Chain Binder Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435722 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Chain Binder Market Size

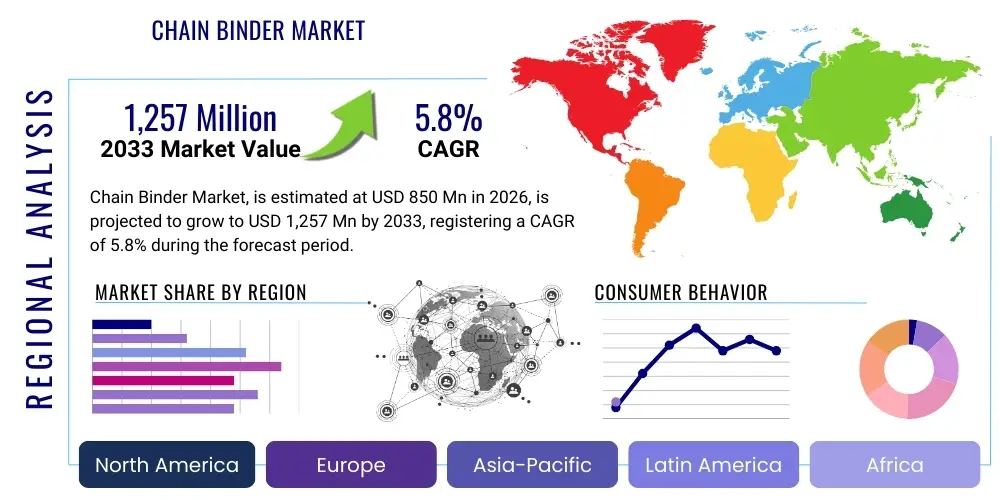

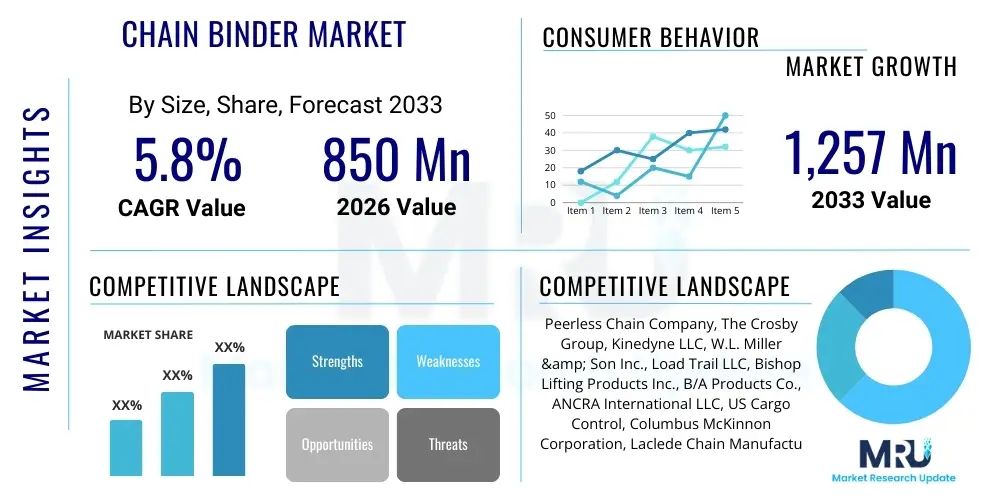

The Chain Binder Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 850 Million in 2026 and is projected to reach USD 1,257 Million by the end of the forecast period in 2033. This consistent expansion is primarily driven by the robust growth in the global construction, logistics, and heavy machinery transportation sectors, where secure load management is a paramount regulatory and safety requirement. Increased infrastructure spending in developing economies, coupled with stricter enforcement of cargo securement standards worldwide, reinforces the necessity for high-quality, reliable chain binders.

Chain Binder Market introduction

The Chain Binder Market encompasses the manufacturing, distribution, and sale of mechanical devices used to tension chains that secure cargo during transportation. These essential tools are designed to efficiently tighten load securement chains, ensuring the stability and safety of freight, particularly heavy and oversized items, across various modes of transport including trucking, rail, and maritime shipping. Products range from standard ratchet binders, which offer superior mechanical advantage and control, to lever binders (or snap binders), which provide quick tensioning capabilities, each tailored to specific operational requirements and safety regulations across different industries globally. The design evolution focuses on enhanced durability, reduced user effort, and improved safety features to minimize the risk of accidents during loading and unloading operations, addressing stringent industry demands for ergonomic and reliable equipment.

Major applications for chain binders span high-demand sectors such as construction equipment hauling, steel and lumber transport, mining logistics, and agricultural machinery movement. The product's fundamental benefit lies in its ability to generate significant tension reliably and maintain that force throughout transit, critical for compliance with national and international Department of Transportation (DOT) regulations and similar safety mandates. The driving factors behind market growth include the burgeoning e-commerce sector requiring sophisticated logistics networks, the revitalization of global infrastructure projects, and the continuous modernization of fleet vehicles that necessitate corresponding upgrades in load securement technologies. Furthermore, technological advancements leading to lighter, more resilient materials, such as high-grade alloy steel, are also accelerating adoption rates across professional transportation companies seeking optimized operational efficiencies and reduced equipment failure rates.

Chain binders, being integral components of the tie-down assembly, are categorized based on their working load limit (WLL), which directly correlates with the size and type of chain they are designed to tension. The selection process is strictly governed by safety standards like the North American Cargo Securement Standard (NACSS) or European norms, ensuring that the combined securement capacity exceeds the weight of the cargo. The longevity and reliability of these devices are constantly being improved through advanced metallurgical techniques and precision engineering, positioning the market favorably amidst increasing global trade volumes and the attendant need for highly dependable transportation solutions. This focus on compliance and performance underpins the steady demand for both replacement units and new installations across the global commercial vehicle landscape.

Chain Binder Market Executive Summary

The Chain Binder Market Executive Summary highlights robust business trends dominated by stringent regulatory environments mandating enhanced load security, thereby boosting demand for high-WLL (Working Load Limit) and ergonomic ratchet binders over traditional lever models due to superior safety control and ease of use. Regionally, North America maintains the leading position, primarily due to expansive logistics infrastructure and stringent enforcement of DOT regulations regarding commercial vehicle cargo securement, while the Asia Pacific region is demonstrating the highest growth trajectory, fueled by rapid industrialization, large-scale infrastructure development, and substantial investments in logistics and supply chain modernization, particularly in countries like China and India. Segmentation trends show the Ratchet Binder segment capturing the largest market share, attributed to its safety profile and mechanical efficiency, whereas the transportation and logistics end-use segment remains the primary revenue generator, reflecting the perpetual movement of heavy goods across the globe. Competition remains fragmented but is increasingly focusing on product differentiation through material science innovation, offering products with higher corrosion resistance and improved durability to cater to demanding environments.

AI Impact Analysis on Chain Binder Market

User queries regarding the impact of Artificial Intelligence (AI) on the Chain Binder Market predominantly revolve around the integration of smart technologies into load securement processes, concerns about automation replacing manual inspection roles, and the potential for predictive maintenance capabilities. Key themes emerging from these questions include the feasibility of developing 'smart' chain binders equipped with sensors to monitor tension levels in real-time, the role of machine learning in optimizing load placement and securement patterns for compliance, and how AI-driven fleet management systems could automatically log and verify compliance data, reducing human error and liability. Users are primarily seeking clarity on whether AI will lead to fundamentally redesigned binding hardware or if its influence will be limited to the software and monitoring layer, ultimately focusing on enhancing safety compliance, operational efficiency, and reducing risks associated with load shifting and accidental release during transit, which is a major concern in heavy haulage operations globally.

Although chain binders are inherently mechanical components, AI and machine learning are poised to impact the associated ecosystem significantly, shifting the focus from manual securing to intelligent monitoring and compliance assurance. Specifically, AI integration enables the development of advanced telematics systems that can continuously analyze data streams from embedded sensors within chains and securement hardware. This data includes vibration analysis, sustained tension levels, and sudden shock events, allowing fleet managers to receive instantaneous alerts about potential load security failures long before a critical event occurs. This predictive maintenance approach extends beyond the binder itself, contributing to overall asset management and significantly improving the safety record of logistics providers, which is a crucial differentiator in a highly regulated industry. Furthermore, AI algorithms can process vast amounts of data related to route characteristics, weather conditions, and cargo type to provide optimal securement recommendations prior to departure, enhancing the precision and efficiency of pre-trip inspections.

The long-term influence of AI also extends into supply chain optimization and regulatory documentation. AI-powered systems can automatically generate comprehensive digital records proving compliance with varied regional cargo securement standards (e.g., FMCSA in the US, specific EU directives). This automation drastically reduces administrative burden, minimizes the potential for fines due to documentation lapses, and speeds up checkpoint processes. As autonomous vehicles become more prevalent in commercial trucking, AI will be essential for verifying that the cargo securing systems operate flawlessly without continuous human intervention. The primary challenge remains the cost and complexity of retrofitting traditional mechanical binders with sophisticated sensor technology that can withstand the harsh environmental conditions inherent in heavy-duty transport, demanding highly durable, low-power sensor arrays integrated seamlessly into existing hardware designs.

- AI enhances real-time tension monitoring via integrated sensors in chains and securement hardware.

- Machine learning optimizes load securement patterns based on cargo characteristics and route dynamics.

- Predictive maintenance algorithms flag potential binder or chain failure before catastrophic load shifting occurs.

- AI-driven telematics systems automate compliance reporting and regulatory documentation for load securement.

- Automation reduces reliance on purely manual inspection, decreasing human error and improving overall safety records.

- AI supports the development of sophisticated autonomous cargo handling and securing protocols in future logistics systems.

DRO & Impact Forces Of Chain Binder Market

The Chain Binder Market is propelled by robust drivers, primarily the rapid expansion of global logistics and construction sectors, coupled with stringent, non-negotiable regulatory standards for cargo securement implemented by governing bodies worldwide, forcing companies to utilize certified and dependable securing mechanisms. Restraints, however, include intense price competition, especially from low-cost manufacturers offering inferior products that compromise safety, and the inherent risks associated with lever binders (kickback), which sometimes leads to operator injury and subsequent calls for exclusive use of the safer ratchet designs. Opportunities are abundant in developing specialized smart binders incorporating IoT and sensor technology for real-time load monitoring, as well as penetrating emerging markets in Asia and Latin America where infrastructure development is accelerating rapidly. These intersecting forces—regulatory push, price pressure, and technological advancement—create a complex impact force matrix where safety and compliance are consistently prioritized over cost, driving a premium market segment focused on durability and advanced features.

Key drivers include the global increase in heavy machinery rentals and sales, requiring specialized transport solutions, and the continuous growth of the global shipping and port activities where intermodal container securement is critical. Furthermore, environmental durability and performance under extreme weather conditions are increasingly becoming competitive advantages, pushing manufacturers toward using specialized coatings and corrosion-resistant materials, justifying higher average selling prices (ASPs). The primary restraint remains the lack of standardized training and awareness regarding proper binder selection and usage among smaller trucking operators, often resulting in improper application, premature product failure, and potential accidents, which negatively impacts the perceived reliability of the entire product category. Addressing this requires greater investment in comprehensive user education programs sponsored by manufacturers and industry associations.

The impact forces are fundamentally shaped by safety legislation (e.g., updates to WLL requirements or mandated securement points), which acts as a powerful external driver forcing continuous product improvement and market consolidation towards quality-certified vendors. The opportunity to leverage lightweight, high-strength materials such as specialized aluminum alloys for handle construction reduces product weight while maintaining strength, enhancing ergonomics—a crucial factor for widespread user adoption and reduced operator fatigue. The market dynamics are highly sensitive to global economic cycles; downturns often lead companies to extend the lifecycle of existing equipment rather than invest in new, potentially smarter, securement technology, posing a cyclical challenge to innovation investment. Ultimately, the long-term growth trajectory is positively secured by the universal and non-discretionary nature of cargo safety compliance across all modes of heavy transport.

Segmentation Analysis

The Chain Binder Market segmentation provides a granular view of demand distribution across different product types, material compositions, and critical end-use applications, which informs strategic manufacturing and marketing decisions. The primary segmentation by Product Type differentiates between ratchet binders and lever binders, with ratchet binders currently dominating due to their inherent safety features and precise tension control, making them preferable for high-stakes, long-haul transportation. Material segmentation highlights the use of heavy-duty steel and specialized alloy steel, dictated by the required Working Load Limit (WLL) and the operational environment, especially the need for corrosion resistance in maritime or perpetually damp conditions. Geographic segmentation clearly identifies regional consumption patterns influenced by local infrastructure investments and the stringency of cargo securement regulations, confirming regional market maturity levels.

Further analysis of the market segments reveals the profound influence of end-user industry requirements. The Transportation and Logistics sector accounts for the largest share, constantly demanding high-volume, standardized binders compliant with varying cross-border regulations. Conversely, the Construction and Mining sectors require fewer units but demand extremely high WLL devices tailored for securing heavy and specialized equipment like excavators, bulldozers, and drill rigs, often operating in severe, high-abrasion environments. This distinction means manufacturers must maintain dual product lines: high-volume standardized products for logistics and highly ruggedized, specialty binders for industrial applications. The growth in specialized transportation, such as wind turbine component logistics, further drives demand for custom, ultra-heavy-duty securement solutions that utilize advanced binder designs capable of handling exceptionally large and irregular loads safely and reliably over extensive distances.

- By Product Type:

- Ratchet Binders (Dominant segment due to superior safety and control)

- Lever Binders (Used for quick tensioning, though facing regulatory scrutiny)

- By Material:

- Steel (Standard heavy-duty applications)

- Alloy Steel (High WLL and specialized corrosive environments)

- Aluminum/Composite (Used primarily for lightweight handle construction)

- By Working Load Limit (WLL):

- Low WLL (Under 5,000 lbs)

- Medium WLL (5,000 lbs to 10,000 lbs)

- High WLL (Above 10,000 lbs)

- By End-Use Industry:

- Transportation and Logistics (Largest consumer, driven by freight volume)

- Construction and Infrastructure

- Mining and Excavation

- Agriculture and Forestry

- Heavy Manufacturing and Industrial (e.g., Steel Coil Transport)

- By Region:

- North America (Mature, heavily regulated market)

- Europe (Strong emphasis on CE certification and ergonomic design)

- Asia Pacific (Fastest growing, driven by infrastructure projects)

- Latin America, Middle East & Africa (Emerging markets with growing logistics needs)

Value Chain Analysis For Chain Binder Market

The value chain for the Chain Binder Market begins with upstream analysis, focusing on the procurement of raw materials, predominantly high-grade steel, specialized alloys, and components like springs and locking mechanisms. Raw material costs and quality directly influence the final product’s Working Load Limit (WLL) and durability, making reliable sourcing critical. Manufacturers typically maintain strong relationships with certified steel mills that can provide materials meeting specific tensile strength and metallurgical composition requirements essential for safety certifications (e.g., Grade 70 or Grade 80 steel). Manufacturing involves sophisticated processes including forging, casting, heat treatment, and precision machining, often requiring specialized robotic welding and assembly lines to ensure consistency and adherence to strict safety standards such as those established by ASTM or regional transportation bodies. This stage of the value chain is highly capital-intensive, favoring established firms with proven quality control systems, ensuring the integrity of the crucial components that manage immense tension forces during operation.

The distribution channel represents the midstream element, characterized by a mix of direct sales to large fleet operators and indirect distribution through a broad network of industrial supply distributors, hardware stores, specialized trucking equipment retailers, and e-commerce platforms. Direct sales are typically preferred for large, customized orders or government procurement contracts, offering manufacturers higher margins and direct customer feedback. Conversely, indirect channels provide extensive market reach, particularly to small and medium-sized enterprises (SMEs) and independent truckers, leveraging the established warehousing and logistics capabilities of major industrial distributors. The choice of channel is dictated by geographical penetration strategy and the type of product, with high-volume, standard products moving efficiently through distributor networks, while highly specialized or smart binders may require more direct technical support and sales intervention to educate end-users effectively about their optimal utilization and maintenance protocols.

Downstream analysis centers on the end-users—the transportation, construction, and heavy industrial sectors—where the product is consumed. Post-sale services, including maintenance advice, repair kits, and safety compliance training, add significant value at this stage, particularly for high-end, long-lifecycle products. The flow of funds and regulatory compliance mandates are strong influences on downstream activity; strict DOT audits often drive immediate replacement cycles for non-compliant or worn equipment, maintaining a constant baseline demand. The market is increasingly seeing the integration of digital platforms, especially in B2B e-commerce, which streamlines the purchasing process, providing quick access to certified products, detailed specifications, and WLL documentation, enhancing supply chain transparency and reducing reliance on traditional physical storefronts. This evolution in purchasing behavior necessitates robust online catalog management and clear digital compliance verification systems by manufacturers.

Chain Binder Market Potential Customers

The primary potential customers for the Chain Binder Market are entities involved in the commercial transport of heavy, oversized, or high-value cargo where load security is paramount for regulatory compliance, safety, and operational efficiency. The largest segment of buyers includes major third-party logistics (3PL) providers and dedicated private fleets operating commercial heavy-duty trucks and specialized trailers across national and international routes. These large fleets require bulk procurement of high-WLL ratchet binders that conform to federal safety standards and are designed for high frequency of use. Their purchasing decisions are heavily influenced by product reliability, manufacturer warranty, and the total cost of ownership (TCO), seeking binders with superior ergonomics to reduce worker strain and maximize operational uptime, often integrating their procurement into comprehensive fleet maintenance protocols.

Another significant customer segment comprises companies in the construction, infrastructure development, and mining industries. These end-users are not primarily logistics providers but require robust binders to secure their own heavy equipment (e.g., dozers, excavators, cranes) when moving between job sites. For this segment, the buying criterion leans heavily towards extreme durability, resistance to harsh environmental elements (dust, mud, moisture), and the ability to handle irregularly shaped, very heavy loads safely. They often purchase specialized alloy steel binders designed for maximum WLL capacity and resilience, prioritizing failure prevention over initial cost savings. Furthermore, governmental agencies and military logistics commands represent specialized, high-demand customers that require binders meeting extremely rigid military specifications for durability and performance under tactical or disaster relief scenarios, often influencing product innovation through their rigorous testing and certification requirements.

The rapidly growing segment of independent owner-operators and smaller local hauling companies constitutes a substantial but fragmented customer base. These buyers often prioritize accessibility, moderate cost, and ease of use, frequently purchasing through local industrial supply houses or online marketplaces. While their individual purchasing volumes are smaller, their collective demand is critical to maintaining the market base, and they are increasingly targeted with mid-range products offering better ergonomics than low-cost imports while remaining budget-conscious. Finally, related industries such as tow truck operators, agricultural machinery dealers, and specialized cargo movers (e.g., oil and gas piping transport) represent niche but essential markets requiring customized chain binder solutions tailored to their unique operational challenges and load types, ensuring comprehensive market coverage across the full spectrum of heavy haulage activities.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850 Million |

| Market Forecast in 2033 | USD 1,257 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Peerless Chain Company, The Crosby Group, Kinedyne LLC, W.L. Miller & Son Inc., Load Trail LLC, Bishop Lifting Products Inc., B/A Products Co., ANCRA International LLC, US Cargo Control, Columbus McKinnon Corporation, Laclede Chain Manufacturing Co., CMCO, Tway Lifting Products Inc., Gunnebo Industries, Vestil Manufacturing Corp., Mazzella Companies, Tie Down Engineering, Delta Rigging and Tools, Zinga Industries Inc., All-Lift Systems Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Chain Binder Market Key Technology Landscape

The technology landscape of the Chain Binder Market, while fundamentally mechanical, is experiencing significant evolutionary shifts driven by material science, ergonomics, and emerging digital integration. Core technological advancements focus on metallurgical improvements, specifically the use of advanced heat-treated alloy steels (e.g., Grade 100 or higher) to achieve higher Working Load Limits (WLLs) with less material bulk, leading to lighter, yet stronger, binders. This addresses a critical market need for equipment that reduces operator fatigue while adhering to increasingly strict safety margins. Furthermore, surface treatment technologies, including specialized powder coatings and galvanization processes, are crucial for enhancing corrosion resistance, thereby extending the lifespan of the binders, particularly in regions with high humidity, salt exposure, or extreme temperature variations. Innovations in mechanism design center on the development of proprietary locking mechanisms and ratchet systems that minimize backlash and slippage under dynamic load conditions, ensuring superior load security during rapid deceleration or maneuvering.

A burgeoning technological trend involves the integration of smart components, specifically IoT sensors, into high-end chain binder assemblies. Although still nascent, this technology allows for real-time monitoring of tension applied to the securement chain. These smart binders utilize micro-sensors to measure strain and transmit data wirelessly to a truck’s telematics system or a driver’s mobile device. This capability transforms load securement from a static, pre-trip activity into a dynamic, continuous monitoring process, which is highly valued in high-risk heavy haulage. The data gathered aids in proving compliance, predicting potential load shift issues, and ensuring that optimal, manufacturer-recommended tension levels are maintained throughout the journey. This digital layer significantly enhances safety and reduces liability, positioning these advanced products as the future standard for regulated industries.

Ergonomics and ease-of-use also represent a key technological focus, particularly in ratchet binder design. Manufacturers are investing in spring-loaded handles, anti-slip grips, and self-cleaning ratchet pawls to improve usability and reduce the physical effort required to achieve maximum tension. The goal is to mitigate common injuries associated with repeated heavy manual labor required by traditional binders. Furthermore, rapid tensioning and release mechanisms are being refined to speed up the loading and unloading cycles without compromising safety. Patented designs that prevent the handle kickback risk inherent in lever binders are also gaining traction, often involving complex gear ratios and fail-safe locking features to encourage the industry-wide transition towards safer, operator-friendly alternatives. These mechanical refinements demonstrate an ongoing commitment to blending robust, traditional engineering with modern operational safety standards.

Regional Highlights

- North America: This region, encompassing the United States and Canada, represents the most mature and dominant market segment, driven primarily by the stringent Federal Motor Carrier Safety Administration (FMCSA) regulations (DOT standards) in the US and similar mandates in Canada regarding cargo securement. The massive scale of cross-country logistics, large-scale energy projects, and continuous investment in infrastructure ensure persistent high demand, particularly for high-WLL, certified ratchet binders. Key drivers include a high rate of fleet modernization and the widespread adoption of specialized heavy haulage services, creating a market environment where quality and compliance certification are non-negotiable prerequisites for market access.

- Europe: The European market is characterized by a high emphasis on standardization (CE marking), ergonomic design, and environmental sustainability. Germany, France, and the UK are major consumers, driven by advanced manufacturing and dense intra-European freight transport. European buyers often prioritize features that reduce manual strain and comply with specific local road safety directives. The market shows a strong preference for high-quality, durable components, reflecting a focus on equipment longevity and minimizing the environmental footprint associated with frequent replacement.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region during the forecast period. This exponential growth is fueled by unprecedented infrastructure investment (e.g., Belt and Road Initiative), rapid industrialization, and the massive expansion of logistics and e-commerce networks across China, India, and Southeast Asia. While cost sensitivity remains a factor, increasing regulatory enforcement and growing awareness of international safety standards are rapidly shifting demand toward higher quality, certified chain binders, moving away from low-cost, uncertified alternatives, particularly in high-value industrial applications.

- Latin America: This region, including Brazil and Mexico, exhibits steady growth linked to increased mining activities, agricultural exports, and developing transportation corridors. The market is moderately fragmented, with a growing demand for durable products that can withstand challenging road conditions and variable climate zones. Regulatory harmonization is less uniform than in North America or Europe, but increasing foreign investment often introduces higher safety standards, pushing local suppliers to improve product quality and certification levels.

- Middle East and Africa (MEA): Growth in the MEA region is sporadic but significant, concentrated mainly around GCC countries due to large-scale oil and gas sector projects, urban development, and logistics hubs (e.g., Dubai, Saudi Arabia). The demand here is highly specialized, requiring robust binders capable of operating effectively in extreme heat and dusty conditions. Investment in new port facilities and internal transportation links suggests a long-term increasing trajectory for heavy-duty securement equipment.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Chain Binder Market.- Peerless Chain Company

- The Crosby Group

- Kinedyne LLC

- W.L. Miller & Son Inc.

- Load Trail LLC

- Bishop Lifting Products Inc.

- B/A Products Co.

- ANCRA International LLC

- US Cargo Control

- Columbus McKinnon Corporation (CMCO)

- Laclede Chain Manufacturing Co.

- Gunnebo Industries

- Vestil Manufacturing Corp.

- Mazzella Companies

- Tie Down Engineering

- Delta Rigging and Tools

- Zinga Industries Inc.

- All-Lift Systems Inc.

- Dixon Valve & Coupling Company

- Lift-It Manufacturing Co. Inc.

Frequently Asked Questions

Analyze common user questions about the Chain Binder market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the difference between ratchet binders and lever binders?

Ratchet binders use a geared mechanism requiring less physical force to apply tension gradually, offering superior control and minimal risk of kickback, making them significantly safer and the preferred choice for high-WLL applications and long-haul transport. Lever binders (or snap binders) use leverage to quickly apply tension in a single motion but store energy that can cause a dangerous kickback upon release if not handled correctly. Due to safety concerns, regulatory bodies increasingly favor the use of ratchet mechanisms.

How is the required Working Load Limit (WLL) calculated for chain binders in compliance?

Compliance standards, such as those set by the DOT, require that the aggregate Working Load Limit (WLL) of all securement devices used must be at least 50% of the total weight of the cargo being transported. The WLL is clearly marked on certified binders and chains, and selection must ensure the binder's WLL matches or exceeds that of the chain or tensioning device it is securing, guaranteeing that the entire system meets the required safety factor for dynamic load handling.

What major factors are driving the growth of the Chain Binder Market?

Primary growth drivers include the mandatory and increasingly strict enforcement of cargo securement regulations globally, particularly in North America and Europe, which necessitates the use of certified, high-quality securing devices. Additionally, the rapid expansion of global infrastructure projects, logistics, e-commerce freight volumes, and demand from the heavy construction and mining sectors are fueling continuous equipment replacement and upgrade cycles, favoring high-WLL ratchet models.

Are smart chain binders with IoT technology becoming standard?

While not yet standard across the entire market, smart chain binders equipped with integrated IoT sensors for real-time tension monitoring represent a significant technological opportunity and are gaining traction in the high-end specialized transport sector. They are primarily used by large fleets and logistics companies seeking enhanced operational safety, automated compliance verification, and predictive maintenance capabilities, moving beyond traditional manual inspection methods to intelligent dynamic load management systems.

Which region currently dominates the Chain Binder Market and why?

North America currently dominates the Chain Binder Market in terms of revenue and maturity. This dominance is attributable to its highly developed logistics infrastructure, the immense volume of commercial freight movement across vast distances, and, most importantly, the exceptionally rigorous enforcement of the FMCSA and DOT cargo securement regulations, compelling continuous investment in certified, high-performance load securing equipment across all heavy transportation segments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Chain Binder Market Size Report By Type (Ratchet Binder, Lever Binder, Others), By Application (Railway Transportation, Waterway Transportation, Highway Transportation), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Chain Binder Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Ratchet Binder, Lever Binder, Others), By Application (Railway Transportation, Waterway Transportation, Highway Transportation), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager