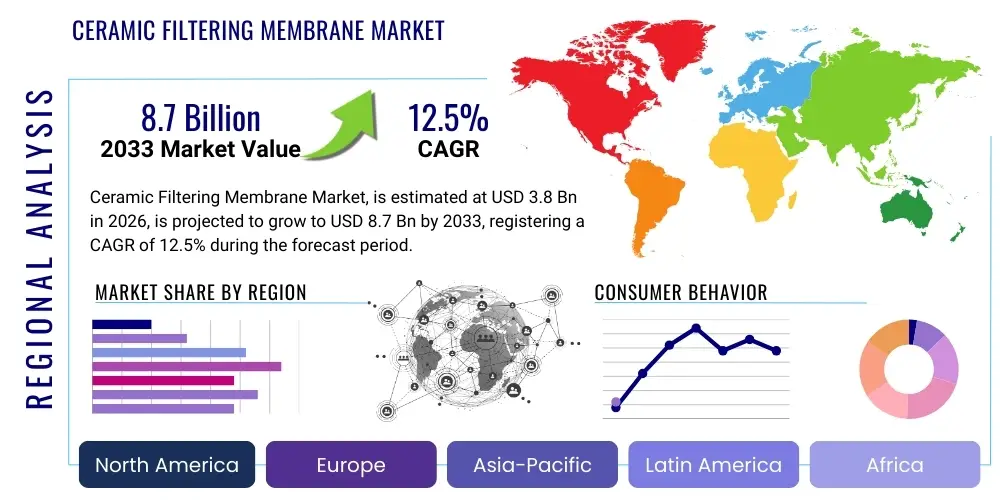

Ceramic Filtering Membrane Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436758 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Ceramic Filtering Membrane Market Size

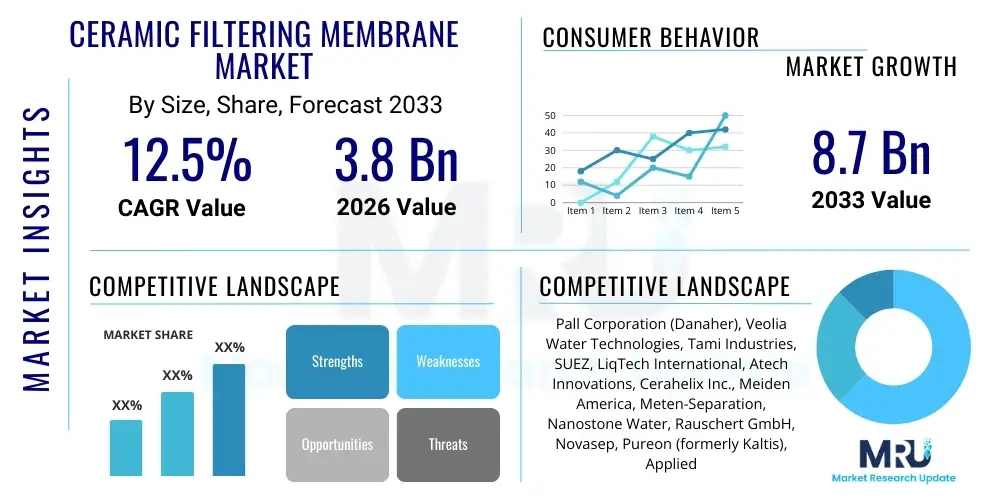

The Ceramic Filtering Membrane Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at USD 3.8 Billion in 2026 and is projected to reach USD 8.7 Billion by the end of the forecast period in 2033.

Ceramic Filtering Membrane Market introduction

The Ceramic Filtering Membrane Market encompasses advanced separation technologies utilizing inorganic materials, primarily metal oxides such as alumina, zirconia, and titania, fabricated into porous structures. These membranes are distinguished by their exceptional thermal stability, chemical resistance, and mechanical strength, making them ideal for stringent filtration applications across various industrial sectors. Unlike polymeric membranes, ceramic counterparts can withstand extreme operating conditions, including high temperatures, aggressive chemical environments, and high pressures, significantly extending their operational lifespan and reducing maintenance frequency. This inherent resilience positions them as critical components in demanding purification and separation processes where reliability is paramount, particularly in sectors focused on sustainable resource management and high-purity product manufacturing. The technological maturity and proven robustness of ceramic membranes drive their increasing adoption as industries seek sustainable, long-term filtration solutions.

The core application areas of ceramic filtering membranes span critical processes such as water purification, industrial wastewater treatment, food and beverage processing, chemical synthesis, and pharmaceutical manufacturing. In water treatment, these membranes efficiently remove suspended solids, bacteria, and viruses, ensuring compliance with stringent regulatory standards for potable water and industrial discharge. Within the food and beverage industry, they are essential for clarifying juices, sterilizing beverages, and concentrating dairy proteins, offering superior sanitation capabilities due to their ability to be chemically and thermally cleaned (Clean-in-Place or CIP). Their non-toxic nature and minimal fouling characteristics ensure product integrity and process efficiency, providing a clear competitive advantage over traditional separation methods.

Major driving factors fueling market expansion include the global imperative for improved water quality, rapidly increasing industrialization in developing economies, and the stringent regulatory frameworks governing environmental protection and food safety. The need for advanced separation technologies capable of treating complex industrial effluents and achieving zero liquid discharge (ZLD) mandates the use of durable ceramic membranes. Furthermore, continuous technological advancements in membrane fabrication, resulting in finer pore sizes (down to nanofiltration range) and enhanced permeability, broaden their applicability in high-value sectors like biotechnology and pharmaceutical purification. Government investments in sustainable infrastructure and water recycling initiatives further solidify the long-term growth trajectory of this specialized market segment.

Ceramic Filtering Membrane Market Executive Summary

The Ceramic Filtering Membrane Market is experiencing robust growth driven by accelerating industrial water recycling mandates and sustained innovation in material science. Key business trends indicate a strong shift towards optimizing membrane manufacturing processes to reduce production costs, thereby increasing competitiveness against traditional polymeric alternatives. Leading manufacturers are focusing on developing composite ceramic membranes and integrating automated cleaning systems to enhance flux stability and minimize downtime. Geographically, Asia Pacific remains the dominant growth engine, fueled by rapid urbanization, massive infrastructure projects focused on wastewater management, and expanding pharmaceutical and chemical manufacturing sectors in countries like China and India. Strategic mergers and acquisitions aimed at consolidating specialized filtration expertise and expanding regional distribution networks characterize the current competitive landscape.

Regional trends highlight differing adoption rates based on water stress and regulatory stringency. North America and Europe are characterized by high implementation rates of ceramic membranes in high-end applications, particularly in microfiltration and ultrafiltration for biotechnology and dairy processing, owing to strict quality control standards. In contrast, emerging markets in Latin America and the Middle East & Africa (MEA) are witnessing increased demand primarily for bulk water treatment and industrial effluent polishing, often driven by government tender processes favoring highly durable, long-life assets. The adoption pattern globally suggests that mature markets prioritize high purity and low operating expenditure (OPEX), while developing markets emphasize capital expenditure (CAPEX) efficiency and ruggedness in challenging industrial environments.

Segment trends underscore the rising prominence of the ultrafiltration segment due to its versatility in handling complex feed streams, particularly in oil/water separation and protein fractionation. By material, alumina membranes continue to hold the largest market share due to their cost-effectiveness and proven performance history, although titania and zirconia membranes are gaining traction rapidly in applications requiring extreme chemical stability (e.g., highly acidic or alkaline streams). The food and beverage application segment is projected to exhibit the highest CAGR, propelled by the global demand for aseptic processing and the enhanced separation efficiency required for functional ingredients and specialized dairy products. Innovation is segment-specific, with multi-channel elements dominating industrial usage for high throughput requirements.

AI Impact Analysis on Ceramic Filtering Membrane Market

Common user questions regarding AI's impact on the Ceramic Filtering Membrane Market center on how artificial intelligence can improve operational efficiency, extend membrane life, and optimize cleaning cycles. Users are particularly concerned about the feasibility of integrating predictive maintenance models with existing sensor infrastructure and whether AI can accurately model fouling kinetics under variable feed conditions. There is high expectation that AI will transition membrane filtration from reactive maintenance to proactive, data-driven optimization. Key themes revolve around enhanced process control, autonomous system operation, and the utilization of machine learning algorithms to analyze complex filtration data patterns for real-time adjustments, ultimately aiming to maximize membrane productivity (flux) while minimizing energy consumption and chemical usage for cleaning cycles.

The integration of AI and Machine Learning (ML) algorithms is poised to revolutionize the operation and maintenance of ceramic membrane systems, moving beyond basic automation towards intelligent, self-optimizing filtration plants. AI models can process vast amounts of data gathered from pressure transducers, flow meters, temperature sensors, and analytical instruments to precisely identify the onset of fouling, determining the optimal moment and intensity required for backwashing or chemical cleaning. This predictive capability significantly reduces the unnecessary wear caused by scheduled, overly conservative cleaning routines and ensures that energy is only expended when required, thereby lowering OPEX and extending the membrane's physical service life. Such optimization is critical in applications like tertiary wastewater treatment where feed water quality can fluctuate significantly.

Furthermore, AI-driven process modeling is influencing the R&D and manufacturing phases of ceramic membranes. Generative design techniques coupled with ML are being used to simulate and optimize membrane pore structure, porosity distribution, and channel geometry to enhance filtration efficiency and anti-fouling characteristics before physical production. This simulation reduces the dependence on lengthy, expensive laboratory testing cycles, accelerating the development of specialized membranes tailored for niche applications, such as high-viscosity fluid handling or selective molecular separation. The ability of AI to rapidly analyze material interaction dynamics under stress conditions promises faster material iteration and improvement in membrane durability and selectivity.

- AI enables predictive fouling detection and proactive maintenance scheduling, minimizing downtime.

- Machine Learning optimizes backwash and chemical cleaning cycles, significantly reducing energy and chemical consumption.

- AI-driven data analytics improve system performance monitoring and anomaly detection in real-time.

- ML models accelerate R&D by simulating optimal ceramic material compositions and pore structures.

- Integration of smart sensors and IoT creates autonomous filtration systems requiring minimal human intervention.

- Enhanced process modeling improves separation selectivity and overall flux performance across varying feed qualities.

DRO & Impact Forces Of Ceramic Filtering Membrane Market

The Ceramic Filtering Membrane Market dynamics are governed by a robust framework of Drivers, Restraints, and Opportunities (DRO), collectively shaping the competitive intensity and overall market trajectory. Key drivers include stringent global regulations mandating improved industrial effluent treatment and the increasing global scarcity of freshwater resources, which necessitate reliable water recycling technologies. These drivers are amplified by the inherent advantages of ceramic membranes—superior chemical resistance, thermal stability, and long lifespan—over traditional polymeric alternatives. However, the market faces significant restraints, primarily the high initial capital investment required for ceramic systems compared to polymeric setups and the perceived complexity of system integration, particularly in smaller operational footprints. The primary impact forces influencing adoption rates are the economic pressure to reduce long-term operating costs and the imperative of maximizing resource recovery (e.g., catalyst or protein recovery) in specialized process industries.

Opportunities for market expansion are substantial, driven by untapped potential in emerging high-growth applications such as oil and gas produced water treatment, specialized battery recycling processes, and the growth of the biotechnology sector requiring aseptic and chemically resistant separation media. The development of next-generation ceramic materials offering lower production costs and enhanced flux rates will further mitigate the current restraint of high CAPEX. Furthermore, strategic opportunities exist in coupling ceramic membranes with other advanced separation techniques (like electrocoagulation or advanced oxidation processes) to create synergistic hybrid systems capable of treating extremely complex waste streams, opening avenues for high-value contracts in heavy industry and environmental remediation.

The core impact forces manifest through shifts in technological standards and economic viability. The force of buyer power is increasing as end-users demand customized solutions that promise faster returns on investment, pressuring manufacturers to standardize components and reduce delivery timelines. Simultaneously, the threat of substitution remains moderate, primarily from high-performance polymeric membranes that are continually improving their tolerance limits. However, the intensity of rivalry is high, driven by technological differentiation and patent battles focused on membrane geometry (e.g., multi-channel vs. tubular). Overall, the positive momentum generated by environmental drivers and performance superiority outweighs the high initial cost restraint, leading to a net positive impact force propelling steady, high-CAGR growth.

Segmentation Analysis

The Ceramic Filtering Membrane Market is comprehensively segmented based on material type, membrane configuration (type), pore size, and end-use application. This segmentation provides clarity regarding the diverse technological requirements and tailored solutions needed across various industries. Material segmentation (alumina, zirconia, titania) reflects differences in chemical stability and temperature resistance required for specific chemical environments. Pore size dictates the filtration efficacy, ranging from microfiltration for coarse particulate removal to ultrafiltration and nanofiltration for molecular separation and virus reduction. Understanding these segments is crucial for manufacturers to align their product portfolios with evolving industrial demands, particularly those driven by stringent regulatory requirements for product purity and environmental discharge quality.

The application segmentation is particularly critical as it defines the primary revenue streams. Water and wastewater treatment constitute the dominant segment due to the sheer volume of global water processing required, encompassing municipal, industrial, and tertiary treatment phases. However, high-value segments like Food and Beverage and Pharmaceutical manufacturing, while smaller in volume, offer higher profit margins due to the need for advanced sterility and precise component separation. The configurations segment (tubular, flat sheet, multi-channel) relates directly to system design and throughput requirements; multi-channel designs are increasingly favored in large industrial installations for their high surface area density and efficient fluid dynamics, optimizing operational footprints.

Strategic growth depends heavily on excelling within high-growth sub-segments, notably ultrafiltration and nanofiltration, as industries increasingly require the separation of finer dissolved organic matter and specific salts or molecules. Market players are strategically investing in R&D to enhance the mechanical integrity and selectivity of these finer pore membranes. Furthermore, the cross-segmental integration of ceramic membranes, such as their use in membrane bioreactors (MBRs) within the wastewater treatment sector, further solidifies the need for robust segmentation analysis to track nuanced technological adoption and regional market preferences.

- By Material:

- Alumina (Al2O3)

- Zirconia (ZrO2)

- Titania (TiO2)

- Silicon Carbide (SiC)

- Others (Mixed Oxides, etc.)

- By Type/Configuration:

- Tubular Membranes

- Flat Sheet Membranes

- Multi-channel Elements

- Hollow Fiber (Emerging)

- By Pore Size:

- Microfiltration (MF)

- Ultrafiltration (UF)

- Nanofiltration (NF)

- By Application:

- Water and Wastewater Treatment

- Food & Beverage Processing (Dairy, Juices, Beer/Wine)

- Chemical Processing (Catalyst Recovery, Acid/Base Filtration)

- Pharmaceutical & Biotechnology (Sterile Filtration, Protein Fractionation)

- Oil & Gas (Produced Water Treatment, Emulsion Separation)

Value Chain Analysis For Ceramic Filtering Membrane Market

The value chain for the Ceramic Filtering Membrane Market begins with the upstream sourcing of high-purity raw materials, primarily specialized metal oxide powders such as alumina, zirconia, and titania. The quality and consistency of these precursors are crucial, as they directly influence the final membrane properties, including porosity, pore size distribution, and mechanical strength. Key activities in this stage involve powder synthesis, milling, and homogenization. The central stage involves complex membrane manufacturing processes, including extrusion, slip-casting, sintering (at extremely high temperatures, often exceeding 1,000°C), coating, and module assembly. Technological expertise and proprietary sintering techniques form the primary competitive advantage for manufacturers in this mid-stream segment, ensuring optimal performance characteristics and minimizing defects.

The distribution channel plays a critical role in connecting the specialized manufacturer with the diverse range of industrial end-users. Direct distribution is common for large, complex, custom-engineered projects, particularly in the water treatment and chemical processing sectors where installation, system integration, and post-sale technical support are mandatory. Manufacturers utilize highly skilled in-house engineering teams for direct sales and service. Indirect distribution, leveraging specialized distributors, engineering procurement and construction (EPC) firms, and local system integrators, is frequently used to reach smaller industrial clients or penetrate specific regional markets efficiently. EPC firms often act as crucial intermediaries, incorporating ceramic membrane systems into larger infrastructure projects.

Downstream activities focus on the installation, commissioning, operation, and maintenance of the filtration systems. These activities generate significant revenue through long-term service contracts, spare part sales (modules and gaskets), and provision of tailored cleaning chemicals. The end-users, or potential customers, represent the final link, deriving value through enhanced product quality, reduced waste generation, compliance with environmental standards, and lower total cost of ownership (TCO) compared to traditional technologies. Efficiency in the downstream service provision, including rapid technical response and predictive maintenance capabilities, significantly influences customer loyalty and repeat business in this technology-intensive market.

Ceramic Filtering Membrane Market Potential Customers

The primary consumers and end-users of ceramic filtering membranes are large industrial entities and municipal authorities seeking high-performance, durable separation solutions in challenging operational environments. Municipal water treatment plants represent substantial potential customers, particularly those upgrading infrastructure to handle increasingly polluted source waters or implementing advanced tertiary treatment steps for water reuse and recycling. The inherent reliability of ceramic membranes against pH extremes and chemical shocks makes them highly desirable for continuous, large-scale municipal operations where system failure is unacceptable. These customers prioritize longevity, low maintenance requirements, and reliable pathogen removal capabilities.

Furthermore, major corporations in the Food and Beverage sector, especially global dairy processors, breweries, and nutraceutical manufacturers, are key customers. In these sectors, ceramic membranes are essential for achieving regulatory compliance for pasteurization substitutes (cold sterilization), concentration of valuable proteins (e.g., whey protein isolation), and juice clarification. The ability of ceramic membranes to withstand frequent high-temperature cleaning (steam sterilization or chemical CIP) without structural degradation is a non-negotiable requirement for maintaining stringent hygiene standards and ensuring product safety throughout the processing chain. This commitment to sanitation drives consistent demand from leading market players.

In the non-consumer industrial sphere, customers include chemical companies involved in catalyst recovery, petrochemical firms dealing with challenging oil-water emulsions, and pharmaceutical/biotechnology companies focused on fermentation broth clarification and cell harvesting. These customers are motivated by process efficiency, yield maximization, and the recovery of high-value components. For instance, in chemical synthesis, ceramic membranes offer an efficient method for separating expensive catalysts from reaction mixtures, facilitating their reuse and significantly reducing operational costs. The decision-making process for these high-value industrial buyers is typically technical, focusing heavily on proven pilot data, material compatibility, and long-term TCO metrics.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.8 Billion |

| Market Forecast in 2033 | USD 8.7 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Pall Corporation (Danaher), Veolia Water Technologies, Tami Industries, SUEZ, LiqTech International, Atech Innovations, Cerahelix Inc., Meiden America, Meten-Separation, Nanostone Water, Rauschert GmbH, Novasep, Pureon (formerly Kaltis), Applied Membrane Technology, Ceramic Membrane Systems Co., Ltd., OriginWater, Jiangsu Little Sun Filter Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ceramic Filtering Membrane Market Key Technology Landscape

The technological landscape of the Ceramic Filtering Membrane Market is characterized by continuous advancements aimed at improving membrane performance, durability, and cost-effectiveness. A fundamental technology used is the slip-casting and sintering process, where highly specialized ceramic slurries are formed into porous supports and then fired at high temperatures (often over 1,000°C) to create the robust, stable structure. Recent innovations focus heavily on optimizing the sintering profile to precisely control pore size distribution and porosity, critical factors determining both flux and selectivity. Furthermore, the development of asymmetric membranes, featuring a thin, selective top layer over a thicker, macroporous support layer, maximizes throughput while maintaining high separation efficiency. Advanced characterization tools, such as porosimetry and electron microscopy, are indispensable in quality control and R&D for these intricate structures.

A significant area of technological focus is the evolution from traditional single-oxide membranes (like pure alumina) to composite and hybrid ceramic structures, including Silicon Carbide (SiC) membranes. SiC membranes, though higher in cost, offer superior chemical resistance, exceptionally high flux rates, and excellent thermal conductivity, making them highly desirable for challenging applications such as high-temperature gas filtration and aggressive solvent treatment. Research is also progressing on developing stable ceramic nanofiltration (CNF) membranes capable of removing divalent ions and smaller organic molecules, bridging the performance gap historically dominated by polymeric NF membranes while maintaining the thermal and chemical stability of ceramic materials. This push towards finer separation limits is unlocking new opportunities in desalination pre-treatment and specialized pharmaceutical separation.

Furthermore, technological progress is evident in the module design and system integration aspects. Multi-channel tubular configurations are the industry standard for industrial applications, maximizing surface area density and reducing the system footprint. Innovations here include optimizing channel geometry for reduced pressure drop and enhanced turbulent flow characteristics, which minimizes surface fouling. Integration technologies now frequently involve advanced monitoring and control systems (often IoT-enabled) that utilize machine learning to manage optimal cross-flow velocity and automated backwashing cycles, maximizing uptime and reducing manual intervention. The convergence of material science, process engineering, and digital controls defines the competitive edge in the current market landscape.

Regional Highlights

- Asia Pacific (APAC): APAC represents the largest and fastest-growing regional market, primarily driven by massive infrastructure investments in China, India, and Southeast Asia focused on municipal and industrial wastewater recycling. Rapid industrialization, particularly in chemical processing, pharmaceuticals, and manufacturing, generates immense volumes of challenging effluents requiring robust filtration solutions. Government policies, such as China's rigorous "Water Ten Plan," enforce stringent discharge standards, creating mandatory demand for ceramic membrane systems. The region benefits from localized manufacturing capabilities, offering cost-competitive membrane elements that cater to large-scale, cost-sensitive projects.

- North America: This region is characterized by high adoption rates in high-value, specialized applications, including food and beverage (especially dairy and microbrewery sectors) and biotechnology. Strict regulatory requirements set by the FDA and EPA necessitate high-purity separation, favoring the use of chemically inert and thermally stable ceramic membranes. While the municipal water segment is mature, demand is steady, driven by infrastructure upgrades and the utilization of ceramic ultrafiltration for drinking water treatment in areas facing source water quality challenges. High R&D expenditure contributes to technological leadership in advanced membrane materials.

- Europe: Europe exhibits strong market growth spurred by pioneering efforts in implementing circular economy principles and sustainable water management. Countries like Germany, France, and the Netherlands show high deployment in industrial wastewater treatment aimed at achieving zero liquid discharge (ZLD) goals and maximizing resource recovery, particularly in the chemical and automotive industries. High energy costs in the region also favor ceramic membranes due to their lower maintenance and energy consumption over their long lifespan. Regulatory compliance with REACH and stringent pharmaceutical production standards drives specialized demand.

- Latin America (LATAM): The LATAM market is experiencing moderate growth, primarily centered on mining and petrochemical operations in countries like Brazil, Chile, and Mexico, where robust membranes are needed to handle highly contaminated or corrosive process waters. Adoption is often linked to large-scale resource extraction projects requiring reliable on-site water management. Price sensitivity remains a factor, but the durability benefits of ceramics are increasingly recognized in remote and demanding operational environments.

- Middle East & Africa (MEA): Growth in MEA is highly concentrated on desalination pre-treatment and produced water management in the oil and gas sector. The severe water scarcity issues across the Middle East necessitate advanced water recycling and reuse, providing a solid foundation for ceramic membrane deployment. Investment in mega-projects and sovereign wealth fund initiatives in the UAE and Saudi Arabia are driving the integration of cutting-edge filtration technology, despite initial cost barriers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ceramic Filtering Membrane Market.- Pall Corporation (Danaher)

- Veolia Water Technologies

- Tami Industries

- SUEZ

- LiqTech International

- Atech Innovations GmbH

- Cerahelix Inc.

- Meiden America, Inc.

- Meten-Separation

- Nanostone Water

- Rauschert GmbH

- Novasep

- Pureon (formerly Kaltis)

- Applied Membrane Technology

- Ceramic Membrane Systems Co., Ltd.

- OriginWater

- Jiangsu Little Sun Filter Co., Ltd.

- AQUA Industrial Waters

- Hengji Membrane Technology

- Fraunhofer IKTS

Frequently Asked Questions

Analyze common user questions about the Ceramic Filtering Membrane market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of ceramic membranes over polymeric membranes?

Ceramic membranes offer superior thermal stability, chemical resistance, mechanical strength, and longevity compared to polymeric membranes. They withstand high temperatures, aggressive cleaning agents (CIP), and extreme pH conditions, resulting in longer operational lifespans and lower total cost of ownership (TCO).

Which application segment holds the largest share in the Ceramic Filtering Membrane Market?

The Water and Wastewater Treatment segment currently holds the largest market share globally, driven by stringent environmental regulations and the necessity for robust, reliable solutions for municipal water treatment and industrial effluent recycling.

What is the main restraining factor affecting the widespread adoption of ceramic filtering membranes?

The primary restraint is the high initial capital expenditure (CAPEX) required for ceramic membrane systems and modules compared to the initial cost of polymeric membrane systems. However, this is often offset by significantly lower operating expenditures (OPEX) over the system's long lifecycle.

How is Asia Pacific dominating the Ceramic Filtering Membrane Market?

APAC dominates the market share and exhibits the fastest growth due to rapid industrialization, massive government investments in centralized water and wastewater infrastructure, and strict regulatory enforcement for industrial discharge in key economies like China and India.

Are ceramic nanofiltration (CNF) membranes commercially viable, and what are their typical uses?

Yes, CNF membranes are increasingly viable, offering stability superior to polymer-based NF. They are used in highly specialized tasks such as selective removal of multivalent ions, high-temperature solvent separation, and specific purification steps in the pharmaceutical and chemical industries.

What distinguishes Silicon Carbide (SiC) membranes from traditional alumina membranes?

SiC membranes offer enhanced chemical compatibility, exceptionally high flux rates, and superior thermal conductivity compared to standard alumina membranes. They are preferred for highly demanding, high-temperature, or aggressive chemical filtration processes, despite their higher material cost.

How does the integration of AI impact the operational efficiency of ceramic membrane systems?

AI integration improves operational efficiency by enabling predictive maintenance. It analyzes sensor data to optimize cleaning schedules (backwashing and CIP), thereby minimizing downtime, reducing chemical usage, saving energy, and extending the overall life of the membrane module.

What is the importance of the multi-channel configuration in ceramic membranes?

The multi-channel configuration is crucial for industrial high-throughput applications. It maximizes the membrane surface area packed within a single module, leading to higher filtration capacity (flux) and a smaller overall system footprint, which is beneficial for large-scale installations.

Which segment in the application category is anticipated to experience the highest growth rate?

The Food and Beverage processing segment is projected to show the highest Compound Annual Growth Rate (CAGR), driven by increasing global demand for high-purity aseptic processing, protein fractionation, and enhanced quality control in dairy and beverage manufacturing.

What is the role of Engineering Procurement and Construction (EPC) firms in the ceramic membrane value chain?

EPC firms act as critical intermediaries in the value chain, especially for large industrial or municipal projects. They integrate the specialized ceramic membrane systems into larger infrastructure builds, managing the procurement, engineering, and construction phases for end-users.

How do regulatory changes influence the market for ceramic filtering membranes?

Stricter environmental regulations worldwide, particularly those pertaining to industrial discharge quality and water reuse mandates (e.g., ZLD goals), are the primary market drivers. These regulations necessitate the adoption of robust separation technologies like ceramics to ensure compliance.

What is the typical lifespan of a ceramic filtering membrane compared to a polymeric membrane?

Ceramic membranes generally boast a significantly longer operational lifespan, often exceeding 10 years, whereas polymeric membranes typically require replacement every 3 to 5 years, contributing substantially to the lower long-term TCO of ceramic systems.

What are the two most critical technical properties influencing membrane selection?

The two most critical technical properties are Pore Size (determining the level of separation/selectivity needed, e.g., MF vs. UF) and Chemical Compatibility (ensuring the membrane material, such as zirconia or alumina, can withstand the pH and chemical composition of the feed stream and cleaning agents).

Beyond water treatment, where is titania (TiO2) based ceramic membrane highly utilized?

Titania-based membranes are highly utilized in applications requiring photocatalytic degradation. They offer both physical filtration and chemical oxidation capabilities when exposed to UV light, making them suitable for removing recalcitrant organic contaminants and specialized chemical purification.

What R&D efforts are currently focused on reducing the cost of ceramic membranes?

R&D is focused on optimizing manufacturing techniques, primarily through the use of less energy-intensive sintering processes, utilizing cheaper but equally effective precursor materials, and developing novel composite structures that reduce the amount of expensive ceramic material needed in the supporting layer.

Explain the concept of 'Zero Liquid Discharge' (ZLD) as it relates to ceramic membranes.

ZLD systems aim to treat and recycle all wastewater generated, leaving no liquid waste. Ceramic membranes, particularly in combination with high-pressure systems, are used as pre-treatment or concentration steps in ZLD processes due to their high resilience against high solid content and temperature variations typical of concentrated waste streams.

In what way does the pharmaceutical sector rely on ceramic membranes for critical processes?

The pharmaceutical sector relies on ceramic membranes for sterile filtration, protein fractionation, and clarification of fermentation broths. Their ability to be repeatedly steam-sterilized (autoclaved) or chemically sanitized without performance loss is essential for maintaining Good Manufacturing Practice (GMP) standards.

How is the threat of substitution by high-performance polymeric membranes addressed in the market?

While polymeric membranes improve, the ceramic market addresses this threat by focusing on niche, extreme applications (high heat, highly corrosive streams) where polymers inherently fail, and by innovating in cost reduction and enhanced anti-fouling designs to maximize the performance differential.

What role does upstream analysis play in the Ceramic Filtering Membrane value chain?

Upstream analysis focuses on securing the supply of high-purity raw materials (metal oxide powders). The quality of these precursors directly dictates the consistency, porosity, and performance of the final sintered membrane product, making quality control at this stage paramount.

Which geographical market segment is characterized by favoring highly customized, high-end filtration solutions?

North America and Europe are typically characterized by demanding markets favoring customized, high-end solutions, driven by rigorous product quality standards in biotechnology, pharmaceuticals, and specialized food processing sectors.

How do ceramic membranes contribute to resource recovery in the chemical industry?

In the chemical industry, ceramic membranes are effectively used for catalyst recovery and solvent purification. Their robust structure allows for efficient separation under harsh chemical conditions, enabling the reuse of expensive catalysts and maximizing process yields.

What technological advancement is bridging the gap between ceramic and polymeric membrane performance?

The advancement of Ceramic Nanofiltration (CNF) technology is bridging this gap, offering separation capabilities previously achievable only by polymeric NF membranes, but with the added benefits of ceramic robustness (thermal and chemical stability).

What is the significance of the Base Year 2025 in the market forecasting methodology?

The Base Year 2025 serves as the anchor point for market calculation. It represents the fully analyzed, most recent set of historical market data and metrics used as the foundation from which all future growth projections and CAGR calculations for the 2026-2033 forecast period are derived.

In the Oil and Gas sector, what is the key use case for ceramic membranes?

The key use case is the treatment of produced water—the large volume of highly contaminated water extracted during oil and gas operations. Ceramic membranes efficiently handle challenging oil-water emulsions and high solid loads prevalent in produced water streams prior to disposal or reuse.

What characteristic makes alumina the most widely used material by volume in the market?

Alumina (Al2O3) is the most widely used material primarily due to its proven performance, excellent mechanical stability, and relatively lower cost of production compared to specialized materials like zirconia or silicon carbide, making it suitable for large-scale municipal and industrial microfiltration.

How does the concept of Total Cost of Ownership (TCO) favor ceramic membranes?

TCO favors ceramic membranes because while their initial CAPEX is high, their exceptional longevity, resistance to fouling, lower need for chemical cleaning, and reduced frequency of replacement lead to significantly lower operating expenses (OPEX) over a 10+ year period.

What specific material is gaining rapid traction in the market due to its chemical stability in harsh environments?

Zirconia (ZrO2) is gaining rapid traction as it provides superior chemical stability, particularly in highly acidic or alkaline process streams where standard alumina membranes might degrade, making it essential for certain specialized chemical manufacturing applications.

What is the function of the macroporous support layer in an asymmetric ceramic membrane?

The macroporous support layer provides the necessary mechanical strength and rigidity to the membrane module. It supports the extremely thin, selective top layer, ensuring the membrane can withstand high operating pressures without collapsing, while minimizing resistance to fluid flow.

How do manufacturers mitigate the impact of the high initial investment restraint for ceramic systems?

Manufacturers mitigate this restraint by focusing on demonstrating superior life cycle costs (TCO), offering financing solutions, and emphasizing long-term system guarantees and service contracts that assure performance and lower eventual operational costs to the end-user.

What is the correlation between the global trend of resource scarcity and the ceramic membrane market growth?

The increasing global scarcity of freshwater drives demand for reliable water reuse and recycling technologies. Ceramic membranes, due to their robust performance in treating challenging wastewater, are crucial enablers of industrial and municipal water recycling initiatives, directly correlating scarcity with market growth.

What defines the difference between direct and indirect distribution channels in this market?

Direct distribution involves manufacturers handling sales, installation, and servicing for large, custom projects. Indirect distribution relies on third parties like specialized distributors and EPC firms to reach smaller clients and manage regional sales and system integration needs.

In the context of the ceramic membrane market, what is meant by "flux stability"?

Flux stability refers to the membrane's ability to maintain a consistent filtration rate (flux) over extended operational periods despite fouling or varying feed conditions. Ceramic membranes generally exhibit high flux stability due to their inert surface and efficient cleaning capabilities.

Which membrane pore size segment is responsible for the removal of bacteria and viruses in water treatment?

The Ultrafiltration (UF) segment, with pore sizes typically ranging from 0.01 to 0.1 micrometers, is highly effective and widely used for reliable removal of bacteria, viruses, and large colloidal particles in water purification and sterile processing applications.

How does the complexity of system integration act as a restraint in certain geographical markets?

The need for specialized expertise to integrate ceramic systems, including cross-flow configuration and automated cleaning loops, can be complex. In markets with limited specialized technical labor or smaller operational sizes, this complexity acts as a restraint favoring simpler, plug-and-play polymeric systems.

What technological innovation aids ceramic membranes in handling high-viscosity fluids?

Innovations in module geometry, specifically optimizing the design of multi-channel elements to promote high turbulence and reduce shear stress, are essential. This fluid dynamic optimization minimizes concentration polarization and fouling when filtering high-viscosity fluids, such as in food processing.

Why are ceramic membranes often preferred over polymeric options in the dairy industry?

The dairy industry requires frequent, rigorous sanitation (CIP and steam sterilization). Ceramic membranes are preferred because they withstand the harsh chemicals and high temperatures necessary for sterilization without degrading, preserving membrane integrity and hygiene standards.

How do the competitive forces within the value chain influence pricing in the mid-stream segment?

The mid-stream segment (manufacturing) faces high rivalry, leading to price pressure, especially for standard alumina modules. Manufacturers compete primarily through technological differentiation, patent protection on module design, and achieving economies of scale in sintering processes to drive down unit costs.

What is the forecasted CAGR for the Ceramic Filtering Membrane Market between 2026 and 2033?

The market is projected to grow at a robust Compound Annual Growth Rate (CAGR) of 12.5% during the forecast period from 2026 to 2033, driven by sustained industrial and environmental demand.

In R&D, what role does material simulation play in developing next-generation ceramic membranes?

Material simulation, often accelerated by AI/ML tools, plays a crucial role in predicting how changes in precursor composition, particle size, and sintering temperature will affect the final membrane's porosity, strength, and selectivity, significantly speeding up the product development cycle.

Which end-user category is typically characterized by focusing on maximizing the recovery of high-value components?

The Pharmaceutical and Biotechnology sectors, along with certain specialized Chemical Processing segments, are primary end-users focused on maximizing the recovery of high-value components such as specific proteins, therapeutic molecules, or expensive catalysts.

What primary characteristic defines the microfiltration pore size segment?

Microfiltration (MF) membranes are defined by their relatively large pore sizes (typically 0.1 to 10 micrometers) and are used primarily for the bulk removal of suspended solids, large bacteria, and coarse particulate matter from process streams.

What influence does the global trend towards Clean-in-Place (CIP) technology have on membrane selection?

The necessity for automated CIP protocols, often involving high-temperature or aggressive chemical cleaning, heavily favors ceramic membranes. Their material stability ensures they can endure these stringent cleaning routines repeatedly, which is critical for aseptic industries.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager