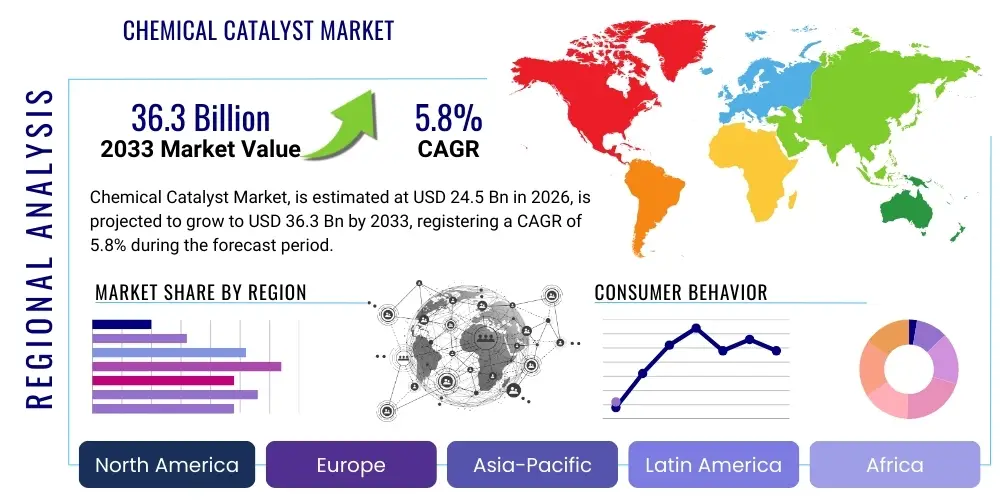

Chemical Catalyst Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437092 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Chemical Catalyst Market Size

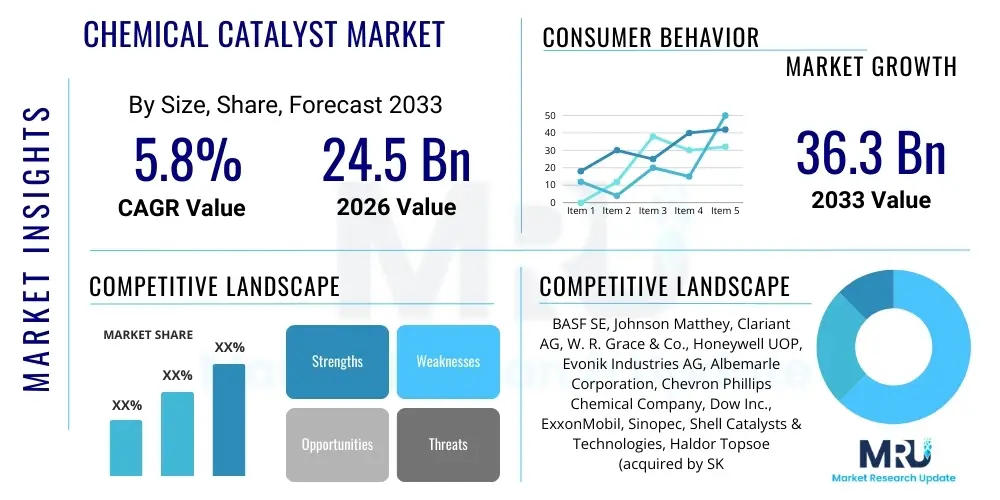

The Chemical Catalyst Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $24.5 billion in 2026 and is projected to reach $36.3 billion by the end of the forecast period in 2033.

Chemical Catalyst Market introduction

Chemical catalysts are indispensable materials utilized across various industrial processes, primarily to accelerate chemical reactions without being consumed themselves. These materials, which range from heterogeneous (solid-state) catalysts like zeolites and metals to homogeneous (liquid-state) catalysts, are foundational to the petrochemical, refining, environmental, and polymer industries. The primary product description encompasses base metal catalysts, precious metal catalysts, and specialty catalysts designed for highly selective operations. Major applications include fluid catalytic cracking (FCC) in oil refining, synthesis gas production, polymerization of plastics (such as polyethylene and polypropylene), and critical environmental applications like automotive and industrial emission control systems.

The benefits derived from employing chemical catalysts are transformative for industrial economics and sustainability. Catalysts enhance reaction efficiency, drastically reducing the required reaction temperatures and pressures, thereby lowering energy consumption and operational costs. Furthermore, they significantly improve product selectivity, minimizing unwanted byproducts and boosting overall yield purity. The evolution towards highly efficient and sustainable catalytic processes is crucial for maintaining competitive advantages in high-volume chemical manufacturing environments globally, particularly as regulatory pressures intensify regarding energy efficiency and reduced carbon footprint.

The market is predominantly driven by sustained demand for petrochemical derivatives and refined fuels, especially in emerging economies undergoing rapid industrialization. Increased focus on environmental regulations mandates the adoption of advanced catalysts for reducing harmful emissions from both mobile and stationary sources. Additionally, significant investments in research and development, particularly in developing novel heterogeneous catalysts that offer easier separation and recyclability, are propelling market expansion and technological innovation across diverse application segments.

Chemical Catalyst Market Executive Summary

The Chemical Catalyst Market is characterized by robust business trends centered on sustainability, process intensification, and the shift towards bio-based raw materials. Leading manufacturers are investing heavily in customized catalyst solutions and digitalization of catalytic processes to optimize reactor performance and extend catalyst life. Consolidation and strategic partnerships, focused on vertical integration and securing stable supply chains for critical raw materials like platinum group metals (PGMs), define the competitive landscape. Key business trends also involve the development of high-performance catalysts capable of converting low-cost feedstocks (e.g., shale gas) into high-value chemicals, addressing feedstock volatility and enhancing operational margins across the refining and chemical sectors.

Regionally, Asia Pacific (APAC) stands out as the primary growth engine, driven by massive capacity expansions in refining and petrochemical complexes, particularly in China and India, aiming to meet escalating domestic and export demands. North America and Europe, while mature markets, are leading in technological adoption, primarily focusing on environmental catalysts (e.g., selective catalytic reduction or SCR technologies) and catalysts for sustainable chemistry, such as those enabling carbon capture and utilization (CCU). Regulatory frameworks in these regions, demanding ultra-low sulfur fuels and stringent emission controls, strongly dictate the pace and direction of regional catalyst consumption patterns.

Segment-wise, polymerization catalysts hold a commanding share due to the sustained global growth in plastics consumption, requiring specialized Ziegler-Natta and metallocene catalysts for manufacturing high-density and linear low-density polyethylene. The catalyst material segment sees increasing prominence of zeolites and non-zeolite molecular sieves, valued for their unique pore structures and acid sites, making them ideal for cracking and isomerization processes. Environmental catalysts are witnessing the highest growth trajectory, fueled by global policy shifts towards cleaner air and stringent vehicle emission standards (e.g., Euro 7 and equivalent regulations globally), necessitating highly durable and efficient three-way catalysts (TWC) and diesel oxidation catalysts (DOC).

AI Impact Analysis on Chemical Catalyst Market

User queries regarding the impact of Artificial Intelligence (AI) on the Chemical Catalyst Market predominantly revolve around three critical areas: accelerating catalyst discovery, optimizing existing reactor operations, and improving sustainability metrics. Users are actively questioning how machine learning algorithms can rapidly screen vast databases of material compositions to identify novel, high-performing catalyst formulations, a process traditionally characterized by time-consuming trial-and-error experimental methodologies. There is significant interest in AI's capability to predict catalyst deactivation rates and optimize regeneration schedules, thereby extending catalyst lifetime and reducing replacement costs—a major operational concern for refineries and chemical plants.

Furthermore, user expectations center on AI-driven process control systems that can maintain optimal reaction conditions in real-time by analyzing sensor data streams (temperature, pressure, flow rates, conversion metrics). This is crucial for maximizing selectivity and yield, especially in complex, exothermic reactions. The recurring theme is the desire for "smart" catalytic manufacturing environments where AI not only aids in the initial design phase (predicting stability and activity) but also provides prescriptive maintenance advice, leading to higher throughput, lower energy expenditure, and superior environmental compliance. This shift signifies a transformation from traditional chemical engineering to data-driven chemical material science, promising unprecedented efficiency gains in catalyst usage.

- AI accelerates the discovery and synthesis of novel catalyst materials by predicting promising chemical structures.

- Machine learning algorithms optimize reactor conditions (temperature, pressure, flow) in real-time, maximizing yield and selectivity.

- Predictive maintenance models forecast catalyst deactivation, allowing for timely regeneration or replacement, minimizing downtime.

- AI enhances process control, leading to significant reductions in energy consumption and improved overall operational sustainability.

- High-throughput screening techniques are integrated with AI to test and characterize thousands of potential catalysts simultaneously.

- Data analytics improve quality control and consistency in large-scale catalyst manufacturing processes.

DRO & Impact Forces Of Chemical Catalyst Market

The Chemical Catalyst Market is shaped by a confluence of accelerating drivers (D), persistent restraints (R), and compelling opportunities (O), creating significant impact forces. Key drivers include rapid industrialization and escalating demand for high-performance plastics and fuels, particularly in emerging economies. The stringent global environmental regulations, mandating catalysts for emission control (automotive, stationary sources), further amplify demand. Conversely, the market faces restraints such as high dependency on volatile raw material pricing, particularly precious metals like palladium, platinum, and rhodium, which introduce cost instability. The susceptibility of catalysts to poisoning and deactivation, necessitating frequent replacement or complex regeneration processes, also acts as a constraint, raising operational expenditure for end-users.

Significant opportunities lie in the commercialization of novel, cost-effective catalysts that utilize earth-abundant metals (non-PGM alternatives) for traditional processes, reducing material procurement risks. The burgeoning field of biocatalysis and the increasing focus on green chemistry offer avenues for developing highly selective, sustainable catalytic systems for complex organic syntheses. Furthermore, the push towards utilizing unconventional feedstocks, such as syngas derived from biomass or waste plastic pyrolysis, requires new generations of specialized conversion catalysts, presenting lucrative market expansion opportunities for innovative players.

The combined impact forces dictate a shift towards high-value, specialized catalyst segments. The powerful regulatory impetus (R) combined with technological drivers (D) ensures continuous innovation, forcing manufacturers to focus on highly durable, selective, and environmentally benign catalyst solutions. While raw material cost volatility (R) remains a challenge, the potential for non-PGM catalysts and advanced process optimization (O) provides a strong counterbalancing force, positioning the market for steady, technologically driven growth focused on sustainability and efficiency gains across the refining and chemical industry value chain.

Segmentation Analysis

The Chemical Catalyst Market is comprehensively segmented based on material, application, and process type, reflecting the highly specialized nature of the industry. The material segment includes diverse chemical compositions essential for inducing specific reactions, such as metallic elements, metal oxides, and highly porous zeolites. Application segmentation highlights the primary end-use industries—petrochemicals demanding catalysts for olefin production, refining requiring cracking and hydrotreating catalysts, and environmental controls driving demand for advanced emission reduction technologies. Process segmentation distinguishes between heterogeneous (solid-phase) and homogeneous (liquid-phase) systems, impacting reactor design and downstream separation efficiency, with heterogeneous catalysts dominating large-scale industrial use due to their ease of separation and recyclability.

- By Material Type:

- Zeolites

- Metallocene Catalysts

- Chemical Compounds (Acid Catalysts, Alkylation Catalysts)

- Metals (Precious Metals, Base Metals)

- Organometallic Materials

- By Application:

- Petrochemicals (Polymerization, Oxidation)

- Refining (FCC, Hydrotreating, Reforming)

- Environmental (Automotive, Stationary Sources)

- Chemical Synthesis (Fine Chemicals, Intermediates)

- By Process:

- Heterogeneous Catalysis

- Homogeneous Catalysis

- Biocatalysis

Value Chain Analysis For Chemical Catalyst Market

The value chain of the Chemical Catalyst Market initiates with intensive upstream analysis, primarily encompassing the sourcing and processing of specialized raw materials. This includes mining and refining of precious metals (Pt, Pd, Rh) and base metals (Ni, V, Cu), alongside the production of specialty chemicals like alumina, silica, and molecular sieves used as supports or precursor materials. R&D institutions and specialized chemical companies play a crucial role upstream in developing proprietary synthesis methods and advanced catalyst formulations, focusing on thermal stability, surface area optimization, and pore structure engineering. Cost management and securing reliable, ethical supplies of PGMs are critical upstream concerns due to their scarcity and price volatility.

The manufacturing stage involves highly specialized chemical engineering, where raw materials are converted into finished catalyst products, often involving complex processes like impregnation, precipitation, calcination, and shaping (extrudates, pellets, spheres). Midstream activities include quality control and specialized packaging to maintain catalyst integrity. Distribution channels are highly structured and involve both direct and indirect routes. Major catalyst producers often sell directly to large integrated oil companies and chemical manufacturers, providing technical services and support alongside the product. Indirect channels utilize specialized distributors and regional agents, particularly for smaller end-users or standardized catalyst products.

The downstream analysis focuses on the final consumption across major industrial sectors. End-users, such as oil refineries and petrochemical complexes, integrate these catalysts into their reactor systems (e.g., fluid catalytic cracking units, hydrotreaters). The critical aspect downstream is the regeneration and disposal of spent catalysts. Companies specializing in catalyst recovery and recycling, particularly for precious metals, form a vital part of the downstream value chain, minimizing environmental impact and ensuring the sustainable reuse of expensive components, thereby closing the material loop and influencing overall operational economics for the end-user.

Chemical Catalyst Market Potential Customers

Potential customers for chemical catalysts are predominantly large-scale industrial entities whose production processes rely heavily on chemical transformations to generate high-volume end products. The most significant customer base is the global refining industry, which uses vast quantities of catalysts for processes like hydrocracking, reforming, and isomerization to produce cleaner transportation fuels such as gasoline and diesel meeting modern specifications. These refiners are constant buyers, driven by capacity utilization rates and the need to periodically refresh catalyst beds due to deactivation.

The petrochemical sector constitutes another core customer group, encompassing manufacturers of primary polymers and bulk chemicals. This includes producers of polyethylene, polypropylene, PVC, and key intermediates like ethylene oxide and phthalic anhydride. Polymerization catalysts (Ziegler-Natta, metallocene) and oxidation catalysts are critical inputs for these businesses, whose purchasing decisions are dictated by catalyst selectivity, yield improvement, and the ability to handle various feedstock types efficiently to maintain high margins in competitive commodity markets.

Furthermore, environmental control segments, including automotive manufacturers and industrial plant operators (power generation, chemical processing), are rapidly growing customer segments. These customers purchase catalysts such as three-way catalysts (TWC) for gasoline vehicles, selective catalytic reduction (SCR) catalysts for NOx abatement, and volatile organic compound (VOC) abatement catalysts for industrial stack emissions. The purchase drivers in this segment are strictly regulatory compliance and minimizing environmental liability, leading to sustained demand for high-performance, robust catalyst systems designed for long operational life under harsh conditions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $24.5 Billion |

| Market Forecast in 2033 | $36.3 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BASF SE, Johnson Matthey, Clariant AG, W. R. Grace & Co., Honeywell UOP, Evonik Industries AG, Albemarle Corporation, Chevron Phillips Chemical Company, Dow Inc., ExxonMobil, Sinopec, Shell Catalysts & Technologies, Haldor Topsoe (acquired by SK Capital), LyondellBasell Industries N.V., Umicore, JGC Catalysts and Chemicals, CRI Catalyst Company, and Kataleuna GmbH. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Chemical Catalyst Market Key Technology Landscape

The technological landscape of the Chemical Catalyst Market is rapidly evolving, driven by the imperative to achieve higher efficiency, better selectivity, and enhanced sustainability. A major trend is the development and commercial application of advanced catalyst support materials, such as hierarchical zeolites and mesoporous silica, which offer improved mass transfer capabilities and expose more active sites, thereby maximizing reaction rates and minimizing diffusional limitations, particularly in large industrial reactors. Furthermore, surface engineering technologies, including atomic layer deposition (ALD), are being utilized to precisely control the thickness and composition of the active catalyst layer on the support, enhancing stability and resistance to poisoning.

Another crucial technology focus area is the shift towards sustainable catalysis, encapsulated by the rise of biocatalysis and organocatalysis. Biocatalysts, primarily enzymes, offer unparalleled selectivity and the ability to operate under mild conditions (ambient temperature and pressure), significantly reducing the energy footprint compared to traditional thermal processes. This is especially impactful in the pharmaceutical and fine chemical sectors. Concurrently, high-throughput experimentation (HTE) platforms are transforming catalyst development. These automated systems rapidly synthesize, test, and characterize thousands of potential catalyst candidates using minute quantities of reagents, drastically cutting down the R&D cycle time and accelerating the commercialization of novel catalytic systems.

The digitalization of catalytic processes, often termed Industry 4.0 integration, is becoming standard practice. This involves deploying sophisticated sensors, digital twins, and AI-powered simulation tools to model complex catalytic reactions accurately. These technologies allow manufacturers to predict catalyst behavior under varying operational stress, optimize reaction pathways dynamically, and design reactors that maximize contact efficiency. The ongoing technological advancement is heavily biased towards developing robust, recyclable, and cost-efficient catalysts capable of efficiently utilizing low-cost or sustainable feedstocks, such as carbon dioxide and agricultural waste, signaling a major paradigm shift in chemical manufacturing.

Regional Highlights

The regional dynamics of the Chemical Catalyst Market reflect differential levels of industrial maturity, regulatory stringency, and capacity expansion investments globally. Asia Pacific (APAC) currently dominates the market in terms of volume and exhibits the highest growth rate. This exponential growth is underpinned by massive government and private investment in establishing new crude oil refining facilities and large-scale petrochemical complexes, particularly in Southeast Asia, China, and India, catering to burgeoning populations and rapidly industrializing economies. The region is seeing strong uptake of polymerization catalysts and hydroprocessing catalysts, driven by the need for domestic supply security for fuels and plastics.

North America and Europe represent mature, high-value markets defined less by capacity expansion and more by regulatory modernization and technological sophistication. North America, benefiting from the shale gas revolution, sees significant demand for catalysts facilitating the conversion of light hydrocarbons into valuable chemicals (e.g., methanol and olefins). Both regions are leading consumers of environmental catalysts, driven by stringent mandates like the EPA and Euro standards concerning vehicle and industrial emissions. The market in these areas emphasizes performance, durability, and compliance, prioritizing advanced catalysts for sustainable processes, waste gas treatment, and green hydrogen production.

The Middle East and Africa (MEA) and Latin America are poised for moderate to strong growth, fueled by strategic initiatives to diversify economies beyond crude oil exports by moving into downstream chemical production. MEA, leveraging abundant hydrocarbon resources, is building integrated refinery-petrochemical complexes, creating substantial sustained demand for hydroprocessing and heavy-oil upgrading catalysts. Latin America's growth is tied to modernization efforts in its existing refining infrastructure and increased focus on bio-fuel production, necessitating specialized catalysts for biodiesel and bioethanol synthesis, reflecting a localized strategic focus on energy independence and resource utilization.

- Asia Pacific (APAC): Highest growth market driven by major expansion in petrochemical and refining capacity, leading the consumption of polymerization and FCC catalysts.

- North America: Mature market focused on high-value, niche catalysts, particularly those converting light alkanes (shale gas) and meeting stringent environmental standards (hydrotreating, emission control).

- Europe: Driven primarily by the environmental segment and sustainable chemistry initiatives; strong adoption of specialized catalysts for biomass conversion and green processes mandated by EU regulations.

- Middle East & Africa (MEA): Growth centered on strategic integration of refining and petrochemical segments, increasing demand for complex heavy-oil upgrading catalysts.

- Latin America: Market growth linked to modernization of existing refining infrastructure and significant regional investment in bio-fuel (bioethanol, biodiesel) production catalysts.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Chemical Catalyst Market.- BASF SE

- Johnson Matthey

- Clariant AG

- W. R. Grace & Co.

- Honeywell UOP

- Evonik Industries AG

- Albemarle Corporation

- Chevron Phillips Chemical Company

- Dow Inc.

- ExxonMobil

- Sinopec Catalyst Co. Ltd.

- Shell Catalysts & Technologies

- Haldor Topsoe (acquired by SK Capital)

- LyondellBasell Industries N.V.

- Umicore

- JGC Catalysts and Chemicals Ltd.

- CRI Catalyst Company

- Kataleuna GmbH

- Kureha Corporation

- Sud-Chemie India Pvt. Ltd.

Frequently Asked Questions

Analyze common user questions about the Chemical Catalyst market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for environmental catalysts?

The demand for environmental catalysts, particularly in automotive and industrial applications, is overwhelmingly driven by increasingly stringent global government regulations (e.g., Euro 7, EPA standards) aimed at reducing harmful air emissions, necessitating highly efficient catalysts for NOx, CO, and VOC abatement.

How are precious metal price fluctuations impacting catalyst manufacturers and end-users?

High volatility in the prices of precious metals (PGMs) significantly increases the cost structure for manufacturers and introduces procurement risks. This pressure accelerates research into developing cost-effective, high-performance catalysts utilizing non-PGM or earth-abundant base metal alternatives to mitigate supply chain dependency and price exposure.

Which application segment holds the largest market share in the Chemical Catalyst industry?

The polymerization catalyst segment, essential for the production of high-volume plastics like polyethylene and polypropylene, currently holds the largest market share due to sustained global growth in the plastics industry and constant demand for packaging, construction materials, and consumer goods.

What role does the adoption of Industry 4.0 technologies play in catalyst manufacturing?

Industry 4.0 technologies, including AI, sensor integration, and digital twins, enable real-time monitoring and predictive maintenance of catalytic processes. This substantially optimizes reactor performance, extends catalyst service life, enhances product selectivity, and reduces energy consumption in large-scale chemical plants.

Why is the Asia Pacific region projected to experience the fastest growth in this market?

APAC's rapid market growth is directly attributed to massive ongoing investments in new refining and petrochemical capacity expansions, particularly in China and India, coupled with rapid urbanization and industrial development driving the regional demand for fuels and downstream chemical products.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager