higher-quality, design-centric, and often premium ceramic tableware, moving beyond mere utility to an emphasis on enhancing dining experiences. The relentless growth and modernization of the global hospitality sector, encompassing hotels, restaurants, and cafes, also represent a significant demand driver, as these establishments continuously seek durable, appealing, and high-performance dinnerware to meet evolving customer expectations and operational requirements. This dynamic interplay of demographic shifts, economic prosperity, and industry expansion solidifies the market's positive outlook, ensuring sustained growth throughout the forecast period.

Beyond these foundational drivers, the market's promising trajectory is significantly amplified by ongoing innovations in ceramic manufacturing processes and material science. These advancements are leading to the development of products that offer superior durability, enhanced aesthetic versatility, and improved environmental sustainability, such as lead-free glazes and energy-efficient production methods. While established markets in North America and Europe continue to exhibit consistent demand, driven by sophisticated consumer preferences for branded and heritage products, the Asia Pacific region is poised to demonstrate the most accelerated growth. This surge in APAC is attributed to its burgeoning middle-class population, rapidly evolving lifestyle preferences that increasingly adopt global dining standards, and a booming food service industry that mirrors economic prosperity. Strategic market players are keenly focused on diversifying their product portfolios, expanding their digital footprint through sophisticated e-commerce platforms, and integrating sustainable practices into their core operations to capture a larger share of this evolving market. Such proactive measures, coupled with consumer trends towards premiumization and unique design, are expected to ensure that the forecasted growth remains resilient against potential economic fluctuations and shifts in consumer behavior, maintaining the ceramic dinnerware market as a vibrant and expanding sector.

Ceramic Dinnerware Market introduction

Ceramic dinnerware represents a fundamental and enduring category within the global homeware and hospitality sectors, encompassing an extensive array of tableware items meticulously crafted from natural clay-based materials and other inorganic compounds. These materials undergo a rigorous manufacturing process involving shaping, drying, and subsequent firing at intensely high temperatures, which imbues the final products with their characteristic permanence, durability, and non-porous qualities. The product spectrum is vast, typically including essential items such as plates, bowls, cups, mugs, saucers, and various serving dishes, all indispensable for the daily rituals of meal preparation, elegant food presentation, and comfortable consumption in both domestic environments and professional culinary settings. The inherent versatility of ceramic dinnerware is highlighted by the diverse range of materials employed in its production, such as fine porcelain, robust stoneware, delicate bone china, and rustic earthenware. Each material offers distinct aesthetic qualities, functional attributes, and price points, enabling manufacturers to cater to an expansive spectrum of consumer preferences, budget constraints, and cultural requirements across different global markets. These dinnerware items are highly valued not only for their practical attributes like excellent heat retention, chemical non-reactivity with food, and ease of cleaning, but also for their profound ability to elevate dining experiences through their intrinsic visual appeal, tactile quality, and capacity to complement interior design schemes, firmly establishing them as timeless staples in contemporary households and prestigious dining establishments worldwide.

The major applications for ceramic dinnerware are broadly bifurcated into residential and commercial sectors, each presenting unique demand patterns and product specifications. In residential settings, ceramic dinnerware is integral to everyday family meals, celebratory gatherings, and special occasions, often reflecting personal tastes and home aesthetics. The commercial sector, a substantial revenue contributor, includes the expansive HoReCa segment (Hotels, Restaurants, and Cafes), catering services, and various institutional facilities such as corporate cafeterias, hospitals, and educational institutions. These commercial clients demand dinnerware that is not only visually appealing but also exceptionally durable, chip-resistant, stackable, and capable of withstanding the rigors of frequent washing and heavy use in demanding environments. The market's underlying momentum is fundamentally driven by global demographic shifts, notably a steadily increasing population and the continuous formation of new households, coupled with rising discretionary incomes in both established and emerging markets that enable consumers to invest in higher-quality and more specialized home goods. Furthermore, the flourishing global tourism and hospitality industry directly correlates with heightened demand for resilient and aesthetically pleasing dinnerware, underscoring its crucial role in creating memorable guest experiences. The benefits of ceramic dinnerware extend beyond mere utilitarian purposes; it offers significant aesthetic value as a key component of interior décor, can subtly encourage healthier eating habits through thoughtful portioning, and provides excellent long-term value due to its inherent longevity and resistance to wear, all contributing to sustained market interest and the continuous evolution of this traditionally significant product category in the modern era.

Ceramic Dinnerware Market Executive Summary

The Ceramic Dinnerware Market is currently navigating a period of significant transformation, characterized by compelling business trends that are reshaping consumer expectations and operational paradigms. A prominent trend is the pervasive drive towards premiumization, wherein consumers are increasingly willing to invest in dinnerware that transcends basic functionality, prioritizing pieces that embody sophisticated design, superior craftsmanship, and robust durability. This shift is fueling demand for artisanal, designer, and sustainably produced ceramic items, reflecting a growing consumer consciousness about product origins and environmental impact. Simultaneously, the digital transformation of retail is profoundly impacting market dynamics, with e-commerce platforms emerging as pivotal channels for market expansion. These platforms offer brands unprecedented direct access to a global consumer base, facilitate the penetration of niche markets, and enable highly targeted marketing campaigns. Furthermore, strategic partnerships between ceramic manufacturers and renowned designers, coupled with continuous investments in advanced manufacturing technologies, are fostering significant product differentiation. These collaborations and technological integrations are not only optimizing production processes but also empowering companies to meet the rapidly evolving consumer demand for both exceptional quality and ethically produced goods, thereby securing a competitive advantage and expanding market share within an increasingly fragmented and dynamic landscape.

Concurrently, distinct regional and segmentation trends are providing nuanced insights into market behavior and future growth opportunities. The Asia Pacific region stands out as a dominant force, exhibiting robust and accelerated growth primarily driven by its rapid urbanization, a burgeoning middle class with increasing purchasing power, and a rapidly expanding hospitality sector across economic powerhouses like China, India, and Southeast Asian nations. This makes APAC an indispensable region for future market development, investment, and strategic expansion. In contrast, North America and Europe, while representing mature markets, continue to demonstrate consistent and steady demand, primarily propelled by prevalent lifestyle upgrades, evolving home décor trends, and the natural replacement cycle of existing dinnerware. Within these established markets, there is a pronounced preference for high-quality, durable, and branded products, often emphasizing heritage, artisanal craftsmanship, and sustainable attributes. Analysis of product segmentation reveals a sustained and growing preference for materials such as bone china and high-quality porcelain within the premium category, valued for their intrinsic elegance, delicate translucence, and exceptional durability. Simultaneously, stoneware and earthenware maintain widespread popularity for everyday use, lauded for their versatility, resilience, and often rustic aesthetic appeal. The commercial segment, particularly the HoReCa sector, remains an enduring and substantial revenue contributor, consistently seeking dinnerware solutions that seamlessly blend aesthetic sophistication with operational robustness, capable of withstanding intensive daily use. This comprehensive overview of market trends underscores the diverse and multifaceted demand drivers that shape the global ceramic dinnerware industry.

AI Impact Analysis on Ceramic Dinnerware Market

The pervasive integration of Artificial Intelligence (AI) across various industrial sectors is now profoundly influencing the ceramic dinnerware market, directly addressing numerous user questions and industry concerns regarding efficiency, innovation, and sustainability. Consumers and businesses alike frequently inquire about how AI can effectively streamline complex manufacturing processes, enhance the aesthetic appeal of ceramic products, or contribute meaningfully to more eco-friendly and responsible production methodologies. The overarching themes derived from these common inquiries center on AI's transformative potential to revolutionize traditional practices, spanning from its capacity to accurately predict nascent consumer trends and enable highly personalized design options to optimizing raw material utilization, minimizing waste, and significantly improving quality control mechanisms. Stakeholders across the value chain are particularly keen to comprehend how AI technologies can be leveraged to substantially reduce product lead times, curtail operational costs, mitigate environmental impact, and ultimately create ceramic dinnerware that is not only visually captivating but also economically viable and environmentally conscientious. This collective curiosity underscores a broad expectation that AI will unlock unprecedented levels of innovation, foster operational excellence, and redefine competitive landscapes across the entire spectrum of ceramic dinnerware production, distribution, and consumption.

AI's expansive influence is extending deeply into critical areas such as comprehensive market research, advanced product development, and intricate supply chain management, offering unparalleled capabilities for data-driven decision-making and strategic foresight. By meticulously analyzing vast and complex datasets encompassing consumer preferences, prevailing social media trends, and intricate sales patterns, sophisticated AI algorithms can accurately predict future demand fluctuations and identify popular design aesthetics with remarkable precision. This predictive capability empowers ceramic manufacturers to produce highly relevant, desirable, and marketable products, thereby significantly reducing the risks associated with overproduction, mitigating inventory waste, and preventing market saturation. Furthermore, within the manufacturing environment, AI-powered systems are deployed to continuously monitor production lines for subtle defects, dynamically optimize kiln firing schedules to maximize energy efficiency, and manage intricate inventory levels with superior accuracy. These applications lead to substantial cost reductions, enhanced product consistency, and improved operational throughput. The remarkable ability of AI to rapidly simulate myriad design variations and explore diverse material properties also liberates designers, enabling them to experiment with greater freedom and creativity, thereby accelerating innovation cycles and facilitating the rapid introduction of novel, highly customized ceramic dinnerware collections to the global market, meeting bespoke consumer demands with unprecedented speed and efficiency.

- AI-driven predictive analytics for identifying emerging design trends, consumer preferences, and market demand fluctuations, optimizing product development and inventory management.

- Enhanced automation and robotics integration in manufacturing processes, including precision molding, automated glazing, high-speed decoration, and advanced quality control systems, significantly reducing manual labor, human error, and production costs.

- Optimized supply chain management through sophisticated AI algorithms that forecast demand with greater accuracy, manage intricate inventory levels across multiple warehouses, and streamline logistics and distribution networks, thereby minimizing waste, improving delivery times, and reducing operational inefficiencies.

- Personalized design and customization options facilitated by AI-powered platforms that enable consumers to co-create unique dinnerware sets by selecting specific shapes, patterns, and colors, catering to highly individualized tastes and market niches.

- Advanced material innovation and sustainability insights, with AI analyzing material properties to develop more eco-friendly ceramic compounds, optimize raw material utilization, and identify opportunities for waste reduction and recycling in production.

- Automated defect detection and quality assurance systems, utilizing computer vision and machine learning to identify even microscopic imperfections during various stages of production, ensuring consistent product quality, reducing rejection rates, and enhancing brand reputation.

- Improved energy efficiency in kilns and manufacturing facilities through AI-driven process optimization, which precisely controls temperature and firing cycles, leading to substantial reductions in energy consumption, lower environmental impact, and decreased operational expenses.

- AI-powered market analysis for competitive intelligence, helping companies understand competitor strategies, pricing dynamics, and market positioning to inform their own strategic decisions.

- Development of smart ceramic dinnerware with integrated sensors for various applications, potentially enabled by AI for data processing and user interaction, though this is a nascent area.

DRO & Impact Forces Of Ceramic Dinnerware Market

The Ceramic Dinnerware Market's trajectory and competitive landscape are intricately molded by a dynamic interplay of Drivers, Restraints, and Opportunities, which collectively constitute the fundamental 'Impact Forces'. Significant drivers propelling market growth include the accelerating pace of global urbanization, which directly translates into an escalating demand for essential household goods and aesthetically pleasing dining solutions, particularly in increasingly dense urban living environments. Concurrently, the consistent rise in disposable incomes across both developed and rapidly developing economies empowers a broader segment of consumers to invest in higher-quality, design-focused, and often premium ceramic tableware, moving beyond mere functional utility to an emphasis on enriching their overall dining experiences. The robust and continuous expansion of the global hospitality sector, encompassing a vast network of hotels, restaurants, and cafes (HoReCa), further acts as a pivotal demand generator. These establishments consistently require substantial quantities of durable, stylish, and high-performance ceramic dinnerware, necessitating frequent bulk purchases and regular replacements to maintain service standards and aesthetic appeal. Moreover, evolving consumer lifestyles, coupled with the pervasive influence of social media trends emphasizing home entertaining and aesthetically pleasing food presentation, are increasingly motivating consumers to upgrade their dinnerware collections, thereby enhancing their culinary experiences and facilitating visual sharing, adding another layer to the demand drivers.

However, the market is not without its significant restraints, posing challenges to sustained growth. Foremost among these is the inherent volatility in the prices of critical raw materials, such as various types of clay, feldspar, and silica. Fluctuations in these commodity prices can directly impact manufacturing costs, subsequently influencing final product pricing and potentially affecting consumer affordability and market demand. Another formidable restraint stems from intense competition from a diverse array of alternative materials, including glass, melamine, stainless steel, and even bamboo-based products, each offering distinct advantages in terms of durability, weight, price point, or perceived eco-friendliness. The intrinsic fragility of ceramic dinnerware, making it susceptible to breakages during transportation, handling, or regular use, contributes to significant replacement costs for both consumers and commercial establishments, and can lead to customer dissatisfaction. Despite these considerable challenges, the market is replete with promising opportunities. The exponential expansion of e-commerce platforms represents a transformative avenue, offering ceramic dinnerware manufacturers direct access to an exponentially wider global customer base, circumventing traditional distribution complexities and lowering market entry barriers for smaller brands. The burgeoning trend towards customization and personalization, allowing consumers to design bespoke dinnerware sets tailored to their unique tastes and preferences, provides a significant avenue for product differentiation, value addition, and enhanced consumer engagement. Furthermore, growing global consumer awareness and a pronounced preference for sustainable and eco-friendly products are compelling manufacturers to innovate in green production methods, utilize recycled content, and develop biodegradable packaging. This shift opens up lucrative new market segments and substantially bolsters the brand image of forward-thinking companies committed to environmental stewardship. These dynamic and often conflicting forces necessitate agile strategic adaptation, continuous innovation, and resilient business models from all market participants to ensure sustained growth and maintain a competitive edge in the evolving global ceramic dinnerware landscape.

Segmentation Analysis

The Ceramic Dinnerware Market is meticulously segmented to provide a granular and comprehensive understanding of its diverse landscape, offering critical insights into various product categories, prevalent consumer preferences, and the intricate web of distribution channels that collectively shape its dynamics and drive market evolution. This detailed analytical approach is indispensable for stakeholders, enabling them to precisely identify high-potential lucrative niches, formulate highly targeted and effective marketing strategies, and optimize their product development efforts to align seamlessly with specific end-user demands across different geographical and demographic cohorts. The market is primarily delineated by several key criteria: material type, which inherently dictates the aesthetic qualities, durability attributes, and price positioning of the dinnerware; application, distinguishing clearly between residential household use and the rigorous requirements of commercial enterprises; and distribution channel, which elucidates the myriad pathways through which finished products effectively reach the ultimate consumer. Each of these defined segments exhibits distinct growth patterns, unique demand drivers, and its own competitive landscape, accurately reflecting the diverse global consumption habits, cultural nuances, and specific industry requirements prevalent in the ceramic dinnerware industry.

A profound understanding of these detailed segmentations is absolutely crucial for both manufacturers and retailers striving to strategically position their products for maximum market penetration and sustained success. For instance, an in-depth analysis of the material segment provides invaluable insights into prevailing consumer preferences for the delicate translucence, exceptional strength, and refined elegance of bone china, juxtaposed against the rustic charm, artisanal appeal, and robust nature of stoneware, or the classic sophistication and versatile applications of high-fired porcelain. The application segment, on the other hand, starkly reveals the differing demands and performance expectations between a typical household setting, which prioritizes aesthetic appeal and everyday functionality, versus the demanding, high-volume environment of a bustling commercial restaurant, which necessitates superior durability, chip resistance, and operational efficiency. Similarly, a meticulous examination of the distribution channel analysis illuminates the accelerating importance and growing dominance of online retail and e-commerce platforms, which are increasingly complementing and sometimes even supplanting traditional brick-and-mortar stores, specialty boutiques, and department stores. This granular and multifaceted view of the market empowers companies to precisely tailor their product offerings, ranging from cost-effective, durable earthenware suitable for daily casual dining to exquisitely crafted, premium porcelain sets designed for fine dining and formal occasions. Such precise market intelligence ensures unparalleled market relevance, facilitates agile strategic decision-making, and optimizes resource allocation across the entire comprehensive value chain of the ceramic dinnerware industry.

- By Material:

- Porcelain: Valued for its delicate appearance, high strength, translucency, and non-porous surface, ideal for fine dining and premium segments.

- Stoneware: Known for its earthy, rustic aesthetic, excellent durability, chip resistance, and versatility for everyday and casual use.

- Bone China: Renowned for its exceptional whiteness, strength, lightness, and elegant translucency, considered a luxury dinnerware material.

- Earthenware: Characterized by its porous nature and often thicker, heavier feel; frequently glazed for functionality, popular for its handcrafted look and affordability.

- Others (e.g., Dolomite, Vitrified Ceramic, Faience, Majolica): Encompassing various other ceramic compositions and historical styles catering to specific aesthetic or functional niches.

- By Application:

- Residential: Includes dinnerware purchased for household use, daily meals, special occasions, home décor, and gifting purposes, driven by personal aesthetics and lifestyle.

- Commercial:

- Hotels, Restaurants, & Cafes (HoReCa): Demands high-durability, chip-resistant, stackable, and aesthetically consistent dinnerware for intensive daily use in professional environments.

- Institutional (e.g., Hospitals, Schools, Corporate Canteens): Requires robust, hygienic, and often standardized dinnerware solutions for large-scale catering and specific functional needs.

- Catering Services: Needs portable, durable, and often elegant dinnerware for events and off-site dining experiences, balancing aesthetics with logistical considerations.

- By Distribution Channel:

- Supermarkets & Hypermarkets: Mass-market retail outlets offering a wide range of affordable to mid-range ceramic dinnerware, emphasizing convenience and competitive pricing.

- Specialty Stores: Focus on niche markets, premium brands, artisanal products, or specific design aesthetics, offering personalized service and unique collections.

- Online Retail (E-commerce): Rapidly growing channel providing vast product selection, competitive pricing, convenience, and direct-to-consumer sales for global reach.

- Department Stores: Offers a curated selection of mid-to-high-end dinnerware, often featuring established brands and seasonal collections, providing a complete shopping experience.

- Others (e.g., Direct Sales from Manufacturers, Wholesalers, Exclusive Boutiques): Includes diverse channels for specific B2B or luxury segments, focusing on direct engagement or bulk supply.

Value Chain Analysis For Ceramic Dinnerware Market

The value chain for the Ceramic Dinnerware Market represents a highly integrated and intricate network of activities, systematically spanning from the foundational stages of raw material extraction and processing through to the eventual acquisition and utilization by the final consumer. This comprehensive chain incorporates several critical stages, each contributing distinct value to the evolution of the ceramic dinnerware product. It rigorously commences with upstream activities, which are inherently capital-intensive and involve the meticulous sourcing, extraction, and precise processing of essential raw materials. These include various specialized types of clay, such as kaolin and ball clay, along with vital minerals like feldspar, silica, alumina, and other inorganic compounds, all indispensable for achieving the desired composition and properties of ceramic bodies. This initial stage demands substantial investment in advanced mining operations, sophisticated purification technologies, and precision grinding facilities to ensure that materials meet the exact specifications required for high-quality dinnerware manufacturing. The efficiency, purity, and consistency achieved at this fundamental level are paramount, directly influencing the final product's physical characteristics, aesthetic appeal, durability, and ultimately, its cost-effectiveness. Therefore, robust management of upstream suppliers, encompassing stringent quality control and ensuring a stable, sustainable supply of high-grade raw materials, is absolutely critical for maintaining consistent production quality, mitigating supply chain vulnerabilities, and securing a competitive advantage in the market.

Progressing downstream along the value chain, the subsequent stages encompass the core manufacturing processes, which involve the intricate artistry and precision engineering of shaping, glazing, firing, and decorating the individual ceramic pieces. This phase often leverages a sophisticated blend of traditional craftsmanship and advanced industrial machinery, including automated presses, robotic glazing lines, and high-efficiency kilns, to achieve consistent quality and scale. Following the meticulous production, the finished ceramic dinnerware products are then channeled through diverse distribution networks, which can be broadly categorized into direct and indirect routes. Direct channels offer manufacturers complete control over their brand image, pricing strategies, and customer engagement, typically involving sales through proprietary branded stores, dedicated showrooms, or increasingly dominant direct-to-consumer (D2C) e-commerce platforms. Conversely, indirect channels are more extensive and multifaceted, utilizing a broad spectrum of intermediaries such as large-scale wholesalers, regional distributors, expansive hypermarkets and supermarkets, specialized home goods retailers, prestigious department stores, and versatile online marketplaces, all aimed at achieving broader market penetration and reaching a diverse customer base. Each intermediary within this complex distribution ecosystem adds incremental value through specialized logistical services, effective merchandising, localized marketing efforts, and direct customer support. The strategic optimization of this entire network, particularly the discerning selection of appropriate distribution partners, the implementation of efficient inventory management systems, and the agile management of global logistics, is unequivocally crucial for maximizing market reach, enhancing cost efficiency, and ultimately ensuring profound consumer satisfaction within the intensely competitive global ceramic dinnerware industry.

Ceramic Dinnerware Market Potential Customers

The Ceramic Dinnerware Market caters to an exceptionally broad and multifaceted spectrum of potential customers, encompassing everyone from individual households to extensive commercial and institutional enterprises, each characterized by their distinct purchasing motivations, specific needs, and varying behavioral patterns. Residential consumers constitute a singularly significant and foundational segment, comprising individuals, nuclear families, and extended households who acquire dinnerware for a myriad of purposes, including routine daily meals, festive special occasions, thoughtful gifting, or as integral components of their broader home décor schemes. This substantial segment's purchasing decisions are primarily influenced by a dynamic interplay of evolving lifestyle trends, prevailing disposable income levels, household size, and deeply ingrained aesthetic preferences, with a discernible and growing demand for products that are not only durable and visually appealing but also increasingly aligned with eco-friendly and sustainable principles. These discerning consumers actively seek dinnerware that authentically reflects their personal style, enhances the overall ambiance of their dining spaces, and elevates their culinary experiences. Consequently, marketing strategies meticulously tailored for this segment often prioritize brand reputation, showcase cutting-edge design innovation, highlight superior material quality, and emphasize the perceived long-term value and aspirational aspects of the products.

On the commercial front, the array of potential customers is equally vast and critically important, predominantly featuring the extensive global hospitality sector. This vital segment encompasses hotels of varying star ratings, diverse restaurants from casual eateries to fine-dining establishments, bustling cafes, and specialized catering services, alongside significant institutional buyers such as corporate canteens, healthcare facilities (hospitals), and educational institutions (schools). These commercial entities possess distinct and rigorous requirements, prioritizing dinnerware that demonstrates exceptional durability, superior chip resistance, efficient stackability for operational convenience, and effortless ease of cleaning, all while maintaining an aesthetic appeal that seamlessly aligns with their unique brand image and demanding operational schedules. For this segment, factors such as the ability to withstand industrial dishwashers, consistent product availability, and adherence to specific design and functional specifications are paramount. Bulk purchasing, the establishment of robust long-term supply contracts, and the assurance of consistent quality and supply chain reliability are common and expected characteristics of transactions within this demanding sector. Furthermore, with the contemporary rise of corporate gifting initiatives, promotional events, and sophisticated event planning, businesses and various organization

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 18.5 Billion |

| Market Forecast in 2033 | USD 27.3 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Villeroy & Boch, Wedgewood (Fiskars Group), Lenox Corporation, Noritake Co., Limited, Royal Doulton (Fiskars Group), Churchill China plc, Corelle Brands LLC (Instant Brands), BHS tabletop AG, Rosenthal GmbH, KAHLA/Thüringen Porzellan GmbH, Portmeirion Group PLC, F. Schumacher & Co., Homer Laughlin China Company, Dudson Ltd., Mikasa (Lifetime Brands), Dinnerware Company, Denby Pottery, Steelite International, Rak Porcelain, World Kitchen (Corelle Brands) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ceramic Dinnerware Market Key Technology Landscape

The Ceramic Dinnerware Market is undergoing continuous evolution, rigorously propelled by relentless advancements in manufacturing technologies and innovative material science, all fundamentally aimed at comprehensively enhancing product quality, optimizing operational efficiency, expanding design flexibility, and significantly bolstering environmental sustainability across the entire production cycle. Pivotal technological innovations are systematically integrated throughout the complete manufacturing journey, commencing from the meticulous preparation of raw materials to the final, intricate stages of firing and decoration. Advanced milling and sophisticated purification techniques applied to various clays and minerals are now ensuring the production of exceptionally finer particles and more homogeneous mixtures, which in turn leads to the creation of ceramic bodies that exhibit superior strength, greater uniformity, and reduced susceptibility to defects. The development and widespread adoption of sophisticated molding technologies, including highly precise pressure casting and advanced isostatic pressing, enable manufacturers to create exceptionally intricate shapes and achieve remarkably thinner profiles with unparalleled accuracy and significantly reduced material waste. These innovations are instrumental in the production of lightweight yet robust dinnerware, catering to modern consumer preferences for elegant and durable designs. Furthermore, the pervasive integration of automation and advanced robotics is increasingly evident in various critical stages of production, such as automated handling of delicate pieces, uniform glazing application, and stringent quality control inspections, which not only dramatically boosts overall productivity but also ensures an unparalleled level of product consistency, significantly minimizes human error, and effectively reduces labor-related costs.

Moreover, substantial technological breakthroughs have been achieved in the realm of firing techniques, with the widespread adoption of highly energy-efficient kilns, including continuous kilns and advanced fast-firing kilns. These cutting-edge systems are engineered to operate at considerably lower energy consumption rates while simultaneously achieving optimal material vitrification, thereby making significant contributions to reducing the overall carbon footprint of manufacturing operations and substantially decreasing operational expenses. Innovations in glaze formulation technologies have also yielded remarkable progress, resulting in the development of glazes that are not only more durable and highly scratch-resistant but also completely non-porous, exceptionally food-safe, and offer an expanded spectrum of vibrant colors and sophisticated finishes. This allows for greater creative freedom and product differentiation. Furthermore, digital printing and advanced decal application technologies have fundamentally revolutionized the decoration process, enabling the precise application of high-resolution, intricate, and highly customized designs both economically and with remarkable efficiency. This technological leap has opened up entirely new avenues for personalized and trend-driven dinnerware collections, catering to bespoke consumer demands and rapidly changing market aesthetics. These collective and synergistic technological advancements empower ceramic dinnerware manufacturers to meet and exceed escalating consumer demands for superior aesthetic appeal, exceptional functional performance, unwavering durability, and increasingly, environmentally conscious and sustainable products, thereby maintaining and strengthening their competitiveness in an intensely globalized and rapidly evolving market landscape.

Regional Highlights

- Asia Pacific (APAC): The Asia Pacific region stands as the undisputed leader in the global ceramic dinnerware market, demonstrating unparalleled dominance and experiencing rapid, sustained growth. This surge is fueled by a potent combination of accelerating urbanization, which leads to a dramatic increase in household formation and a subsequent rise in demand for home furnishings; steadily rising disposable incomes across key economies like China, India, Japan, and the dynamic Southeast Asian nations, empowering consumers to invest in quality and designer dinnerware; and the exponential expansion of the region's hospitality and tourism sectors. APAC is not only a colossal consumer market but also a preeminent manufacturing hub, benefiting significantly from its abundant access to raw materials, highly skilled labor, and efficient production infrastructures. This dual role supports both robust domestic consumption and substantial exports to global markets, making it a critical strategic focus for international players seeking growth opportunities and market expansion.

- North America: Representing a mature yet highly dynamic market, North America exhibits consistent demand for ceramic dinnerware, characterized by a sophisticated consumer base that places significant emphasis on product quality, brand heritage, and design aesthetics. Market propulsion in this region is driven by prevalent lifestyle upgrades, a strong focus on home renovation and interior design trends, and the natural replacement cycle of existing dinnerware sets. There is a discernible and growing preference among North American consumers for premium, durable, and aesthetically appealing dinnerware, often influenced by European designs and a rising awareness regarding sustainable and ethically produced goods. E-commerce penetration is exceptionally high, providing brands with efficient direct-to-consumer channels, while the commercial sector, particularly fine dining and casual restaurants, remains a stable and substantial source of demand for high-performance tableware.

- Europe: Europe holds a strong and influential position in the ceramic dinnerware market, boasting a rich heritage in ceramic manufacturing, particularly in renowned countries like Germany, France, Italy, and the UK. The region is celebrated for its unwavering emphasis on superior craftsmanship, innovative and timeless design, and the use of high-quality, often locally sourced, materials. Consumer demand in Europe is stable and sophisticated, with a strong cultural appreciation for tableware that combines functionality with artistic merit. There is a pronounced focus on sustainable production methods, adherence to stringent environmental regulations, and a preference for classic, enduring designs, often complemented by vibrant niche markets for artisanal, bespoke, and collectible ceramic products. The HoReCa sector maintains robust demand for durable and aesthetically matching sets, underscoring the region's commitment to culinary excellence and dining experience.

- Latin America: The Latin American ceramic dinnerware market exhibits moderate yet promising growth, intrinsically linked to the region's varying degrees of economic stability and ongoing urbanization trends. Major economies such as Brazil, Mexico, and Argentina represent key markets within the region, demonstrating an increasing demand for both highly functional and decoratively appealing dinnerware. While the market remains somewhat sensitive to broader macroeconomic fluctuations and currency volatility, it concurrently presents significant opportunities, particularly for manufacturers and retailers offering aesthetically pleasing, durable, and affordably priced products that cater to a growing middle-class demographic. Cultural factors and family-centric dining traditions often influence purchasing patterns, leading to a demand for larger sets and designs that resonate with local aesthetics and traditions.

- Middle East and Africa (MEA): The Middle East and Africa represent an emerging market with considerable growth potential in the ceramic dinnerware sector. This potential is primarily driven by rapidly increasing tourism activities, extensive hospitality infrastructure development, and steadily rising household incomes across the affluent Gulf Cooperation Council (GCC) countries. The region's growing expatriate population also contributes to diversifying demand patterns. Cultural preferences play a substantial role in dictating design choices, material types, and patterns, creating unique demand segments for specific types of dinnerware that align with traditional and contemporary regional aesthetics. Investment in luxury hotels and fine dining establishments further stimulates the high-end segment, while improving retail infrastructure supports broader market penetration.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ceramic Dinnerware Market.- Villeroy & Boch

- Wedgewood (Fiskars Group)

- Lenox Corporation

- Noritake Co., Limited

- Royal Doulton (Fiskars Group)

- Churchill China plc

- Corelle Brands LLC (Instant Brands)

- BHS tabletop AG

- Rosenthal GmbH

- KAHLA/Thüringen Porzellan GmbH

- Portmeirion Group PLC

- F. Schumacher & Co.

- Homer Laughlin China Company

- Dudson Ltd.

- Mikasa (Lifetime Brands)

- Dinnerware Company

- Denby Pottery

- Steelite International

- Rak Porcelain

- World Kitchen (Corelle Brands)

Frequently Asked Questions

Analyze common user questions about the Ceramic Dinnerware market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate and market value of the Ceramic Dinnerware Market?

The Ceramic Dinnerware Market is projected to experience a robust growth at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. This consistent expansion is expected to elevate the market's value from an estimated USD 18.5 Billion in 2026 to a projected USD 27.3 Billion by the conclusion of the forecast period in 2033. This trajectory is underpinned by significant global macroeconomic and demographic shifts that continue to drive demand across diverse sectors.

What are the primary factors driving the demand for ceramic dinnerware across global markets?

The demand for ceramic dinnerware is primarily propelled by several key factors. These include accelerating global urbanization, which leads to increased household formation and consumer needs for home essentials; rising disposable incomes in both developing and developed economies, empowering consumers to invest in quality and premium tableware; and the robust, continuous expansion of the global hospitality sector (HoReCa), which consistently requires durable, aesthetically appealing, and high-performance dinnerware in substantial quantities to meet operational and guest experience demands.

How is the Ceramic Dinnerware Market typically segmented for analysis?

The Ceramic Dinnerware Market is comprehensively segmented for detailed analysis primarily based on three critical criteria: material type, application, and distribution channel. Material segmentation includes categories like Porcelain, Stoneware, Bone China, and Earthenware. Application segmentation differentiates between Residential use and various Commercial uses, such as Hotels, Restaurants, & Cafes (HoReCa), Institutional settings, and Catering Services. Distribution channel segmentation covers Supermarkets & Hypermarkets, Specialty Stores, Online Retail (E-commerce), and Department Stores, reflecting varied consumer purchasing pathways and market reach strategies.

What is the observed impact of Artificial Intelligence (AI) on the ceramic dinnerware industry?

Artificial Intelligence (AI) is significantly impacting the ceramic dinnerware industry by revolutionizing several key areas. Its influence is evident in AI-driven predictive analytics for identifying emerging design trends and consumer preferences, optimizing manufacturing processes for enhanced efficiency and precise quality control, and streamlining complex supply chain management. AI also facilitates personalized design and customization options for consumers, contributes to material innovation for greater sustainability, and improves operational energy efficiency, thereby leading to more innovative, cost-effective, and environmentally responsible products throughout the value chain.

Which geographical region is anticipated to exhibit the most significant growth in the Ceramic Dinnerware Market?

The Asia Pacific (APAC) region is anticipated to demonstrate the most significant and accelerated growth in the Ceramic Dinnerware Market. This is primarily attributed to a confluence of factors, including its burgeoning middle-class population with increasing purchasing power, rapid urbanization, and the substantial growth of its hospitality and tourism sectors, particularly in economic powerhouses like China, India, and various Southeast Asian nations. APAC also functions as a major global manufacturing hub, further solidifying its dominant position in the market.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager