Chemical Engineering Simulation Software Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434743 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Chemical Engineering Simulation Software Market Size

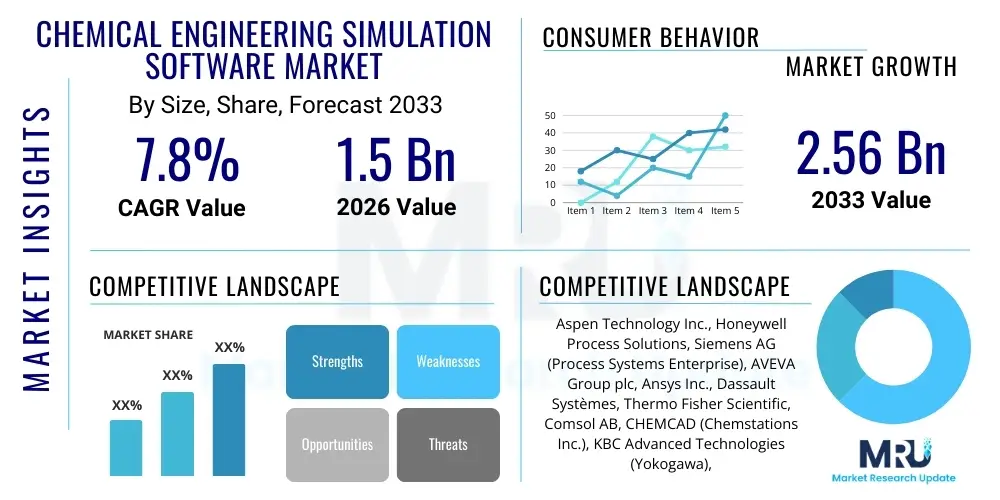

The Chemical Engineering Simulation Software Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 2.56 Billion by the end of the forecast period in 2033.

Chemical Engineering Simulation Software Market introduction

The Chemical Engineering Simulation Software Market encompasses sophisticated computational tools designed to model, simulate, and optimize complex chemical processes, equipment design, and reaction kinetics. These solutions, ranging from steady-state process simulators to dynamic flow sheet packages and computational fluid dynamics (CFD) tools, are fundamental for industries involved in chemical manufacturing, oil and gas, pharmaceuticals, specialty chemicals, and materials science. The primary function of this software is to enable engineers to predict process behavior under various operating conditions, evaluate safety parameters, minimize material waste, and significantly reduce the time and cost associated with physical experimentation and pilot plant trials. Key product offerings include comprehensive process modeling suites (like ASPEN Plus or HYSYS), specialized reaction engineering tools, and environmental modeling software, all critical for achieving operational excellence and regulatory compliance in modern industrial environments.

Major applications for chemical engineering simulation software span across the entire process lifecycle, beginning with conceptual design and feasibility studies, moving through detailed engineering and optimization, and extending into operational troubleshooting and asset management. In the petrochemical sector, simulations are vital for designing distillation columns, heat exchanger networks, and complex reactor systems, ensuring high yield and energy efficiency. Similarly, pharmaceutical companies utilize these tools for modeling crystallization processes, drug delivery systems, and continuous manufacturing trains. The inherent benefits of employing these technologies include accelerated time-to-market for new products, enhanced process safety through rigorous scenario analysis, optimization of utility consumption, and the ability to rapidly iterate on design changes without physical constraints. This ability to test 'what-if' scenarios virtually provides a substantial competitive advantage.

The market's sustained growth is primarily driven by the global imperative for enhanced process efficiency, reduced carbon footprint, and stricter environmental regulations requiring precise emissions modeling and control. Furthermore, the increasing complexity of chemical processes, especially in specialized areas like bio-based chemicals and advanced materials, necessitates the use of high-fidelity simulation tools that can handle non-ideal thermodynamic behavior and complex multi-phase systems. The integration of simulation tools with other digital technologies, such as IoT sensors and data analytics platforms, is also propelling adoption, allowing for the creation of digital twins of chemical plants. This convergence enables real-time optimization, predictive maintenance, and highly agile operational management, solidifying the software's role as an indispensable asset in the chemical and process industries.

Chemical Engineering Simulation Software Market Executive Summary

The Chemical Engineering Simulation Software Market is characterized by robust growth, driven by the expanding need for operational efficiency and sustainability across key industrial verticals such as oil & gas, chemicals, and pharmaceuticals. Business trends indicate a strong shift towards subscription-based cloud deployment models, favoring accessibility and scalability over traditional on-premise perpetual licenses. Strategic mergers and acquisitions among major vendors are consolidating market expertise, particularly in specialized areas like advanced process control (APC) and computational fluid dynamics (CFD). Furthermore, vendors are increasingly embedding artificial intelligence and machine learning algorithms into their platforms to enhance predictive accuracy, automate model calibration, and facilitate rapid design exploration, thereby accelerating innovation cycles and improving process performance metrics significantly.

Regionally, North America and Europe maintain dominance, attributed to high R&D investments, stringent regulatory frameworks necessitating detailed process validation, and the early adoption of digital transformation initiatives within mature chemical and refining industries. However, the Asia Pacific region is demonstrating the highest growth trajectory, primarily fueled by rapid industrial expansion in countries like China, India, and South Korea, coupled with significant governmental investments in infrastructure and chemical manufacturing capacity. This regional dynamism is creating substantial demand for scalable and cost-effective simulation solutions to optimize newly constructed large-scale plants and meet escalating local and international consumer demand for chemical products and refined fuels.

Segment trends reveal that the core Process Simulation software segment remains the largest revenue contributor, essential for fundamental process design and optimization. However, the market for specialized simulation tools, particularly those focused on specialized areas like molecular simulation and crystallization modeling for the pharmaceutical and specialty chemicals sectors, is exhibiting above-average growth rates. Furthermore, deployment trends highlight the surging demand for cloud-based solutions, offering flexibility and computational power necessary for running large, complex models, particularly beneficial for small and medium-sized enterprises (SMEs). This technological shift is democratizing access to high-fidelity simulation capabilities, previously restricted to large corporations with extensive in-house IT infrastructure, thereby broadening the overall market penetration.

AI Impact Analysis on Chemical Engineering Simulation Software Market

User inquiries concerning the impact of AI on chemical engineering simulation primarily focus on three key themes: enhanced model accuracy, automation of design workflows, and the feasibility of real-time predictive control through digital twins. Users often question how AI can improve the notoriously time-consuming steps of parameter estimation, model tuning, and validation against experimental data. There is strong interest in using machine learning (ML) to bridge the gap between low-fidelity models used in early design stages and high-fidelity models required for detailed engineering, specifically aiming to reduce computational time without sacrificing prediction quality. Additionally, chemical engineers are keen to understand AI’s role in accelerating the discovery of novel materials and reaction pathways, moving beyond traditional combinatorial approaches to intelligent, goal-directed optimization.

The integration of artificial intelligence (AI) and machine learning (ML) algorithms is revolutionizing the chemical engineering simulation software domain by transforming traditional, physics-based modeling approaches into hybrid, data-driven frameworks. AI tools are increasingly used to handle complex non-linear process data and thermodynamic anomalies that are challenging for traditional simulators to capture accurately, leading to more robust and reliable design decisions. Specifically, ML models are being trained on vast datasets of historical plant operations and experimental results to create highly accurate surrogate models—faster, simplified representations of complex rigorous models. This capability significantly accelerates optimization routines and allows for rapid exploration of design spaces that were previously too computationally expensive to analyze fully. Furthermore, AI facilitates automated data reconciliation and fault detection, transforming the simulation platform from a purely design tool into a proactive operational intelligence system.

This transformative impact extends deeply into the realm of advanced process control (APC) and the development of digital twins. AI algorithms enable the digital twin to learn from live sensor data, autonomously update model parameters, and predict future performance deviations with high fidelity. This real-time feedback loop allows for immediate optimization adjustments, ensuring the process remains close to its optimal operating point, maximizing throughput, and minimizing energy consumption. Expectations are high that AI will eventually handle entire design synthesis tasks, suggesting optimal flowsheets and material selections based on predefined performance criteria, moving the engineer from a modeler role to a supervisor role focused on validating AI-generated hypotheses. This shift is crucial for tackling intricate challenges in sustainable chemistry and complex, multi-component separations.

- AI enhances model accuracy through automated parameter calibration and data-driven surrogate modeling.

- Machine learning accelerates computational fluid dynamics (CFD) and process optimization by reducing simulation runtimes significantly.

- Digital twin platforms leverage AI for real-time process monitoring, predictive maintenance, and adaptive control.

- Natural Language Processing (NLP) integration improves user interaction and documentation accessibility within simulation environments.

- AI facilitates materials informatics, accelerating the discovery and screening of new catalysts and specialty chemicals.

- Automated fault detection and diagnostic capabilities improve process safety and minimize unplanned downtime.

DRO & Impact Forces Of Chemical Engineering Simulation Software Market

The market dynamics of the Chemical Engineering Simulation Software are shaped by powerful internal drivers and external constraints, moderated by significant opportunities stemming from technological innovation. The primary driver is the accelerating digital transformation within the process industries, coupled with global competitive pressures that mandate higher yields, lower operational costs, and rapid product development cycles. Restraints primarily involve the high initial cost of licenses, particularly for comprehensive enterprise solutions, the requirement for highly specialized training for advanced usage, and inherent challenges in accurately modeling extremely complex or novel chemical systems where experimental data is sparse or unreliable. Opportunities are largely concentrated around the deployment of cloud-native simulation platforms, the integration of simulation with Industry 4.0 technologies (like IoT and Big Data), and the increasing global focus on developing sustainable and green chemical processes, which require rigorous modeling of new, non-traditional feedstocks and reaction mechanisms.

Key impact forces affecting market trajectory include intensifying regulatory scrutiny regarding environmental and safety compliance, which increases the necessity for verifiable simulation outputs (e.g., dispersion modeling, relief system sizing). Competitive intensity among vendors forces continuous software innovation, particularly in usability (UX/UI) and integration capabilities with other enterprise systems (like PLM or ERP). The bargaining power of buyers remains moderately high due to the specialized nature and significant investment required for software suites, leading to demand for flexible pricing models and customized module selection. The threat of substitutes is relatively low, as physical experimentation cannot fully replace the comprehensive, cost-effective optimization offered by high-fidelity simulation, but internal organizational resistance to change and reliance on legacy proprietary models present internal substitution risks.

The shift towards modular, microservices-based architectures is mitigating the restraint of high initial costs, allowing smaller enterprises to adopt specific simulation capabilities on a pay-as-you-go basis. Furthermore, the global push toward energy transition, decarbonization, and hydrogen economy development represents a massive market opportunity, as these emerging fields entirely rely on sophisticated simulation tools for designing new electrolysis, carbon capture, and storage systems. Vendors who successfully tailor their offerings to address these net-zero engineering challenges, perhaps through specialized module development and enhanced AI-driven material selection, are positioned for substantial market growth and competitive differentiation in the medium term.

- Drivers: Demand for process efficiency and cost reduction; stringent environmental and safety regulations; rapid industrial digitalization (Industry 4.0); increasing complexity of chemical processes (e.g., bio-based chemicals).

- Restraints: High initial software licensing costs; requirement for highly specialized user expertise; difficulty in modeling highly non-ideal or proprietary processes; concerns over data security in cloud deployment.

- Opportunity: Expansion into emerging fields like Carbon Capture, Utilization, and Storage (CCUS) and Hydrogen economy; integration with Digital Twin technology; adoption of SaaS/Cloud deployment models; leveraging AI for accelerated material design.

- Impact Forces:

- Threat of New Entrants: Low to Moderate (High barriers to entry due to required domain expertise and R&D investment).

- Bargaining Power of Suppliers (Software Vendors): High (Due to proprietary algorithms and specialized nature of products).

- Bargaining Power of Buyers (End-Users): Moderate (High switching costs, but strong negotiating leverage due to high license value).

- Threat of Substitutes: Low (Physical testing is costly and time-consuming; no complete digital substitute exists).

- Competitive Rivalry: High (Dominated by a few major players with continuous feature competition).

Segmentation Analysis

The Chemical Engineering Simulation Software Market is primarily segmented based on the type of software, the specific application area, the deployment model, and the end-use industry. This multifaceted segmentation helps in understanding the varying needs and adoption patterns across the industrial landscape. The segmentation by software type differentiates between core process simulators, which focus on mass and energy balances across flowsheets, and specialized tools like computational fluid dynamics (CFD) and molecular modeling software, which address micro-scale phenomena and complex physical transport processes. The increasing demand for detailed predictive capabilities in specialized fields is driving the rapid growth of the specialized tools segment, particularly in areas like particulate matter processing and polymer engineering.

Deployment model segmentation is crucial, reflecting the industry's shift from traditional monolithic installations to flexible, scalable computing environments. While on-premise deployment still prevails in highly regulated industries with strict data sovereignty requirements, the Software-as-a-Service (SaaS) or cloud-based model is gaining significant traction due to its lower capital expenditure, reduced IT overhead, and superior computational resource access, which is essential for running large-scale dynamic simulations and optimization studies. Furthermore, the segmentation by application highlights distinct use cases, such as reaction engineering, equipment design (e.g., heat exchangers, reactors), and environmental and safety modeling, each requiring tailored features and libraries to ensure accurate results relevant to the specific engineering task.

Finally, the market is defined by end-use industry, demonstrating where the investment in simulation technology is concentrated. The petrochemical and oil & gas sectors traditionally account for the largest market share due to the scale and inherent hazards of their operations, demanding continuous optimization and rigorous safety analysis. However, sectors such as pharmaceuticals and biotechnology are becoming increasingly vital growth areas, driven by the adoption of Quality by Design (QbD) principles and the necessity for accurate modeling of complex biological and crystallization processes. The specialty chemicals sector, focusing on high-value products and intricate synthesis pathways, also represents a critical, high-growth consumer segment for advanced simulation tools.

- By Software Type:

- Process Simulation Software (Steady-State and Dynamic)

- Computational Fluid Dynamics (CFD)

- Molecular Modeling and Quantum Chemistry Software

- Reaction Engineering and Kinetics Software

- Customizable Thermodynamic Property Packages

- By Application:

- Process Design and Optimization

- Equipment Design (Reactors, Separators, Heat Exchangers)

- Safety and Risk Assessment (Relief System Sizing, Flare Analysis)

- Real-Time Optimization and Advanced Process Control (APC)

- Environmental Modeling and Emissions Control

- By Deployment Model:

- On-Premise

- Cloud-Based (SaaS)

- By End-Use Industry:

- Oil and Gas (Upstream, Midstream, Downstream)

- Chemicals and Petrochemicals

- Pharmaceuticals and Biotechnology

- Specialty Chemicals and Materials

- Power Generation and Utilities

- Food and Beverage

Value Chain Analysis For Chemical Engineering Simulation Software Market

The value chain for chemical engineering simulation software is complex, starting with intensive upstream research and development, progressing through software creation and licensing, and culminating in downstream implementation and continuous support for end-users. Upstream activities are dominated by specialized software vendors investing heavily in proprietary thermodynamic models, numerical solvers, and advanced algorithms, often collaborating closely with academic institutions and industrial consortia to validate new features and integrate cutting-edge computational chemistry techniques. The core value generated here lies in the accuracy, robustness, and comprehensiveness of the underlying engineering libraries and data packages, which require continuous updates to reflect new chemical species, reaction data, and industry standards.

The mid-chain activities involve software production, packaging, and distribution, where vendors decide on licensing models (perpetual, subscription, cloud access) and configure modules tailored to specific industry requirements (e.g., polymer modeling, electrolyte systems). Distribution channels are critical; direct sales channels are typically used for large enterprise clients requiring extensive customization and dedicated integration support, while indirect channels, involving specialized engineering consulting firms and value-added resellers (VARs), provide localized training, implementation, and integration services, particularly important in geographically dispersed or emerging markets. The software platforms often need integration capabilities with third-party tools such as CAD systems, data historians (OSIsoft PI, etc.), and manufacturing execution systems (MES), adding complexity to the deployment phase.

Downstream activities focus entirely on the end-user application and support. This stage includes comprehensive training for chemical engineers, ensuring they possess the necessary expertise to build, run, and interpret complex models correctly—a significant bottleneck in adoption. Post-sales support involves troubleshooting model convergence issues, providing software updates, and offering consultancy services for complex project simulation work. The feedback loop from the downstream end-users (chemical plant operators, process designers) back to the upstream R&D teams is essential for continuous product improvement and ensuring the simulation software accurately reflects real-world plant behavior, thereby closing the loop and sustaining the core value proposition of the software.

Chemical Engineering Simulation Software Market Potential Customers

Potential customers for chemical engineering simulation software are organizations whose core operations involve complex chemical transformations, separations, and energy management, requiring high levels of precision, safety, and efficiency. The largest segment of buyers comprises major international oil and gas corporations (IOCs and NOCs), who utilize the software extensively for designing refining units, gas processing facilities, and optimizing pipeline networks. These entities require enterprise-level licenses, robust dynamic simulation capabilities, and dedicated integration with their operational technology (OT) systems for digital twin creation and real-time asset performance monitoring, making them high-value, long-term clients focused on maximizing asset longevity and minimizing operational risk.

Another major buying group consists of large multinational chemical and petrochemical manufacturers (e.g., producers of plastics, fertilizers, industrial gases), who use simulation for greenfield plant design, debottlenecking existing units, and optimizing reaction yields for high-value chemical products. For this segment, the software is crucial for achieving product purity specifications, managing energy consumption in separation processes, and ensuring compliance with tightening environmental regulations. The decision-makers here often include corporate engineering departments and R&D divisions seeking tools that can expedite the transition from laboratory proof-of-concept to full-scale commercial production, emphasizing tools with strong reactor modeling and advanced thermodynamic capabilities.

Emerging but rapidly growing customer bases include pharmaceutical companies adopting Continuous Manufacturing (CM), where simulation is mandatory for modeling complex fluid dynamics and crystallization kinetics under continuous flow conditions to ensure Quality by Design (QbD). Furthermore, engineering, procurement, and construction (EPC) firms represent vital buyers, as they utilize the software to deliver detailed engineering packages and validated process designs to their clients across various industries globally. Finally, academic and research institutions are critical customers, utilizing specialized, often heavily discounted licenses for educational purposes, fundamental research in chemical thermodynamics, and training the next generation of industrial chemical engineers, thereby influencing future commercial adoption patterns.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 2.56 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Aspen Technology Inc., Honeywell Process Solutions, Siemens AG (Process Systems Enterprise), AVEVA Group plc, Ansys Inc., Dassault Systèmes, Thermo Fisher Scientific, Comsol AB, CHEMCAD (Chemstations Inc.), KBC Advanced Technologies (Yokogawa), Virtual Materials Group, Inc. (VMG), CD-adapco (now Siemens Digital Industries Software), GTT Technologies, Reaction Design (Synopsys), Gaussian Inc., DWSIM Simulation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Chemical Engineering Simulation Software Market Key Technology Landscape

The technological landscape of the Chemical Engineering Simulation Software Market is defined by the convergence of advanced numerical methods, cloud computing infrastructure, and data science integration. Core technologies remain centered on highly robust numerical solvers, including sequential modular and equation-oriented approaches, optimized for solving massive systems of coupled non-linear algebraic and differential equations (DAEs) that govern chemical processes. Modern simulation packages are heavily reliant on sophisticated thermodynamic property prediction methods, such as Equation of State (EOS) models (e.g., SRK, Peng-Robinson) and activity coefficient models (e.g., NRTL, UNIQUAC), which are continuously refined to accurately predict complex phase equilibria in multi-component and highly non-ideal mixtures, particularly crucial for high-pressure or supercritical fluid applications.

A major technological shift involves the transition toward High-Performance Computing (HPC) environments, facilitated by cloud platforms (e.g., AWS, Azure). This transition is crucial for running computationally intensive tasks such as transient (dynamic) simulations, complex Computational Fluid Dynamics (CFD) studies requiring millions of mesh elements, and large-scale global optimization routines. Leveraging parallel processing and Graphics Processing Unit (GPU) acceleration allows engineers to achieve simulation runtimes that were previously unattainable on standard workstations, enabling the rapid testing of a much wider range of operating scenarios, enhancing design robustness and accelerating troubleshooting efforts. Furthermore, modular software architectures utilizing microservices are becoming standard, improving platform scalability, facilitating easier integration with proprietary client models, and streamlining the deployment of updates and new features.

The future of the technology landscape is being shaped by integrated data analytics and AI/ML capabilities. Digital twin frameworks, which merge dynamic simulation models with live plant data historians, represent the apex of this integration, offering predictive maintenance and prescriptive control recommendations. Furthermore, advancements in specialized areas, such as mesoscale simulation techniques (like Discrete Element Method - DEM for particle processes) and rigorous quantum mechanics methods for catalyst design, are pushing the boundaries of what can be accurately modeled. This emphasis on multi-scale modeling, bridging the gap from the molecular level up to the entire plant operation, is the primary focus of R&D investment, aiming to deliver truly comprehensive, predictive, and autonomous process engineering solutions that drastically minimize the need for physical prototypes and costly late-stage design modifications.

Regional Highlights

Regional dynamics are critical to understanding the Chemical Engineering Simulation Software Market, with adoption rates and demand drivers varying significantly across geographies based on industrial maturity, regulatory environment, and investment in R&D and digital infrastructure. North America, encompassing the United States and Canada, stands as a mature market leader, characterized by high adoption rates in the oil and gas (shale energy exploration), large-scale chemical manufacturing, and burgeoning biopharmaceutical sectors. The region benefits from substantial corporate R&D spending, a strong academic base collaborating on advanced modeling techniques, and stringent safety standards enforced by bodies like the EPA and OSHA, which necessitates the use of high-fidelity simulation for compliance and risk management. This region often leads in the adoption of cutting-edge technologies like digital twins and AI-enhanced process control systems.

Europe represents another key market, driven by the emphasis on sustainability, circular economy initiatives, and regulatory frameworks such as REACH, pushing the industry toward efficient, lower-carbon processes. European chemical companies are heavy users of simulation tools for optimizing energy consumption, designing sustainable separation technologies, and modeling complex specialty chemical synthesis. Countries like Germany (due to its strong chemical manufacturing base) and the UK (with its focus on pharmaceutical innovation and R&D) are significant contributors. The region is also a hotspot for the development and commercialization of specialized simulation software, particularly in the areas of crystallization, polymerization, and process integration (e.g., pinch analysis for energy efficiency), often spearheaded by specialized simulation firms with strong academic ties.

The Asia Pacific (APAC) region is projected to register the highest growth rate during the forecast period. This rapid expansion is attributed to massive industrialization, capacity expansion in the petrochemical and refining industries (especially in China and India), and growing government investment in infrastructure and technology modernization. As new chemical plants and refineries are built, the demand for licensed simulation software for design and commissioning escalates. While initial adoption may favor cost-effective or locally developed solutions, the complexity of new projects increasingly demands globally recognized, high-fidelity platforms. Furthermore, Southeast Asian nations are increasing their focus on enhancing local manufacturing competitiveness, driving demand for optimization tools to improve yields and reduce operational costs.

Latin America and the Middle East & Africa (MEA) offer substantial opportunities, particularly within the oil & gas and basic chemicals sectors. The MEA region, heavily reliant on hydrocarbon processing, uses simulation extensively for optimizing upstream production, designing large-scale LNG facilities, and enhancing refinery efficiency, driven by state-owned enterprises making strategic investments in technology to diversify and maximize resource value. Latin America's market growth is more varied, with strong demand in Brazil and Mexico for both chemical and agricultural processing optimization. These regions are increasingly adopting cloud-based solutions to overcome localized IT infrastructure limitations and gain access to high-performance computing necessary for their large, often remote, industrial assets.

- North America (Market Leader):

- High investment in R&D and digital transformation initiatives across oil & gas and biopharma.

- Stringent environmental regulations demanding advanced safety and environmental modeling (e.g., dispersion analysis).

- Early adopter of Digital Twin technology and AI integration for predictive operations.

- Europe (Innovation Hub):

- Strong focus on process efficiency, decarbonization, and Circular Economy principles.

- High demand for specialized software in advanced materials, fine chemicals, and crystallization processes.

- Market driven by regulatory compliance (REACH) and energy optimization goals.

- Asia Pacific (Fastest Growing Region):

- Rapid capacity expansion in petrochemicals, fertilizers, and refining, particularly in China and India.

- Increasing adoption of global standard simulation platforms for new plant design and commissioning.

- Demand fueled by government-led industrial modernization and infrastructure investment programs.

- Middle East & Africa (Resource-Driven):

- Significant utilization in optimizing large-scale hydrocarbon processing facilities (refining, petrochemicals).

- Strategic adoption of technology by National Oil Companies (NOCs) to maximize asset performance and longevity.

- Growing need for solutions to manage complex, remote operations efficiently.

- Latin America (Emerging Market):

- Demand driven by process optimization in chemical manufacturing, mining, and agricultural industries (e.g., bioethanol production).

- Increased shift towards flexible, cloud-based deployment models to address infrastructure gaps.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Chemical Engineering Simulation Software Market.- Aspen Technology Inc. (AspenTech)

- Honeywell Process Solutions

- Siemens AG (Process Systems Enterprise - PSE)

- AVEVA Group plc

- Ansys Inc.

- Dassault Systèmes

- Comsol AB

- CHEMCAD (Chemstations Inc.)

- KBC Advanced Technologies (Yokogawa)

- Virtual Materials Group, Inc. (VMG)

- GTT Technologies

- CD-adapco (now part of Siemens Digital Industries Software)

- Reaction Design (part of Synopsys)

- MATLAB/Simulink (The MathWorks, Inc.)

- Oli Systems, Inc.

- Gaussian Inc.

- SCHNEIDER ELECTRIC SE

- HTRI (Heat Transfer Research, Inc.)

- FLUENT (Ansys)

- Star-CCM+ (Siemens Digital Industries Software)

Frequently Asked Questions

Analyze common user questions about the Chemical Engineering Simulation Software market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Chemical Engineering Simulation Software Market?

The Chemical Engineering Simulation Software Market is projected to exhibit a robust Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033, driven by increasing industrial digitalization and the global demand for operational efficiency and sustainability.

How is cloud computing impacting the deployment of chemical engineering simulation tools?

Cloud computing, particularly the Software-as-a-Service (SaaS) model, is fundamentally changing deployment by offering lower capital expenditure, enhanced computational scalability for dynamic and complex models, and improved accessibility, especially for SMEs and remote facilities.

Which industry segment is the largest end-user of simulation software?

The Oil and Gas and Petrochemicals sector historically represents the largest end-user segment, utilizing simulation extensively for large-scale process design, refining optimization, and rigorous safety and risk assessment (relief systems, flare analysis).

What role does Artificial Intelligence (AI) play in modern chemical engineering simulation?

AI is integrated to enhance simulation accuracy through data-driven surrogate modeling, accelerate complex calculations (like CFD), automate parameter estimation, and power digital twins for real-time predictive control and autonomous operational optimization.

What are the primary challenges restraining the widespread adoption of advanced simulation software?

Key challenges include the high initial cost of perpetual licenses, the requirement for highly specialized training and domain expertise to effectively use high-fidelity models, and the complexity associated with integrating simulation outputs into legacy manufacturing execution systems (MES).

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager