Ceramic Saddles and Packing Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432456 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Ceramic Saddles and Packing Market Size

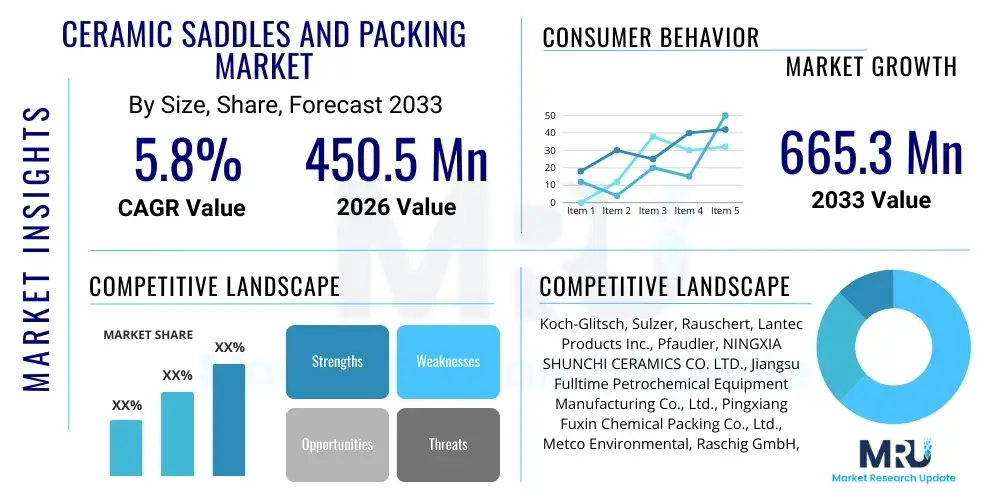

The Ceramic Saddles and Packing Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 450.5 Million in 2026 and is projected to reach USD 665.3 Million by the end of the forecast period in 2033. This growth trajectory is fundamentally driven by the continuous expansion of industrial processing capacity, particularly within the petrochemical and fine chemical sectors, which rely heavily on high-efficiency, corrosion-resistant mass transfer columns. The inherent chemical inertness and superior thermal stability of ceramic packing materials make them indispensable in harsh operating environments where metallic or plastic alternatives quickly degrade, thereby securing steady demand and contributing significantly to the market's overall valuation increase.

The valuation reflects the critical role ceramic packing plays in ensuring process efficiency and longevity in demanding applications such as sulfuric acid production, chlorine drying, and high-temperature scrubbing towers. While facing competition from advanced polymer and specialized metallic packing, ceramic materials maintain a niche leadership position due to their unmatched resistance to high temperatures and corrosive chemical agents. Market size calculations incorporate sales of standard ceramic shapes, including Berl saddles, Intalox saddles, and ceramic ring types, across global manufacturing hubs. Furthermore, the increasing stringency of global environmental regulations requiring improved scrubbing and gas absorption technologies further stimulates the need for durable and reliable ceramic packing media, acting as a crucial underpinning for the expected market growth over the forecast period.

Ceramic Saddles and Packing Market introduction

The Ceramic Saddles and Packing Market encompasses materials used as random packing media within industrial mass transfer equipment, primarily distillation, absorption, and stripping columns. These products, such as Berl Saddles and Intalox Saddles, are distinctively characterized by their high surface area, robust mechanical strength, and exceptional chemical inertness, making them the preferred choice for processes involving strong acids, high temperatures, and corrosive liquids. The fundamental application involves providing an optimized surface for liquid-vapor contact, maximizing mass transfer efficiency in chemical processing operations. Historically, ceramic packing has been pivotal in the early development of industrial chemistry, and modern manufacturing techniques have only enhanced their efficacy and consistency, broadening their application scope significantly beyond traditional chemical production into environmental remediation and gas cleaning technologies.

Ceramic packing, typically manufactured from chemical porcelain or specialized alumina ceramics, offers unparalleled resistance to thermal shock and chemical attack, often outperforming metallic and polymeric counterparts in hostile environments. Major applications span the petrochemical industry for refining processes, the chemical industry for acid manufacturing and solvent recovery, and environmental engineering for flue gas desulfurization (FGD) and biological filtering systems. The primary benefit derived from utilizing ceramic saddles and packing is the achievement of highly efficient separation and reaction kinetics alongside reduced maintenance frequency due to the material's durability. This translates directly into lower operational expenditures and enhanced plant uptime, which are crucial metrics for capital-intensive industries.

The primary driving factors propelling the market include the global resurgence in chemical manufacturing output, particularly in Asia Pacific, and the increasing focus on resource efficiency and environmental compliance worldwide. Regulations targeting sulfur dioxide and nitrogen oxide emissions necessitate superior scrubbing technologies, which often rely on the stable performance of ceramic packing. Furthermore, ongoing innovation in ceramic composition and geometric design allows for greater void fraction and lower pressure drop, continually improving performance metrics and sustaining the competitive relevance of ceramic packing materials against alternative, newer technologies. These structural and regulatory tailwinds ensure sustained investment in upgrading existing columns with high-performance ceramic media.

Ceramic Saddles and Packing Market Executive Summary

The Ceramic Saddles and Packing Market is currently characterized by moderate, stable growth, heavily influenced by capital expenditure cycles in the global chemical and refining industries. Key business trends indicate a strategic shift towards optimizing supply chain resilience, particularly concerning raw material sourcing (high-quality clay and alumina), given the energy-intensive nature of ceramic firing. Manufacturers are increasingly focusing on specialized, engineered ceramic compositions that offer enhanced thermal shock resistance and superior wettability, moving beyond standard porcelain to advanced materials that command premium pricing and ensure high-efficiency performance required by modern, high-throughput processing plants. Consolidation among smaller regional producers is also evident, aiming to achieve economies of scale and better manage global distribution logistics necessary for servicing large multinational clients with diverse operational footprints. The aftermarket service sector, including inspection and replacement services, forms a vital and recurring revenue stream, stabilizing market fluctuations.

Regional trends highlight the Asia Pacific region, led by China and India, as the primary engine of growth, spurred by massive investments in new chemical and petrochemical complexes, driving demand for initial fill volumes of packing materials. North America and Europe, while exhibiting slower growth, demonstrate strong demand for replacement packing and high-performance ceramic media utilized in stringent environmental applications, such as large-scale industrial effluent treatment and air pollution control. The Middle East remains a steady consumer, anchored by large-scale oil refining and basic chemicals production, prioritizing robustness and longevity in their packing solutions due to extreme operating conditions. These geographical disparities necessitate tailored market entry strategies, focusing on cost competitiveness in emerging markets and technical superiority in mature markets.

Segment trends reveal that Intalox Saddles continue to dominate the product type landscape due to their superior pressure drop characteristics and mass transfer efficiency compared to traditional Berl Saddles. The application segment is heavily skewed towards the chemical and petrochemical industries, although environmental applications, particularly those related to volatile organic compound (VOC) abatement and acidic gas scrubbing, are demonstrating the fastest growth rate. Material-wise, high-purity alumina ceramics are gaining traction over standard chemical porcelain where extreme temperatures or highly aggressive chemical agents are present, reflecting a trend towards material specification based strictly on operational parameters rather than merely initial cost considerations. This segmentation divergence underscores the market's maturity and the move towards precision engineering in mass transfer technology.

AI Impact Analysis on Ceramic Saddles and Packing Market

Common user questions regarding AI's impact on the Ceramic Saddles and Packing Market frequently revolve around how artificial intelligence can enhance the operational lifespan, optimize the physical installation, and improve the manufacturing quality of these passive components. Users often inquire about predictive failure analysis—whether AI models can accurately predict when a column section requires repacking due to fouling or structural degradation, minimizing unplanned downtime. Furthermore, questions address the role of machine learning in optimizing packing geometry for specific chemical reactions and fluid dynamics, seeking customized solutions that maximize efficiency gains. The core concerns center on leveraging AI to reduce the total cost of ownership (TCO) by moving from time-based maintenance to condition-based monitoring, ensuring that the passive nature of the ceramic material does not preclude its integration into smart factory ecosystems.

AI's primary influence on the market will manifest in process optimization and predictive quality control. By integrating deep learning algorithms with real-time operational data—such as pressure drop readings, temperature profiles, and composition analysis from mass transfer columns—AI systems can accurately model and predict the performance degradation of ceramic packing due due to fouling, crushing, or channeling. This capability allows plant operators to schedule repacking or cleaning activities precisely when performance drops below a critical threshold, significantly extending the effective lifespan of the packing and eliminating premature replacement costs. Furthermore, AI-driven process simulation can test thousands of ceramic packing geometries virtually, leading to faster development cycles for specialized packing shapes optimized for novel industrial separation tasks, driving high-value innovation in a historically low-tech component segment.

On the manufacturing front, AI is utilized to enhance the quality and consistency of the ceramic materials themselves. Machine vision systems, trained by machine learning algorithms, are employed during the extrusion and sintering phases to detect minute structural flaws, cracks, or inconsistencies that could compromise mechanical integrity under high load or thermal stress. This level of stringent, automated quality control reduces batch variability and ensures that the final product meets the demanding specifications required for critical applications like acid drying towers. The integration of AI also aids in optimizing energy consumption during the firing process, a significant cost driver, by dynamically adjusting kiln temperatures and timings based on material composition and ambient conditions, thus impacting the overall manufacturing cost structure of ceramic saddles and packing.

- AI-driven predictive maintenance modeling extends the operational life cycle of ceramic packing by accurately forecasting performance decline.

- Machine learning algorithms optimize mass transfer column performance by analyzing real-time pressure, flow, and temperature data to detect anomalies.

- Computer vision systems enhance quality control during manufacturing, ensuring structural integrity and geometric accuracy of saddles.

- AI facilitates the development of novel ceramic compositions and engineered geometries tailored for specific, complex separation processes.

- Optimization of energy-intensive sintering processes via AI reduces manufacturing costs and improves environmental footprints.

DRO & Impact Forces Of Ceramic Saddles and Packing Market

The Ceramic Saddles and Packing Market is shaped by a robust set of dynamic forces including regulatory mandates driving environmental protection, continuous industrial expansion, material fragility challenges, and the emergence of advanced alternatives. Drivers focus on the material’s inherent advantages in extreme environments, while restraints largely concern handling and installation issues. Opportunities lie primarily in material science breakthroughs and expanding geographical coverage in rapidly industrializing regions. The resultant impact forces underscore the market’s stability, provided manufacturers successfully navigate competition from structured packing and continuously improve logistics and material handling practices. Strategic positioning relative to global chemical industry capital expenditure cycles is paramount for market participants to capitalize on replacement and new column fill opportunities, ensuring long-term profitability amidst potential material substitution pressures.

Key drivers include the indispensable requirement for corrosion resistance in highly aggressive chemical streams, such as those found in metallurgical acid plants and chemical waste processing facilities, where no other material offers comparable longevity and performance stability. Furthermore, stricter environmental regulations, particularly concerning sulfur and nitrogen oxides emissions, necessitate specialized scrubbing and absorption towers utilizing reliable ceramic media. Restraints predominantly involve the inherent fragility of ceramic material, leading to significant breakage during transportation, installation, and column operation, thus increasing overall installation time and cost. The relatively high-pressure drop associated with random ceramic packing compared to modern structured packing also poses a competitive constraint in highly energy-sensitive operations, limiting their adoption in certain large-scale distillation processes where efficiency is the absolute priority.

Opportunities are centered on developing advanced ceramic composites that minimize breakage while maintaining chemical inertness, leveraging nanoceramics or surface treatment technologies to improve mechanical resilience and wettability. Expansion into emerging applications, such as high-temperature thermal energy storage and specialized catalyst carriers, represents new revenue streams. The impact forces show that while competition from other materials is high, the critical nature of ceramic packing in specific, harsh environments ensures sustained demand. The market players are compelled to invest in robust packaging and handling protocols to mitigate the fragility restraint, simultaneously focusing R&D efforts on geometric improvements that reduce pressure drop, thus enhancing overall operational efficiency and strengthening the market position of ceramic packing in the broader mass transfer media landscape.

Segmentation Analysis

The Ceramic Saddles and Packing Market is comprehensively segmented based on product type, material composition, and industrial application, reflecting the diverse requirements of the end-user industries. This segmentation is crucial for understanding specific demand drivers and competitive dynamics within specialized niches. Product type differentiation, particularly between various saddle designs like Berl and Intalox, highlights preferences concerning pressure drop versus mass transfer efficiency trade-offs. Material composition segmentation (e.g., standard chemical porcelain vs. high-purity alumina) dictates suitability for different operational severity levels, directly impacting pricing and market penetration in critical, high-temperature, or ultra-corrosive environments. Furthermore, analyzing demand across applications, from bulk chemical production to focused environmental control, provides insights into future growth hotspots driven by regulatory shifts and industrial capacity expansion.

The dominance of Intalox Saddles in the product segmentation stems from their geometrically optimized design, offering a higher usable surface area and reduced nesting tendencies compared to older designs. This technical superiority translates into better hydraulic performance, making them the default choice for efficiency-focused column operators. Concurrently, the application segment highlights the Petrochemical and Chemical Industries as the largest consumers, utilizing ceramic packing for essential separation steps, acid regeneration, and drying. However, the fastest growth is observed in the Environmental segment, driven by global mandates for flue gas desulfurization (FGD), NOx removal, and stringent wastewater treatment, requiring chemically stable packing that can withstand complex gas and liquid matrices.

Material composition remains a critical factor, with chemical porcelain constituting the bulk volume due to its cost-effectiveness and excellent general-purpose chemical resistance. However, the demand for specialized ceramics, such as high-alumina (>90% Al2O3) or specialized silica ceramics, is rapidly expanding in areas requiring superior thermal shock resistance, higher mechanical crushing strength, and resistance to highly concentrated hydrofluoric acid or extreme alkaline solutions. Manufacturers are adapting their production capabilities to meet this demand for customized, higher-specification ceramic materials, signaling a move towards value-added product offerings rather than sheer volume production of standard-grade packing media. The interplay between these segments defines the modern competitive landscape and strategic direction of the market.

- By Product Type:

- Intalox Saddles (Including Super Intalox)

- Berl Saddles

- Raschig Rings

- Pall Rings (Ceramic Equivalent)

- Specialty Engineered Shapes

- By Material Type:

- Chemical Porcelain (Standard Grade)

- High Alumina Ceramics

- Silicon Carbide Ceramics (Niche applications)

- Specialized Glazed Ceramics

- By Application:

- Chemical Processing and Manufacturing (Acid Production, Drying)

- Petrochemical and Refining (Absorption, Stripping)

- Environmental Engineering (FGD, Scrubbing, Gas Cleaning)

- Fertilizer Manufacturing

- Pharmaceutical Processing

- By End-Use Industry:

- Oil & Gas

- Chemicals & Petrochemicals

- Metallurgy

- Water and Wastewater Treatment

- Power Generation

Value Chain Analysis For Ceramic Saddles and Packing Market

The value chain for Ceramic Saddles and Packing is initiated by the upstream sourcing of specialized raw materials, primarily high-grade kaolin clay, feldspar, quartz, and various alumina compounds, which are critical for achieving the desired chemical and mechanical properties of the final product. Material procurement involves rigorous quality checks to ensure purity and consistency, as these factors directly influence the sintering process and the final product's resistance to corrosion and thermal shock. The manufacturing phase is highly capital-intensive, involving slurry preparation, extrusion, drying, and high-temperature firing (sintering) in large kilns. Energy costs during the firing process represent a significant portion of the total manufacturing expense, making energy efficiency a crucial operational focus point for ceramic producers globally. Technical expertise in ceramic engineering and process control is paramount at this stage to minimize defects and ensure dimensional tolerances essential for optimal column performance.

The midstream involves the distribution and logistics of the finished packing materials. Given the inherent fragility of ceramic products, specialized, robust packaging and careful handling are mandatory to minimize breakage during transit, which significantly affects landed costs. Distribution channels are typically bifurcated into direct sales to large engineering, procurement, and construction (EPC) firms involved in building new industrial plants, and indirect sales through specialized distributors and agents who serve the aftermarket replacement demand, small-to-medium enterprises, and provide localized inventory. EPC contracts often require large, single-volume deliveries, demanding sophisticated logistics management, while the aftermarket requires rapid response and high inventory levels across key industrial regions to facilitate urgent replacements and maintenance shutdowns.

Downstream analysis focuses on the end-use consumption and the critical service providers supporting the installation and maintenance phase. End-users are primarily chemical plant operators, refinery managers, and environmental facility engineers. The consumption cycle includes initial fill for new construction and replacement fill driven by planned maintenance or unforeseen failure (e.g., column fouling or crushing). Specialized engineering firms often provide consultation services, advising clients on optimal packing type, size, and installation techniques to ensure maximum column efficiency. Direct channel sales dominate large, strategic projects where technical specifications are complex, whereas indirect channels are highly effective in reaching fragmented industrial bases and providing essential support for ongoing operational needs and minor column modifications, cementing the role of specialized distributors in bridging the gap between producers and operational plant requirements.

Ceramic Saddles and Packing Market Potential Customers

The primary potential customers for Ceramic Saddles and Packing products are large-scale industrial operators and asset owners whose processes involve corrosive fluids, high temperatures, and the necessity for efficient mass transfer operations. These include integrated chemical manufacturers, particularly those involved in producing bulk inorganic acids (sulfuric acid, hydrochloric acid), and alkali chemicals. These customers require ceramic media for drying, scrubbing, and absorption towers where chemical resistance is non-negotiable. Furthermore, metallurgical processing plants utilizing hydrometallurgical routes and specialized solvent extraction systems also constitute a major end-user group, demanding high-purity, inert packing to maintain process integrity and avoid catalyst poisoning or equipment corrosion.

Another significant customer segment resides within the global energy sector, specifically oil refineries and natural gas processing plants. These facilities utilize ceramic packing in atmospheric and vacuum distillation columns, and increasingly, in units dedicated to cleaning and sweetening hydrocarbon streams, particularly where high-temperature environments preclude the use of plastic or less stable metallic packing. The operational demands of 24/7 refining require packing media that guarantees decades of stable performance, making the longevity and durability of ceramic materials a key selling point for asset managers focused on minimizing downtime and maximizing throughput across complex, high-pressure separation units.

The fastest-growing segment of potential customers is found within the environmental and pollution control industries. Municipal and industrial wastewater treatment facilities, alongside flue gas desulfurization (FGD) systems in coal-fired power plants and large industrial boilers, are major buyers. These entities require chemically resistant packing for scrubbing towers designed to remove regulated pollutants (SOx, NOx, particulates) from gaseous emissions. As environmental standards tighten globally, particularly in industrialized and rapidly developing nations, the demand from this segment for reliable, high-performance ceramic packing is projected to rise substantially, representing a crucial future growth vector for manufacturers focusing on application-specific solutions that meet stringent compliance criteria.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Million |

| Market Forecast in 2033 | USD 665.3 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Koch-Glitsch, Sulzer, Rauschert, Lantec Products Inc., Pfaudler, NINGXIA SHUNCHI CERAMICS CO. LTD., Jiangsu Fulltime Petrochemical Equipment Manufacturing Co., Ltd., Pingxiang Fuxin Chemical Packing Co., Ltd., Metco Environmental, Raschig GmbH, Applied Porous Technologies, Inc., Trowbridge & Company, CECO Peerless, Finepac Structures Pvt. Ltd., Dalin Industrial Co., Ltd., Zhejiang Lanyu Chemical Packing Co., Ltd., Dezhou Huajing Chemical Packing Co., Ltd., Zehua Chemical Engineering Co., Ltd., Saint-Gobain NorPro, Beijing CCE&I Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ceramic Saddles and Packing Market Key Technology Landscape

The technology landscape in the Ceramic Saddles and Packing Market primarily revolves around advanced material formulation, precision manufacturing processes, and rigorous quality control methodologies designed to enhance the physical and chemical performance of the packing media. Core manufacturing technology relies on sophisticated extrusion and pelletizing techniques to form green bodies, which are then subjected to controlled, high-temperature sintering (firing) processes. Modern advancements in sintering technology include the use of continuous kilns and precise atmospheric controls to ensure uniform density, minimize porosity, and achieve superior mechanical strength, thereby significantly reducing the risk of breakage during operational loading. Process automation, often utilizing sensors and feedback loops, ensures consistent geometric dimensions across large batches, which is critical for minimizing channeling and ensuring optimal hydrodynamic performance when the packing is loaded into the column.

Material science innovation is a key technological differentiator. While traditional chemical porcelain (acid-resistant ceramics) remains standard, key players are investing in research and development to commercialize high-performance ceramic compositions. This includes utilizing higher concentrations of pure alumina (up to 99%) and incorporating mineral additives to create specialized ceramics resistant to hydrofluoric acid or extreme pH fluctuations. Furthermore, surface treatment technologies, such as micro-glazing or specialized coatings, are being explored to enhance the packing's wettability—its ability to be uniformly covered by liquid—which directly correlates with mass transfer efficiency. Improving wettability reduces dry spots and ensures that the entire surface area of the packing is utilized for contact between the liquid and vapor phases, optimizing column throughput.

Beyond material fabrication, diagnostic and installation technologies contribute significantly to the modern landscape. Laser scanning and 3D modeling are increasingly used to analyze packed bed integrity, ensuring proper randomization and detecting potential void or crush zones that could lead to maldistribution and performance degradation. These advanced imaging techniques, often deployed during maintenance shutdowns, allow for predictive analysis and targeted replacement rather than full column repacking. The focus on quality assurance, leveraging non-destructive testing (NDT) methods like ultrasonic inspection, ensures that even the large volumes of random packing meet extremely high standards for crush strength and thermal stability, reflecting the market’s technological maturation from a purely commodity component towards an engineered process media requiring precise specifications and verifiable quality control documentation.

Regional Highlights

The Ceramic Saddles and Packing Market exhibits distinct growth patterns influenced by regional industrialization rates, regulatory environments, and the maturity of local chemical processing sectors. Asia Pacific (APAC) currently dominates the market, driven by unparalleled infrastructure investment in basic chemicals, petrochemicals, and fertilizer production, particularly in China, India, and Southeast Asia. The region’s demand is characterized by high volume consumption for new column construction (initial fill), often prioritizing cost-effectiveness alongside robust performance due to the sheer scale of manufacturing operations being established. Furthermore, increasing regulatory pressure in China regarding industrial emissions and wastewater treatment necessitates widespread adoption of advanced scrubbing technologies, directly fueling demand for chemically inert ceramic packing materials.

North America and Europe represent mature markets defined primarily by replacement demand, maintenance, and the upgrade of existing facilities, rather than large-scale new construction. Demand in these regions is highly specified, focusing on premium, high-efficiency ceramic saddles and specialized alumina materials suitable for complex, high-value separation processes, such as isomer separation or pharmaceutical intermediate production. Regulatory frameworks like the European Union's Industrial Emissions Directive (IED) enforce stringent requirements on pollution control, ensuring sustained demand for ceramic packing in environmental applications, including thermal oxidizers and acid gas scrubbing. Pricing sensitivity is lower here compared to APAC, as performance, longevity, and verifiable certifications hold precedence over initial purchasing cost, leading to higher average selling prices for ceramic products.

The Middle East and Africa (MEA) region shows steady, project-driven growth, intrinsically linked to investments in oil refining, gas processing, and large-scale petrochemical complex expansion. The demand here is concentrated around resilient materials that can withstand the severe operating conditions—high temperatures and high concentrations of H2S or other corrosive agents—typical of refining operations. Latin America, while smaller, presents focused opportunities, particularly in Brazil and Mexico, linked to their domestic chemical production capabilities and burgeoning environmental compliance requirements. In all regions, localized distribution and the ability to provide rapid technical support during crucial plant shutdowns are critical success factors for market penetration and sustained client relationships, differentiating top global suppliers from local manufacturers.

- Asia Pacific (APAC): Market leader due to extensive capital expenditure in petrochemicals, fertilizers, and base chemical manufacturing; strong growth driven by new industrial capacity and environmental mandates in China and India.

- North America: Stable market primarily driven by replacement demand, facility upgrades, and strict regulatory adherence in chemical processing and environmental control (e.g., acid rain mitigation); high demand for specialized, high-purity ceramic materials.

- Europe: Mature market focused on high-specification, energy-efficient packing solutions; demand underpinned by the stringent IED regulations governing industrial emissions and the necessity for continuous process optimization in highly competitive chemical sectors.

- Middle East & Africa (MEA): Growth tied to large, strategic oil and gas downstream projects and refinery expansion; demand characterized by a need for highly robust and thermally stable ceramic packing to handle extreme operating environments.

- Latin America: Emerging market with localized growth opportunities in Brazil and Mexico, linked to domestic chemical production and increasing enforcement of environmental standards in industrial effluent treatment and air pollution control.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ceramic Saddles and Packing Market.- Koch-Glitsch

- Sulzer

- Rauschert

- Lantec Products Inc.

- Pfaudler

- NINGXIA SHUNCHI CERAMICS CO. LTD.

- Jiangsu Fulltime Petrochemical Equipment Manufacturing Co., Ltd.

- Pingxiang Fuxin Chemical Packing Co., Ltd.

- Metco Environmental

- Raschig GmbH

- Applied Porous Technologies, Inc.

- Trowbridge & Company

- CECO Peerless

- Finepac Structures Pvt. Ltd.

- Dalin Industrial Co., Ltd.

- Zhejiang Lanyu Chemical Packing Co., Ltd.

- Dezhou Huajing Chemical Packing Co., Ltd.

- Zehua Chemical Engineering Co., Ltd.

- Saint-Gobain NorPro

- Beijing CCE&I Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Ceramic Saddles and Packing market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary advantage of ceramic saddles and packing over metallic alternatives?

The primary advantage of ceramic packing is its unparalleled chemical inertness and superior thermal stability. Ceramic media can operate reliably in highly corrosive environments (e.g., concentrated acids, strong alkalis) and at extreme temperatures where metallic or plastic packing would quickly corrode or degrade, ensuring process continuity and equipment longevity in harsh chemical and petrochemical applications.

How does the geometry of ceramic packing, such as Intalox Saddles, affect mass transfer efficiency?

The geometry of Intalox Saddles is engineered to maximize the specific surface area available for vapor-liquid contact while minimizing pressure drop across the column. Their optimized shape promotes excellent liquid distribution and randomness in the packed bed, preventing channeling and maximizing the efficiency of separation, absorption, or stripping processes compared to simpler, less optimized ring structures.

What factors influence the typical lifespan of ceramic packing in an industrial column?

The lifespan is primarily influenced by operating temperature, chemical concentration, and mechanical stress (crushing). High purity ceramics often last for decades if protected from thermal shock and mechanical breakage during installation and operation. Failure usually occurs due to fouling, chemical attack by unexpected contaminants, or mechanical crushing under severe load, requiring predictive monitoring and proper installation techniques for maximum longevity.

Which industrial segments are the fastest growing consumers of high-alumina ceramic packing?

The fastest growing consumer segments are Environmental Engineering, particularly Flue Gas Desulfurization (FGD) and specialized acid gas scrubbing, and parts of the Chemical Industry requiring high-temperature resistance, such as certain thermal oxidation processes. High-alumina ceramic is favored here due to its enhanced mechanical strength and superior resistance to extreme thermal cycling and highly aggressive chemical agents compared to standard chemical porcelain.

What are the key considerations for minimizing breakage during the installation of ceramic saddles?

Minimizing breakage during installation requires careful logistics, including the use of robust, protective packaging, and employing wet dumping or sock-loading techniques when filling the tower. Training personnel on gentle handling is essential, and often specialized contractors are used to ensure the packing is randomized correctly and loaded uniformly to prevent localized stress points that can lead to crushing failure during operation.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager