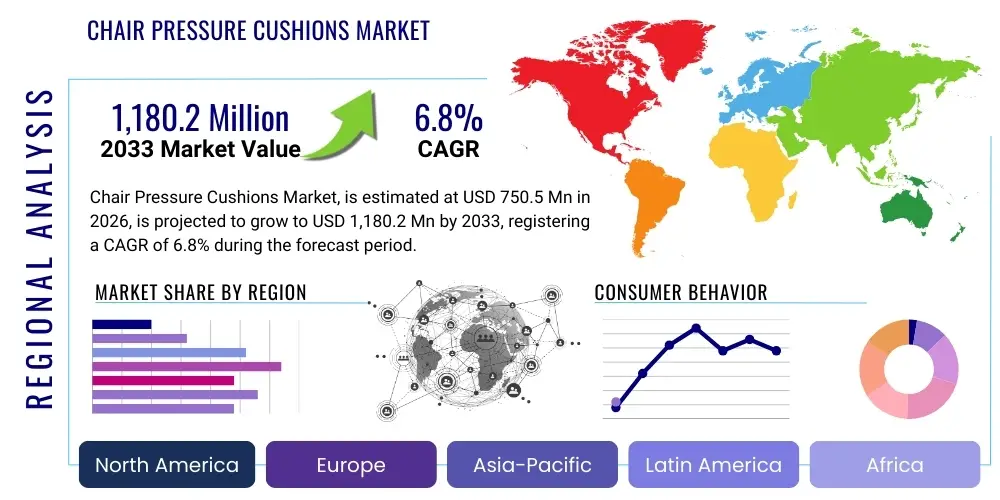

Chair Pressure Cushions Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438250 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Chair Pressure Cushions Market Size

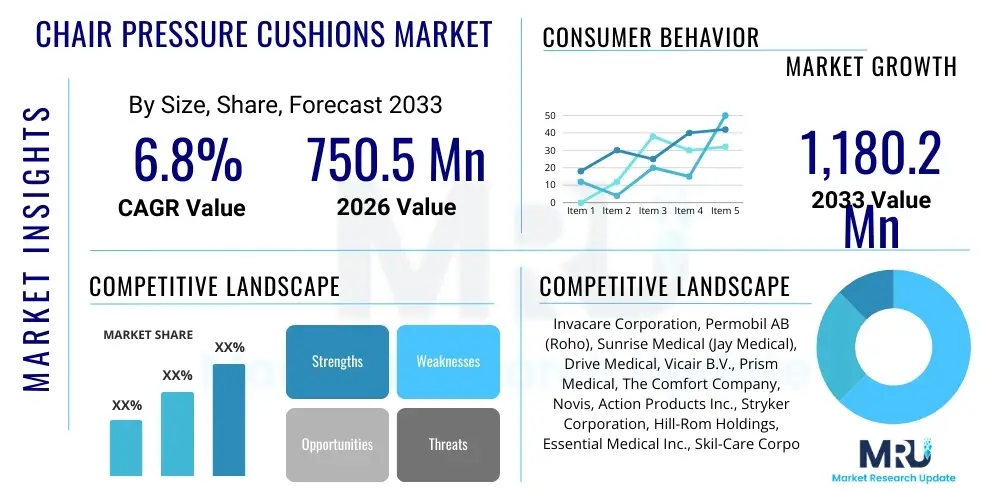

The Chair Pressure Cushions Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $750.5 Million in 2026 and is projected to reach $1,180.2 Million by the end of the forecast period in 2033.

Chair Pressure Cushions Market introduction

The Chair Pressure Cushions Market encompasses specialized seating devices designed primarily for the prevention and treatment of pressure injuries, commonly known as bedsores or pressure ulcers. These medical devices are engineered using advanced materials and complex structural designs, including air cells, viscoelastic foam, gel, and hybrid combinations, to redistribute pressure evenly across the weight-bearing areas of the body, particularly the ischial tuberosities and sacrum. The core objective is to reduce localized pressure intensity below the capillary closing pressure, ensuring adequate blood flow to tissues in individuals who are wheelchair-dependent, confined to sitting for extended durations, or possess limited mobility. The market’s growth trajectory is inextricably linked to global demographic shifts, specifically the rapidly expanding geriatric population and the increasing prevalence of chronic conditions such as spinal cord injuries, multiple sclerosis, and diabetes, which necessitate long-term seating support and pressure management solutions. Furthermore, heightened clinical awareness regarding the economic burden and negative patient outcomes associated with pressure ulcers acts as a pivotal driver for the adoption of sophisticated cushioning systems across various healthcare settings.

Product descriptions within this domain range from static cushions, which rely on material properties like high-density foam or non-moving gel to provide constant support, to sophisticated dynamic systems that utilize alternating air pressure or automated adjustments based on patient movement or weight distribution. Major applications span across clinical environments, including acute care hospitals, long-term care facilities, and rehabilitation centers, as well as extensive use in homecare settings where patient comfort and independence are paramount. The inherent benefits of these products extend beyond mere pressure relief; they significantly improve the quality of life for users by enhancing stability, promoting posture alignment, reducing pain, and critically, mitigating the substantial risk of infection and complications arising from ulcer formation. Innovations are consistently introduced to the market, focusing on optimizing heat and moisture dissipation, which are secondary yet critical factors in maintaining skin integrity, further cementing the importance of these devices in comprehensive patient care protocols.

Driving factors for sustained market expansion include rigorous regulatory frameworks emphasizing proactive patient safety and mandates for pressure ulcer prevention protocols in institutional settings. Moreover, technological advancements, such as the incorporation of smart monitoring systems and IoT capabilities into cushions, are transforming the industry from passive support mechanisms to active, preventative health tools. The market is also seeing increased penetration in non-traditional healthcare environments, such as specialized ergonomic seating for professional environments, although the primary growth remains rooted in medical and geriatric care. This complex interplay of clinical necessity, technological innovation, and favorable demographic trends establishes the Chair Pressure Cushions Market as a vital and evolving segment within the broader medical device and durable medical equipment (DME) sector.

Chair Pressure Cushions Market Executive Summary

The Chair Pressure Cushions Market is characterized by robust growth driven fundamentally by the escalating worldwide burden of immobility-related chronic diseases and the rapid aging of global populations, particularly in developed economies. Business trends indicate a marked shift towards integration and digitization, with leading manufacturers heavily investing in research and development to commercialize smart cushions equipped with pressure mapping sensors and connectivity features, allowing for real-time monitoring and personalized adjustments via mobile applications or institutional monitoring systems. This integration of health technology represents a critical paradigm shift from reactive treatment to proactive, preventative care, fundamentally influencing procurement decisions in major healthcare systems. Consolidation within the market remains a key dynamic, with larger medical device corporations acquiring specialized cushion manufacturers to integrate a complete line of wound care and mobility solutions, thereby streamlining distribution and maximizing market reach across different healthcare verticals. Furthermore, sustainability and material innovation are emerging business focuses, addressing both environmental concerns and the need for lighter, more durable, and more breathable cushioning materials that enhance user compliance and comfort.

Regionally, North America and Europe maintain dominance, primarily due to well-established reimbursement systems, high per capita healthcare spending, and strict regulatory adherence to pressure ulcer prevention protocols, particularly in long-term care settings. However, the Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR) over the forecast period. This accelerated growth in APAC is attributable to expanding healthcare infrastructure, increasing health insurance penetration, and a growing middle class that demands sophisticated home care solutions. Countries like China, India, and Japan, with their vast and rapidly aging populations, present substantial untapped opportunities, even though affordability and lack of standardized clinical guidelines sometimes present temporary restraints. Market participants are increasingly customizing product offerings, particularly in emerging markets, to balance high efficacy with cost-effectiveness, recognizing the diverse socioeconomic landscape.

Segment trends demonstrate strong traction in the hybrid cushion category, which combines the stability of foam bases with the dynamic properties of air or gel inserts, offering a balance of performance and maintenance ease preferred by both clinicians and home users. The end-user segment is experiencing a significant pivot towards homecare settings, catalyzed by global trends favoring early hospital discharge and patient preference for receiving care in comfortable, familiar environments, supported by advancements in telehealth services. From a material perspective, advancements in closed-cell foams and specialized silicone gels that offer superior shear reduction and thermal regulation capabilities are gaining traction, challenging traditional open-cell foam and simple air-only designs. This stratification across segments emphasizes the market’s responsiveness to clinical feedback, aiming to address the nuanced biomechanical needs of diverse patient populations, ranging from pediatric users to complex bariatric cases.

AI Impact Analysis on Chair Pressure Cushions Market

Analysis of common user questions regarding the impact of Artificial Intelligence (AI) on the Chair Pressure Cushions market reveals a consensus centered on four primary themes: predictive ulcer risk, personalized intervention, operational efficiency in manufacturing, and improved clinical decision support. Users frequently inquire, "Can AI predict exactly when a patient is at risk of developing a pressure ulcer?" and "How will AI systems automate cushion adjustments to prevent injury?" This indicates a high expectation for AI to transform static products into sophisticated, predictive therapeutic tools. The key concern revolves around data privacy, the cost of integrated technologies, and the reliability of AI algorithms in interpreting complex physiological data, particularly concerning moisture levels, localized temperature spikes, and sub-dermal tissue stress detected by integrated sensors. Users anticipate that AI integration will lead to highly customized seating profiles that dynamically change based on continuous patient monitoring, minimizing the need for constant manual repositioning by caregivers and improving efficacy beyond current passive support standards. The integration is seen as critical for enhancing the evidence base of pressure injury prevention.

- AI enables real-time data interpretation from embedded pressure mapping sensors, identifying minute changes in tissue loading patterns indicative of high ulcer risk.

- Machine Learning (ML) algorithms facilitate personalized cushion adjustment protocols, optimizing air cell inflation/deflation cycles or fluid displacement based on individual patient biomechanics and activity history.

- Predictive maintenance analytics, powered by AI, reduce equipment downtime by forecasting potential mechanical failures in dynamic air pump systems before they occur, improving reliability in institutional settings.

- AI supports clinical decision-making by correlating patient vitals, movement data, and cushion performance metrics to generate objective, quantifiable risk scores for caregivers.

- Generative design and optimization tools leverage AI to simulate material response under varying loads, accelerating the development of novel cushioning materials with superior shear reduction capabilities.

- Automated quality control systems using computer vision ensure the integrity and consistency of foam density and gel distribution during the high-volume manufacturing process.

- Telehealth platforms utilize AI to aggregate long-term patient usage data, allowing clinicians to remotely assess the effectiveness of the cushion and recommend timely interventions without in-person visits.

DRO & Impact Forces Of Chair Pressure Cushions Market

The Chair Pressure Cushions Market dynamics are shaped by a powerful confluence of demographic drivers, significant economic restraints, promising technological opportunities, and complex external impact forces. The primary drivers revolve around the global surge in the elderly population (aged 65 and above), which correlates directly with an increased incidence of mobility impairments and chronic conditions requiring long-term seating solutions for pressure ulcer prophylaxis. Coupled with this is the rising global prevalence of conditions such as spinal cord injuries, cerebral palsy, and neuromuscular disorders, which mandate specialized pressure relief interfaces. The demand is further amplified by growing awareness among healthcare providers and caregivers regarding best practices in wound care management, shifting the focus from treating ulcers to actively preventing them, thereby creating consistent demand for advanced cushion technologies. This emphasis on prevention is financially motivated, given the extremely high costs associated with treating established pressure injuries in hospital settings, making proactive cushion investment a financially prudent decision for institutions.

However, market expansion faces notable restraints, chiefly the substantial initial investment cost associated with high-quality, dynamic, or smart pressure cushions, particularly in comparison to basic foam pads. This cost barrier often impedes rapid adoption in low- and middle-income regions, and sometimes limits availability in homecare settings where reimbursement coverage may be inadequate. Furthermore, a general lack of standardized education and training regarding appropriate cushion selection and usage poses a significant restraint; improper cushion specification or incorrect setup can negate the therapeutic benefits, leading to user dissatisfaction and decreased clinical outcomes. Regulatory complexities and the protracted timelines required for obtaining medical device approvals across various international jurisdictions also act as market frictions, particularly impacting smaller innovators attempting to introduce highly specialized, new material-based products.

Opportunities for growth are concentrated in the rapid development and commercialization of next-generation hybrid materials that offer superior pressure distribution combined with temperature and moisture control features, addressing the multifaceted nature of skin integrity challenges. The expansion of remote patient monitoring capabilities, leveraging IoT and wearable technology, offers manufacturers a chance to integrate cushions into broader digital health ecosystems, providing actionable data to clinicians. External impact forces primarily include stringent governmental regulations, such as those imposed by the FDA in the US and the MDR in Europe, demanding robust clinical evidence and post-market surveillance for medical devices. Economic impact forces include fluctuating raw material costs (polymers, silicone) and the ever-present pressure from payers (insurance companies and governmental agencies) to demonstrate clear cost-effectiveness and improved patient outcomes before authorizing widespread reimbursement for high-end seating systems. Geopolitical instability can also influence global supply chains, affecting the availability and pricing of specialized components, underscoring the necessity for resilient manufacturing strategies.

Segmentation Analysis

The Chair Pressure Cushions Market is meticulously segmented based on product type, material composition, application, and end-user environment, reflecting the high degree of specialization required to address diverse clinical needs and anatomical variances among users. The fundamental segmentation provides a structured view of the market, differentiating between simple, static support mechanisms and complex, technologically enhanced dynamic systems. Product types are segmented by the mechanism of action, predominantly Static (Foam, Gel, Viscoelastic) and Dynamic (Alternating Air Systems), with hybrids offering a bridge between the two, typically preferred for maximizing pressure equalization while maintaining postural stability. Material science remains a core differentiator, defining cost structures, durability, and key performance indicators such as immersion depth and envelopment capabilities. The analysis of these segments is crucial for stakeholders to understand where innovation is most concentrated and where procurement budgets are allocated, helping to tailor marketing and product development efforts towards the most lucrative and rapidly evolving areas of patient care.

Application-based segmentation generally categorizes usage by the context of seating, primarily focusing on long-term Wheelchair use—the most dominant segment—but also including specialized applications for standard office chairs, industrial seating, or use within transport vehicles for patients requiring continuous pressure management during travel. This allows manufacturers to target specific design requirements, such as portability or institutional durability, depending on the anticipated environment. The end-user analysis further refines this view by distinguishing between high-volume institutional purchasers, such as Hospitals and Long-Term Care Facilities, and the burgeoning Homecare Settings segment. The Homecare segment is witnessing the fastest growth due to patient preference and technological support, demanding cushions that are intuitive, easy to clean, and less reliant on professional maintenance. Understanding the differences in purchasing power, regulatory requirements, and patient profiles across these various end-user categories is essential for developing effective market penetration strategies globally.

- By Type:

- Static Cushions (Foam, Gel, Viscoelastic)

- Dynamic Cushions (Alternating Air Systems, Low Air Loss)

- Hybrid Cushions (Foam Base with Air/Gel Inserts)

- By Material:

- Foam (Polyurethane, High-Density, Contoured)

- Gel (Silicone, Fluid-Filled Bladders)

- Air-Filled (Single Valve, Multi-cell Systems)

- Honeycomb/Elastomeric Polymers

- By Application:

- Standard Wheelchairs

- Specialized Seating (Pediatric, Bariatric)

- Institutional Chairs (Geriatric Recliners, Day Chairs)

- Home and Office Use

- By End-User:

- Hospitals and Acute Care Centers

- Long-Term Care Facilities (Nursing Homes)

- Rehabilitation Centers

- Homecare Settings

Value Chain Analysis For Chair Pressure Cushions Market

The value chain for the Chair Pressure Cushions Market begins with intensive upstream activities focused on the procurement of specialized raw materials, which are critical determinants of the cushion's performance characteristics, including its shear reduction capability, durability, and pressure equalization effectiveness. Key raw materials include high-grade viscoelastic foams, complex polymer compounds for gel matrices, durable rubber and specialized plastics for air cell construction, and advanced sensor technology for smart cushions. Manufacturers must maintain robust relationships with specialized chemical and polymer suppliers, often requiring highly customized formulations to meet stringent medical device standards (biocompatibility, flammability). The upstream process is characterized by high R&D intensity, as innovations in material science directly translate to competitive advantage, particularly in developing lightweight, breathable, and highly effective materials that minimize heat buildup and moisture retention, key factors in preventing skin breakdown.

The core manufacturing and processing stage involves complex fabrication techniques, especially for dynamic and hybrid cushions. This stage includes precision molding for contoured foam products, ultrasonic welding for air cell bladders, and meticulous assembly for pump and sensor integration. Quality control is paramount, as defects can compromise patient safety and clinical efficacy. Downstream activities are dominated by specialized distribution channels essential for reaching the targeted medical and homecare end-users. Direct distribution channels are often employed when dealing with large institutional buyers, such as national hospital systems or government procurement agencies, allowing for bulk orders, customized clinical support, and direct training for institutional staff. These direct channels benefit from established sales forces specializing in complex medical equipment and long-term contracts based on negotiated pricing and service level agreements (SLAs).

Indirect distribution channels rely heavily on Durable Medical Equipment (DME) providers, specialized medical supply retailers, and national pharmacy chains, particularly for reaching the rapidly expanding homecare segment. DME providers play a crucial role as they often handle assessment, delivery, setup, and maintenance services, which are critical for the patient’s successful adoption of the product. The value chain is heavily influenced by third-party payers (insurance companies and government programs) whose reimbursement policies dictate patient access and market volume, effectively making them powerful gatekeepers in the downstream flow. Effective distribution strategies must therefore encompass rigorous clinical documentation to satisfy reimbursement requirements and partnerships with established DME networks capable of navigating the fragmented homecare supply logistics. The final stage involves post-sales support and feedback loops, crucial for continuous product improvement, clinical evidence generation, and maintenance of high customer satisfaction in this medically sensitive sector.

Chair Pressure Cushions Market Potential Customers

The primary consumers, or end-users, of chair pressure cushions are diverse populations suffering from chronic mobility limitations or conditions that necessitate long periods of seated immobility, thereby placing them at high risk of pressure ulcer development. The most significant customer base resides within the institutional medical sector, particularly Rehabilitation Centers, which manage patients with acute spinal cord injuries, severe traumatic brain injuries, or post-stroke paralysis—groups requiring immediate and long-term specialized seating solutions to initiate mobility training while ensuring skin integrity. Hospitals, specifically acute care and intensive care units, are crucial early adopters, utilizing cushions for patients who are temporarily immobilized or experiencing significant orthopedic trauma, often favoring high-end dynamic systems that can manage rapidly changing physiological conditions. The procurement decision in these settings is typically centralized, driven by clinical efficacy data, ease of cleaning and infection control features, and favorable contracts secured through Group Purchasing Organizations (GPOs).

Another major demographic segment comprises the elderly population residing in Long-Term Care Facilities (Nursing Homes). As residents in these facilities often have multiple comorbidities, cognitive impairments, and progressive mobility decline, preventative pressure care is a daily necessity. Purchasing decisions in long-term care are highly sensitive to budget constraints but are increasingly influenced by regulatory penalties associated with pressure ulcer incidence, compelling facilities to invest in demonstrably effective cushions to maintain high quality-of-care ratings. Additionally, the Homecare Setting segment represents a rapidly expanding customer group. These buyers are typically individuals or their caregivers who purchase cushions through DMEs, often utilizing insurance or government programs like Medicare/Medicaid. This customer base values comfort, ease of use, portability, and minimal maintenance, driving demand for technologically simple yet clinically effective static or hybrid cushions suitable for prolonged, unsupervised daily use.

Beyond the core medical and geriatric populations, there are highly specialized niche customer groups. Bariatric patients, due to the unique challenges of weight distribution and higher pressure loads, require specialized, heavy-duty cushions that often incorporate highly contoured or low-profile designs to ensure stability and maximum surface area immersion. Pediatric patients with chronic conditions such as cerebral palsy or spina bifida represent another critical segment, demanding custom-molded seating systems that adapt to growth and postural changes while providing meticulous pressure management. Finally, the broader segment of individuals requiring ergonomic seating due to professional risks or pre-existing conditions (e.g., severe chronic back pain) also contributes to market demand, typically seeking highly supportive, high-performance foam or air/foam hybrid cushions. The key differentiator for manufacturers successfully penetrating these diverse segments lies in providing customized clinical assessment tools and comprehensive educational support for prescribers across various professional settings.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $750.5 Million |

| Market Forecast in 2033 | $1,180.2 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Invacare Corporation, Permobil AB (Roho), Sunrise Medical (Jay Medical), Drive Medical, Vicair B.V., Prism Medical, The Comfort Company, Novis, Action Products Inc., Stryker Corporation, Hill-Rom Holdings, Essential Medical Inc., Skil-Care Corporation, Supracor, Synergy Seating Systems, Ottobock, Karma Healthcare, Netti Seating. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Chair Pressure Cushions Market Key Technology Landscape

The technological landscape of the Chair Pressure Cushions Market is rapidly evolving, moving beyond passive material science into active, interconnected digital health solutions. A crucial trend is the integration of advanced pressure mapping systems directly into the cushion interface. These systems utilize high-resolution arrays of capacitive or resistive sensors capable of measuring precise pressure distribution points in real-time. This diagnostic data is invaluable for clinicians to correctly prescribe and adjust seating systems, ensuring optimal load redistribution and identifying "hot spots" before tissue damage occurs. Furthermore, these sensor networks form the basis of "Smart Cushions," which are emerging as a disruptive force. These cushions typically incorporate low-power wireless communication (Bluetooth Low Energy or Wi-Fi) to transmit data to external monitoring devices or cloud platforms, allowing continuous tracking of sitting posture, duration, and potentially patient compliance, which is transforming the capability for remote patient management in homecare settings.

Material innovation remains foundational, focusing on developing foams and gels with enhanced viscoelastic properties and thermal regulation capabilities. Viscoelastic (memory) foam formulations are continuously being optimized to provide deeper immersion and better envelopment, reducing peak pressure points without sacrificing stability. A major technical challenge is managing heat and moisture—two critical precursors to skin breakdown. Manufacturers are responding by engineering breathable, open-cell foam structures and incorporating cooling gel layers or specialized moisture-wicking fabric covers. Additionally, the dynamic cushion segment relies on sophisticated microprocessor-controlled air pump systems. These systems employ proprietary algorithms to intelligently inflate and deflate multiple air cells in sequence, mimicking the body’s natural movement and providing cyclical pressure relief, which is often customized based on the patient's weight and clinical risk profile. These pneumatic technologies require miniaturization, energy efficiency, and silent operation to ensure user comfort and compliance, especially in nocturnal or home environments.

The integration of the Internet of Things (IoT) and artificial intelligence (AI) represents the frontier of technological development in this market. IoT enables seamless data flow between the cushion and clinical monitoring systems, supporting robust telehealth models. AI algorithms are being developed to analyze the vast streams of sensor data to predict pressure ulcer risk based on historical trends, patient movement patterns, and environmental factors. Furthermore, advanced manufacturing techniques, such as 3D printing, are starting to be explored for creating truly custom-fit cushions that conform exactly to an individual's unique anatomy, addressing limitations inherent in mass-produced, standardized contour designs. These additive manufacturing processes allow for precise control over material density and internal structure, potentially leading to cushions that offer optimized support geometry previously unattainable. This comprehensive technological ecosystem elevates the cushion from a simple assistive device to an integral component of a preventative, personalized healthcare strategy.

Regional Highlights

-

North America: Market Leader Due to Established Healthcare Infrastructure and High Reimbursement

North America, spearheaded by the United States and Canada, currently holds the largest share of the Chair Pressure Cushions Market. This dominance is attributed primarily to highly mature healthcare systems, significant healthcare expenditure per capita, and robust, albeit complex, reimbursement mechanisms provided by government programs (Medicare, Medicaid) and private insurance payers. The US market is highly demanding in terms of clinical evidence; manufacturers must provide extensive data demonstrating the efficacy and cost-effectiveness of their products to secure favorable coverage decisions. Furthermore, the region has a high concentration of market leaders and innovators who drive the development and rapid adoption of high-end technologies, such as smart cushions and personalized seating systems. The focus here is heavily skewed towards premium products, recognizing that the cost of preventing a pressure ulcer far outweighs the device cost.

Regulatory adherence is extremely strict, demanding rigorous FDA approval processes, which ensures a high standard of product safety and quality but also slows the entry of new market participants. The significant prevalence of obesity and spinal cord injuries also contributes to a substantial patient pool requiring specialized bariatric and complex rehabilitation seating solutions. Growth within North America is steady, fueled by the push for improved patient outcomes in long-term care facilities and the increasing trend toward home-based skilled nursing care, requiring DMEs to stock a wide array of pressure relief options. Competition is intense, focusing heavily on brand reputation, clinical support services, and strategic partnerships with rehabilitation specialists and GPOs.

-

Europe: Focus on Regulatory Harmonization and Geriatric Care Standards

The European market for chair pressure cushions is characterized by fragmentation across national healthcare systems but unified by the implementation of the Medical Device Regulation (MDR), which has raised the bar for clinical data requirements and post-market surveillance. Western European countries, particularly Germany, the UK, and France, represent significant mature markets driven by substantial geriatric populations and well-established institutional care models. Procurement decisions are often centralized or highly influenced by national health technology assessments (HTA), which prioritize value-based purchasing—cushions must demonstrate long-term clinical benefit and economic justification.

The focus in Europe is particularly strong on integrating cushions into comprehensive mobility and seating assessments, often utilizing advanced pressure mapping technologies as standard protocol in rehabilitation settings. Scandinavia, known for its high-quality public healthcare and focus on home independence, shows a high adoption rate of intuitive, low-maintenance cushions suitable for elderly living alone. Eastern Europe presents an emerging market opportunity, though growth is often hampered by lower healthcare spending and less sophisticated reimbursement structures. Overall, the European trajectory is marked by a steady increase in demand, driven by aging demographics and institutional policies focused on maximizing patient dignity and reducing preventable complications.

-

Asia Pacific (APAC): Highest Growth Potential Driven by Expanding Infrastructure and Population

The Asia Pacific region is forecast to exhibit the highest CAGR during the projected period, fundamentally driven by two macro factors: the sheer scale of the aging population in countries like Japan, China, and South Korea, and the rapid modernization and expansion of healthcare infrastructure across the region. Japan is a major consumer of advanced pressure care devices due to its highly aged society and sophisticated technology adoption. However, the most significant volumetric growth is expected from emerging economies like China and India.

In countries where government healthcare expenditure is rising and private insurance penetration is increasing, the demand for quality medical devices is soaring. Challenges in the APAC market include varying regulatory standards across countries, price sensitivity, and the need for localized clinical training. Manufacturers often enter this market through strategic partnerships or localized manufacturing to reduce costs. The shift from traditional care models to specialized institutional and home care services is directly boosting the demand for both cost-effective foam/gel cushions and advanced hybrid systems, positioning APAC as the critical engine for future global market expansion.

-

Latin America (LATAM) and Middle East & Africa (MEA): Emerging Markets with Pockets of High Demand

LATAM and MEA currently hold smaller market shares but offer focused growth opportunities. In LATAM, countries like Brazil and Mexico are witnessing increased investment in private healthcare and rehabilitation services, driving demand, especially for standardized, durable cushion types. Economic volatility and currency fluctuations, however, often restrain large-scale capital investments in advanced equipment. The MEA region shows strong demand originating from affluent Gulf Cooperation Council (GCC) countries, where high healthcare spending supports the import and adoption of premium European and North American cushion systems in newly built, state-of-the-art hospitals. Elsewhere in Africa, the market remains nascent, focused primarily on essential pressure relief solutions provided through NGOs or localized public health initiatives, emphasizing affordability and robust design over technological complexity.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Chair Pressure Cushions Market.- Invacare Corporation

- Permobil AB (Roho)

- Sunrise Medical (Jay Medical)

- Drive Medical

- Vicair B.V.

- Prism Medical

- The Comfort Company

- Novis

- Action Products Inc.

- Stryker Corporation

- Hill-Rom Holdings

- Essential Medical Inc.

- Skil-Care Corporation

- Supracor

- Synergy Seating Systems

- Ottobock

- Karma Healthcare

- Netti Seating

Frequently Asked Questions

Analyze common user questions about the Chair Pressure Cushions market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of a pressure relief cushion and how does it prevent pressure ulcers?

The primary function is to redistribute the body weight across a larger surface area, minimizing localized peak pressure points below the threshold required to occlude blood flow (capillary closing pressure). Cushions achieve this by optimizing immersion and envelopment, thereby ensuring adequate circulation to vulnerable tissues, particularly around the ischial tuberosities and sacrum, preventing tissue ischemia and subsequent ulcer formation.

Which type of chair pressure cushion is generally considered the most effective for high-risk patients?

For patients categorized as high-risk for pressure injury, dynamic air cushions or high-quality hybrid cushions (combining contoured foam and adjustable air or fluid inserts) are often recommended. Dynamic systems provide cyclical pressure relief, while hybrids offer a superior balance of stability, postural control, and excellent shear reduction properties, making them preferred by clinicians for complex seating needs.

How do 'Smart Cushions' differ from traditional pressure relief cushions?

Smart cushions integrate embedded sensor technology (pressure mapping, temperature, moisture) and often utilize IoT connectivity and AI algorithms. Unlike traditional static cushions, smart models actively monitor pressure distribution in real-time, alert users or caregivers to potentially harmful seating positions, and in some advanced models, automatically adjust air cell inflation to maintain optimal skin perfusion, supporting proactive care.

What factors drive the high cost of advanced chair pressure cushions in the market?

High costs are primarily driven by three factors: the use of highly specialized, durable, and clinically proven medical-grade materials (advanced polymers, viscoelastic foams); the necessity for sophisticated R&D and engineering (e.g., dynamic pump systems, sensor integration); and the significant investment required for clinical trials and regulatory compliance (FDA/MDR) to validate therapeutic effectiveness and secure reimbursement eligibility.

What are the key regulatory hurdles manufacturers face when launching new chair pressure cushion products?

Manufacturers must navigate stringent regulatory frameworks, such as the US FDA 510(k) pathway or the European Medical Device Regulation (MDR). These regulations demand robust documentation of biocompatibility, mechanical durability, and extensive clinical evidence demonstrating product safety and efficacy, often requiring multi-site clinical trials to substantiate claims, leading to prolonged market entry processes.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager