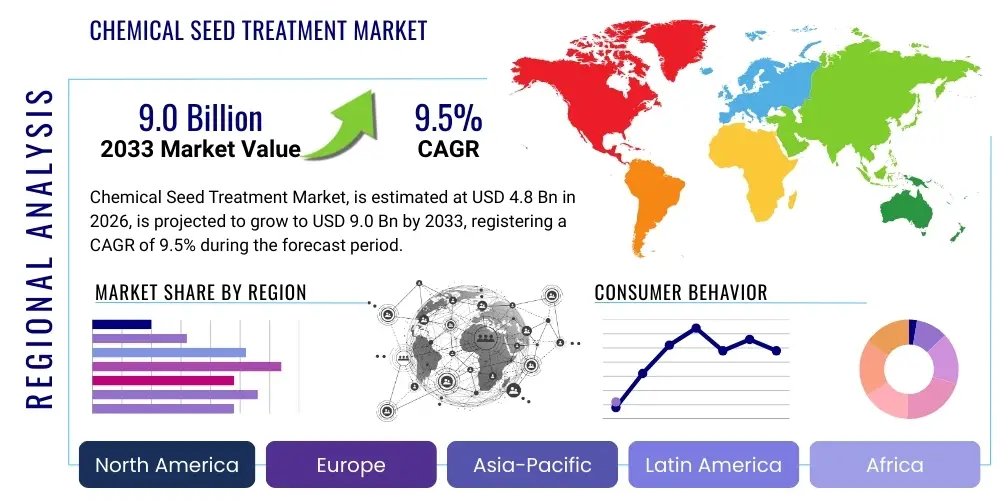

Chemical Seed Treatment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437459 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Chemical Seed Treatment Market Size

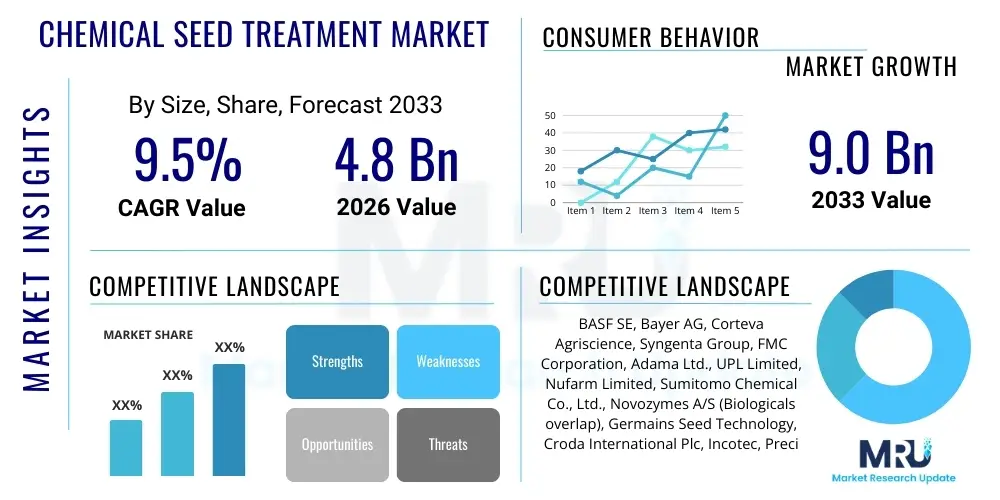

The Chemical Seed Treatment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 9.0 Billion by the end of the forecast period in 2033.

Chemical Seed Treatment Market introduction

Chemical seed treatment involves the application of various chemical agents, primarily fungicides, insecticides, and nematicides, directly onto the seed surface prior to planting. This process offers prophylactic protection against soil-borne and seed-borne pathogens and pests during the vulnerable stages of germination and early seedling growth. Unlike conventional broadcast applications, seed treatments deliver targeted active ingredients precisely where and when they are needed, enhancing resource efficiency and minimizing environmental residue.

The primary product category encompasses synthetic pesticides optimized for seed coating, often formulated with specialized polymers and colorants to ensure adhesion, uniformity, and safety tracking. Major applications span across essential row crops, including corn, soybean, wheat, and cotton, where maximizing early stand establishment is critical for yield potential. Beyond basic crop protection, advanced treatments increasingly incorporate growth regulators and micronutrients to boost vigor, a holistic approach driving adoption worldwide.

Key benefits driving market expansion include superior disease and pest control, reduced reliance on in-field spraying (lowering operational costs), and enhanced crop quality and uniformity. The market is propelled by factors such as increasing global population necessitating higher food production, technological advancements leading to highly effective and safe formulations, and the escalating threat posed by pesticide resistance and new aggressive pest species globally.

Chemical Seed Treatment Market Executive Summary

The global Chemical Seed Treatment Market is characterized by robust growth, primarily fueled by the increasing demand for sustainable agriculture practices and the need to protect high-value seeds. Business trends indicate a strong focus on integration, with major agrochemical companies acquiring or partnering with specialized seed coating technology firms to offer holistic seed enhancement packages. This strategic consolidation aims to streamline the supply chain and provide farmers with pre-treated, high-performance seeds that guarantee better initial crop establishment and higher return on investment (ROI). Furthermore, stringent regulatory environments in developed markets, particularly the EU, are pushing innovation towards biopesticide compatibility and lower-dosage chemical applications.

Regional trends highlight the dominance of North America and Asia Pacific (APAC). North America, driven by massive acreage devoted to corn and soybean and high adoption rates of advanced transgenic seeds, remains the largest revenue generator. However, APAC, particularly India and China, represents the fastest-growing market, spurred by rapid agricultural modernization, government subsidies promoting quality inputs, and the escalating need to improve per-acre yields in densely populated regions. Europe, while slower due to regulatory hurdles concerning specific active ingredients (like neonicotinoids), is seeing growth in fungicide treatments and integrated pest management (IPM) compatible solutions.

Segmentation trends confirm that insecticides hold a significant market share, predominantly protecting against early-season pests like wireworms and rootworms, which cause devastating stand losses. Fungicides, critical for managing diseases like damping-off and smuts, also command substantial market presence. Crop type analysis shows that cereals and grains constitute the largest segment due to their widespread cultivation, though the high-value oilseeds and pulses segment exhibits accelerated growth owing to increased processing demands and premiumization efforts globally.

AI Impact Analysis on Chemical Seed Treatment Market

Common user inquiries regarding the influence of Artificial Intelligence (AI) in the Chemical Seed Treatment Market frequently revolve around optimizing formulation efficacy, predicting regional pest outbreaks, and automating quality control during the coating process. Users are keenly interested in how machine learning can analyze vast datasets—including weather patterns, soil microbiology, historical yield data, and pest migration tracking—to recommend the precise chemical treatment regimen necessary for specific field conditions, thereby moving beyond blanket applications. Key concerns center on data privacy, the cost barrier of implementing sophisticated AI-driven systems for smaller agricultural enterprises, and ensuring the reliability of predictive models in highly variable agricultural ecosystems. Overall user expectation is that AI will usher in an era of hyper-precision seed treatment, significantly reducing chemical waste and maximizing crop resilience.

- AI-driven Predictive Analytics: Utilizing machine learning algorithms to forecast regional disease pressure and pest infestation risks, allowing manufacturers to tailor regionalized chemical formulations for maximum effectiveness.

- Optimized Formulation Development: Accelerating R&D by simulating the interaction between new active ingredients, seed genetics, and various environmental stressors, thereby reducing time-to-market for novel treatments.

- Precision Coating and Quality Control: Implementing computer vision and deep learning models on coating lines to ensure uniform application thickness, detect defects in the polymer layer, and maintain batch consistency, minimizing waste.

- Demand Forecasting and Inventory Management: Employing AI to analyze planting intentions, commodity price fluctuations, and regional weather forecasts to optimize the production and distribution of specific seed treatment products across the supply chain.

- Automated Recommendation Systems: Developing farmer-facing digital platforms that use historical field data and real-time inputs to provide customized advice on the most effective seed treatment for their specific soil and environmental profile.

DRO & Impact Forces Of Chemical Seed Treatment Market

The Chemical Seed Treatment Market dynamic is defined by the critical balance between the increasing need for reliable crop protection and the growing regulatory constraints targeting specific chemical classes. Drivers include the rising global population demanding higher yields, the inherent efficiency advantages of seed treatments over foliar sprays (saving time and resources), and widespread adoption of genetically modified (GM) seeds that often require integrated protective coatings. These factors collectively push the industry towards continuous technological refinement and product portfolio expansion, securing early-season protection crucial for optimizing genetic yield potential.

Restraints are primarily driven by regulatory pressures, particularly the restrictions and outright bans on highly effective but environmentally contentious chemicals, such as certain neonicotinoids, in key agricultural regions like the European Union. Furthermore, the development of pesticide resistance in target pests requires constant, costly R&D investment to maintain product efficacy, posing a long-term challenge. Consumer preference shifts towards organic and residue-free produce also introduce market friction, pressuring manufacturers to develop hybrid or biological alternatives.

Opportunities reside predominantly in integrating chemical treatments with biologicals (biofungicides and bioinsecticides) to form comprehensive, synergistic protection systems, aligning with Integrated Pest Management (IPM) strategies. Furthermore, untapped potential exists in emerging economies in Africa and Southeast Asia, where modernization of agricultural practices, coupled with greater awareness of input quality, is driving demand for reliable seed protection products. The market impact forces indicate that technological superiority (efficacy and safety) and regulatory compliance are the primary determinants of competitive advantage.

Segmentation Analysis

The Chemical Seed Treatment Market is structurally segmented based on the type of chemical active ingredient, the specific crop requiring protection, and the formulation of the product used. Understanding these segments is crucial for strategic market positioning, as each category faces unique regulatory challenges, efficacy demands, and growth projections. The segmentation reflects the diverse threats faced by different agricultural systems globally, ranging from fungal pathogens in cereals to insect pests in oilseed crops, necessitating specialized and often customized chemical solutions applied directly to the seed.

Analysis of the segments reveals a complex ecosystem where fungicides and insecticides dominate in terms of volume and value, providing essential protection against the most common threats to germination and stand establishment. The shift towards higher-value crops, such as fruits, vegetables, and ornamental seeds, while smaller in volume, demands premium, highly effective, and often custom-blended treatments, driving innovation in niche chemical categories. Geographically, the segmentation strategy is tailored to address local agronomic conditions, regulatory nuances, and the prevalence of specific pests unique to major agricultural hubs globally.

- By Type:

- Fungicides (e.g., Triazoles, Strobilurins, Phenylamides)

- Insecticides (e.g., Neonicotinoids, Pyrethroids, Diamides)

- Nematicides

- Other Chemicals (including Growth Regulators and Micronutrients)

- By Crop Type:

- Cereals & Grains (Corn, Wheat, Rice, Barley)

- Oilseeds & Pulses (Soybean, Cotton, Canola, Sunflower)

- Fruits & Vegetables

- Others (Turf, Ornamental Seeds)

- By Formulation:

- Wettable Powders (WP)

- Suspension Concentrates (SC)

- Flowable Concentrates for Seed Treatment (FS)

- Other Formulations (including Ready-to-use Liquids)

Value Chain Analysis For Chemical Seed Treatment Market

The value chain for the Chemical Seed Treatment Market begins upstream with the synthesis of active chemical ingredients and specialized polymer materials used for coating. This stage is dominated by a few large multinational agrochemical manufacturers possessing extensive R&D capabilities and patent portfolios. Key activities involve complex chemical synthesis, toxicology testing, and the formulation of highly concentrated technical-grade materials, which require strict adherence to global safety and environmental standards. Efficiency at this upstream level is critical, as it dictates the cost and efficacy profile of the final seed treatment product delivered to the market.

Midstream activities involve the formulation and compounding of the technical materials into usable seed treatment products, such as Flowable Concentrates for Seed Treatment (FS) or wettable powders. This phase also includes the physical application process, typically performed by large commercial seed producers or specialized seed treaters who utilize high-precision equipment to apply the chemical coatings uniformly onto seeds. Quality control and regulatory compliance are paramount here, ensuring the treated seeds maintain viability and the chemical dosage is precise. Direct application by farmers using smaller, on-farm treaters represents a minor but growing segment, particularly in markets where customized treatments are favored.

Downstream distribution channels are diverse, relying on both direct and indirect networks. Direct sales involve large agrochemical firms selling formulated treatments directly to major seed companies (e.g., Bayer, Syngenta) for bulk application. Indirect channels utilize established agricultural distributors, retailers, and cooperative networks to reach regional seed treaters and individual farmers. The importance of technical support and advisory services at the distribution level is high, as the efficacy of seed treatment is highly dependent on proper handling, storage, and application techniques, emphasizing the necessity of trained personnel across the entire market continuum.

Chemical Seed Treatment Market Potential Customers

The primary customers in the Chemical Seed Treatment Market are segmented based on their role in the agricultural supply chain and their volume requirements for treated seeds. The largest and most influential customer base consists of major multinational and regional seed companies, which procure chemical treatments in bulk volumes to apply to their proprietary high-value seeds (e.g., hybrid corn, patented soybean varieties). These companies prioritize product efficacy, consistency, and compatibility with specific seed genetics, requiring strong technical partnership with the agrochemical suppliers.

A second significant customer group includes commercial seed treaters and custom applicators. These entities offer specialized treating services, often serving smaller regional seed companies or farmers who require tailored seed protection packages based on local soil conditions and pest pressures. For this segment, ease of application, formulation stability, and a broad portfolio of active ingredients are key purchase criteria, allowing them to provide flexible solutions to their clientele.

Finally, large-scale commercial farmers and grower cooperatives constitute the end-user base. While they primarily purchase pre-treated seeds, a growing subset (especially in specialty crops or regions with strict regulations) procures treating products directly for on-farm application. These customers are highly sensitive to price-performance ratios and are increasingly seeking treatments that offer dual benefits, such as pest protection coupled with growth enhancement features, thereby driving demand for integrated chemical-biological solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 9.0 Billion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BASF SE, Bayer AG, Corteva Agriscience, Syngenta Group, FMC Corporation, Adama Ltd., UPL Limited, Nufarm Limited, Sumitomo Chemical Co., Ltd., Novozymes A/S (Biologicals overlap), Germains Seed Technology, Croda International Plc, Incotec, Precision Laboratories, LLC, Marrone Bio Innovations, Inc., Verdesian Life Sciences, LLC, Chemtura Corporation (Platform integration), Koppert Biological Systems. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Chemical Seed Treatment Market Key Technology Landscape

The technological landscape of the Chemical Seed Treatment Market is characterized by continuous innovation in both the active ingredients (chemistries) and the delivery systems (application technology). A primary focus remains on developing systemic active ingredients that are highly selective, offering broad-spectrum protection against multiple threats while exhibiting favorable environmental profiles, ensuring rapid degradation in the soil after the seedling stage. Advancements in fungicide classes, such as novel SDHIs (Succinate Dehydrogenase Inhibitors) and strobilurins, provide superior management of complex fungal diseases, maintaining seed health through vulnerable early growth phases.

In terms of application, key technologies center around improving the uniformity and adherence of the chemical coating. Polymer technology plays a crucial role; specialized seed coating polymers ensure the active ingredients remain fixed to the seed surface, minimizing dust-off during handling, which is a major regulatory and safety concern. These polymers are often designed for controlled release, ensuring the active ingredient is available at optimal concentrations precisely when the plant requires protection, maximizing efficacy and minimizing potential non-target exposure in the environment.

Furthermore, precision application equipment utilizing automated dosing systems and advanced mixing units is becoming standard among commercial treaters. This equipment incorporates sophisticated monitoring technology to ensure accurate and repeatable application rates, minimizing waste and ensuring compliance with label recommendations. The convergence of seed treatment with biological inoculants (like rhizobia or beneficial fungi) necessitates robust formulation technology that can maintain the viability of the biological agent while co-existing with the chemical components, representing a complex area of current technological investment.

Regional Highlights

- North America: Dominant Market Share and Innovation Hub

North America currently holds the largest share of the global Chemical Seed Treatment Market, driven primarily by the extensive cultivation of high-value crops such as corn, soybean, and cotton. The region benefits from highly integrated agricultural supply chains, where major seed producers routinely offer pre-treated seeds using sophisticated chemical packages, including advanced insecticides to manage high-pressure pests like corn rootworm and soybean aphid. The high adoption rate of expensive, genetically modified seeds necessitates robust chemical protection to safeguard initial investment and maximize the genetic potential of the crop. The market is highly mature, characterized by strong competition and rapid adoption of the latest chemical innovations, often driven by the need to manage evolving pest resistance profiles.

Regulatory frameworks in the US and Canada are generally conducive to new product registration, though certain state-level regulations, particularly regarding neonicotinoid use, introduce complexity. Innovation is focused on creating combination products that integrate multiple modes of action (MOAs) to provide comprehensive protection against a spectrum of threats simultaneously. Key demand drivers include minimizing environmental exposure through targeted application and maximizing field uniformity, which is essential for large-scale mechanized farming operations. Furthermore, the region acts as a testing ground for new integrated chemical-biological seed solutions before their global rollout, securing its position as the primary hub for market value.

The robust infrastructure for seed handling and application, coupled with substantial farmer income allowing investment in premium inputs, ensures sustained high demand. Specific market strength is noted in fungicide treatments for wheat and barley, essential for preventing economically significant diseases such as Fusarium head blight and various smut diseases. The focus on stewardship and product safety also pushes market leaders toward transparent and verifiable application practices.

- Europe: Focus on Regulatory Compliance and Bio-Integration

The European Chemical Seed Treatment Market faces unique challenges due to the stringent and often restrictive regulatory landscape, particularly the phased ban or severe limitation on key systemic insecticides, most notably certain neonicotinoids, due to environmental concerns related to pollinators. This environment has significantly constrained the growth of specific chemical segments, forcing manufacturers to pivot swiftly towards safer, alternative chemical treatments and, crucially, to accelerate the development of biological seed treatment alternatives and combinations.

Despite these restraints, the market remains substantial, driven by the critical need for reliable protection for cereal crops (wheat, barley) against fungal pathogens like Septoria and rusts, especially in the major producing nations like France, Germany, and the UK. Fungicides constitute the strongest segment in Europe, with continuous R&D focused on highly efficacious, targeted chemistries that meet the strict standards set by the European Food Safety Authority (EFSA). The market is characterized by a strong emphasis on Integrated Pest Management (IPM), favoring treatments that offer localized protection without broad ecosystem impact.

Future growth in Europe will be primarily determined by the success of chemical companies in developing novel, regulatorily approved chemistries and, more significantly, in creating synergistic chemical-biological pairings. These combined solutions aim to deliver the efficacy traditionally associated with synthetic chemicals while adhering to the sustainability and low-residue demands of the Green Deal. Eastern European countries, currently undergoing agricultural intensification, present smaller, high-growth pockets, particularly for standard fungicide and insecticide treatments for grains and oilseeds, though they are rapidly aligning with Western European regulatory standards.

- Asia Pacific (APAC): Fastest Growth and Modernization Drive

The Asia Pacific region is projected to exhibit the fastest growth rate globally, driven by massive agricultural economies, particularly China, India, and Southeast Asian nations. The high population density necessitates maximizing food production from limited arable land, making the protection of early-stage crops paramount. Government initiatives promoting agricultural modernization, subsidies for quality inputs, and increasing farmer awareness regarding the benefits of sophisticated seed protection are key accelerators for market adoption across the continent.

In APAC, the market is characterized by diverse crop requirements, ranging from rice and wheat (where blast disease and various smuts are major concerns) to cotton and oilseeds. Demand is high for both fungicides and insecticides, addressing high levels of biotic stress prevalent in tropical and subtropical climates. Chemical treatments in this region are vital for ensuring germination under varying moisture and temperature conditions and for managing the substantial threat posed by vector-borne diseases transmitted by early-season insect pests.

While the market is becoming increasingly sophisticated, price sensitivity remains a factor in developing APAC economies, leading to a strong demand for cost-effective, high-performing generic and patented products. Regulatory standards are rapidly tightening, especially in China and India, pushing local manufacturers to invest in quality assurance and more environmentally sound formulations. The region presents significant opportunities for companies that can navigate diverse local regulatory landscapes and effectively train farmers on the precise application and stewardship of chemical seed treatments, thereby unlocking substantial market potential.

- Latin America (LATAM) and Middle East & Africa (MEA): Emerging High-Potential Markets

Latin America, particularly Brazil and Argentina, represents a critical growth engine, largely due to the vast acreage dedicated to soybean, corn, and sugarcane production. Seed treatment is fundamental to the successful cultivation of these crops, protecting against diseases common in warm, humid climates and tackling high-pressure insect pests, such as the initial phases of the fall armyworm infestation. The market is highly dynamic, characterized by rapid adoption of new active ingredients, often introduced initially in the US and then quickly adapted for the diverse tropical and sub-tropical conditions of the region.

The application rates of systemic insecticides and high-performance fungicides in LATAM are among the highest globally, reflecting the intense pest and disease pressure experienced throughout the planting season. Infrastructure improvements in Brazil, coupled with aggressive R&D investment by multinational firms tailored to local soybean genetics, solidify its importance. The focus here is overwhelmingly on maximizing yield security through robust, multi-layered chemical protection packages applied directly to the seed.

The Middle East and Africa (MEA) market, though smaller, offers high growth potential, driven by the need to enhance food security in challenging climatic zones. Seed treatments are crucial for ensuring successful stand establishment under water-stressed and high-temperature environments. Adoption is accelerating in sophisticated agricultural nations within the GCC and in high-potential farming regions in South Africa, Nigeria, and Kenya. The market requires products specifically designed to manage drought stress alongside pest control, leading to increased interest in chemical treatments that incorporate growth-enhancing elements and stress-mitigation capabilities, signifying a key area for future innovation.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Chemical Seed Treatment Market.- BASF SE

- Bayer AG

- Corteva Agriscience

- Syngenta Group

- FMC Corporation

- Adama Ltd.

- UPL Limited

- Nufarm Limited

- Sumitomo Chemical Co., Ltd.

- Mitsui Chemicals Agro, Inc.

- Albaugh, LLC

- Koppert Biological Systems

- Novozymes A/S

- Germains Seed Technology

- Croda International Plc

- Precision Laboratories, LLC

- Incotec

- Verdesian Life Sciences, LLC

- Marrone Bio Innovations, Inc.

- Seed Dynamics, Inc.

Frequently Asked Questions

Analyze common user questions about the Chemical Seed Treatment market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary chemical types dominating the global seed treatment market?

The market is primarily dominated by Fungicides, which protect against seed-borne and soil-borne diseases (e.g., damping-off, smuts), and Insecticides, which offer crucial early-season protection against pests (e.g., wireworms, aphids) that threaten germination and stand establishment.

How do stringent regulations, especially in the EU, affect market growth?

Stringent regulations, particularly restrictions on neonicotinoid insecticides due to pollinator concerns, act as a primary restraint. This forces manufacturers to invest heavily in developing safer, alternative chemistries and integrated chemical-biological solutions (bio-seed treatments) to maintain efficacy while ensuring environmental compliance.

What is the main driver for the adoption of chemical seed treatments in developing countries?

The main driver in developing countries like India and China is the urgent need to boost per-acre yields and ensure food security. Chemical seed treatments guarantee reliable crop establishment, minimizing losses from common pests and diseases in areas where farming practices are rapidly modernizing and inputs are subsidized.

What role does polymer technology play in modern seed treatment application?

Polymer technology is critical for encapsulation, ensuring active chemical ingredients adhere firmly to the seed surface (minimizing dust-off) and providing controlled release mechanisms. This improves safety, enhances application uniformity, and optimizes the timing of chemical availability to the developing seedling.

How is Artificial Intelligence (AI) expected to impact the future of chemical seed treatment?

AI is expected to enable hyper-precision agriculture by analyzing environmental data to predict pest outbreaks and disease pressure. This allows chemical companies to customize and tailor treatment formulations for specific regions or fields, optimizing efficacy and minimizing unnecessary chemical usage.

Which crop segment contributes the highest revenue to the market?

The Cereals and Grains segment, particularly corn and wheat, contributes the highest revenue due to their vast global acreage and the mandatory application of treatments to protect against numerous endemic fungal diseases and pervasive insect pests.

What is the significance of integrating chemical treatments with biologicals (bio-seed treatments)?

Integration of chemicals with biologicals (biofungicides, bioinoculants) is a major opportunity. This strategy provides synergistic protection, enhances plant vigor, and helps chemical treatments comply with increasingly strict environmental standards by offering lower synthetic active ingredient loads.

In which region is the market showing the fastest Compound Annual Growth Rate (CAGR)?

The Asia Pacific (APAC) region is demonstrating the fastest CAGR, driven by agricultural intensification, modernization efforts, and increasing investment in high-quality agricultural inputs across major economies like India and China.

What are the major challenges related to pesticide resistance in this market?

A significant challenge is the development of resistance in target pests and pathogens to existing active ingredients. This requires continuous, expensive research and development to introduce new chemical classes and promote rotational use strategies to maintain the long-term effectiveness of the treatments.

Who are the primary end-users or potential customers for bulk chemical seed treatment products?

The primary customers are large multinational and regional seed companies, which purchase chemical formulations in bulk for industrial application onto their commercial seed varieties before distribution to farmers.

What differentiates seed treatment from traditional broadcast pesticide application?

Seed treatment is highly targeted and localized, applying a minimal amount of active ingredient directly to the seed. This contrasts with broadcast application, which covers a much wider area, often resulting in lower efficacy per unit of active ingredient and higher environmental residue.

How does the value chain transition from upstream production to downstream distribution?

The value chain moves from upstream chemical synthesis by large firms to midstream formulation and application (often by commercial seed treaters) before reaching downstream distribution networks (retailers and co-operatives) or direct sales to major seed producers.

What specific treatments are critical for oilseeds and pulses?

For oilseeds and pulses, treatments critical for managing fungal diseases like Sclerotinia and sudden death syndrome are highly important. Furthermore, these crops often require specific insecticide treatments to protect against early insect damage and, crucially, specific inoculants to fix atmospheric nitrogen.

Why is North America considered the innovation hub for chemical seed treatment technologies?

North America possesses the largest market size and high adoption of technology, driven by extensive investment in R&D by major agrochemical corporations. The market readily adopts complex, integrated solutions necessary to protect high-value transgenic seeds, setting global benchmarks for efficacy and stewardship.

What are flowable concentrates for seed treatment (FS) and why are they popular?

FS formulations are stable liquid suspensions that offer excellent coverage and adherence on the seed surface. They are popular because they are easy to mix and apply using commercial equipment, providing uniform dosage and minimal dust-off compared to powder formulations.

How does the increased cultivation of specialty crops influence the market?

The growth in specialty crops (fruits and vegetables) drives demand for premium, custom-blended seed treatments. These crops often have higher per-unit value and require specialized formulations to address unique pathogen and insect profiles, leading to higher spending on targeted chemical solutions.

What impact do micronutrients have when included in chemical seed treatments?

Micronutrients (like zinc or manganese) included in the treatment package enhance early seedling vigor, improve the plant’s ability to handle abiotic stress (such as drought or cold soil), and optimize the crop's initial nutritional uptake, complementing the protective function of the chemical agents.

What is the primary concern regarding environmental safety associated with chemical seed treatments?

The main environmental concern revolves around the potential for "dust-off," where treated seed particles or chemical residue become airborne during planting, potentially exposing non-target organisms, especially pollinators, necessitating the use of specialized polymers to lock chemicals onto the seed.

How does the need for food security influence investment in this market?

The escalating global demand for food, driven by population growth, mandates maximum productivity from existing farmland. Seed treatment ensures the critical success of early stand establishment, a fundamental step in achieving high yields, thus justifying substantial investment in research and commercialization.

What role do third-party commercial treaters play in the market ecosystem?

Commercial treaters provide essential customized services, applying chemical packages tailored to local soil and pest conditions for regional seed companies or farmers. They bridge the gap between large-scale manufacturing and localized agricultural needs, maintaining application quality control.

Which segment of the market faces the most acute regulatory scrutiny globally?

The Insecticides segment, particularly those targeting systemic control (like neonicotinoids), faces the most acute regulatory scrutiny due to documented concerns about their potential impact on non-target insects, leading to significant market volatility and driving innovation toward alternatives.

What are the key technological advancements in application equipment?

Technological advancements include high-precision automated dosing systems, computerized monitoring for real-time application adjustments, and dust mitigation technologies, ensuring accurate, uniform, and safe treatment of seed batches across large commercial operations.

How does commodity price volatility affect farmer adoption of premium seed treatments?

When commodity prices are high, farmers are more willing to invest in premium, multi-component seed treatments to safeguard their high-revenue potential. Conversely, low commodity prices can lead to cost-cutting, sometimes favoring basic or cheaper treatment options over advanced packages.

Why is the early protection stage (germination and seedling) so critical for high yields?

The early protection stage is critical because seedlings are most vulnerable to pests and diseases during emergence. Losses incurred at this stage directly translate to reduced plant density (stand loss), which cannot be recovered later, fundamentally limiting final yield potential.

What opportunities are available in the Middle East and Africa (MEA) region?

Opportunities in MEA center on developing treatments that combine protection with abiotic stress tolerance, addressing severe water scarcity and high-temperature conditions prevalent in the region, focusing on enhancing seed survival rates under difficult growing environments.

How do leading companies manage the conflict between chemical efficacy and sustainability mandates?

Leading companies manage this conflict by developing highly selective, low-dose chemistries (minimizing environmental footprint) and actively integrating synthetic active ingredients with biological solutions, creating synergistic products that align efficacy with sustainability goals.

What specific challenges does the rice seed treatment market face in Asia?

The rice seed treatment market faces challenges related to managing major diseases like blast and bacterial blight under flooded conditions. Treatments must be highly effective and stable under saturated soil environments typical of rice paddies across key Asian growing regions.

What is the role of nematicides in the chemical seed treatment portfolio?

Nematicides protect seeds and young roots from parasitic nematodes, microscopic worms that cause significant root damage, particularly in high-value crops like soybean and cotton, thereby improving water and nutrient absorption capacity from the outset.

How does the patent landscape influence market competitiveness and innovation?

The patent landscape is highly influential, as R&D success hinges on novel active ingredient discovery. Patent protection grants exclusive market access, driving high profitability for the innovators and encouraging continuous investment in new, non-resistant chemical classes.

What is the difference between systemic and contact seed treatments?

Systemic treatments are absorbed by the seed or seedling and translocated throughout the plant, offering internal protection. Contact treatments remain on the seed surface or in the immediate vicinity, primarily protecting against direct attack from soil-borne pathogens or surface-feeding pests.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager