Chemical Vapour Deposition Synthetic Diamond Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438718 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Chemical Vapour Deposition Synthetic Diamond Market Size

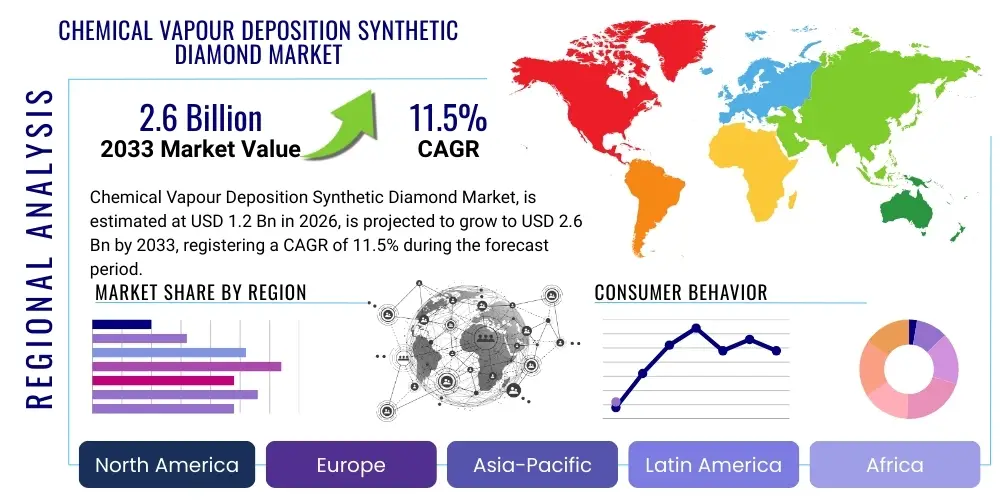

The Chemical Vapour Deposition Synthetic Diamond Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 2.6 Billion by the end of the forecast period in 2033.

Chemical Vapour Deposition Synthetic Diamond Market introduction

The Chemical Vapour Deposition (CVD) Synthetic Diamond Market encompasses the production and utilization of diamonds synthesized under controlled laboratory environments, specifically employing the CVD technique. This method involves introducing carbon-containing gases (such as methane) into a vacuum chamber, where they are broken down into their elemental constituents by microwave plasma or hot filament techniques. These carbon atoms then deposit layer by layer onto a substrate, forming high-quality, single-crystal or polycrystalline diamond films. The purity and structural perfection achieved through CVD often exceed those of natural diamonds, making them indispensable in advanced technological applications. The core distinction of CVD is its ability to grow uniform films over large areas and to precisely control impurities, allowing for the creation of diamonds tailored for specific electronic or optical properties. The continuous advancement in plasma reactor technology and gas purity management remains central to market competitiveness.

CVD synthetic diamonds are increasingly vital across various high-technology sectors due to their superior physical, mechanical, and electronic characteristics. Key applications span from sophisticated thermal management solutions, high-power electronics, and advanced cutting tools to specialized optical windows and emerging quantum computing components. The product description highlights diamonds characterized by exceptional hardness, high thermal conductivity, low dielectric constant, and chemical inertness. Unlike High-Pressure High-Temperature (HPHT) methods, CVD allows for greater control over isotopic composition and crystal morphology, enhancing their suitability for demanding semiconductor and photonics applications. The economic benefits include a reliable supply chain, standardized quality, and the capacity for mass production tailored to industrial specifications, overcoming the rarity and variability associated with mined diamonds.

Driving factors propelling this market include the escalating demand from the semiconductor industry for high-performance heat sinks to manage rising thermal loads in microprocessors and power devices. Furthermore, the global shift towards sustainable manufacturing and the ethical sourcing of materials boosts the adoption of laboratory-grown alternatives over mined stones. Significant investments in research and development aimed at lowering production costs and scaling up reactor sizes are also contributing substantially to market expansion. The versatility of CVD diamonds, particularly their use in novel quantum technologies and radiation detection equipment, ensures sustained growth across diverse, high-value end-user segments globally.

Chemical Vapour Deposition Synthetic Diamond Market Executive Summary

The Chemical Vapour Deposition Synthetic Diamond Market is poised for robust expansion, driven primarily by technological advancements in materials science and increasing industrial reliance on materials with extreme performance characteristics. Business trends indicate a consolidation among key manufacturers, focusing on vertically integrated operations to control quality from gas source to final product, alongside significant capital expenditure dedicated to expanding production capacity, particularly in the Asia-Pacific region. There is a discernible trend towards producing larger, high-purity single-crystal diamonds specifically for semiconductor applications and optics, moving beyond traditional abrasive and cutting tool segments. Strategic alliances between diamond manufacturers and leading technology integrators are becoming prevalent, aimed at accelerating product qualification in novel fields like 5G infrastructure and advanced laser systems. Furthermore, market players are actively pursuing cost reduction through improved energy efficiency in plasma generation and optimization of growth cycle times, enhancing overall market accessibility.

Regional trends highlight Asia Pacific (APAC), led by China, India, and Japan, as the dominant and fastest-growing region, fueled by massive domestic electronics manufacturing bases and substantial government support for advanced materials research. North America and Europe maintain significant market shares, characterized by high demand for specialized, high-specification CVD diamonds used in defense, aerospace, and medical device manufacturing, often commanding premium prices. These regions are also hubs for innovation in quantum technologies, which necessitate ultra-pure diamond substrates. Segment trends reveal that the Electronics and Thermal Management application segment is projected to experience the highest CAGR, surpassing traditional Industrial Abrasives usage. In terms of product type, thick-film diamonds are gaining traction due to their necessity in high-power laser optics and demanding engineering applications requiring mechanical robustness and superior thermal dissipation capabilities.

Overall, the market structure is evolving from a niche material provider to a critical component supplier for next-generation technological infrastructure. The executive outlook emphasizes that successful market participation relies heavily on maintaining intellectual property, ensuring repeatable quality control, and developing scalable, energy-efficient production processes. While restraints such as high initial capital investment and complex manufacturing processes persist, the compelling opportunities presented by emerging applications, particularly in solid-state lighting and medical diagnostics, far outweigh the impediments, ensuring a strong, sustained growth trajectory throughout the forecast period. The increasing ethical consideration surrounding diamond sourcing also favors the continued adoption of certified, lab-grown CVD alternatives across consumer and industrial markets.

AI Impact Analysis on Chemical Vapour Deposition Synthetic Diamond Market

User queries regarding the impact of Artificial Intelligence (AI) on the CVD Synthetic Diamond Market frequently revolve around optimizing growth parameters, predicting material properties, and automating complex manufacturing steps. Common concerns include how AI can reduce the prohibitively long growth cycle times, whether machine learning models can enhance the purity and size of single-crystal diamonds, and the potential for AI-driven robotics to handle delicate substrate manipulation and reactor maintenance. Users also seek clarity on AI's role in quality assurance, particularly in detecting minute defects invisible to traditional inspection methods. The overarching theme is the expectation that AI and associated computational techniques will serve as transformative tools, moving diamond synthesis from an empirically-driven science to a precisely engineered, predictive manufacturing process, thereby increasing yield, reducing costs, and accelerating material innovation cycles necessary for new applications in electronics and photonics.

- AI-driven optimization of plasma parameters (temperature, pressure, gas flow ratios) to maximize growth rate and uniformity.

- Machine learning algorithms used for real-time defect detection and quality control during the growth process.

- Predictive modeling of resulting diamond properties (thermal conductivity, crystal orientation) based on input synthesis conditions.

- Automation and robotics deployment, guided by computer vision, for precise substrate preparation and post-growth processing.

- Computational materials science accelerated by AI to design novel diamond-based devices and doping strategies (e.g., nitrogen-vacancy centers for quantum computing).

- Enhanced process control resulting in reduced energy consumption per carat, improving the sustainability profile of CVD production.

- Supply chain optimization and demand forecasting for precursor gases and consumables driven by AI-powered analytics.

DRO & Impact Forces Of Chemical Vapour Deposition Synthetic Diamond Market

The market dynamics are defined by powerful drivers stemming from technological convergence, juxtaposed with significant operational and economic restraints, while substantial opportunities emerge from high-growth electronics and quantum sectors. The primary drivers include the escalating demand for advanced thermal management solutions in high-power electronic devices (like electric vehicle inverters and 5G base stations) and the non-negotiable need for superior materials in high-frequency applications where diamond's low dielectric loss is paramount. Restraints largely center on the intensive energy requirements and the substantial capital outlay necessary to establish and operate high-purity CVD reactors, alongside the challenge of scaling up production of large, single-crystal diamonds without introducing critical defects. Opportunities are heavily concentrated in emerging fields such as quantum computing and advanced medical imaging, where unique properties of CVD diamonds enable entirely new functionalities. These intertwined forces create a highly dynamic environment, necessitating continuous innovation in process efficiency and material purity to maintain competitive edge and capture high-value end-user markets.

Impact forces currently favoring market acceleration include the rapidly maturing technology of CVD synthesis, which has significantly closed the quality gap with natural diamonds and, in many cases, surpassed them for specific industrial metrics. Furthermore, the societal and corporate focus on supply chain transparency and ethical sourcing provides a substantial tailwind for lab-grown alternatives, influencing purchasing decisions across consumer and industrial sectors. Conversely, a restraining force involves the complex intellectual property landscape surrounding specific reactor designs and growth processes, which can impede new market entry and diffusion of advanced techniques. Economic volatility and the high cost of precursor gases (such as ultra-high purity methane) also periodically exert downward pressure on profitability, impacting smaller-scale operations more severely. The overall impact force is strongly positive, pushing the market towards widespread industrial adoption, provided manufacturers successfully navigate the challenges of yield improvement and cost optimization.

Specifically focusing on market drivers, the miniaturization of electronic components paired with increasing power density necessitates materials capable of exceptional heat dissipation, a niche perfectly filled by diamond's industry-leading thermal conductivity. The superior mechanical properties of CVD diamonds also ensure their sustained adoption in demanding mechanical applications, such as high-precision machining of aerospace alloys and wear-resistant coatings. Key restraints involve the stringent purity requirements for electronic-grade diamonds; any trace impurities or lattice imperfections drastically reduce performance in sensitive applications like radiation detectors or quantum sensors. Overcoming these purity challenges requires incredibly precise control over the growth environment, adding complexity and cost. Major opportunities reside in developing mass-producible, NV-center (Nitrogen-Vacancy) doped diamonds for magnetic sensing and quantum entanglement applications, representing a paradigm shift in material value proposition beyond traditional industrial uses.

Segmentation Analysis

The Chemical Vapour Deposition Synthetic Diamond Market segmentation provides a granular view of the market landscape, structured primarily by type, application, and geographical region. Segmentation by type differentiates between Polycrystalline Diamond (PCD) films, characterized by small, randomly oriented crystals suitable for abrasive tools and mechanical parts, and Single-Crystal Diamond (SCD), which boasts uniform atomic structure necessary for high-technology applications such as optics, electronics, and quantum research. The application segment reveals the end-use hierarchy, demonstrating the market's migration from predominantly industrial uses (cutting, grinding) towards sophisticated technology sectors like thermal management, medical devices, and advanced research. Understanding these segments is critical for manufacturers to tailor their production capabilities and marketing strategies, ensuring alignment with high-growth sectors and specific material requirements globally.

- By Type:

- Single-Crystal Diamond (SCD)

- Polycrystalline Diamond (PCD)

- By Application:

- Industrial Abrasives and Machining Tools

- Thermal Management and Heat Sinks

- Optical Applications (Windows, Lenses, Lasers)

- Electronics and Semiconductor Devices (RF transistors, Power electronics)

- Medical Devices and Instrumentation

- Research and Development (Quantum Computing, Sensors)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East and Africa (MEA)

Value Chain Analysis For Chemical Vapour Deposition Synthetic Diamond Market

The CVD synthetic diamond value chain begins with the upstream segment, focusing on the procurement and preparation of ultra-high purity precursor materials, primarily methane and hydrogen gases, alongside specialized substrate materials (often silicon or high-quality HPHT diamonds for homoepitaxial growth). This stage demands stringent quality control, as gas impurities directly correlate with the quality and defect density of the final diamond product, particularly critical for electronic and optical grades. Key activities in the midstream involve the highly specialized manufacturing process itself: reactor design, plasma generation, substrate seeding, and the lengthy growth cycle, which constitutes the highest cost and technology barrier in the entire chain. Efficient energy management and optimization of the growth conditions through proprietary techniques are central to value creation at this stage, determining yield and consistency.

The downstream segment encompasses post-processing, certification, and distribution. Post-processing activities include laser cutting, polishing, and chemical cleaning to achieve the desired dimensions and surface finish, crucial for applications like wafer fabrication and optical windows. Rigorous quality assurance and certification processes follow, often involving advanced characterization techniques (e.g., Raman spectroscopy, thermal conductivity mapping) to grade the material based on its suitability for high-tech applications. The distribution channel is bifurcated: direct channels are typically used for high-value, custom-engineered products sold directly to R&D institutions, semiconductor foundries, and defense contractors. Indirect channels involve specialized distributors or trading houses that supply standard industrial-grade diamonds (PCD) to tool manufacturers and abrasive markets globally, leveraging established logistics networks optimized for industrial commodities.

Direct distribution offers greater margin control and allows for close collaboration between the producer and the end-user, facilitating rapid feedback loops essential for continuous product improvement in highly specified markets like quantum technology. Conversely, indirect distribution provides wider market penetration, especially in fragmented industrial sectors and geographies where the manufacturer lacks a direct operational footprint. The selection of the distribution strategy heavily influences market reach and profitability. The overall efficiency of the value chain is increasingly dependent on minimizing process bottlenecks and securing a stable supply of high-purity precursor gases, thereby ensuring cost-effective, scalable production to meet the accelerating demand from cutting-edge technological sectors.

Chemical Vapour Deposition Synthetic Diamond Market Potential Customers

Potential customers for CVD synthetic diamonds are diverse, spanning multiple high-technology and traditional industrial sectors requiring materials with extreme performance characteristics. The primary consumers are manufacturers in the electronics and semiconductor industry, who utilize CVD diamonds as advanced heat spreaders and substrates for high-power Radio Frequency (RF) and microwave devices, particularly gallium nitride (GaN) based power transistors critical for 5G infrastructure and electric vehicle traction control systems. Another significant customer base includes specialized tooling companies that embed these diamonds into cutting, drilling, and grinding tools used in the machining of hard, brittle materials found in aerospace and automotive components. These customers prioritize mechanical toughness, thermal stability, and consistent material quality, driving demand for high-grade PCD and thick-film SCD materials.

Furthermore, major end-user groups include research institutions and technology developers focusing on next-generation scientific instruments, such as high-energy physics laboratories and companies involved in quantum information science. These entities purchase ultra-pure single-crystal diamonds, often nitrogen-vacancy doped, for constructing sensitive quantum sensors, advanced laser components, and high-resolution imaging systems, where specific optical and electronic defect properties are paramount. The medical sector also represents a growing customer segment, utilizing CVD diamond coatings for bio-compatible implants and surgical tools, leveraging diamond's inertness and durability. The diversity of the customer portfolio, ranging from high-volume industrial commodity users to low-volume, high-value specialty purchasers, underscores the broad applicability and technological versatility of CVD synthesized materials.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 2.6 Billion |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Element Six, Sumitomo Electric Industries, IIa Technologies, Pure Grown Diamonds, CVD Diamond Corporation, Sandvik Hyperion, Advanced Diamond Technologies, Diamond Materials GmbH, Heyaru Engineering, Microwave Enterprises, Beijing Worldia Diamond Tools Co., Scio Diamond Technology Corporation, Applied Diamond Inc., Tomei Diamond Co., Diamond Producers Association (DPA), Norton Diamond Industrial Co., Drukker International, Washington Diamond, De Beers Group (Lightbox), Nanjing Uni-Diamond Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Chemical Vapour Deposition Synthetic Diamond Market Key Technology Landscape

The core technology landscape in the CVD Synthetic Diamond market is centered around advanced plasma reactor systems, primarily Microwave Plasma Chemical Vapour Deposition (MPCVD), which is the dominant technique for growing high-quality, electronic-grade single-crystal diamonds. MPCVD utilizes microwave energy to generate high-density, high-temperature plasma, effectively breaking down the precursor gases and facilitating uniform carbon deposition. Recent technological advancements focus heavily on reactor scaling—moving from small research-scale reactors to large-area, industrial-sized chambers capable of simultaneously growing multiple high-purity substrates, thereby improving throughput and reducing unit costs. Furthermore, specialized techniques like homoepitaxial growth, where CVD diamonds are grown on high-quality HPHT seeds, are essential for maintaining the crystal structure and minimizing defect introduction, a critical factor for quantum and semiconductor applications.

Another crucial technological frontier involves the precise control of doping mechanisms. For instance, the introduction of nitrogen or boron atoms during the CVD process is essential for tailoring the electronic properties, creating p-type or n-type semiconductors, or producing specific defects like Nitrogen-Vacancy (NV) centers, which are fundamental to quantum sensing. This requires ultra-precise gas metering and process monitoring capabilities, often integrating real-time spectroscopy to analyze plasma chemistry. The Hot Filament Chemical Vapour Deposition (HFCVD) technique remains relevant, particularly for growing large-area polycrystalline diamond films used in robust mechanical coatings and large optical windows, due to its lower capital cost compared to MPCVD, though it typically sacrifices the purity levels achievable by plasma methods. Continuous innovation in substrate pretreatment and surface cleaning techniques is also a key technology area, ensuring optimal adhesion and minimizing unwanted nucleation sites that lead to reduced crystal quality.

The increasing digitalization of the manufacturing process, incorporating advanced sensor arrays and AI-driven process control, represents a transformative technology shift. This includes using sophisticated thermal imaging and optical monitoring systems to dynamically adjust plasma stability, gas flow, and substrate temperature throughout the multi-day growth cycle. Such automation reduces reliance on manual intervention, standardizes quality, and allows for the development of complex, multi-stage growth recipes necessary for highly specialized products, such as thick free-standing diamond wafers or structured diamond micro-lenses. The technological focus is consistently moving towards achieving higher growth rates (microns per hour) while maintaining unparalleled material purity (parts per billion impurity levels) to meet the exacting standards of the photonics and semiconductor industries.

Regional Highlights

- Asia Pacific (APAC): APAC represents the largest and fastest-growing market for CVD synthetic diamonds, primarily driven by massive electronics and semiconductor manufacturing ecosystems in China, Japan, South Korea, and Taiwan. China, in particular, has made significant strategic investments to establish domestic self-sufficiency in advanced materials, leading to rapid expansion of local CVD diamond production capacity for industrial tools, thermal management, and consumer jewelry. The region benefits from lower manufacturing overheads and a surging demand for high-performance materials in consumer electronics and electric vehicles.

- North America: North America holds a substantial market share, characterized by high demand for specialized, high-purity CVD diamonds predominantly utilized in defense, aerospace, advanced laser systems, and cutting-edge research, including quantum computing initiatives. The market here is highly innovation-driven, focusing on producing materials with specific electronic and optical specifications, commanding premium pricing. Key demand drivers include government funding for advanced materials R&D and a strong presence of high-tech manufacturing firms.

- Europe: The European market is a mature yet steadily growing segment, driven by stringent quality requirements in the automotive, medical device, and precision engineering sectors, especially in countries like Germany and the UK. Europe excels in the application of CVD diamonds for high-precision cutting tools and sophisticated industrial coatings. Furthermore, significant research activities focused on utilizing diamond in solid-state dosimetry and high-power optics contribute substantially to regional demand.

- Latin America & Middle East and Africa (MEA): These regions currently represent smaller market shares but are exhibiting promising growth potential, particularly in industrial abrasive applications linked to mining and infrastructure development. The MEA region is showing increasing interest in leveraging diamond technology for oil and gas drilling equipment (PCD inserts) and developing regional R&D capabilities for thermal solutions in telecommunication infrastructure expansion.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Chemical Vapour Deposition Synthetic Diamond Market.- Element Six

- Sumitomo Electric Industries

- IIa Technologies

- Pure Grown Diamonds

- CVD Diamond Corporation

- Sandvik Hyperion

- Advanced Diamond Technologies

- Diamond Materials GmbH

- Heyaru Engineering

- Microwave Enterprises

- Beijing Worldia Diamond Tools Co.

- Scio Diamond Technology Corporation

- Applied Diamond Inc.

- Tomei Diamond Co.

- De Beers Group (Lightbox)

- Norton Diamond Industrial Co.

- Drukker International

- Washington Diamond

- Nanjing Uni-Diamond Co., Ltd.

- Zhongnan Diamond Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Chemical Vapour Deposition Synthetic Diamond market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technical advantage of CVD diamonds over HPHT diamonds?

CVD synthesis offers superior control over material purity and crystallographic orientation, crucial for electronic and optical applications. CVD allows for the growth of thick, large-area films and the precise incorporation of dopants (like NV centers) for quantum technology, which is difficult to achieve consistently via the High-Pressure High-Temperature (HPHT) method.

How significant is the Thermal Management segment for the CVD Diamond Market?

The Thermal Management segment is expected to be one of the highest-growth application areas. Diamond's exceptional thermal conductivity makes it indispensable for heat dissipation in high-power devices, including 5G base stations, military radar systems, and electric vehicle inverters, mitigating performance degradation caused by excess heat generation.

What are the main restraints impacting the cost of CVD synthetic diamond production?

The high cost is primarily restrained by substantial initial capital investment required for Microwave Plasma CVD reactors, the intensive energy consumption during the growth cycle, and the necessity for ultra-high purity precursor gases. Furthermore, the lengthy growth time needed to produce large, single-crystal wafers adds significantly to operational expenditure.

In which region is the demand for CVD synthetic diamond witnessing the fastest growth?

The Asia Pacific (APAC) region, spearheaded by manufacturing hubs like China, is experiencing the fastest growth in demand. This is fueled by the expansion of domestic semiconductor manufacturing, robust investment in industrial technology, and the large-scale production of consumer electronics, all requiring advanced diamond materials.

What role do CVD synthetic diamonds play in emerging Quantum Computing technologies?

CVD synthetic diamonds serve as a fundamental platform for quantum computing and sensing due to their capacity to host Nitrogen-Vacancy (NV) centers, which act as stable solid-state qubits and highly sensitive magnetic field sensors. The precision of the CVD method allows for the creation of diamond substrates with the necessary ultra-low defect density and specific doping profiles critical for quantum applications.

This report provides an extensive analysis of the Chemical Vapour Deposition Synthetic Diamond Market, detailing market dynamics, key technological advancements, and strategic implications for market participants. The projected growth trajectory reflects the material's increasing indispensability across high-technology sectors globally.

The analysis confirms that the migration from traditional industrial uses to advanced electronic and optical applications is the principal factor driving investment and innovation within the CVD diamond sector. Manufacturers must continue to prioritize research into reactor efficiency and material purity to capture the high-value segments, particularly those related to quantum technology and next-generation power electronics. The ethical and sustainable benefits of lab-grown diamonds further solidify their long-term position as the preferred material choice for advanced engineering requirements worldwide.

The segmentation analysis highlights that Single-Crystal Diamond (SCD) production for thermal and electronic applications is the key area of competitive differentiation. Companies focusing on large-area, high-purity SCD are best positioned to capitalize on the soaring demand from semiconductor manufacturers. Conversely, the Polycrystalline Diamond (PCD) segment remains a stable, high-volume market tied closely to the global industrial manufacturing cycle. Regional expansion, particularly in APAC, coupled with strategic partnerships targeting specific end-user qualification cycles, are critical success factors for maintaining market leadership and achieving the forecasted growth rates through 2033.

The comprehensive review of the value chain underscores the strategic importance of upstream material control and midstream process optimization. Investments in AI-driven process control systems are anticipated to generate significant returns by minimizing batch variability and maximizing yield, directly addressing the core restraints related to cost and consistency. Ultimately, the future growth of the CVD Synthetic Diamond market is inextricably linked to continuous technological refinement, enabling the transition of this material from a niche component to a pervasive enabler of future electronic and industrial innovation.

Addressing the complex technical requirements of emerging industries necessitates a sustained commitment to R&D. For instance, the demand for diamond optical windows used in high-power CO2 and excimer lasers requires materials with exceptionally low absorption coefficients, achievable only through meticulously controlled CVD environments. Similarly, the integration of diamond into Micro-Electro-Mechanical Systems (MEMS) requires thin, stress-free films with high modulus and excellent chemical resistance. These diversified demands push manufacturers toward continuous customization and specialized production lines, necessitating flexible manufacturing infrastructure capable of rapid reconfiguration. The market thus evolves beyond standardization, moving towards tailored material solutions for specific, high-performance applications across the globe.

The competitive landscape is characterized by established materials science conglomerates, like Element Six and Sumitomo Electric, leveraging decades of expertise alongside agile, specialized firms focused purely on scaling advanced CVD technology. The interplay between these players fuels innovation, often resulting in rapid improvements in crystal growth rates and the availability of larger wafer sizes. Strategic mergers and acquisitions (M&A) are also anticipated as larger firms seek to acquire proprietary reactor designs or specialized doping techniques developed by smaller, highly focused technology companies. Intellectual property ownership, particularly concerning reactor designs and growth recipes, remains a critical barrier to entry and a source of competitive advantage in this highly technical domain.

Furthermore, sustainability and ethical sourcing are increasingly integrated into the overall market narrative. Certified lab-grown CVD diamonds offer traceability and conflict-free guarantees, resonating strongly with modern corporate responsibility initiatives and consumer preference shifts. This ethical dimension not only strengthens the position of CVD diamonds in the luxury jewelry market but also provides an additional compelling reason for industrial buyers, particularly in consumer-facing electronics and luxury goods sectors, to favor synthesized materials over mined equivalents, ensuring long-term market acceptance and expansion across diverse industrial sectors requiring responsible sourcing practices. The convergence of superior performance and ethical supply chain guarantees solidifies the market's trajectory.

Final analysis of the impact forces suggests that while capital intensity remains a structural challenge, the exponentially increasing performance needs of next-generation technologies provide an overwhelming incentive for investment. The market is transitioning towards a state where the ability to precisely engineer atomic-level defects (such as NV centers for quantum applications) is becoming more valuable than mere crystal size or thermal conductivity. This pivot toward functionalized, high-specification diamonds represents the most lucrative growth opportunity, requiring sophisticated sensor integration and computational analysis—areas where AI deployment will be critical for maintaining competitive excellence.

To successfully capture market share in high-value segments, companies must focus on two key strategic pillars: achieving ultra-high purity (sub-ppb level) for electronic and quantum grades, and drastically reducing the cost-per-carat for industrial and thermal management applications through improved energy efficiency and process automation. The geographical emphasis remains on APAC for mass production capacity expansion and North America/Europe for niche, high-specification material development and application innovation. This dual strategy is essential for navigating the complex and rapidly evolving market landscape of the CVD synthetic diamond industry through 2033.

The demand for large, free-standing diamond wafers in high-power semiconductor applications, particularly for GaN-on-Diamond systems, is creating intense technological pressure. Manufacturers are actively developing methods to separate thick CVD diamond layers from their underlying substrates without causing structural damage, a non-trivial engineering challenge. Success in this area will unlock massive market potential in the solid-state power switching market, enabling next-generation power modules that operate at significantly higher temperatures and power densities than conventional silicon or silicon carbide based solutions. The market is thus actively driven by the technological requirements of major industrial shifts, including the global push toward energy efficiency and electrification.

In the optical segment, the unique broadband transparency of diamond, extending from the deep UV to far infrared, makes it ideal for harsh environment optical windows in defense and industrial laser applications. The ability of the CVD process to produce exceptionally low-absorption material, free from the inclusions common in mined stones, is a decisive factor for adoption. Technological breakthroughs in surface polishing techniques that minimize sub-surface damage are crucial for maximizing the optical performance and durability of these components. The precision required for these optical applications necessitates highly specialized manufacturing environments and rigorous, non-destructive testing protocols, differentiating this segment substantially from industrial abrasive production.

Furthermore, the market's reliance on highly specialized equipment, particularly high-power microwave generators and proprietary reactor linings, creates a secondary market for specialized equipment providers and maintenance services. The intellectual capital associated with operating and maintaining these complex systems is substantial, further elevating the barriers to entry. Future technological improvements are expected in plasma containment and stability, enabling even higher growth rates without compromising crystal quality. This pursuit of efficiency and scale defines the ongoing competitive battle within the core manufacturing segment of the CVD synthetic diamond industry, reinforcing the high-tech nature of this materials market.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager