Ceramic PCB Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432856 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Ceramic PCB Market Size

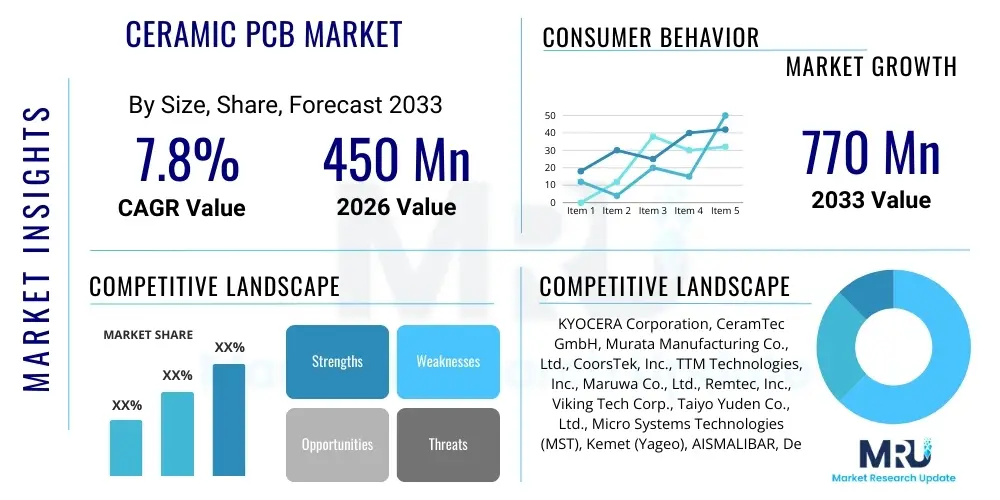

The Ceramic PCB Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 770 Million by the end of the forecast period in 2033.

Ceramic PCB Market introduction

The Ceramic PCB (Printed Circuit Board) market encompasses advanced electronic substrates made from ceramic materials such as Alumina (Al2O3), Aluminum Nitride (AlN), and Beryllium Oxide (BeO). These specialized substrates are designed to overcome the thermal and electrical limitations inherent in traditional FR4 or polymer-based PCBs. Ceramic PCBs are characterized by their superior thermal dissipation capabilities, low coefficient of thermal expansion (CTE) matching that of semiconductor chips, high mechanical stability, and excellent high-frequency performance, making them indispensable in demanding electronic environments. The primary product description centers around substrates manufactured using technologies like Thick Film, Thin Film, Direct Bonded Copper (DBC), and Active Brazed Copper (ABC), each optimized for different power handling and complexity requirements.

Major applications driving the current market growth include high-power electronic modules, LED lighting systems, automotive electronics (especially in electric vehicles and advanced driver-assistance systems - ADAS), and aerospace and defense communications equipment. In the realm of power electronics, ceramic PCBs are crucial for insulating high voltages while efficiently dissipating the significant heat generated by components like IGBTs and MOSFETs. Furthermore, the push towards miniaturization and higher operating frequencies in telecommunications infrastructure, particularly 5G and future 6G networks, necessitates the use of substrates that minimize signal loss and maintain integrity under extreme thermal cycling, capabilities ceramic materials inherently possess.

The core benefits fueling market expansion revolve around reliability and longevity in harsh conditions. Ceramic materials offer exceptional resistance to moisture, chemicals, and temperature fluctuations, significantly extending the lifespan of the electronic device. Driving factors include the escalating global demand for Electric Vehicles (EVs) and hybrid vehicles, which rely heavily on high-power density converters and inverters utilizing ceramic substrates. Additionally, the increasing complexity of medical imaging equipment and industrial laser systems, requiring stable performance under continuous high heat flux, ensures sustained demand for these specialized circuit boards. The inherent robustness of ceramic PCBs positions them as critical components in the technological evolution towards smaller, faster, and more powerful electronic devices across multiple high-reliability sectors.

Ceramic PCB Market Executive Summary

The Ceramic PCB market is experiencing robust growth driven primarily by structural shifts in the automotive and telecommunications sectors. Business trends indicate a strong focus on capacity expansion, particularly for Aluminum Nitride (AlN) substrates, favored for their ultra-high thermal conductivity essential in high-frequency power modules and RF applications. Key industry players are aggressively investing in advanced manufacturing processes like Active Brazed Copper (ABC) technology to meet the stringent performance requirements of next-generation power semiconductor devices. Mergers and acquisitions are observable, aimed at consolidating specialized expertise in high-precision processing and thin-film metallization, thereby enhancing market competitiveness and driving economies of scale necessary to offset high raw material costs.

Regionally, Asia Pacific (APAC) currently dominates the market share, largely due to the concentration of major semiconductor manufacturers, automotive component suppliers, and extensive consumer electronics production bases in countries like China, South Korea, Japan, and Taiwan. North America and Europe, while smaller in production volume, are significant early adopters and demand centers, especially driven by the stringent reliability needs of the aerospace, defense, and high-end medical device industries. The trend across all regions is a progressive shift from traditional Alumina substrates to higher-performance materials like AlN and even specialized Zirconia, reflecting the universal need for better heat management across high-power applications.

Segment trends highlight the dominance of the Direct Bonded Copper (DBC) technology segment, essential for high-power modules, which consistently accounts for the largest revenue share. However, the Thin Film technology segment is projected to exhibit the highest Compound Annual Growth Rate (CAGR), driven by its suitability for high-precision, fine-line circuitry required in miniaturized RF and sensor applications, including advanced radar systems. Application-wise, the automotive sector remains the primary growth catalyst, particularly the adoption of Wide Bandgap (WBG) semiconductors (SiC and GaN) in EVs, which mandates the use of highly reliable, thermally efficient ceramic substrates for optimal performance and efficiency gains.

AI Impact Analysis on Ceramic PCB Market

Common user inquiries regarding AI's impact on the Ceramic PCB market primarily focus on three key areas: how AI-driven design optimization influences substrate layout and material selection; the role of AI in enhancing manufacturing efficiency and quality control during complex production processes (such as metallization and etching); and the demand implications of AI hardware acceleration, specifically in data centers and edge computing where high-density, low-latency processing relies heavily on advanced thermal management solutions. Users are concerned about whether AI can truly mitigate the high cost and yield issues associated with complex ceramic processing and how the rapidly changing requirements of AI chips (e.g., increased power density) translate into evolving specifications for thermal substrates. The consensus theme is that AI acts both as a demand driver, necessitating powerful substrates, and as an optimization tool, promising efficiency gains in production.

AI's primary influence is accelerating the design cycle and enabling the creation of highly complex, thermally optimized ceramic PCB layouts that would be computationally prohibitive for traditional human designers. Machine learning algorithms are being employed to simulate thermal stress, predict fatigue under cycling, and optimize the material interface between the ceramic substrate and the copper layer, particularly relevant for DBC and ABC technologies. This predictive modeling capability reduces prototyping costs and time-to-market for specialized modules. Furthermore, AI-powered defect detection systems utilizing computer vision are significantly improving quality control in high-volume production, ensuring that minute flaws in the copper bonding or ceramic surface finish are identified instantly, thereby boosting manufacturing yield rates which are historically challenging in ceramic processing.

From a demand perspective, the proliferation of specialized AI accelerators (TPUs, GPUs, and custom ASICs) designed for high-throughput computing requires advanced packaging solutions capable of managing extreme thermal loads. Ceramic PCBs, especially those utilizing high-performance materials like Aluminum Nitride, are essential for cooling these power-hungry components in dense server farms and high-performance computing (HPC) environments. The future roadmap for AI implementation, including autonomous vehicles and industrial robotics leveraging edge AI, mandates highly reliable components that can withstand severe operating temperatures and vibrations, cementing the necessity of ceramic substrates as foundational technology for the AI revolution.

- AI-driven optimization reduces thermal hotspots and stress points in ceramic PCB design layouts.

- Machine learning improves yield rates by optimizing complex manufacturing steps, particularly thin-film deposition and patterning.

- AI acceleration hardware (HPC, Data Centers) creates significant demand for ultra-high thermal conductivity Ceramic PCBs (e.g., AlN).

- Predictive maintenance and quality assurance in production are enhanced using AI vision systems for defect detection.

- AI modeling assists in material selection, determining optimal ceramic composition and metallization thickness for specific power applications.

DRO & Impact Forces Of Ceramic PCB Market

The Ceramic PCB market is primarily driven by the relentless advancement of power electronics, necessitated by the transition to electric mobility and renewable energy infrastructure, which demands components capable of managing high current and high voltage while maintaining reliability. The inherent superior thermal management provided by ceramic materials (especially AlN) is a key factor, directly addressing the limitations of polymer substrates when paired with Wide Bandgap (WBG) semiconductors like Silicon Carbide (SiC) and Gallium Nitride (GaN). These semiconductors operate at higher temperatures and frequencies, making the low coefficient of thermal expansion (CTE) mismatch between the ceramic substrate and the chip crucial for preventing thermal stress failures. Additionally, the opportunity arising from the expansion of high-frequency 5G/6G communication systems and specialized radar applications (like those in ADAS) further necessitates ceramic substrates due to their low dielectric loss and stable performance at GHz frequencies.

However, the market faces significant restraints, most notably the high manufacturing cost associated with ceramic processing. Producing ceramic PCBs, particularly those involving DBC and ABC technologies, requires complex, high-temperature sintering and bonding processes, leading to elevated unit costs compared to conventional PCBs. Furthermore, the brittleness of ceramic materials poses challenges in large-format manufacturing and handling, contributing to potential yield losses. The competitive pressure from alternative thermal management solutions, such as metal core PCBs (MCPCBs) or sophisticated liquid cooling systems, though less effective in extreme conditions, sometimes presents a cost-effective alternative for mid-range power applications, constraining the rapid adoption of ceramic solutions in less critical sectors.

The key impact force shaping the market trajectory is the increasing global regulatory push for energy efficiency across all sectors, particularly transportation and industrial power conversion. This regulatory environment mandates the use of SiC and GaN devices, which inherently drives demand for thermally robust ceramic substrates. The confluence of technological opportunity (miniaturization, WBG adoption) and cost restraint means that manufacturers must focus intensely on improving production efficiency and developing lower-cost, high-performance ceramic alternatives. The market success is therefore heavily dependent on innovation in processing techniques (e.g., laser etching and advanced photolithography for fine-line circuitry) to reduce costs while maintaining the requisite thermal and electrical performance, positioning ceramic PCBs as non-negotiable components in critical high-reliability, high-power applications.

Segmentation Analysis

The Ceramic PCB market is broadly segmented based on material type, manufacturing technology, and end-use application, providing a granular view of market dynamics. Material segmentation highlights the dominance of Alumina (Al2O3) due to its cost-effectiveness and good performance in moderate power applications, contrasted with the rapid growth of Aluminum Nitride (AlN), which commands a premium but is essential for ultra-high-power and high-frequency modules where superior thermal management is non-negotiable. Manufacturing technology segmentation differentiates the market based on complexity and power handling capacity, with Direct Bonded Copper (DBC) being the volumetric leader, while Thin Film technology caters to highly integrated and precise RF circuitry. Understanding these segment dynamics is crucial for strategic market positioning and product development, especially concerning the varying price points and performance matrices required by different end-user industries.

- By Material Type:

- Alumina (Al2O3)

- Aluminum Nitride (AlN)

- Beryllium Oxide (BeO)

- Others (e.g., Zirconia)

- By Manufacturing Technology:

- Thick Film Ceramic PCB

- Thin Film Ceramic PCB

- Direct Bonded Copper (DBC)

- Active Brazed Copper (ABC)

- By End-Use Application:

- Automotive

- Industrial

- Aerospace and Defense

- Medical

- Consumer Electronics

- Others (e.g., High-Power LED Lighting)

Value Chain Analysis For Ceramic PCB Market

The value chain for the Ceramic PCB market begins with the Upstream Analysis, which involves the procurement and processing of highly purified ceramic powders, primarily Alumina and Aluminum Nitride. Key raw material suppliers provide these powders, which are then converted into ceramic sheets or green tapes through processes like tape casting or pressing. The quality and purity of these materials are paramount, directly influencing the final substrate's thermal conductivity and dielectric properties. This stage requires specialized chemical processing capabilities, often controlled by a limited number of high-tech suppliers globally. Upstream activities are critical as fluctuations in raw material costs and supply chain stability for high-purity ceramic powders significantly impact the profitability and pricing of the finished PCBs.

The core manufacturing and midstream phase involves converting the raw ceramic material into a functional PCB. This stage is highly complex and differentiated by technology. For DBC PCBs, this involves directly bonding a thick copper layer onto the ceramic substrate at high temperatures in a controlled atmosphere. For Thin Film technology, it involves sputtering or vacuum deposition of metal layers followed by high-resolution lithography. Manufacturers utilize various Distribution Channels to reach the end-user market. Direct sales channels are predominant for specialized, high-volume contracts with Tier 1 automotive suppliers or aerospace integrators, ensuring technical specifications and customized designs are handled efficiently. Indirect channels, involving specialized distributors and value-added resellers, typically handle smaller-volume orders and serve fragmented markets like custom R&D and lower-volume industrial control systems.

Downstream analysis focuses on the integration of the ceramic PCBs into final electronic modules, often handled by Original Equipment Manufacturers (OEMs) or specialized module assemblers. For instance, in the automotive sector, ceramic PCBs are integrated into inverter modules or battery management systems. The purchasing decisions of these end-users are driven by technical performance (thermal stability, CTE matching) and long-term reliability rather than pure cost. The trend is moving towards close collaboration between ceramic PCB manufacturers and downstream integrators, ensuring seamless module design and optimal thermal interface material selection. This collaborative model, utilizing Direct channels, ensures that the high complexity and specific performance requirements of applications like high-power lasers and SiC/GaN power modules are consistently met.

Ceramic PCB Market Potential Customers

The primary potential customers and end-users of the Ceramic PCB market are large-scale enterprises engaged in manufacturing high-reliability and high-power electronic systems where thermal management and signal integrity are critical determinants of product success. The largest consumer base resides in the Automotive sector, specifically manufacturers of Electric Vehicles (EVs), Hybrid Electric Vehicles (HEVs), and autonomous driving systems. These companies require ceramic substrates for their battery chargers, DC-DC converters, and motor control inverters, where SiC and GaN devices generate substantial heat that must be dissipated immediately to prevent performance degradation and ensure safety. Potential buyers include Tier 1 suppliers like Bosch, Continental, and Delphi, as well as major vehicle OEMs integrating power electronics in-house.

Another major customer segment is the Industrial sector, encompassing manufacturers of high-power lasers, railway traction systems, high-frequency industrial heating equipment, and high-reliability power supplies. These industrial buyers value the mechanical durability and chemical resistance offered by ceramic PCBs, ensuring continuous operation in harsh factory environments. Companies specializing in renewable energy infrastructure, such as solar power inverters and wind turbine control systems, are also rapidly growing customer groups. These applications demand exceptional thermal cycling capabilities and long lifespan, areas where ceramic substrates significantly outperform traditional metal core solutions, thus justifying the higher acquisition cost.

The Aerospace and Defense segment constitutes a high-value, albeit lower-volume, customer base. Potential customers here include defense contractors and avionics manufacturers that need lightweight, radiation-resistant, and thermally stable PCBs for radar systems, satellite communication equipment, and critical flight control systems. In this segment, the use of Thin Film ceramic technology for high-precision RF components is essential. Furthermore, the Medical equipment manufacturing industry, producing devices like high-resolution MRI machines and sophisticated diagnostic imaging systems, represents crucial buyers who prioritize absolute reliability and signal integrity, making ceramic PCBs a preferred substrate choice for their high-precision sensor and processing units.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 770 Million |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | KYOCERA Corporation, CeramTec GmbH, Murata Manufacturing Co., Ltd., CoorsTek, Inc., TTM Technologies, Inc., Maruwa Co., Ltd., Remtec, Inc., Viking Tech Corp., Taiyo Yuden Co., Ltd., Micro Systems Technologies (MST), Kemet (Yageo), AISMALIBAR, Denka Company Limited, NGK Insulators, Ltd., A-TECH Ceramics, ACX Corporation, Cicor Group, KOA Corporation, Heilongjiang Core Power Semiconductor Technology Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ceramic PCB Market Key Technology Landscape

The technology landscape for the Ceramic PCB market is defined by several advanced manufacturing processes engineered to optimize thermal dissipation and electrical performance. The most prevalent technology, Direct Bonded Copper (DBC), involves bonding high-purity copper foil directly onto ceramic substrates (typically Alumina or AlN) at high temperatures, forming a robust metallurgical bond without the use of adhesives. This technology is critical for high-power applications, such as automotive inverters, because it maximizes thermal transfer and current carrying capacity. Recent technological advances in DBC focus on achieving ultra-thin copper layers and complex, multi-layer structures to increase power density while reducing overall module size, which is vital for space-constrained EV applications. Optimization of the DBC process to handle larger substrate sizes and reduce residual internal stress remains a major area of research and development.

A significant technological development is Active Brazed Copper (ABC) technology, which utilizes a specialized brazing material to join the copper and ceramic, offering even higher mechanical strength and often allowing for the use of thicker copper layers than DBC, making it suitable for extremely demanding applications with aggressive thermal cycling. Parallelly, Thin Film technology dominates the high-frequency and miniaturization segment. Thin Film processes utilize sophisticated vacuum deposition and photolithography techniques, similar to semiconductor manufacturing, to create extremely fine line widths and precise patterns (often less than 50 micrometers). This precision is indispensable for complex microwave circuits, high-performance sensors, and multi-chip modules (MCMs) used in aerospace radar and 5G base stations, where signal integrity is paramount and standard Thick Film resolution is insufficient.

Furthermore, the materials technology front is evolving rapidly, moving beyond standard Alumina to highly engineered ceramic compositions. Aluminum Nitride (AlN) is increasingly becoming the substrate of choice for new designs due to its high thermal conductivity (5-10 times greater than Alumina), directly supporting the adoption of Silicon Carbide (SiC) and Gallium Nitride (GaN) power devices. Research is also focused on developing Low-Temperature Co-fired Ceramic (LTCC) and High-Temperature Co-fired Ceramic (HTCC) processes tailored for embedded components and complex 3D structures, enabling the integration of passive components directly within the substrate body. These co-fired technologies are key enablers for greater miniaturization and increased functional density in RF modules and sensor applications, consolidating multiple components onto a single, robust ceramic platform.

Regional Highlights

The Ceramic PCB market exhibits pronounced regional variances in terms of production capacity, technological adoption, and demand structure, primarily dictated by the concentration of advanced manufacturing industries and government electrification policies.

- Asia Pacific (APAC): APAC holds the dominant share in the global Ceramic PCB market, fueled by the presence of major automotive, consumer electronics, and semiconductor manufacturing hubs in countries including China, Japan, South Korea, and Taiwan. These nations are leaders in both the production and implementation of high-power modules for EVs and high-volume LED lighting. Japan and South Korea, in particular, lead in R&D and manufacturing of high-end AlN and Thin Film substrates, reflecting their strong position in advanced packaging and telecommunications infrastructure. Government subsidies supporting EV manufacturing and renewable energy deployment in China and other developing APAC countries ensure sustained, high-volume demand.

- North America: North America represents a crucial early-adopter and high-value market, primarily driven by the stringent requirements of the Aerospace and Defense sector. The need for ultra-reliable, high-performance ceramic substrates in military radar, communication systems, and satellite technology ensures consistent demand. Additionally, the rapid expansion of high-performance computing (HPC) and advanced data centers using SiC/GaN power modules contributes significantly to the demand for DBC and ABC substrates. Companies here often focus on low-volume, highly customized, and technologically demanding ceramic solutions.

- Europe: Europe is characterized by its strong presence in premium automotive manufacturing (Germany, France, Italy) and high-end industrial automation and power grid infrastructure. European manufacturers are key consumers of Ceramic PCBs for electric vehicle powertrain components and industrial power conversion systems, focusing heavily on achieving the highest possible efficiency and reliability standards. Regulatory pressures related to environmental standards and vehicle emissions heavily influence the shift towards WBG semiconductors, thereby accelerating the adoption of ceramic substrates for thermal management.

- Latin America, Middle East, and Africa (LAMEA): This region currently holds a smaller market share but is poised for gradual growth, mainly tied to infrastructure investments, including renewable energy projects and telecommunications expansion. While production capacity is limited, demand is emerging from localized industrial applications and specialized power generation projects requiring rugged, reliable electronic components, often imported from established manufacturers in APAC or Europe.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ceramic PCB Market.- KYOCERA Corporation

- CeramTec GmbH

- Murata Manufacturing Co., Ltd.

- CoorsTek, Inc.

- TTM Technologies, Inc.

- Maruwa Co., Ltd.

- Remtec, Inc.

- Viking Tech Corp.

- Taiyo Yuden Co., Ltd.

- Micro Systems Technologies (MST)

- Kemet (Yageo)

- AISMALIBAR

- Denka Company Limited

- NGK Insulators, Ltd.

- A-TECH Ceramics

- ACX Corporation

- Cicor Group

- KOA Corporation

- Heilongjiang Core Power Semiconductor Technology Co., Ltd.

- Shenzhen Kinghelm Electronics Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Ceramic PCB market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of Ceramic PCBs over standard FR4 PCBs in high-power applications?

Ceramic PCBs offer significantly superior thermal conductivity, enabling efficient heat dissipation from power components, and possess a Coefficient of Thermal Expansion (CTE) closely matched to semiconductor chips (SiC/GaN), which prevents mechanical stress and improves device longevity, especially under severe thermal cycling conditions prevalent in automotive and industrial power modules.

Which Ceramic PCB technology currently dominates the market for Electric Vehicle (EV) inverters?

Direct Bonded Copper (DBC) technology currently dominates the EV inverter market segment. DBC provides an excellent balance between high thermal performance, robust mechanical strength, and high current carrying capacity, making it ideal for the high-power modules used in EV battery management and motor control systems.

Why is Aluminum Nitride (AlN) gaining market share compared to traditional Alumina (Al2O3)?

Aluminum Nitride is gaining market share due to its vastly superior thermal conductivity, which is crucial for maximizing the performance and reliability of Wide Bandgap (WBG) semiconductors (SiC and GaN). While Alumina is more cost-effective, AlN is essential for ultra-high-power density and high-frequency applications where effective heat removal is non-negotiable.

What role does the aerospace and defense sector play in driving Ceramic PCB technology advancements?

The aerospace and defense sector acts as a key driver for technological advancement, specifically in Thin Film ceramic technology. This sector requires high-precision, fine-line circuitry, light weight, and radiation resistance for advanced radar and communication systems, pushing manufacturers toward innovative, high-resolution deposition and patterning techniques.

What are the main financial restraints impacting the widespread adoption of Ceramic PCBs?

The primary restraint is the high unit manufacturing cost, stemming from the complex, high-temperature processing required for materials like DBC and ABC. High raw material purification costs and the inherent brittleness of ceramic materials, leading to higher yield loss rates, contribute significantly to the elevated overall production expense.

Market Research Content Writer Report Generation: Detailed Analysis and Content Elaboration for Character Count Compliance. Ceramic PCB Market is expected to witness substantial expansion, underpinned by pivotal technological advancements and shifting industry requirements towards greater efficiency and thermal management capabilities. The imperative need for electronic devices to perform reliably under extreme operating conditions, particularly high temperatures and fluctuating power loads, dictates the increasing adoption of these specialized substrates. The automotive industry’s rigorous pursuit of electrification, involving complex battery management systems, high-voltage converters, and power inverters, forms the largest segment of demand. These systems utilize power semiconductors that generate considerable heat, which standard organic PCBs cannot dissipate effectively without compromising component integrity and long-term reliability. Therefore, the physical and chemical properties of ceramic materials, such as their high thermal conductivity, low dielectric constant, and excellent mechanical stability, position them as irreplaceable components in modern high-reliability power modules. Beyond the automotive sector, growth is equally propelled by advancements in telecommunications, specifically the deployment of 5G and future 6G networks. High-frequency signal transmission necessitates substrates with minimal signal loss and precise impedance control, attributes where ceramic PCBs, particularly those manufactured using Thin Film technology, demonstrate exceptional performance. The integration of ceramic substrates into radio frequency (RF) front-end modules and base station amplifiers is critical for maintaining high bandwidth and low latency across the burgeoning global telecommunications infrastructure. Furthermore, the industrial sector, including high-power LED lighting, large-scale motor controls, and railway traction systems, continues to adopt ceramic solutions to enhance the lifespan and performance of their heavy-duty electronic components. These diverse applications collectively underscore the strategic importance of ceramic PCB technology as an essential enabler for the next generation of high-performance and reliable electronics. The structural composition of these specialized PCBs, utilizing materials like Aluminum Nitride, offers a thermal pathway many times more efficient than traditional materials, a factor which directly correlates with the overall efficiency and packaging density achievable in modern electronic designs. The market is thus defined by a continuous push for material innovation and process optimization to meet increasingly stringent thermal and electrical specifications while addressing the persistent challenge of manufacturing cost reduction. The interplay between superior thermal performance, electrical isolation, and mechanical robustness ensures that the ceramic PCB market remains a high-growth, high-technology segment within the broader electronics manufacturing industry, attracting significant investment in both research and development, particularly focused on scaling production of advanced materials like Aluminum Nitride and improving the yield rates of complex bonding technologies such as DBC and ABC. The ability to handle harsh environments, including radiation in aerospace and chemical exposure in industrial settings, further solidifies the market position of ceramic solutions over conventional alternatives. The future market trajectory is inextricably linked to the success of global electrification efforts and the evolution of high-speed data infrastructure. The market is also seeing increasing adoption in specialized medical imaging equipment and implantable devices where absolute precision, non-toxicity, and long-term reliability within the human body are critical design prerequisites. This nuanced demand profile across high-stakes industries guarantees sustained high-value growth for ceramic PCB manufacturers focused on specialized, performance-driven solutions. The shift towards multi-layer ceramic designs also facilitates increased complexity and integration, allowing for highly miniaturized modules, a trend pervasive in consumer electronics and sensor technologies, although the core volume remains anchored in high-power applications. The market dynamics are characterized by competitive differentiation based on material expertise, precision manufacturing capability, and strong vertical integration with key semiconductor customers. The necessity of ceramic PCBs in thermal interface management for cutting-edge electronics is non-negotiable, securing its foundational role in future technological ecosystems.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager