Chargeback Management Software Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431788 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Chargeback Management Software Market Size

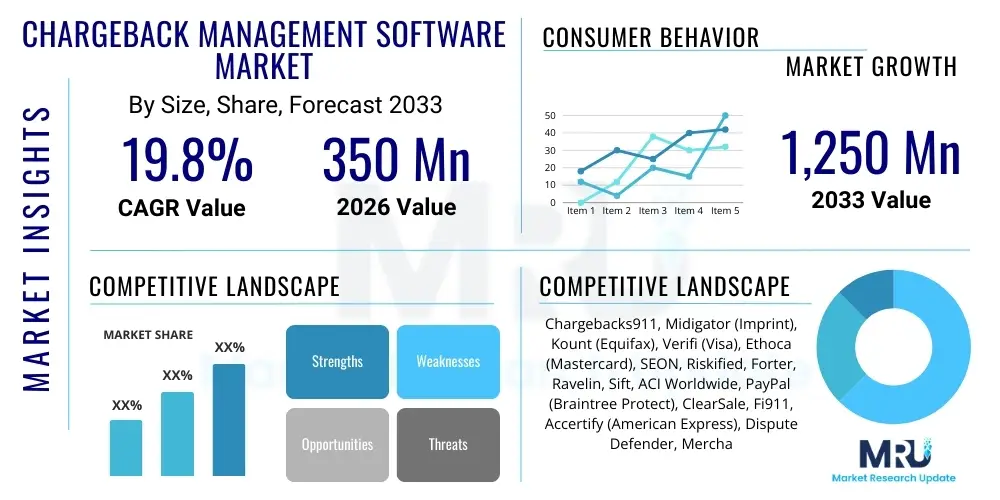

The Chargeback Management Software Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 19.8% between 2026 and 2033. The market is estimated at $350 Million USD in 2026 and is projected to reach $1,250 Million USD by the end of the forecast period in 2033.

Chargeback Management Software Market introduction

The Chargeback Management Software Market encompasses technological solutions designed to assist merchants, financial institutions, and payment processors in mitigating financial losses resulting from fraudulent or legitimate transaction disputes, commonly known as chargebacks. These sophisticated platforms automate the complex process of monitoring transactions, identifying potential risks, collecting compelling evidence, and submitting appropriate documentation to card networks for dispute resolution. The primary objective of these solutions is to reduce the volume of chargebacks, recover lost revenue, and prevent merchants from incurring excessive chargeback ratios that could lead to penalties or even termination of payment processing privileges. These solutions are becoming indispensable tools for high-volume e-commerce entities and subscription services operating in an increasingly complex and globalized digital economy.

Product descriptions typically emphasize features such as real-time transaction monitoring, integration with major card networks (Visa, Mastercard, etc.), case management systems, and detailed reporting capabilities focused on deciphering the root cause of disputes. Furthermore, many modern chargeback solutions leverage advanced machine learning models to differentiate between true fraud, friendly fraud, and merchant error, allowing for targeted strategies in each case. Major applications span across various high-risk and high-transaction sectors, including retail e-commerce, digital goods and services, travel and hospitality, and financial technology (FinTech) providers, all of whom face significant exposure to chargeback liabilities. The software often operates on a Software-as-a-Service (SaaS) model, ensuring scalability and easy integration into existing enterprise resource planning (ERP) or payment gateway infrastructures.

The benefits of adopting comprehensive chargeback management software are substantial, extending beyond mere revenue recovery to include enhanced operational efficiency and improved customer trust. Key driving factors fueling market growth include the exponential rise in global e-commerce transactions, leading to higher instances of digital fraud and friendly fraud. Regulatory pressures, such as updated rules from card networks mandating faster dispute resolution and compelling evidence requirements, further necessitate automated, sophisticated tools. Moreover, the increasing sophistication of organized fraud rings and the subsequent need for proactive risk scoring mechanisms are propelling greater investment in intelligent chargeback mitigation strategies across all levels of the payment ecosystem.

Chargeback Management Software Market Executive Summary

The Chargeback Management Software Market is experiencing robust expansion, driven primarily by evolving regulatory landscapes and the accelerating digitization of global commerce. Business trends indicate a strong shift towards comprehensive, integrated platforms that offer end-to-end chargeback lifecycle management, moving beyond simple dispute representation to incorporate proactive fraud prevention and detailed root-cause analysis. This integration facilitates a holistic approach to revenue protection, positioning software providers as strategic partners rather than mere operational tools. Furthermore, the market is witnessing significant merger and acquisition activities as larger cybersecurity and FinTech firms seek to incorporate specialized chargeback expertise and technology into their existing portfolios, streamlining the competitive environment and consolidating advanced technological capabilities.

Regionally, North America maintains market dominance, attributed to high e-commerce penetration, stringent regulatory frameworks (especially regarding consumer protection), and the presence of numerous early adopters and leading technology vendors. However, the Asia Pacific (APAC) region is projected to exhibit the highest growth rate during the forecast period, fueled by massive increases in digital payment adoption, particularly in emerging economies like India and Southeast Asia, coupled with nascent but rapidly maturing regulatory structures addressing payment security. European markets are driven by adherence to the Payment Services Directive (PSD2) and the need for sophisticated authentication mechanisms, prompting investments in automated solutions that reduce false declines while minimizing fraud exposure.

Segment trends highlight the significant adoption of cloud-based deployment models due to their flexibility, scalability, and lower total cost of ownership compared to on-premise solutions. Among end-users, large enterprises, particularly those in high-transaction volume sectors like digital retail and subscription services, remain the primary revenue generators, although Small and Medium-sized Enterprises (SMEs) are increasingly leveraging affordable SaaS solutions to protect themselves from potentially devastating chargeback penalties. The functionality segment demonstrates a strong preference for predictive analytics and AI-driven screening modules, emphasizing the market's trajectory towards proactive prevention rather than reactive management of disputes, thereby maximizing operational efficiency and minimizing human intervention in the often-tedious process of evidence compilation.

AI Impact Analysis on Chargeback Management Software Market

User inquiries regarding the integration of Artificial Intelligence (AI) in chargeback management frequently center on its ability to enhance accuracy, speed dispute resolution, and distinguish between complex fraud types, particularly "friendly fraud." Users often question how AI and Machine Learning (ML) algorithms can proactively predict and prevent chargebacks before they occur, reducing reliance on manual review processes. Key expectations revolve around achieving higher win rates in chargeback disputes, automating the tedious process of collecting compelling evidence, and providing granular, actionable insights into fraud patterns that are too subtle for traditional rule-based systems to detect. There is also significant concern regarding data privacy and the integration complexity of advanced AI systems with legacy payment infrastructure. This analysis reveals a consensus that AI is transformative, moving chargeback management from a reactive, cost-recovery function to a proactive, risk-mitigation strategy essential for maintaining profitability in high-volume digital environments.

AI’s influence is rapidly professionalizing the chargeback management sector by enabling systems to continuously learn from historical data, dispute outcomes, and transactional anomalies, leading to dynamic risk scoring. Traditional rule-based systems often result in high false positive rates, unnecessarily declining legitimate transactions and frustrating customers, a problem AI effectively mitigates through contextual analysis. ML models are highly effective in processing vast amounts of metadata—including geolocation, device fingerprinting, and behavioral biometrics—in real time to construct precise profiles of legitimate customers versus potential fraudsters. This enhanced capability allows merchants to implement extremely targeted transaction filters, significantly lowering both fraud rates and chargeback ratios simultaneously, thereby improving merchant account health and reducing associated processing fees levied by financial institutions.

Furthermore, AI algorithms are revolutionizing the dispute representation phase. By analyzing card network regulations, past successful submissions, and the specific reason code assigned to a chargeback, AI can automatically compile the most compelling package of evidence—including proof of delivery, IP logs, and communication records—in compliance with network requirements. This automation dramatically reduces the time needed to prepare a defense, often moving resolution from days to minutes, and critically increases the success rate of overturning unjust chargebacks (friendly fraud). The adoption of Natural Language Processing (NLP) within these tools also aids in analyzing customer service transcripts and communication histories to better understand the root cause of a dispute, providing strategic data that merchants can use to refine business practices and product delivery, thereby preemptively minimizing future disputes arising from service deficiencies.

- AI enables dynamic, real-time transaction scoring, drastically lowering false positive decline rates.

- Machine Learning (ML) optimizes evidence collection and submission, significantly increasing dispute win rates against friendly fraud.

- Predictive analytics identify transactions with a high likelihood of resulting in a chargeback before settlement occurs, allowing for preemptive intervention.

- Natural Language Processing (NLP) analyzes customer interactions to identify service failures that precipitate legitimate disputes, informing operational improvements.

- Automation of case management reduces reliance on manual processes, cutting operational costs and speeding up the resolution timeline.

- AI-driven pattern recognition helps distinguish subtle differences between true fraud, friendly fraud, and technical errors, refining mitigation strategies.

- Continuous learning algorithms ensure the system adapts immediately to new fraud vectors and evolving card network rules, maintaining high accuracy.

- AI supports enhanced compliance by automatically formatting evidence packages according to specific requirements mandated by Visa, Mastercard, and other networks.

- Adoption of deep learning models facilitates advanced behavioral biometrics analysis for stronger customer authentication without friction.

- AI solutions provide granular reporting on chargeback drivers, segmenting data by product, region, time, and payment method for strategic insights.

DRO & Impact Forces Of Chargeback Management Software Market

The market for Chargeback Management Software is significantly influenced by a confluence of accelerating drivers (D), persistent restraints (R), substantial opportunities (O), and potent impact forces. Key drivers include the overwhelming growth of global e-commerce, which invariably increases the surface area for fraudulent transactions and customer disputes, coupled with the increasingly strict monitoring and penalty structure imposed by major card networks on merchants with high chargeback ratios. The rising prevalence of "friendly fraud," where legitimate cardholders initiate a chargeback falsely claiming non-receipt or unauthorized usage, is a powerful driver necessitating automated tools capable of providing compelling evidence for dispute resolution. Regulatory mandates like PSD2 in Europe, requiring enhanced security protocols, also push merchants towards sophisticated, integrated chargeback prevention and management solutions.

Conversely, market growth faces notable restraints. High implementation costs and complexity, particularly for advanced, AI-driven solutions, can deter Small and Medium-sized Enterprises (SMEs) which often operate on thin margins and possess limited technical integration capabilities. Another significant restraint is the fragmented nature of the global payment ecosystem; integration across numerous payment gateways, banks, and regional processors requires specialized expertise and can be technically challenging, leading to slower adoption rates in certain jurisdictions. Furthermore, the persistent lack of awareness or misclassification of chargeback management software as a purely reactive cost center, rather than a strategic profit protector, limits proactive investment among less technologically mature organizations, maintaining a resistance to comprehensive system overhaul.

Opportunities abound, primarily driven by the transition of chargeback management from an operational burden to a strategic function. The expanding global subscription economy presents a continuous revenue stream opportunity for providers, as recurring billing models are highly susceptible to disputes related to cancellation confusion or service quality issues. Moreover, the integration of chargeback solutions directly into ERP systems, Customer Relationship Management (CRM) platforms, and existing fraud prevention suites creates streamlined, high-value offerings. The massive untapped potential in emerging markets, where digital payments are rapidly outpacing traditional banking infrastructure, offers long-term growth prospects. Impact forces, such as the accelerating rate of digital transformation and the continuous evolution of sophisticated fraud tactics, ensure that the demand for cutting-edge, adaptive software solutions remains inelastic and essential for operational continuity.

Segmentation Analysis

The Chargeback Management Software Market is segmented based on deployment model, enterprise size, component, functionality, and end-use industry, providing a granular view of market dynamics and adoption patterns. The segmentation by deployment model clearly differentiates between cloud-based (SaaS) and on-premise solutions, with cloud deployment currently dominating due to its advantages in scalability, rapid updates, and accessibility, making it highly attractive to e-commerce merchants operating globally. Component segmentation typically includes software modules (focused on prevention, monitoring, and dispute management) and associated professional services, where consulting and implementation support add substantial value, particularly for large enterprises navigating complex cross-border regulations and system integrations.

Functionality segmentation is critical, highlighting the market's progression from basic dispute filing to sophisticated, predictive analytics. Core functionalities include transaction monitoring and screening, real-time risk scoring, automated dispute representation, and detailed chargeback reporting tools used for post-mortem analysis. The shift towards solutions that offer integrated, pre-chargeback intervention—such as alerts and customer engagement tools designed to resolve disputes before they escalate to formal chargebacks—represents the highest growth area. This focus on prevention is vital for maintaining merchant processing accounts in good standing and minimizing the long-term financial impact associated with high chargeback ratios and penalty fees imposed by card networks.

In terms of enterprise size, the market is categorized into large enterprises and Small and Medium-sized Enterprises (SMEs). While large corporations represent the bulk of revenue due to their high transaction volumes and greater capacity for investment in customized solutions, the SME segment is anticipated to exhibit faster CAGR, driven by the increasing availability of modular, subscription-based chargeback tools designed specifically for smaller-scale digital operations. End-use industries are diverse, covering retail and e-commerce, travel and hospitality, digital goods and services (including gaming and streaming), and financial institutions, each requiring specialized rulesets and integration points tailored to their unique risk profiles and transactional behaviors.

- By Deployment Model:

- Cloud-Based (SaaS)

- On-Premise

- By Enterprise Size:

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

- By Component:

- Software (Prevention, Dispute Management, Reporting)

- Services (Consulting, Integration, Managed Services)

- By Functionality:

- Pre-Chargeback Prevention (Alerts, Risk Scoring)

- Dispute Management and Representation

- Data Analysis and Reporting

- By End-Use Industry:

- Retail and E-commerce

- Digital Goods and Services (Streaming, Gaming)

- Travel and Hospitality

- Financial Institutions and Payment Processors

- Telecommunications

Value Chain Analysis For Chargeback Management Software Market

The value chain for the Chargeback Management Software Market begins with the upstream activities of core technology development, focusing heavily on building robust AI/ML algorithms, securing data infrastructure, and obtaining necessary certifications for payment security compliance (e.g., PCI DSS). Upstream providers include specialized data science firms, cybersecurity vendors, and core software developers responsible for creating the foundational intellectual property that powers the dispute resolution mechanisms and real-time monitoring capabilities. Access to high-quality, diverse historical transaction and fraud data is a critical input in this stage, essential for training the predictive models that underpin modern chargeback prevention systems. Maintaining cutting-edge technology requires continuous investment in R&D to adapt to constantly evolving fraud methodologies and card network regulation updates.

The midstream segment involves software customization, integration, and delivery. This phase includes tailoring the SaaS platform to meet specific merchant needs, such as integrating with various e-commerce platforms (Shopify, Magento), existing payment gateways (Stripe, Adyen), and internal ERP systems. Distribution channels are predominantly direct, involving direct sales teams engaging with high-volume merchants and financial institutions. However, indirect channels, such as partnerships with payment processors, third-party fraud solution providers, and system integrators, are becoming increasingly vital. These partnerships allow the software vendor to reach a broader base of potential customers who are already using a partner's infrastructure, facilitating seamless deployment and integrated billing solutions. The provision of specialized professional services, including risk consulting and managed chargeback defense, often accompanies the core software sale.

Downstream activities focus on the end-user adoption and support ecosystem. End-users are primarily merchants, acquiring banks, and payment service providers who utilize the software to reduce financial losses and operational overhead. The effectiveness of the software is measured by key performance indicators (KPIs) such as chargeback win rates, reduction in chargeback ratios, and time-to-resolution. Continuous customer support, training, and rapid response to implementation challenges are crucial for retaining clients. Feedback loops from the downstream users inform upstream development, ensuring the software remains effective against emerging fraud trends. The overall efficiency of the distribution channel—whether direct sales or via integrated partnerships—determines the speed of market penetration and the total cost of acquiring new enterprise clients in this competitive software segment.

Chargeback Management Software Market Potential Customers

The primary consumers and end-users of Chargeback Management Software are organizations that handle high volumes of digital transactions, where the risk of financial loss from fraudulent or disputed transactions is substantial. The most immediate potential customers are large-scale e-commerce retailers, particularly those engaging in cross-border sales, who face complex regulatory requirements and heightened exposure to both criminal and friendly fraud. These retailers require robust, scalable solutions capable of integrating deeply with diverse payment processors and international shipping logistics. Furthermore, subscription-based businesses, including Software-as-a-Service (SaaS) providers, streaming services, and online gaming platforms, represent a critical customer segment, as recurring billing models generate high rates of disputes related to customer confusion over cancellations or perceived unauthorized charges, necessitating specialized recurring transaction management tools.

Financial institutions, specifically acquiring banks and payment service providers (PSPs), constitute another major segment of potential customers. These entities are directly responsible for managing their merchant portfolios' chargeback ratios and are often penalized by card networks when these ratios exceed established thresholds. Therefore, they invest heavily in sophisticated chargeback prevention and dispute resolution software, often offering these tools as value-added services to their own merchant clients to foster loyalty and ensure regulatory compliance. The demand from financial technology (FinTech) startups and neo-banks, focused on rapid digital expansion, is also growing, as they require reliable risk mitigation infrastructure from inception to handle exponential transaction growth while maintaining compliance standards.

Beyond traditional e-commerce, the travel and hospitality industry, including online travel agencies (OTAs) and airlines, are significant users, driven by the high monetary value of their transactions and the vulnerability to fraud related to identity theft and non-delivery of services claims. Other specialized sectors, such as digital content distributors, online education providers, and telecommunications companies, also represent strong potential customer bases. The unifying characteristic among all these potential customers is the critical need to automate the labor-intensive chargeback process, maximize revenue recovery, and protect their merchant accounts health—making the investment in comprehensive chargeback management software a strategic necessity for sustainable digital operations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $350 Million USD |

| Market Forecast in 2033 | $1,250 Million USD |

| Growth Rate | 19.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Chargebacks911, Midigator (Imprint), Kount (Equifax), Verifi (Visa), Ethoca (Mastercard), SEON, Riskified, Forter, Ravelin, Sift, ACI Worldwide, PayPal (Braintree Protect), ClearSale, Fi911, Accertify (American Express), Dispute Defender, Merchant Consulting Group, Chargeback.com, Riskonnect, Worldpay from FIS |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Chargeback Management Software Market Key Technology Landscape

The technology landscape within the Chargeback Management Software Market is characterized by a strong convergence of advanced analytics, artificial intelligence, and deep integration capabilities across the payment stack. Central to these solutions are sophisticated Machine Learning (ML) models, which are continuously trained on vast datasets of transactional history, fraud attempts, and historical dispute outcomes. These models enable predictive risk scoring, allowing merchants to assess the probability of a transaction leading to a chargeback in real-time. This predictive capability moves the software beyond mere reactive processing to proactive intervention, such as implementing step-up authentication or delaying fulfillment until risk is mitigated, often leveraging specialized algorithms designed specifically to isolate and combat "friendly fraud" with high precision.

Another crucial technological element is robust API-driven integration. Modern chargeback management platforms must seamlessly connect with a multitude of payment gateways, acquiring banks, e-commerce platforms (e.g., headless commerce systems), and customer data repositories (CRM). This interoperability is achieved through standardized, low-latency APIs, facilitating the automated collection of compelling evidence necessary for chargeback representation, such as proof of usage, device identification data, and geo-location metrics. Cloud-native architecture, typically employing microservices and serverless computing, is the preferred deployment model, offering the elasticity required to handle the volatile, high-volume transaction loads characteristic of global e-commerce peaks and ensure high availability and data redundancy.

Furthermore, the incorporation of Card Network Alert Systems (like Visa's VROL and Mastercard's Ethoca Alerts) technology is foundational. These proprietary integrations allow merchants to receive early warning notifications of impending disputes, enabling them to issue a refund or contact the customer to resolve the issue before a formal chargeback is filed. This 'preventative alert' technology is essential for mitigating chargeback counts and preventing detrimental impacts on merchant account health. Finally, advancements in tokenization and cryptographic security protocols ensure that sensitive payment information handled during the dispute resolution process remains protected, adhering to stringent global data security and privacy standards, including GDPR and CCPA, while ensuring the integrity of the evidence presented.

Regional Highlights

Regional dynamics heavily influence the adoption and maturity of Chargeback Management Software, reflecting differences in e-commerce penetration, regulatory scrutiny, and fraud prevalence. North America, encompassing the United States and Canada, stands as the most mature and dominant market segment. This region benefits from an advanced digital economy, high consumer spending, and a prevalent culture of credit card usage, which inherently leads to high chargeback volumes, especially friendly fraud. The presence of numerous key industry vendors, coupled with aggressive investment in AI and FinTech infrastructure, solidifies its leadership. North American merchants, facing high regulatory pressure from card networks to maintain low chargeback ratios, are compelled to adopt sophisticated, automated solutions quickly, thereby driving continuous innovation in the regional market.

Europe represents the second-largest market, characterized by strict regulatory oversight, particularly the Payment Services Directive (PSD2), which mandates Strong Customer Authentication (SCA). While SCA aims to reduce traditional fraud, it sometimes introduces transactional friction, which necessitates advanced risk scoring to prevent false declines. European businesses, dealing with multiple currencies and diverse national regulations within the EU framework, require highly flexible and localized chargeback management solutions. The UK, Germany, and France are the largest contributors to the European segment, driven by large digital retail sectors and a high adoption rate of SaaS solutions tailored for cross-border e-commerce complexities and ensuring GDPR compliance in data handling.

The Asia Pacific (APAC) region is forecasted to be the fastest-growing market globally. This exponential growth is underpinned by rapid digital transformation, burgeoning mobile payment adoption, and the massive scale of e-commerce markets in China, India, and Southeast Asia. While fraud types vary regionally, the sheer volume of new digital transactions creates immense demand for scalable chargeback prevention infrastructure. Localized technology providers are emerging alongside global players to address specific regional payment methods and regulatory nuances. Growth in Latin America (LATAM) and the Middle East & Africa (MEA) is driven by increasing financial inclusion and rising digital penetration, though these regions are still developing foundational payment infrastructure, leading to a focus on essential fraud prevention solutions before fully adopting complex chargeback representation systems.

- North America: Market leader due to advanced e-commerce infrastructure, high credit card usage, and stringent card network regulations imposing penalties for high chargeback rates. High adoption of AI-driven solutions to combat sophisticated friendly fraud.

- Europe: Driven by compliance with PSD2 and Strong Customer Authentication (SCA) requirements. Focus on solutions that balance security with low transactional friction, maintaining GDPR compliance across highly fragmented national markets.

- Asia Pacific (APAC): Highest projected CAGR, propelled by explosive growth in mobile payments and e-commerce penetration in high-volume markets like China and India. Growing emphasis on integrating chargeback management with diverse local payment methods.

- Latin America (LATAM): Emerging market characterized by rapid growth in digital banking and increasing fraud rates. Demand is focused on foundational risk scoring and fraud prevention tools, with slower but accelerating adoption of full dispute management suites.

- Middle East and Africa (MEA): Growth stimulated by government initiatives for digital transformation and increasing cross-border trade. Need for solutions capable of handling transactions in volatile economic environments and addressing regional security concerns.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Chargeback Management Software Market.- Chargebacks911

- Midigator (Imprint)

- Kount (Equifax)

- Verifi (Visa)

- Ethoca (Mastercard)

- Riskified

- Forter

- Ravelin

- Sift

- ACI Worldwide

- ClearSale

- Fi911

- Accertify (American Express)

- Dispute Defender

- Chargeback.com

- Global Risk Technologies

- Radial (Bpost)

- LexisNexis Risk Solutions

- Plaid

- Worldpay from FIS

Frequently Asked Questions

Analyze common user questions about the Chargeback Management Software market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between fraud prevention software and chargeback management software?

Fraud prevention software focuses on blocking suspicious transactions prior to authorization to prevent financial loss and fraud. Chargeback management software is specialized for post-transaction activities, primarily automating the process of disputing chargebacks that have already occurred (dispute representation) and analyzing root causes to prevent future occurrences, especially focusing on friendly fraud.

How does "friendly fraud" impact merchants, and can chargeback software effectively address it?

Friendly fraud occurs when a legitimate customer makes a purchase and then falsely disputes the charge, leading to revenue loss and high chargeback ratios. Advanced chargeback software utilizes forensic data and AI analysis to compile compelling evidence (proof of delivery, usage logs) to successfully challenge and overturn friendly fraud claims, significantly recovering lost revenue.

What are the key benefits of using a cloud-based (SaaS) chargeback solution over an on-premise system?

Cloud-based SaaS solutions offer superior scalability, lower upfront costs, faster deployment, and automatic, continuous updates to address new fraud patterns and regulatory changes, making them the preferred choice for global e-commerce merchants requiring agility and reduced IT overhead.

How do card network alert systems integrate into chargeback management strategies?

Alert systems like Verifi (Visa) and Ethoca (Mastercard) provide early notifications of a potential dispute before it becomes a formal chargeback. Chargeback software integrates these alerts to enable merchants to issue a proactive refund immediately, thus preventing the chargeback from negatively impacting their official chargeback ratio and avoiding associated penalties.

Is Chargeback Management Software primarily focused on recovering lost revenue or maintaining compliance?

The software serves both critical functions. While revenue recovery is the immediate goal, the strategic focus is on maintaining regulatory compliance and preserving merchant account health by keeping chargeback ratios below mandated thresholds. Failure to maintain compliance can result in substantial fees or the inability to process payments, posing an existential risk to digital businesses.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager