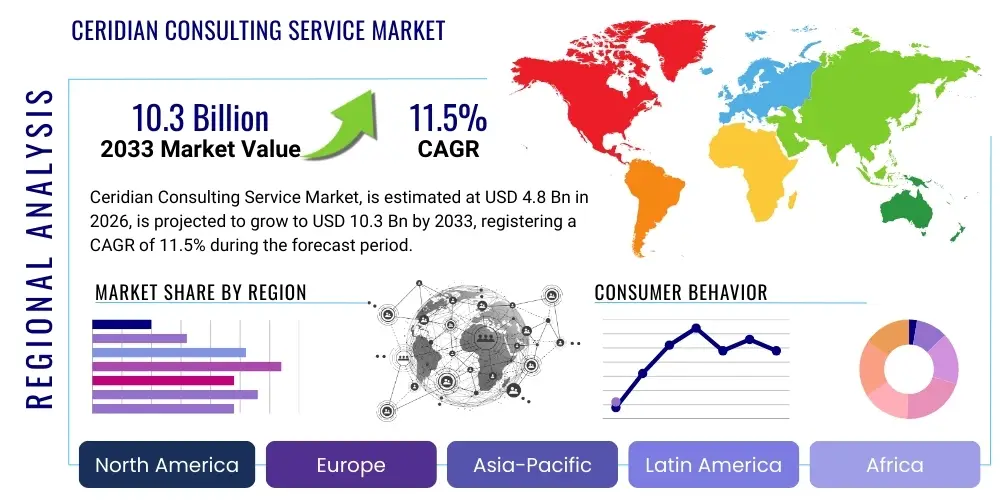

Ceridian Consulting Service Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437701 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Ceridian Consulting Service Market Size

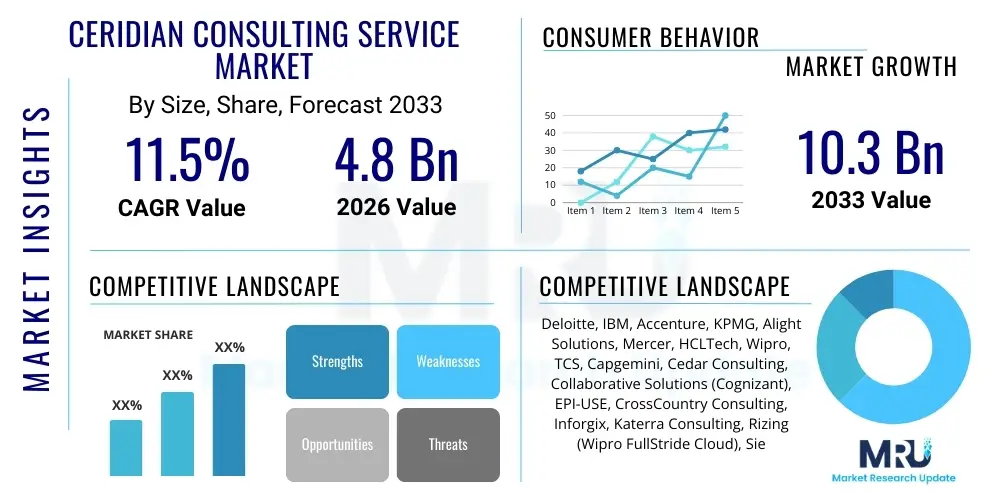

The Ceridian Consulting Service Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 10.3 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the increasing global adoption of Ceridian’s flagship Human Capital Management (HCM) platform, Dayforce, coupled with the inherent complexity of integrating robust, end-to-end cloud-based payroll and workforce management solutions across diverse operational landscapes. Organizations globally are accelerating digital transformation initiatives, necessitating expert guidance for system configuration, compliance adherence, and strategic optimization to maximize return on investment (ROI) from their software investments.

Ceridian Consulting Service Market introduction

The Ceridian Consulting Service Market encompasses specialized professional services focused on the implementation, integration, customization, optimization, and managed services support for Ceridian’s Dayforce platform and related products. This market addresses the critical need for technical expertise and deep process knowledge required by enterprises transitioning to modern, unified HCM systems. Consultants in this space provide strategic road mapping, change management support, complex multi-country payroll configuration, and workforce management design to ensure seamless migration and operational efficiency. The primary function of these services is to translate organizational HR strategies and regulatory requirements into functional, optimized Dayforce system configurations.

Major applications of Ceridian Consulting Services span the entire spectrum of the HCM lifecycle, including Global Payroll processing, Time and Attendance management, Talent Management (recruiting, performance, learning), and Benefits Administration. Given that Dayforce is a single application with unified data, consulting mandates often involve intricate data migration from disparate legacy systems, rigorous testing, and phased deployment strategies across large, often geographically dispersed organizations. The precision required for critical functions like compliance-driven payroll across various tax jurisdictions necessitates highly specialized consulting inputs, differentiating this market from generic IT consulting.

Key benefits derived from utilizing specialized Ceridian consulting include accelerated time-to-value, minimization of implementation risks, ensuring regulatory compliance across complex legal environments, and achieving higher user adoption rates through effective organizational change management (OCM). Driving factors fueling market demand include the relentless trend toward cloud-based HCM solutions, the continuous evolution of global labor laws requiring frequent system updates, and the increasing need for real-time workforce analytics that Dayforce promises. Furthermore, organizations undergoing mergers, acquisitions, or rapid global expansion frequently rely on these services to quickly standardize and consolidate their HR technology footprint.

Ceridian Consulting Service Market Executive Summary

Current business trends within the Ceridian Consulting Service Market highlight a significant shift towards outcome-based consulting models, where service providers are incentivized based on measurable improvements in client operational efficiency or cost savings post-implementation. The market is witnessing strong consolidation among large systems integrators (SIs) acquiring boutique, highly specialized Ceridian partners to enhance their proprietary intellectual property (IP) and implementation accelerators. A critical theme is the increased demand for managed services, suggesting clients prefer long-term partnerships for continuous optimization and maintenance rather than one-time implementation projects, thereby ensuring system resilience and ongoing compliance in an environment of constant regulatory flux. This trend stabilizes revenue streams for consulting firms and embeds them deeper into the client’s strategic HR operations, fostering robust, recurring service contracts.

Regionally, North America maintains its dominance, primarily due to the maturity of the HCM SaaS market and a high concentration of large enterprises with complex payroll and compliance needs driving initial Dayforce adoption and subsequent enhancement projects. However, the Asia Pacific (APAC) region is demonstrating the most accelerated growth trajectory, fueled by multinational corporations requiring centralized, multi-country payroll solutions to manage operations across diverse regulatory environments such as India, China, and Australia. European demand remains robust, focused specifically on GDPR compliance and complex labor union agreements that require highly customized workforce management configurations, emphasizing specialized localized expertise over broad platform skills.

Segment trends reveal a rapid expansion in the post-implementation services category, encompassing optimization consulting, advanced reporting and analytics setup, and comprehensive managed services for application support and ongoing configuration changes. While initial implementation consulting remains crucial, the high investment required in core Dayforce modules is increasingly followed by supplementary consulting focused on maximizing the use of tangential modules like talent acquisition and compensation planning. Furthermore, there is a clear segmentation emerging based on organizational size, with mid-market companies favoring streamlined, template-based implementations delivered by focused regional partners, contrasting sharply with large enterprises demanding highly customized, complex global rollouts led by premier global system integrators (GSIs).

AI Impact Analysis on Ceridian Consulting Service Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Ceridian Consulting Service Market frequently center on concerns about the automation of routine implementation tasks, the potential for AI tools to replace human consultants in data migration and basic configuration, and the expected emergence of AI-driven predictive maintenance for Dayforce systems. Key themes indicate that users anticipate AI will significantly enhance efficiency, particularly in initial system audits, data validation, and drafting process documentation, leading to faster go-live times and reduced labor costs. However, users also express the need for consultants to pivot their skills towards strategic advisory roles, focusing on integrating advanced AI capabilities within Dayforce (e.g., predictive scheduling, talent intelligence) rather than manual configuration work. The consensus suggests AI will augment, not replace, expert consultants, by offloading low-value, repetitive activities, thereby freeing up specialized resources for complex, strategic organizational change management and highly bespoke solution design.

- AI-powered Configuration Accelerators: Utilizing AI and machine learning algorithms to automate the discovery and configuration mapping of client requirements, significantly speeding up the initial design phase of Dayforce implementation projects.

- Intelligent Data Migration: Employing AI tools for automated data cleansing, validation, and complex transformation mapping between legacy systems and the unified Dayforce schema, reducing manual errors and project timelines associated with data handling.

- Predictive System Optimization: Use of AI to continuously monitor client Dayforce systems post-go-live, predicting potential performance bottlenecks or compliance risks (e.g., upcoming regulatory changes requiring specific system updates) and automatically flagging or suggesting necessary consulting interventions.

- Chatbot and Knowledge Management Augmentation: Implementing AI-driven chatbots trained on implementation methodologies and Ceridian documentation to assist consulting teams and end-users with real-time issue resolution and training support.

- Enhanced Talent Analytics Consulting: Focusing consultant efforts on utilizing Dayforce’s native AI capabilities to generate strategic workforce insights (e.g., flight risk analysis, optimal staffing levels) and translating these insights into actionable organizational strategies.

- Automated Testing and Quality Assurance: Leveraging AI tools to generate comprehensive test scripts and execute regression testing automatically following system updates or patches, drastically improving the speed and reliability of post-implementation support services.

DRO & Impact Forces Of Ceridian Consulting Service Market

The dynamics of the Ceridian Consulting Service Market are powerfully shaped by a complex interplay of internal and external forces. The primary drivers include the inherent complexity of integrating Dayforce’s unified platform—especially multi-country payroll—across varying legislative landscapes, necessitating specialized expertise beyond standard IT skills. Furthermore, the mandatory requirement for organizations to stay abreast of continuously changing global and regional labor laws and tax regulations significantly accelerates the need for ongoing compliance consulting, creating continuous demand. Coupled with the strategic imperative for organizations to shift from decentralized HR models to standardized, data-driven cloud solutions, these factors ensure sustained market growth. The strategic value of Dayforce as a foundational system for operational excellence dictates that organizations prioritize highly qualified consulting partners to safeguard their substantial technology investment.

Restraints impeding faster growth include the substantial initial investment required for sophisticated Dayforce implementations, which can deter smaller enterprises or organizations with limited IT budgets, slowing adoption in the mid-market segment. A pervasive and critical restraint is the acute scarcity of highly certified and experienced Ceridian consultants globally. The specialized nature of Dayforce requires significant training and experience, leading to high consulting rates and prolonged hiring cycles, which pressures both consulting firms and clients. Additionally, the reliance on Ceridian’s product roadmap and update cycles means consulting firms must constantly invest in training and re-certification, representing a perpetual operational challenge and cost factor.

Significant opportunities within this market revolve around the underdeveloped mid-market segment, where standardized, scalable implementation packages utilizing pre-configured templates can lower barriers to entry and accelerate deployment. A key strategic opportunity lies in the burgeoning demand for specialized Organizational Change Management (OCM) services; successful Dayforce adoption hinges heavily on managing user resistance and process realignment, creating a distinct high-value consulting niche. Furthermore, expanding the service offering to focus on integrating Dayforce with peripheral enterprise systems (e.g., ERP, Financials) through complex API development represents a high-margin opportunity. The market is also capitalizing on the shift toward advanced strategic analytics, moving beyond basic reporting to offering data science consulting that leverages Dayforce data for predictive workforce modeling and resource optimization.

Segmentation Analysis

The Ceridian Consulting Service Market is meticulously segmented based on the type of service offered, the size of the enterprise served, the specific deployment model utilized, and the industry vertical. This granular segmentation allows service providers to tailor specialized engagement models and pricing structures to specific client needs, ranging from quick-start implementation packages for mid-market clients to complex, multi-year managed service agreements for global organizations. The segmentation highlights the market's maturity, reflecting diverse customer requirements spanning technical execution, regulatory adherence, and strategic business transformation, with the largest revenue contribution historically derived from full-suite implementation and integration services in large enterprises.

- By Service Type:

- Implementation and Integration Consulting: Focuses on initial system setup, data migration, configuration, and integration with third-party systems.

- Managed Services and Post Go-Live Support: Ongoing technical support, system maintenance, patching, user management, and regulatory updates.

- Optimization and Enhancement Consulting: Focuses on improving existing Dayforce functionality, expanding module usage, and tuning performance post-initial deployment.

- Strategy and Advisory Services: High-level guidance on HCM strategy, digital transformation roadmap development, and vendor selection processes.

- Organizational Change Management (OCM): Services dedicated to training, communication, and process alignment necessary for successful user adoption.

- By Enterprise Size:

- Large Enterprises (5,000+ Employees)

- Mid-Market Enterprises (500 – 4,999 Employees)

- By Deployment Model:

- Cloud-Based Consulting (Standard Dayforce SaaS Model)

- Hybrid/Co-Managed Consulting (Involving co-management of IT infrastructure or proprietary integrations)

- By Industry Vertical:

- Retail and Hospitality

- Healthcare and Life Sciences

- Manufacturing and Distribution

- Financial Services and Insurance

- Government and Public Sector

- Technology and Telecom

Value Chain Analysis For Ceridian Consulting Service Market

The value chain for Ceridian Consulting Services begins with the upstream activities centered on talent acquisition, continuous skill development, and the creation of proprietary consulting assets. Upstream analysis involves service providers investing heavily in specialized Ceridian partner certifications, developing proprietary implementation accelerators, pre-configured industry templates, and migration tools to standardize and accelerate project delivery. The intellectual property (IP) generated in the upstream phase—such as reusable code for complex integrations or specialized compliance checklists—is a key differentiator, reducing dependency on manual labor and enhancing project profitability. Effective upstream management ensures that consulting firms maintain a sufficient pipeline of highly trained resources capable of handling niche requirements, such as global payroll implementations across non-standard jurisdictions.

The midstream process involves the core service delivery, which includes requirements gathering, system design and configuration, data migration, testing, and go-live deployment. This phase is characterized by intense client collaboration and rigorous project management methodologies (e.g., Agile, Waterfall, or a hybrid approach tailored to Dayforce). Quality assurance, particularly concerning payroll accuracy and compliance testing, is paramount during midstream execution, as failures in these areas carry significant financial and regulatory risk for the client. The shift towards outcome-based pricing is transforming the midstream, requiring consultants to integrate performance metrics directly into their delivery framework, ensuring the configured system meets pre-defined business goals.

Downstream activities focus on the post-go-live phase, encompassing continuous optimization, long-term managed services, and strategic advisory relationships. Distribution channels in this market are predominantly direct, involving direct contracts between the client and the consulting firm, especially for large, bespoke transformation projects. However, indirect channels play a crucial role through the Ceridian partner ecosystem; Ceridian often refers clients to preferred system integrators (GSIs) or specialized partners based on project scope, geographic location, and complexity. The continued success of the consulting firm hinges on maintaining high client satisfaction downstream, leading to contract renewals for managed services and securing opportunities for future system enhancements, thereby creating sustainable, recurring revenue streams.

Ceridian Consulting Service Market Potential Customers

Potential customers for Ceridian Consulting Services are primarily organizations that utilize or plan to implement the Dayforce HCM suite, characterized by a need for standardized global HR processes, advanced workforce management capabilities, or complex payroll requirements. The ideal target customer is typically a large enterprise or a rapidly growing mid-market company undergoing a significant digital transformation initiative, often triggered by the retirement of legacy on-premise systems or the consolidation of HR operations following a merger or acquisition. These organizations require expert assistance not only for the technical system implementation but also for navigating the profound organizational changes associated with shifting to a unified, cloud-based platform, particularly concerning decentralized workforce management practices.

Specific buyers within these organizations often include the Chief Human Resources Officer (CHRO), the Chief Information Officer (CIO), the VP of HR Technology, and key operational stakeholders in payroll, benefits, and time management. Organizations operating across multiple international jurisdictions represent a particularly high-value segment, as they require specialized consulting expertise in global payroll configuration and localized compliance adherence, which is often the most challenging aspect of Dayforce deployment. Furthermore, sectors facing stringent labor regulations, such as retail, healthcare, and manufacturing, are perennial customers due to their complex shift scheduling, regulatory reporting needs, and high volume of hourly workers, making effective workforce management configuration essential and highly reliant on expert consulting input.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 10.3 Billion |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Deloitte, IBM, Accenture, KPMG, Alight Solutions, Mercer, HCLTech, Wipro, TCS, Capgemini, Cedar Consulting, Collaborative Solutions (Cognizant), EPI-USE, CrossCountry Consulting, Inforgix, Katerra Consulting, Rizing (Wipro FullStride Cloud), Sierra-Cedar, ProspHire, L&T Technology Services |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ceridian Consulting Service Market Key Technology Landscape

The key technology landscape underpinning the Ceridian Consulting Service Market extends beyond the core Dayforce platform to include a suite of specialized tools and methodologies used by consultants to accelerate delivery and enhance quality. Consultants frequently leverage proprietary implementation accelerators—pre-built configurations and industry-specific templates that significantly reduce the time spent on fundamental system setup and configuration mapping. These accelerators are crucial in maximizing efficiency, particularly in competitive mid-market engagements where speed and standardized deployment are highly valued. Furthermore, integration platforms and middleware specialized in connecting Dayforce's robust APIs with legacy Enterprise Resource Planning (ERP) systems, financial platforms, and niche industry applications form a critical part of the technology toolkit, ensuring seamless flow of master data and payroll information.

Security and compliance tools are integral to the consulting technology landscape, especially those designed to audit role-based security permissions and ensure data privacy protocols (e.g., GDPR, CCPA) are met within the Dayforce environment. Consultants rely heavily on advanced data migration utilities, which are often customized scripts or third-party software optimized for handling the complexity of historical HR and payroll data cleansing and transformation required before loading into Dayforce. The use of automation tools for testing and quality assurance is also rapidly becoming standard practice; these tools perform automated regression testing following monthly Dayforce updates, ensuring that custom configurations and integrations remain intact without human intervention, thereby drastically reducing post-go-live risk.

The ongoing trend of digital documentation and knowledge management is facilitated by advanced collaboration platforms and specialized project management software that integrate directly with client-side communication tools. These technologies ensure real-time status reporting, centralized document control, and transparent stakeholder communication throughout the multi-phase implementation process. Finally, as consulting shifts toward optimization and advanced analytics, consultants employ sophisticated business intelligence (BI) visualization tools that overlay Dayforce reporting functions, allowing them to extract deeper strategic insights and present workforce performance metrics in a highly consumable format for executive decision-makers, thus maximizing the strategic utility of the Dayforce investment.

Regional Highlights

- North America (NA): Dominates the Ceridian Consulting Services Market, driven by high Dayforce penetration, especially among large multi-national corporations based in the United States and Canada. The complexity of federal and state-level labor laws and tax regulations necessitates continuous, specialized consulting for payroll and compliance modules. The region benefits from a mature IT and consulting ecosystem, fostering intense competition and specialization, particularly in managed services and advanced HCM optimization projects. Demand is stable and highly sophisticated, focusing on maximizing ROI through advanced features like predictive scheduling and talent management integrations.

- Europe: Exhibits significant growth, primarily focused on adapting Dayforce to meet the highly fragmented and complex regulatory environment across the European Union and the UK. Consulting demand is concentrated on achieving GDPR compliance, managing works council agreements, and navigating diverse social security and benefits schemes. Countries such as Germany, France, and the UK are primary markets, where organizations prioritize OCM consulting due to strong labor traditions and established organizational structures, requiring careful management during HCM system transitions.

- Asia Pacific (APAC): Represents the fastest-growing region, fueled by rapid economic expansion and the increasing requirement for centralized HR systems for multinational companies expanding into diverse markets like India, Southeast Asia, and Australia. The consulting focus here is heavily skewed towards multi-country payroll standardization, localization requirements, and integrating Dayforce with local HR systems where applicable. The lack of localized certified consultants drives high-value opportunities for global system integrators (GSIs) capable of deploying resources with both technical Dayforce expertise and specific in-country compliance knowledge.

- Latin America (LATAM): Market activity is characterized by moderate but consistent growth, mainly driven by larger companies in Brazil and Mexico seeking to modernize their highly localized and manual payroll processes. Consulting services must be deeply specialized in navigating volatile economic conditions, frequent legislative changes, and unique tax reporting requirements within the major economies. Cost-sensitivity is higher in this region, favoring consulting partners who can deliver robust solutions leveraging nearshore talent pools for efficiency.

- Middle East and Africa (MEA): This region is emerging, with demand concentrated in the GCC states (Saudi Arabia, UAE) due to large-scale government-backed digital transformation initiatives and the influx of foreign investment requiring modern workforce management tools. Consulting challenges involve addressing unique labor requirements, such as sponsorship and visa management, and navigating complex governmental reporting mandates. The market is highly opportunistic, with early movers gaining significant market share through strategic partnerships and localized service delivery centers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ceridian Consulting Service Market.- Deloitte

- IBM

- Accenture

- KPMG

- Alight Solutions

- Mercer

- HCLTech

- Wipro

- TCS

- Capgemini

- Cedar Consulting

- Collaborative Solutions (Cognizant)

- EPI-USE

- CrossCountry Consulting

- Inforgix

- Katerra Consulting

- Rizing (Wipro FullStride Cloud)

- Sierra-Cedar

- ProspHire

- L&T Technology Services

Frequently Asked Questions

Analyze common user questions about the Ceridian Consulting Service market and generate a concise list of summarized FAQs reflecting key topics and concerns.What specific Dayforce modules require the most specialized consulting expertise?

The most specialized consulting expertise is required for the Global Payroll module, particularly in multi-country implementations due to the need to configure complex compliance rules, tax jurisdictions, and statutory reporting across dozens of unique regulatory environments. Workforce Management, involving complex scheduling optimization and time capture integrations, is also highly specialized.

How does the Dayforce Partner Program influence the competitive landscape of consulting services?

The Dayforce Partner Program directly structures the market by granting tiers of certification (e.g., Premier Partner, Global System Integrator) which dictates implementation access and resource allocation. This system favors firms with deep, proven expertise and certified resources, creating a clear hierarchy and driving smaller firms to specialize in niche areas like optimization or specific regional compliance to compete effectively.

What is the typical duration and cost structure for a large enterprise Ceridian Dayforce implementation?

A full-suite Dayforce implementation for a large enterprise typically ranges from 9 to 18 months, depending on organizational complexity, data quality, and the number of integrated modules. Cost structures generally include fixed-fee components for well-defined phases and time-and-materials components for complex integration or customization work, often representing a cost factor of 1x to 3x the initial software licensing fees.

Are consulting services moving towards managed services or remaining focused on one-time implementation projects?

The market is experiencing a definitive shift towards managed services. While implementation remains foundational, clients increasingly seek long-term partnerships for continuous system optimization, regulatory maintenance, and application management services (AMS). This transition ensures system resilience and provides recurring, stable revenue streams for consulting firms.

What are the primary factors driving mid-market adoption of Ceridian consulting services?

Mid-market adoption is primarily driven by the need for simplified, accelerated implementations utilizing standardized industry templates to achieve rapid digital transformation without the high cost and complexity associated with large-scale customization. Key drivers include replacing aging, disparate systems and needing better compliance management and workforce scheduling tools for immediate operational improvement.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager