Chemical PCB Etching Machines Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439064 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Chemical PCB Etching Machines Market Size

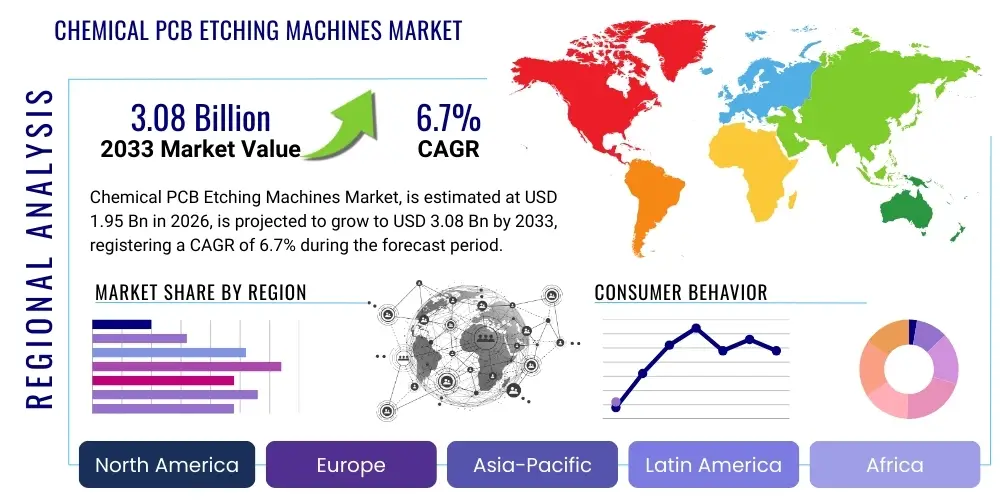

The Chemical PCB Etching Machines Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.7% between 2026 and 2033. The market is estimated at $1.95 Billion USD in 2026 and is projected to reach $3.08 Billion USD by the end of the forecast period in 2033.

Chemical PCB Etching Machines Market introduction

Chemical PCB etching machines are indispensable equipment within the electronics manufacturing ecosystem, serving the critical function of selectively removing copper from a printed circuit board (PCB) substrate to delineate the conductive pathways and traces. These machines utilize various chemical solutions, such as ferric chloride, cupric chloride, or specialized alkaline etchants, coupled with sophisticated mechanical handling systems, to ensure precise and uniform material removal based on the photolithographically patterned resist layer. The machines are integral to the production of single-sided, double-sided, and multi-layer PCBs, catering to complexity levels ranging from consumer-grade electronics to highly specialized aerospace components. The primary product description centers around systems offering high throughput, precise temperature control, automated replenishment of etchants, and robust waste management capabilities, ensuring consistent quality and regulatory compliance in high-volume production environments.

The major applications of these etching machines span across virtually all sectors reliant on electronic hardware. Key industries include consumer electronics (smartphones, tablets, and wearable devices), automotive electronics (ADAS systems, engine control units, and infotainment systems), telecommunications (5G infrastructure, routers, and base stations), and the aerospace & defense sector, where high reliability and durability are paramount. The benefit derived from utilizing modern chemical etching machines lies in their ability to achieve high resolution and fine line widths, essential for the miniaturization trend dominating the electronics industry. Furthermore, advanced etching systems offer superior process control, minimizing undercut and ensuring high yield rates, which is crucial for controlling manufacturing costs in competitive markets.

Driving factors propelling the market growth include the relentless expansion of the Internet of Things (IoT), the global rollout of 5G networks necessitating new high-frequency PCBs, and the accelerated electrification of the automotive sector. The increasing complexity of electronic devices mandates PCBs with higher density and multiple layers, requiring more advanced and precise etching capabilities. Additionally, the proliferation of data centers and cloud computing infrastructure further fuels the demand for high-performance PCBs, securing the Chemical PCB Etching Machines Market’s steady trajectory.

Chemical PCB Etching Machines Market Executive Summary

The Chemical PCB Etching Machines Market is characterized by robust business trends focusing on automation, sustainability, and process integration. Manufacturers are heavily investing in integrating AI and advanced sensor technology to monitor and optimize etching bath parameters in real-time, thereby reducing chemical consumption and improving consistency. Key business trends include the shift towards fully enclosed, automated systems that minimize operator exposure and enhance safety standards. Furthermore, strategic alliances and mergers focused on incorporating specialized chemical handling and effluent treatment technologies are becoming common, emphasizing compliance with increasingly stringent environmental regulations globally. The market sees strong competition based on machine throughput, etch uniformity specifications, and the total cost of ownership (TCO), driven by the requirement for continuous high-volume production.

Regionally, Asia Pacific (APAC) dominates the market, primarily due to the concentration of global PCB manufacturing hubs in China, Taiwan, South Korea, and Japan. This region exhibits the highest demand for new installations and upgrades, driven by the massive scale of consumer electronics and semiconductor production. North America and Europe, while exhibiting slower growth in terms of unit volume, show strong demand for specialized, high-precision etching machines tailored for advanced applications in aerospace, medical devices, and high-performance computing, where process control and quality traceability are non-negotiable. Emerging economies in Southeast Asia and Latin America are increasingly attractive as manufacturing shifts occur, potentially driving moderate growth in those areas in the medium term.

Segment trends reveal a sustained preference for Automatic Etching Machines due to their superior efficiency, repeatability, and reduced reliance on manual intervention, aligning with industry 4.0 standards. In terms of etchant type, Cupric Chloride-based systems are gaining traction over traditional Ferric Chloride systems, especially in high-volume, continuous etching processes, owing to their regenerability and ability to handle complex copper configurations. The Application segment is witnessing exceptional growth stemming from the Automotive Electronics and Telecommunications sectors, requiring equipment capable of handling highly specialized board materials and fine-pitch etching requirements necessary for advanced connectivity modules and safety systems.

AI Impact Analysis on Chemical PCB Etching Machines Market

User inquiries regarding AI's impact on the Chemical PCB Etching Machines Market frequently revolve around predictive maintenance capabilities, optimization of chemical bath parameters, and enhancing yield through real-time process control. Common concerns focus on how AI can stabilize the volatile chemical reaction process, minimize chemical waste, and predict equipment failure before it causes costly downtime. Users expect AI integration to move beyond basic automation toward intelligent systems that can self-calibrate and adapt to variations in copper thickness or etchant concentration, ultimately improving the mean time between failures (MTBF) and achieving higher production efficiency and material utilization. The overarching theme is the desire for 'smart etching,' where the process is autonomously managed and optimized by algorithms trained on extensive operational datasets.

- AI algorithms enable real-time monitoring and predictive maintenance, forecasting component wear and scheduling service intervals precisely.

- Machine learning models optimize etching parameters (temperature, spray pressure, concentration) dynamically, minimizing undercut and improving etch uniformity.

- AI drives advanced process control (APC) systems, reducing chemical replenishment frequency and lowering operational costs associated with etchant disposal.

- Vision systems integrated with deep learning identify microscopic defects or inconsistencies immediately post-etching, improving quality assurance (QA) efficiency.

- Data analytics capabilities allow manufacturers to correlate process inputs with final PCB performance, supporting faster process tuning and high-yield manufacturing strategies.

DRO & Impact Forces Of Chemical PCB Etching Machines Market

The market dynamics are defined by a complex interplay of internal and external forces summarized by Drivers, Restraints, and Opportunities (DRO). The primary Drivers fueling growth include the relentless global push toward electronic device miniaturization, which demands higher precision etching for High-Density Interconnect (HDI) PCBs, coupled with massive infrastructure spending related to 5G, IoT, and cloud computing data centers globally. These technological advances necessitate continuous investment in sophisticated etching equipment. However, significant Restraints persist, notably the increasingly stringent global environmental regulations concerning the handling and disposal of hazardous chemical waste (spent etchants). These regulations necessitate costly and complex effluent treatment systems, which increase the overall operational expenditure for manufacturers. Furthermore, the cyclical nature and economic sensitivity of the broader electronics industry can lead to volatile capital expenditure patterns affecting equipment purchases.

Opportunities in the market center on the development and adoption of advanced, eco-friendly etching technologies, such as plasma etching or alternative non-chemical methods, although chemical etching remains dominant for high volume. A major opportunity lies in the rapid industrial expansion across emerging economies, particularly in the APAC region, where electronics production capacity is continuously scaling up. Impact Forces influencing the competitive landscape include technological leaps toward automated process control, which pressure small manufacturers to upgrade or risk obsolescence, and intense price competition, especially from Asian manufacturers. Market growth is structurally impacted by the foundational reliance of every electronic device on etched PCBs, securing its indispensable role in the global electronics value chain, albeit constrained by environmental stewardship requirements.

Segmentation Analysis

The Chemical PCB Etching Machines Market is systematically segmented based on Type, Application, and Etchant Type, providing a structured view of the market landscape and identifying key areas of investment and growth. Analyzing these segments allows market participants to tailor their offerings to specific operational requirements, ranging from small-scale prototyping to large-volume industrial manufacturing, and to address the increasing environmental considerations related to chemical use. The dominance of automated systems highlights the industry’s shift toward efficiency and reduced labor dependence, while application segmentation underscores the critical role of these machines in high-growth areas like automotive and telecommunications hardware.

- By Type:

- Automatic Etching Machines

- Semi-Automatic Etching Machines

- Manual Etching Machines

- By Application:

- Consumer Electronics

- Automotive Electronics

- Industrial Electronics

- Telecommunications

- Aerospace & Defense

- Medical Devices

- By Etchant Type:

- Ferric Chloride Based

- Cupric Chloride Based

- Alkaline Etchants

Value Chain Analysis For Chemical PCB Etching Machines Market

The value chain for Chemical PCB Etching Machines begins with the upstream suppliers, primarily providing high-precision components, specialized materials (like corrosion-resistant plastics and metals), control systems (PLCs, sensors), and the core chemical etchants (Ferric Chloride, Cupric Chloride, etc.). Upstream analysis indicates that the quality and availability of chemical feedstock are paramount, as stable supply and consistent purity directly affect the etching outcome and machine longevity. Machine manufacturers source these components, focusing heavily on integrating durable pumping systems, reliable spray nozzle technology, and advanced heating/cooling elements crucial for process stability. Supplier relationships often involve long-term contracts to ensure component standardization and compliance with industry-specific certifications.

The core manufacturing stage involves machine assembly, rigorous testing, and software integration for process control and automation. The distribution channel plays a vital role in connecting manufacturers to end-users, primarily PCB fabricators. Distribution is typically mixed: Direct sales are common for high-value, customized, fully automatic systems, where technical consultation and post-sales support are critical. Indirect channels, utilizing specialized industrial equipment distributors and technical representatives, serve smaller fabricators and standard machine models. These distributors often manage localized inventory and initial technical support, bridging the gap between global manufacturers and regional customers. The effectiveness of the channel heavily depends on the technical expertise of the sales force to handle complex installation and training requirements.

Downstream analysis focuses on the end-users—PCB manufacturing facilities—and the provision of essential services, including installation, calibration, maintenance contracts, and chemical replenishment services. Post-sale support, especially for chemical management, regeneration systems, and waste disposal consulting, constitutes a crucial value-added component. As machines become more automated and integrated into factory management systems (MES), the service aspect, including software updates and remote diagnostics, becomes a significant revenue stream. The overall value chain is highly dependent on logistics capabilities, given the large size of the machinery and the hazardous nature of the chemicals involved.

Chemical PCB Etching Machines Market Potential Customers

The primary potential customers and end-users of Chemical PCB Etching Machines are Printed Circuit Board (PCB) Fabrication Houses, which range from large multinational contract manufacturers serving global electronics giants to smaller, specialized job shops focusing on prototype development or niche markets. These fabricators are the direct buyers, utilizing the machines to perform the necessary subtractive manufacturing process that defines the electrical circuitry. Their purchasing decisions are driven by production volume requirements, the complexity of the boards they produce (e.g., number of layers, minimum feature size), and the required compliance with industry standards like ISO certifications.

Beyond traditional PCB fabricators, captive manufacturing units operated by large Original Equipment Manufacturers (OEMs) in sectors like Aerospace & Defense or specialized Medical Devices also represent significant potential customers. These OEMs often maintain in-house PCB production capabilities to ensure strict quality control, intellectual property protection, and rapid prototyping cycles, especially for highly sensitive or mission-critical hardware. Furthermore, research institutions, university engineering departments, and vocational training centers focusing on microelectronics also constitute a segment of the buyer base, usually requiring smaller, manual, or semi-automatic systems for educational and development purposes. The continuous evolution of electronics demands constant upgrades and capacity expansion, positioning existing PCB manufacturers as perpetual customers for advanced machinery.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.95 Billion USD |

| Market Forecast in 2033 | $3.08 Billion USD |

| Growth Rate | 6.7% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | M.R.O. Systems, PCB Etch Systems, Circuit Equipment Company, Pluritec S.p.A., Chemcut Corporation, Schmoll Maschinen GmbH, Atotech Deutschland GmbH, Taiyo Ink Mfg. Co., Ltd., C Sun Mfg. Corp., KLN Ultraschall GmbH, Accu-Labs Inc., T.R.W. Machine Co., LPKF Laser & Electronics AG, V-TEK Systems, Sunking Technology. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Chemical PCB Etching Machines Market Key Technology Landscape

The core technology landscape of chemical PCB etching machines centers on achieving precision, uniformity, and sustainability. Advanced etching systems leverage highly controlled spray etching technology, where etchant solutions are precisely sprayed onto the PCB surface. Key advancements focus on optimizing spray nozzle geometry and oscillation patterns to ensure highly uniform material removal across the entire board surface, critical for achieving fine line definitions required in HDI applications. Process control is governed by sophisticated sensors that continuously monitor critical parameters such as etchant specific gravity, pH, oxidation-reduction potential (ORP), and temperature. These sensor readings feed into automated dosing systems that inject fresh chemicals or water to maintain optimal chemical balance, crucial for consistent etch rates and minimizing chemical waste.

A significant technological focus is on regenerative etching systems, particularly those utilizing cupric chloride. These systems incorporate continuous electrochemical or chemical regeneration units that restore the spent etchant back to its active state, significantly extending the chemical lifespan and reducing the volume of hazardous waste requiring disposal. This regenerative capability addresses both operational cost reduction and environmental compliance concerns. Furthermore, the integration of automation through robotic handling systems and fully enclosed processing chambers minimizes human interaction, enhances safety, and ensures process repeatability, aligning with Industry 4.0 principles of manufacturing.

Modern machines are increasingly adopting specialized material construction, utilizing robust and corrosion-resistant plastics and alloys, such as PVDF and Titanium, to handle highly aggressive etchants over extended operational periods. Software integration is also a critical component, providing comprehensive data logging, recipe management, and connectivity to factory-wide Manufacturing Execution Systems (MES). The ongoing development trajectory involves integrating AI-driven feedback loops to further fine-tune the etching process beyond simple proportional-integral-derivative (PID) controls, moving towards truly autonomous process management for zero-defect manufacturing.

Regional Highlights

The global distribution of the Chemical PCB Etching Machines Market shows distinct regional characteristics driven by manufacturing concentration and technological maturity. Asia Pacific (APAC) dominates the global market, accounting for the largest share due to its established position as the world’s primary electronics manufacturing hub. North America and Europe emphasize technological leadership and specialized applications, while emerging regions focus on capacity building.

- Asia Pacific (APAC): Dominates the market owing to high-volume manufacturing hubs in China, Taiwan, South Korea, and Japan. Demand is driven by scaling production of consumer electronics, 5G infrastructure, and automotive components. The region is characterized by continuous investment in high-throughput, automated etching lines.

- North America: Exhibits strong demand for high-precision, low-volume etching systems utilized in advanced sectors like defense, aerospace, and specialized medical device fabrication. Market growth is stable, driven by technological upgrades and strict quality requirements.

- Europe: Focuses heavily on compliance and sustainability, driving demand for machines featuring advanced chemical regeneration and waste minimization technologies. Key growth sectors include industrial electronics and specialized automotive applications, supported by strong regulatory frameworks.

- Latin America (LATAM) & Middle East and Africa (MEA): Represent emerging markets with moderate growth potential. Demand is driven by localized electronics assembly operations and initial stages of domestic electronics manufacturing expansion. Purchases often favor semi-automatic or cost-effective standard models.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Chemical PCB Etching Machines Market.- M.R.O. Systems

- PCB Etch Systems

- Circuit Equipment Company

- Pluritec S.p.A.

- Chemcut Corporation

- Schmoll Maschinen GmbH

- Atotech Deutschland GmbH

- Taiyo Ink Mfg. Co., Ltd.

- C Sun Mfg. Corp.

- KLN Ultraschall GmbH

- Accu-Labs Inc.

- T.R.W. Machine Co.

- LPKF Laser & Electronics AG

- V-TEK Systems

- Sunking Technology

- Universal Instruments Corporation

- Micro-Plate/Systems, Inc.

- Wuxi Linya Technology Co., Ltd.

- EPM Equipment Inc.

- Tecnovi S.p.A.

Frequently Asked Questions

Analyze common user questions about the Chemical PCB Etching Machines market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary differences between Ferric Chloride and Cupric Chloride etching systems?

Ferric Chloride is traditionally used due to its lower initial cost and effectiveness, but it is generally a non-regenerative, batch process generating significant hazardous waste. Cupric Chloride systems are favored for high-volume manufacturing because they are highly efficient and incorporate continuous regeneration capabilities, drastically reducing chemical waste volume and operational costs over time.

How does the miniaturization trend impact the requirements for chemical etching machines?

Miniaturization and the demand for High-Density Interconnect (HDI) PCBs necessitate etching machines capable of achieving extremely fine line widths and small feature sizes (below 50 microns). This requires superior control over parameters like spray pressure, etchant concentration, and temperature to minimize undercut and ensure high dimensional accuracy, driving demand for highly automated and precise equipment.

What is the role of automation and Industry 4.0 principles in the chemical etching market?

Automation (Industry 4.0) is crucial for maximizing throughput and repeatability. Modern machines feature automated material handling, real-time sensor monitoring, and connectivity to Manufacturing Execution Systems (MES) to enable autonomous parameter adjustment and predictive maintenance, thereby reducing labor costs and improving process stability.

Which geographical region dominates the Chemical PCB Etching Machines Market?

The Asia Pacific (APAC) region currently dominates the market, holding the largest revenue share. This dominance is attributed to the presence of major global PCB manufacturing hubs, especially in China, Taiwan, and South Korea, catering to the enormous global demand for electronics and communication hardware.

What are the major environmental constraints affecting the operation of chemical etching machines?

The key environmental constraint is the management and disposal of hazardous waste, specifically spent chemical etchants and copper-laden rinse water. Stringent regulations require manufacturers to invest in advanced effluent treatment systems, regeneration technology, and closed-loop recycling processes to minimize environmental impact and ensure compliance.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager