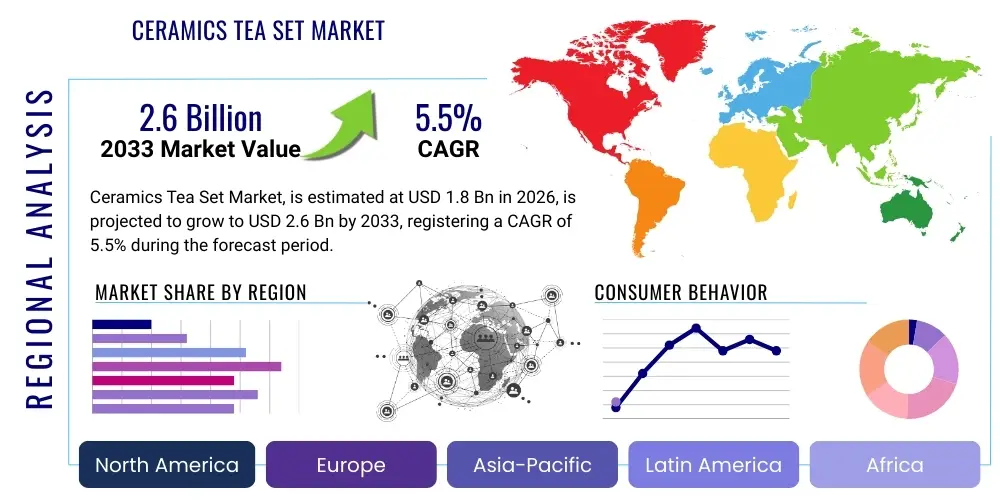

Ceramics Tea Set Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437897 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Ceramics Tea Set Market Size

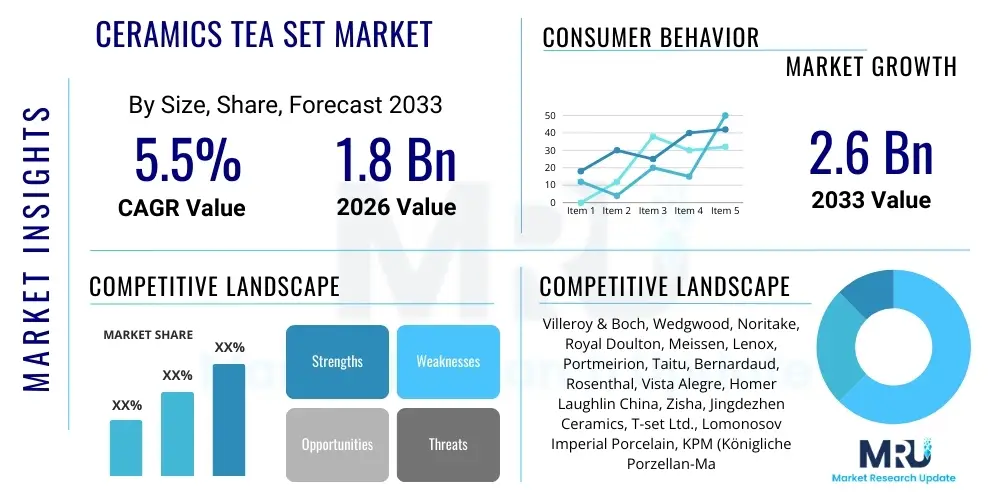

The Ceramics Tea Set Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.5% between 2026 and 2033. The market is estimated at $1.8 Billion in 2026 and is projected to reach $2.6 Billion by the end of the forecast period in 2033.

Ceramics Tea Set Market introduction

The Ceramics Tea Set Market encompasses the manufacturing, distribution, and sale of tableware specifically designed for brewing and serving tea, primarily made from ceramic materials such as porcelain, bone china, earthenware, and stoneware. These sets typically include teapots, cups, saucers, sugar bowls, and creamers. Historically significant, ceramics tea sets are now positioned at the intersection of cultural tradition and modern luxury consumer goods. The demand is heavily influenced by global tea culture revival, particularly in Asian countries, coupled with increased consumer spending on home décor and lifestyle products in developed economies.

The product’s application extends across various settings, including routine household use, formal dining and entertainment, luxury hospitality sectors, and specialized tea houses. Major benefits include superior heat retention compared to glass or metal alternatives, non-reactive material properties that preserve the delicate flavor profile of tea, and inherent aesthetic appeal, offering extensive decorative potential. Furthermore, ceramics tea sets are often viewed as durable, heirloom-quality items, reinforcing their value proposition in the premium segment of the houseware market.

Key driving factors fueling market expansion involve the growing trend of premiumization and artisanal craftsmanship, where consumers seek unique, hand-painted, or limited-edition sets. The resurgence of traditional tea ceremonies (such as Gongfu Cha and Japanese Chanoyu) globally, coupled with the rising disposable incomes in emerging markets like China and India, further accelerates adoption. Additionally, the flourishing e-commerce sector has significantly improved global accessibility for specialized and high-end ceramics manufacturers, transforming niche products into globally recognized commodities.

Ceramics Tea Set Market Executive Summary

The Ceramics Tea Set Market is characterized by robust growth driven by shifting consumer preferences towards sophisticated lifestyle products and the deep integration of tea consumption into global wellness and social rituals. Business trends highlight a strong focus on supply chain resilience, emphasizing sustainable sourcing of raw materials like kaolin and feldspar, alongside investments in automated production technologies to maintain quality and scale. Competitive intensity is defined by the dichotomy between large global houseware brands specializing in mass production and numerous regional artisanal producers offering high-value, bespoke products. Successful market penetration increasingly relies on digital engagement and targeted marketing campaigns that leverage cultural storytelling and heritage associated with ceramic artistry.

Regional trends indicate Asia Pacific (APAC) maintaining its dominance, attributed to ingrained tea traditions and massive consumer bases in China and Japan, which prioritize high-quality ceramics, such as Yixing clay teapots or fine bone china. North America and Europe demonstrate significant growth in the luxury and gifting segments, driven by rising consumption of specialty teas and the use of tea sets as decorative items and collectibles. Geopolitical stability and international trade agreements play a crucial role in managing the export routes for high-volume ceramic producers primarily situated in East Asia.

Segment trends reveal that bone china continues to command the highest revenue share due to its perceived luxury and superior whiteness and translucency, though earthenware and stoneware are gaining traction in the casual and sustainable consumer segments. The online distribution channel is experiencing the fastest expansion, fueled by Millennial and Gen Z buyers seeking convenience and greater variety, alongside direct-to-consumer models adopted by high-end manufacturers. Commercial application, particularly in five-star hotels and luxury restaurants, presents a crucial B2B segment, emphasizing durability, custom branding, and aesthetic compatibility with interior design.

AI Impact Analysis on Ceramics Tea Set Market

Common user questions regarding AI's impact on the ceramics tea set market center around personalized design capabilities, supply chain optimization, and quality assurance. Consumers frequently inquire whether AI can design unique patterns based on personal preferences or cultural aesthetics, and manufacturers are keen on understanding how AI can predict demand fluctuations for specific designs or materials, thereby reducing inventory risk. Furthermore, questions arise concerning the integration of computer vision and machine learning (ML) in detecting microscopic flaws during the highly intricate firing and glazing processes. Users anticipate AI driving efficiency in mass customization, allowing niche markets to be served profitably.

AI's primary influence is observed in enhancing operational efficiency and accelerating product innovation cycles. In design, generative adversarial networks (GANs) are being explored to create novel, aesthetically pleasing surface designs and ergonomic forms that meet contemporary demands while respecting traditional constraints. For the supply chain, predictive analytics models optimize raw material procurement, minimizing wastage and ensuring timely delivery of components like decals and specialized glazes. This integration allows companies to respond rapidly to fast-changing consumer trends, such as the sudden popularity of matte finishes or specific color palettes dictated by global design forecasts.

On the consumer-facing side, AI is instrumental in enhancing the e-commerce experience. AI-powered recommendation engines suggest tea sets based on past purchase history, preferred tea type (e.g., green tea requiring thin porcelain vs. Pu-erh requiring thick clay), and even home décor styles uploaded by the user. This level of personalization elevates the shopping journey, bridging the gap between the tactile experience of traditional retail and the convenience of online purchasing, ultimately driving higher conversion rates and improving customer loyalty within the specialized ceramics market.

- AI-driven pattern generation and ergonomic design optimization for novel tea set shapes.

- Predictive maintenance and quality control using computer vision to detect micro-cracks and glaze imperfections during firing.

- Optimized inventory management and demand forecasting for seasonal or culturally significant collections.

- Enhanced personalized shopping experiences through recommendation engines and virtual try-on tools (AR/VR).

- Automation of complex glazing and decoration processes, improving consistency and reducing labor costs.

DRO & Impact Forces Of Ceramics Tea Set Market

The Ceramics Tea Set Market is governed by a dynamic interplay of Drivers (D), Restraints (R), and Opportunities (O), collectively shaping the competitive landscape. The primary driver is the global expansion of tea culture, fueled by its perceived health benefits and association with mindful living, making tea sets essential household items. Simultaneously, the inherent fragility of ceramic products, leading to high shipping and packaging costs and risks of breakage, acts as a significant restraint. However, the rapidly expanding e-commerce sector presents a major opportunity for manufacturers to bypass traditional retail limitations and reach global niche markets directly, offering specialized and high-margin products.

Impact forces further define the market trajectory. Supplier power is moderate; while raw materials like high-grade kaolin are essential, global sourcing options prevent monopolies. Buyer power is high due to the vast array of choices, ranging from budget utility sets to premium collectible sets, forcing manufacturers to compete fiercely on design innovation, brand reputation, and pricing strategies. Threat of substitutes is moderate, primarily stemming from glass, metal, and durable plastic tea ware, though ceramic remains the material of choice for flavor integrity and tradition. Threat of new entrants is low to moderate; while basic production is accessible, establishing the required infrastructure for high-quality, high-firing ceramics (like bone china) and building brand heritage pose substantial barriers.

Technological impact is accelerating through automation in molding and firing, leading to improved production speed and consistency. Societal impact centers on the growing consumer emphasis on sustainability, pushing manufacturers towards eco-friendly production methods, lead-free glazes, and recyclable packaging. Economically, fluctuations in energy costs (critical for kiln firing) significantly influence production costs, directly impacting final retail pricing and margin viability across all market segments.

Segmentation Analysis

The Ceramics Tea Set Market is comprehensively segmented based on material type, application, and distribution channel, providing a granular view of consumer preferences and market dynamics. Segmentation by material type—encompassing Bone China, Porcelain, Stoneware, and Earthenware—allows manufacturers to target specific price points and aesthetic requirements, with Bone China dominating the luxury segment due to its superior durability and lightweight elegance. Application segmentation distinguishes between Household (day-to-day use and gifting) and Commercial (Horeca sector), each demanding different features regarding aesthetics, volume capacity, and physical resilience to high-frequency use. Geographic segmentation provides critical insights into regional tea customs and material preferences, influencing inventory placement and marketing localization strategies globally.

- Material Type

- Bone China

- Porcelain (Hard-paste and Soft-paste)

- Stoneware

- Earthenware

- Others (e.g., Zisha Clay)

- Application

- Household Use

- Commercial Use (Hotels, Restaurants, Cafés, Tea Houses)

- Distribution Channel

- Offline

- Specialty Stores

- Departmental Stores

- Supermarkets and Hypermarkets

- Online

- E-commerce Portals (Amazon, eBay)

- Company Websites (Direct-to-Consumer)

- Offline

Value Chain Analysis For Ceramics Tea Set Market

The value chain for ceramics tea sets is intricate, starting with the procurement of essential raw materials and culminating in final consumer delivery. Upstream activities involve sourcing high-quality raw materials such as kaolin, feldspar, quartz, and specialized minerals required for glazes and decals. These raw materials, often sourced globally, undergo initial processing (purification, grinding, mixing) before being supplied to the manufacturing units. Efficient upstream logistics are crucial as the quality of these materials directly dictates the final product quality and the success rate during the high-temperature firing process, a critical bottleneck in production.

The manufacturing phase is centered around forming (casting, jiggering, or pressing), drying, biscuit firing, glazing, and final firing. Significant value addition occurs here through skilled craftsmanship, particularly in hand-painting, decal application, and detailed finishing, which differentiate luxury brands. Downstream analysis focuses on distribution channels. Direct channels (company-owned stores, dedicated e-commerce sites) allow for greater margin capture and brand control, while indirect channels (specialty retailers, wholesalers, department stores) provide broad market reach but involve margin sharing. The choice of channel significantly impacts brand positioning, with premium products often favoring controlled, high-end specialty stores.

Packaging and logistics are uniquely challenging due to the extreme fragility of the product, necessitating specialized, high-impact resistance packaging, particularly for international and e-commerce shipments. After-sales service, especially concerning replacement of broken components or authentication of collectible sets, adds further value. The distribution strategy must balance the need for rapid market penetration with the imperative to minimize transit damage, often involving dedicated ceramics logistics providers familiar with handling delicate goods. The efficiency of the entire chain determines the profitability and competitive pricing of the final tea set.

Ceramics Tea Set Market Potential Customers

Potential customers for ceramics tea sets span a broad demographic spectrum, segmented primarily into the Household and Commercial categories. Within the Household segment, key buyers include middle-to-high income consumers who engage in tea drinking as a lifestyle choice, prioritizing quality, aesthetics, and design heritage. This segment includes gift-givers seeking high-value, culturally significant presents, and collectors who prioritize limited-edition, artisanal, or antique bone china and famous Zisha clay ware. Demographic analysis shows a strong correlation between age (35+) and purchasing high-end sets, though younger generations (Millennials) are driving demand for modern, minimalist designs via online channels.

The Commercial sector, encompassing the Hotels, Restaurants, and Cafés (HoReCa) industry, represents a substantial B2B market. Luxury hotels and fine dining establishments require durable, high-capacity, often custom-branded porcelain sets that withstand industrial dishwashing and frequent handling while maintaining an elegant appearance suitable for premium customer service. Specialized tea houses and independent coffee shops also constitute important buyers, often seeking functional, large-volume stoneware or specialized regional ceramic types to enhance their unique beverage offerings and ambiance. Procurement decisions in the B2B sphere heavily weigh cost-per-use, replacement availability, and the ability of the supplier to handle large, consistent orders.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.8 Billion |

| Market Forecast in 2033 | $2.6 Billion |

| Growth Rate | 5.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Villeroy & Boch, Wedgwood, Noritake, Royal Doulton, Meissen, Lenox, Portmeirion, Taitu, Bernardaud, Rosenthal, Vista Alegre, Homer Laughlin China, Zisha, Jingdezhen Ceramics, T-set Ltd., Lomonosov Imperial Porcelain, KPM (Königliche Porzellan-Manufaktur), Mikasa, Royal Albert, Fissman |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ceramics Tea Set Market Key Technology Landscape

The technological landscape of the Ceramics Tea Set market is primarily centered on enhancing efficiency, achieving product consistency, and enabling complex decoration techniques. Key technologies employed include high-pressure casting (HPC) and isostatic pressing, which significantly improve the uniformity and density of the ceramic body, leading to fewer defects during firing, particularly crucial for delicate materials like bone china. Advanced kiln technologies, such as fast-firing shuttle kilns and continuous tunnel kilns, utilize sophisticated temperature control systems and energy management protocols to reduce firing times and energy consumption, addressing both operational cost pressures and sustainability concerns within the industry.

In the decoration phase, digital printing technology has revolutionized the application of complex, multicolored, and photorealistic decals and glazes onto curved ceramic surfaces. Unlike traditional methods requiring expensive screen or pad printing plates, digital printing allows for rapid customization, small batch production of specialized designs, and a higher level of precision. Furthermore, nanotechnology is being explored to develop scratch-resistant and stain-resistant glazes, enhancing the product's longevity and ease of maintenance, a significant factor for commercial buyers.

The integration of robotics and automation is increasingly prominent, particularly in handling delicate greenware (unfired clay) and automating repetitive tasks like glazing and packaging. Robotics ensures minimal handling damage and high throughput consistency, vital for large-scale producers competing in the global market. Furthermore, manufacturers are adopting Computer-Aided Design (CAD) and simulation software to optimize mold design and predict material shrinkage during firing, reducing material waste and accelerating the time-to-market for new product lines and intricate shapes.

Regional Highlights

The Ceramics Tea Set Market exhibits pronounced regional variances driven by cultural heritage, disposable income, and prevailing lifestyle trends. Asia Pacific (APAC) stands as the largest and fastest-growing region, dominated by high demand from China, Japan, and India, where tea consumption is deeply embedded in daily life and ceremonial practice. China, in particular, drives significant volume due to its vast manufacturing base, particularly for fine porcelain (Jingdezhen) and specialized clays (Yixing). The rapid urbanization and expansion of the middle class in APAC increase demand for both traditional, ornate sets and modern, functional designs suitable for urban living.

Europe represents a mature market characterized by a strong historical connection to high-end ceramics. Countries like the UK, Germany, and France are major consumers of luxury bone china, driven by heritage brands like Wedgwood and Meissen. The demand here is highly seasonal, peaking during holiday and gifting seasons, and is significantly influenced by interior design trends. While volume growth is slower compared to APAC, the Average Selling Price (ASP) for premium European-made sets remains high, emphasizing quality, craftsmanship, and brand legacy over sheer quantity.

North America demonstrates robust growth in the specialty tea and collectible segments. Consumers are increasingly adopting specialty teas, driving demand for specific tea ware—such as delicate Japanese-style sets for green tea or robust stoneware for high-volume American brewing. E-commerce facilitates the widespread adoption of international brands. The Middle East and Africa (MEA) market shows steady growth, particularly in Gulf Cooperation Council (GCC) countries, where coffee and tea serving is central to hospitality culture, leading to demand for ornate, gold-rimmed sets often imported from European luxury houses or specialized Turkish and Iranian producers, merging traditional aesthetics with modern luxury presentation requirements.

- China (APAC): Dominant manufacturing hub and largest consumer base; drives innovation in Zisha clay and high-fire porcelain.

- Japan (APAC): Focus on highly functional, aesthetically minimalist designs (Wabi-sabi); strong market for handmade ceramics.

- United Kingdom (Europe): Key market for premium Bone China and heritage brands; strong gifting culture.

- United States (North America): High demand for casual, durable stoneware and imported specialty sets via online channels.

- Germany (Europe): Significant B2B market for commercial applications and strong presence of major porcelain manufacturers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ceramics Tea Set Market.- Villeroy & Boch

- Wedgwood

- Noritake

- Royal Doulton

- Meissen

- Lenox

- Portmeirion

- Taitu

- Bernardaud

- Rosenthal

- Vista Alegre

- Homer Laughlin China

- Zisha

- Jingdezhen Ceramics

- T-set Ltd.

- Lomonosov Imperial Porcelain

- KPM (Königliche Porzellan-Manufaktur)

- Mikasa

- Royal Albert

- Fissman

Frequently Asked Questions

Analyze common user questions about the Ceramics Tea Set market and generate a concise list of summarized FAQs reflecting key topics and concerns.What material is considered the highest quality for ceramics tea sets?

Bone China is generally considered the highest quality material due to its exceptional whiteness, delicate translucency, high resistance to chipping, and lightweight durability, making it preferred for luxury and formal use. Porcelain follows closely, offering excellent strength and aesthetic appeal.

How is the growth of e-commerce impacting the sale of fragile ceramics tea sets?

E-commerce is a primary growth driver, overcoming geographical barriers. Specialized, high-impact packaging techniques and improved logistics tracking mitigate fragility risks, enabling manufacturers to reach global collectors and personalized niche markets directly, boosting overall revenue and market access.

What is the primary difference between stoneware and porcelain tea sets?

Porcelain is fired at very high temperatures (over 1,200°C), resulting in a non-porous, highly durable, white, and translucent body. Stoneware is fired at slightly lower temperatures, resulting in a more opaque, thicker, and rustic body that is durable and ideal for casual, daily use.

Which geographical region dominates the global ceramics tea set market in terms of production and consumption?

Asia Pacific (APAC), particularly China, dominates both production capacity and consumption volume. This dominance is attributed to centuries-old tea culture, a massive domestic consumer base, and established specialized manufacturing centers like Jingdezhen for fine porcelain.

Are ceramics tea sets influenced by sustainability and eco-friendly manufacturing trends?

Yes, consumers increasingly demand eco-friendly options. Manufacturers are responding by adopting lead-free glazes, optimizing kiln processes to reduce energy consumption, sourcing local raw materials to minimize transport emissions, and utilizing recycled or recyclable packaging materials.

Market Dynamics Deep Dive: Consumer Behavior and Premiumization

Consumer behavior in the Ceramics Tea Set Market is shifting dramatically, moving beyond utilitarian needs towards emotional and experiential purchasing. Modern consumers, particularly those in developed economies, view tea sets not just as functional items but as elements of interior design, personal expression, and tools for practicing wellness rituals. This shift fuels the premiumization trend, where consumers are willing to pay significantly more for sets that offer exceptional craftsmanship, unique design narratives, or limited-edition status. Brands that successfully convey a story—whether historical heritage, artisanal origin, or sustainable production methods—gain a distinct competitive advantage over generic mass-market producers.

The purchasing decision is increasingly polarized. At the lower end, demand focuses on durable, machine-washable stoneware for everyday use, primarily driven by convenience and budget. At the high end, fine porcelain and bone china sets are acquired for gifting, formal entertaining, and investment purposes. The rise of social media platforms, especially visual ones like Instagram and Pinterest, has significantly influenced aesthetic preferences, leading to cyclical spikes in demand for specific colors (e.g., pastel tones, deep blues) and finish styles (matte vs. high gloss). Manufacturers must maintain agility in their design pipelines to capitalize on these rapidly evolving aesthetic trends.

Furthermore, the crossover appeal of ceramics tea sets into the collectibles market cannot be overstated. High-end brands often collaborate with famous designers or artists to release exclusive series, creating artificial scarcity that drives demand and maintains high price points. Authenticity, verifiable provenance, and the potential for appreciation in value are critical factors for collectors. For manufacturers, managing brand integrity and preventing counterfeiting are crucial strategic pillars in protecting their premium market positioning and ensuring long-term profitability within this niche, high-margin segment.

Competitive Strategy Analysis and Brand Positioning

The competitive landscape is fragmented, demanding sophisticated segmentation strategies from key players. Global giants like Villeroy & Boch and Wedgwood leverage their century-spanning heritage, extensive distribution networks, and strong brand recall to dominate the high-end retail and B2B hospitality sectors. Their strategy revolves around maintaining perceived quality through controlled production processes and diversifying their portfolio to include adjacent tableware products, ensuring consumers remain within their brand ecosystem for all home dining needs.

Conversely, regional manufacturers and artisanal producers, particularly those specializing in local ceramics (e.g., Japanese pottery studios, Chinese Zisha manufacturers), focus on niche specialization and cultural authenticity. Their competitive edge lies in hand-craftsmanship, unique material properties, and direct engagement with consumers via specialized tea houses or curated online platforms. These smaller players often achieve higher margins per unit due to the perceived artistic value and rarity, challenging the mass-market scale of larger entities.

A key trend in competitive strategy is the emphasis on sustainability and ethical sourcing, which is transitioning from a niche requirement to a core business imperative. Brands that transparently communicate their efforts in minimizing environmental impact, such as using recycled clay or optimizing kiln energy consumption, are gaining favor among environmentally conscious consumers, particularly in Western markets. Future growth will be secured by companies that effectively blend technological efficiency (for cost control) with emotional branding (for premium market access) and robust digital distribution capabilities.

Emerging Market Trends and Future Outlook

Several emerging trends are set to reshape the Ceramics Tea Set market over the forecast period. The concept of "functional minimalism" is gaining prominence, moving away from heavily ornate designs towards clean lines, practical stackability, and versatile use. This trend is particularly popular among urban dwellers and younger consumers who favor Scandinavian or Japanese aesthetics in their home décor. Manufacturers are responding by introducing modular tea sets where components can be mixed and matched or utilized for serving other beverages.

The "gifting economy" remains a powerful accelerator. Personalized and customized tea sets, often featuring engraved messages, monogramming, or unique painted motifs, are highly sought after for weddings, anniversaries, and corporate events. Advances in digital decoration technologies facilitate this customization economically, allowing smaller batches of bespoke products to be produced profitably, thereby unlocking new revenue streams for manufacturers who can integrate efficient customization into their supply chains.

Looking forward, the integration of smart technology, though nascent, represents a future opportunity. While traditionalists may resist, basic smart functionalities such as temperature monitoring integrated into teapots or self-heating coasters could appeal to convenience-seeking segments. Furthermore, as the specialty coffee market continues its global expansion, there is a substantial cross-pollination of consumers interested in high-quality brewing apparatus. Ceramics tea set manufacturers are strategically positioning their stoneware and porcelain lines to appeal to this segment, emphasizing the versatility and superior heat retention qualities of their products for specialty coffee brewing methods like pour-over.

Regulatory and Safety Standards Landscape

The Ceramics Tea Set Market operates under stringent international and regional regulatory frameworks primarily focused on consumer health and safety. The most critical regulations pertain to the potential leaching of heavy metals, specifically lead and cadmium, from ceramic glazes into beverages. Regulators, such as the U.S. Food and Drug Administration (FDA) and the European Union (EU) via Regulation (EC) No 1935/2004, impose strict migration limits for these substances. Manufacturers must demonstrate continuous compliance through rigorous batch testing and certification, requiring substantial investment in quality control laboratories and specialized testing equipment.

Beyond chemical safety, standards also cover physical safety and performance. International Organization for Standardization (ISO) standards often dictate requirements for thermal shock resistance, mechanical strength, and dishwasher safety, particularly relevant for commercial-grade ceramics. In the export-heavy Asian market, manufacturers must navigate the varying compliance requirements of multiple destination countries simultaneously, often necessitating dual or triple certifications for the same product line. Non-compliance can result in costly product recalls, damage to brand reputation, and complete loss of market access in key territories.

The trend towards sustainable manufacturing is also leading to the emergence of voluntary, self-imposed industry standards regarding raw material sourcing and production energy efficiency. Certification schemes (e.g., Fair Trade, specific environmental seals) are becoming powerful marketing tools, offering assurance to consumers that the entire production chain, from mining to packaging, adheres to ethical and ecological practices. Continuous monitoring of these evolving regulations is paramount for maintaining uninterrupted global market participation and ensuring consumer trust.

Distribution Channel Analysis: E-commerce vs. Brick-and-Mortar

The distribution of ceramics tea sets is undergoing a significant transformation, marked by the rapid ascendance of the online channel. Brick-and-mortar stores, traditionally including specialty home goods retailers, high-end department stores, and gift shops, continue to play a crucial role, particularly for premium and luxury sets. These physical environments offer consumers the vital tactile experience—allowing them to feel the weight, inspect the glaze finish, and assess the ergonomics of handles and spout designs—which is crucial for high-value purchases. Physical stores also serve as important brand showcases and centers for personalized customer service.

However, the online distribution channel (e-commerce portals and Direct-to-Consumer, D2C, websites) is experiencing exponential growth, primarily driven by logistical improvements and enhanced digital shopping experiences. E-commerce platforms offer unmatched product diversity, allowing consumers to easily compare prices and access niche or international brands that are unavailable locally. For manufacturers, the D2C model offers higher margin retention, direct access to consumer data for personalized marketing, and rapid feedback loops on new product launches, streamlining the entire sales cycle.

The greatest challenge in online distribution remains the risk of transit damage. Manufacturers utilizing the online channel invest heavily in robust, custom-fitted protective packaging and often partner with specialized logistics providers experienced in handling fragile goods. Successful channel strategy involves an omnichannel approach: leveraging physical stores for brand immersion and premium sales, while utilizing the efficiency and reach of e-commerce for high-volume, global distribution and serving the customization market efficiently. The future of distribution lies in seamless integration between these two channels, offering click-and-collect options and in-store returns for online purchases.

Material Type Focus: Bone China and Porcelain

Bone China represents the pinnacle of ceramics tea ware, holding a substantial revenue share in the premium market segment. Defined by the inclusion of calcined bone ash (typically 25% to 50%), Bone China achieves remarkable properties: superior mechanical strength despite its thinness, a characteristic translucent body when held up to light, and an unmatched creamy white color. These characteristics make it the material of choice for formal dining, luxury hotel tableware, and heirloom collections. The complex, multi-stage manufacturing process of bone china—involving two separate firings and high precision—contributes to its elevated price point, justifying its luxury positioning.

Porcelain, encompassing both hard-paste (true) and soft-paste varieties, dominates the broader mid-to-high segment. Hard-paste porcelain, fired at extremely high temperatures, is known for its incredible durability, non-porous surface, and resistance to thermal shock, making it highly valued in both commercial settings and busy households. Soft-paste porcelain, while less durable, is often preferred by artisans for its ability to hold vivid colors and intricate underglaze decorations, allowing for greater artistic expression and diverse aesthetic appeal in specialized tea sets.

The choice between Bone China and Porcelain often hinges on the end-user’s priorities: luxury consumers prioritize the aesthetic elegance and lightness of Bone China, whereas commercial clients often lean towards the robust, standardized durability and ease of replacement offered by high-quality hard-paste porcelain. Both segments require strict adherence to regulatory standards regarding food contact safety, ensuring that glazes are free from harmful heavy metal leaching, a fundamental requirement for global market acceptance.

Application Segment Details: Household vs. Commercial Use

The Household application segment constitutes the largest volume market for ceramics tea sets. This segment is highly diverse, ranging from budget-friendly earthenware sets purchased for daily use to expensive, branded porcelain sets acquired for special occasions, entertaining guests, or as decorative home accents. Key drivers in the household segment include lifestyle trends, gifting occasions (especially weddings and housewarmings), and the cultural appreciation of tea as a hobby. Consumers in this segment prioritize design aesthetics, brand heritage, and the ability of the set to enhance the domestic atmosphere. The household segment shows greater sensitivity to promotional activity and seasonal retail campaigns.

The Commercial application segment, primarily serving the HoReCa industry (Hotels, Restaurants, Cafés, and dedicated Tea Houses), focuses heavily on practical utility and durability. Commercial purchasers require ceramics that can withstand rigorous, high-frequency use, including repeated cycles in industrial dishwashers, resistance to chipping, and retention of heat. Aesthetics remain important, particularly in luxury hotels where the presentation of food and beverage service contributes significantly to the guest experience. Procurement decisions often favor suppliers who can provide consistent, large-volume supply, excellent after-sales support for replacement pieces, and customization options such as corporate logos or specific color matching.

A notable distinction is the functional capacity. Commercial sets often feature thicker walls for superior insulation and larger serving capacities, whereas household sets prioritize delicate design and portability. The growth trajectory of the commercial segment is intrinsically linked to the global expansion of tourism, the luxury hospitality sector, and the emergence of specialized tea houses focusing on traditional or artisanal tea experiences, requiring unique and culturally specific ceramic ware.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager