Chai Tea Mix Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432796 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Chai Tea Mix Market Size

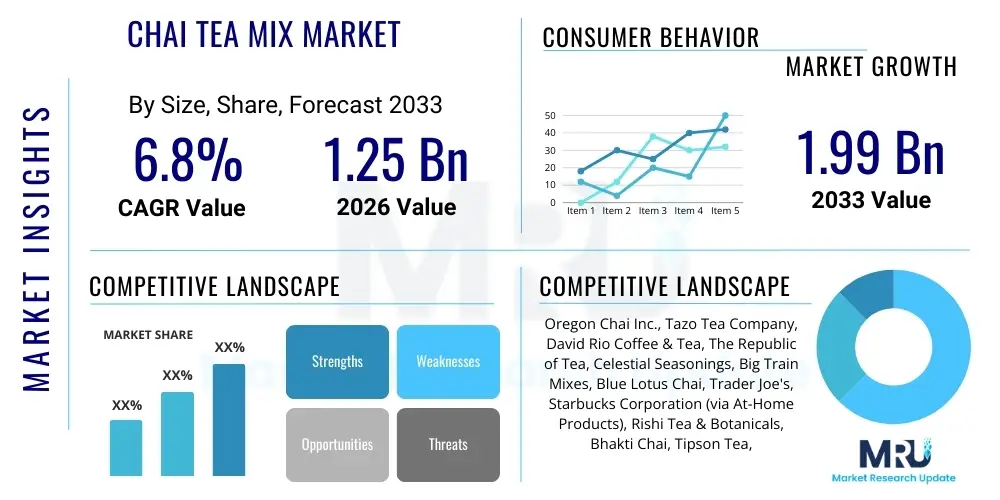

The Chai Tea Mix Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.25 Billion in 2026 and is projected to reach USD 1.99 Billion by the end of the forecast period in 2033. This consistent growth trajectory is fueled by rising consumer preference for convenient, globally inspired beverages that offer functional health benefits, coupled with continuous innovation in flavor profiles and product formats across key geographical regions.

Chai Tea Mix Market introduction

The Chai Tea Mix Market encompasses a variety of instant and concentrated beverage products designed to replicate the traditional spiced Indian tea (chai). These mixes typically include black tea extract, a blend of spices such as cardamom, cinnamon, ginger, cloves, and sometimes sweeteners and milk solids, formulated for ease of preparation. The core product definition revolves around convenience and authenticity, offering consumers a quick way to enjoy complex, aromatic flavors without the lengthy traditional brewing process. Major applications include household consumption, foodservice industries (cafés, restaurants), and institutional settings (offices, schools), where speed and consistency are highly valued. The expansion of these applications is crucial for market penetration and growth globally, especially in non-traditional tea-drinking regions.

The primary benefit driving adoption is the unparalleled convenience factor, which appeals significantly to busy, modern consumers seeking indulgent experiences with minimal effort. Furthermore, the inherent health benefits derived from the antioxidant properties of black tea and the anti-inflammatory qualities of the spices contribute positively to market perception. Driving factors include the increasing urbanization trend, the subsequent demand for ready-to-drink or instant gourmet options, and aggressive marketing strategies by key industry players emphasizing exotic flavor profiles and wellness attributes. This confluence of convenience, health, and global flavor integration positions chai tea mixes as a highly dynamic segment within the broader beverage market, poised for sustained expansion over the next decade.

Chai Tea Mix Market Executive Summary

The global Chai Tea Mix Market is exhibiting robust business trends characterized by a rapid shift towards premiumization and functional ingredients. Manufacturers are focusing heavily on developing specialty mixes, including organic, low-sugar, and vegan variants, responding directly to evolving dietary preferences and health consciousness among target consumers. A key trend involves strategic partnerships between chai mix producers and specialty coffee chains, leveraging the established distribution networks and consumer loyalty of the foodservice sector. Furthermore, the incorporation of adaptogens and nootropics into chai formulations is creating a new segment appealing to consumers seeking cognitive and stress-relief benefits, moving the product category beyond simple flavor indulgence into the functional beverage space.

Regionally, Asia Pacific (APAC) continues to dominate the market volume due to the entrenched cultural significance of chai, but North America and Europe are experiencing the highest growth rates, driven primarily by the product’s status as a trendy, globalized beverage alternative to traditional coffee. In North America, accessibility through mass retail channels and the popularity of 'chai lattes' in cafe culture propel sales. European growth, conversely, is largely focused on specialty food stores and e-commerce, catering to consumers interested in high-quality, authentic imports. Emerging markets in Latin America and the Middle East offer untapped opportunities, as rising disposable incomes and exposure to global culinary trends foster interest in exotic tea preparations.

Segment trends indicate that the powder form segment retains the largest market share due to its extended shelf life and cost-effectiveness. However, the liquid concentrate segment is experiencing the fastest growth, favored by the foodservice sector for its superior consistency and quick preparation time, crucial for high-volume environments. Ingredient segmentation highlights a pronounced consumer preference shift toward natural sweeteners (stevia, monk fruit) and plant-based milk powders (oat, almond), reflecting broader clean-label movement demands. Distribution channel analysis shows that e-commerce platforms are increasingly vital, offering direct access to niche brands and specialized formulations that are not readily available in conventional supermarkets, thereby diversifying the competitive landscape and enhancing market reach.

AI Impact Analysis on Chai Tea Mix Market

User queries regarding the impact of Artificial Intelligence (AI) on the Chai Tea Mix Market frequently center on supply chain efficiency, personalized flavor creation, and optimized marketing strategies. Users are keen to understand how AI-driven predictive analytics can manage the volatile global spice supply—a core component of chai—mitigating risks associated with climate change and geopolitical instability. Another major theme is AI's role in consumer segmentation and preference mapping, allowing companies to launch highly targeted flavor variations (e.g., seasonal or regional-specific mixes) that minimize product development risk. Furthermore, concerns revolve around the ethical deployment of AI in automated processing and quality control to maintain the authenticity and sensory characteristics cherished by traditional chai drinkers, ensuring technological efficiency does not compromise product integrity.

- AI-Powered Predictive Sourcing: Utilizing machine learning algorithms to forecast demand for specific spices (cardamom, ginger) and optimize procurement, thereby stabilizing input costs and ensuring supply chain resilience.

- Automated Flavor Formulation: Employing AI to analyze consumer sensory data and ingredient interactions, accelerating the development cycle for new, complex flavor profiles that resonate highly with specific demographic groups.

- Personalized Consumer Engagement: Implementing AI-driven recommendation engines and dynamic pricing models on e-commerce platforms, tailoring product offerings and promotions based on individual purchasing history and consumption patterns.

- Optimized Quality Control: Deploying computer vision systems and sensors throughout the mixing and packaging lines to detect inconsistencies in texture, color, and particle size, ensuring superior and consistent product quality across batches.

- Efficiency in Vertical Farming Simulation: Modeling ideal growth environments for specialty tea and spice cultivation (if companies move towards integrated supply) using AI to enhance yield and sustainability.

DRO & Impact Forces Of Chai Tea Mix Market

The dynamics of the Chai Tea Mix Market are governed by significant driving factors, inherent restraints, and compelling opportunities that collectively shape its trajectory. The primary driving force is the global health and wellness trend, which favors natural, low-sugar, and minimally processed ingredients found in premium chai mixes, positioning the product as a healthier alternative to carbonated drinks and highly sweetened coffee beverages. Simultaneously, the profound cultural influence of globalization promotes the acceptance and adoption of ethnic foods and beverages across diverse geographies, making chai a universally recognized and desired flavor profile. These drivers exert a strong positive impact, continually expanding the consumer base beyond traditional demographics.

However, the market faces notable restraints, chiefly related to the volatility and high cost associated with sourcing critical spices like cardamom and cloves, which are susceptible to climatic variations and fragmented supply chains. This cost instability directly impacts pricing strategies and profit margins. Furthermore, the increasing consumer preference for fresh, homemade beverages poses a challenge to the pre-packaged nature of chai tea mixes, demanding constant innovation in packaging technology to maintain freshness and sensory appeal. These restraints necessitate robust risk management strategies and investments in transparent, ethical sourcing practices to sustain long-term profitability and consumer trust.

Opportunities for expansion are abundant, particularly in leveraging the rise of specialty diets, such as keto, paleo, and veganism, by introducing specialized mix formulations that cater directly to these nutritional requirements. Expansion into new geographical territories, particularly in untapped areas of Eastern Europe and Southeast Asia, offers significant market entry potential. The increasing adoption of convenient single-serve packaging (pods and capsules compatible with existing beverage systems) also presents a lucrative pathway for accessing convenience-focused consumers, further solidifying the market's favorable impact forces and providing avenues for synergistic growth across various distribution channels.

Segmentation Analysis

The Chai Tea Mix Market is highly differentiated, categorized extensively based on product type, form, distribution channel, and key ingredients, reflecting the diverse preferences of the global consumer base. Understanding these segments is paramount for strategic market positioning and product development, allowing companies to address specific niche demands, ranging from instant convenience sought by household users to consistent quality required by the foodservice industry. The segmentation analysis reveals crucial insights into growth pockets, particularly the rapid uptake of liquid concentrates and the strong consumer demand for natural and organic certification, which influences formulation strategies across all major market players.

The segmentation by form—powder, liquid concentrate, and ready-to-drink (RTD)—is pivotal, with each form catering to different consumption moments and channels. While powders offer versatility and cost efficiency, concentrates are optimizing the professional preparation process in cafes. Ingredient-based segmentation, focusing on sweetener types (natural vs. artificial) and milk base (dairy vs. plant-based), directly correlates with major consumer trends surrounding health, wellness, and ethical consumption. Moreover, analyzing distribution channels—Supermarkets, Convenience Stores, and E-commerce—reveals the increasing importance of digital platforms in driving brand discovery and direct-to-consumer sales, providing unparalleled market penetration for specialized and niche brands.

- By Form:

- Powder Mixes

- Liquid Concentrates

- Ready-to-Drink (RTD)

- By Product Type:

- Instant Chai Mixes

- Masala Chai Mixes

- Ginger Chai Mixes

- Cardamom Chai Mixes

- Specialty/Gourmet Mixes

- By Distribution Channel:

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Retail (E-commerce)

- Foodservice/HORECA

- By Ingredients:

- Dairy-Based

- Non-Dairy/Plant-Based (e.g., oat, almond, coconut)

- By Sweetener Type:

- Sugar-Based

- Sugar-Free/Low-Calorie (Natural sweeteners, e.g., Stevia)

Value Chain Analysis For Chai Tea Mix Market

The value chain for the Chai Tea Mix Market begins with the highly sensitive upstream activities involving the sourcing of raw materials, primarily black tea leaves and a complex array of global spices (cinnamon, ginger, cloves, cardamom, black pepper). Upstream analysis highlights the necessity for stringent quality control and sustainable, traceable sourcing practices, often involving direct relationships with specialized tea gardens and spice growers. The inherent complexity in managing variable commodity prices and ensuring ethical labor practices during harvesting necessitates significant investment in supplier relationship management and sophisticated logistics for importation and processing. The efficiency of this stage directly impacts the authenticity, flavor profile, and final cost of the chai mix product.

Midstream activities encompass the manufacturing processes, including blending, grinding, drying, extraction, and packaging, where technological innovation plays a crucial role in maintaining the aromatic volatility of the spices and ensuring shelf stability. Manufacturers invest in specialized drying techniques for powders and aseptic processing for liquid concentrates to prevent spoilage and maintain consistency. Downstream analysis focuses on distribution channels, which are bifurcated into direct and indirect routes. Direct distribution involves sales through proprietary e-commerce sites or brand stores, offering higher margins and direct consumer feedback loops. Indirect channels utilize extensive networks of wholesalers, retailers (supermarkets, hypermarkets), and foodservice distributors, providing massive scale and market access.

The choice between distribution channels often dictates market visibility and consumer interaction. Indirect distribution through large retail chains offers immediate volume but requires intensive promotional activity and slotting fees. Conversely, the increasingly vital role of e-commerce allows niche brands to bypass traditional gatekeepers and target consumers globally, minimizing geographical barriers. The value chain culminates in the end-user consumption, emphasizing the importance of attractive, informative packaging and consistent product quality, driving repeat purchases and brand loyalty within this highly competitive and flavor-driven market segment.

Chai Tea Mix Market Potential Customers

The primary potential customers and end-users of chai tea mixes fall into three broad categories: convenience-seeking households, the high-volume foodservice sector, and health-conscious specialty consumers. Households represent the largest volume segment, valuing the product for its ease of preparation, requiring only hot water or milk. This demographic typically prioritizes powder mixes due to their affordability and long shelf life, integrating them into daily routines as a warming beverage or an afternoon pick-me-up. Marketing efforts targeting this group emphasize family-friendly consumption, quick fixes, and accessibility through mainstream grocery channels, making ease of use and price point critical drivers of purchase decisions.

The foodservice industry, comprising cafes, restaurants, and catering services (HORECA), forms a crucial segment, predominantly favoring liquid concentrates. For these professional users, consistency in flavor and rapid preparation speed are non-negotiable requirements, as they need to serve large volumes quickly while maintaining brand standards. Cafes specifically utilize chai mixes as the base for popular menu items like iced chai lattes and hot chai beverages, viewing the mix as a critical ingredient that minimizes labor costs and ensures standardized quality across multiple locations. Business-to-business (B2B) marketing focuses on bulk procurement options, operational efficiency, and flavor authenticity to secure long-term contracts with major chains.

The third key segment comprises specialty consumers, including Millennials and Gen Z, who are actively seeking premium, ethical, and functional beverages. These buyers prioritize clean labels, organic certification, specific dietary compatibility (vegan, gluten-free), and unique, complex flavor blends. They are willing to pay a premium for products with transparent sourcing narratives and added functional ingredients (e.g., turmeric, maca). This segment heavily relies on direct-to-consumer e-commerce channels and specialty food stores for discovery and purchase, making influencer marketing and strong brand storytelling essential to capture their interest and loyalty in a crowded marketplace.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.25 Billion |

| Market Forecast in 2033 | USD 1.99 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Oregon Chai Inc., Tazo Tea Company, David Rio Coffee & Tea, The Republic of Tea, Celestial Seasonings, Big Train Mixes, Blue Lotus Chai, Trader Joe's, Starbucks Corporation (via At-Home Products), Rishi Tea & Botanicals, Bhakti Chai, Tipson Tea, Stash Tea, Twinings, Hindustan Unilever Limited. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Chai Tea Mix Market Key Technology Landscape

The technological landscape of the Chai Tea Mix Market is rapidly evolving, driven primarily by the need to preserve complex flavor profiles and enhance product stability across various formats. A critical area of technological focus is advanced spray drying and agglomeration techniques, especially for powder mixes. These processes ensure uniform particle size and superior dissolution characteristics, preventing clumping and sedimentation when the mix is reconstituted. Specialized low-temperature drying methods are increasingly utilized to minimize the loss of volatile essential oils from the spices, thereby retaining the desired aromatic intensity and sensory authenticity that consumers demand in a premium chai product. Furthermore, the integration of automation and precise digital dosing systems in blending is essential to achieve perfect batch-to-batch consistency, a crucial factor for B2B clients in the competitive foodservice sector.

In the liquid concentrate segment, the dominant technology revolves around aseptic processing and ultra-high-temperature (UHT) sterilization combined with specialized packaging, such as multi-layer Tetra Paks or retort pouches. These technologies extend the shelf life dramatically without relying heavily on artificial preservatives, aligning with the clean- label trend. Innovation is also prominent in packaging technology, particularly the development of oxygen-scavenging barrier materials that prevent oxidation of the tea and spice components, preserving freshness over longer retail periods. For the burgeoning RTD segment, cold-fill and high-pressure processing (HPP) techniques are being explored to produce shelf-stable beverages while maintaining the nutritional and sensorial integrity of natural ingredients, avoiding the cooked flavor sometimes associated with traditional thermal processing.

Additionally, technology extends into supply chain management and consumer interface. The adoption of blockchain technology for spice and tea traceability is growing, offering consumers verifiable proof of ethical sourcing and ingredient origin, addressing rising concerns about transparency. On the consumer front, smart packaging technologies, such as QR codes linked to detailed provenance stories and preparation instructions, enhance the consumer experience. The utilization of sophisticated laboratory testing equipment, including Gas Chromatography–Mass Spectrometry (GC-MS), ensures that the flavor compounds in every batch of spices meet rigorous quality benchmarks, guaranteeing the high standard expected in specialty and gourmet chai tea mixes.

Regional Highlights

North America: North America represents a dynamic and high-growth market for chai tea mixes, driven largely by the proliferation of specialized coffee and tea houses and the widespread adoption of the 'chai latte' as a menu staple. Consumers in the United States and Canada prioritize convenience and flavor innovation, leading to a strong demand for high-quality liquid concentrates and RTD formats suitable for on-the-go consumption. Market expansion is strongly supported by aggressive product positioning emphasizing functional health benefits and specialty formulations, including organic, fair-trade certified, and adaptogenic variants. E-commerce penetration is particularly strong here, allowing niche artisanal brands to compete effectively with established corporate players, fostering a highly innovative and competitive market environment.

- United States: Dominates the regional market, driven by cafe culture and consumer willingness to pay a premium for specialty flavors and health-conscious alternatives.

- Canada: Exhibits steady growth with a focus on sustainable and ethically sourced ingredients, often favoring natural sweeteners over refined sugar.

- Key Trend: Significant growth in plant-based chai mixes (oat and almond milk bases) to cater to the growing vegan and dairy-free populations.

Europe: The European market demonstrates significant appetite for chai tea mixes, although consumption patterns are more fragmented compared to North America. Western European countries, particularly the UK, Germany, and France, lead the adoption, fueled by increasing exposure to global cuisine and a rising interest in Ayurvedic and traditional herbal remedies, which chai ingredients often align with. European consumers often prefer powder formats for home use but demand sophisticated, less-sweet flavor profiles. Regulations surrounding organic certification and clean labeling are stringent, prompting manufacturers to invest heavily in transparent ingredient sourcing and minimal processing techniques to comply with local standards and consumer expectations for high-quality, authentic products.

- United Kingdom: High per capita consumption, driven by established tea-drinking traditions and the increasing availability of chai mixes in mainstream supermarkets.

- Germany: Strong demand for organic and naturally sweetened products, reflecting a broader consumer trend toward natural wellness and nutritional transparency.

- Key Trend: Emphasis on gourmet and artisanal brands, viewing chai mix as a premium food item rather than just a commodity convenience product.

Asia Pacific (APAC): The APAC region, especially India, holds immense cultural significance and market volume for chai, representing the traditional heartland of the beverage. While traditional home-brewing remains dominant, the urbanized centers of APAC are experiencing rapid growth in the consumption of packaged chai tea mixes and RTD formats, driven by hectic metropolitan lifestyles and the younger generation’s demand for instant options. Markets like China, Japan, and Southeast Asia, where tea is deeply embedded in the culture but chai is an exotic import, show promising growth. Manufacturers strategically focus on adapting spice levels and sweetness profiles to local palates while ensuring that mixes offer the familiar comfort of traditional masala chai, navigating the delicate balance between convenience and cultural authenticity.

- India: Massive volume base, with rapid growth in instant and RTD formats catering to busy urban populations seeking quick, quality alternatives to lengthy home preparation.

- China and Japan: High potential due to strong existing tea markets, with chai positioned as a premium, specialty, or seasonal imported beverage.

- Key Trend: Development of localized chai flavors incorporating regional spices and the increasing use of advanced packaging to maintain quality in varied climatic conditions.

Latin America (LATAM): The Chai Tea Mix Market in Latin America is still nascent but accelerating, benefiting from increased globalization and rising middle-class disposable incomes. Market penetration is concentrated in urban centers such as Brazil and Mexico, where consumers are highly receptive to novel, internationally recognized food and beverage trends. The growth is primarily fueled by the foodservice sector, which introduces chai beverages through international cafe chains. Powder mixes are currently the predominant format due to logistics simplicity and lower introductory costs, but as cold beverage consumption rises, demand for liquid concentrates is expected to increase. Educating consumers on preparation methods and the unique flavor profile is essential for sustainable market expansion in this region.

- Brazil: Key growth hub, driven by cosmopolitan cities and an increasing adoption of health-conscious beverage choices.

- Mexico: Market expansion supported by tourism and cultural exchange, making global flavors more accessible and desirable.

- Key Trend: Focus on developing mixes that pair well with local dairy alternatives and regional sweetener preferences, ensuring cultural alignment.

Middle East and Africa (MEA): The MEA region presents unique dynamics. While coffee consumption is robust, tea, particularly black tea, is also highly popular in many parts of the Middle East, offering a receptive environment for chai mixes. Growth is spurred by expatriate populations, luxury consumption patterns in the Gulf Cooperation Council (GCC) countries, and increased retail infrastructure. South Africa is a significant market entry point in Africa, where consumers seek convenient, warming beverages. Challenges include navigating diverse regulatory environments and ensuring product stability in high-temperature climates. Manufacturers often introduce premium, finely milled powder mixes and luxury liquid concentrates to appeal to the high-end retail segment prevalent in the Middle Eastern markets.

- GCC Countries (UAE, Saudi Arabia): High demand for luxury and premium chai mixes sold through specialized stores and high-end cafes.

- South Africa: Growing urban consumer base seeking affordable and convenient instant tea options.

- Key Trend: Importation of highly packaged, authentic, and certified halal chai mixes to meet regional consumer requirements and quality standards.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Chai Tea Mix Market.- Oregon Chai Inc.

- Tazo Tea Company (Unilever)

- David Rio Coffee & Tea

- The Republic of Tea

- Celestial Seasonings (The Hain Celestial Group)

- Big Train Mixes

- Blue Lotus Chai

- Starbucks Corporation (At-Home Products Division)

- Rishi Tea & Botanicals

- Bhakti Chai

- Tipson Tea

- Stash Tea

- Twinings

- Hindustan Unilever Limited

- Trader Joe's

- Nature's Guru

- Ayurveda Pura London

- Third Street Chai

- Pacific Spice Company

- Aiya America

Frequently Asked Questions

Analyze common user questions about the Chai Tea Mix market and generate a concise list of summarized FAQs reflecting key topics and concerns.What primary trends are driving the growth of the Chai Tea Mix Market globally?

The market growth is primarily driven by the increasing consumer demand for convenient, globally inspired beverages that offer functional health benefits. The globalization of ethnic flavors, coupled with a major shift towards premium, low-sugar, and plant-based formulations, significantly accelerates market expansion across North America and Europe.

How is the segmentation by Form impacting product innovation and distribution strategies?

The segmentation by Form heavily dictates channel strategy. Powder mixes maintain market share through mass retail due to low cost, while liquid concentrates are rapidly growing due to their preferred use in the high-volume foodservice sector, demanding rapid, consistent preparation. RTD formats capitalize on the on-the-go convenience trend.

Which geographical region holds the highest growth potential for premium chai mixes?

North America and Europe demonstrate the highest growth potential for premium and specialty chai mixes. This is attributed to high consumer willingness to pay for organic, ethically sourced, and functional ingredients, coupled with strong established distribution networks within the specialty beverage industry.

What are the main challenges facing the supply chain in the Chai Tea Mix Market?

The main challenge is the high volatility and cost associated with sourcing key global spices (like cardamom and cinnamon), which are susceptible to unpredictable climate changes and geopolitical disruptions. This necessitates robust, sustainable sourcing strategies and significant investment in supply chain resilience to maintain stable production costs.

How are clean label preferences influencing the ingredient composition of chai tea mixes?

Clean label preferences are forcing manufacturers to eliminate artificial ingredients, transitioning heavily towards natural sweeteners (Stevia, monk fruit), and replacing traditional dairy solids with plant-based alternatives such as oat, almond, and coconut milk powders. This shift ensures alignment with prevailing health-conscious and ethical consumption trends.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager