Chemical Storage Tank Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437748 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Chemical Storage Tank Market Size

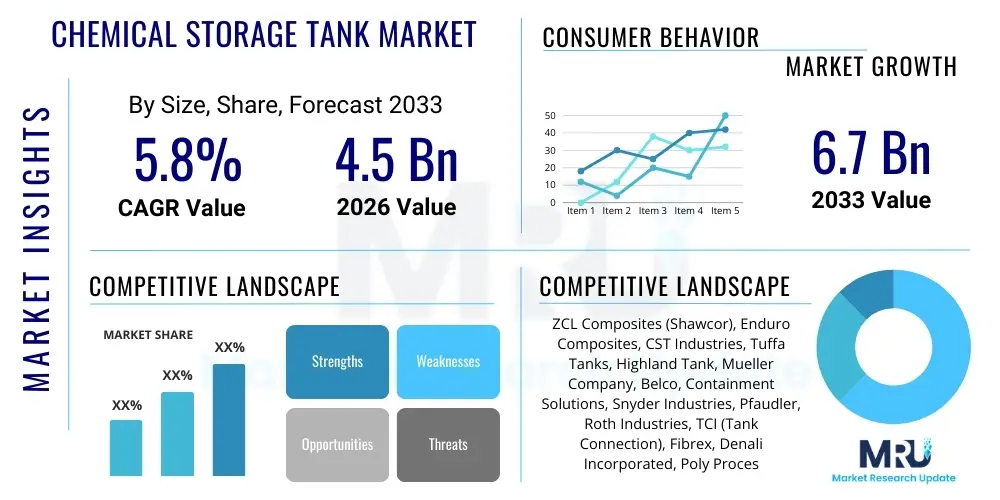

The Chemical Storage Tank Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.5 billion in 2026 and is projected to reach USD 6.7 billion by the end of the forecast period in 2033. This robust growth trajectory is primarily underpinned by escalating demand across the chemical manufacturing, oil and gas, and water treatment sectors globally. The market expansion is also significantly influenced by stringent safety and environmental regulations compelling industries to upgrade or replace aging storage infrastructure with advanced, compliant, and corrosion-resistant tanks, driving substantial capital expenditure in developed and rapidly industrializing economies.

Chemical Storage Tank Market introduction

The Chemical Storage Tank Market encompasses the design, manufacture, and deployment of specialized containers utilized for the safe, stable, and compliant storage of various chemical substances, ranging from corrosive acids and bases to flammable solvents and toxic intermediates. These tanks are critical infrastructure components across numerous industrial verticals, engineered with specific material properties—such as stainless steel, carbon steel, fiberglass reinforced plastic (FRP), and high-density polyethylene (HDPE)—to withstand the chemical aggressiveness, temperature variations, and pressure requirements inherent in handling diverse chemical inventories. Product descriptions emphasize structural integrity, regulatory compliance (e.g., API, ASME, EPA standards), and advanced monitoring capabilities to prevent leaks and ensure operational safety.

Major applications of these storage solutions span the entirety of the industrial landscape, including primary chemical production facilities, petrochemical refineries, pharmaceutical manufacturing plants, agrochemical processing units, and municipal wastewater treatment operations. The operational integrity of these industries is directly tied to the reliability of their chemical storage systems. The inherent benefits derived from high-quality chemical storage tanks include enhanced safety protocols, minimization of environmental contamination risks through superior containment, reduced product loss due to corrosion or volatilization, and optimized logistical efficiency in raw material and finished product handling.

Driving factors propelling market growth include the global expansion of the chemical industry, particularly in the Asia Pacific region, increasing investments in infrastructure projects requiring bulk chemical handling, and the imperative for companies to adhere to evolving international environmental, health, and safety (EHS) mandates. Furthermore, technological advancements in material science, leading to the development of tanks with superior chemical resistance and lighter weight, coupled with increasing focus on digitalization for real-time inventory and condition monitoring, further stimulate market demand and adoption across diverse end-user sectors seeking operational excellence and risk mitigation.

Chemical Storage Tank Market Executive Summary

The Chemical Storage Tank Market is navigating a dynamic landscape characterized by significant shifts in business trends, driven largely by sustainability mandates and infrastructure modernization. Key business trends involve consolidation among manufacturers to achieve economies of scale and specialized material development, particularly focusing on composite and thermoplastic solutions that offer superior corrosion resistance compared to traditional metallic tanks. The market is witnessing increased demand for double-walled containment systems and advanced leak detection mechanisms, reflecting industry priorities toward environmental stewardship and liability mitigation. Furthermore, the integration of Industrial Internet of Things (IIoT) sensors for predictive maintenance and inventory management is becoming a standard offering, transforming tank maintenance from reactive to proactive, thereby extending asset lifecycle and improving safety compliance.

Regionally, the market growth momentum is strongest in the Asia Pacific (APAC), driven by massive industrialization, rapid urbanization, and significant government investment in chemical processing and water treatment infrastructure, particularly in China and India. North America and Europe, characterized by stringent environmental regulations, exhibit mature demand patterns focused primarily on replacement, upgrade, and specialized high-performance tanks (e.g., fluoropolymer-lined tanks for aggressive media). Latin America and the Middle East & Africa (MEA) are emerging as high-potential markets, fueled by expansion in oil and gas processing activities and diversification into specialized chemical production, necessitating robust and high-capacity storage solutions that comply with international safety standards.

Segmentation trends highlight the dominance of Fiberglass Reinforced Plastic (FRP) and engineered thermoplastics due to their exceptional corrosion resistance, cost-effectiveness over the long term, and lighter installation requirements, making them highly favored in sectors like water treatment and less aggressive chemical storage. In terms of capacity, tanks exceeding 20,000 liters are experiencing heightened demand, particularly in the bulk chemical and petrochemical industries where centralized, high-volume storage is essential for optimizing supply chain logistics. The Above Ground storage segment maintains the largest market share owing to ease of inspection, maintenance, and lower installation costs, although stringent regulatory environments continue to drive steady demand for underground and specialized secondary containment systems.

AI Impact Analysis on Chemical Storage Tank Market

User queries regarding AI's influence in the Chemical Storage Tank Market frequently revolve around topics such as the feasibility and benefits of predictive maintenance using machine learning, the role of AI in optimizing inventory levels and preventing hazardous overfills, and the effectiveness of integrating AI-powered risk assessment tools into existing tank farm operations. Users are specifically concerned about how AI can enhance safety compliance (e.g., detecting microscopic fissures or corrosion patterns earlier than human inspection) and reduce operational expenditure (OpEx) through optimized maintenance schedules. The underlying theme is the expectation that AI and associated data analytics will transition chemical storage management from scheduled, time-based maintenance to condition-based, predictive interventions, significantly mitigating catastrophic failure risks and improving throughput efficiency in complex chemical processes.

- AI-driven predictive maintenance models leverage sensor data (temperature, pressure, vibration, ultrasonic measurements) to forecast potential equipment failure, reducing unexpected downtime and maximizing asset utilization.

- Optimization of inventory management and supply chain logistics using machine learning algorithms to balance stock levels, minimizing the risk of understocking critical reagents or hazardous overfills.

- Enhanced corrosion and structural integrity analysis through deep learning image processing of visual and Non-Destructive Testing (NDT) data, identifying defects earlier than traditional methods.

- Automation of regulatory compliance reporting and auditing by AI systems, ensuring adherence to complex local and international safety standards (e.g., API 653 inspections).

- Simulation and digital twinning of tank farms to test stress scenarios, train operators, and optimize physical layouts for maximum safety and efficiency before physical deployment.

DRO & Impact Forces Of Chemical Storage Tank Market

The Chemical Storage Tank Market is primarily driven by escalating global industrial production, which inherently necessitates robust and specialized bulk chemical storage. A major driving force is the tightening regulatory landscape across North America and Europe, mandating the replacement of single-wall tanks with safer, double-containment systems, alongside strict anti-corrosion requirements that favor high-performance materials like FRP and specialized alloys. Restraints largely center on the significant initial capital investment required for high-capacity, chemically inert storage solutions and the complex, time-consuming permitting processes associated with new tank farm construction or major upgrades. Furthermore, the volatility in raw material prices, particularly steel and specialized resin composites, introduces cost uncertainties for manufacturers and end-users alike.

Opportunities abound in developing economies, particularly in sectors where infrastructure modernization is accelerating, such as municipal water treatment and new petrochemical complexes in Southeast Asia and the Middle East. The increasing adoption of sustainable chemicals and green hydrogen storage presents a niche, high-growth opportunity requiring specialized, pressure-rated cryogenic and non-metallic tanks. Technological advancements in coatings, lining materials, and smart monitoring systems (IoT integration) offer manufacturers avenues for product differentiation and increased service revenue through asset lifecycle management.

The key impact forces reshaping the market include regulatory pressure (the strongest force driving upgrades), technological innovation in materials (influencing cost and performance), and the sustained global demand for specialty chemicals and energy derivatives. Environmental concerns relating to ground and water contamination heavily influence purchasing decisions, favoring technologies that guarantee zero leakage. Furthermore, geopolitical stability and trade policies impacting the cross-border transport of raw materials and finished tanks also exert a significant, albeit indirect, influence on manufacturing lead times and overall project costs across the major industrial regions, dictating the pace of new installations and replacement cycles in crucial industrial hubs.

Segmentation Analysis

The Chemical Storage Tank Market is intricately segmented based on material composition, product type, capacity, and diverse application areas, reflecting the necessity for highly customized solutions tailored to specific chemical media and operational environments. Material segmentation is crucial, determining the tank's chemical inertness, structural lifespan, and cost profile, with traditional materials like carbon steel competing aggressively against advanced polymer and composite solutions. Product type differentiation separates permanent, site-specific installations (Above Ground and Underground) from mobile or localized containment systems, serving distinct logistical and safety requirements. Capacity segmentation reflects the scale of industrial operations, ranging from localized laboratory storage to vast petrochemical tank farms, directly impacting engineering complexity and regulatory oversight.

Application segmentation illustrates the breadth of the market's reach, spanning heavy industrial sectors such as oil & gas and core chemical manufacturing, to specialized, highly regulated environments like pharmaceuticals and food & beverages, where cleanliness and material non-reactivity are paramount. Understanding these segments is vital for manufacturers, enabling them to align their production capabilities with the specific regulatory and performance demands of targeted end-user industries. The trend toward modular and prefabricated tanks is also gaining traction, particularly for smaller to medium-capacity requirements, driven by faster deployment times and reduced site work, ultimately contributing to better project timelines and cost predictability for end-users implementing infrastructural upgrades.

- Material: Stainless Steel, Carbon Steel, Fiberglass Reinforced Plastic (FRP), Polyethylene (PE/HDPE), Other Polymers (PP, PVC, PTFE), Concrete, Specialty Alloys.

- Product Type: Above Ground Storage Tanks (ASTs), Underground Storage Tanks (USTs), Portable/Mobile Tanks (Intermediate Bulk Containers - IBCs and Drum Tanks).

- Storage Capacity: Below 500 Liters, 500-5,000 Liters, 5,000-20,000 Liters, Above 20,000 Liters (including very large capacity utility tanks).

- Application: Oil & Gas (Refineries, Midstream Storage), Chemical Manufacturing (Bulk Petrochemicals, Specialty Chemicals), Water & Wastewater Treatment (Chemical Dosing, Sludge Storage), Pharmaceuticals & Biotechnology, Food & Beverages (Processing Chemicals, CIP solutions), Agrochemicals, Pulp & Paper, Mining & Metallurgy.

Value Chain Analysis For Chemical Storage Tank Market

The value chain for the Chemical Storage Tank Market begins with the upstream segment, primarily involving the procurement and processing of raw materials crucial for tank construction. This includes steel mills providing carbon and stainless steel sheets, chemical resin suppliers for fiberglass and polymer tanks, and specialized coating manufacturers. Quality and cost control at this stage are paramount, as material consistency directly impacts the tank's chemical resistance and structural lifespan. Key upstream challenges involve managing commodity price volatility and ensuring sustainable sourcing practices, particularly for specialized alloys and high-performance polymer resins which are often sourced from a concentrated global supply base, leading to potential supply bottlenecks and price fluctuations that affect final product pricing and lead times.

The midstream segment involves the core manufacturing, fabrication, and engineering design processes. Tank manufacturers specialize in various welding techniques (for metallic tanks), winding/laminating processes (for FRP tanks), or rotational/blow molding (for polyethylene tanks). This phase also encompasses rigorous quality assurance and testing, including adherence to international standards like API 650, ASME, and local regulatory mandates. Following fabrication, the distribution channel takes over, often involving specialized heavy haul logistics and installation contractors trained in handling large, often complex, industrial equipment. Direct distribution often occurs for custom, large-scale projects where the manufacturer manages installation, while indirect channels utilize authorized distributors or engineering, procurement, and construction (EPC) firms for standardized or modular tank systems, particularly in regional markets where local presence is crucial for maintenance support.

The downstream analysis focuses on the end-users and the after-market services, which constitute a critical part of the value proposition. End-users, ranging from small chemical distributors to multinational petrochemical giants, require ongoing maintenance, inspection services, repair, and eventual decommissioning. The growing trend toward digitalization means the downstream value chain now heavily involves technology providers offering remote monitoring, condition-based inspection planning, and predictive analytics software. This service-oriented segment generates significant recurring revenue, emphasizing the importance of long-term customer relationships, specialized certification requirements for inspectors, and a reliable spare parts supply chain to ensure minimal disruption to the continuous operational requirements of high-volume chemical processing plants.

Chemical Storage Tank Market Potential Customers

The potential customer base for the Chemical Storage Tank Market is broad and highly diversified, spanning nearly all heavy and specialized industrial sectors that handle, process, or distribute chemicals, solvents, fuels, or specialized media. Primary end-users include major chemical manufacturing corporations (e.g., producers of basic chemicals, polymers, and specialty chemicals) that require massive, reliable bulk storage for raw materials and finished goods. Petrochemical companies and oil & gas midstream operators are key buyers, demanding high-pressure, durable tanks for crude oil, refined products, and various chemical intermediates required during the refining process, often requiring specialized coatings and advanced safety features to manage hazardous, flammable materials effectively.

Beyond these core sectors, municipal organizations and private water utility companies represent a significant customer segment, purchasing tanks for storing coagulants, flocculants, and disinfection chemicals essential for water purification and wastewater treatment processes, where polyethylene and FRP tanks are often preferred due to their excellent resistance to mild corrosives like sodium hypochlorite. Furthermore, the pharmaceutical and biotechnology sectors, though requiring smaller capacity, demand ultra-high purity tanks, typically polished stainless steel or glass-lined reactors/storage vessels, adhering to strict Good Manufacturing Practice (GMP) standards where contamination avoidance is non-negotiable. This diversity mandates that suppliers maintain flexible manufacturing capabilities and detailed regulatory expertise to serve the unique specifications of each customer group effectively and compliantly.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 billion |

| Market Forecast in 2033 | USD 6.7 billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ZCL Composites (Shawcor), Enduro Composites, CST Industries, Tuffa Tanks, Highland Tank, Mueller Company, Belco, Containment Solutions, Snyder Industries, Pfaudler, Roth Industries, TCI (Tank Connection), Fibrex, Denali Incorporated, Poly Processing Company, Custom-Bilt Tanks, GEP Ecotech, L. F. Manufacturing, Trusco Tank, Worthington Industries, Fibrex, Augusta Fiberglass, Tankinetics, Mass Tank. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Chemical Storage Tank Market Key Technology Landscape

The Chemical Storage Tank market is undergoing significant technological transformation, moving far beyond traditional static metal containers toward integrated, smart storage systems designed for enhanced safety, longevity, and operational efficiency. A core technological focus is advanced material science, particularly the innovation in non-metallic composite materials such such as specialized Fiberglass Reinforced Plastics (FRP) utilizing high-performance resins (e.g., vinyl ester, epoxy) that provide superior chemical and temperature resistance over a broader range of applications compared to generic polyester resins. Furthermore, the development of advanced thermoplastic linings (like PTFE and PVDF) for metallic tanks is crucial, offering double-layer protection against highly corrosive chemicals, significantly extending the service life of carbon steel tanks in aggressive environments and ensuring higher compliance margins against leakage risks inherent in aging infrastructure.

The second major technological wave centers on digitalization and the integration of Industrial Internet of Things (IIoT) infrastructure. Modern chemical tanks are increasingly equipped with sophisticated sensor arrays that continuously monitor critical parameters, including internal and external temperature, pressure, liquid level, and structural integrity via ultrasonic testing probes and strain gauges embedded within the tank walls. This data is processed through cloud-based platforms utilizing advanced analytics to enable real-time risk assessment, automated inventory tracking, and most crucially, predictive maintenance scheduling. This shift reduces the reliance on manual inspections and mitigates human error, leading to fewer catastrophic failures and optimizing the use of maintenance resources across extensive tank farm installations.

A third critical area involves innovations in containment and secondary protection technologies. The rising global prevalence of double-wall tanks, utilizing interstitial space monitoring for early leak detection, is a direct result of stringent environmental regulations. Furthermore, modular and customizable tank designs, facilitated by precise computerized numerical control (CNC) manufacturing and advanced welding robotics, allow for faster, more accurate field assembly and easier scalability. Technologies focusing on specialized coatings, such as those incorporating ceramic or nanotechnology elements, also play a vital role by providing enhanced resistance to abrasion, microbial corrosion (MIC), and extreme chemical attack, ensuring maximum asset protection and compliance with evolving global safety protocols.

Regional Highlights

- Asia Pacific (APAC): APAC represents the fastest-growing market segment, fueled primarily by rapid industrialization, massive infrastructure development, and the relocation of global chemical manufacturing bases to countries like China, India, and Southeast Asia. The region exhibits high demand for both bulk metallic storage for petrochemicals and specialized composite tanks for water treatment and agrochemicals. Regulatory enforcement is increasing, driving replacement and modernization efforts, especially in coastal industrial zones where environmental standards are tightening.

- North America: This is a mature market driven predominantly by strict environmental regulations (EPA, state-level mandates) and the need for infrastructure replacement. Demand is highly concentrated on upgrading aging underground storage tanks (USTs) to compliant double-wall systems and investing heavily in advanced monitoring technologies (IoT/AI). The resurgence in oil and gas production, particularly in the U.S., maintains steady demand for large-capacity, high-specification metallic tanks and associated containment vessels compliant with API standards.

- Europe: The European market is characterized by high adoption rates of advanced, highly customized tanks, reflecting stringent safety standards (e.g., ATEX requirements for flammable substances) and a strong focus on sustainability. Growth is moderate but stable, driven by the specialty chemicals sector, pharmaceutical manufacturing, and significant investment in sustainable technologies, including specialized tanks for biogas, biofuels, and hydrogen storage, favoring advanced stainless steel and composite materials.

- Latin America (LATAM): Market expansion in LATAM is driven by investments in the downstream oil and gas sector (especially in Brazil and Mexico) and burgeoning chemical production. While price sensitivity remains a factor, increasing cross-border regulatory harmonization is pushing local industries toward adopting higher international safety standards, creating demand for imported and locally manufactured high-quality containment solutions.

- Middle East and Africa (MEA): Growth in MEA is strongly tied to massive investments in large-scale petrochemical projects, refinery expansions, and diversification away from crude oil extraction. This drives intense demand for very large, high-pressure, and high-temperature metallic storage tanks. The region focuses heavily on ensuring robust capacity and structural integrity to support major export activities, with specialized tanks needed for managing corrosive media used in enhanced oil recovery and desalination processes.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Chemical Storage Tank Market.- ZCL Composites (Shawcor)

- Enduro Composites

- CST Industries

- Tuffa Tanks

- Highland Tank

- Mueller Company

- Belco

- Containment Solutions

- Snyder Industries

- Pfaudler

- Roth Industries

- TCI (Tank Connection)

- Fibrex

- Denali Incorporated

- Poly Processing Company

- Custom-Bilt Tanks

- GEP Ecotech

- L. F. Manufacturing

- Trusco Tank

- Worthington Industries

- Tankinetics

- Mass Tank

- Augusta Fiberglass

- Fisher Tank Company

Frequently Asked Questions

Analyze common user questions about the Chemical Storage Tank market and generate a concise list of summarized FAQs reflecting key topics and concerns.What regulatory standards primarily govern the design and installation of chemical storage tanks?

The design and installation of chemical storage tanks are primarily governed by international standards such as API (American Petroleum Institute) for metallic tanks, ASME (American Society of Mechanical Engineers) for pressure vessels, and regulations enforced by bodies like the EPA (Environmental Protection Agency) in the US and equivalent agencies globally, focusing on secondary containment and leak prevention.

Which tank material offers the best balance of corrosion resistance and cost-effectiveness?

Fiberglass Reinforced Plastic (FRP) generally offers an excellent balance of high corrosion resistance, long operational lifespan, and lower long-term maintenance costs compared to specialized alloys, making it highly cost-effective for storing a wide range of mild to moderately aggressive chemicals, especially in water treatment and agricultural chemical applications.

How is IoT technology improving safety in chemical storage tank operations?

IoT technology enhances safety by enabling continuous, real-time monitoring of critical parameters such as internal pressure, temperature, and liquid levels. This data facilitates predictive maintenance scheduling, immediate detection of potential leaks or structural anomalies, and provides automated alarms to prevent overfills, significantly reducing the risk of catastrophic failure and environmental contamination.

What are the key differences between Above Ground Storage Tanks (ASTs) and Underground Storage Tanks (USTs) in terms of regulation?

ASTs are easier to inspect and maintain but require stringent external containment measures (dike walls). USTs, while saving space and offering insulation, face stricter environmental regulations regarding double-wall construction, cathodic protection, and mandatory interstitial monitoring systems due to the higher difficulty in detecting and remediating subsurface leaks that can contaminate groundwater.

Which geographical region is expected to drive the highest growth in demand for new chemical storage installations?

The Asia Pacific (APAC) region, driven by extensive industrial expansion, booming petrochemical projects, and increasing regulatory pressure to upgrade outdated infrastructure in rapidly developing economies like China, India, and Southeast Asian nations, is projected to exhibit the highest growth rate and demand for new chemical storage installations through the forecast period.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager