Chemical Storage Cabinets Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437208 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Chemical Storage Cabinets Market Size

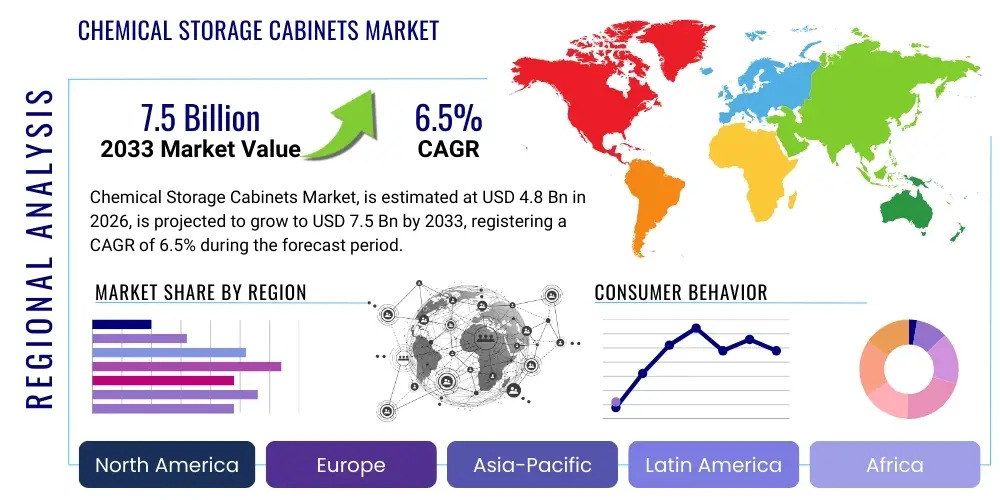

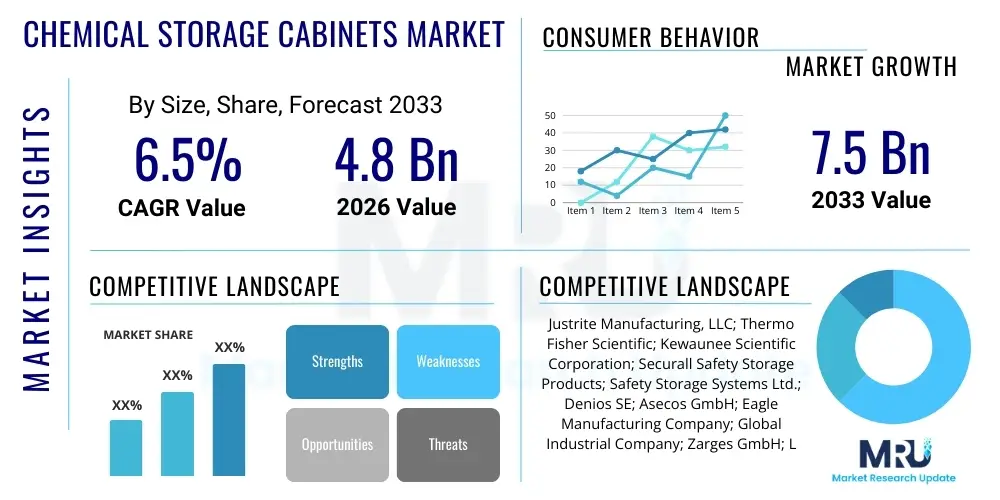

The Chemical Storage Cabinets Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 7.5 Billion by the end of the forecast period in 2033.

Chemical Storage Cabinets Market introduction

The Chemical Storage Cabinets Market encompasses the manufacturing and distribution of specialized enclosures designed to safely store hazardous substances, including flammable liquids, corrosives, pesticides, and reactive chemicals. These cabinets are engineered to meet stringent international regulatory standards, such as those set by OSHA (Occupational Safety and Health Administration) and NFPA (National Fire Protection Association), ensuring worker safety and environmental protection. The core function of these products is containment, preventing chemical exposure, minimizing fire risk, and organizing hazardous materials effectively within industrial, laboratory, and institutional settings. Compliance mandates regarding the segregated storage of incompatible chemicals are a primary driver for product adoption across various end-user sectors.

Chemical storage cabinets are essential assets across sectors characterized by heavy chemical usage, notably pharmaceuticals, biotechnology, academic research, and specialty chemical manufacturing. The typical product portfolio includes models differentiated by material (steel, polyethylene, polypropylene), capacity (ranging from small countertop units to large floor-standing models), and specific chemical compatibility (e.g., acid cabinets versus flammable safety cabinets). The key benefit derived from investing in high-quality chemical storage solutions is the reduction of operational risk, which translates into lower insurance liabilities and fewer incidents that could disrupt production or research activities. Furthermore, effective storage ensures the integrity and stability of sensitive chemicals, preserving their efficacy for intended processes.

Key factors driving the expansion of this market include the increasing global focus on occupational safety standards, particularly in emerging industrial economies, and the continuous growth of the life sciences sector. The rigorous enforcement of environmental, health, and safety (EHS) regulations compels organizations to upgrade or replace outdated storage infrastructure to maintain compliance. Technological advancements, such as integrated sensor monitoring for temperature and leak detection, further enhance the value proposition of modern cabinets, positioning them as critical components of comprehensive laboratory and industrial safety programs. The necessity for fire-rated storage, especially for volatile organic compounds (VOCs) and flammable solvents, underpins sustained demand.

Chemical Storage Cabinets Market Executive Summary

The Chemical Storage Cabinets Market is experiencing stable growth driven by global standardization of safety protocols and robust investment in the pharmaceutical and petrochemical industries. Business trends indicate a shift towards incorporating smart technology, such as integrated ventilation systems and RFID-enabled inventory management, into standard cabinet designs to enhance operational efficiency and regulatory adherence. Manufacturers are focusing on developing chemically resistant materials, particularly for corrosive storage, and offering modular solutions that can adapt to evolving laboratory layouts and storage requirements. Furthermore, the market is characterized by intense competition based not only on price but critically on regulatory certification, fire rating specifications, and durability, necessitating continuous product innovation to maintain market relevance.

Regionally, North America and Europe dominate the market, primarily due to well-established, strict regulatory frameworks enforced by bodies like OSHA, NFPA, and REACH (in Europe), which mandate the use of certified safety cabinets. The Asia Pacific (APAC) region, however, represents the fastest-growing market segment, fueled by rapid industrialization, expansion of manufacturing bases, and increasing governmental emphasis on EHS compliance in rapidly developing economies like China and India. This growth in APAC is driving demand for both standard industrial safety cabinets and specialized laboratory-grade units, prompting global players to expand their manufacturing and distribution networks within the region to capitalize on the burgeoning market potential.

Segment trends reveal that the flammable storage cabinets segment maintains the largest market share owing to the pervasive use of flammable solvents across nearly all chemical-handling industries. However, the segment dedicated to corrosive and acid storage cabinets is projected to exhibit above-average growth, spurred by the increasing complexity of chemical processes in advanced manufacturing and R&D. In terms of capacity, mid-sized cabinets (30 to 60 gallons) remain the most popular due to their balance of storage efficiency and handling convenience, while demand for smaller, point-of-use safety cabinets is growing rapidly within academic and biotech research facilities prioritizing decentralized, immediate safety measures at workstations.

AI Impact Analysis on Chemical Storage Cabinets Market

Common user questions regarding the influence of Artificial Intelligence (AI) on the Chemical Storage Cabinets Market often center on how AI can enhance safety compliance, streamline inventory management, and predict maintenance needs for critical infrastructure. Users frequently inquire about the feasibility of integrating smart sensors within cabinets for real-time monitoring of internal conditions (temperature, humidity, pressure, and vapor detection) and how AI algorithms analyze this data to provide actionable safety alerts or compliance reports. Furthermore, there is significant user interest in using machine learning models to optimize chemical segregation patterns within labs, minimizing the risk of accidental incompatible mixing, and utilizing AI for predictive replacement schedules of ventilation filters or seals based on usage patterns and environmental exposure.

The core theme emerging from these inquiries is the expectation that AI will transform chemical storage from a passive, containment function into an active, intelligent safety management system. AI integration moves beyond simple asset tracking (which is typically done via RFID or IoT) to providing cognitive safety layers. For example, AI can analyze historical storage incidents and cross-reference them with current ambient conditions and stored inventory composition to calculate dynamic risk scores, informing managers when specific operational changes might increase hazard exposure. This capability shifts the paradigm from reactive incident response to proactive hazard mitigation, significantly boosting the cabinet's value proposition as a safety tool.

This technological shift influences purchasing decisions, with end-users increasingly prioritizing cabinets capable of data integration and interoperability with existing Laboratory Information Management Systems (LIMS). Manufacturers are responding by embedding advanced processing capabilities and connectivity protocols (like MQTT or secure API access) directly into cabinet monitoring hardware. While the physical cabinet structure (fire-rated steel or polyethylene) remains crucial, the competitive edge is increasingly derived from the sophistication of the embedded intelligence, offering features such as automated documentation for auditing purposes and prescriptive recommendations for waste disposal or chemical relocation based on usage lifecycle tracked by the AI system.

- AI-driven Predictive Maintenance: Analyzing sensor data to anticipate filter replacement, seal degradation, or ventilation fan failure, ensuring continuous regulatory compliance.

- Intelligent Inventory Control: Integrating cabinet access control with LIMS/ERP systems, using AI to track precise quantities, usage rates, and shelf-life monitoring for stored chemicals.

- Enhanced Segregation Compliance: Utilizing machine learning algorithms to audit and recommend optimal placement of chemicals based on real-time incompatibility matrices (e.g., NFPA 400), dynamically alerting users to unsafe co-storage.

- Automated Compliance Reporting: Generating instantaneous, verifiable digital logs of storage conditions, access times, and inventory levels required for OSHA, EPA, or REACH audits, minimizing human error.

- Real-time Hazard Detection: AI analyzing sensor input (vapor concentration, temperature fluctuations) to differentiate standard deviations from actual hazardous events, triggering calibrated emergency responses faster than traditional static alarms.

DRO & Impact Forces Of Chemical Storage Cabinets Market

The dynamics of the Chemical Storage Cabinets Market are powerfully shaped by an interplay of regulatory drivers, cost-related restraints, and technological opportunities, all converging to determine market penetration and adoption rates. The overwhelming regulatory environment is the principal growth driver, particularly the mandates established by international and national bodies concerning fire safety and handling of hazardous materials. Simultaneously, the high initial capital expenditure associated with purchasing certified, fire-rated, and corrosion-resistant cabinets, especially those incorporating advanced smart features, presents a significant restraint for smaller organizations and facilities operating on restricted budgets. This tension between mandatory safety compliance and investment cost defines the market's trajectory. Opportunities are predominantly found in the technological integration sphere, where connectivity and smart features offer value-added safety management tools that justify the higher price points and propel market evolution towards intelligent storage solutions.

Key drivers include the global expansion of the life sciences sector, which necessitates specialized storage for sensitive reagents and samples, and the ongoing modernization of industrial infrastructure, particularly in burgeoning economies. The stringency of fire codes, requiring 10-minute or 90-minute fire ratings for flammable liquid storage, ensures continuous demand for certified products, often requiring organizations to replace aging, non-compliant infrastructure. The increasing volume and complexity of chemicals utilized in advanced manufacturing processes, such as semiconductor fabrication and nanotechnology, also act as a driver, demanding highly specific storage conditions that only purpose-built cabinets can reliably provide. This adherence to mandated safety specifications, often codified into law, creates a stable and persistent foundation for market demand that is less sensitive to typical economic downturns than other industrial sectors.

Restraints primarily revolve around the logistical and financial barriers to adoption. The large size and weight of many fire-rated cabinets pose logistical challenges during installation and facility rearrangement. Furthermore, the market faces constraints related to standardization; while NFPA and OSHA provide guidance, regional variations in building codes and specific material handling requirements can complicate global product distribution and necessitate regional-specific certifications, increasing manufacturing complexity and cost. Opportunities are heavily focused on innovation in material science, offering lighter, more durable, and intrinsically safer materials that can reduce shipping costs and extend product life. Moreover, the integration of cloud-based monitoring services and subscription models for data analysis represents a significant opportunity to transition cabinet purchasing from a pure capital expenditure to a safety-as-a-service model, potentially lowering the barrier to entry for smaller enterprises seeking advanced compliance features.

Segmentation Analysis

The Chemical Storage Cabinets Market is meticulously segmented based on critical factors including product type, material composition, capacity range, and end-user application, reflecting the diverse and specialized requirements inherent in chemical handling and safety compliance. This segmentation is crucial for understanding specific demand patterns, as regulatory requirements often dictate which cabinet type (e.g., flammable vs. acid/corrosive) must be procured. The choice of material, typically heavy-gauge steel or high-density polyethylene, is determined by the chemical class being stored, with fire resistance being the primary concern for steel cabinets and chemical inertness being the focus for polymer-based solutions. Analyzing these segments helps manufacturers align their product development efforts with the unique safety needs of targeted industries, ensuring optimal design for compliance and operational longevity.

The market volume is heavily influenced by the end-user segmentation, with the industrial sector, particularly petrochemical and manufacturing, accounting for the largest share due to the massive volume of chemicals processed and stored. Conversely, the academic and research laboratory sector drives demand for smaller, more specialized cabinets that require precise ventilation connectivity and often necessitate customized internal shelving for high-value reagents. Capacity segmentation further refines market offerings, with 4-gallon and 12-gallon units catering to localized, point-of-use storage, while 30-gallon and 90-gallon units are essential for centralized chemical storage rooms or large-scale dispensing areas. Understanding these distinctions allows for targeted marketing strategies and efficient resource allocation across the manufacturing value chain, optimizing production cycles for high-demand configurations.

- By Product Type:

- Flammable Storage Cabinets (Most dominant segment due to universal requirement for flammable solvents)

- Acid and Corrosive Storage Cabinets (High growth segment driven by complex chemical synthesis)

- Pesticide Storage Cabinets

- Toxic and Poisonous Material Cabinets

- Drum Storage Cabinets (For 55-gallon drums, crucial in industrial settings)

- By Material Type:

- Steel Cabinets (Predominantly for fire safety, offering robust fire resistance ratings)

- Polyethylene Cabinets (Preferred for high corrosion resistance against acids and bases)

- Polypropylene Cabinets (Used for ultra-pure or specialized corrosive storage)

- By Capacity:

- Small Capacity (Under 12 Gallons / Point-of-use storage)

- Medium Capacity (12 to 60 Gallons / Standard laboratory and mid-scale industrial storage)

- Large Capacity (Over 60 Gallons / Central storage facilities and heavy industrial use)

- By End-User:

- Pharmaceutical and Biotechnology Industries

- Chemical and Petrochemical Industries

- Academic and Research Institutions

- Food and Beverage Processing

- Healthcare and Clinical Laboratories

- Government and Defense

Value Chain Analysis For Chemical Storage Cabinets Market

The value chain for the Chemical Storage Cabinets Market begins with the upstream procurement of essential raw materials, primarily high-grade, corrosion-resistant sheet steel (typically 18-gauge to 12-gauge) and specialized polymers like high-density polyethylene (HDPE) or polypropylene. Steel suppliers must meet rigorous standards for structural integrity and weldability, while polymer suppliers must guarantee specific chemical resistance properties and material purity. This upstream segment is highly quality-sensitive, as the final safety certifications (e.g., FM approval, UL listing) depend directly on the consistent quality of input materials. Manufacturers then undertake specialized fabrication processes, including double-wall construction, sophisticated welding, powder coating for chemical resistance, and the integration of crucial safety features like three-point locking mechanisms and sequential closing doors.

The downstream segment focuses heavily on distribution and installation, which often involves specialized third-party providers or direct sales channels due to the technical nature of the product and the compliance requirements. Direct distribution channels are often preferred for large industrial clients (e.g., petrochemical plants) requiring custom configurations or bulk orders, allowing manufacturers to offer integrated services such as compliance consultation and facility design review. Conversely, indirect channels, utilizing specialized laboratory equipment distributors and industrial supply houses, efficiently serve the fragmented academic and small research laboratory markets. These distributors often maintain regional inventories and provide crucial last-mile logistical support, handling the challenging transport of heavy, bulky items.

The critical element in the distribution channel is the necessity for expertise; sales representatives and distributors must possess deep knowledge of regulatory codes (NFPA 30, OSHA 1910.106) to ensure the client purchases the correct cabinet type, capacity, and ventilation accessories for their specific hazard class. Failure to correctly specify the product can result in non-compliance, making consultancy an integral part of the sales process. Therefore, the value chain emphasizes service and compliance verification, extending the relationship beyond the point of sale into installation support and future recertification guidance. The direct channel offers greater control over compliance assurance, while the indirect channel maximizes market reach across smaller, decentralized customer bases.

Chemical Storage Cabinets Market Potential Customers

Potential customers for chemical storage cabinets span a wide spectrum of industries united by the common need to handle and store hazardous or sensitive chemicals safely and legally. The primary end-users are concentrated within sectors requiring significant R&D, large-scale chemical processing, or stringent regulatory adherence. The pharmaceutical and biotechnology sectors are significant buyers, necessitating controlled storage for high-value solvents, acids, and temperature-sensitive biological reagents crucial for drug discovery and manufacturing. These facilities often require specialized stainless steel or polypropylene cabinets to maintain ultra-clean environments and prevent cross-contamination, driven heavily by cGMP (current Good Manufacturing Practice) standards.

Another major segment comprises the chemical and petrochemical industries, where the sheer volume of flammable liquids (such as gasoline, solvents, and specialty additives) mandates the installation of high-capacity, fire-rated drum storage and floor-standing cabinets. These industrial buyers prioritize durability, large capacity, and compliance with the most stringent fire codes (e.g., 90-minute fire ratings, often exceeding minimum requirements) to minimize catastrophic risk. Academic and governmental research laboratories represent the third core customer group, typically purchasing smaller, modular safety cabinets for individual lab benches, focusing on safe segregation of materials and ease of integration into existing fume hood ventilation systems. Their buying decisions are often guided by grant funding restrictions and university-wide safety mandates.

The secondary customer base includes institutions involved in materials testing, food and beverage processing (where sanitation chemicals and flavorings require segregated storage), agriculture (pesticide storage requirements), and maintenance/utility operations across large campuses or manufacturing sites. For these diverse buyers, the focus shifts slightly towards versatility and long-term durability in varied environments. For example, customers in utilities might opt for polyethylene outdoor storage sheds for remote hazardous waste accumulation, while food processors require smooth, easily cleanable surfaces resistant to caustic washdowns. In all cases, the decision to purchase is fundamentally driven by the need to mitigate liability, ensure employee well-being, and pass regulatory inspections, making compliance assurance the ultimate purchasing criteria.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 7.5 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Justrite Manufacturing, LLC; Thermo Fisher Scientific; Kewaunee Scientific Corporation; Securall Safety Storage Products; Safety Storage Systems Ltd.; Denios SE; Asecos GmbH; Eagle Manufacturing Company; Global Industrial Company; Zarges GmbH; Labconco Corporation; Bio-Rad Laboratories, Inc.; Spectrum Chemical Mfg. Corp.; Flinn Scientific, Inc.; Hemco Corporation; Mystaire, Inc.; InterFocus Ltd.; Air Science, LLC; Churchill Container; S&S Technical, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Chemical Storage Cabinets Market Key Technology Landscape

The technological landscape of the Chemical Storage Cabinets Market is evolving rapidly, moving beyond basic fire-rated containment towards integrated, intelligent safety solutions. The most significant technological advancements center on connectivity and active safety management. Key technologies include the integration of IoT sensors for continuous monitoring of internal cabinet conditions, such as temperature, humidity, and the presence of volatile organic compound (VOC) vapors. These sensor packages often communicate wirelessly via secure network protocols to centralized safety dashboards or cloud platforms, providing facility managers with real-time data access and immediate alerts if conditions deviate from regulatory or operational thresholds. This shift from passive compliance equipment to active monitoring tools is redefining the competitive environment, prioritizing manufacturers who can seamlessly embed sophisticated electronics into rugged industrial hardware.

Another crucial technological area involves enhanced access control and inventory tracking systems, essential for high-security or high-value chemical storage. Modern cabinets frequently incorporate biometric scanners, RFID tags, or networked keypad locks, ensuring only authorized personnel can access specific chemicals and creating an immutable audit trail for every transaction. This level of granular access control is vital for mitigating theft, preventing unauthorized mixing, and adhering to strict accountability protocols mandated by certain regulatory bodies, particularly in research institutions handling controlled substances. Furthermore, the integration with LIMS (Laboratory Information Management Systems) allows for automated tracking of chemical depletion, minimizing manual inventory counts and reducing human error in regulatory documentation.

The third area of technological focus is advanced ventilation and filtration systems, specifically designed for cabinets storing materials that off-gas noxious fumes (e.g., acids or highly volatile solvents). Ductless filtration technology, utilizing specialized carbon filters and adsorbent media, allows cabinets to trap hazardous vapors efficiently without the need for complex, costly ductwork to the outside environment, offering greater flexibility in laboratory layout. Conversely, ducted cabinets are increasingly incorporating variable air volume (VAV) controls and pressure monitoring systems to ensure continuous negative pressure within the cabinet, preventing vapor escape while conserving energy. These advanced features ensure that the cabinet provides not just physical containment, but also active atmospheric control necessary for protecting both personnel and sensitive research processes.

Regional Highlights

- North America: Regulatory Hegemony and Advanced Adoption

North America, particularly the United States, holds a dominant position in the global Chemical Storage Cabinets Market, primarily driven by the pervasive and rigorously enforced safety standards set by OSHA, NFPA (especially NFPA 30 for Flammable and Combustible Liquids), and EPA. The market here is characterized by high demand for certified, high-end products, with FM Approved and UL Listed cabinets being the industry standard. Substantial R&D expenditure in the pharmaceutical and biotechnology hubs, coupled with a large established petrochemical industry, ensures continuous procurement of both flammable safety cabinets and specialized corrosive storage units. Manufacturers in this region focus on product durability, sophisticated safety features, and integration capabilities to cater to customers who prioritize compliance above initial cost.

- Europe: Focus on REACH Compliance and Environmental Stewardship

Europe represents a mature and technologically advanced market, driven significantly by the REACH regulation (Registration, Evaluation, Authorisation, and Restriction of Chemicals), which mandates strict handling and inventory protocols for hazardous substances. The European market shows a strong preference for 90-minute fire-rated cabinets (Type 90), which exceed many global minimum standards and facilitate safer storage within research and industrial facilities, often eliminating the need for separate chemical storage buildings. Germany, the UK, and France are key consumers, propelled by their robust manufacturing and chemical sectors. Innovation is concentrated on environmentally friendly solutions, including optimized ventilation systems designed for maximum energy efficiency and cabinets manufactured using sustainable materials where possible.

- Asia Pacific (APAC): The Fastest Growing Market Fueled by Industrialization

The Asia Pacific region is projected to register the highest Compound Annual Growth Rate (CAGR) during the forecast period. This rapid expansion is a direct consequence of escalating industrialization, significant foreign direct investment into manufacturing (especially electronics and specialty chemicals), and the subsequent strengthening of local EHS regulatory frameworks in countries such as China, India, and South Korea. While historically focused on cost-effective solutions, the APAC market is rapidly shifting toward adopting international safety standards, leading to increased demand for certified, high-quality safety cabinets. The pharmaceutical and academic sectors in this region are rapidly expanding, creating a substantial need for laboratory-grade storage solutions, though the challenge remains in balancing affordability with adherence to globally recognized safety certifications.

- Latin America (LATAM) and Middle East & Africa (MEA): Emerging Safety Awareness

The LATAM and MEA regions currently hold smaller market shares but are exhibiting steady growth as awareness regarding occupational safety increases and multinational corporations establish operational bases, importing their strict safety protocols. In the Middle East, substantial investment in the oil & gas and petrochemical sectors drives demand for high-capacity industrial cabinets capable of enduring harsh environmental conditions. In LATAM, regulatory harmonization and economic development are slowly pushing institutions towards greater compliance, although price sensitivity remains a major factor. Growth in both regions is contingent on government enforcement of safety laws and continued industrial modernization projects that prioritize worker protection infrastructure.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Chemical Storage Cabinets Market.- Justrite Manufacturing, LLC

- Thermo Fisher Scientific

- Kewaunee Scientific Corporation

- Securall Safety Storage Products

- Denios SE

- Asecos GmbH

- Eagle Manufacturing Company

- Global Industrial Company

- Zarges GmbH

- Labconco Corporation

- Bio-Rad Laboratories, Inc.

- Spectrum Chemical Mfg. Corp.

- Flinn Scientific, Inc.

- Hemco Corporation

- Mystaire, Inc.

- InterFocus Ltd.

- Air Science, LLC

- Churchill Container

- S&S Technical, Inc.

Frequently Asked Questions

Analyze common user questions about the Chemical Storage Cabinets market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary regulations governing the installation of flammable storage cabinets?

The primary regulations are mandated by the NFPA (National Fire Protection Association), particularly NFPA 30 (Flammable and Combustible Liquids Code), and enforced by OSHA (Occupational Safety and Health Administration) in the U.S. These codes dictate cabinet construction, fire rating (typically 10-minute or 90-minute protection), permissible capacity limits per storage area, and mandatory grounding requirements.

Should chemical storage cabinets be vented, and if so, how?

Flammable liquid cabinets are not required to be vented unless specific chemical properties necessitate it. Vented cabinets are mandatory for corrosive materials or highly odorous substances to prevent harmful vapor accumulation. If venting is required, it must be connected to a negative pressure exhaust system designed to draw air from the cabinet bottom, often utilizing engineered venting kits and complying with NFPA guidelines to prevent fire propagation through the ductwork.

What is the difference between steel and polyethylene cabinets?

Steel cabinets (typically 18-gauge steel with double-wall construction) are primarily designed for fire resistance, particularly for storing flammable liquids and solvents, offering certified fire ratings. Polyethylene (or polypropylene) cabinets are used exclusively for storing highly corrosive acids and bases, as polymer materials resist degradation and rust, providing superior chemical resistance where fire rating is secondary or not achievable due to chemical reactivity.

How does the capacity of a safety cabinet affect compliance?

Compliance requirements strictly limit the total volume of flammable liquids permitted in a facility or specific control area. OSHA and NFPA generally limit the size of an individual cabinet to 60 gallons of Class I, II, and III flammable liquids, and restrict the total number of cabinets permitted in a given fire area, necessitating capacity management and proper segregation across the facility.

Are smart chemical storage cabinets worth the added cost?

Yes, for facilities prioritizing advanced safety and operational efficiency, smart cabinets justify the added cost. They offer significant value through integrated features like real-time temperature and vapor monitoring, automated inventory tracking (via RFID/IoT), and digital audit trails, which reduce manual compliance burden, mitigate high-risk events, and enhance overall chemical security and accountability.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager