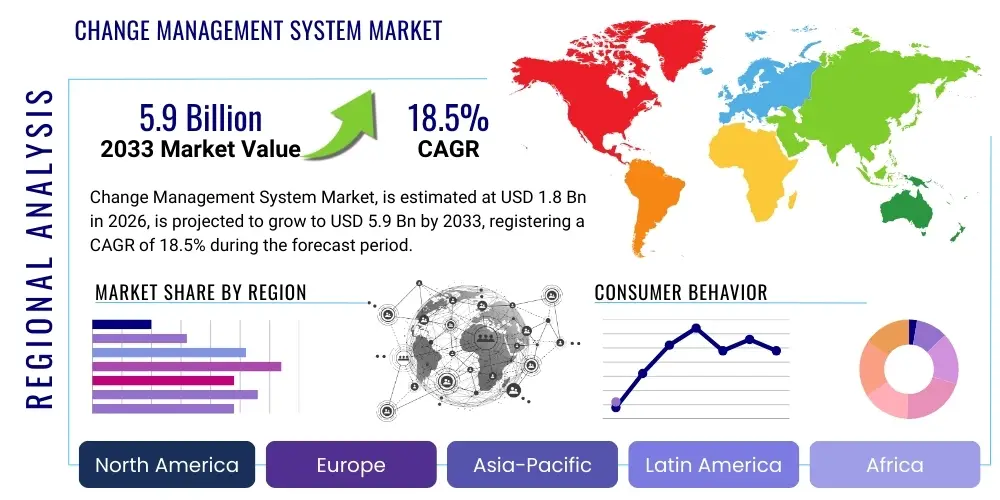

Change Management System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436162 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Change Management System Market Size

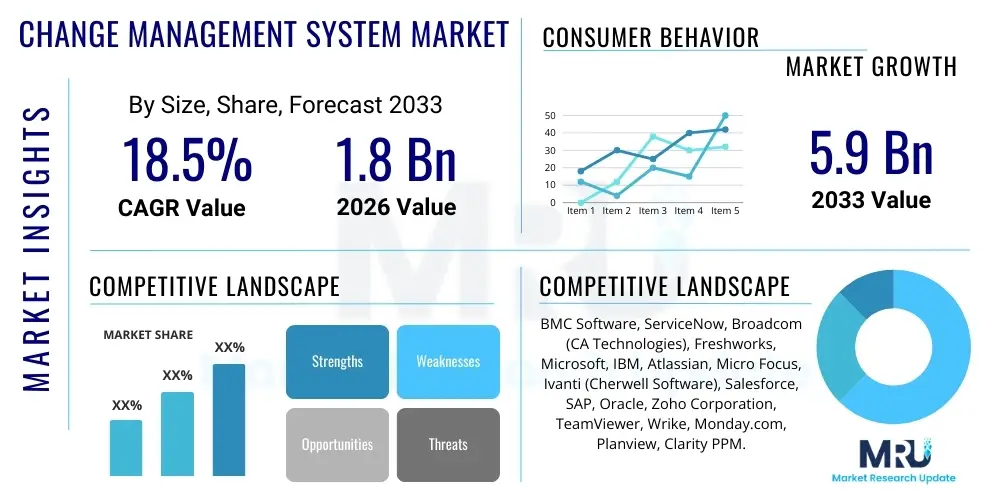

The Change Management System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at $1.8 Billion in 2026 and is projected to reach $5.9 Billion by the end of the forecast period in 2033.

Change Management System Market introduction

The Change Management System (CMS) Market encompasses software solutions and integrated services designed to systematically manage the transitions of an organization's resources, processes, or technologies. These systems provide a structured framework for defining, approving, implementing, and verifying changes within an IT infrastructure or business operation, ensuring minimized disruption and adherence to governance policies. The primary objective of a robust CMS is to reduce risk associated with modifications, thereby improving service availability and operational efficiency. Modern CMS solutions often integrate deeply with IT Service Management (ITSM) platforms, offering capabilities like automated workflows, dependency mapping, and comprehensive audit trails crucial for complex enterprise environments.

Products within this market range from sophisticated, enterprise-grade ITIL-compliant platforms to agile, modular solutions focusing on specific business transformation needs. Key applications include managing IT infrastructure changes (e.g., patching, hardware upgrades), business process shifts (e.g., new regulatory compliance procedures), and organizational restructuring. The utility of CMS extends beyond IT departments, becoming indispensable across sectors like BFSI (for system stability), Healthcare (for patient data system updates), and Manufacturing (for production line optimizations). Effective utilization of these systems ensures that organizational goals are met without compromising security or compliance posture.

The market is predominantly driven by the accelerating pace of digital transformation, which necessitates frequent and controlled changes to maintain competitive advantage. Organizations are increasingly adopting DevOps methodologies and continuous delivery pipelines, dramatically increasing the volume and velocity of changes. Furthermore, stringent regulatory requirements, particularly in highly regulated industries, mandate detailed documentation and traceability for every change implemented, making automated CMS tools essential for maintaining audit readiness and preventing costly non-compliance penalties. The shift towards cloud computing and hybrid infrastructure further fuels the demand for scalable and flexible change management solutions that can handle distributed and dynamic environments.

Change Management System Market Executive Summary

The Change Management System Market is experiencing robust growth fueled by mandatory digital transformation initiatives and the transition from monolithic IT structures to microservices and cloud-native applications. Business trends indicate a strong move toward integrated platforms, where change management is not an isolated function but is seamlessly embedded within broader IT Operations Management (ITOM) and ITSM frameworks. Companies are prioritizing solutions that offer predictive analytics and machine learning capabilities to assess the impact of changes proactively, moving beyond reactive approval processes. The integration of specialized configuration management databases (CMDBs) remains a critical factor, providing the necessary context and dependency data for effective change risk assessment. Furthermore, the increasing adoption of low-code/no-code platforms within CMS tools is democratizing change initiation, allowing non-IT staff to submit and track routine business changes efficiently.

Regionally, North America maintains its dominance due to the high concentration of major technology providers, early adoption of advanced ITSM practices, and significant investment in cloud infrastructure modernization across large enterprises. However, the Asia Pacific (APAC) region is projected to exhibit the highest growth rate, driven by rapid industrialization, increasing governmental focus on digital governance, and the massive deployment of IT infrastructure across emerging economies like India and China. Europe shows mature market characteristics, with stringent adherence to standards like ITIL and regulatory frameworks like GDPR compelling organizations to invest in highly structured and auditable CMS solutions. The Middle East and Africa (MEA) and Latin America are poised for accelerated growth, supported by governmental digitalization efforts and the expansion of the BFSI and telecommunications sectors requiring foundational enterprise management tools.

In terms of segmentation, the Cloud deployment model is the undisputed leader in market expansion, offering scalability, reduced infrastructure overhead, and subscription-based flexibility, making it highly attractive to Small and Medium Enterprises (SMEs). The Services segment, encompassing consulting, implementation, and managed services, is crucial for supporting complex organizational changes and ensuring successful system adoption. Large Enterprises remain the primary revenue generators due to the complexity and sheer volume of changes they manage, while the IT & Telecom industry consistently leads in technology adoption, driven by the need for continuous service delivery improvement. Overall, the market trajectory favors vendors that can deliver highly automated, AI-augmented, and cloud-native CMS solutions capable of integrating across diverse enterprise technology stacks.

AI Impact Analysis on Change Management System Market

User queries regarding AI's impact on Change Management Systems primarily revolve around automation capabilities, predictive risk assessment, and the potential for 'No-Touch' change execution. Common concerns include how AI can reduce the massive backlog of manual change requests, whether machine learning can accurately predict the failure rate of a proposed change, and the ethical implications of delegating approval decisions to algorithms. Users are highly interested in AI’s ability to analyze historical performance data and configuration item (CI) relationships to automatically suggest optimal change windows, minimize collision risks, and fast-track low-risk, routine changes. Expectations center on AI transforming CMS from a bureaucratic bottleneck into an intelligent orchestration engine that enhances organizational agility while maintaining control.

Artificial Intelligence (AI), particularly Machine Learning (ML) and Natural Language Processing (NLP), is fundamentally reshaping the Change Management System landscape by introducing proactive and predictive capabilities. Historically, change approval processes were largely manual, dependent on human committees, and often slow, leading to IT backlogs and missed opportunities. AI algorithms now ingest vast amounts of data—including past change successes/failures, configuration data, incident reports, and system performance metrics—to calculate a real-time risk score for every proposed change. This allows organizations to automate the approval process for low-risk changes (often referred to as 'Standard Changes' or 'Fast-Track Changes'), freeing up senior IT personnel to focus on high-impact strategic initiatives. The result is a significant acceleration of deployment cycles, aligning CMS tools with modern DevOps and Agile delivery models.

Furthermore, AI is instrumental in enhancing the crucial task of impact analysis. By utilizing advanced dependency mapping across the Configuration Management Database (CMDB), AI can identify subtle and non-obvious relationships between configuration items that a human analyst might miss. If a server patch is proposed, the AI system not only checks immediate dependent applications but also analyzes performance baselines to predict potential bottlenecks post-implementation. NLP capabilities are also being utilized to analyze incoming service desk tickets related to changes, categorize the nature of post-change incidents, and feed this data back into the ML model to continuously refine its predictive accuracy. This shift from reactive monitoring to predictive orchestration represents the most substantial evolution in change management practices.

- Automated Risk Assessment: AI models predict the probability of change failure based on historical data and environmental context.

- Intelligent Change Scheduling: ML algorithms suggest optimal timing for changes, minimizing collision conflicts and service disruption.

- Change Automation/Fast-Tracking: Low-risk, standard changes are automatically approved and deployed without human intervention (No-Touch Change).

- Enhanced Impact Analysis: AI identifies complex dependencies across the CMDB, providing a holistic view of potential downstream consequences.

- Root Cause Analysis (RCA) Acceleration: AI speeds up the diagnosis of incidents caused by recent changes, improving mean time to resolution (MTTR).

- Natural Language Processing (NLP) for Documentation: AI assists in standardizing change descriptions and analyzing feedback from change-related communications.

DRO & Impact Forces Of Change Management System Market

The dynamics of the Change Management System market are governed by a powerful interplay of accelerating organizational needs and inherent technological complexities. Drivers center on the necessity for controlled speed in modern IT environments, while restraints largely stem from the difficulty of integrating these systems into entrenched legacy processes. Opportunities are vast, driven by technological evolution like AI and specialized cloud platforms. These forces collectively shape the competitive landscape and dictate the rate and direction of market penetration. The continuous evolution of IT frameworks, such as the adoption of ITIL 4 and increasing regulatory oversight (e.g., SOX, HIPAA, GDPR), creates a permanent demand floor for auditable and compliant change systems, ensuring sustained market growth despite economic volatility.

Key drivers include the imperative for regulatory compliance, especially within BFSI and Healthcare, where failure to document changes correctly can lead to massive fines. Furthermore, the global proliferation of DevOps practices requires automated change approval and deployment gates, essentially integrating CMS functionality directly into CI/CD pipelines. This rapid iteration cycle mandates a robust, highly automated system to prevent critical errors. Conversely, significant restraints include the high initial implementation costs associated with enterprise-grade CMS solutions and the complexity involved in integrating these tools with diverse legacy systems and fragmented Configuration Management Databases (CMDBs). Resistance to cultural change within large organizations—where manual processes are deeply ingrained—also acts as a major impediment to successful CMS adoption and utilization.

Opportunities for market expansion are primarily found in the shift towards Software-as-a-Service (SaaS) and cloud-native solutions, which offer lower Total Cost of Ownership (TCO) and faster time-to-value, appealing particularly to SMEs. The rise of hybrid and multi-cloud environments creates a critical need for centralized, unified change management platforms capable of governing changes across disparate infrastructures simultaneously. The impact forces driving the market include competitive pressure for service uptime (high availability mandates), the pervasive threat of cyberattacks (requiring rigorous control over infrastructure changes), and the ongoing industry skills gap, which compels organizations to adopt automated tools to compensate for a shortage of specialized IT operations talent. Vendors capitalizing on AI-driven automation and seamless platform integration are best positioned to leverage these opportunities and overcome implementation restraints.

Segmentation Analysis

The Change Management System market is systematically segmented based on component type, deployment model, organizational size, and the specific industry vertical served. This granular analysis provides insights into user preferences and technology adoption trends across different operational contexts. The market structure reflects a growing preference for integrated services that complement core software capabilities, acknowledging that successful change management is as much about process re-engineering and consulting as it is about software functionality. The fundamental distinction between on-premise and cloud deployment defines the operational architecture, while the size of the organization dictates the necessary scale, complexity, and feature set required, ranging from simple workflow tools for SMEs to highly customized, enterprise-wide governance platforms.

The segmentation by Component highlights the symbiotic relationship between core software licenses and the professional services necessary for successful implementation, customization, and training. Services often account for a substantial portion of the initial investment, reflecting the complexity of aligning CMS tools with existing ITIL processes and organizational hierarchies. Deployment segmentation shows the rapid migration towards cloud solutions due to scalability and accessibility benefits, although highly regulated sectors or those with strict data sovereignty concerns maintain a reliance on robust on-premise deployments. Vertical segmentation is crucial, as the change requirements of a bank (security and regulatory adherence) differ significantly from those of a manufacturing firm (operational technology integration and supply chain changes), demanding industry-specific features and compliance modules.

- By Component:

- Software (Platform and Modules)

- Services (Consulting, Implementation, Training, Managed Services)

- By Deployment:

- Cloud (SaaS)

- On-Premise

- By Organization Size:

- Small and Medium Enterprises (SMEs)

- Large Enterprises

- By Industry Vertical:

- Banking, Financial Services, and Insurance (BFSI)

- IT and Telecom

- Healthcare and Life Sciences

- Retail and Consumer Goods

- Manufacturing

- Government and Public Sector

- Others (Education, Media, Energy)

Value Chain Analysis For Change Management System Market

The value chain of the Change Management System Market begins with the upstream activities of core technology development and specialized software engineering. This stage involves significant investment in R&D to incorporate advanced features like AI, machine learning for predictive analysis, and integration capabilities with contemporary DevOps toolchains. Upstream suppliers include cloud infrastructure providers (AWS, Azure, Google Cloud) critical for SaaS deployment and specialized technology vendors supplying components such as database management systems and advanced security modules. Successful vendors in this stage focus on creating highly modular, scalable, and resilient platform architectures that can be quickly adapted to evolving IT standards and security requirements. Intellectual property related to automated risk calculation algorithms and deep CMDB integration constitutes a major source of competitive advantage in this initial phase.

The middle segment of the value chain focuses on the transformation and delivery process, encompassing software customization, quality assurance, and localization for global markets. This stage heavily relies on skilled professional services teams who specialize in translating client-specific organizational processes into functional CMS workflows. The distribution channel plays a vital role here, often involving a mix of direct sales teams for large enterprise accounts and indirect channels through system integrators (SIs) and value-added resellers (VARs). SIs are particularly crucial as they bundle the CMS software with adjacent technologies (like IT asset management or security tools) and provide comprehensive deployment expertise, especially in complex hybrid IT environments. The effectiveness of the channel strategy directly impacts market reach and customer penetration, especially across diverse geographical regions.

The downstream analysis centers on deployment, continuous support, and customer success activities. Direct distribution models ensure higher margin control and tighter feedback loops for product improvement, which is typical for major proprietary vendors like ServiceNow or BMC. Indirect channels extend reach but require strong partnership management and shared service level agreements (SLAs). Key activities downstream include post-implementation support, regular software updates, and managed services where the vendor or partner takes responsibility for system maintenance and optimization. For customers, the value proposition is realized through seamless adoption, demonstrated ROI via reduced change failure rates, and improved IT governance, making ongoing support quality a critical differentiator in vendor selection. The continuous feedback loop from end-users informs the next cycle of upstream development, perpetually refining the product offering.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.8 Billion |

| Market Forecast in 2033 | $5.9 Billion |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BMC Software, ServiceNow, Broadcom (CA Technologies), Freshworks, Microsoft, IBM, Atlassian, Micro Focus, Ivanti (Cherwell Software), Salesforce, SAP, Oracle, Zoho Corporation, TeamViewer, Wrike, Monday.com, Planview, Clarity PPM. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Change Management System Market Potential Customers

Potential customers for Change Management Systems are predominantly organizations undergoing rapid digital transformation, facing strict regulatory requirements, or operating highly complex, hybrid IT environments where service uptime is critical to business continuity. The primary buyers are typically within the Chief Information Officer (CIO) organization, spanning IT Operations, Service Management departments (ITSM/ITIL teams), and specialized Compliance and Risk management groups. Large enterprises across all major verticals represent the highest value customers, seeking comprehensive, integrated platforms that can manage thousands of changes per month across globally distributed infrastructures. These customers prioritize solutions offering deep integration with existing ERP, CRM, and security platforms, demanding high availability and extensive audit logging capabilities to satisfy internal and external governance requirements.

The fastest-growing segment of potential customers includes Small and Medium Enterprises (SMEs) that are increasingly moving their operations to the cloud and adopting modern software delivery practices. While SMEs previously managed changes via simple spreadsheets or less formal methods, the inherent risks associated with cloud adoption and the push towards standardized processes are driving the adoption of more affordable, SaaS-based CMS solutions. These buyers seek ease of deployment, intuitive user interfaces, and minimal administrative overhead, often preferring modular platforms that can scale with their growth without requiring massive upfront investment. The key differentiating factor for vendors targeting SMEs is the ability to deliver ITIL-aligned processes in a user-friendly, non-burdensome format.

Furthermore, specialized industry verticals, such as government and defense sectors, represent highly lucrative, albeit demanding, customer segments. These organizations require CMS solutions with stringent security clearances, robust on-premise or government-cloud deployment options, and full traceability capabilities to meet national security and public accountability standards. In the financial sector (BFSI), regulatory mandates like Basel IV and various data protection laws compel organizations to invest heavily in change systems that provide an irrefutable trail of accountability for every system modification. Ultimately, any organization that views its IT infrastructure as mission-critical and operates in a dynamic regulatory or competitive landscape is a prime candidate for advanced Change Management Systems.

Change Management System Market Key Technology Landscape

The technological landscape of the Change Management System Market is characterized by convergence and intelligence, moving far beyond simple ticket logging and approval workflows. The foundational technology remains the Configuration Management Database (CMDB), which provides the single source of truth for all configuration items (CIs) and their dependencies. However, modern CMS platforms augment the CMDB with automated discovery tools that utilize network scanning and integration APIs to maintain real-time, accurate dependency maps, eliminating the historical issue of stale or inaccurate configuration data. The architecture is rapidly shifting towards microservices and containerized applications, necessitating CMS tools that can manage change velocity in ephemeral environments like Kubernetes clusters and serverless functions.

Integration capabilities are paramount in this ecosystem. Contemporary CMS solutions must provide robust APIs (Application Programming Interfaces) to facilitate seamless integration with continuous integration/continuous delivery (CI/CD) tools (e.g., Jenkins, GitLab), incident management systems, IT Asset Management (ITAM), and core organizational resource planning (ERP) systems. The shift towards hyper-automation is driven by intelligent workflow engines utilizing Robotic Process Automation (RPA) to handle routine, repetitive administrative tasks associated with change documentation and post-implementation validation. This technological maturity is essential for supporting modern operational frameworks such as Site Reliability Engineering (SRE), which emphasizes programmatic approaches to change management and infrastructure stability.

The most transformative technology in this space is Artificial Intelligence (AI) and Machine Learning (ML). AI algorithms are deployed for crucial tasks like natural language processing (NLP) to understand the intent of change requests, clustering similar changes to identify patterns, and predictive modeling to forecast the risk of system instability. Furthermore, advanced visualization technologies, including real-time dashboards and graphical dependency viewers, enhance the user experience and provide crucial insights for Change Advisory Board (CAB) members. Cloud-native architecture is also a key enabler, providing the scalable computing resources necessary to run complex AI models and handle the massive data ingestion required for accurate predictive analytics across hybrid and multi-cloud infrastructures.

Regional Highlights

Regional dynamics significantly influence the adoption rates and technological focus within the Change Management System market, primarily driven by economic maturity, regulatory environment, and the prevalence of enterprise-level digital infrastructure. North America, especially the United States, represents the largest market share, predominantly due to early and widespread adoption of IT Service Management (ITSM) frameworks, high levels of IT spending, and the presence of nearly all major CMS vendors. The market here is mature but constantly innovates, focusing heavily on integrating cutting-edge AI, deep automation, and specialized cloud orchestration tools to manage the most complex hybrid IT landscapes.

Europe stands as the second-largest market, characterized by stringent regulatory landscapes such as GDPR and financial compliance standards, which mandate highly documented and auditable change processes. European organizations prioritize solutions that offer robust governance, clear audit trails, and strict adherence to ITIL best practices. Adoption rates are high across the UK, Germany, and the Nordic countries. The growth is fueled by mandatory system modernization efforts, particularly in the public sector and banking industry, moving away from legacy systems to highly governed cloud environments. European vendors often emphasize compliance and security features tailored specifically to regional data protection requirements.

Asia Pacific (APAC) is projected to be the fastest-growing market globally. This exponential growth is driven by rapid digitalization, massive infrastructure investments across countries like India, China, and Southeast Asia, and a strong push toward modernizing IT infrastructure in both the private and government sectors. While adoption in mature markets like Japan and Australia mirrors North American trends, emerging economies focus on implementing first-generation CMS solutions, primarily through flexible, SaaS-based models to circumvent large capital expenditures. The high growth rate is sustained by the sheer volume of new businesses and the increasing necessity for competitive digital services.

Latin America (LATAM) is an emerging market showing steady growth, primarily concentrated in larger economies like Brazil and Mexico. The adoption is driven largely by the need for better operational efficiency in the BFSI and Telecommunications sectors, combating historical issues of service outages and manual intervention. Implementation challenges often relate to fluctuating local economic conditions and the necessity for solutions that support multi-language capabilities and local regulatory requirements. Vendors entering this region often leverage strong partnerships with local system integrators to navigate complex deployment environments and provide localized support.

The Middle East and Africa (MEA) region is witnessing increasing adoption, propelled by large-scale government-led digital transformation visions, suchastically in the Gulf Cooperation Council (GCC) nations (e.g., Saudi Arabia, UAE). Substantial investments in smart city projects, banking infrastructure, and oil and gas operations necessitate world-class change management governance. The African segment is developing, focusing on mobile and telecom infrastructure growth, where managing high-volume, dispersed networks requires robust CMS solutions. Security and on-premise or sovereign cloud deployments often feature prominently in regional requirements due to geopolitical stability concerns and high data sovereignty mandates.

- North America: Market leader due to high IT spending, mature ITSM adoption, and vendor concentration. Focuses on AI-driven automation and cloud orchestration.

- Europe: Strong second market, driven by stringent regulatory compliance (GDPR, ITIL adherence) and public sector modernization.

- Asia Pacific (APAC): Fastest-growing region, fueled by rapid digitalization, infrastructure investment, and preference for scalable SaaS solutions in emerging economies.

- Latin America (LATAM): Steady growth focused on BFSI and Telecom sectors, with increasing demand for localized and efficient governance tools.

- Middle East and Africa (MEA): Growth driven by large-scale governmental digital transformation initiatives and infrastructure investment in the GCC states, prioritizing security and sovereignty.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Change Management System Market.- ServiceNow

- BMC Software

- Broadcom (CA Technologies)

- Freshworks

- Microsoft

- IBM

- Atlassian

- Micro Focus

- Ivanti (Cherwell Software)

- Salesforce

- SAP

- Oracle

- Zoho Corporation

- TeamViewer

- Wrike

- Monday.com

- Planview

- Clarity PPM

Frequently Asked Questions

Analyze common user questions about the Change Management System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary benefit of implementing an automated Change Management System (CMS)?

The primary benefit is significantly reducing the risk of system failures and service outages caused by uncontrolled changes. An automated CMS enforces standardized workflows, conducts mandatory risk assessments, and ensures all modifications are fully documented and approved before deployment, leading to higher service availability and reduced operational costs.

How does AI contribute to modern Change Management processes?

AI, specifically Machine Learning, transforms CMS by enabling predictive risk assessment. It analyzes historical data to calculate the probability of a change failing, automates the approval of low-risk changes (Fast-Track), suggests optimal deployment windows, and enhances impact analysis across complex dependencies.

What is the difference between Change Management and Configuration Management in the ITIL framework?

Change Management focuses on controlling the lifecycle of all changes to minimize disruption, ensuring only authorized changes occur. Configuration Management (supported by the CMDB) focuses on maintaining accurate information about configuration items (CIs) and their relationships, providing the essential context data needed for Change Management to perform accurate impact assessments.

Is the Cloud deployment model secure enough for regulated industries like BFSI regarding Change Management?

Yes, modern CMS SaaS solutions offer enterprise-grade security, often exceeding on-premise capabilities. For BFSI and other regulated industries, Cloud CMS provides the necessary scalability, continuous compliance checks, data encryption, and robust audit trails required by regulatory bodies, provided the vendor adheres to relevant standards (e.g., SOC 2, ISO 27001).

What are the key challenges organizations face when implementing a new CMS solution?

Key challenges include cultural resistance to formalized processes, complexity in integrating the CMS with existing legacy systems, maintaining accuracy in the Configuration Management Database (CMDB), and the high cost and resource requirements associated with initial system customization and training across large, disparate teams.

How do DevOps methodologies influence the demand for Change Management Systems?

DevOps accelerates change frequency, necessitating CMS tools that can handle rapid, high-volume changes. This drives demand for CMS platforms that offer API integration with CI/CD pipelines, enabling continuous delivery through automated change validation and approval gates, thereby ensuring control without sacrificing speed.

Which organization size segment currently drives the most revenue in the CMS Market?

Large Enterprises currently drive the most significant revenue in the CMS Market. Their expansive, complex IT environments generate a massive volume of changes, requiring sophisticated, high-cost, and deeply integrated enterprise-level platforms capable of global scale and extensive regulatory compliance adherence.

What role do professional services play in the overall CMS market value chain?

Professional services, including consulting, implementation, and training, are critical components. They ensure that the standardized CMS software is correctly mapped to an organization's unique operational processes, facilitating user adoption, data migration, and successful integration with the broader IT ecosystem, often representing a significant portion of the initial contract value.

What is an 'Impact Force' in the context of the Change Management System market?

An impact force represents external pressures or internal needs that significantly shape market growth and vendor strategies. Examples include the imperative for continuous service uptime (mandating better change control), intensifying global cyber threats (requiring rigorous change security protocols), and the economic necessity of IT automation.

Why is the Asia Pacific (APAC) region projected to have the highest growth rate?

APAC's high growth rate is attributed to rapid digital transformation across emerging economies, large-scale government initiatives to modernize public IT services, and increasing adoption of cloud infrastructure by a rapidly expanding base of SMEs and enterprises seeking competitive advantages through process standardization and efficiency.

What is a 'No-Touch' change process enabled by AI?

A 'No-Touch' change process refers to the automated execution and deployment of standard, low-risk changes (e.g., routine patching, minor configuration updates) without requiring manual human review or approval. AI algorithms assess the change risk in real-time and, if below a defined threshold, automatically pass the change to the deployment pipeline.

How do compliance requirements impact the feature set of a CMS?

Compliance requirements (like SOX, HIPAA, GDPR) mandate that CMS solutions incorporate non-repudiable audit trails, detailed logging of every approval and modification, mandatory separation of duties, and comprehensive reporting capabilities to demonstrate adherence to legal and internal governance standards, making these features essential.

What are upstream activities in the CMS market value chain?

Upstream activities involve core product development, including research and development (R&D) into AI algorithms, architecture design for cloud-native deployment, sourcing base technologies (like cloud infrastructure), and creating proprietary intellectual property related to workflow engines and risk assessment models.

Which industry vertical is consistently the highest adopter of sophisticated CMS technology?

The IT and Telecommunications vertical is consistently the highest adopter. Given their core business involves managing vast, complex, and rapidly evolving technological infrastructure, they require the most sophisticated, high-velocity change management tools to ensure continuous service delivery and network stability.

How does the shift to microservices affect Change Management Systems?

Microservices increase the volume and velocity of changes exponentially. CMS solutions must adapt by offering specialized tools for container orchestration management (e.g., Kubernetes change tracking), automated dependency mapping for decoupled services, and risk assessment that can handle highly dynamic, ephemeral infrastructure components.

What is the role of the Change Advisory Board (CAB) in an AI-augmented CMS environment?

In an AI-augmented environment, the CAB shifts focus from reviewing routine, low-risk changes (handled automatically by AI) to concentrating exclusively on complex, strategic, or high-impact changes. AI provides the CAB with advanced data and predictive risk scores, allowing their decisions to be more informed and efficient.

Why is integration with the IT Asset Management (ITAM) system important for CMS?

Integration with ITAM ensures that the CMS knows exactly which assets are affected by a change, including software licenses and hardware life cycles. This prevents unauthorized changes to critical assets and provides comprehensive data for impact assessment, ensuring regulatory and contractual compliance.

What is the projected CAGR for the Change Management System Market between 2026 and 2033?

The Change Management System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% during the forecast period from 2026 to 2033, reflecting strong enterprise demand for controlled automation and advanced governance.

How do SMEs typically access Change Management System solutions?

SMEs predominantly access CMS solutions via the Cloud (SaaS) deployment model. This allows them to benefit from robust functionality with lower upfront capital expenditure, simplified maintenance, and fast deployment times, leveraging subscription-based pricing models that fit scaled budgets.

What factors restrain market growth in the Change Management System sector?

Market growth is often restrained by the high complexity and associated cost of migrating from legacy systems, internal organizational resistance to adopting new formalized change processes, and the significant challenge of ensuring the accuracy and completeness of the Configuration Management Database (CMDB) data required for effective CMS operation.

Which technology is fundamental for accurate impact analysis in CMS?

The Configuration Management Database (CMDB) is fundamental. It provides the structured data detailing all IT components (CIs) and their dependency relationships. Without accurate, real-time CMDB data, the CMS cannot perform reliable impact analysis to predict which services might fail due to a proposed change.

What is the significance of ITIL 4 in the current CMS market?

ITIL 4 emphasizes flexibility, value streams, and faster change velocity, moving away from rigid hierarchical processes. This forces CMS vendors to develop platforms that support integration with DevOps pipelines, focus on value delivery, and accommodate different types of changes (Standard, Normal, Emergency) with scalable automation.

How does the shift towards hybrid and multi-cloud environments affect CMS design?

CMS design must evolve to provide a unified platform capable of governing changes across disparate infrastructures—on-premise, private cloud, and multiple public clouds (multi-cloud). This requires centralized policy enforcement, unified reporting, and integration with various cloud-native tools to ensure consistency and control.

What differentiates direct and indirect distribution channels in the CMS market?

Direct distribution involves the vendor's internal sales team handling the transaction, common for major enterprise contracts, allowing high margin and direct customer feedback. Indirect distribution utilizes System Integrators (SIs) and Value-Added Resellers (VARs) to extend market reach, particularly in diverse regional markets or for bundled technology solutions.

In the context of downstream analysis, what defines the realization of customer value?

Customer value realization downstream is defined by the measurable results achieved post-implementation, primarily through a demonstrably reduced change failure rate, significant improvements in service uptime, enhanced compliance reporting capabilities, and overall optimization of the IT operational efficiency and agility.

What is the primary driver for CMS adoption in the Government and Public Sector?

The primary driver is the need for enhanced public accountability and compliance. Government entities must adhere to strict transparency and security standards, necessitating highly formalized and auditable CMS solutions to manage critical infrastructure modifications and ensure data integrity.

How are low-code/no-code platforms influencing the CMS market?

Low-code/no-code platforms within CMS tools allow non-technical business users to customize basic workflows, request changes, and track status without requiring specialized development skills. This democratization of access simplifies process adjustments and accelerates the adoption of standardized change practices across the organization.

What is the typical time frame considered for the historical year period in this market report?

The historical year period covered in this market analysis spans from 2019 to 2024, providing a comprehensive baseline of market performance preceding the base year of 2025 and projecting forward to the forecast end year of 2033.

What role does Robotic Process Automation (RPA) play in Change Management?

RPA is used to introduce hyper-automation by handling routine, repetitive tasks within the change process, such as data entry for documentation, cross-referencing information between different systems, and automating post-change validation and verification checks, significantly reducing manual effort and potential human error.

Why is North America considered the dominant region in the Change Management System Market?

North America's dominance stems from its high saturation of technology-intensive industries, massive corporate IT spending, early establishment of formalized IT governance practices (like ITIL), and the geographical concentration of global market leaders who continuously drive innovation in AI and cloud-native CMS solutions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager