Ceric Ammonium Nitrate Powder Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434326 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Ceric Ammonium Nitrate Powder Market Size

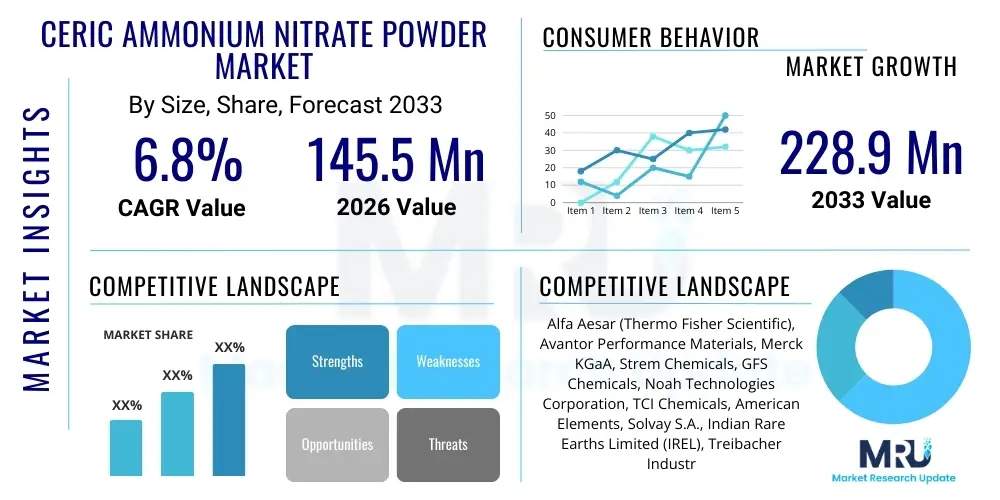

The Ceric Ammonium Nitrate Powder Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 145.5 Million in 2026 and is projected to reach USD 228.9 Million by the end of the forecast period in 2033.

Ceric Ammonium Nitrate Powder Market introduction

Ceric Ammonium Nitrate (CAN), chemically represented as (NH4)2Ce(NO3)6, is a highly potent, orange-red inorganic salt that functions predominantly as a strong oxidizing agent. It is widely recognized for its high standard reduction potential, making it indispensable in diverse fields ranging from advanced organic synthesis to material science and high-precision electronics manufacturing. Historically, CAN was primarily utilized in analytical chemistry as a volumetric reagent for redox titrations, but its modern significance lies in its role as a versatile oxidant and catalyst in the burgeoning pharmaceutical and specialty chemical industries. The unique chemical structure of CAN allows it to effectively initiate oxidation reactions, facilitate the cleavage of certain chemical bonds, and act as a source of the ceric ion, which is crucial for various radical reactions.

Major applications of Ceric Ammonium Nitrate Powder encompass its use as an oxidizing agent in organic chemistry, particularly for the oxidative coupling of phenols, oxidation of primary alcohols to aldehydes, and for specific transformations like the removal of p-methoxybenzyl (PMB) protecting groups in complex synthesis steps, which is critical in drug manufacturing. Furthermore, its ability to generate highly reactive intermediate species has cemented its role as a key component in the synthesis of numerous fine chemicals and intermediates. The demand for ultra-high-purity grades of CAN, particularly the electronic grade, has surged due to its irreplaceable function as an etchant in the semiconductor fabrication process, specifically in the manufacturing of thin-film transistors (TFTs) and integrated circuits (ICs), driven by the global expansion of consumer electronics and advanced computing infrastructure.

The primary benefit derived from the use of CAN is its efficiency and selectivity as an oxidant, often allowing for reactions to proceed under mild conditions with high yields, reducing the need for harsh solvents or extreme temperatures, which aligns with sustainable chemistry principles. Key driving factors propelling market growth include the robust expansion of the global electronics industry, which continuously demands higher purity etching chemicals for miniaturization, and the increasing complexity of pharmaceutical research and development requiring specialized and efficient synthetic reagents. Additionally, growing investment in academic and industrial chemical research focused on novel synthetic routes and catalysis further stimulates the consumption of high-grade Ceric Ammonium Nitrate Powder globally.

Ceric Ammonium Nitrate Powder Market Executive Summary

The Ceric Ammonium Nitrate Powder market exhibits dynamic growth, fundamentally influenced by evolving technological requirements in the electronics and fine chemical sectors. Current business trends indicate a strong shift towards vertical integration among major chemical suppliers seeking to control the supply chain from raw material (cerium extraction) to final, high-purity product, thereby mitigating risks associated with supply volatility and ensuring grade consistency, especially for electronic applications. Geographically, the market expansion is overwhelmingly concentrated in the Asia Pacific region, primarily driven by the massive concentration of semiconductor manufacturing foundries and consumer electronics production hubs in countries such as China, South Korea, Taiwan, and Japan. This regional dominance necessitates robust logistics networks capable of handling hazardous chemicals while adhering to stringent environmental and safety regulations imposed by various national bodies.

Regional trends highlight that while APAC dominates demand volume, North America and Europe maintain critical importance due to intensive research and development activities in specialty chemicals, pharmaceuticals, and advanced material science. These Western markets prioritize high-margin, ultra-high-purity grades used in specialized laboratory settings and pilot-scale pharmaceutical production, demonstrating higher average selling prices compared to bulk commodity grades. Furthermore, sustainability initiatives in Europe are beginning to influence manufacturing processes, pushing suppliers to adopt greener synthesis methods for CAN to reduce waste streams and energy consumption, though the chemical's core oxidizing role remains unchanged.

Segment trends reveal that the Electronic Grade segment is experiencing the fastest growth rate, fueled by the relentless pursuit of smaller feature sizes and higher performance in microelectronics, demanding CAN with purity levels exceeding 99.999%. The application segment dedicated to Catalysis and Organic Synthesis also shows steady expansion, supported by the increasing complexity of Active Pharmaceutical Ingredient (API) synthesis, where CAN acts as an essential catalyst or selective oxidizing agent. Manufacturers are increasingly focused on process innovation to differentiate their product offerings within these segments, emphasizing reduced metallic impurities and improved physical characteristics, such as controlled particle size distribution, crucial for demanding industrial applications.

AI Impact Analysis on Ceric Ammonium Nitrate Powder Market

User queries regarding AI's influence in the Ceric Ammonium Nitrate Powder market commonly revolve around optimization of complex chemical processes, prediction of material purity outcomes, and streamlining of supply chain logistics for hazardous materials. Users frequently ask if AI can accelerate the discovery of alternative, potentially safer oxidants, or whether machine learning algorithms can minimize batch-to-batch variability, which is critical for electronic-grade chemicals. The overarching theme is the application of predictive analytics to enhance efficiency, reduce production costs, and ensure compliance in the handling and manufacturing of this crucial, yet sensitive, inorganic compound.

The application of Artificial Intelligence and Machine Learning (ML) is beginning to revolutionize the manufacturing and utilization of Ceric Ammonium Nitrate Powder, primarily through optimizing synthesis pathways and quality control. AI-driven predictive modeling is being used to analyze parameters such as temperature, pH, and reactant concentration during the crystallization and purification stages of CAN production. This allows manufacturers to dynamically adjust process variables in real-time, significantly improving yield, reducing energy consumption, and crucially, ensuring consistent achievement of ultra-high purity levels necessary for semiconductor etching applications, minimizing expensive batch failures caused by metallic contamination.

Beyond manufacturing, AI significantly impacts the R&D landscape where CAN is utilized. Machine learning models analyze vast datasets of chemical reactions (chem-informatics) to predict optimal reaction conditions, reaction kinetics, and potential side products when CAN is used as an oxidant or catalyst in novel organic synthesis routes. This accelerates the identification of highly efficient, selective, and safer synthetic protocols for complex molecules (e.g., APIs), reducing the reliance on extensive, time-consuming laboratory experimentation. Furthermore, AI enhances supply chain resilience by forecasting demand fluctuations and optimizing routing for transporting high-purity, often regulated, CAN shipments across international borders, minimizing storage times and managing associated regulatory complexities.

- AI-enhanced modeling optimizes crystallization parameters, leading to ultra-high purity (>99.999%) Ceric Ammonium Nitrate required for electronics.

- Predictive analytics minimizes batch-to-batch variability and reduces production waste, improving cost efficiency in synthesis.

- Machine Learning accelerates chemical reaction optimization when CAN is used as a reagent in complex organic synthesis, aiding drug discovery.

- AI algorithms improve supply chain forecasting and risk assessment for the transportation and storage of hazardous CAN.

- Computer vision systems are used in quality control for visual inspection of crystal morphology and consistency.

DRO & Impact Forces Of Ceric Ammonium Nitrate Powder Market

The market for Ceric Ammonium Nitrate Powder is propelled by strong underlying demand forces originating primarily from technological advancements and robust industrial growth, yet it faces significant constraints related to regulatory compliance and material characteristics. The primary driver is the accelerating pace of miniaturization in the semiconductor industry, which mandates consistent, reliable supply of electronic-grade CAN for essential etching processes. Concurrently, the increasing complexity of pharmaceutical drug molecules requires sophisticated and selective oxidizing agents, boosting demand for high-grade CAN in specialty chemical synthesis. These positive drivers establish a high-growth environment for suppliers capable of meeting rigorous purity standards. However, the market growth potential is tempered by the inherent toxicity and strict handling requirements of CAN, which increase operational costs and complexity throughout the value chain, coupled with the persistent threat of substitution by alternative, less hazardous oxidants or emerging dry-etching technologies in microelectronics, presenting substantial restraints to market expansion.

Significant opportunities exist through strategic investment in green chemistry and advanced manufacturing techniques. Developing environmentally benign synthesis methods for CAN, minimizing the generation of nitrate waste, and exploring the chemical’s role in heterogeneous catalysis could unlock new application areas and enhance market acceptability. Moreover, expanding into niche applications, such as advanced polymer synthesis or specialized battery components where cerium compounds play a critical role, offers future revenue streams. The collective impact forces shape a competitive landscape where technological superiority in purification (to achieve 99.999% purity) and compliance with stringent environmental, health, and safety (EHS) standards are the key determinants of long-term market leadership and profitability across all geographical segments.

The interrelation between the driving forces and the restraints creates a highly dynamic market equilibrium. While the burgeoning electronics sector continuously pulls demand upward, the high capital expenditure required to establish EHS-compliant manufacturing facilities acts as a significant entry barrier, consolidating market share among established players. Furthermore, geopolitical stability plays a crucial role, as cerium, the raw material precursor, is often subject to geopolitical supply chain dynamics, requiring manufacturers to implement sophisticated risk mitigation strategies, including securing diversified sourcing agreements and maintaining strategic stockpiles, directly impacting pricing and supply consistency.

Segmentation Analysis

The Ceric Ammonium Nitrate Powder market is segmented primarily based on the purity Grade, the application for which it is utilized, and the specific end-use industry driving the demand. Segmentation by grade is the most critical differentiator, as the purity level dictates suitability for highly sensitive applications like microelectronics versus bulk applications in general laboratory use, resulting in vast price discrepancies between the segments. The application analysis highlights the diverse roles of CAN, ranging from its function as a primary reactant in chemical synthesis to its use as an essential component in material removal processes (etching) for semiconductors. Understanding these segments is crucial for suppliers to tailor production processes and marketing strategies to meet the exacting, yet varied, demands of specialized customers.

- By Grade:

- Reagent Grade (Standard purity for general lab use)

- High Purity Grade (Used in complex organic synthesis and analytical standards)

- Electronic Grade (Ultra-high purity, 99.999% or higher, critical for semiconductor etching)

- By Application:

- Oxidizing Agent in Organic Synthesis

- Catalysis (Specific radical reactions and Polymerization)

- Etching Agent (Semiconductor and Thin Film Manufacturing)

- Analytical Reagent (Redox Titrations)

- Source of Cerium Ions

- By End-Use Industry:

- Electronics and Semiconductor Industry

- Pharmaceutical and Biotechnology Industry

- Chemical and Petrochemical Industry

- Academia and Research Laboratories

- Advanced Material Manufacturing

Value Chain Analysis For Ceric Ammonium Nitrate Powder Market

The value chain for Ceric Ammonium Nitrate Powder begins with the upstream sourcing and processing of raw materials, primarily cerium-containing rare earth ores such as bastnäsite and monazite, which are extracted and refined to yield high-purity cerium salts, typically cerium oxide or cerium carbonate. This upstream segment is characterized by high capital intensity, complex chemical processing, and strong regulatory scrutiny due to environmental impacts associated with rare earth mining and separation. Manufacturers must secure stable, long-term supply agreements for refined cerium precursors, as the quality of these initial materials directly impacts the feasibility of achieving the ultra-high purity levels required downstream, especially for the electronic-grade market segment, where trace metal contamination is intolerable.

The midstream involves the sophisticated chemical synthesis of Ceric Ammonium Nitrate from the refined cerium salts, typically through dissolution in nitric acid followed by complex reaction and crystallization processes, often utilizing proprietary purification techniques like fractional crystallization and ion exchange to remove contaminants. This manufacturing stage is highly specialized, demanding rigorous quality control and specialized containment infrastructure due to the corrosive and hazardous nature of the reactants and products. Manufacturers differentiate themselves here through process efficiency, yield maximization, and the ability to consistently achieve specific particle morphology and moisture content tailored to end-user specifications, particularly for semiconductor applications where homogeneity is paramount for consistent etching rates.

The downstream distribution channels are bifurcated into direct and indirect routes. Direct sales are common for large-volume purchasers, particularly major semiconductor fabrication plants and large pharmaceutical manufacturers, where customized contracts and specialized logistics (e.g., just-in-time delivery of highly pure material) are necessary. Indirect channels involve regional chemical distributors and specialized material suppliers who handle inventory management, smaller-volume sales to R&D laboratories and smaller specialty chemical manufacturers, and compliance with local regulatory storage requirements. Due to the classified hazardous nature of CAN, transportation and storage must comply with international and national dangerous goods regulations, significantly influencing logistical costs and requiring specialized warehousing and transportation expertise within the distribution network.

Ceric Ammonium Nitrate Powder Market Potential Customers

The primary end-users and potential customers of Ceric Ammonium Nitrate Powder are technologically advanced industries that require high-performance oxidizing agents or precision etching capabilities. Foremost among these are semiconductor fabrication facilities (Fabs), particularly those involved in the production of advanced logic chips, memory devices (DRAM, NAND), and power semiconductors, where electronic-grade CAN is essential for etching metallic layers, most notably aluminum and copper films, with precision measured in nanometers. These customers demand extremely high purity levels (often five nines or more) and consistent supply to maintain high yields and operational continuity within their multi-billion dollar manufacturing lines, making them the most demanding, yet lucrative, customer segment in the market.

Another major customer segment resides within the global pharmaceutical and biotechnology sectors, encompassing both large multinational drug companies and specialized Contract Research Organizations (CROs) or Contract Manufacturing Organizations (CMOs). In this context, CAN is used extensively in the synthesis of complex Active Pharmaceutical Ingredients (APIs) as a highly selective oxidant or for specialized deprotection steps during multi-step synthesis. These customers prioritize high quality (often USP or ACS grade), reliability, and robust documentation demonstrating compliance with Good Manufacturing Practice (GMP) standards. The increasing complexity of small-molecule therapeutics ensures sustained demand from this sector, often requiring customized packaging and stringent quality assurance protocols.

Further potential customers include specialty chemical manufacturers that use CAN for the creation of unique polymer additives, advanced material precursors, and other fine chemicals used in industrial catalysis or material science research. Academic and industrial research laboratories also represent a steady customer base, albeit for smaller volumes, utilizing the reagent for exploratory synthesis, analytical standardization, and educational purposes. The sustained investment in green chemistry research further fuels demand, as researchers investigate methods to leverage CAN's oxidative potential in more environmentally sound reaction systems, confirming a broad, diversified customer base across the chemical and technology spectrums.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 145.5 Million |

| Market Forecast in 2033 | USD 228.9 Million |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Alfa Aesar (Thermo Fisher Scientific), Avantor Performance Materials, Merck KGaA, Strem Chemicals, GFS Chemicals, Noah Technologies Corporation, TCI Chemicals, American Elements, Solvay S.A., Indian Rare Earths Limited (IREL), Treibacher Industrie AG, Prochem, BOC Sciences, Shanghai Rare-Earth Chemical Co., Ltd., Deepwater Chemicals, Inc., Wako Pure Chemical Industries (Fujifilm), Loba Chemie, PVS Chemicals, Inc., Gelest Inc., Otto Chemie Pvt. Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ceric Ammonium Nitrate Powder Market Key Technology Landscape

The core technology landscape in the Ceric Ammonium Nitrate Powder market centers not on novel chemical synthesis routes, which are largely established, but rather on advanced purification technologies critical for achieving the required ultra-high purity levels, particularly the electronic grade. The primary technological advancements involve highly optimized multi-stage purification processes, including specialized fractional crystallization techniques and sophisticated ion-exchange resin systems. These methods are designed to meticulously remove trace metallic impurities—such as iron, sodium, and heavy metals—which, even at parts per billion (ppb) concentrations, can severely compromise the performance of sensitive semiconductor devices. Investing in these state-of-the-art purification units and cleanroom manufacturing environments is a significant capital expenditure, acting as a technological barrier to entry for new market players, thereby concentrating the supply of electronic-grade CAN among a few established global suppliers who can afford and manage this rigorous technological infrastructure.

A secondary, yet rapidly developing, technology is the implementation of continuous flow chemistry techniques in CAN production. Traditional batch processes present challenges in terms of controlling reaction homogeneity, heat dissipation, and ensuring consistent particle morphology, especially when scaling up production. Continuous flow systems offer superior control over reaction parameters, allowing for safer handling of exothermic reactions, reducing hazardous chemical inventory at any given time, and enhancing the ability to rapidly adjust process variables to meet exact customer specifications. This technological shift is crucial for improving safety, reducing waste generation, and ensuring the scalable production of consistent, high-quality material, aligning production capabilities with the demanding just-in-time delivery requirements of major industrial end-users like semiconductor fabricators.

Furthermore, analytical technology plays an indispensable role in maintaining market standards. Advanced spectroscopic and elemental analysis techniques, such as Inductively Coupled Plasma Mass Spectrometry (ICP-MS) and Atomic Absorption Spectroscopy (AAS), are essential for routine quality control to verify the absence of critical metallic contaminants down to sub-ppb levels. Technological innovation in this area focuses on developing faster, more sensitive, and highly automated analytical workflows that can seamlessly integrate into the manufacturing process, providing real-time feedback. The ability to guarantee and certify these ultra-low impurity levels through superior analytical technology is a key competitive differentiator, particularly in securing contracts with tier-one electronics manufacturers who demand unequivocal proof of material integrity for mission-critical applications.

Regional Highlights

- Asia Pacific (APAC) Dominance: APAC commands the largest share of the Ceric Ammonium Nitrate Powder market, fundamentally driven by its unparalleled concentration of electronics manufacturing capabilities. Countries like China, South Korea, Taiwan, and Japan are home to the world's largest semiconductor foundries and display panel manufacturers, which rely heavily on high-purity CAN for critical etching processes. The rapid expansion of 5G infrastructure, electric vehicle electronics, and advanced consumer devices continues to accelerate the demand trajectory, making this region the primary global consumption center, characterized by high volume utilization and fierce competition among regional suppliers focused on logistics efficiency and cost competitiveness.

- North America Strategic Growth: North America represents a mature, high-value segment, focusing intensely on R&D, specialized pharmaceutical synthesis, and military/aerospace electronics where exceptional material consistency and regulatory compliance are paramount. Demand is less volume-driven compared to APAC but is concentrated in high-margin, ultra-high-purity grades required by major pharmaceutical companies for API synthesis and advanced university research centers exploring novel catalytic applications. The region is also a key hub for developing innovative green chemistry techniques applied to CAN manufacturing and usage, reflecting a priority on sustainability alongside performance.

- European Market Stability and Regulation: The European market maintains stable demand, anchored by a strong specialty chemical manufacturing base and robust pharmaceutical industry in countries such as Germany, Switzerland, and the UK. Market activities are strongly influenced by stringent REACH regulations and comprehensive EHS directives concerning the handling and disposal of hazardous chemicals like CAN. European consumers often prioritize suppliers demonstrating transparent sustainable manufacturing practices and robust safety protocols. While not the largest volume consumer, Europe drives market trends toward process optimization and regulatory compliance excellence.

- Latin America and MEA Emerging Opportunities: Latin America and the Middle East & Africa (MEA) represent emerging markets characterized by growing industrialization and increasing investment in localized pharmaceutical and chemical production hubs. While current consumption remains low, the expansion of local drug manufacturing in countries like Brazil and India (often counted in MEA context due to chemical trade flows) and the nascent development of electronics assembly plants signal future growth potential. Suppliers are currently focused on establishing distribution partnerships and navigating complex local regulatory frameworks to capture early market entry advantages in these developing industrial landscapes.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ceric Ammonium Nitrate Powder Market.- Alfa Aesar (Thermo Fisher Scientific)

- Avantor Performance Materials

- Merck KGaA

- Strem Chemicals

- GFS Chemicals

- Noah Technologies Corporation

- TCI Chemicals

- American Elements

- Solvay S.A.

- Indian Rare Earths Limited (IREL)

- Treibacher Industrie AG

- Prochem

- BOC Sciences

- Shanghai Rare-Earth Chemical Co., Ltd.

- Deepwater Chemicals, Inc.

- Wako Pure Chemical Industries (Fujifilm)

- Loba Chemie

- PVS Chemicals, Inc.

- Gelest Inc.

- Otto Chemie Pvt. Ltd.

Frequently Asked Questions

Analyze common user questions about the Ceric Ammonium Nitrate Powder market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary application of Electronic Grade Ceric Ammonium Nitrate (CAN)?

The primary application of Electronic Grade Ceric Ammonium Nitrate is as a high-precision chemical etchant in the semiconductor industry. Its ultra-high purity formulation (often >99.999%) is critical for selectively removing metallic layers, particularly aluminum and copper films, during the fabrication of microchips, integrated circuits, and advanced display technologies like TFT-LCDs, ensuring optimal device performance and structural integrity at the nanoscale.

Why is the Asia Pacific region the dominant market for CAN consumption?

The Asia Pacific region dominates the Ceric Ammonium Nitrate market due to its overwhelming concentration of global high-tech manufacturing, specifically the semiconductor and consumer electronics industries. Countries such as China, South Korea, and Taiwan host the world's largest fabrication facilities (fabs) and utilize vast quantities of electronic-grade CAN for etching processes required in mass production, driving both volume and revenue growth.

What are the main purity grades available in the Ceric Ammonium Nitrate market?

The market typically segments Ceric Ammonium Nitrate into three main purity grades: Reagent Grade (standard laboratory use), High Purity Grade (used in complex chemical synthesis and analytical standards), and the highly sensitive Electronic Grade. The Electronic Grade mandates the lowest levels of metallic impurities, often measured in parts per billion (ppb), critical for sensitive microelectronic manufacturing processes.

What are the key substitutes for Ceric Ammonium Nitrate in oxidizing reactions?

While CAN is a highly selective oxidant, potential substitutes include other powerful oxidizing agents such as potassium permanganate, chromium trioxide, various hypochlorites, or specialized iodine-based reagents. However, substitution is challenging, especially in semiconductor etching and selective organic synthesis, due to CAN’s unique redox potential, high selectivity, and mild reaction conditions in specific chemical transformations.

How do raw material supply dynamics impact the pricing of Ceric Ammonium Nitrate?

Ceric Ammonium Nitrate pricing is directly linked to the supply and cost volatility of its precursor, Cerium, a critical rare earth element. Geopolitical stability affecting rare earth mining and refinement, coupled with fluctuations in global demand for cerium across various industries (catalysts, polishing powders), exerts significant upward pressure or instability on the cost of the raw material, which is subsequently passed through the value chain to the final CAN product.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager