Cermet Potentiometer Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434509 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Cermet Potentiometer Market Size

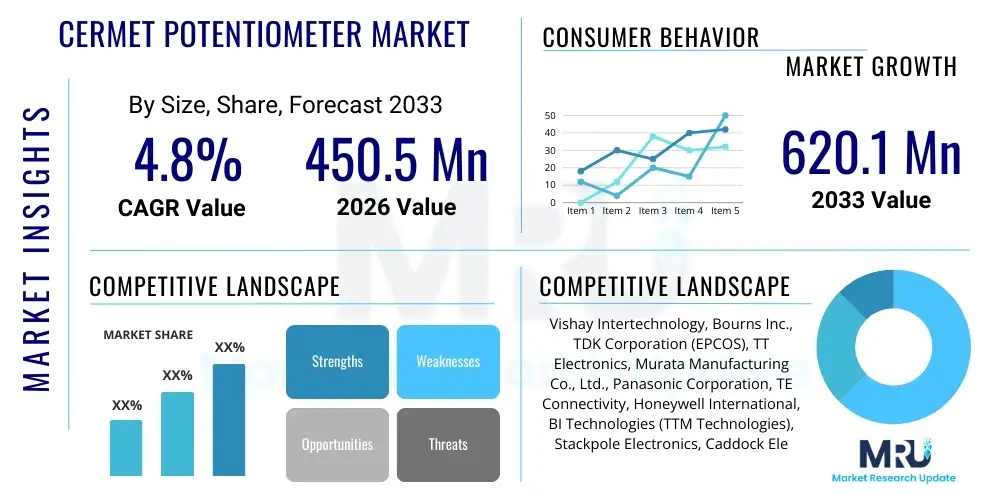

The Cermet Potentiometer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 450.5 Million in 2026 and is projected to reach USD 620.1 Million by the end of the forecast period in 2033.

Cermet Potentiometer Market introduction

The Cermet Potentiometer Market encompasses devices utilized across various electronic circuits for adjusting resistance, voltage division, or current control. Cermet, a composite material consisting of ceramic (ceramic oxides) and metallic (metal particles, typically ruthenium oxide) components, is applied as the resistive element. This composition grants Cermet potentiometers superior characteristics compared to traditional carbon film alternatives, particularly in areas requiring high stability, low temperature coefficient of resistance (TCR), and excellent power handling capabilities. These devices are critical components in precision instrumentation, telecommunications equipment, industrial automation systems, and high-reliability aerospace applications where operational accuracy and long-term performance stability are paramount.

The primary applications driving market growth include advanced industrial controls, medical diagnostic devices, and high-frequency communication systems. Cermet potentiometers are frequently employed as trimmers or preset resistors in professional-grade electronics due to their ruggedness and ability to withstand high operating temperatures and harsh environments. Their robust construction ensures minimal resistance drift over time and temperature variations, which is essential for maintaining the calibration and accuracy of sophisticated electronic assemblies. The demand surge is directly correlated with the increasing complexity and miniaturization of electronic devices that require precise and durable resistance adjustment mechanisms.

Key benefits driving the adoption of Cermet technology include exceptional thermal stability, reduced noise characteristics, and extended operational lifespans. Unlike organic resistive materials, the ceramic-metal blend offers inherent resilience against thermal shock and chemical degradation, leading to reliable performance in demanding conditions. Driving factors for this market expansion involve the stringent quality requirements in the automotive sector for electronic stability systems, the continuous innovation in portable medical devices, and the growing investment in Industry 4.0 infrastructure which mandates high-precision sensors and control circuitry.

Cermet Potentiometer Market Executive Summary

The Cermet Potentiometer Market is characterized by robust demand stemming from high-reliability applications where precision and durability supersede cost considerations. Business trends indicate a strong move toward miniaturization, particularly in surface mount device (SMD) packages, catering to the compact design requirements of modern consumer electronics and integrated industrial modules. Manufacturers are focusing on enhancing the power rating and temperature range of these components to meet the escalating performance demands from sectors such as aerospace and defense. Strategic mergers and acquisitions among established players are consolidating market share, while innovation in thin-film Cermet deposition techniques is emerging as a critical competitive differentiator.

Regionally, the Asia Pacific (APAC) continues to dominate the market landscape, driven by its expansive electronics manufacturing base, particularly in countries like China, South Korea, and Taiwan. The increasing prevalence of automotive electronics production and the rapid industrialization across emerging economies in Southeast Asia fuel the consumption of high-specification Cermet potentiometers. North America and Europe, while mature markets, maintain significant demand focused on high-end specialized applications, medical technology, and military systems, where regulatory standards mandate the use of highly reliable Cermet components over less stable alternatives. Investment in 5G infrastructure globally is also creating a sustained requirement for precision trimming devices in radio frequency (RF) circuitry.

Segment trends highlight the dominance of the Trimmer Potentiometer segment due to its widespread use in setting bias points and calibration in circuit boards. However, the Multiturn Potentiometer segment is experiencing accelerated growth, propelled by complex machinery and specialized test and measurement equipment requiring exceptionally fine resolution and control. Regarding end-use, the Industrial and Automotive sectors are the primary revenue generators, driven by the need for robust position sensing and current limiting in harsh operational environments. The market trajectory indicates continuous technological refinement aimed at improving linearity and rotational life, ensuring Cermet components remain indispensable in precision electronic design.

AI Impact Analysis on Cermet Potentiometer Market

User inquiries regarding AI's impact on Cermet potentiometers generally center on whether advanced digital controls or smart sensors will render physical adjustment components obsolete, and how AI can optimize the manufacturing process of these highly specialized devices. The central theme emerging from user questions is the perceived conflict between analog trimming devices and the digitalization trend driven by Artificial Intelligence. Users seek clarification on the longevity of analog components like Cermet potentiometers in systems increasingly controlled by predictive algorithms. Conversely, manufacturers are exploring how AI-driven quality control, precision deposition techniques, and supply chain management optimization can enhance the production efficiency and consistency of Cermet resistive elements, ensuring tighter tolerances and improved batch uniformity necessary for high-volume, high-reliability applications.

While AI and digital calibration methods can reduce the dependency on physical potentiometers for routine adjustments in many consumer-grade systems, Cermet potentiometers maintain a critical niche in high-precision, safety-critical, and legacy industrial systems where physical hardware trimming is essential for initial calibration, redundancy, or handling extreme environmental conditions. AI's integration is currently focusing more on the backend, particularly in advanced manufacturing facilities. Machine learning algorithms are being deployed to monitor the sintering process of the cermet paste, predicting defects, and dynamically adjusting furnace temperatures or gas mixtures to optimize the material composition and crystalline structure, thereby enhancing the component's stability and reliability parameters.

Furthermore, AI-driven predictive maintenance in industrial machinery, which heavily utilizes Cermet potentiometers for position feedback and control, relies on the consistent and reliable signals these components provide. The collected data, processed by AI, enables maintenance schedules to be optimized, thereby extending the operational life of the machinery. AI is not replacing Cermet potentiometers but rather refining their usage and optimizing their production, ensuring that the analog interface remains precise, stable, and cost-effective for mission-critical functions where instantaneous, physical trimming cannot be entirely supplanted by software control loops, especially in environments susceptible to electromagnetic interference or power fluctuations.

- AI-driven manufacturing processes enhance the precision of cermet paste application, improving resistance tolerance.

- Machine learning optimizes material sintering and composition, leading to better thermal stability (lower TCR).

- AI-powered predictive analytics depend on stable input from Cermet components used in industrial control loops.

- Digital twins and AI simulation models are used to accelerate the design and testing of Cermet component performance under extreme stress.

- Automation fueled by AI increases the demand for Cermet components in robotic and sophisticated motion control systems.

DRO & Impact Forces Of Cermet Potentiometer Market

The Cermet Potentiometer Market is influenced by a dynamic interplay of factors. Key drivers include the escalating demand for high-reliability electronic components in the aerospace, defense, and medical sectors, where the stable temperature coefficient and mechanical endurance of Cermet technology are non-negotiable requirements. The expansion of industrial automation and the proliferation of complex test and measurement equipment also necessitate potentiometers capable of fine resolution and long operational life. However, restraints such as the relatively higher manufacturing cost of Cermet components compared to carbon film or wirewound types, coupled with the increasing trend towards purely digital calibration methods in non-critical consumer applications, pose significant challenges to market penetration. Opportunities lie in developing ultra-miniature Cermet devices (SMD Cermet trimmers) for high-density printed circuit boards (PCBs) and leveraging advancements in thick-film technology to achieve higher power ratings, appealing to power electronics designers. The impact forces are strong, driven by rigorous industry standards (e.g., military specifications) and the lifecycle costs associated with component failure, thereby perpetually favoring the reliability offered by Cermet materials despite their premium price point.

The primary driver remains the indispensable need for stability under extreme operating conditions. Cermet materials excel in environments characterized by high humidity, wide temperature swings, and vibration, making them the preferred choice for ruggedized electronics. Furthermore, the longevity and low contact resistance variation (CRV) associated with Cermet potentiometers reduce maintenance frequency and operational downtime, offering significant total cost of ownership benefits in heavy industrial and specialized transportation applications. This intrinsic reliability acts as a powerful barrier against substitution by cheaper, less stable technologies, reinforcing the market for Cermet solutions, especially in long-lifecycle products.

Conversely, the technological transition toward software-defined systems presents a structural restraint. Microcontrollers and digital-to-analog converters (DACs) are increasingly handling functions traditionally performed by analog potentiometers, particularly in mid-range consumer and general-purpose industrial equipment. While this shift impacts volume, it simultaneously elevates the technical requirements for the Cermet components that remain, forcing manufacturers to invest heavily in precision manufacturing techniques to ensure linearity below 1% and ultra-low TCR values, thus increasing the development cost and complexity. Nonetheless, the opportunity to integrate Cermet technology with digital interfaces (e.g., motor drive positioning feedback) offers a growth avenue by combining the robustness of analog trimming with the precision of digital control.

Segmentation Analysis

The Cermet Potentiometer Market is meticulously segmented based on product type, rotational mechanism, end-use application, and geographical region, reflecting the diverse requirements of the global electronics industry. Analyzing these segments provides strategic insights into areas of highest growth and technological focus. The market is primarily driven by the Trimmer Potentiometer segment, which accounts for the largest volume share due to its essential role in circuit calibration. However, the Multiturn Potentiometer segment, while smaller in volume, generates premium revenue driven by niche applications requiring exceptional setting accuracy and resolution, such as precision measurement devices and sophisticated medical imaging equipment. Technological advancements are focused on improving the heat dissipation capabilities and reducing the size of all Cermet product types to align with high-density circuit designs.

The segmentation by rotational mechanism distinguishes between single-turn and multiturn devices. Single-turn potentiometers, characterized by rapid adjustment and simplicity, dominate general purpose calibration and volume control in audio equipment. In contrast, multiturn devices, which require multiple rotations (typically 5, 10, or 25 turns) to span the full resistance range, are crucial for feedback systems in CNC machinery, flight simulators, and scientific laboratory equipment where microscopic adjustments are necessary. The stability of the cermet resistive material ensures that the high resolution offered by the multiturn mechanism is maintained reliably across various environmental conditions.

End-use application segmentation reveals the reliance of the Industrial and Aerospace & Defense sectors on Cermet technology. Industrial applications, encompassing factory automation, process control, and motor drives, demand Cermet's robust nature to withstand dust, vibration, and temperature extremes. The Aerospace & Defense segment mandates Cermet for critical avionic controls and communication gear due to military specifications requiring unmatched long-term stability and radiation resistance. These high-value segments justify the premium cost associated with Cermet potentiometers, ensuring sustained investment in material science and specialized manufacturing capacity.

- By Product Type:

- Trimmer Potentiometers (Preset Resistors)

- Panel-mount Potentiometers

- Multiturn Potentiometers

- Modular Potentiometers

- By Rotational Mechanism:

- Single-Turn

- Multi-Turn (e.g., 10-Turn)

- By Mounting Type:

- Surface Mount Device (SMD)

- Through-Hole Device (THD)

- By End-Use Application:

- Industrial Automation and Control

- Aerospace and Defense

- Medical Devices and Instrumentation

- Telecommunications

- Automotive Electronics (e.g., sensors, control modules)

- Test and Measurement Equipment

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Cermet Potentiometer Market

The value chain for the Cermet Potentiometer Market begins with upstream activities centered on specialized material procurement and processing. This stage involves sourcing high-purity ceramic substrates (like alumina), precious metal powders (such as ruthenium or palladium oxides), and proprietary organic binders necessary for formulating the cermet resistive paste. The specialized nature of these raw materials and the precise formulation techniques required to achieve optimal temperature stability and resistance linearity mean that the upstream segment is concentrated among a few specialized chemical and material science suppliers. Consistency in raw material quality is paramount, directly affecting the final component's performance characteristics, thus creating high barriers to entry at the initial stage of the chain.

The middle segment involves the manufacturing and assembly process, which includes substrate preparation, thick-film screening or deposition of the cermet paste, high-temperature firing (sintering) to bond the ceramic and metal matrix, laser trimming for fine resistance adjustment, and the integration of mechanical components (shaft, wiper, housing). Direct distribution channels are often favored for high-volume, standardized products, leveraging manufacturers' dedicated sales teams and large global distributors specializing in electronic components (e.g., Avnet, Arrow Electronics). Indirect channels, including specialized resellers and value-added distributors, become critical for niche markets, providing technical support and customized inventory management for specialized industrial and military contractors who require tailored specifications and certification.

Downstream activities focus on the integration of the potentiometers into sophisticated electronic assemblies by Original Equipment Manufacturers (OEMs) across target industries—such as control panel manufacturers, medical equipment producers, and defense contractors. The final users are the maintenance departments, field engineers, and end-consumers who utilize the equipment. The performance feedback from the downstream market, especially concerning operational life and tolerance drift, heavily influences the research and development pipeline of Cermet potentiometer manufacturers. The efficiency of the distribution network, particularly the ability to rapidly supply components with military or specific environmental certifications, significantly impacts competitive advantage within the value chain.

Cermet Potentiometer Market Potential Customers

Potential customers for Cermet potentiometers are predominantly businesses operating in sectors where component failure is costly, hazardous, or simply unacceptable due to stringent regulatory or operational requirements. The primary buyers are Original Equipment Manufacturers (OEMs) specializing in industrial process control and safety systems, where Cermet trimmers are used for critical system calibration and sensor interfacing. These customers prioritize components that offer superior long-term stability and resistance to environmental stress, justifying the higher unit cost of Cermet over less reliable alternatives. Secondary buyers include defense prime contractors and aerospace electronics integrators who require components that meet stringent military standards (Mil-Specs) for shock, vibration, and temperature cycling in avionics, radar systems, and communication equipment.

The medical device industry represents another critical customer segment. Manufacturers of advanced diagnostic imaging equipment (MRI, CT scanners), patient monitoring systems, and laboratory instrumentation require high-resolution multiturn Cermet potentiometers for precise mechanical positioning and setting critical current limits. Reliability in medical devices is non-negotiable, driving demand for the inherently stable resistive properties of cermet compounds. Furthermore, the burgeoning electric vehicle (EV) market and advanced driver-assistance systems (ADAS) in the automotive sector are increasingly incorporating Cermet technology for robust position sensing in actuators and throttle controls, where components must survive engine bay temperatures and intense vibration for the vehicle's entire lifespan.

Finally, the growing market for specialized test and measurement equipment—including oscilloscopes, function generators, and calibration standards—are perennial buyers. These applications require potentiometers with excellent linearity and noise characteristics to maintain measurement accuracy. In essence, the market targets sophisticated engineering departments and procurement specialists within any industry segment that demands high precision, sustained operation in hostile conditions, and minimal maintenance intervention, ensuring that the customer base remains concentrated but highly lucrative for Cermet potentiometer suppliers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Million |

| Market Forecast in 2033 | USD 620.1 Million |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Vishay Intertechnology, Bourns Inc., TDK Corporation (EPCOS), TT Electronics, Murata Manufacturing Co., Ltd., Panasonic Corporation, TE Connectivity, Honeywell International, BI Technologies (TTM Technologies), Stackpole Electronics, Caddock Electronics, Ohmcraft Inc., Novotechnik U.S. Inc., ALPS Alpine Co., Ltd., ETI Systems, Song Huei Industrial Co., Ltd., Spectrol Electronics, Kamaya, Tocos America, Precision Resistive Products Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cermet Potentiometer Market Key Technology Landscape

The technological landscape of the Cermet Potentiometer Market is fundamentally defined by advancements in thick-film technology and material science. Cermet technology employs a resistive element composed of a finely dispersed metal oxide (such as ruthenium oxide or palladium oxide) embedded in a ceramic binder (glass frit). This mixture is applied to a high-purity alumina substrate using screen printing or deposition techniques, followed by a critical high-temperature firing process (sintering) typically exceeding 800°C. This process fuses the ceramic and metallic phases, resulting in a highly stable, chemically inert resistive layer with excellent heat dissipation capabilities. The technological focus is on optimizing the ratio and particle size of the metal-ceramic composition to achieve extremely low Temperature Coefficient of Resistance (TCR) values, ensuring minimal resistance change across wide operational temperature ranges, crucial for aerospace and industrial grade specifications.

Modern manufacturing processes incorporate advanced laser trimming techniques to achieve precise nominal resistance values and highly accurate resistance curve profiles (linearity). After the initial firing, automated laser systems ablate microscopic sections of the cermet material, incrementally increasing the resistance until the exact target value is reached. This process allows manufacturers to produce potentiometers with resistance tolerances as tight as 1% and non-linearity down to 0.1%, which is indispensable for high-resolution feedback systems. Continuous technological refinement focuses on improving the wiper contact mechanism, often utilizing noble metal alloys (like gold or silver-palladium) for the wiper arms to minimize contact resistance variation (CRV) and maximize rotational life, which is a key performance indicator (KPI) for multiturn devices.

Furthermore, the shift towards miniaturization is driving innovation in Surface Mount Device (SMD) Cermet potentiometers. Developing robust, heat-resistant SMD packages requires materials science expertise to ensure the component survives reflow soldering processes without degrading the integrity of the cermet element or the mechanical wiper system. Packaging technologies are also evolving to meet demanding vibration standards, particularly in the automotive and military sectors, leading to enhanced encapsulation techniques and hermetically sealed housings. These technological refinements collectively ensure Cermet potentiometers remain the benchmark for precision and reliability in extreme electronic environments, despite competition from digital controls.

Regional Highlights

The Cermet Potentiometer Market exhibits distinct regional consumption and manufacturing patterns. Asia Pacific (APAC) stands as the undisputed market leader, primarily driven by its massive electronic contract manufacturing industry, which caters to global demand for industrial equipment, automotive components, and consumer electronics. Countries like China, Japan, and South Korea are major hubs for both consumption and production, benefiting from favorable government policies supporting electronics R&D and manufacturing capacity expansion. The rapid adoption of Industry 4.0 automation and the proliferation of electric vehicle manufacturing in China further consolidate APAC’s dominant position, generating high volume demand for standard and specialized Cermet trimmers used in control units and battery management systems (BMS). This region emphasizes rapid supply chain efficiency and competitive pricing, alongside meeting stringent international quality standards.

North America and Europe represent mature markets characterized by higher average selling prices (ASPs) due to a focus on niche, high-specification applications. Demand in North America is heavily concentrated in the Aerospace and Defense sector, where procurement often mandates components qualified under strict military and aerospace specifications (e.g., MIL-R-39015). The region also maintains robust requirements from the medical device industry for high-precision, long-life Cermet components. Similarly, Europe’s demand is anchored by its strong automotive sector, especially for premium vehicle electronics, and its established industrial automation manufacturers (Germany, Italy), who prioritize the mechanical and thermal stability inherent to Cermet technology for process control systems and high-reliability industrial sensors.

Latin America and the Middle East & Africa (MEA) currently hold smaller market shares but offer significant growth potential, particularly in the telecommunications and infrastructure development sectors. Investment in oil and gas infrastructure in the MEA region requires ruggedized electronic equipment capable of operating in extremely harsh desert conditions, driving specialized demand for thermally stable Cermet potentiometers. Growth in LATAM is closely linked to foreign investment in automotive assembly plants and industrial modernization projects, creating opportunities for suppliers who can navigate complex import regulations and establish strong local distribution partnerships. Overall, regional growth is segmented: APAC drives volume and speed, while North America and Europe drive innovation in high-specification, specialized Cermet products.

- Asia Pacific (APAC): Dominant market share due to large-scale electronics manufacturing, rapid industrial automation adoption, and strong automotive electronics production, particularly in China and South Korea.

- North America: High-value market focused on Aerospace & Defense (Mil-Spec components), medical instrumentation, and advanced test and measurement equipment, prioritizing stability and certification.

- Europe: Strong demand from the high-end Automotive sector and mature industrial control and machinery markets, valuing longevity and precision engineering.

- Latin America (LATAM): Emerging market driven by infrastructure projects, telecommunications expansion, and local manufacturing growth.

- Middle East and Africa (MEA): Growth tied to oil and gas sector investments and specialized demand for ruggedized electronic components resilient to extreme environmental conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cermet Potentiometer Market.- Vishay Intertechnology

- Bourns Inc.

- TDK Corporation (EPCOS)

- TT Electronics

- Murata Manufacturing Co., Ltd.

- Panasonic Corporation

- TE Connectivity

- Honeywell International

- BI Technologies (TTM Technologies)

- Stackpole Electronics

- Caddock Electronics

- Ohmcraft Inc.

- Novotechnik U.S. Inc.

- ALPS Alpine Co., Ltd.

- ETI Systems

- Song Huei Industrial Co., Ltd.

- Spectrol Electronics

- Kamaya

- Tocos America

- Precision Resistive Products Inc.

Frequently Asked Questions

Analyze common user questions about the Cermet Potentiometer market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of Cermet potentiometers over carbon and wirewound types?

Cermet potentiometers offer superior advantages, including exceptionally high thermal stability, a lower temperature coefficient of resistance (TCR), high power dissipation capabilities, and better resistance to chemical and environmental degradation, making them ideal for high-reliability, precision, and high-temperature applications where drift must be minimized.

Which industry applications drive the highest demand for multiturn Cermet potentiometers?

The highest demand for multiturn Cermet potentiometers stems from precision instrumentation, advanced industrial automation (CNC machinery, robotic control), and specialized medical equipment (imaging devices) that require extremely fine adjustment resolution and setting accuracy for critical control loops and position sensing.

How does the shift toward Surface Mount Device (SMD) packaging affect Cermet potentiometer performance?

The shift to SMD packaging mandates specialized materials and manufacturing processes to ensure the Cermet component can withstand reflow soldering temperatures without compromising its resistive stability or mechanical integrity. SMD versions facilitate miniaturization and high-density PCB designs while maintaining the robust electrical characteristics of Cermet technology.

Is the Cermet Potentiometer Market expected to decline due to digital alternatives?

No, while digital controls (DACs) are replacing potentiometers in general consumer applications, the Cermet market, focused on high-reliability, industrial, and defense sectors, is sustained by the indispensable need for analog trimming, redundancy, and components resilient to severe environmental stress, ensuring continuous specialized demand.

What role does ruthenium oxide play in the composition of Cermet potentiometers?

Ruthenium oxide (RuO2) is the most common metallic phase used in Cermet paste. When mixed with the ceramic binder, it forms a highly stable, complex conducting network. Its primary role is to provide the necessary resistive properties and ensure long-term stability with minimal drift across the operational temperature range.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager