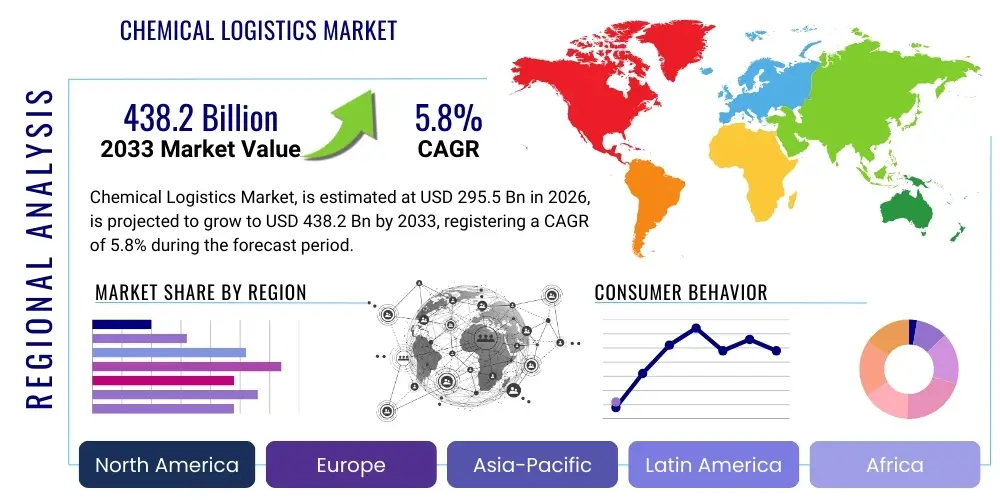

Chemical Logistics Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435055 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Chemical Logistics Market Size

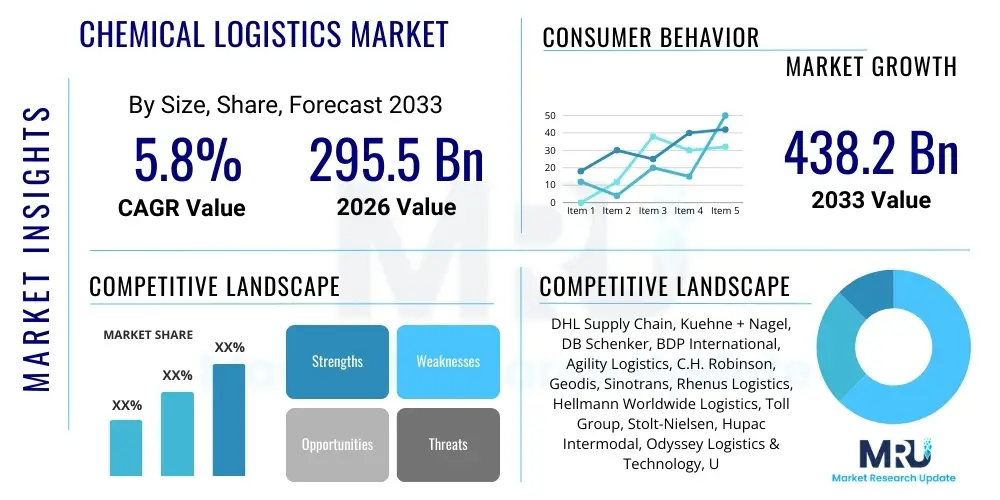

The Chemical Logistics Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 295.5 Billion in 2026 and is projected to reach USD 438.2 Billion by the end of the forecast period in 2033. This consistent growth trajectory is primarily attributed to the expanding global chemical manufacturing base, particularly in emerging economies, coupled with increasingly complex international trade regulations that necessitate specialized logistics services focused on safety, compliance, and efficiency. The demand for meticulous handling of hazardous materials (Hazmat) and temperature-sensitive chemicals further drives the premium nature of specialized chemical logistics.

Chemical Logistics Market introduction

The Chemical Logistics Market encompasses the specialized transportation, warehousing, distribution, and supply chain management services tailored for chemical products, ranging from basic commodities like ethylene and methanol to highly specialized products such as performance chemicals, pharmaceuticals, and agricultural inputs. Given the inherent risks associated with handling flammable, corrosive, toxic, or explosive materials, chemical logistics providers must adhere to stringent global and regional regulatory frameworks, including Responsible Care initiatives and specific guidelines set by organizations like the International Maritime Dangerous Goods (IMDG) Code and regulations governing ADR (Agreement concerning the International Carriage of Dangerous Goods by Road). The necessity for multi-modal transport solutions, specialized tank containers, and advanced handling equipment defines this market segment.

Major applications for chemical logistics services span diverse industrial sectors, notably petrochemicals, pharmaceuticals, specialty chemicals, agrochemicals, and industrial coatings. The core benefits derived from professional chemical logistics include enhanced supply chain reliability, reduced operational risk through strict safety protocols, optimized inventory management via just-in-time (JIT) deliveries, and compliance assurance, minimizing the potential for costly penalties or environmental incidents. Effective management of cold chain logistics for temperature-sensitive chemical reagents and biopharmaceuticals represents a high-growth segment within this industry, demanding significant technological investment in real-time monitoring and control systems.

Driving factors propelling market expansion include sustained growth in global chemical production capacity, particularly the shift towards Asia Pacific as a primary manufacturing hub, necessitating long-haul international logistics solutions. Furthermore, the trend toward outsourcing non-core competencies by major chemical manufacturers to specialized Third-Party Logistics (3PL) providers is accelerating. These 3PLs offer scalability, deep regulatory expertise, and advanced digital platforms for supply chain visibility, which are critical for managing complex, multi-jurisdictional chemical distribution networks. The focus on sustainability and green logistics, demanding optimized routing and reduced carbon footprints, is also influencing strategic investment decisions across the market.

Chemical Logistics Market Executive Summary

The global Chemical Logistics Market is characterized by robust resilience and strategic consolidation, driven by significant business trends focusing on digitalization, sustainability integration, and enhanced safety protocols. Current business trends indicate a strong move toward end-to-end supply chain visibility, facilitated by advanced telematics, Internet of Things (IoT) sensors, and cloud-based management systems. Chemical manufacturers are increasingly demanding tailored, risk-mitigated solutions that can handle complex product portfolios, including both bulk liquid transfers and specialized packaged goods. Furthermore, merger and acquisition activities among top-tier logistics providers are reshaping the competitive landscape, aiming to create integrated global networks capable of offering seamless multi-modal services.

Regionally, the Asia Pacific (APAC) market dominates growth projections, fueled by massive industrialization, high domestic chemical consumption in countries like China and India, and the establishment of large-scale chemical manufacturing clusters. North America and Europe maintain significant market shares, characterized by advanced regulatory compliance standards and a high adoption rate of digital supply chain tools, focusing heavily on optimizing existing infrastructure and transitioning toward intermodal transport options like rail to reduce environmental impact. The Middle East, leveraging its position as a major petrochemical exporter, sees strong demand for global deep-sea shipping and specialized terminal services, connecting vast production capacities to consumer markets worldwide.

Segment trends highlight the continued dominance of road transport for first- and last-mile connectivity, though rail logistics is gaining prominence for long-haul, high-volume chemical movements due to cost efficiency and reduced risk profiles. In terms of service type, transportation services hold the largest market share, but value-added services such as specialized warehousing, packaging, and custom brokerage are experiencing faster growth, reflecting the increasing complexity and regulatory burden placed upon shippers. Demand for cold chain logistics, especially within the pharmaceutical and high-purity chemical sectors, is a major differentiator, commanding premium pricing and driving technological innovation in insulated containers and real-time temperature tracking.

AI Impact Analysis on Chemical Logistics Market

User inquiries concerning AI's role in Chemical Logistics primarily revolve around how these technologies can fundamentally enhance safety compliance, optimize complex routing involving multiple regulatory checkpoints, and provide accurate predictive modeling for demand fluctuations and supply chain disruptions. Key themes extracted from user questions include the potential of AI to automate hazardous documentation checks (reducing human error), its application in preventing equipment failures (predictive maintenance on tanks and vessels), and the ability to dynamically adjust transport modes and routes in response to real-time events, such as port congestion or unexpected regulatory changes. Users express high expectations regarding AI's capability to lower operational risks and costs simultaneously, while concerns often center on data security and the integration complexity of proprietary legacy systems with new AI platforms.

The integration of Artificial Intelligence (AI) and Machine Learning (ML) algorithms is revolutionizing the traditionally process-heavy and risk-averse chemical logistics sector. AI systems are being deployed for sophisticated risk assessment, utilizing historical incident data, weather patterns, and route specific hazards to calculate optimal, safest, and most compliant transit paths in real-time. This dynamic route optimization drastically minimizes transit times and fuel consumption while mitigating exposure to high-risk zones. Furthermore, AI-powered predictive demand forecasting allows logistics providers to proactively position specialized assets (tankers, flexitanks, storage space), leading to better asset utilization and reduced demurrage charges, which is crucial in high-capital industries like chemical transport.

Another profound impact of AI lies in enhancing regulatory adherence and documentation management. Chemical shipments often require dozens of certifications, permits, and safety data sheets (SDS) that vary by jurisdiction. AI systems can use Natural Language Processing (NLP) to instantaneously verify document completeness and compliance against current regulatory databases, flagging discrepancies before shipment initiation. This level of automated verification significantly reduces the risk of customs delays or non-compliance fines, ensuring the integrity of the critical safety chain required for Hazmat transportation. The implementation of AI is moving chemical logistics towards a self-optimizing, highly responsive, and inherently safer operational model.

- Real-time predictive maintenance scheduling for specialized transport equipment (tanks, pumps, seals).

- Dynamic route optimization considering regulatory restrictions, traffic, and geopolitical risk factors.

- AI-driven automated compliance checks for hazardous materials documentation (SDS, placards, permits).

- Enhanced security monitoring via AI analysis of sensor data (temperature, pressure, vibration) during transit.

- Machine learning models for accurate forecasting of raw material demand and inventory positioning.

- Automated pricing and yield management based on current market capacity and regulatory complexity.

DRO & Impact Forces Of Chemical Logistics Market

The Chemical Logistics Market is fundamentally shaped by a convergence of strong drivers stemming from industrial growth and globalization, balanced by significant restraints rooted in high capital requirements and stringent regulatory oversight, alongside substantial opportunities arising from technological advancements and sustainability mandates. Drivers include the relentless expansion of the global chemical and petrochemical manufacturing industry, particularly the shift towards producing high-value specialty chemicals and advanced materials, which require complex, specialized logistics. Restraints involve the high investment needed for specialized, compliant fleets and storage facilities, the inherent risk profile of transporting dangerous goods, and the constantly evolving, fragmented nature of global Hazmat regulations, which creates operational complexity and barriers to entry. Opportunities are primarily centered on integrating digital technologies like blockchain for secure tracking and IoT for enhanced monitoring, alongside the growing market demand for sustainable and green logistics solutions, such as alternative fuel vehicles and optimized intermodal transport.

Key drivers include the global push towards outsourcing logistics functions. Chemical manufacturers are recognizing the strategic advantages of leveraging the scale, safety expertise, and dedicated compliance resources offered by 3PLs, allowing them to focus on core manufacturing competencies. Furthermore, liberalization of global trade agreements, though currently facing certain protectionist headwinds, historically facilitates cross-border movement of chemicals, boosting demand for reliable international logistics networks. The increasing consumer demand for derived products, such as plastics, textiles, and pharmaceutical ingredients, maintains a high baseline requirement for chemical logistics services, ensuring sustained volume movement across all regions.

However, the industry faces severe impact forces from external factors. The impact of escalating geopolitical tensions and resulting trade barriers can severely disrupt established supply chains, forcing logistics providers to swiftly redesign routes and secure alternative ports. Fluctuations in crude oil prices directly affect the cost of transportation fuels and the production costs of petrochemicals, leading to volatility in logistics pricing and demand predictability. Moreover, public scrutiny and the high societal cost associated with chemical spills or transportation accidents mandate continuous, high-level investment in safety training, technology, and robust emergency response capabilities, which increases the operating expenditure across the entire market ecosystem.

Segmentation Analysis

The Chemical Logistics Market is strategically segmented based on crucial operational distinctions, including the mode of transport utilized, the specific type of service rendered, the chemical product being handled, and whether the shipment is domestic or international. Analyzing these segments provides a clear view of market dynamics, revealing where investment is flowing and which logistical solutions are gaining traction. The segmentation by mode of transport—Road, Rail, Sea, and Air—is critical, with Sea transport dominating bulk international commodity shipments and Road transport being indispensable for localized, flexible distribution. Service segmentation separates core transport from specialized ancillary services like dedicated warehousing, customs brokerage, and documentation management, the latter being high-growth areas due to regulatory complexity.

Product type segmentation is essential as it dictates the required safety protocols and handling technology; for instance, petrochemicals often move in bulk via pipelines or rail, whereas specialty chemicals and pharmaceuticals require precise packaging, temperature control, and enhanced security. Geographic segmentation underscores the disparate regulatory environments and infrastructure capabilities, revealing that high-growth regions like APAC demand significant investment in all modes, while mature markets focus on efficiency improvements within established infrastructure. Understanding these segments is paramount for strategic planning, enabling logistics providers to tailor their assets and regulatory expertise to meet specific industry needs, whether handling volatile organic compounds or high-purity electronic chemicals.

- Mode of Transport:

- Road

- Rail

- Sea (Ocean Freight)

- Air

- Service Type:

- Transportation

- Warehousing & Storage

- Value-Added Services (e.g., Packaging, Labeling, Custom Clearance)

- Product Type:

- Commodity Chemicals

- Specialty Chemicals

- Petrochemicals

- Pharmaceutical Chemicals

- Agrochemicals

- End-Use Industry:

- Chemicals & Materials

- Pharmaceuticals & Healthcare

- Automotive

- Consumer Goods

- Others

Value Chain Analysis For Chemical Logistics Market

The Value Chain for Chemical Logistics is complex, highly fragmented, and characterized by rigorous scrutiny at every stage, owing to the nature of the products handled. The upstream segment involves the sourcing of raw materials for chemical production, requiring inbound logistics focused on bulk transport of primary feedstocks (e.g., crude oil, natural gas, minerals) often via long-distance shipping or pipeline. Key upstream players include raw material suppliers, specialized port operators, and bulk storage terminal providers. The efficiency and reliability of upstream logistics directly impact the operational costs and production schedules of the chemical manufacturers, who sit centrally in this value chain.

The core logistics phase involves the chemical manufacturers utilizing specialized logistics service providers (LSPs) for storage, packaging, and the primary movement of intermediate and finished products. These LSPs are responsible for ensuring regulatory compliance (e.g., proper classification, documentation, and safe handling procedures) during transit. Distribution channels are varied: direct distribution is common for large, specialized clients (e.g., direct tank delivery to a large automotive plant), while indirect channels utilize extensive networks of distributors, local warehouses, and regional hubs for reaching smaller industrial users or retailers (particularly common for packaged specialty chemicals and agrochemicals).

The downstream segment focuses on last-mile delivery and serving the end-user industries (e.g., automotive, construction, agriculture). This phase necessitates highly flexible and responsive logistics, often involving dedicated trucking and localized warehousing capabilities. The value chain concludes with reverse logistics, which is increasingly important for managing reusable packaging (e.g., IBCs, drums) and handling chemical waste or expired products in an environmentally compliant manner. Technology providers, safety consultants, and regulatory bodies act as critical supporting components throughout the entire chain, ensuring operational integrity and compliance across all transactional interfaces.

Chemical Logistics Market Potential Customers

Potential customers and primary buyers of specialized chemical logistics services span the entire spectrum of chemical production and utilization, categorized predominantly by their output and compliance requirements. The largest segment of buyers consists of major global chemical manufacturing conglomerates and specialized producers of high-value intermediates and polymers, requiring integrated, multi-modal, cross-border logistics solutions for both raw material inbound movements and finished product outbound distribution. These customers prioritize global reach, impeccable safety records, and digital platforms offering real-time tracking and comprehensive risk management, often contracting 3PLs for long-term, dedicated partnerships to manage their entire supply chain.

A significant customer base also exists within the downstream application sectors, including the automotive industry (requiring specialized paints, coatings, and fluids), construction (adhesives, resins), and, critically, the pharmaceutical and biotechnology sectors. Pharmaceutical manufacturers, in particular, demand highly specialized cold chain chemical logistics for active pharmaceutical ingredients (APIs) and sensitive biological precursors, where temperature deviation is unacceptable. These buyers require logistics partners certified for Good Distribution Practice (GDP) and capable of maintaining rigorous quality management systems (QMS) across their transport networks, highlighting the premium nature of these specific services.

Furthermore, agrochemical companies constitute a vital customer segment, requiring seasonal and regional logistics expertise to handle the time-sensitive distribution of fertilizers, pesticides, and herbicides to agricultural markets globally. Their logistics needs are characterized by high volume surges during planting seasons and complex regulations regarding storage and handling in rural or remote areas. Lastly, chemical distributors, who act as intermediaries between large manufacturers and smaller industrial users, are key purchasers of warehousing, break-bulk, and localized transportation services, demanding scalable and flexible operations to meet diverse customer demands efficiently.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 295.5 Billion |

| Market Forecast in 2033 | USD 438.2 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | DHL Supply Chain, Kuehne + Nagel, DB Schenker, BDP International, Agility Logistics, C.H. Robinson, Geodis, Sinotrans, Rhenus Logistics, Hellmann Worldwide Logistics, Toll Group, Stolt-Nielsen, Hupac Intermodal, Odyssey Logistics & Technology, Univar Solutions Logistics, LyondellBasell Logistics, BASF Logistics Services, Brenntag Logistics, Crowley Maritime, GAC Group |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Chemical Logistics Market Key Technology Landscape

The technological landscape of the Chemical Logistics Market is undergoing rapid transformation, moving away from conventional paper-based systems towards fully integrated digital ecosystems designed to enhance safety, improve efficiency, and ensure seamless regulatory compliance. A cornerstone of this evolution is the deployment of advanced telematics and the Internet of Things (IoT). IoT sensors are widely used to monitor critical conditions inside transport units, such as real-time temperature, pressure, humidity, shock, and vibration, which are essential for maintaining the integrity of sensitive chemicals and complying with strict handling requirements. This data is transmitted instantly via telematics platforms, allowing logistics managers to intervene proactively if any parameter deviates from safe thresholds, thereby mitigating high-risk incidents.

Furthermore, sophisticated Supply Chain Management (SCM) software, often incorporating elements of Artificial Intelligence (AI) and Machine Learning (ML), is critical for optimization. These platforms facilitate advanced planning, dynamic scheduling, and risk analysis. AI algorithms process massive amounts of data related to routes, weather, and regulatory changes to generate the most efficient and safest transport plans. Blockchain technology is also gaining traction, particularly for ensuring the immutable and secure tracking of high-value or highly controlled substances, guaranteeing data integrity across multiple stakeholders—from the chemical manufacturer to the end-user—and simplifying complex audit trails required for regulatory submissions.

The industry is also heavily investing in specialized hardware and infrastructure, including automated warehousing systems and advanced tank monitoring systems. Automated storage and retrieval systems (AS/RS) in chemical warehouses minimize human exposure to hazardous materials while increasing throughput and inventory accuracy. On the hardware front, specialized tank containers equipped with enhanced safety features, spill containment mechanisms, and integrated digital monitoring systems represent crucial technological investments aimed squarely at maximizing safety and operational reliability during bulk chemical transport across global supply lanes.

Regional Highlights

The Chemical Logistics Market exhibits distinct operational characteristics and growth momentum across different global regions, heavily influenced by local manufacturing output, regulatory maturity, and infrastructural availability.

- Asia Pacific (APAC): APAC represents the highest growth region globally, driven by the rapid expansion of chemical manufacturing facilities in China, India, South Korea, and Southeast Asian nations. High domestic demand for commodity chemicals, coupled with significant export volumes, fuels the need for extensive sea freight and inter-regional road/rail networks. The region is characterized by high infrastructural investment but faces challenges related to varied regulatory enforcement across borders, making sophisticated customs and compliance services highly valuable.

- North America: This region is a mature market dominated by advanced technological integration and stringent federal regulations (e.g., PHMSA, DOT). Logistics providers focus heavily on maximizing efficiency in intermodal transport, particularly leveraging extensive rail networks for bulk petrochemical movements emanating from the Gulf Coast. Demand is driven by specialty chemicals, automotive production, and a robust pharmaceutical sector, requiring specialized temperature-controlled and high-security logistics solutions.

- Europe: Europe is characterized by strict environmental and safety regulations (REACH, ADR/RID) and a strong emphasis on sustainability. The market utilizes highly developed intermodal infrastructure, including road, rail, and inland waterways, to move high-value specialty chemicals across multiple countries efficiently. Key trends involve the adoption of Green Logistics principles, utilizing low-emission vehicles and optimized network planning to meet ambitious carbon reduction targets.

- Middle East and Africa (MEA): The MEA market is largely driven by the massive petrochemical production capacity in the Gulf Cooperation Council (GCC) countries. Logistics demand here is focused primarily on large-scale bulk storage, specialized pipeline management, and global ocean freight connectivity to major consumer markets in APAC and Europe. Infrastructure development, particularly in port capacity and logistics free zones, is a continuous driver of market expansion.

- Latin America: Characterized by infrastructural challenges and economic volatility, the Latin American chemical logistics market is focused on regional road transport and port efficiency improvements. Brazil and Mexico are the primary centers of chemical demand and production. The complexity of customs procedures and varied national regulations necessitates robust local expertise and localized warehousing solutions for effective distribution.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Chemical Logistics Market.- DHL Supply Chain

- Kuehne + Nagel

- DB Schenker

- BDP International

- Agility Logistics

- C.H. Robinson

- Geodis

- Sinotrans

- Rhenus Logistics

- Hellmann Worldwide Logistics

- Toll Group

- Stolt-Nielsen

- Hupac Intermodal

- Odyssey Logistics & Technology

- Univar Solutions Logistics

- LyondellBasell Logistics

- BASF Logistics Services

- Brenntag Logistics

- Crowley Maritime

- GAC Group

Frequently Asked Questions

Analyze common user questions about the Chemical Logistics market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Chemical Logistics and why is it considered a specialized segment?

Chemical Logistics refers to the management and execution of transport, handling, and storage of chemical products, including hazardous and non-hazardous materials. It is specialized due to stringent international and domestic regulations (e.g., Hazmat, ADR, IMDG), the high safety risks involved, and the necessity for specialized assets like temperature-controlled tanks and compliant packaging, requiring deep regulatory expertise and advanced risk management protocols.

How do regulatory compliance requirements impact the operational costs of chemical logistics?

Regulatory compliance significantly increases operational costs by mandating continuous staff training, requiring high capital investment in certified, specialized equipment (tanks, vessels), and necessitating advanced documentation and audit trails. Non-compliance carries severe financial penalties, further driving the need for robust quality management and specialized third-party logistics (3PL) providers who can absorb these complex compliance responsibilities.

Which mode of transport dominates the movement of bulk chemicals globally?

Sea freight (ocean transport) dominates the global movement of bulk commodity chemicals and petrochemicals, utilizing specialized tank containers and vessels for long-haul international routes due to its high volume capacity and relative cost efficiency. Domestically, particularly in regions like North America, rail transport is critical for moving large volumes over long distances.

What role does digitalization play in mitigating risks within the chemical supply chain?

Digitalization, particularly the use of IoT sensors, telematics, and AI, is crucial for risk mitigation. These technologies provide real-time monitoring of critical parameters (temperature, pressure) inside containers, enabling predictive maintenance on equipment, optimizing routes to avoid high-risk areas, and automating compliance checks, thereby reducing the likelihood of accidents, spills, and regulatory violations.

What are the key growth opportunities for Chemical Logistics providers in the coming years?

Key growth opportunities center on expansion in the Asia Pacific market, catering to the increasing demand for cold chain logistics services driven by the pharmaceutical sector, and offering sustainable logistics solutions (Green Logistics) utilizing alternative fuels and optimized intermodal networks. Specialized value-added services, such as sophisticated packaging and complex customs brokerage, also present significant margin growth potential.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager