Chemical Deflasher Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438441 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Chemical Deflasher Market Size

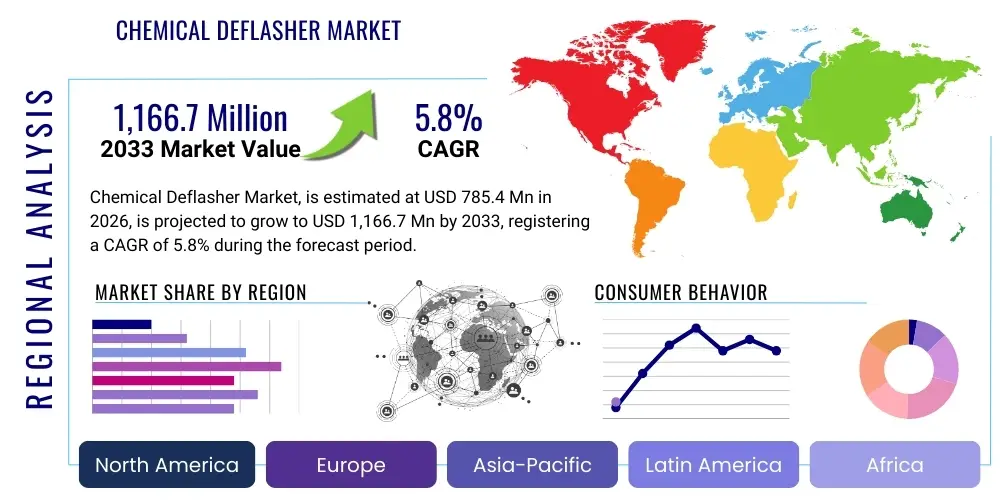

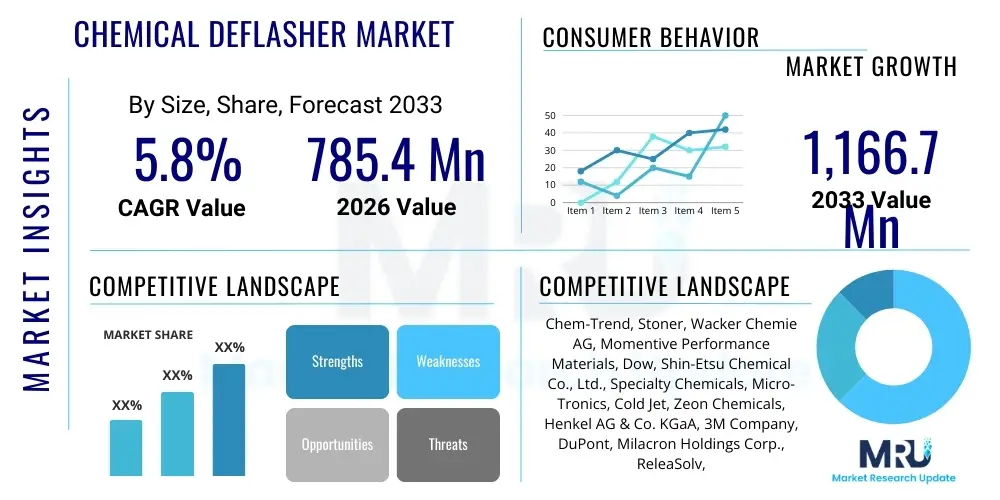

The Chemical Deflasher Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $785.4 Million in 2026 and is projected to reach $1,166.7 Million by the end of the forecast period in 2033.

Chemical Deflasher Market introduction

The Chemical Deflasher Market encompasses specialized chemical compounds designed to remove flash, burrs, and excess material (typically rubber, plastic, or composite) from molded parts following the curing or injection process. Deflashing is a crucial post-molding operation, ensuring product integrity, dimensional accuracy, and aesthetic quality, especially in high-precision industries. These chemical agents work by selectively softening or dissolving the thin flash material without damaging the main component structure, offering an alternative or complement to mechanical deflashing methods like cryogenic tumbling or abrasive blasting. Chemical deflashers are favored for intricate parts and materials prone to damage from mechanical stress.

Major applications of chemical deflashers span the automotive sector, consumer electronics, medical device manufacturing, and industrial rubber goods production. In the automotive industry, these chemicals are vital for refining sealing components, gaskets, and O-rings where flash removal must be precise to maintain sealing performance. Key benefits include significantly reduced manual labor costs, enhanced surface finish quality, and the ability to process delicate or geometrically complex parts that mechanical methods cannot efficiently handle. The increasing demand for miniaturized and complex components, particularly in the electronics and medical fields, drives the necessity for highly controlled chemical deflashing processes.

Market growth is predominantly driven by the expansion of the global manufacturing base, especially in Asia Pacific, coupled with stringent quality requirements for components used in high-reliability applications. Furthermore, ongoing innovation in material science, leading to the use of highly resistant elastomers and specialty polymers, necessitates the continuous development of tailored chemical deflasher formulations. The shift towards automation in post-processing further accelerates the adoption of chemical deflashing solutions that integrate seamlessly into automated production lines, ensuring high throughput and consistent results.

Chemical Deflasher Market Executive Summary

The Chemical Deflasher Market is experiencing robust growth fueled by intensifying manufacturing complexity and the global focus on enhancing operational efficiency and product quality across high-volume industries. Business trends indicate a decisive shift toward environmentally conscious formulations, primarily focusing on reducing Volatile Organic Compound (VOC) content and developing water-based or bio-based solutions, driven by stricter global environmental regulations, particularly in Europe and North America. This transition is redefining competitive landscapes, favoring companies that invest heavily in sustainable chemistry and specialized product lines tailored for next-generation materials like high-performance silicone elastomers and fluorocarbon rubbers. Mergers, acquisitions, and strategic partnerships centered around technology transfer are common strategies used by major players to quickly expand product portfolios and penetrate niche segments requiring custom deflashing solutions.

Regional trends highlight the Asia Pacific (APAC) region as the dominant and fastest-growing market, primarily due to the massive scale of automotive parts manufacturing, consumer electronics assembly, and general industrial production taking place in countries like China, India, and Southeast Asia. While APAC drives volume growth, North America and Europe lead in terms of technological sophistication and the demand for high-value, low-VOC products. The maturity of the medical and aerospace industries in these Western regions requires specialized, validated chemical deflashers that comply with rigorous regulatory standards. Geopolitical factors influencing supply chains, however, prompt manufacturers to seek diversified sourcing strategies for key chemical intermediates.

Segmentation trends reveal strong performance in the Water-Based Deflasher segment, reflecting the industry's commitment to sustainability and worker safety. Concurrently, the Solvent-Based segment remains crucial for high-performance elastomers that require aggressive chemical action for effective flash removal, though manufacturers are actively reformulating these products to comply with evolving hazardous substance limitations. In terms of application, the Automotive segment, driven by electric vehicle (EV) production requiring high-precision seals and thermal management components, constitutes the largest end-use category. Furthermore, the electronics sector demonstrates accelerating demand for deflashers compatible with micro-molded components, emphasizing precision and residue-free cleaning crucial for subsequent assembly stages.

AI Impact Analysis on Chemical Deflasher Market

Common user questions regarding AI's impact on the Chemical Deflasher Market frequently revolve around how artificial intelligence and machine learning (ML) can optimize complex chemical formulations, predict long-term material compatibility, and integrate quality assurance into automated deflashing lines. Users are keenly interested in reducing costly material waste and mitigating the environmental impact associated with suboptimal deflashing processes. Key concerns center on the initial investment required for AI infrastructure, data privacy related to proprietary chemical compositions, and the need for skilled personnel capable of managing AI-driven systems. Expectations are high regarding AI's ability to unlock new levels of efficiency, automate defect detection, and significantly shorten the R&D cycle for novel, environmentally friendly chemical deflashers.

The application of AI and ML is poised to revolutionize the highly specific and complex process of chemical formulation. Traditional R&D is heavily reliant on laborious experimental trials; however, AI can analyze vast chemical databases, correlating molecular structures with efficacy, material compatibility, and toxicological profiles. This allows manufacturers to predict the performance of new compounds under varying temperatures and pressures, dramatically accelerating the time-to-market for optimized deflashing agents, particularly those required for specialized high-performance materials like FKM or HNBR. AI-driven predictive modeling ensures that new deflashers meet stringent regulatory compliance from the outset, focusing development efforts on low-VOC and biodegradable alternatives.

Furthermore, AI-powered vision systems are beginning to integrate into post-processing lines, enhancing quality control far beyond human capability. These systems utilize deep learning algorithms to instantaneously inspect molded parts for residual flash, dimensional inconsistencies, and potential surface damage resulting from the chemical process. By providing real-time feedback, AI allows for dynamic adjustments to chemical concentration, immersion time, and temperature within the deflashing equipment. This level of optimization minimizes chemical usage, reduces processing time variability, and ensures zero-defect output, particularly critical for sensitive applications in the aerospace and medical device industries where failure tolerance is non-existent. This integration transforms chemical deflashing from a batch-process risk into a tightly controlled, predictable manufacturing stage.

- AI-driven Predictive Formulation: Accelerates the development of new, high-performance, and sustainable chemical deflashers by analyzing and modeling chemical performance data.

- Automated Quality Control: Utilizes machine vision and deep learning to detect microscopic flash, surface imperfections, and residue post-deflashing, ensuring zero-defect output.

- Process Optimization: ML algorithms optimize parameters (temperature, concentration, dwell time) in real-time to minimize chemical consumption and maximize throughput.

- Supply Chain Resilience: AI predicts raw material price fluctuations and supply shortages, enabling proactive sourcing and inventory management for complex chemical inputs.

- Waste Minimization: Reduces chemical waste and enhances the efficiency of wastewater treatment processes by precisely monitoring chemical bath degradation.

DRO & Impact Forces Of Chemical Deflasher Market

The Chemical Deflasher Market's trajectory is determined by a complex interplay of internal market dynamics and external regulatory pressures, summarized by Drivers, Restraints, and Opportunities (DRO). Key drivers include the exponential growth in the global production of precision molded components across automotive, aerospace, and electronics sectors, demanding superior surface finish and component accuracy. This demand necessitates reliable and scalable deflashing solutions that chemical methods provide over traditional mechanical alternatives. The continuous development of new high-performance elastomers and polymer compounds that are resistant to mechanical processes further drives the market towards specialized chemical treatments. These forces collectively push manufacturers toward high-efficiency, automated chemical deflashing integration.

Restraints primarily revolve around environmental compliance and operational risks. Stringent global regulations, particularly the mandates limiting Volatile Organic Compound (VOC) emissions in solvents, impose significant barriers for legacy solvent-based deflashers, requiring costly reformulation and new product validation. Furthermore, the volatility and fluctuating costs of key raw chemical precursors, such as specialized surfactants, amines, and organic solvents, impact manufacturing profitability and pricing stability. User safety concerns related to handling aggressive or flammable chemical agents in industrial settings also necessitate substantial investment in specialized ventilation and safety infrastructure, acting as an adoption hurdle for smaller enterprises.

Opportunities for market expansion are centered on technological innovation and geographic penetration. The development of advanced bio-based or green chemical deflashers, derived from renewable resources and exhibiting low environmental toxicity, represents a significant growth vector aligning with global sustainability goals. Moreover, untapped potential exists in emerging manufacturing economies, particularly across Southeast Asia and Latin America, where rapid industrialization is increasing the demand for reliable post-processing solutions. Companies focusing on specialized, customized formulations for niche applications—such as micro-molding in medical devices or additive manufacturing post-processing—are positioned to capitalize on high-margin opportunities. The impact forces indicate that regulatory compliance and sustainable product development will be the primary determinants of competitive advantage over the forecast period.

Segmentation Analysis

The Chemical Deflasher Market is systematically segmented based on chemical type, method, application, and end-use industry to provide granular market insights. This segmentation is crucial as the performance requirements vary drastically depending on the molded material (e.g., silicone vs. EPDM) and the required precision level. The primary categorization by chemical type differentiates between water-based and solvent-based formulations, representing a major bifurcation in product development driven by environmental concerns. Further segmentation by method, such as liquid immersion versus vapor deflashing, addresses varying production scale and geometry requirements, offering tailored solutions for high-volume automotive production versus low-volume, high-value aerospace parts.

The market analysis reveals that the effectiveness and suitability of a deflashing chemical are intrinsically linked to the end-use application. For instance, the electronics industry demands highly specific, residue-free deflashers to ensure optimal electrical performance, while the automotive industry prioritizes cost-effectiveness and scalability for mass-produced rubber components like seals and grommets. Segmentation allows market players to specialize their R&D efforts, offering application-specific products that maximize efficiency and component integrity. The trend is moving towards highly customizable chemical cocktails that can be finely tuned to handle hybrid materials and extremely thin flash layers inherent in complex modern components.

- By Type:

- Solvent-Based Chemical Deflashers

- Water-Based Chemical Deflashers

- Bio-Based/Green Chemical Deflashers

- Specialty Chemical Blends (for complex materials)

- By Application Method:

- Immersion Bath Deflashing

- Vapor Deflashing Systems

- Spray/Jet Deflashing

- By End-Use Industry:

- Automotive and Transportation (Seals, Gaskets, Hoses, O-rings)

- Electronics and Electrical Components (Connectors, Housings, Insulators)

- Medical Devices (Implants, Tubing, Diagnostic Components)

- Aerospace and Defense (Seals, Vibration Dampers)

- Industrial Goods and Machinery (Rubber Rollers, Boots, Diaphragms)

- Consumer Goods

- By Substrate Material:

- EPDM Rubber

- Silicone Rubber

- FKM/Fluoroelastomers

- HNBR/Nitrile Rubber

- Thermoplastics and Composites

Value Chain Analysis For Chemical Deflasher Market

The value chain for the Chemical Deflasher Market commences with upstream activities, involving the sourcing of primary chemical inputs. This includes specialized solvents (e.g., glycols, alcohols, modified hydrocarbons), surfactants, corrosion inhibitors, and various chemical intermediates required for blending proprietary formulations. The supply of these raw materials is often consolidated and subject to global petrochemical market dynamics, meaning price volatility can significantly influence the cost structure for deflasher manufacturers. Successful upstream management involves securing long-term contracts with reliable chemical suppliers and investing in strategic inventory management to mitigate supply risks, particularly concerning regulated or scarce intermediates used in high-performance green formulations.

The core segment of the value chain is the manufacturing and blending stage, where chemical deflasher companies employ specialized chemical engineers to formulate and blend the inputs into finished commercial products. This stage involves rigorous quality control, ensuring that the final product adheres to precise performance specifications (e.g., flash removal rate, compatibility with molded substrate, safety profile). Differentiation is achieved through intellectual property protecting unique formulations, particularly for bio-based or highly selective chemistries. Companies that can provide custom blending and small-batch production for niche high-performance materials possess a significant competitive edge over generic suppliers.

Downstream activities focus on distribution, sales, and end-user application support. Distribution channels are typically a mix of direct sales to large, integrated manufacturers (like Tier 1 automotive suppliers) and indirect sales through specialized industrial chemical distributors and local agents. Direct channels facilitate deep technical collaboration, providing application-specific advice and customized product delivery schedules. Indirect channels, conversely, offer broader geographic reach and accessibility to smaller molding operations. Post-sale support, including technical assistance on bath maintenance, chemical waste management, and regulatory compliance guidance, is critical, transforming the product sale into a long-term service relationship vital for customer retention in this highly technical market.

Chemical Deflasher Market Potential Customers

The primary customers for chemical deflashers are high-volume manufacturing facilities and specialized molding operations that produce precision rubber, plastic, and composite parts requiring stringent quality control and complex geometry adherence. These customers span various high-stakes industries where component failure due to residual flash is unacceptable. A major customer group is the automotive sealing and gasketing industry, including Tier 1 suppliers who manufacture millions of O-rings, engine seals, and vibration dampeners crucial for vehicle performance and safety, especially in the growing electric vehicle segment which demands highly reliable thermal management and battery sealing solutions. Their purchasing decisions are heavily influenced by scalability, cost-per-part, and compliance with automotive standards like IATF 16949.

Another significant customer segment includes manufacturers in the electronics and electrical components industry. These buyers require chemical deflashers for intricate, miniaturized components such as connectors, sensor housings, and insulating grommets where flash must be removed without leaving any residue that could interfere with electrical conductivity or subsequent assembly processes like soldering or bonding. For these precision applications, the customer prioritizes material compatibility, minimal chemical aggressiveness toward the substrate, and the ability of the deflasher to integrate into highly automated production lines where cycle time and consistency are paramount. Leading smartphone and computing component suppliers are constantly seeking next-generation, residue-free deflashing chemistries.

The third key customer group consists of medical device and aerospace component manufacturers. These buyers operate under extremely high regulatory scrutiny (e.g., FDA, FAA standards) and require validated, certified chemical processes. They purchase deflashers for producing specialized parts like surgical tubing, silicone implants, aircraft seals, and custom-molded composites. For these customers, cost is secondary to reliability, validation support, and long-term chemical stability. They often require specialized, non-toxic, and biosafe formulations. Direct engagement with the chemical supplier is preferred to ensure full traceability and access to comprehensive technical documentation regarding compatibility and environmental impact.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $785.4 Million |

| Market Forecast in 2033 | $1,166.7 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Chem-Trend, Stoner, Wacker Chemie AG, Momentive Performance Materials, Dow, Shin-Etsu Chemical Co., Ltd., Specialty Chemicals, Micro-Tronics, Cold Jet, Zeon Chemicals, Henkel AG & Co. KGaA, 3M Company, DuPont, Milacron Holdings Corp., ReleaSolv, Teknor Apex, Taminco, R.H. Liquidating Co., LLC (formerly R.H. Products), Dalian Hualaike Chemical Co., Ltd., Sika AG. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Chemical Deflasher Market Key Technology Landscape

The technological landscape within the Chemical Deflasher Market is undergoing rapid evolution, primarily driven by the imperative to reduce environmental footprint while simultaneously achieving higher precision in deflashing complex materials. A dominant technological advancement is the shift towards advanced low-VOC and solvent-free formulations. Manufacturers are heavily investing in proprietary surfactant chemistries and novel aqueous solutions that maintain high deflashing efficacy on challenging substrates, such as high-durometer EPDM and specialized fluorocarbon elastomers, without relying on traditional, highly restricted solvents. This involves formulating complex microemulsions and colloidal systems designed for selective material degradation, ensuring the bulk part remains undamaged. The core technology focus is achieving near-neutral pH cleaning to minimize equipment corrosion and enhance worker safety, differentiating these modern products from legacy solutions.

Another crucial technological development involves the integration of chemical deflashing with automated material handling and post-processing equipment, often referred to as Chemical Deflashing Systems (CDS). These systems incorporate sophisticated process control technologies, including automatic dosing pumps, real-time chemical bath concentration monitors (using sensors and spectrophotometry), and automated temperature control mechanisms. This technological integration ensures process consistency, critical for high-volume manufacturing lines. The move towards specialized vapor deflashing and spray-jet technologies offers superior precision for very delicate or geometrically inaccessible flash removal, often utilizing modified atmospheric pressure systems to enhance chemical penetration and speed without relying on full immersion, thereby reducing chemical usage.

Furthermore, technology is advancing in the area of customized chemical compatibility mapping. Given the proliferation of new polymer blends and composites, deflasher suppliers are utilizing advanced analytical chemistry techniques, such as Fourier-Transform Infrared Spectroscopy (FTIR) and Differential Scanning Calorimetry (DSC), to create detailed compatibility maps for specific customer materials. This allows for the rapid formulation of bespoke deflashers that address unique material properties, ensuring maximum flash removal efficiency (typically targeting flash thickness of 0.05 mm or less) while maintaining the physical properties, such as tensile strength and elasticity, of the main component. The ability to guarantee non-leaching and residue-free results using these advanced analytical technologies is becoming a key competitive differentiator, particularly in regulated industries.

Regional Highlights

Regional dynamics within the Chemical Deflasher Market are diverse, primarily segmented by regulatory maturity and manufacturing scale. The Asia Pacific (APAC) region currently dominates the market in terms of consumption volume and is projected to exhibit the highest growth rate during the forecast period. This dominance is attributed to the presence of vast manufacturing hubs in China, India, and Southeast Asia, encompassing large-scale production of automotive components, consumer electronics, and industrial rubber goods. While APAC demand initially focused on cost-effective, high-volume solvent-based solutions, increasing awareness regarding worker safety and environmental regulations (particularly driven by export requirements to Western markets) is stimulating rapidly growing demand for advanced water-based and low-VOC deflashers. Manufacturers are establishing local production facilities and technical centers in key APAC countries to serve this burgeoning sophisticated demand.

North America and Europe represent mature markets characterized by stringent environmental regulations, driving innovation and demanding premium, high-value products. These regions are leaders in the adoption of green chemistry, bio-based deflashers, and integrated automated deflashing systems. European regulations, such as REACH and national VOC limitations, necessitate continuous reformulation efforts, positioning European companies at the forefront of sustainable product development. The focus in these regions is less on volume growth and more on technological specialization, serving high-precision industries like medical device manufacturing and aerospace, where chemical validation and residue-free processing are critical success factors. This high regulatory pressure often results in higher average selling prices (ASPs) compared to APAC.

Latin America (LATAM) and the Middle East and Africa (MEA) are emerging markets for chemical deflashers. Growth in LATAM is tied to the automotive and construction sectors, particularly in Mexico and Brazil, which are integrating into global supply chains. MEA growth, while slower, is concentrated in industrial goods production and oil and gas sector applications, requiring specialized chemical treatments for harsh environment elastomers. These regions primarily demand economical solutions, but infrastructure improvements and increased Foreign Direct Investment (FDI) are gradually paving the way for the introduction of more technologically advanced, safer deflashing chemistries. Local partnerships and simplified supply chains are essential strategies for penetrating these emerging geographical segments effectively.

- Asia Pacific (APAC): Market volume leader; fastest growth fueled by electronics and automotive manufacturing expansion; increasing shift from traditional solvents to compliant water-based alternatives.

- North America (NA): Technology leader; high adoption of automated systems and specialty deflashers for aerospace and medical devices; strong regulatory emphasis on VOC reduction.

- Europe: Regulatory frontrunner; driven by REACH compliance and sustainability mandates; high demand for bio-based and highly specialized, validated formulations for high-value elastomers.

- Latin America (LATAM): Emerging growth market, concentrated in Mexico and Brazil; driven by regional automotive production and infrastructure development; cost-effectiveness is a primary purchasing criterion.

- Middle East and Africa (MEA): Niche demand focused on oil and gas seals and general industrial manufacturing; gradual adoption of chemical methods as quality standards rise.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Chemical Deflasher Market.- Chem-Trend (A Subsidiary of Freudenberg Chemical Specialties)

- Stoner Inc.

- Wacker Chemie AG

- Momentive Performance Materials Inc.

- The Dow Chemical Company

- Shin-Etsu Chemical Co., Ltd.

- Specialty Chemicals & Manufacturing Co.

- Micro-Tronics Inc.

- Cold Jet, LLC

- Zeon Chemicals L.P.

- Henkel AG & Co. KGaA

- 3M Company

- DuPont de Nemours, Inc.

- Milacron Holdings Corp.

- ReleaSolv LLC

- Teknor Apex Company

- Taminco (Part of Eastman Chemical Company)

- R.H. Liquidating Co., LLC (formerly R.H. Products)

- Dalian Hualaike Chemical Co., Ltd.

- Sika AG

Frequently Asked Questions

Analyze common user questions about the Chemical Deflasher market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of chemical deflashing over cryogenic or mechanical methods?

Chemical deflashing offers superior precision for intricate parts and delicate materials (like thin-walled silicone), preserves component surface finish better than abrasive methods, and significantly reduces the need for manual trimming, thus improving throughput and process consistency. It is highly effective for inner flash removal in complex geometries.

How are environmental regulations, specifically regarding VOCs, affecting the Chemical Deflasher Market?

Environmental regulations are the single largest driver of innovation, forcing manufacturers to phase out high-VOC solvent-based products. This has led to rapid growth and research investment in water-based, bio-based, and non-halogenated deflasher chemistries that offer effective deflashing while ensuring compliance with stringent standards like REACH and EPA guidelines.

Which end-use industry is the largest consumer of chemical deflashers globally?

The Automotive and Transportation industry represents the largest end-use segment. This sector requires massive volumes of precision seals, gaskets, and O-rings, especially for modern internal combustion engines and electric vehicle battery systems, making high-throughput, quality-assured chemical deflashing indispensable.

What is the future outlook for bio-based chemical deflashers?

The future outlook is highly positive. Bio-based deflashers, formulated from renewable resources, are expected to capture increasing market share as sustainability becomes a core purchasing criterion for major industrial users. Technological advancements are overcoming past limitations related to speed and material compatibility, making them viable alternatives to traditional solvents.

What factors should manufacturers consider when selecting a chemical deflasher for silicone rubber components?

For silicone rubber, manufacturers must prioritize high material compatibility to prevent swelling or degradation, residue-free performance (crucial for medical/electronics applications), and process control, often opting for specialized, mild solvent blends or high-performance aqueous formulations designed specifically for silicone cross-linking chemistry.

How does the cost of raw materials impact the pricing of chemical deflashers?

The pricing of chemical deflashers is highly sensitive to the volatility of petrochemical feedstocks, which form the base of most solvents and specialized surfactants. Fluctuations in crude oil prices and supply chain disruptions directly influence the manufacturing costs, leading to variable market pricing and necessitating robust hedging strategies for deflasher producers.

What role does automation play in the adoption of chemical deflashing processes?

Automation is critical, integrating chemical deflashing baths or spray systems directly into high-speed production lines. Automated systems ensure precise control over dwell time, temperature, and chemical concentration, minimizing human error, enhancing worker safety, and guaranteeing consistent quality necessary for components requiring extremely tight tolerances.

Are water-based deflashers suitable for all types of molded materials?

While water-based deflashers are increasingly versatile, their suitability depends heavily on the specific polymer type. They are highly effective for many elastomers but may struggle with high-performance materials or certain thermoset plastics that require stronger solvent action or are highly moisture-sensitive. Manufacturers must validate water-based products for each specific substrate.

What is the significance of the Value Chain Analysis in the Chemical Deflasher Market?

The Value Chain Analysis highlights critical stages from raw material sourcing (upstream, prone to volatility) through specialized manufacturing (core differentiation) to complex distribution and technical support (downstream). Understanding this chain reveals cost drivers, opportunities for integration, and key areas where competitive advantage, particularly technical service, can be established.

How do specialized deflashers cater to the electronics industry's needs?

Specialized deflashers for electronics must be non-conductive, non-corrosive, and leave absolutely no residue (Non-Volatile Residue, NVR). They are often proprietary blends designed for micro-molded components, focusing on removing sub-millimeter flash without compromising the integrity or surface cleanliness essential for subsequent bonding or coating processes.

Which regions mandate the strictest requirements for low-VOC deflashing chemicals?

Europe, driven by the Registration, Evaluation, Authorisation and Restriction of Chemicals (REACH) regulation and various national environmental agency standards, typically mandates the strictest requirements for limiting VOCs and hazardous substances in industrial chemicals, thereby spearheading the demand for sustainable and bio-friendly deflashers.

What are the technical challenges associated with deflashing fluorocarbon elastomers (FKM)?

FKM elastomers exhibit high chemical resistance, making them difficult to deflash without aggressive solvents that pose environmental risks. The challenge lies in developing selective chemistries that can soften the thin flash layer efficiently without damaging the bulk polymer's critical properties, often requiring elevated temperatures and specific catalyst presence.

What specific impact does AI have on supply chain management within this market?

AI optimizes supply chain management by utilizing predictive analytics to forecast demand for specialized chemical intermediates, anticipate geopolitical or logistical disruptions, and manage inventory levels efficiently, thereby ensuring a stable supply of inputs and reducing operational costs for deflasher manufacturers worldwide.

How do companies achieve differentiation in a highly specialized chemical market?

Differentiation is primarily achieved through proprietary high-performance formulations (IP protection), offering customized technical support and application validation services, ensuring superior regulatory compliance, and integrating deflashing solutions into comprehensive automated post-processing equipment packages for major industrial clients.

What is vapor deflashing and when is it preferred?

Vapor deflashing involves exposing molded parts to a heated chemical vapor rather than liquid immersion. It is preferred for highly intricate or delicate parts where minimal chemical contact is desired, offering high uniformity and faster drying times, often utilized for small, high-precision components in the electronics and medical sectors.

What are the key components of a comprehensive chemical deflashing system beyond the chemical agent itself?

A comprehensive system includes specialized immersion tanks or chambers, heating and cooling units for temperature control, filtration and purification systems for bath longevity, automated dosing and mixing equipment for concentration maintenance, and integrated ventilation systems to manage fumes and ensure worker safety.

How does the shift to electric vehicle (EV) production influence demand for chemical deflashers?

The shift to EVs increases demand for high-precision, reliable elastomer seals and thermal management components (gaskets, battery seals) that must withstand extreme temperatures and environmental conditions. This drives demand for high-quality chemical deflashing to ensure these critical components are defect-free and dimensionally accurate.

What are the main risks associated with using solvent-based chemical deflashers?

The main risks include environmental non-compliance due to high VOC emissions, fire hazards due to flammability, increased operational costs associated with specialized ventilation and chemical disposal, and occupational health concerns related to prolonged exposure to potent chemical agents.

In the Value Chain, why is downstream technical support so crucial for this market?

Downstream technical support is crucial because chemical deflashing is a highly specific process dependent on material science and machine parameters. Customers require continuous assistance with bath stability, troubleshooting process variations, optimizing cycle times, and ensuring documentation for regulatory audits, making the supplier a long-term technical partner.

What is the typical flash thickness chemical deflashers are designed to handle?

Chemical deflashers are typically optimized to handle very thin flash, generally ranging from 0.02 mm to 0.1 mm, which is the type of thin, delicate flash material often found on precision-molded parts that mechanical processes might tear or miss altogether.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager