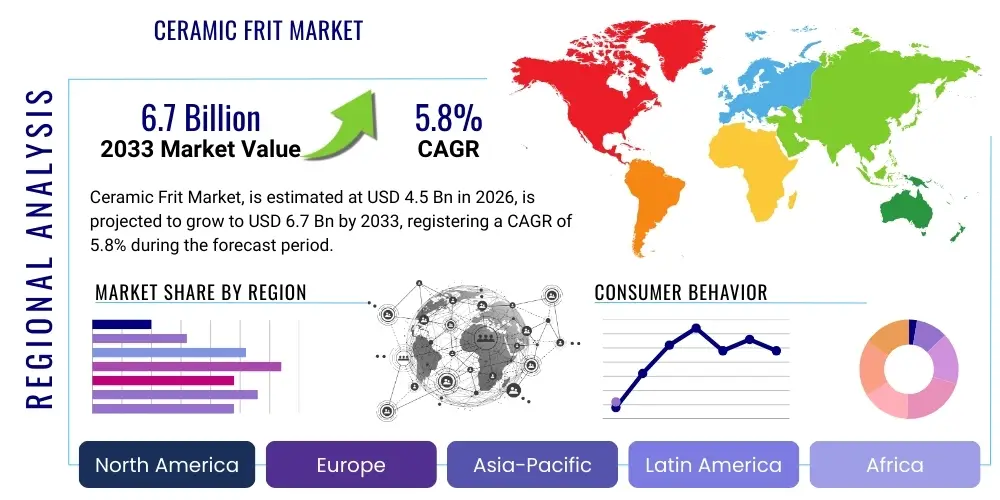

Ceramic Frit Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437456 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Ceramic Frit Market Size

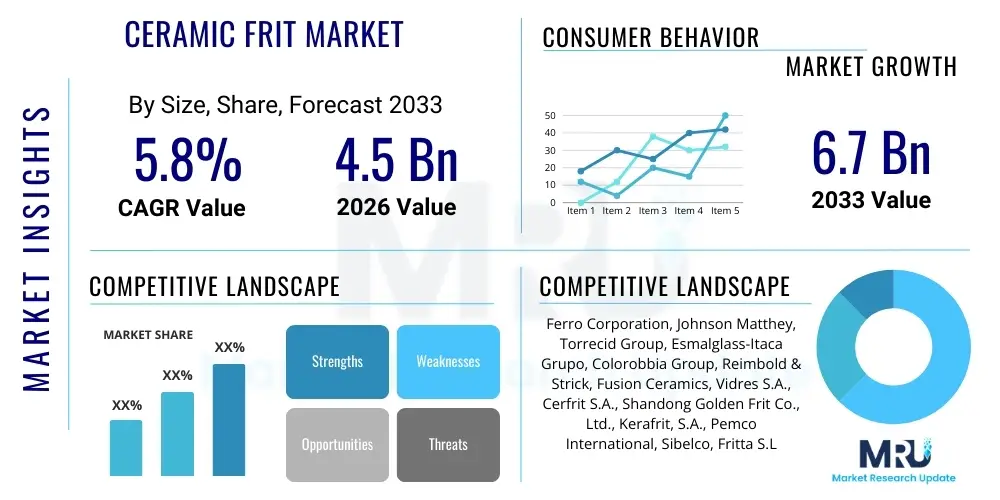

The Ceramic Frit Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $4.5 Billion in 2026 and is projected to reach $6.7 Billion by the end of the forecast period in 2033.

Ceramic Frit Market introduction

Ceramic frit represents a crucial intermediate material utilized extensively across the ceramics industry, fundamentally composed of inorganic compounds that are melted and rapidly quenched to form glassy particles. These particles are then ground into fine powders to be incorporated into glazes and colors, providing essential characteristics such as gloss, opacity, chemical resistance, and specific melting points to final ceramic products. The primary function of ceramic frit is to serve as a fluxing agent and a source of glass-forming oxides, ensuring a smooth, durable, and aesthetically pleasing finish on substrates like ceramic tiles, sanitaryware, and tableware. This material is indispensable in modern ceramic manufacturing, facilitating the creation of products that meet stringent quality and design standards globally.

The product is typically classified based on its chemical composition, notably distinguishing between lead-based and lead-free formulations. Due to increasing regulatory scrutiny concerning heavy metals and growing consumer demand for safer products, the market is rapidly transitioning toward high-performance lead-free alternatives. Major applications span residential and commercial construction, where ceramic tiles are heavily used, as well as specialized industrial applications requiring high-temperature resistance and specific electrical properties. The technical complexity involved in formulating specialized frits for digital printing glazes represents a significant area of innovation.

The market growth is fundamentally driven by the robust expansion of the global construction and infrastructure sectors, particularly in emerging economies of the Asia Pacific region. Furthermore, continuous advancements in ceramic tile aesthetics, including the adoption of large-format tiles and sophisticated surface treatments, necessitate high-quality frits that can achieve superior color intensity and finish consistency. The inherent benefits of utilizing ceramic frit, such as improved mechanical strength, enhanced water resistance, and long-term durability of the final ceramic glaze, solidify its critical role in the manufacturing value chain, sustaining continuous demand worldwide.

Ceramic Frit Market Executive Summary

The Ceramic Frit Market demonstrates strong resilience, underpinned by robust global construction activities and a persistent technological shift towards eco-friendly manufacturing processes. Business trends indicate a focus on vertical integration among key players, aiming to secure raw material supply chains and optimize production efficiencies. Furthermore, significant investment is being directed toward R&D to develop specialized functional frits, including those tailored for specific industrial glass coatings, high-definition digital ceramic printing inks, and highly stable, opacifying agents necessary for premium architectural surfaces. Market participants are leveraging strategic mergers and acquisitions to expand geographic reach and consolidate expertise in complex lead-free formulations, addressing the dual pressures of environmental compliance and performance excellence.

Regionally, the Asia Pacific (APAC) dominates the market, primarily fueled by the massive production bases for ceramic tiles located in China, India, and Vietnam, servicing both local infrastructure projects and global export markets. Europe and North America, while slower in construction volume growth, command higher value segments, driven by stringent quality standards, demand for specialty glazes, and early adoption of advanced digital decoration technologies that require specific, high-flowability frits. Latin America and the Middle East & Africa (MEA) present high-growth opportunities, spurred by rapid urbanization and infrastructure development, which translates into increased demand for locally manufactured and imported ceramic building materials, subsequently boosting local frit consumption.

Segmentation trends highlight the dominance of the ceramic tiles application segment, which accounts for the largest share of frit consumption globally. Within the product type, the shift toward lead-free frits is the most impactful trend, transforming manufacturing processes across the industry. Although lead-free alternatives often require higher firing temperatures or more complex formulations, their superior safety profile and compliance with international regulations are non-negotiable mandates. Simultaneously, there is notable growth in the sanitaryware and tableware segments, driven by rising disposable incomes and changing consumer preferences for aesthetically advanced and hygienically superior home furnishings, demanding specialized frits that guarantee color stability and resistance to wear and tear.

AI Impact Analysis on Ceramic Frit Market

Common user questions regarding AI's influence on the Ceramic Frit Market often center on how AI can optimize complex chemical formulations, predict material performance under various firing conditions, and improve manufacturing efficiency. Users are concerned about whether AI integration will lead to faster product development cycles for new specialized frits, especially regarding challenging compositions like specialized opaque or matt glazes. Key themes highlight the expectation that AI and Machine Learning (ML) will primarily be used for predictive maintenance of high-temperature furnaces, quality control through automated vision systems detecting surface defects, and, crucially, accelerating the time-to-market for novel, environmentally compliant frit recipes by simulating raw material interactions and finished product characteristics before large-scale testing. The underlying concern remains the capital investment required for implementing sophisticated AI-driven analysis tools in traditional manufacturing settings.

- Optimization of Frit Composition: AI algorithms can analyze vast datasets of raw material characteristics (e.g., purity, particle size) and final glaze properties (e.g., gloss, melting point) to suggest optimal chemical mixes, accelerating the transition to high-performance lead-free formulations.

- Predictive Quality Control (QC): Implementation of AI-powered vision systems in the grinding and firing stages to instantly identify inconsistencies in frit particle size distribution or potential defects in the applied glaze, minimizing batch-to-batch variation.

- Enhanced Process Efficiency: Use of ML models for predictive maintenance of frit melting furnaces and spray drying equipment, reducing unexpected downtime and optimizing energy consumption, a major cost component in frit production.

- Accelerated R&D Cycles: Utilizing generative AI to simulate the thermodynamic behavior of new frit chemistries, drastically shortening the experimental phase required to develop specialized glazes for digital printing or technical ceramics.

- Supply Chain Forecasting: AI-driven analytics help predict volatility in key raw material prices (boron, zinc oxide, silica) and forecast demand fluctuations, allowing manufacturers to optimize inventory and procurement strategies more effectively.

DRO & Impact Forces Of Ceramic Frit Market

The market dynamics are defined by a strong convergence of infrastructural growth drivers and stringent environmental constraints. The primary impetus stems from the escalating global demand for ceramic tiles, fueled by rapid urbanization, substantial investment in commercial and residential construction projects across Asia Pacific and Latin America, and continuous renovation activities in mature markets. This expansion directly translates into higher consumption of glazes and colors, thereby boosting demand for specialized ceramic frits. Concurrently, technological innovation, particularly in digital ceramic printing, mandates the use of highly specific, stable, and fine-particle frits, creating premium, high-value segments within the market. These demand-side forces ensure a positive long-term growth trajectory, despite cyclical construction slowdowns.

However, the market faces significant restraints, most notably the high volatility and increasing cost of essential raw materials, such as boron derivatives, zinc oxide, and various mineral pigments. Since the production of frit is highly energy-intensive, fluctuating fuel and energy prices also place considerable pressure on manufacturing margins. Furthermore, the regulatory environment presents a complex challenge, particularly the global shift away from lead, cadmium, and other heavy metals, requiring manufacturers to undertake expensive and time-consuming reformulation efforts to maintain compliance and performance parity with traditional chemistries. These constraints necessitate continuous optimization of manufacturing processes and aggressive raw material sourcing strategies.

Opportunities for market expansion are centered around niche and technical applications, including the use of specialized frits in protective coatings for solar photovoltaic (PV) panels, high-performance glass, and electronic components, leveraging their dielectric and protective properties. The untapped potential in emerging economies, where localized manufacturing is being incentivized, also provides avenues for strategic expansion. The key impact forces shaping competitive intensity include high technological intensity, as specialized frit formulation is proprietary and complex; strong supplier power, particularly for specific high-purity minerals; and moderate buyer power, as switching costs for large ceramic manufacturers are significant once a frit recipe is standardized. These forces collectively define the market structure, pushing companies toward innovation and integration to maintain competitive advantages.

- Drivers:

- Surging global demand from the rapidly expanding residential and commercial construction sectors, particularly in developing economies.

- Continuous technological advancements in digital ceramic decoration requiring high-performance, precision-formulated frits.

- Increasing adoption of large-format and technical ceramic tiles demanding durable and chemically resistant glazes.

- Restraints:

- High volatility and rising prices of crucial raw materials (e.g., silica, alumina, boron compounds).

- Strict global environmental regulations prohibiting the use of lead and cadmium, forcing costly product reformulation.

- Energy-intensive production process leading to sensitivity to fluctuating utility costs.

- Opportunities:

- Expansion into niche applications such as high-performance glass coatings, solar panel technology, and protective layers for electronic displays.

- Growing consumer preference for visually appealing, anti-microbial, and easy-to-clean ceramic surfaces, creating demand for specialized functional frits.

- Market penetration in untapped regions of Africa and specific parts of Southeast Asia experiencing accelerated industrialization.

- Impact Forces:

- Supplier Power: High, due to concentrated supply of high-purity minerals and the necessity for long-term sourcing agreements.

- Buyer Power: Moderate to High, exerted by large, consolidated ceramic tile producers who demand stringent quality and competitive pricing.

- Technological Intensity: High, driven by the need for complex, proprietary formulations for high-end applications like digital glazes and technical ceramics.

Segmentation Analysis

The Ceramic Frit Market is comprehensively segmented based on Type, Application, and End-Use, offering a granular view of market dynamics and growth potential across various industries. Segmentation by Type, primarily distinguishing between lead-based and lead-free frits, is the most crucial classification driving current technological investment and regulatory compliance, with lead-free variants experiencing rapid uptake and dominating new product development. The Application segment illustrates the primary consuming industries, where ceramic tiles remain the largest volume consumer globally, although niche segments like sanitaryware and tableware demonstrate stable, value-added growth.

The shift within the segmentation landscape reflects a transition toward value and sustainability. Manufacturers are increasingly prioritizing the development of low-temperature frits to reduce energy consumption in the kiln, catering specifically to the needs of the fast-growing Application segment of ceramic tiles, particularly for porcelain and mono-porous firing cycles. Furthermore, the End-Use segmentation—Residential, Commercial, and Industrial—highlights the pervasive reliance of the construction sector on this material, with commercial construction (e.g., offices, hotels, hospitals) often demanding the highest specifications for durability and specialized aesthetic features, driving demand for premium frit products.

Analyzing these segments reveals that future growth will be heavily concentrated in specialized, high-functionality frits that offer specific aesthetic properties (e.g., deep matt finishes, metallic effects) while simultaneously complying with increasingly strict health and safety standards. The sustained urbanization trends in Asia Pacific and Latin America will continue to ensure the Ceramic Tile Application segment maintains its market dominance, while Europe and North America will remain pivotal for innovations within the specialized decorative and technical frit sub-segments, providing a robust base for global technological transfer.

- By Type:

- Lead-free Frits (Dominant and fastest-growing segment)

- Lead-based Frits (Declining, primarily restricted to specific industrial uses and regions with laxer regulations)

- By Application:

- Ceramic Tiles (Floor tiles, Wall tiles, Porcelain tiles, Monoporosa tiles)

- Sanitaryware (Washbasins, Toilets, Bathroom accessories)

- Tableware (Porcelain, Fine China)

- Other Applications (e.g., Industrial Ceramics, Technical Ceramics, Glass Coatings, Electronic Components)

- By End-Use Industry:

- Residential Construction (New homes, renovation projects)

- Commercial Construction (Offices, Retail spaces, Hospitality sector)

- Industrial Applications (Manufacturing facilities, specialized equipment)

Value Chain Analysis For Ceramic Frit Market

The Ceramic Frit market value chain begins with the upstream procurement of complex raw materials, which include silica, alumina, kaolin, feldspar, zinc oxide, zircon sand, and various coloring oxides (e.g., iron, cobalt). The raw material supply stage is critical, characterized by high concentration for specific high-purity minerals, granting significant leverage to suppliers. Frit manufacturers invest heavily in R&D and proprietary melting technology to ensure precise formulation and quality control during the high-temperature fusion process, transforming these raw minerals into glassy, amorphous materials. This manufacturing stage represents the highest value addition due to the complexity of the chemical engineering involved in tailoring specific performance characteristics, such as thermal expansion matching and chemical resistance.

The distribution network for ceramic frit is multilayered, involving both direct sales and indirect channels. Large, multinational frit manufacturers often engage in direct sales to major, high-volume downstream consumers, particularly the largest ceramic tile conglomerates, allowing for customized technical support and immediate feedback loops. Indirect distribution involves a network of specialized local distributors and agents, who manage logistics, inventory, and technical servicing for smaller ceramic producers scattered across various regions. The efficiency and technical expertise of the distribution channel are paramount, as frits are sensitive materials that require proper handling and timely delivery to sustain continuous production lines in ceramic plants.

The downstream component of the value chain involves the large-scale industrial consumers—the ceramic manufacturers—who integrate the frit into glazes, inks, and engobes. These manufacturers operate in highly competitive environments and demand consistency, performance, and cost-effectiveness, placing pressure on frit suppliers. Ultimately, the product reaches the final consumer through construction projects (residential and commercial) and retail sales of tableware. The continuous interaction between the frit manufacturer and the ceramic producer is vital for innovation, ensuring that frit compositions evolve in line with new ceramic firing technologies and aesthetic trends, thereby optimizing the entire chain from mineral extraction to finished glazed product.

Ceramic Frit Market Potential Customers

The primary consumers and end-users of ceramic frit are large-scale industrial entities deeply embedded in the construction and home furnishings sectors. The most significant customer base comprises ceramic tile manufacturers, who utilize frit as the foundational component of glazes applied to floor and wall tiles. These customers prioritize suppliers who can provide highly consistent, large-volume batches of frit that meet exacting specifications for color, gloss, abrasion resistance, and coefficient of thermal expansion (CTE) compatibility with the ceramic body. The global consolidation of the ceramic tile industry means a few major players represent substantial procurement volume.

A secondary, yet highly critical, group of buyers includes sanitaryware manufacturers (producing toilets, washbasins, and bidets) and tableware producers (manufacturing plates, mugs, and fine china). Sanitaryware production demands specialized frits that offer exceptional opacity, durability, and resistance to harsh cleaning agents, often requiring specific white-opacity characteristics. Tableware manufacturers focus on frits that are non-toxic, food-safe, and capable of achieving specific aesthetic finishes while resisting chipping and cracking from thermal shock, which translates into higher pricing power for specialized frit suppliers.

Emerging potential customer segments include technical ceramics producers and industrial glass manufacturers. Technical ceramic companies use specialized frits for sealing and bonding high-performance components used in electronics or high-temperature environments, where the dielectric properties and sealing capability are critical. Glass manufacturers employ frits in specialized coatings for architectural glass and solar panels to enhance solar control, opacity, or structural integrity. These niche applications, although lower in volume compared to tiles, offer high-margin opportunities due to the highly customized and stringent performance requirements.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $4.5 Billion |

| Market Forecast in 2033 | $6.7 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Ferro Corporation, Johnson Matthey, Torrecid Group, Esmalglass-Itaca Grupo, Colorobbia Group, Reimbold & Strick, Fusion Ceramics, Vidres S.A., Cerfrit S.A., Shandong Golden Frit Co., Ltd., Kerafrit, S.A., Pemco International, Sibelco, Fritta S.L., Anhui Wanda Chemical Co., Ltd., CCT Ceramics Co., Ltd., Yingling Glass & Ceramic Materials Co., Ltd., China New Fine Ceramic Co., Ltd., Prince & Izant Company, Imerys Ceramics |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ceramic Frit Market Key Technology Landscape

The technological landscape of the Ceramic Frit Market is characterized by a strong emphasis on achieving higher performance parameters while optimizing energy usage and ensuring environmental compliance. Core technology centers on advanced melting and quenching processes, specifically designed high-temperature furnaces (e.g., rotary kilns, continuous electric furnaces) used to fuse raw materials uniformly. Crucially, the process of rapid quenching, typically achieved using water or rollers, ensures the glass is formed into an amorphous state (frit), preventing crystallization which would compromise the final glaze properties. Innovation in this area focuses on improving thermal efficiency to reduce the substantial energy costs associated with the melting phase, often involving complex heat recovery systems.

Post-melting, the most critical technology is the milling and particle size control phase. Modern ceramic production, particularly digital decoration, requires ultra-fine frit powders with a narrow particle size distribution (PSD) to ensure smooth flow, prevent clogging in digital print heads, and achieve flawless surface finishes. Manufacturers are increasingly utilizing advanced jet mills and specialized vertical roller mills coupled with sophisticated laser diffraction analyzers for real-time quality control. Furthermore, encapsulation technology is becoming important, where specific functional materials, such as metallic pigments or unstable compounds, are embedded within the frit matrix to maintain color stability and prevent undesirable chemical reactions during high-temperature firing.

The most transformative recent technology is the integration of frits with digital ceramic printing (DCP) systems. DCP technology uses specialized, highly fluid glazes and inks, which necessitates the development of low-viscosity, high-stability frits that can be dispersed finely in solvent-based or water-based vehicles. This requires significant R&D investment in chemical compatibility and dispersion science. Future technological trends point toward the development of 'smart frits'—materials designed to react predictably under specific environmental conditions (e.g., self-cleaning, photo-catalytic activity) or frits optimized for ultra-low-temperature firing, enabling new applications in materials science and potentially reducing the carbon footprint of the entire ceramics industry.

Regional Highlights

The global Ceramic Frit market exhibits significant regional variation in terms of production volume, technological maturity, and regulatory adherence. Asia Pacific (APAC) stands out as the undisputed leader, accounting for the largest share of global consumption and production. This dominance is intrinsically linked to the immense ceramic manufacturing capabilities concentrated in countries like China, India, and Indonesia, driven by massive infrastructure and housing projects. The APAC region not only provides the highest volume demand, especially for standardized tiles but is also rapidly adopting advanced manufacturing techniques, fueling demand for specialized imported frits alongside expanding local production capabilities.

Europe represents a mature yet high-value market segment. While production volume is lower than APAC, European manufacturers are pioneers in aesthetic trends, environmental compliance, and the development of advanced digital glazing solutions. Regulations such as REACH drive consistent investment into specialized lead-free and cadmium-free formulations, ensuring that the frits used meet the highest global safety standards. North America follows a similar pattern, characterized by strong demand for premium, imported tiles and a focus on specialized frits for technical and industrial ceramic applications, where performance and safety standards are paramount.

The emerging markets of Latin America (LATAM) and the Middle East & Africa (MEA) are characterized by significant growth potential. LATAM, particularly Brazil and Mexico, possesses established ceramic manufacturing bases serving rapidly urbanizing populations, driving high-volume consumption. MEA is witnessing high growth driven by diversification projects in the Gulf Cooperation Council (GCC) countries and steady infrastructural development in key African nations, creating substantial opportunities for both local frit manufacturing setup and imports of high-quality material for construction use. Regional growth strategies must therefore balance high-volume efficiency for APAC with high-value specialization for the North American and European markets.

- Asia Pacific (APAC): Market leader by volume; driven by China and India’s construction booms; focus on capacity expansion and efficiency in ceramic tile production; highest growth rate projected.

- Europe: High-value market focused on advanced aesthetic frits and strict environmental compliance (lead-free, low-emission); primary consumer of specialty frits for digital printing and technical surfaces.

- North America: Stable demand primarily for premium imported ceramic products and high-specification frits used in industrial and technical applications; focus on quality and innovation over volume.

- Latin America (LATAM): Strong, sustained growth driven by urbanization and local construction activities, particularly in Brazil and Mexico; increasing modernization of ceramic plants.

- Middle East & Africa (MEA): High potential growth supported by significant government infrastructure investments (e.g., Saudi Arabia, UAE) and rising disposable incomes driving demand for modern sanitaryware and decorative tiles.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ceramic Frit Market.- Ferro Corporation

- Johnson Matthey

- Torrecid Group

- Esmalglass-Itaca Grupo

- Colorobbia Group

- Reimbold & Strick

- Fusion Ceramics

- Vidres S.A.

- Cerfrit S.A.

- Shandong Golden Frit Co., Ltd.

- Kerafrit, S.A.

- Pemco International

- Sibelco

- Fritta S.L.

- Anhui Wanda Chemical Co., Ltd.

- CCT Ceramics Co., Ltd.

- Yingling Glass & Ceramic Materials Co., Ltd.

- China New Fine Ceramic Co., Ltd.

- Prince & Izant Company

- Imerys Ceramics

Frequently Asked Questions

Analyze common user questions about the Ceramic Frit market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for lead-free ceramic frit?

The main driver is stringent global regulatory pressure, particularly in North America and Europe, mandating the elimination of heavy metals like lead and cadmium from consumer products, especially tableware and tiles, to ensure public health and environmental safety. Manufacturers are rapidly adopting lead-free alternatives to maintain market access and consumer trust.

How does the volatility in raw material prices affect the profitability of frit manufacturers?

Volatile raw material prices (especially for boron, zinc, and specialized coloring oxides) significantly compress the operating margins of frit manufacturers. Since frit production is highly sensitive to input costs, companies must employ advanced hedging strategies, optimize their procurement, and continuously seek out alternative, cost-effective formulations to mitigate financial risks.

Which application segment holds the largest market share in the ceramic frit industry?

The Ceramic Tiles application segment holds the largest market share globally. This is primarily due to the massive scale of residential and commercial construction worldwide, requiring vast volumes of glazed tiles for flooring and wall coverings. The trend towards large-format tiles further sustains this high demand.

What role does digital ceramic printing technology play in shaping frit requirements?

Digital ceramic printing (DCP) mandates highly technical frit compositions. Frits used in DCP inks must have ultra-fine particle sizes, excellent stability, and low viscosity to ensure flawless jetting through industrial printheads. This technology drives demand for specialized, high-performance frits, often commanding a premium price.

Which geographical region is projected to exhibit the highest growth rate during the forecast period?

The Asia Pacific (APAC) region is projected to demonstrate the highest Compound Annual Growth Rate (CAGR). This strong growth is attributed to massive ongoing urbanization, governmental investments in infrastructure, and the expansion of the indigenous ceramic manufacturing capacity in key markets such as China, India, and Southeast Asian nations.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Ceramic Frit Market Size Report By Type (Leaded Frit, Lead-free Frit), By Application (Produce Ceramic Glazes, Application II), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Building Spandrel Glass Market Statistics 2025 Analysis By Application (Commercial Building, Residential Building, Public Building), By Type (Ceramic Frit Spandrel Glass, Silicone Coated Spandrel Glass, Others), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Spandrel Glass Market Statistics 2025 Analysis By Application (Commercial Building, Residential Building, Public Building), By Type (Ceramic Frit Spandrel Glass, Silicone Coated Spandrel Glass), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager