Cheesecake Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431751 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Cheesecake Market Size

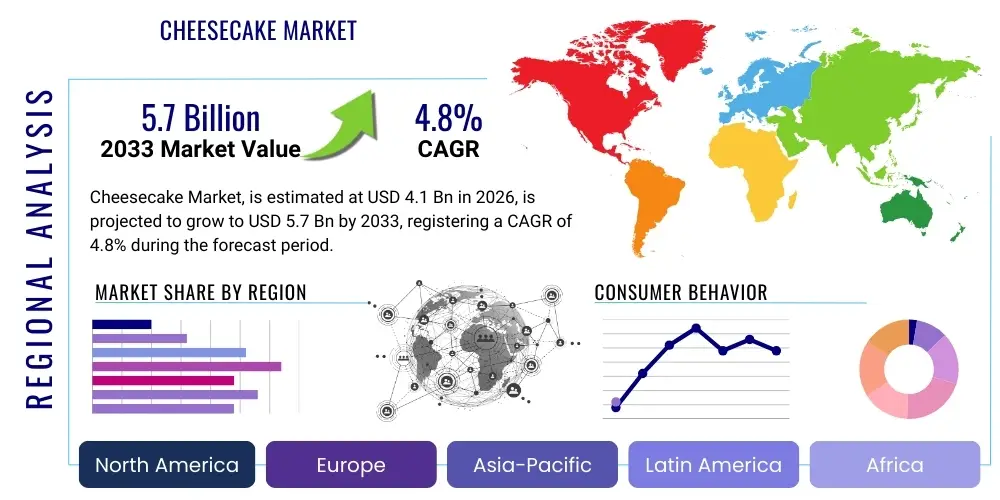

The Cheesecake Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. This robust expansion is fueled by evolving consumer preferences for indulgence, the rising popularity of gourmet desserts across emerging economies, and the continuous introduction of innovative flavors and formats by key market players. The market is estimated at USD 4.1 Billion in 2026 and is projected to reach USD 5.7 Billion by the end of the forecast period in 2033, demonstrating stable demand across retail and food service sectors globally.

Cheesecake Market introduction

The Cheesecake Market encompasses the manufacturing, distribution, and sale of cheesecakes, which are sweet desserts consisting of one or more layers, typically a base made from crushed biscuits, graham crackers, or pastry, topped with a thick filling made of soft, fresh cheese (usually cream cheese, ricotta, or Neufchâtel), eggs, and sugar. These products range from traditional baked varieties to chilled, no-bake, and frozen formats, catering to diverse consumption occasions from celebratory events to daily indulgence. Major applications span commercial food service (restaurants, cafes, hotels) and retail consumption (supermarkets, convenience stores, online platforms).

The primary benefits driving market penetration include the high level of consumer satisfaction derived from indulgent dessert options, the convenience offered by pre-made and frozen products, and the versatility of cheesecakes which allows for extensive customization in terms of flavor profiles (e.g., fruit, chocolate, savory) and dietary modifications (e.g., gluten-free, low-sugar). Furthermore, cheesecakes often command a premium price point, offering attractive margins for manufacturers and retailers, incentivizing innovation in both production techniques and marketing strategies across different geographical regions.

Key driving factors accelerating market growth include increasing disposable incomes in Asia Pacific, the globalization of Western dessert culture, particularly in urban centers, and strategic marketing emphasizing the quality and artisan nature of gourmet cheesecake offerings. The surge in online food delivery platforms has also significantly boosted accessibility, enabling consumers to purchase high-quality desserts directly to their homes, thereby expanding the market reach beyond traditional brick-and-mortar establishments.

Cheesecake Market Executive Summary

The Cheesecake Market is characterized by intense competition and a strong focus on product differentiation through flavor innovation and ingredient quality. Business trends indicate a pivot towards premiumization, with consumers increasingly willing to pay more for cheesecakes made with authentic, locally sourced, or natural ingredients, responding to the broader clean label movement. Strategic mergers, acquisitions, and partnerships aimed at strengthening distribution networks and accessing niche markets, such as vegan or specialized dietary segments, remain prominent competitive strategies among leading global manufacturers.

Regional trends highlight North America and Europe as established markets exhibiting steady, value-driven growth, propelled by strong brand loyalty and sophisticated cold chain logistics. Conversely, the Asia Pacific region, particularly countries like China and India, presents the highest growth opportunities, driven by rapid urbanization, Western influence on culinary tastes, and the expansion of modern retail infrastructure. Demand for single-serve and portion-controlled cheesecakes is particularly strong in urban APAC environments, reflecting changing consumption patterns focused on convenience.

Segmentation trends reveal robust growth in the fruit-flavored and seasonal cheesecake categories, aligning with consumer demand for freshness and novelty. The distribution channel segment is seeing significant structural change, with the e-commerce sector experiencing explosive growth, especially for direct-to-consumer sales of specialty and customized cheesecakes. Furthermore, there is a substantial uptick in the development and marketing of frozen cheesecake varieties, which offer extended shelf life and operational efficiency for both retailers and food service operators seeking to minimize waste and ensure consistent product availability.

AI Impact Analysis on Cheesecake Market

Common user questions regarding AI's impact on the Cheesecake Market primarily revolve around how AI can enhance supply chain efficiency, optimize flavor creation, and personalize consumer experiences. Users frequently inquire about AI-driven predictive analytics for forecasting seasonal demand shifts, especially concerning holiday-specific flavors or limited-time offerings. There is significant interest in using machine learning algorithms to analyze consumer feedback data (from social media, reviews, and transactional history) to identify unmet needs and emerging flavor trends, allowing manufacturers to reduce time-to-market for new products. Concerns often center on the ethical implications of data collection and whether AI-driven automation might reduce the perceived artisan quality of premium cheesecakes.

- AI-driven predictive demand forecasting optimizes inventory management, reducing spoilage of perishable ingredients (cream cheese, fresh fruit).

- Machine Learning (ML) algorithms analyze consumer sensory data and flavor pairings to suggest innovative, market-ready cheesecake recipes, enhancing R&D efficiency.

- Automated quality control systems utilizing computer vision ensure product consistency in size, texture, and topping application during mass production.

- AI personalization engines recommend specific cheesecake flavors or customization options to individual consumers on e-commerce platforms, improving conversion rates.

- Optimization of cold chain logistics and distribution routes using AI minimizes energy consumption and maintains optimal freezing temperatures during transport.

DRO & Impact Forces Of Cheesecake Market

The Cheesecake Market is fundamentally driven by high consumer demand for indulgent desserts and sweet treats, underpinned by stable macroeconomic factors such as rising global middle-class populations and increased discretionary spending on premium food items. Innovation in flavor profiles, including the incorporation of exotic fruits, spices, and unique textured inclusions, sustains consumer interest and fosters repeat purchases. Additionally, the operational efficiency improvements brought about by advanced food processing technologies, allowing for consistent quality and scalable production of both baked and no-bake variants, significantly reduce production costs and expand market accessibility.

Restraints primarily stem from regulatory challenges related to ingredient sourcing, particularly dairy prices volatility, and stringent food safety standards required for dairy and egg-based products. Furthermore, increasing consumer awareness regarding health and wellness poses a structural challenge, prompting demand for healthier alternatives, though many consumers still prioritize taste over nutritional content when selecting desserts. The high sugar and calorie content of traditional cheesecakes necessitate ongoing R&D investment into reformulations (e.g., reduced sugar, use of alternative sweeteners) to mitigate consumer pushback and comply with emerging public health initiatives targeting caloric intake.

Opportunities for expansion are largely concentrated in emerging markets, where rapid growth in modern retail formats provides new avenues for product placement. Developing functional cheesecakes, incorporating probiotics, high protein content, or utilizing plant-based dairy substitutes, offers lucrative pathways to capture the health-conscious demographic. The strategic utilization of digital marketing and social media engagement to showcase product aesthetics and promote limited-edition collaborative flavors also presents a substantial opportunity to build brand loyalty and generate buzz among younger consumer segments. The impact forces are characterized by moderate product intensity, high competitive rivalry, and increasing bargaining power of health-focused consumers demanding transparency and better nutritional value from indulgent products.

Segmentation Analysis

The Cheesecake Market is strategically segmented based on factors such as flavor, type, distribution channel, and application, allowing manufacturers to tailor their offerings to specific consumer needs and operational requirements. Flavor segmentation remains paramount, defining the core product appeal, with traditional flavors like Original/Plain and Chocolate serving as market staples, while fruit and seasonal varieties drive episodic sales spikes. The bifurcation between baked and unbaked (no-bake) types reflects consumer preference for texture and richness, influencing product shelf stability and requiring distinct production methods and ingredient sets.

Further analysis of the distribution channels reveals a continuous shift toward retail sales, especially via large supermarket chains and hypermarkets offering convenience and bulk purchase options. However, the food service segment, comprising restaurants, specialized dessert shops, and cafes, is crucial for establishing premium brand image and showcasing innovative flavor combinations that often penetrate the retail market later. Understanding these segmented dynamics is essential for effective market entry, targeted marketing campaigns, and optimizing supply chain logistics to meet the distinct demands of commercial versus household consumption applications.

- Flavor:

- Original/Plain

- Chocolate

- Fruit (Strawberry, Blueberry, Raspberry, Lemon)

- Seasonal & Specialty (Pumpkin, Red Velvet, Caramel Pecan)

- Type:

- Baked Cheesecake

- No-Bake Cheesecake

- Frozen Cheesecake

- Distribution Channel:

- Food Service (Restaurants, Cafes, Bakeries, Hotels)

- Retail (Supermarkets/Hypermarkets, Convenience Stores, Specialty Food Stores, Online Retail)

- Application:

- Commercial Use (Bulk Sales, Catering)

- Household Consumption (Direct Consumer Purchase)

Value Chain Analysis For Cheesecake Market

The Value Chain for the Cheesecake Market begins with the upstream procurement of critical raw materials, primarily high-quality dairy products (cream cheese, butter), sugar, eggs, and flour for the crusts, alongside flavorings and stabilizers. This stage is highly sensitive to commodity price fluctuations and requires rigorous quality control and specialized cold storage facilities to maintain ingredient integrity. Key activities in the upstream segment include establishing long-term contracts with large-scale dairy farms and specialized ingredient suppliers, ensuring adherence to food safety certifications and sustainability standards, which increasingly influence brand reputation and consumer purchasing decisions.

Midstream activities involve the complex manufacturing and processing stages, including batter preparation, baking (for traditional varieties), freezing, and packaging. This stage demands specialized equipment—such as large-scale mixers, industrial ovens, and advanced rapid-freezing tunnels—to achieve consistent texture and quality while maintaining high volume output. Efficiency in this segment is paramount; modern manufacturers utilize automated mixing and portioning systems to minimize human error and contamination risk. Effective quality assurance protocols, including sensory testing and microbiological analysis, are integrated throughout the production cycle to meet stringent international food standards.

Downstream analysis focuses on the distribution channels, which are crucial due to the perishable nature of the product. The cold chain logistics network, involving refrigerated transport and specialized warehousing, is essential for delivering products to market, whether directly to food service operators (B2B) or through retail chains (B2C). Distribution channels are increasingly segmented into traditional retail, specialty bakeries, and the burgeoning e-commerce sector. Direct and indirect distribution strategies are employed; large players often use indirect methods through national distributors and brokers to reach mass markets, while smaller, artisan brands may opt for direct sales via online platforms or dedicated physical storefronts to control brand experience and pricing.

Cheesecake Market Potential Customers

Potential customers for the Cheesecake Market encompass a wide demographic spectrum, segmented primarily by consumption occasion, disposable income, and dietary requirements. End-users typically fall into two broad categories: commercial buyers (food service operators) and household consumers. Commercial buyers, including high-end restaurants, hotel chains, and catering services, seek bulk orders of high-quality, consistently sized, and often customized cheesecakes that can be easily plated or served as part of a varied dessert menu. Their purchasing decisions are heavily influenced by supplier reliability, price stability, and ease of preparation or thawing.

Household consumers represent the largest volume segment and are diverse, ranging from individuals purchasing single slices for immediate consumption to families buying whole cakes for celebrations, holidays, or weekend treats. Key subsets include younger consumers (Gen Z and Millennials) who drive demand for novel, visually appealing flavors promoted through social media, and older consumers who prefer established, classic flavors and value brand heritage and reliability. Furthermore, the rising number of consumers with specific dietary needs, such as lactose intolerance or gluten sensitivity, constitutes a growing potential customer base actively seeking specialized, allergen-free or plant-based cheesecake alternatives.

Targeted marketing efforts are focused on identifying these distinct buying behaviors. For example, marketing to food service clients emphasizes operational benefits such as extended shelf life of frozen products and labor savings, while marketing to household consumers focuses on emotional appeal, indulgence, and the celebratory nature associated with premium desserts. The expansion of online ordering and delivery services has also created a significant potential customer base of urban dwellers prioritizing convenience and seeking immediate access to gourmet dessert options, often leading to impulse purchases.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.1 Billion |

| Market Forecast in 2033 | USD 5.7 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | The Cheesecake Factory, Sara Lee Frozen Bakery, Eli's Cheesecake, Junior's Cheesecake, Harry & David, Pepperidge Farm, Goya Foods, Flowers Foods, Entenmann's, Nestle, F&N, Grupo Bimbo, Bakkavor Group, Dawn Foods, General Mills, CSM Bakery Solutions, Rich Products, Barry Callebaut, Del Monte Foods, Costco Wholesale (Kirkland) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cheesecake Market Key Technology Landscape

The technology landscape within the Cheesecake Market is primarily focused on achieving manufacturing consistency, extending shelf life, and ensuring food safety across large-scale production facilities. Advanced food processing technologies are crucial, particularly specialized baking equipment that ensures uniform heat distribution to prevent cracking and uneven texture in baked cheesecakes, a common quality defect. Furthermore, rapid freezing and cryogenic technology, utilizing liquid nitrogen or high-speed blast freezers, are increasingly deployed to minimize ice crystal formation, preserving the smooth texture and flavor profile of frozen cheesecakes, making them virtually indistinguishable from freshly prepared products upon thawing.

Automation and robotics play a pivotal role in handling the delicate products, particularly in the precision topping and decoration stages. Automated depositing systems ensure accurate and consistent layering of ingredients, while robotic arms handle packaging and placement into trays, reducing labor costs and improving hygiene standards. Sensor technology is integrated into the production line to monitor critical control points, such as temperature, moisture content, and pH levels, providing real-time data crucial for quality assurance and minimizing batch variations, thereby satisfying the stringent demands of commercial customers.

Beyond the factory floor, digitalization is transforming the supply chain. Companies are adopting sophisticated Enterprise Resource Planning (ERP) systems integrated with Cold Chain Management software to track inventory, manage ingredient traceability, and optimize distribution logistics. This integration, often leveraging IoT sensors placed within refrigerated transportation units, ensures regulatory compliance and provides end-to-end visibility, critical for managing highly perishable products. The adoption of sustainable packaging technologies, including biodegradable and recyclable materials, is also a growing technological focus, responding to both regulatory pressures and consumer demand for environmentally responsible products.

Regional Highlights

- North America: This region holds a dominant market share, driven by strong consumer purchasing power, a deeply ingrained dessert culture, and the presence of major global cheesecake brands and specialty retailers like The Cheesecake Factory. The market here is mature but experiences continuous innovation, particularly in ready-to-eat and frozen segments, alongside high demand for holiday and seasonal flavors. Focus is shifting towards healthy indulgence, driving research into portion control and reduced-sugar recipes.

- Europe: Characterized by diverse consumer preferences, with strong regional traditions influencing flavor profiles, such as the preference for ricotta-based or yogurt-based cheesecakes in Mediterranean countries. Western Europe maintains steady growth, emphasizing artisan quality and clean-label ingredients. The key trend involves premiumization and the growth of private-label offerings within major European supermarket chains.

- Asia Pacific (APAC): The fastest-growing region, fueled by rapid economic expansion and the increasing westernization of diets among urban populations, particularly in China, South Korea, and India. Local adaptation is crucial; manufacturers introduce less intensely sweet or distinctly local flavors (e.g., green tea, mango) to appeal to local palates. The expansion of organized retail and QSR chains is the primary driver of commercial sales volume.

- Latin America (LATAM): Growth is steady but faces challenges related to cold chain infrastructure reliability and economic volatility impacting commodity prices. The market primarily targets mid-to-high income segments, with artisanal bakeries holding significant influence alongside imported frozen brands. Opportunities exist through modernizing distribution networks and establishing localized production facilities.

- Middle East and Africa (MEA): Emerging markets show promising potential, particularly in the GCC countries, where high disposable income and a strong culture of hospitality drive demand for high-end desserts in hotels and catering services. Growth is contingent on investment in efficient cold chain logistics and addressing unique consumption patterns during major religious or cultural festivals.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cheesecake Market.- The Cheesecake Factory

- Sara Lee Frozen Bakery

- Eli's Cheesecake

- Junior's Cheesecake

- Harry & David

- Pepperidge Farm

- Goya Foods

- Flowers Foods

- Entenmann's

- Nestle

- F&N

- Grupo Bimbo

- Bakkavor Group

- Dawn Foods

- General Mills

- CSM Bakery Solutions

- Rich Products

- Barry Callebaut

- Del Monte Foods

- Costco Wholesale (Kirkland)

Frequently Asked Questions

Analyze common user questions about the Cheesecake market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the growth of the frozen cheesecake segment globally?

The frozen cheesecake segment is primarily driven by enhanced cold chain logistics, consumer demand for extended shelf life and convenience, and technological improvements in freezing processes that preserve taste and texture effectively, making high-quality desserts readily accessible.

Which geographical region offers the highest growth potential for cheesecake manufacturers?

The Asia Pacific (APAC) region, particularly emerging economies like China and India, offers the highest growth potential due to rapid westernization of dietary habits, increasing urbanization, and expanding modern retail infrastructure facilitating greater product availability.

How are health and wellness trends impacting the traditional cheesecake recipe?

Health and wellness trends are forcing manufacturers to innovate by developing reduced-sugar, low-calorie, and alternative-dairy (e.g., plant-based) cheesecake variants. While traditional indulgence remains strong, focus is increasing on cleaner labels and functional ingredients to attract health-conscious consumers.

What are the primary raw material cost pressures affecting the Cheesecake Market?

The primary cost pressures are associated with the volatile pricing of essential dairy ingredients, particularly cream cheese and butter, as well as eggs and specialized sweeteners. Supply chain disruptions and global commodity market fluctuations significantly impact manufacturers' operating margins.

What role does e-commerce play in the distribution of premium cheesecakes?

E-commerce is critical for premium cheesecakes, facilitating direct-to-consumer sales, personalized customization, and nationwide delivery. Specialized packaging and reliable chilled delivery services allow niche, high-end brands to bypass traditional retail limitations and access a broader consumer base.

The extensive analysis of the Cheesecake Market demonstrates a dynamic environment driven by consumer desire for premium, indulgent experiences, balanced against increasing scrutiny regarding nutritional content. Strategic technological investments in production efficiency, quality control, and cold chain logistics are essential for competitive advantage. The future growth trajectory hinges significantly on successful flavor innovation and strategic market entry into high-growth APAC economies, coupled with effective mitigation of raw material price volatility. Continuous adaptation to evolving distribution channels, especially e-commerce, and proactive response to the demand for specialized dietary products, such as plant-based alternatives, will define market leadership in the forecast period.

Manufacturers must prioritize sustainability initiatives across the value chain, from ethical sourcing of dairy to eco-friendly packaging solutions, aligning with global corporate social responsibility trends. Furthermore, leveraging AI and data analytics to anticipate hyper-localized flavor preferences and optimize promotional activities will be crucial for maintaining relevance in highly saturated markets. The competitive landscape requires robust brand building and portfolio diversification to capture both the mass retail convenience segment and the high-margin, specialized food service sector. The inherent appeal of cheesecake as a celebratory and comfort food ensures sustained underlying demand, making strategic investment in infrastructure and product development a sound long-term decision.

The market structure favors integrated players capable of managing complex cold supply chains and investing heavily in automation to ensure product consistency at scale. The trend toward experiential dining and the rise of boutique bakeries specializing in artisan cheesecakes underscore the dual nature of the market—catering both to mass convenience and individualized gourmet preferences. Successful market penetration relies on a deep understanding of these segmented needs and the ability to execute targeted marketing campaigns that resonate with distinct demographic groups, emphasizing either speed and value or quality and novelty. Final considerations involve navigating evolving international trade regulations and tariffs that could impact cross-border ingredient sourcing and finished product distribution, requiring adaptable sourcing and manufacturing footprints across core operating regions.

The demand for innovative fruit pairings, regional spice combinations, and hybrid desserts incorporating cheesecake elements (e.g., cheesecake bars, bites, or inclusions in other desserts) shows no sign of slowing. This relentless pursuit of novelty necessitates flexible production lines and agile R&D processes. Moreover, the adoption of advanced shelf-life extension techniques for chilled and baked varieties allows retailers to manage inventory more effectively, reducing waste and contributing to overall profitability. The increasing influence of social media food influencers and content creators further amplifies product visibility, making visually appealing and photogenic cheesecake creations a key marketing tool, especially targeting younger, digitally native consumers globally. This aesthetic appeal translates directly into consumer purchasing behavior across both physical and digital retail environments.

In terms of operational dynamics, the emphasis on vertical integration, particularly securing reliable and cost-effective cream cheese supply, is becoming a decisive competitive factor. Companies that successfully hedge against dairy commodity price fluctuations through forward contracts or internal sourcing capabilities are better positioned to maintain stable pricing and profit margins, crucial during periods of economic uncertainty. Furthermore, the rising energy costs associated with maintaining the extensive cold chain network represent a significant operational challenge. Thus, investments in energy-efficient refrigeration technologies and optimized transportation routes are necessary not only for environmental compliance but also for core business profitability, reinforcing the importance of sophisticated logistics management systems throughout the cheesecake market value proposition.

Regulatory adherence remains a non-negotiable aspect of market operation, particularly concerning ingredient labeling, allergen declaration, and nutritional facts panels. As governments worldwide implement stricter guidelines regarding sugar content and trans fats, manufacturers are constantly pressured to reformulate products while maintaining the sensory characteristics that define cheesecake indulgence. This regulatory push often necessitates substantial R&D expenditure into novel ingredients and processing techniques. The successful navigation of these regulatory environments, coupled with a transparent communication strategy regarding ingredient sourcing and nutritional profiles, strengthens consumer trust and enhances brand equity in a highly competitive food sector.

The evolution of packaging technology is also central to market growth, moving beyond mere preservation to include functionality and sustainability. Innovations such as single-serve, tamper-evident containers and microwave-safe packaging (for certain variants) cater to the convenience-focused consumer. Simultaneously, manufacturers are exploring advanced materials that minimize environmental impact, such as compostable or fully recyclable plastic alternatives and reduced-material designs, responding to the growing consumer preference for sustainable consumption. This focus on environmentally conscious operations is transitioning from a niche requirement to a standard expectation across major global retail partners, necessitating significant capital outlay in new packaging infrastructure and processes.

Lastly, strategic alliances between cheesecake producers and major coffee shop chains or Quick Service Restaurants (QSRs) are proving highly effective for product penetration, particularly in high-traffic urban locations. These partnerships offer manufacturers consistent bulk demand and exposure to a broad consumer base seeking dessert items as part of an immediate consumption occasion. This commercial channel, driven by impulse purchases and curated menu offerings, complements the retail sector and helps stabilize overall market demand, providing manufacturers with diverse revenue streams and enhanced resilience against fluctuations in household consumer spending patterns.

The integration of advanced supply chain visibility tools, enabled by blockchain technology, is emerging as a potential differentiator, especially in markets where consumers demand high transparency regarding ingredient origins (e.g., organic dairy, fair trade cocoa). While nascent in the cheesecake sector, blockchain offers an immutable ledger for tracking ingredients from farm to factory to consumer, enhancing both food safety recall capabilities and marketing claims related to provenance and ethical sourcing. Early adopters of these transparency technologies are expected to gain a significant competitive edge among conscientious consumer segments, particularly in affluent North American and European markets where ethical consumption is a rising priority. This technological investment underscores the increasing complexity required to compete effectively in the modern global dessert market.

The market dynamics are further shaped by the cyclical nature of agricultural outputs, which directly impacts the cost and availability of key dairy components. Manufacturers must employ sophisticated risk management strategies, including comprehensive commodity hedging, to buffer the business from unexpected price spikes caused by environmental factors or geopolitical instability. Failure to manage these external raw material risks can lead to abrupt and substantial changes in pricing strategies, potentially eroding brand loyalty among price-sensitive consumers. Therefore, operational excellence in procurement and financial risk mitigation is as crucial as product innovation in sustaining long-term market profitability in the cheesecake industry.

Furthermore, the segmentation by Type, specifically the distinction between baked and no-bake variants, dictates operational complexity and market positioning. Baked cheesecakes generally require longer production cycles, higher energy input, and specialized skill, often positioning them in the premium or artisan segment. Conversely, no-bake cheesecakes, while requiring precise ingredient formulation for stability, typically offer faster production times and lower energy costs, making them popular for high-volume retail and private-label production. Successful companies strategically manage a portfolio that maximizes the benefits of both types, catering to both the perceived value and the convenience needs of the diverse global consumer base.

In summary, the cheesecake market is defined by a delicate balance between tradition and technological advancement. While the core product satisfies deep-seated consumer desires for indulgence, sustained success requires continuous investment in cold chain management, responsible sourcing, digital commerce capabilities, and relentless, data-driven flavor innovation. Addressing the twin challenges of health consciousness and operational efficiency will be pivotal for market growth and the realization of the projected USD 5.7 Billion valuation by 2033.

Geopolitical stability and trade agreements also play an undeniable role in the flow of essential ingredients, impacting production costs particularly for manufacturers operating across multiple continents. For example, trade barriers affecting sugar, wheat, or specialized imported flavorings can quickly disrupt regional production economics. Large multinational cheesecake producers often maintain decentralized production hubs to mitigate this risk, ensuring local sourcing and manufacturing flexibility that allows them to navigate complex regulatory landscapes while minimizing delivery times and carbon footprint, aligning with global logistics best practices.

The commercial application segment is exhibiting a shift towards customization and bulk convenience. Food service providers increasingly demand ready-to-serve, pre-portioned cheesecakes that minimize labor and ensure consistent plate presentation across all outlets. This demand necessitates manufacturers to invest in precision cutting and individual packaging technologies. The trend of mini-cheesecakes and dessert shooters further reinforces this operational requirement, catering to tasting menus and events that favor smaller, more manageable portions while maintaining high visual appeal and flavor intensity. This focus on modularity offers significant scaling opportunities for B2B suppliers.

Finally, market penetration in underserved rural areas within emerging economies relies heavily on the expansion of cold chain infrastructure. Governments and large retailers investing in improved logistics are indirectly facilitating market access for perishable dessert items like cheesecake. This infrastructure development is critical for transforming latent demand into measurable market growth, opening up vast untapped consumer bases currently reliant on non-refrigerated or shelf-stable goods. The future viability of the cheesecake market in these regions is intrinsically linked to the speed and efficiency of this cold chain buildout, representing a key macroeconomic factor influencing long-term forecasts.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Baked Cheesecake Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Cheesecake Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Vanilla, Strawberry, Lemon, Chocolate, Others), By Application (Online Store, Retailer, Supermarket, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager