Chain Block Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437064 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Chain Block Market Size

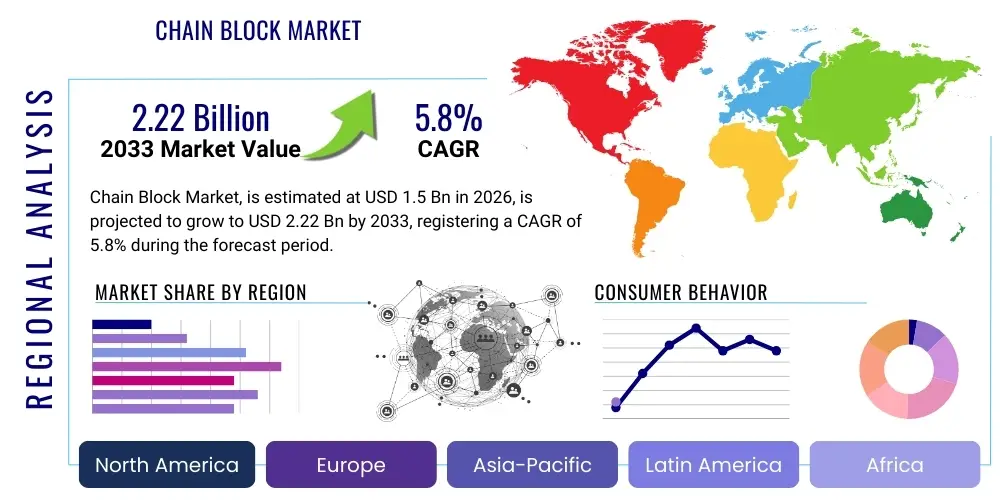

The Chain Block Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 2.22 Billion by the end of the forecast period in 2033.

Chain Block Market introduction

The Chain Block Market encompasses the manufacturing, distribution, and utilization of lifting devices designed for raising and lowering heavy loads using a chain drive system. Chain blocks, also known as hand chain hoists or manual hoists, are indispensable tools in various industrial settings where heavy lifting and precision load placement are required without the need for external power sources, although electric variants are increasingly common in large-scale operations. These devices operate on the principle of mechanical advantage, employing a gear system that allows a small input force (applied via a hand chain) to lift significantly heavier loads. The market is characterized by a strong emphasis on safety, durability, and compliance with rigorous international lifting standards.

Major applications of chain blocks span across sectors such as construction, where they are used for positioning structural steel and machinery; manufacturing, particularly in maintenance and assembly lines; shipping and logistics, for loading and unloading cargo; and automotive repair, for engine handling. Key benefits include their portability, ease of use, reliability in harsh environments, and low maintenance requirements compared to sophisticated powered lifting equipment. The fundamental product description involves robust housing, hardened steel chains, reliable braking systems (such as Weston-style brakes), and specialized hooks designed for secure attachment. Product innovation is increasingly focusing on ergonomic design, lightweight materials, and enhanced corrosion resistance to cater to specialized environments like marine and chemical processing.

The primary driving factors sustaining market growth include accelerated global infrastructure development, particularly in emerging economies, which necessitates consistent demand for lifting equipment in construction and civil engineering projects. Furthermore, stringent safety regulations enforced by occupational health and safety bodies worldwide mandate the use of certified and reliable lifting apparatus, thereby favoring high-quality chain block manufacturers. The ongoing expansion of the manufacturing sector, coupled with the need for efficient maintenance, repair, and overhaul (MRO) activities across mature industrial bases, consistently fuels the replacement and upgrade cycles for existing chain block inventory, contributing significantly to market volume.

Chain Block Market Executive Summary

The Chain Block Market demonstrates resilient growth driven by infrastructural spending and industrial maintenance needs, exhibiting strong momentum in Asia Pacific markets while simultaneously focusing on technological integration in established North American and European industries. Current business trends indicate a critical shift towards electric chain hoists, offering superior speed and operational efficiency, although manual variants maintain dominance in cost-sensitive and remote operational settings. Key manufacturers are investing heavily in supply chain resilience following recent global disruptions, prioritizing localized production capabilities and enhanced material traceability to meet rising safety compliance demands. Mergers and acquisitions focusing on vertical integration—particularly acquiring specialized component manufacturers for chains and braking mechanisms—are shaping the competitive landscape, aiming to consolidate quality control and reduce dependence on external suppliers.

Regionally, the Asia Pacific (APAC) region stands out as the primary growth engine, fueled by massive government investments in smart cities, railway networks, and large-scale manufacturing capacity expansion, especially in China and India. North America and Europe, while growing at a slower pace, exhibit a higher adoption rate of premium, technologically advanced chain blocks, including those equipped with overload protection sensors and variable speed drives, driven by high labor costs and stringent automation mandates. Segmentation trends highlight that the 1-to-5-ton capacity segment holds the largest market share due to its versatility across medium-duty industrial and construction applications. Moreover, the end-user landscape confirms that the manufacturing sector, encompassing automotive, heavy machinery, and metal fabrication, remains the most significant consumer segment, continuously seeking robust and reliable material handling solutions for precision assembly and routine MRO activities.

The market faces challenges primarily related to the price sensitivity of the manual chain block segment and the availability of cheaper, often non-compliant, alternatives from unorganized local players, which pressures margins for established brands focused on safety certifications. However, opportunities abound in specialized sectors such as clean room environments, explosion-proof zones (Oil & Gas, Chemical), and nuclear facilities, requiring highly customized and certified lifting solutions. Sustainable market expansion is contingent upon successful differentiation through enhanced digital features, such as predictive maintenance integration via IoT sensors, and improved ergonomic designs that reduce operator fatigue, thereby contributing to higher utilization rates and overall operational safety compliance across diverse industries globally.

AI Impact Analysis on Chain Block Market

Users frequently inquire about the direct and indirect influence of Artificial Intelligence (AI) and associated technologies, such as the Internet of Things (IoT) and machine learning (ML), on traditional lifting equipment like chain blocks. Common user concerns revolve around whether AI will automate the actual lifting process, making manual or simple electric hoists obsolete, and how AI can genuinely enhance the safety and maintenance cycles of these robust, mechanical devices. Key themes emerging from these inquiries focus on the transition from reactive maintenance to predictive failure detection, the potential for autonomous load management systems, and the integration of operational data (e.g., duty cycle, load weight, environmental stress) into centralized management platforms. Users are keen to understand if "smart chain blocks" justify the additional investment through demonstrable reductions in downtime and improvements in compliance reporting, confirming that the primary expectation is safety enhancement and operational efficiency through data-driven insights, rather than complete operational replacement.

While the mechanical function of a chain block remains fundamentally simple, AI integration profoundly impacts its operational lifecycle and safety profile. AI algorithms, when coupled with embedded IoT sensors that monitor chain tension, temperature, speed variation, and motor vibration in electric hoists, allow for sophisticated anomaly detection. This transition enables users to move away from scheduled preventative maintenance (which often replaces parts prematurely or too late) to a highly efficient predictive maintenance (PdM) regime. By analyzing patterns in operational data, the AI system can accurately forecast the remaining useful life (RUL) of critical components, such as brake pads or load chains, scheduling necessary interventions precisely when they are needed, thus minimizing unexpected breakdowns and extending equipment lifespan.

Furthermore, AI-driven analytics enhance operational safety by continuously monitoring duty cycle compliance and identifying behaviors that could lead to overloading or improper use. If a hoist is routinely operating near or above its rated capacity—a critical safety violation—the AI system can immediately flag this risk, notify supervisors, and integrate the usage history into safety audits. In advanced automated warehouse and manufacturing settings, AI can optimize the sequencing and path planning of remotely operated electric chain hoists (often utilized on crane systems), minimizing transit time and avoiding collisions, ultimately driving the overall efficiency and safety of material flow. This technological layer transforms the chain block from a mere mechanical tool into a connected asset contributing valuable data to the overall factory ecosystem.

- AI enables predictive maintenance by analyzing sensor data (vibration, temperature, load) to forecast component failure, drastically reducing unscheduled downtime.

- Integration of machine learning models optimizes load balancing and lifting synchronization in multi-hoist applications, enhancing precision and stability.

- AI-powered monitoring systems ensure real-time compliance with mandated duty cycles and prevent unauthorized overloading, improving worker safety profiles.

- Supply chain management benefits from AI forecasting, optimizing inventory levels for critical spare parts (chains, motors, hooks) based on predicted equipment wear.

- Advanced analytics support remote diagnostics and troubleshooting for electric chain blocks, accelerating repair times and reducing reliance on on-site technicians.

- AI assists in training simulators by analyzing optimal lifting practices, translating operational data into actionable feedback for improving operator technique and efficiency.

DRO & Impact Forces Of Chain Block Market

The dynamics of the Chain Block Market are shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively define the impact forces influencing strategic decision-making and market trajectory. The primary drivers stem from relentless global infrastructure development and the mandatory implementation of stringent safety standards. Restraints often center on market competition from low-cost alternatives and the inherent limitations of manual equipment in high-speed, automated production environments. Opportunities are identified in the adoption of smart, connected hoisting solutions, targeting specialized industrial applications that demand high levels of precision, certification, and traceability, creating a segmented growth strategy for premium manufacturers.

The impact forces driving the market expansion include the exponential growth in construction activity across developing regions and the robust demand for efficient handling tools within the established manufacturing and logistics sectors. This consistent demand ensures a stable market foundation. Conversely, the forces restraining growth are predominantly economic; the high initial capital expenditure associated with certified, heavy-duty electric chain hoists, coupled with the prevalent availability of inexpensive, uncertified manual blocks, particularly in informal economies, creates significant price pressure. Furthermore, regulatory forces act as both a driver and a restraint; while mandating high-quality certified equipment (a driver), compliance costs and liability risks can sometimes deter small businesses (a restraint).

Strategic opportunities are amplified by technological forces, specifically the maturation of IoT and sensor technology, allowing chain block manufacturers to move beyond purely mechanical offerings. The integration of data logging, remote monitoring capabilities, and anti-tamper security features offers a compelling value proposition in sectors like aerospace, nuclear, and high-tech manufacturing, where accountability and absolute safety are non-negotiable. The market must strategically navigate the balance between offering cost-effective, durable manual blocks for general utility and developing advanced, data-enabled electric hoists that satisfy the demands of Industry 4.0 environments. Successful players will leverage the opportunity to bundle advanced services (predictive maintenance contracts, calibration services) with their physical products, increasing long-term customer value.

Segmentation Analysis

The Chain Block Market is extensively segmented based on key functional, capacity, and end-user parameters, providing a detailed understanding of demand patterns across diverse industrial applications. Functional segmentation distinguishes between manual (hand-operated) and electric chain blocks, representing a fundamental split in operational requirement—manual blocks dominate in low-duty, remote, or temporary setups due to portability and lack of power requirement, while electric hoists are preferred for continuous, high-speed, and high-capacity lifting operations in established facilities. Understanding this segmentation is crucial for manufacturers in tailoring product specifications, particularly concerning material choice, gearing precision, and safety mechanism robustness.

Capacity segmentation, measured in tons, is arguably the most critical dimension, dictating the volume and type of application. The market generally segregates into light-duty (below 1 ton), medium-duty (1 to 5 tons), and heavy-duty (above 5 tons) categories. The medium-duty range historically accounts for the largest revenue share, being the most flexible for general fabrication, construction site logistics, and standard warehouse operations. The heavy-duty segment, though smaller in volume, commands high per-unit revenue and serves specialized sectors such as shipbuilding, heavy machinery assembly, and mining, demanding highly durable, custom-engineered hoisting solutions that meet specific environmental and load requirements.

The end-user application segmentation reveals the dominant consumers, with the manufacturing and construction sectors holding significant sway. The manufacturing segment requires precise, repetitive lifting for assembly lines and machine maintenance, driving demand for electric and sometimes automated hoists. The construction sector, conversely, often relies on the rugged, portable nature of manual hoists for on-site, intermittent lifts, though large-scale infrastructure projects are increasingly adopting heavy-duty electric models. Specialized end-users, including marine, oil and gas, and aerospace, emphasize highly certified, explosion-proof, or corrosion-resistant models, creating lucrative, albeit niche, market opportunities defined by stringent material and operational specifications.

- Type:

- Manual Chain Block (Hand Chain Hoist)

- Electric Chain Block (Powered Hoist)

- Capacity (Tons):

- Less than 1 Ton

- 1 Ton to 5 Tons

- 5 Tons to 10 Tons

- Above 10 Tons

- End-User Industry:

- Construction

- Manufacturing (Automotive, Metal Fabrication, Heavy Machinery)

- Oil & Gas and Energy

- Marine and Shipbuilding

- Mining and Material Processing

- Logistics and Warehousing

- Lifting Height:

- Standard (Up to 10 meters)

- High Lift (Above 10 meters)

Value Chain Analysis For Chain Block Market

The value chain for the Chain Block Market begins with the upstream activities of raw material procurement, dominated by high-grade steel and specialized alloys necessary for manufacturing load chains, hooks, gear systems, and housing components. Quality control at this stage is paramount, as the integrity of the steel directly affects the load capacity and safety rating of the final product. Key upstream suppliers include steel mills and specialized forging companies. Manufacturers focus on precision machining, heat treatment, and assembly, requiring significant investment in automated production lines to meet high tolerance standards, particularly for electric hoists where motor integration and sophisticated braking systems are essential components demanding rigorous testing.

The midstream stage involves the core manufacturing process, followed by quality assurance and certification. Because chain blocks are safety-critical equipment, adherence to international standards (like ASME, DIN, and relevant ISO certifications) is a non-negotiable factor that adds significant value and complexity. Effective distribution constitutes the downstream segment, utilizing both direct and indirect channels. Direct sales are often employed for large industrial clients, government contracts, and complex custom-engineered hoisting systems, allowing manufacturers to offer tailored support and maintenance contracts directly. This channel fosters stronger relationships and ensures precise compliance with specific operational requirements, particularly in highly regulated sectors.

Indirect distribution relies heavily on a robust network of industrial distributors, specialized material handling equipment dealers, and online platforms. These intermediaries play a crucial role in market penetration, especially reaching smaller construction firms, repair workshops, and general MRO markets. Distributors often provide local inventory, technical advice, and immediate service support, enhancing accessibility. The choice between direct and indirect channels is often dictated by the product type and regional maturity; high-volume, standard manual blocks frequently move through indirect channels, while premium, integrated electric hoists with service contracts often favor a direct or highly controlled distribution network to ensure service quality and installation expertise are maintained throughout the product lifecycle.

Chain Block Market Potential Customers

The potential customer base for the Chain Block Market is diverse yet concentrated within heavy industrial and infrastructural domains that necessitate the regular manipulation of heavy loads. The primary end-users are characterized by operational environments demanding reliability, safety certification, and often portability in material handling. Key segments include general contractors involved in commercial and residential construction, who rely on manual and light-duty electric blocks for structural steel erection, material positioning, and equipment setup on site, prioritizing durability and ease of transport. Manufacturing facilities, particularly those in the automotive, aerospace, and heavy machinery sectors, represent high-value customers needing repetitive, high-precision lifts for assembly lines and routine machine maintenance.

Beyond traditional industrial sectors, specialized applications represent a growing segment of high-potential customers. These include the global maritime industry (shipbuilding, cargo handling, and port operations) which demands specialized marine-grade, corrosion-resistant chain blocks designed to withstand harsh saline environments. Similarly, the Oil & Gas sector, encompassing upstream drilling, midstream pipelines, and downstream refining, requires certified, often explosion-proof (EX-rated) chain blocks for equipment installation and crucial maintenance in hazardous areas where sparks must be avoided. These specialized sectors often exhibit low price sensitivity but high demand for premium quality, thorough documentation, and compliance with specific regional safety mandates (e.g., ATEX directives in Europe).

Furthermore, maintenance, Repair, and Overhaul (MRO) service providers and rental equipment companies constitute a perpetual customer base. MRO services require a constant supply of reliable chain blocks for periodic plant maintenance shutdowns, while rental firms stock a wide range of capacities to meet the temporary needs of various construction and industrial projects. Emerging market segments also include large-scale warehousing and logistics operations, where electric chain blocks integrated with overhead crane systems are used for the precise placement of extremely heavy pallets or machinery, highlighting the shift towards automated, yet robust, lifting solutions as operational scale increases globally.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 2.22 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Columbus McKinnon Corporation, KITO Corporation, Konecranes, Liftket International GmbH, ABUS Kransysteme GmbH, Street Crane Company Ltd., Harrington Hoists Inc., SWF Krantechnik GmbH, JD Neuhaus GmbH & Co. KG, Zhejiang Wuyi Machinery Co., Ltd., William Hackett Lifting Products Ltd., Elephant Lifting Products, VERLINDE S.A., TBM Hoist & Crane, Gorbel Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Chain Block Market Key Technology Landscape

The technological landscape of the Chain Block Market is undergoing a transformation, particularly within the electric hoist segment, driven by the demands of Industry 4.0 for connectivity, automation, and enhanced safety monitoring. While manual chain blocks remain fundamentally mechanical, relying on optimized gear ratios and advanced material science (e.g., high-tensile alloy steel chains and precision-machined load wheels) for efficiency and durability, the electric sector is rapidly adopting sophisticated electronic controls. Variable Frequency Drives (VFDs) are a critical technology, enabling smooth acceleration and deceleration of the lift, which minimizes load sway, reduces mechanical wear, and allows for highly precise load placement, a necessity in delicate assembly processes like aerospace manufacturing. VFDs also offer energy efficiency benefits by optimizing motor speed based on the load weight and required speed.

Furthermore, safety technology integration is accelerating through the adoption of advanced load monitoring sensors and electronic limit switches. Digital load cells embedded within the hoists provide real-time data on the lifted weight, actively preventing overloading which is a primary cause of industrial accidents and equipment failure. This data is often logged internally and can be transmitted wirelessly using IoT protocols (like Wi-Fi or Bluetooth Low Energy) to centralized fleet management software, enabling supervisors to monitor compliance and duty cycle usage remotely. Modern electric chain blocks also frequently incorporate advanced braking systems beyond the standard mechanical brake, such as regenerative braking or electromagnetic disc brakes, offering enhanced redundancy and improved control, especially for heavy loads operating at height.

The emergence of "Smart Hoists" integrates these electronic advancements with connectivity features. These hoists feature embedded microprocessors and IoT gateways that facilitate predictive maintenance capabilities, as discussed previously, by transmitting operational telemetry. This connectivity also supports remote configuration, diagnostics, and firmware updates, significantly simplifying fleet management for large industrial users. Material innovation continues to be a key area, with manufacturers utilizing lighter, stronger composite materials for hoist housing and specialized coatings (e.g., galvanized or ceramic coatings) to improve corrosion resistance for deployment in demanding environments such as offshore platforms, wastewater treatment plants, and acidic chemical processing facilities, ensuring the long-term integrity and reliability of the lifting apparatus.

Regional Highlights

The global distribution and growth profile of the Chain Block Market is highly segmented geographically, reflecting regional differences in industrial maturity, infrastructure investment levels, and safety enforcement regimes. Asia Pacific (APAC) currently dominates the market volume and is the fastest-growing region, driven by rapid industrialization, extensive urbanization, and government-led initiatives supporting massive construction and manufacturing expansion in economies like China, India, and Southeast Asian nations. The demand in APAC is particularly strong for both reliable, cost-effective manual chain blocks for small to medium-sized enterprises (SMEs) and heavy-duty electric hoists for newly built automotive and electronics manufacturing hubs. This region’s high growth potential is underpinned by its growing manufacturing output and the necessity to continuously upgrade material handling capabilities.

North America and Europe represent mature markets characterized by stringent safety regulations and a strong preference for high-quality, certified, and technologically advanced products. While growth rates are more moderate compared to APAC, these regions exhibit higher per-unit revenue due to the dominance of electric chain hoists equipped with IoT connectivity, VFDs, and advanced safety features, catering to high-automation environments. The market in these regions is largely driven by replacement cycles, modernization of existing infrastructure, and the continuous push towards workplace automation to counter high labor costs. Furthermore, the specialized industries, such as aerospace in North America and advanced manufacturing in Germany, drive demand for precision-engineered, custom-lifting solutions with full traceability and documentation.

Latin America and the Middle East & Africa (MEA) offer substantial long-term potential, primarily linked to resource extraction (mining, oil, and gas) and developing infrastructure projects. The MEA region, particularly the Gulf Cooperation Council (GCC) countries, shows strong demand fueled by large-scale construction projects, port expansions, and investments in downstream petrochemical facilities, requiring robust, often explosion-proof, lifting equipment. These regions often rely on imported, certified equipment from major global manufacturers, leading to complex supply chain logistics and varying levels of regulatory enforcement. The key market factor here is often the lifecycle cost and operational durability in demanding, often high-temperature, environments, presenting significant opportunities for durable, heavy-duty product lines.

- North America: Focus on automation, high safety standards, and adoption of smart electric hoists in automotive and general manufacturing; mature replacement market.

- Europe: Driven by stringent CE mark compliance, high demand for ergonomic design, and specialized hoists for nuclear and regulated industries; strong presence of premium German manufacturers.

- Asia Pacific (APAC): Leading global growth due to massive construction and manufacturing capacity additions (China, India); high volume demand for both manual and electric blocks.

- Latin America: Demand linked primarily to mining, infrastructure, and oil exploration; market sensitivity to commodity price fluctuations affecting capital expenditure.

- Middle East and Africa (MEA): Strong demand from oil & gas, petrochemicals, and mega-infrastructure projects; high requirement for robust, certified, and sometimes explosion-proof equipment.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Chain Block Market.- Columbus McKinnon Corporation

- KITO Corporation

- Konecranes

- Liftket International GmbH

- ABUS Kransysteme GmbH

- Street Crane Company Ltd.

- Harrington Hoists Inc.

- SWF Krantechnik GmbH

- JD Neuhaus GmbH & Co. KG

- Zhejiang Wuyi Machinery Co., Ltd.

- William Hackett Lifting Products Ltd.

- Elephant Lifting Products

- VERLINDE S.A.

- TBM Hoist & Crane

- Gorbel Inc.

- Hitachi Industrial Equipment Systems Co., Ltd.

- TIGER Lifting

- Pewag Group

- The Crosby Group

- DEMAG Cranes & Components GmbH

Frequently Asked Questions

Analyze common user questions about the Chain Block market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Chain Block Market?

The Chain Block Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033, driven by global industrialization and infrastructure development projects.

Which region dominates the current demand for Chain Blocks?

The Asia Pacific (APAC) region currently dominates the market volume and is expected to be the fastest-growing market segment due to extensive manufacturing expansion and large-scale government infrastructure investments in countries like China and India.

What are the key differences between Manual and Electric Chain Blocks?

Manual chain blocks are portable, cost-effective, and require no power, ideal for intermittent, light-duty, or remote operations. Electric chain blocks offer higher speed, capacity, and continuous operation, typically utilized in high-volume assembly lines and heavy industrial settings, often incorporating smart technology.

How is AI impacting the safety and maintenance of Chain Blocks?

AI, leveraging IoT sensors, is primarily enabling predictive maintenance (PdM) by analyzing usage data to forecast component wear, reducing unexpected breakdowns. AI also enhances safety by monitoring for compliance with load limits and duty cycles in real time.

Which end-user industries represent the highest growth potential?

While construction and general manufacturing remain the largest segments, specialized industries such as Oil & Gas, Marine/Shipbuilding, and high-precision Aerospace manufacturing offer the highest growth potential for premium, customized, and certified heavy-duty chain blocks.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Chain Block Market Size Report By Type (Manual Chain Blocks, Electric Chain Blocks, Others), By Application (Factories and warehouse, Construction Sites, Marine & Ports, Mining & Excavating Operation, Energy, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Chain Block Market Statistics 2025 Analysis By Application (Factories and warehouse, Construction Sites, Marine & Ports, Mining & Excavating Operation, Energy), By Type (Manual Chain Blocks, Electric Chain Blocks), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager