Chamfer Gage Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433985 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Chamfer Gage Market Size

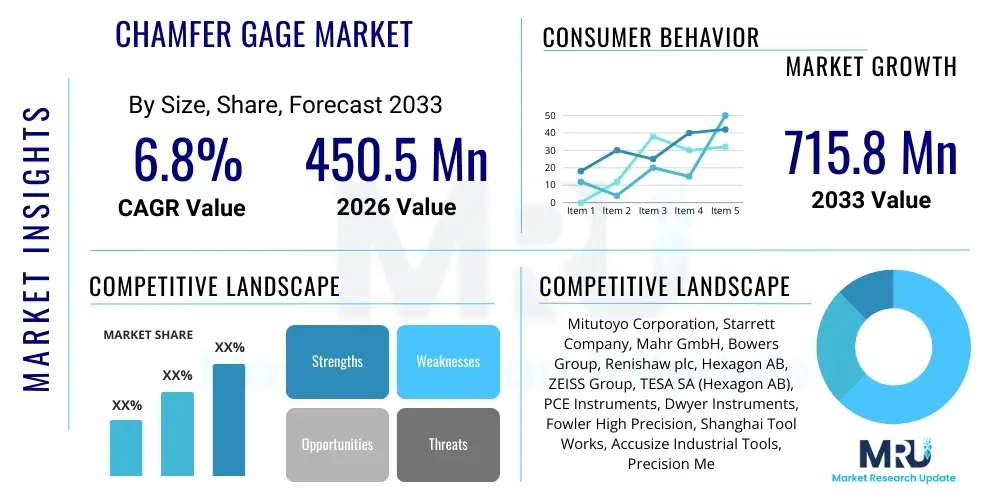

The Chamfer Gage Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 450.5 Million in 2026 and is projected to reach USD 715.8 Million by the end of the forecast period in 2033.

Chamfer Gage Market introduction

The Chamfer Gage Market encompasses the global trade and utilization of precision instruments designed specifically to measure the diameter, depth, and angle of chamfers (beveled edges) and countersinks in manufactured parts. These specialized gages are critical tools in quality control, ensuring that components meet rigorous geometric tolerance specifications essential for performance and assembly across various high-stakes industries. The primary product category includes both analog (mechanical) and digital gages, the latter offering enhanced accuracy, data logging capabilities, and connectivity, aligning with modern manufacturing requirements for traceability and automation.

Major applications of chamfer gages span the automotive sector, where precise bore and edge preparation is vital for engine components and braking systems; the aerospace industry, necessitating flawless chamfers on critical structural elements and fasteners; and the precision machining sector, covering everything from medical devices to complex molds. These instruments offer substantial benefits, including the reduction of production errors, minimization of scrap material, and validation of compliance with international quality standards (such as ISO requirements). Furthermore, the ease of use and rapid measurement capability of modern gages significantly improves inspection throughput compared to more cumbersome methods like traditional protractors or Coordinate Measuring Machines (CMMs) for basic chamfer checks.

The market is predominantly driven by the continuous global emphasis on achieving Zero Defect manufacturing environments and the proliferation of complex CNC machining processes that inherently generate numerous chamfered features. As regulatory standards in sectors like defense and medical devices become increasingly stringent regarding dimensional accuracy and surface finish, the indispensable role of dedicated, highly accurate chamfer measurement tools solidifies. The transition towards digital manufacturing, facilitating direct data capture and integration into Statistical Process Control (SPC) systems, further acts as a powerful catalyst for market growth, particularly for advanced digital chamfer gages.

Chamfer Gage Market Executive Summary

The Chamfer Gage Market is poised for stable expansion, underpinned by robust global industrial output and mandatory quality assurance protocols across critical manufacturing sectors. Business trends indicate a clear preference shift towards digital and connected measurement tools. Manufacturers are increasingly integrating wireless data transmission capabilities into their gages, facilitating real-time monitoring and compliance documentation, which addresses the growing need for smart factory solutions. Competition within the market is intense, characterized by established metrology giants focusing on innovation in sensor technology and ergonomic design, while smaller specialized firms concentrate on offering niche, high-accuracy instruments for unique applications, such as micro-chamfer measurement in electronics manufacturing.

Regional trends reveal that the Asia Pacific (APAC) region, spearheaded by China, India, and Southeast Asian nations, represents the fastest-growing market segment due to massive investments in automotive production, electronics assembly, and general industrial infrastructure expansion. North America and Europe, while mature, maintain significant market share, driven primarily by demand for advanced, high-end digital gages required by the highly regulated aerospace and medical device industries. These mature markets are not focused on volume growth but rather on technology upgrades, replacement cycles, and the adoption of integrated quality management systems that necessitate sophisticated metrology tools.

Segmentation trends highlight that the Digital Chamfer Gages segment is experiencing superior growth compared to the traditional Analog segment. Digital gages offer superior resolution, reduce operator variability, and provide indispensable features like instant conversion between metric and imperial units. Application-wise, the Automotive segment remains the dominant consumer, driven by high-volume production of components requiring precise edge breaks. However, the Aerospace and Defense segment commands premium pricing due to the stringent accuracy requirements and certified calibration demands associated with measuring highly critical, high-value components. The ongoing evolution of material science and additive manufacturing also presents long-term opportunities for specialized chamfer measurement tools capable of inspecting complex geometries produced by these advanced methods.

AI Impact Analysis on Chamfer Gage Market

Common user questions regarding AI's influence on the Chamfer Gage Market frequently revolve around whether AI could automate or entirely replace manual measurement, how data generated by digital gages can be leveraged beyond basic SPC, and the potential for AI to enhance measurement consistency and predictive maintenance. Users are concerned about the security of cloud-connected metrology data and the required skill shift for operators handling AI-integrated systems. Key expectations center on AI serving as a powerful analytical layer, enabling faster fault detection, optimizing calibration schedules based on usage patterns, and autonomously correcting measurement drift in high-throughput environments.

The integration of Artificial Intelligence primarily impacts the post-measurement phase and quality data analysis, rather than the core mechanical function of the chamfer gage itself. AI algorithms are increasingly being applied to the substantial datasets generated by digital, connected gages (IoT metrology devices). This allows for deep pattern recognition, identifying subtle correlations between machine tool wear, environmental conditions (temperature, humidity), and slight deviations in chamfer measurements that might be missed by standard Statistical Process Control (SPC) charts. This capability transforms reactive quality control into predictive quality assurance, minimizing the need for extensive rework.

Furthermore, AI facilitates advanced Generative Engine Optimization (GEO) in manufacturing by feeding highly precise chamfer data back into the digital twin models used for production simulation. This closed-loop feedback mechanism enables tool path optimization in CNC machining, predicting and compensating for thermal deformation or vibration before it affects the part geometry. While the physical act of using a handheld chamfer gage remains largely human-centric, AI enhances the strategic value of the data collected, driving operational efficiency and guaranteeing conformity across large batches of components, thereby redefining best practices in dimensional inspection.

- AI enables predictive quality control by analyzing historical gage data for potential tool wear correlation.

- Machine learning algorithms enhance measurement consistency by identifying and flagging human or environmental bias in readings.

- AI facilitates automatic classification and prioritization of quality anomalies reported by connected digital gages.

- Integration with digital twins allows for real-time process optimization based on metrology feedback.

- Natural Language Processing (NLP) integration improves user interfaces and simplifies complex inspection instructions for operators.

DRO & Impact Forces Of Chamfer Gage Market

The market dynamics are shaped by a complex interplay of Drivers, Restraints, and Opportunities. Key drivers include the global expansion of high-tolerance manufacturing, the intensification of quality regulations, particularly in medical and defense sectors, and the inherent simplicity and speed of dedicated chamfer measurement tools compared to generalized equipment. These forces collectively push manufacturers toward adopting dedicated precision instruments. Conversely, the market faces restraints such as the relatively high capital investment required for advanced digital models, economic downturns affecting overall capital expenditure in manufacturing, and the persistent challenge posed by competing non-contact measurement technologies, such as advanced vision systems and laser scanners, which can perform chamfer measurements without physical contact.

Significant opportunities arise from the ongoing paradigm shift toward Industry 4.0, which prioritizes connected, intelligent manufacturing environments. This presents a chance for chamfer gage manufacturers to integrate their products fully into factory IoT networks, offering sophisticated data analytics platforms alongside the hardware. Geographic expansion into emerging markets, coupled with the development of application-specific gages for growing niche industries (e.g., electric vehicle battery manufacturing, specialized semiconductor equipment), provides fertile ground for differentiated market entry and revenue diversification. The need for precise dimensional verification of additively manufactured (3D printed) parts, which often require post-processing and chamfering, also constitutes a significant emerging opportunity.

The collective impact forces ensure sustained market growth, albeit moderated by technological substitution risks. The primary impact force is the immutable requirement for dimensional conformity in high-reliability components, ensuring that as long as physical parts are manufactured, their critical features, including chamfers, must be verified. Regulatory pressure acts as a powerful external force, mandating the use of calibrated and traceable measurement equipment, thus supporting the premium pricing of high-quality gages. Therefore, while non-contact technologies are evolving, the reliability, cost-effectiveness, and simplicity of the dedicated chamfer gage for rapid shop-floor checks guarantee its persistent role as a fundamental tool in the metrology landscape.

Segmentation Analysis

The Chamfer Gage Market is systematically segmented based on the type of technology employed, which predominantly dictates accuracy and connectivity features, and the primary application industry, which reflects specific regulatory and volume demands. The segmentation framework is crucial for manufacturers to target marketing strategies and for end-users to select instruments tailored to their precision requirements and operational environments. The fundamental division between analog and digital technologies underscores a significant trend where digital systems increasingly capture market share due to their inherent advantages in data management and precision reading.

Further granularity in segmentation involves distinguishing between the measuring range capabilities, separating gages designed for very large bores (e.g., aerospace turbine components) from those targeting micro-chamfers in delicate electronics. Application segmentation is vital for understanding demand volatility; for instance, the cyclical nature of the automotive industry influences high-volume gage purchases, whereas the aerospace sector generates steady demand for highly specialized, often custom-calibrated, high-reliability gages. These segment profiles enable precise forecasting and strategic resource allocation across product development and regional sales efforts.

- By Type:

- Digital Chamfer Gages

- Analog (Mechanical) Chamfer Gages

- Multi-functional Chamfer & Countersink Gages

- By Application/End-User:

- Automotive and Transportation

- Aerospace and Defense

- Precision Machinery and Tooling

- Heavy Machinery and Industrial Equipment

- Medical Devices and Implants

- Electronics and Semiconductors

- General Manufacturing

- By Measuring Range:

- Small Range (e.g., 0.5 mm to 10 mm)

- Medium Range (e.g., 10 mm to 50 mm)

- Large Range (Above 50 mm)

Value Chain Analysis For Chamfer Gage Market

The value chain for the Chamfer Gage Market begins with upstream activities focused heavily on raw material procurement, specifically high-grade stainless steel and specialized alloys required for measuring contacts and body construction, ensuring dimensional stability and resistance to wear. Crucially, the upstream stage includes the sourcing of high-precision electronic components, such as linear encoders and display units, necessary for digital gages. Manufacturing processes involve intricate CNC machining, precision grinding, and specialized surface treatments to achieve the necessary micro-level tolerances and hardness required for accurate and durable instruments. Intellectual property associated with proprietary measurement algorithms and sensor design forms a key competitive asset in this early phase.

Midstream activities center on distribution channels, which are bifurcated into direct and indirect routes. Direct distribution involves sales teams engaging directly with large original equipment manufacturers (OEMs) in aerospace or automotive sectors, often involving custom calibration and service contracts. Indirect channels rely on a global network of specialized industrial distributors, metrology equipment resellers, and e-commerce platforms. These distributors play a vital role in local market penetration, inventory management, and providing immediate technical support to smaller job shops and general manufacturers. Effective management of the indirect channel, including comprehensive training and inventory optimization, is essential for maintaining brand presence and maximizing market reach.

Downstream activities involve post-sales services, which include mandatory calibration, repair, and ongoing software support (especially for digital and connected gages). For high-precision metrology, the provision of traceable calibration services—often compliant with ISO/IEC 17025 standards—is a non-negotiable component of the offering, significantly influencing customer retention and satisfaction. The interaction between the manufacturer and the end-user (potential customers) is characterized by the need for continuous education on best measurement practices, which ensures the gages are used correctly to achieve their rated accuracy. This emphasis on support and calibration services transforms the product from a simple tool into a long-term quality assurance partnership.

Chamfer Gage Market Potential Customers

The potential customer base for Chamfer Gages is highly concentrated in industries where component interoperability, structural integrity, and fluid dynamics are critically dependent on precise edge geometry. The largest single group of customers comprises automotive component manufacturers, including Tier 1 suppliers specializing in engine blocks, transmission cases, brake components, and chassis parts, where chamfers are essential for stress distribution, sealing, and proper assembly fit. These customers prioritize speed, durability, and integration into shop-floor data collection systems to handle high-volume inspection tasks efficiently and maintain high throughput without compromising quality.

A second major segment consists of the aerospace and defense sector, including aircraft manufacturers, engine producers, and specialized suppliers of military hardware. These end-users demand the absolute highest level of accuracy, often requiring NIST-traceable calibration and specialized gages designed to measure chamfers on exotic materials and complex, high-value components, such as turbine blades, structural joints, and critical fasteners. For this clientele, the ability of the gage to log data securely and provide comprehensive audit trails is often more important than the initial cost, driving demand for premium, certified digital instruments.

Furthermore, precision machining job shops and manufacturers of industrial machinery represent a vast and diverse customer pool. These smaller-to-medium enterprises utilize chamfer gages for general quality control on components ranging from hydraulic valves and pumps to specialized tooling and fixtures. While they may lean towards cost-effective, durable analog gages for basic checks, the trend is moving toward digital solutions to streamline documentation and minimize human error, driven by increasing demands from their own customers for higher quality assurance standards and digital inspection records.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Million |

| Market Forecast in 2033 | USD 715.8 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Mitutoyo Corporation, Starrett Company, Mahr GmbH, Bowers Group, Renishaw plc, Hexagon AB, ZEISS Group, TESA SA (Hexagon AB), PCE Instruments, Dwyer Instruments, Fowler High Precision, Shanghai Tool Works, Accusize Industrial Tools, Precision Measuring Tools (PMT), Shars Tool Co., Gagemaker, Baker Gauges, General Tools & Instruments, INSIZE Co., Trimos SA. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Chamfer Gage Market Key Technology Landscape

The technology landscape in the Chamfer Gage Market is undergoing a rapid evolution, primarily driven by the imperative for enhanced accuracy, reduced operator error, and seamless integration into digitized factory floors. The fundamental divide remains between mechanical (analog) and electronic (digital) measurement. Analog gages utilize precise mechanical movements and calibrated scales (like micrometers or vernier scales) and are favored for their robustness, simplicity, and zero requirement for power, making them staples in harsh shop-floor environments. However, they are inherently limited by human reading interpretation and lower resolution, typically only accurate to 0.01mm or 0.0005 inches.

Conversely, the digital segment leverages highly advanced linear encoder technology, often incorporating capacitive or optical sensors, which provide significantly higher resolution (down to 0.001mm or better) and instantaneously display the measurement, eliminating reading variability. Modern digital gages are increasingly featuring integrated wireless data communication capabilities, typically via Bluetooth or dedicated proprietary protocols, allowing immediate transfer of measurement data into Statistical Process Control (SPC) software or cloud-based quality management systems. This connectivity is critical for achieving compliance with Industry 4.0 principles, enabling real-time monitoring and minimizing manual transcription errors.

The forefront of technological development involves integrating multi-sensor fusion and ergonomic design enhancements. Some high-end chamfer gages incorporate multiple contact points or specialized probes to measure complex or irregular chamfer profiles, providing a more comprehensive inspection than traditional single-point measurement. Furthermore, design efforts are focused on improving the durability and ingress protection (IP) rating of digital gages to withstand coolant, chips, and dust prevalent in machining environments. The future direction involves developing 'smart' gages with onboard processing capabilities that can guide the operator through the measurement process and provide immediate pass/fail feedback based on pre-set tolerance limits, further reducing reliance on external computer systems.

Regional Highlights

The Asia Pacific (APAC) region stands out as the predominant engine of growth for the Chamfer Gage Market. This accelerated expansion is directly attributable to the massive influx of foreign direct investment into manufacturing infrastructure, particularly in high-volume sectors like automotive components (internal combustion engines and burgeoning electric vehicle supply chains) and consumer electronics. Countries such as China, South Korea, and Japan not only manufacture components for local consumption but also serve as major global export hubs, necessitating world-class quality control systems, which drives continuous investment in advanced metrology tools, including digital chamfer gages.

North America and Europe collectively represent the largest market for high-precision and customized chamfer gages. These regions are characterized by stringent quality regulations, particularly within the aerospace, defense, and medical device industries, which mandate the use of highly accurate and fully traceable measurement equipment. The market here is mature, driven primarily by technological replacement cycles, the adoption of Industry 4.0 standards, and the need for seamless data integration into enterprise resource planning (ERP) systems. European manufacturers, especially those in Germany and Switzerland, are key innovators in developing precision instruments, focusing on ergonomic design and advanced calibration services.

Latin America and the Middle East & Africa (MEA) currently hold smaller market shares but are exhibiting promising growth potential. Latin America's growth is tied to its stabilizing automotive manufacturing base and mining equipment production. The MEA region, particularly the Gulf Cooperation Council (GCC) countries, is seeing increased demand driven by diversification efforts away from oil and gas, focusing on developing defense, aerospace maintenance, and localized manufacturing capabilities. The demand in these regions is often price-sensitive but shows a long-term trajectory toward adopting internationally recognized quality standards, gradually transitioning demand from analog to entry-level digital gages.

- Asia Pacific (APAC): Dominates market growth due to massive investments in automotive, electronics, and precision tooling manufacturing, especially in China and India.

- North America: High demand for premium, customized digital gages driven by highly regulated aerospace and medical device industries and robust R&D investment.

- Europe: Characterized by strong adoption of advanced metrology, focusing on Industry 4.0 integration and leadership in precision instrument innovation, particularly in Germany.

- Latin America (LATAM): Emerging market driven by automotive assembly and industrial growth, prioritizing value and durability in measurement tools.

- Middle East & Africa (MEA): Growth potential tied to industrial diversification projects, requiring implementation of international quality control standards.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Chamfer Gage Market.- Mitutoyo Corporation

- Starrett Company

- Mahr GmbH

- Bowers Group

- Renishaw plc

- Hexagon AB

- ZEISS Group

- TESA SA (Hexagon AB)

- PCE Instruments

- Dwyer Instruments

- Fowler High Precision

- Shanghai Tool Works

- Accusize Industrial Tools

- Precision Measuring Tools (PMT)

- Shars Tool Co.

- Gagemaker

- Baker Gauges

- General Tools & Instruments

- INSIZE Co.

- Trimos SA

Frequently Asked Questions

Analyze common user questions about the Chamfer Gage market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of a Chamfer Gage, and why is it preferred over calipers?

The primary function of a chamfer gage is to precisely measure the diameter, depth, or angle of an internal or external chamfer or countersink. It is preferred over standard calipers because chamfer gages utilize dedicated, precise contact points designed to seat perfectly against the chamfer surface, ensuring high accuracy and repeatability that calipers cannot achieve for angled features. They significantly reduce measurement ambiguity and operator error.

What are the key differences between Analog and Digital Chamfer Gages?

Analog gages rely on mechanical scales and dials, offering durability and independence from power sources but limited resolution (typically 0.01mm) and higher potential for reading error. Digital chamfer gages employ electronic encoders, providing superior resolution (up to 0.001mm), instant digital readout, data output capabilities (for SPC), and often include features like metric/inch conversion, making them essential for modern, high-precision quality control and data logging requirements.

How does Industry 4.0 adoption affect the demand for Chamfer Gages?

Industry 4.0 significantly boosts demand for advanced digital chamfer gages by requiring seamless data integration. Connected gages, often referred to as IoT metrology devices, automatically transmit measurement results to cloud-based or local quality management systems, facilitating real-time Statistical Process Control (SPC), automated traceability, and reducing the critical need for manual data entry, thereby ensuring full alignment with smart factory goals.

Which end-user industry is the largest consumer of Chamfer Gages globally?

The Automotive and Transportation industry is globally the largest consumer of chamfer gages. This is driven by the high volume of components—including engine parts, braking systems, and transmission housings—that require precise chamfers for reliable assembly, fluid sealing, and stress distribution. The need for rapid, shop-floor quality checks in high-throughput production environments makes the chamfer gage an indispensable tool.

What major challenges constrain the growth of the Chamfer Gage Market?

The main constraints include the high initial capital investment required for top-tier digital and customized gages, which can limit adoption by smaller job shops. Furthermore, the market faces significant competitive pressure from advanced, non-contact measurement technologies, such as industrial vision systems and laser scanners, which offer faster, multi-feature inspection capabilities, potentially reducing the reliance on dedicated physical contact gages.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager