Chemical Cylinders Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432209 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Chemical Cylinders Market Size

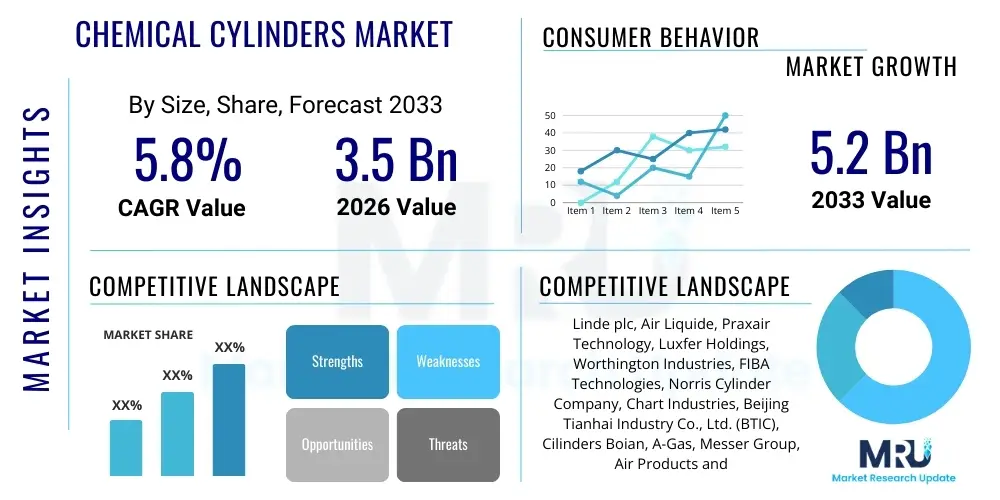

The Chemical Cylinders Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 5.2 Billion by the end of the forecast period in 2033. This consistent growth trajectory is primarily driven by the escalating demand for specialty gases and high-purity chemicals across critical industrial sectors, particularly semiconductors, healthcare, and advanced manufacturing. The inherent safety requirements and stringent regulatory frameworks governing the transport and storage of hazardous chemical substances necessitate the use of highly specialized and robust chemical cylinders, sustaining market valuation and expansion.

The market expansion is also supported by continuous innovation in cylinder material science, focusing on reducing weight and increasing pressure capacity. Composite cylinders, utilizing carbon fiber and fiberglass, are increasingly penetrating traditional steel markets due to their superior performance-to-weight ratio, offering significant logistical and operational cost benefits to end-users. Furthermore, the burgeoning industrialization across emerging economies, coupled with increased infrastructure spending and expansion of chemical production facilities, acts as a pivotal force in the consistent upward revision of market size projections towards 2033. Regulatory compliance remains a significant cost driver and quality assurance point, indirectly influencing market size by favoring established providers with certified product lines.

Chemical Cylinders Market introduction

The Chemical Cylinders Market encompasses the manufacturing, distribution, and utilization of high-pressure vessels specifically designed for the secure containment and transport of gases, highly volatile liquids, and specialty chemicals. These products, typically constructed from robust materials such as high-strength steel, aluminum alloys, or advanced composites, are engineered to meet stringent international safety standards (like ISO and DOT specifications) necessary for handling hazardous, corrosive, flammable, or toxic substances. The primary applications span across diverse industries, including the storage and delivery of industrial gases (e.g., nitrogen, oxygen, argon), specialty gases for electronics fabrication (e.g., silane, ammonia), and calibration mixtures essential for environmental monitoring and analytical chemistry.

The major benefits derived from using specialized chemical cylinders include enhanced safety in material handling, precise control over gas purity and flow rate, and regulatory adherence crucial for global supply chain operations. The inherent durability and integrity of these vessels ensure that high-purity chemicals maintain their quality from production to point-of-use, preventing contamination which is critical in sensitive applications like semiconductor manufacturing and pharmaceutical synthesis. Driving factors for market growth include the global expansion of the semiconductor industry, which demands vast quantities of ultra-high purity specialty gases, and the increasing utilization of industrial gases in metal fabrication, water treatment, and food preservation processes worldwide.

Chemical Cylinders Market Executive Summary

The Chemical Cylinders Market is characterized by robust growth underpinned by strong business trends focusing on material innovation and supply chain resilience. Regionally, the Asia Pacific region dominates the market share due to rapid industrialization, particularly in China and India, coupled with the dense concentration of electronics and chemical manufacturing hubs. North America and Europe maintain stable growth driven by strict safety regulations and high demand for advanced composite cylinders in specialized applications. Key segments trends indicate a decisive shift towards composite cylinders over traditional steel, driven by logistical efficiencies and reduced overall cost of ownership. The specialty gas segment is exhibiting the fastest growth, primarily fueled by the accelerating technological advancements in display manufacturing and semiconductor fabrication, demanding extremely high-purity chemical containment solutions.

Business trends highlight intense competition centered on achieving global regulatory certifications and developing smart cylinder technologies incorporating IoT sensors for real-time monitoring of pressure, temperature, and location. This integration of digital technology is enhancing safety protocols and optimizing inventory management for large industrial gas suppliers. Furthermore, consolidation among major gas producers and cylinder manufacturers is shaping the competitive landscape, aiming for economies of scale and broader geographic reach. Investment in high-pressure hydrogen cylinders, specifically Type IV composites, represents a forward-looking trend, positioning the market for potential expansion alongside the emerging hydrogen economy and fuel cell technology development.

AI Impact Analysis on Chemical Cylinders Market

User inquiries concerning AI's impact on the Chemical Cylinders Market frequently revolve around how artificial intelligence and machine learning (ML) can enhance safety protocols, predict cylinder maintenance needs, optimize logistics, and improve traceability within the supply chain. Users are particularly keen on understanding AI's role in predictive corrosion modeling, leakage detection, and automating the rigorous regulatory compliance checks inherent in handling hazardous materials. Key expectations center on AI providing proactive insights to minimize dangerous incidents and reduce operational downtime associated with unexpected cylinder failures or regulatory non-compliance. There is also significant interest in how AI algorithms can revolutionize routing and inventory allocation for industrial gas suppliers, ensuring optimal utilization of high-value assets and reducing transportation costs while maintaining safety.

AI's primary influence is moving the chemical cylinder lifecycle from a reactive maintenance model to a highly proactive, data-driven management system. By analyzing sensor data (IoT integration), AI models can precisely forecast the remaining useful life of a cylinder based on usage history, pressure cycles, and environmental exposure, scheduling maintenance before structural integrity is compromised. This capability significantly elevates safety standards, mitigating catastrophic risks associated with high-pressure vessel failure. Beyond safety, AI-driven demand forecasting allows cylinder manufacturers and suppliers to optimize production schedules and strategically locate inventory closer to anticipated customer demand, reducing lead times and improving service levels across complex global supply chains. This optimization directly translates to higher asset utilization rates and capital efficiency for major market participants.

- Predictive Maintenance: AI algorithms analyze sensor data (pressure, temperature, handling shocks) to forecast corrosion rates and scheduled maintenance, preventing structural failure.

- Logistics Optimization: Machine learning models optimize complex routing for hazardous materials transport, reducing transit time, fuel consumption, and operational risk.

- Enhanced Safety Monitoring: Real-time anomaly detection for pressure drops or unusual temperature fluctuations, triggering immediate safety alerts.

- Quality Control Automation: AI-powered vision systems rapidly inspect cylinder welding seams and external defects during manufacturing, ensuring higher quality compliance.

- Demand Forecasting: ML models analyze historical consumption patterns and macroeconomic indicators to optimize inventory levels and strategic stocking locations for specialty gases.

DRO & Impact Forces Of Chemical Cylinders Market

The dynamics of the Chemical Cylinders Market are governed by a complex interplay of Drivers, Restraints, Opportunities, and high-impact forces that collectively shape strategic decisions and market trajectory. Primary drivers include the massive expansion of semiconductor fabrication facilities globally, demanding ultra-high-purity specialty gases contained only in certified cylinders, and the stringent global safety regulations that mandate the use of high-integrity, regularly tested pressure vessels. Opportunities are prominently visible in the emerging hydrogen economy, which requires specialized Type IV composite cylinders for storage and transport, and the increasing adoption of smart cylinder technologies (IoT integration) that offer enhanced monitoring capabilities. Conversely, the high initial cost of composite cylinders and the complex, time-consuming recertification processes act as significant restraints on faster market penetration.

Impact forces are predominantly structural and regulatory. The foremost impact force is the necessity for absolute safety; any failure or accident related to a chemical cylinder can have devastating environmental and human consequences, leading to immediate and severe regulatory scrutiny and liability costs. This constant regulatory pressure (e.g., DOT, TPED, ISO standards) compels manufacturers to prioritize quality, testing, and traceability above cost, stabilizing the market against lower-quality alternatives. Another major impact force is raw material price volatility, particularly steel and carbon fiber, which significantly influences production costs and ultimately the final price point for both end-users and gas suppliers. Lastly, the push toward lighter-weight materials for transportation efficiency (a strong opportunity) continuously forces innovation and research spending among leading manufacturers.

Segmentation Analysis

The Chemical Cylinders Market is comprehensively segmented based on material, capacity, gas type, and end-use industry, providing a granular view of demand patterns and technological preferences across various industrial ecosystems. Analyzing these segments helps stakeholders understand where growth is concentrated and where innovative products, such as lightweight composites, are achieving maximum penetration. The material segment, covering steel, aluminum, and composite structures, highlights the ongoing technological migration towards materials that offer superior pressure containment, corrosion resistance, and weight reduction benefits, directly addressing logistics challenges.

The segmentation by gas type—ranging from high-volume industrial gases to niche, high-value specialty gases—is crucial as it directly dictates the necessary purity levels, valve requirements, and internal surface treatments required for the cylinder. High-purity specialty gases for electronics fabrication command the highest margins and require the most stringent cylinder specifications. Furthermore, segmentation by end-use reveals diverse application landscapes, with the chemicals and manufacturing sectors acting as the bedrock of demand, while the electronics and healthcare sectors drive innovation toward higher-specification, smaller-capacity units for critical, controlled environments.

- Material

- Steel Cylinders

- Aluminum Cylinders

- Composite Cylinders (Type I, II, III, IV)

- Capacity

- Small Capacity (Up to 10 Liters)

- Medium Capacity (10 Liters – 50 Liters)

- Large Capacity (Above 50 Liters)

- Gas Type

- Industrial Gases (Oxygen, Nitrogen, Argon, Acetylene)

- Specialty Gases (Calibration Gases, High-Purity Gases for Electronics)

- Toxic and Corrosive Gases

- End-Use Industry

- Chemical and Petrochemical

- Manufacturing and Metal Fabrication

- Electronics and Semiconductors

- Healthcare and Medical

- Automotive and Transportation

- Food and Beverage

Value Chain Analysis For Chemical Cylinders Market

The Chemical Cylinders Market value chain is intricate, beginning with the upstream supply of raw materials, primarily high-strength steel alloys, specialized aluminum, and advanced composite fibers (carbon and glass). Upstream analysis focuses on securing stable, high-quality material inputs that meet the stringent material standards required for pressure vessel construction, with price negotiation power often residing with major suppliers of these specialized alloys. The subsequent manufacturing phase involves complex processes like deep drawing, spinning, welding (for steel), and filament winding (for composites), requiring significant capital investment and highly specialized machinery to achieve regulatory compliance and structural integrity. Certification and testing by third-party regulatory bodies are integrated throughout the manufacturing process, adding substantial cost and time to the cycle.

The downstream segment involves the core industrial gas companies (such as Linde and Air Liquide) who purchase or lease these cylinders, fill them with industrial or specialty gases, and then manage the distribution network. Distribution channels are highly specialized, often involving direct distribution through proprietary fleets due to the hazardous nature of the cargo, ensuring compliance with transport regulations. Indirect distribution may occur through regional distributors or authorized dealers, particularly for smaller end-users or in geographically distant markets. The gas supplier typically retains ownership or stringent control over the cylinder assets to manage safety, maintenance, and mandatory recertification cycles, making the cylinder asset management a critical component of the downstream value proposition.

Chemical Cylinders Market Potential Customers

Potential customers for chemical cylinders are highly diversified but predominantly concentrated in sectors relying on precise, consistent, and safe delivery of gaseous or volatile chemical compounds for their core operations. The largest consumers are integrated gas suppliers and distributors who require massive volumes of cylinders for their asset pools to service their global customer base across various industries. Manufacturing sectors, particularly metal fabrication (welding, cutting), represent major end-users of standard industrial gas cylinders (oxygen, nitrogen, acetylene). These customers prioritize durability, cost-effectiveness, and availability of standardized cylinder types for high-volume operations.

A second crucial customer segment is the high-tech electronics and semiconductor industry. These buyers require ultra-high-purity (UHP) specialty gas cylinders, which demand specialized internal coatings and extremely tight tolerances to prevent contamination that could ruin sensitive production processes. For these customers, purity assurance and reliability override cost considerations. Other significant end-users include research laboratories and pharmaceutical manufacturers utilizing calibration gases and specific chemical mixtures, and healthcare facilities relying on medical gas cylinders (e.g., medical oxygen, nitrous oxide). These buyers often require smaller, highly portable, and lightweight aluminum or composite cylinders, emphasizing portability and immediate availability in critical care environments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 5.2 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Linde plc, Air Liquide, Praxair Technology, Luxfer Holdings, Worthington Industries, FIBA Technologies, Norris Cylinder Company, Chart Industries, Beijing Tianhai Industry Co., Ltd. (BTIC), Cilinders Boian, A-Gas, Messer Group, Air Products and Chemicals, CIMC ENRIC, Hebei Baigong Industrial, Metal Mate Co., Ltd., Everest Kanto Cylinder Ltd., Jiangsu Fushun Pressure Vessel Co., Ltd., Faber Industrie S.p.A., Hubei Dali Special Automobile Manufacturing Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Chemical Cylinders Market Key Technology Landscape

The Chemical Cylinders Market is undergoing significant technological transformation, moving beyond traditional manufacturing methods toward highly engineered and integrated systems. The most critical technological advancement is the widespread adoption of composite cylinder fabrication, particularly Type III (aluminum liner wrapped in composite fiber) and Type IV (plastic liner wrapped in composite fiber). These technologies significantly reduce the weight of the cylinder—often by 50% to 70% compared to steel—while maintaining or exceeding high-pressure ratings. This advancement is vital for applications requiring portability (like medical oxygen) and for the burgeoning hydrogen transportation sector, where weight reduction directly translates to increased fuel efficiency and operational range. The manufacturing process for these composites requires precision filament winding and specialized curing techniques, representing a high barrier to entry for new market players.

Another pivotal technological trend is the integration of digital capabilities, leading to the development of "smart cylinders." This involves embedding radio-frequency identification (RFID) tags, Near Field Communication (NFC) chips, and Internet of Things (IoT) sensors directly into the cylinder structure or valve assembly. These embedded systems allow for real-time tracking of critical parameters such as internal pressure, temperature, location, and fill level. This technology revolutionizes asset management, improves safety by immediately alerting operators to potential issues, and drastically enhances regulatory compliance tracking by providing an immutable record of testing and fill cycles. Furthermore, specialized valve technology, including residual pressure valves and integrated pressure regulators, is crucial for maintaining gas purity and ensuring efficient discharge, especially important for sensitive specialty gases used in the electronics industry.

Surface treatment and internal coating technology also constitute a crucial part of the technological landscape, particularly for cylinders containing highly corrosive or reactive specialty chemicals. Advanced passivation techniques, such as electropolishing or application of inert internal coatings, are used to minimize adsorption and prevent chemical reactions between the gas and the cylinder walls, thereby ensuring the ultra-high purity required by the semiconductor industry. Continuous research and development in non-destructive testing (NDT) methods, such as advanced ultrasonic and acoustic emission testing, are essential for mandatory periodic inspections, ensuring cylinder safety and extending their operational lifespan while minimizing downtime and inspection costs. These technological innovations collectively support higher safety standards and operational efficiencies across the global supply chain.

Regional Highlights

- Asia Pacific (APAC): APAC dominates the global chemical cylinders market, primarily due to the rapid industrial expansion and massive infrastructure projects across China, India, and Southeast Asian nations. The region is the epicenter of global semiconductor and display manufacturing, driving exceptionally high demand for specialty gas cylinders. Government initiatives supporting manufacturing and favorable foreign direct investment policies further accelerate the establishment of new chemical and industrial gas production hubs, ensuring continuous demand for containment vessels.

- North America: Characterized by mature industrial gas markets and extremely stringent safety regulations (DOT standards). The focus in North America is shifting rapidly towards high-value composite cylinders, particularly in the healthcare, aerospace, and specialized industrial sectors seeking lightweight alternatives. The expanding shale gas extraction industry also maintains a strong, continuous demand for industrial gas cylinders used in various drilling and processing applications.

- Europe: Europe showcases robust demand driven by advanced manufacturing (especially automotive and chemicals) and a strong regulatory environment (TPED certification). The region is pioneering the adoption of hydrogen fuel cell technologies, leading to significant early investment and R&D in high-pressure Type IV hydrogen cylinders, positioning it as a key innovation hub for future market growth.

- Latin America: This region presents substantial growth potential, driven by infrastructure development and expanding petrochemical and mining sectors, particularly in Brazil and Mexico. Demand is steadily rising for standard steel and aluminum cylinders, though economic volatility and less harmonized regulatory frameworks compared to North America and Europe can occasionally restrain rapid market expansion.

- Middle East and Africa (MEA): Growth in MEA is closely tied to the massive petrochemical and oil & gas industries, which require large volumes of industrial gases for various refining and processing applications. Significant investment in industrial diversification projects, especially in the UAE and Saudi Arabia, is expected to fuel increased demand for large-capacity chemical cylinders in the coming decade.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Chemical Cylinders Market.- Linde plc

- Air Liquide

- Praxair Technology, Inc.

- Luxfer Holdings PLC

- Worthington Industries, Inc.

- FIBA Technologies, Inc.

- Norris Cylinder Company

- Chart Industries, Inc.

- Beijing Tianhai Industry Co., Ltd. (BTIC)

- Cilinders Boian

- A-Gas International

- Messer Group GmbH

- Air Products and Chemicals, Inc.

- CIMC ENRIC Holdings Limited

- Hebei Baigong Industrial Co., Ltd.

- Metal Mate Co., Ltd.

- Everest Kanto Cylinder Ltd. (EKC)

- Faber Industrie S.p.A.

- Composite pressure vessel manufacturer

- Advanced Gas Technologies Inc.

Frequently Asked Questions

Analyze common user questions about the Chemical Cylinders market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the adoption of composite chemical cylinders?

The primary driver is the significant weight reduction offered by composite cylinders (Type III and IV), typically resulting in 50% to 70% lighter weight compared to steel. This reduction leads to substantial cost savings in logistics, improved handling safety, and greater payload capacity, especially crucial for portable applications and emerging markets like hydrogen storage.

How does regulatory compliance impact the cost structure of chemical cylinders?

Regulatory compliance heavily influences cost because cylinders must adhere to mandatory international standards (e.g., DOT, ISO, TPED) and undergo expensive periodic recertification and testing (hydrostatic tests). This necessitates the use of high-quality materials and rigorous manufacturing quality control, adding substantial fixed costs, thereby favoring certified, premium manufacturers.

Which end-use industry represents the fastest-growing segment for chemical cylinders?

The electronics and semiconductor industry represents the fastest-growing segment. The global expansion of chip manufacturing necessitates a vast and specialized supply chain for ultra-high-purity (UHP) specialty gases, requiring highly specific, contamination-resistant cylinders designed for maximum gas integrity and safety, driving high-value cylinder demand.

What role does IoT and AI play in the future of cylinder management?

IoT and AI enable the shift toward predictive maintenance and smart asset management. IoT sensors provide real-time data on pressure, temperature, and location, while AI algorithms analyze this data to predict component failure, optimize complex supply chain logistics, ensure timely maintenance, and enhance overall safety compliance.

What are the key materials used in the manufacture of high-pressure chemical cylinders?

The key materials include high-strength chromium-molybdenum steel alloys (for traditional industrial cylinders), specialized aluminum alloys (for medical and beverage cylinders), and advanced composites like carbon fiber or fiberglass over aluminum or plastic liners (for Type III and Type IV cylinders, used increasingly for high-pressure applications like hydrogen).

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager