Chewable Vitamins and Supplements Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436428 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Chewable Vitamins and Supplements Market Size

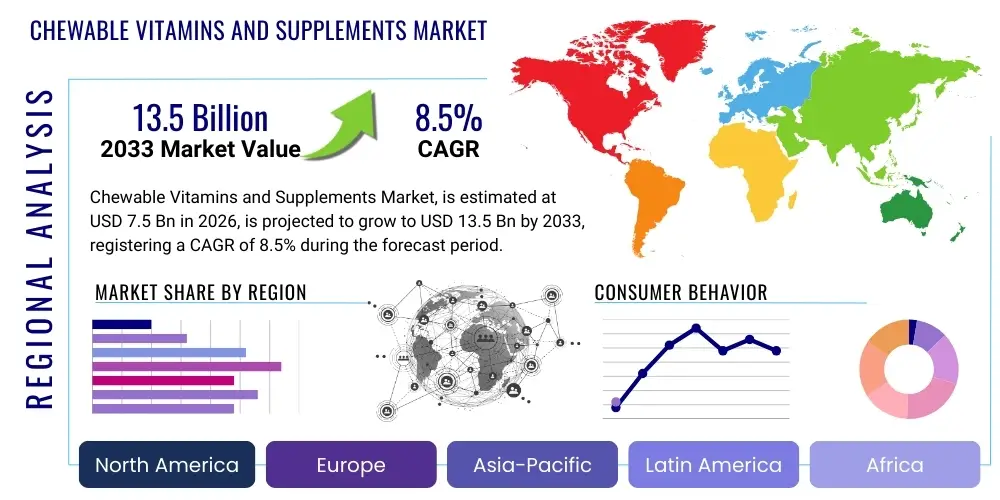

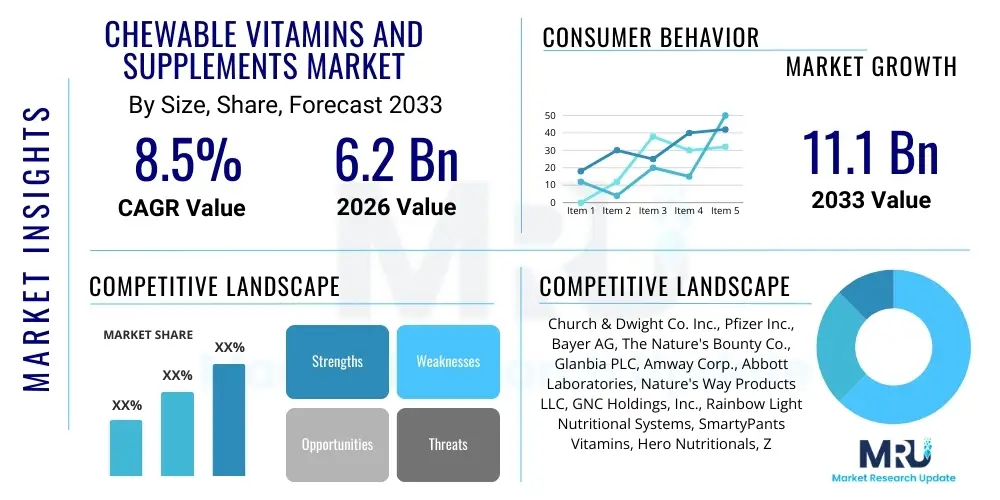

The Chewable Vitamins and Supplements Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 6.2 Billion in 2026 and is projected to reach USD 11.1 Billion by the end of the forecast period in 2033. This robust expansion is primarily driven by increasing consumer preference for convenient, non-pill dosage forms, coupled with heightened awareness regarding preventive healthcare and nutritional deficiencies, particularly across pediatric and geriatric demographics. The appeal of chewable formats, often incorporating improved palatability and flavor profiles, addresses significant adherence challenges associated with traditional capsules and tablets, further stimulating market demand in developed and rapidly developing economies.

Chewable Vitamins and Supplements Market introduction

The Chewable Vitamins and Supplements Market encompasses a diverse range of nutritional products formulated as soft chews, gummies, chewable tablets, and dissolving strips, designed to deliver essential micronutrients, vitamins, and minerals. These products bypass the need for swallowing traditional pills, making them exceptionally popular among children, older adults, and individuals experiencing dysphagia (difficulty swallowing). Key product categories include multivitamins, Vitamin D, Vitamin C, B-complex vitamins, and specialty supplements like probiotics and omega fatty acids, addressing common dietary gaps and supporting immune function, bone health, and cognitive performance. The intrinsic appeal lies in the convenience and enhanced user experience, positioning chewables as a dominant force in the modern dietary supplement landscape, particularly as consumers increasingly prioritize wellness and self-care routines.

Major applications of chewable vitamins extend across preventive health maintenance, pediatric nutrition, athletic recovery, and specific condition management, such as bolstering immunity during seasonal changes or supporting prenatal health in an easily digestible format. The increasing market penetration is strongly correlated with consumer shifts towards personalized nutrition and functional foods that offer both health benefits and enjoyable consumption experiences. Formulation advancements have been crucial, allowing manufacturers to mask the often unpleasant tastes of essential compounds, utilizing natural flavorings and sweeteners to enhance compliance. Furthermore, the rising incidence of chronic diseases and the growing understanding of micronutrient inadequacy across global populations serve as foundational drivers for continuous innovation and expansion within this market segment, solidifying its role as a cornerstone of the broader nutraceutical industry.

Driving factors for this market include rapid urbanization leading to altered dietary habits, significant investments in research and development by pharmaceutical and nutraceutical companies focusing on bioavailability and novel delivery systems, and proactive government campaigns promoting nutritional health. The sustained trend toward preventive medicine, coupled with the increasing digitalization of health information empowering consumers to make informed choices, amplifies the demand. The robust distribution network, spanning pharmacies, supermarkets, and e-commerce platforms, ensures wide accessibility, further accelerating market growth. The flexibility of manufacturing processes to incorporate specialized ingredients, such as plant-based alternatives and allergen-free formulations, addresses specific consumer sensitivities and lifestyle choices, ensuring the market remains highly adaptable and responsive to evolving consumer needs.

Chewable Vitamins and Supplements Market Executive Summary

The Chewable Vitamins and Supplements Market is characterized by high innovation and fragmentation, with business trends leaning heavily towards clean-label products, sustainable packaging, and personalized nutritional formulations based on genetic or lifestyle data. Strategic collaborations between supplement manufacturers and technology firms are becoming commonplace, aimed at improving supply chain transparency and optimizing dosage forms for maximum nutrient absorption. E-commerce dominance remains a critical business trend, facilitating direct-to-consumer sales and allowing emerging brands to rapidly gain market share. Manufacturers are increasingly focusing on the development of specialized chewables targeting specific health outcomes, such as sleep support, gut health, and stress relief, moving beyond general multivitamins to capture niche markets.

Regional trends indicate that North America, particularly the United States, holds the largest market share due to high consumer spending on dietary supplements, a well-established regulatory framework, and widespread adoption of preventive healthcare measures. However, the Asia Pacific (APAC) region is projected to exhibit the fastest growth rate, fueled by rising disposable incomes, increasing health consciousness, and a massive demographic of young families seeking convenient nutritional options for their children. Regulatory harmonization efforts across Europe are streamlining product launches, while Latin America and the Middle East & Africa (MEA) represent high-potential emerging markets where consumer education regarding vitamin deficiencies is rapidly expanding, driving foundational market penetration.

Segmentation trends highlight the dominance of the Gummy segment due to its superior palatability and aesthetic appeal, particularly among the pediatric population. However, the Chewable Tablet segment maintains relevance for high-dose formulations where stability and precision are paramount. Based on ingredients, Multivitamins consistently account for the largest revenue share, though specialty supplements, particularly Probiotics and Omega-3s in chewable forms, are demonstrating superior growth rates, reflecting shifting consumer priorities toward gut and cognitive health. The end-user segment analysis confirms that the Pediatric population remains the primary consumer base, though the Geriatric segment is rapidly gaining ground, underscoring the necessity for easy-to-consume formulations for an aging global population grappling with polypharmacy challenges.

AI Impact Analysis on Chewable Vitamins and Supplements Market

User queries regarding the impact of Artificial Intelligence (AI) on the chewable supplement market frequently center on three critical areas: personalized formulation accuracy, optimization of the supply chain for temperature-sensitive ingredients, and the role of AI in novel product development and flavor profiling. Consumers and industry stakeholders alike are keen to understand how AI algorithms can move beyond simple demographic recommendations to provide highly specific micronutrient advice based on blood markers, genetic data, and real-time activity metrics. Key concerns often revolve around data privacy when integrating health wearables and genetic testing, alongside expectations for AI to significantly reduce the time-to-market for complex, bioavailable chewable formulations, especially in stabilizing sensitive ingredients like probiotics and specific vitamins during the manufacturing process and ensuring flavor consistency across large batches.

AI is fundamentally transforming the research and development pipeline within the chewable vitamins sector. Machine learning algorithms are being deployed to analyze vast datasets of ingredient stability, consumer preference patterns, and pharmacological interactions, accelerating the identification of optimal ingredient combinations for enhanced efficacy and shelf life. For chewable forms, AI excels in predictive modeling related to texture, flavor masking, and disintegration rates, allowing manufacturers to create formulations that are both highly effective and maximally palatable without extensive, time-consuming human trials. This capability significantly reduces material waste and R&D costs, enabling faster iteration cycles for new gummy or tablet profiles that meet stringent quality and sensory standards.

Furthermore, the integration of AI across the supply chain enhances operational efficiency and product quality management. Predictive maintenance in manufacturing facilities ensures continuous production flow, reducing contamination risks crucial for food-grade supplements. In logistics, AI optimizes cold chain management for sensitive ingredients like certain Omega-3 oils or probiotics, predicting delivery delays and adjusting routes to maintain precise temperature control, thereby guaranteeing product integrity until it reaches the consumer. AI-driven consumer engagement platforms also provide sophisticated tools for analyzing post-purchase feedback and adherence rates, allowing companies to dynamically adjust marketing strategies and product sizing, ensuring higher long-term customer loyalty and repeat purchases in a highly competitive market environment.

- AI-driven personalized dosage recommendations based on metabolic and genetic data.

- Optimization of ingredient blend ratios using machine learning to maximize bioavailability.

- Predictive modeling for flavor masking, texture, and stability in gummy formulations.

- Enhanced supply chain transparency and cold chain monitoring for heat-sensitive active ingredients.

- Automated quality control (QC) systems utilizing computer vision to detect manufacturing defects in chewable tablets.

- Demand forecasting and inventory management optimization specific to seasonal vitamin requirements (e.g., Vitamin D in winter).

- Development of novel natural sweeteners and flavor combinations using AI sensory analysis.

DRO & Impact Forces Of Chewable Vitamins and Supplements Market

The Chewable Vitamins and Supplements Market is dynamically shaped by a potent combination of Drivers, Restraints, and Opportunities (DRO), collectively forming the Impact Forces that dictate market velocity and strategic direction. The primary drivers revolve around heightened consumer focus on preventative health, the widespread issue of nutritional deficiency globally, and the superior compliance rates facilitated by the easy-to-consume, palatable nature of chewable formats, particularly among key demographics like children and the elderly. These drivers are intrinsically linked to rising healthcare costs, pushing consumers towards accessible wellness solutions. However, the market faces significant restraints, notably the regulatory complexities concerning health claims and ingredient standardization, and the inherent stability challenges of certain vitamins (like Vitamin C) when formulated into chewable matrices that require moisture and heat during processing. Furthermore, the higher cost of manufacturing high-quality, low-sugar chewable formulations compared to standard tablets presents a pricing pressure point, potentially limiting mass adoption in price-sensitive segments.

Opportunities within this sector are substantial and diverse. A major opportunity lies in expanding personalized nutrition services, utilizing biomarker data to create bespoke chewable vitamin packs, thus commanding premium pricing and enhanced consumer trust. The burgeoning demand for plant-based and vegan chewables presents a massive white space, requiring innovation in gelatin alternatives and flavor systems that meet stringent ethical and dietary requirements. Furthermore, leveraging advanced encapsulation techniques to improve the absorption and stability of sensitive compounds like Omega-3s and probiotics, particularly within gummy formats, offers significant competitive advantage. The expansion into emerging markets, coupled with targeted marketing campaigns addressing localized deficiency issues, provides a clear pathway for sustained double-digit growth outside mature Western markets.

The collective impact forces suggest a market trajectory defined by rapid innovation focused on overcoming technical restraints (e.g., sugar content reduction and heat stability) through technological advancements (e.g., advanced encapsulation and cold-press manufacturing). The strong underlying driver of consumer preference for convenience, however, outweighs many of the current manufacturing hurdles, ensuring steady growth. The most significant impact force remains the rising geriatric population globally, which relies heavily on non-pill forms for daily supplementation, guaranteeing a sustained demand floor for chewable formats. Companies that successfully navigate the regulatory environment while innovating on natural ingredient sourcing and low-sugar formulations will be best positioned to capitalize on the overarching market opportunity.

Segmentation Analysis

The Chewable Vitamins and Supplements Market is intricately segmented based on Product Type, Ingredient, End-User, and Distribution Channel, reflecting the diverse applications and consumer bases. This granular segmentation is essential for understanding purchasing behavior and tailoring product development. Product segmentation distinguishes between Gummies, which prioritize flavor and ease of consumption; Chewable Tablets, which offer precise dosing and higher active ingredient load; and Soft Chews, which bridge the gap between confectionery and supplementation. The market's high degree of segmentation allows manufacturers to target specific demographic needs, such as high-fiber gummies for gut health or iron-fortified chewable tablets for anemia prevention, ensuring broad market coverage.

Ingredient segmentation reveals which nutritional components are driving revenue growth. Multivitamins remain the foundational segment, appealing to general wellness needs. However, specific vitamins such as Vitamin D (due to deficiency concerns), Vitamin C (for immunity), and specialty ingredients like Probiotics and Omega Fatty Acids are experiencing accelerated growth. The End-User segmentation clearly highlights the dominance of the Pediatric group, driven by parental concerns over nutrition and the ease of administration. The Geriatric segment, however, is the fastest-growing cohort, reflecting the aging population’s difficulty with swallowing traditional pills and increased requirements for bone and cognitive support. Understanding these segment dynamics is crucial for strategic resource allocation and market penetration efforts.

The Distribution Channel analysis underscores the transition towards digital platforms. While Pharmacies and Drug Stores maintain high importance due to consumer trust and professional guidance, the Online/E-commerce channel is rapidly gaining dominance. E-commerce platforms offer a vast product selection, competitive pricing, and convenience, particularly attracting younger consumers and those seeking specialized or niche products. This shift necessitates robust digital marketing strategies and optimized supply chain logistics to handle direct-to-consumer fulfillment efficiently, ensuring product quality is maintained during transit, especially for heat-sensitive gummy formulations.

- By Product Type:

- Gummies

- Chewable Tablets

- Soft Chews

- Lozenges

- By Ingredient:

- Multivitamins

- Vitamin D

- Vitamin C

- B-Complex Vitamins

- Calcium

- Iron

- Specialty Supplements

- Probiotics

- Omega-3 Fatty Acids (DHA/EPA)

- Botanicals and Herbal Extracts

- By End-User:

- Pediatric Population (Children 2-12 years)

- Adult Population (13-60 years)

- Geriatric Population (60+ years)

- By Distribution Channel:

- Online/E-commerce

- Retail Pharmacies and Drug Stores

- Supermarkets and Hypermarkets

- Direct Sales

Value Chain Analysis For Chewable Vitamins and Supplements Market

The value chain for the Chewable Vitamins and Supplements Market is complex, beginning with the procurement of highly specialized raw materials, moving through stringent manufacturing and quality assurance, and culminating in multi-channel distribution to the end consumer. The upstream segment involves sourcing high-purity active pharmaceutical ingredients (APIs), vitamins (often synthetic or fermented), minerals, and excipients like natural sweeteners, flavoring agents, and gelling agents (pectin, gelatin). Critical challenges in the upstream phase include securing stable pricing for quality natural ingredients, verifying source traceability to ensure compliance, and managing supply volatility for specialty ingredients like Omega-3 oils. Strong supplier relationships and vertical integration are key to mitigating these input risks and ensuring consistent product quality, especially for popular clean-label formulations.

The midstream phase, comprising formulation and manufacturing, is highly capital-intensive, requiring specialized machinery for blending, molding (for gummies), compression (for tablets), and specialized drying and coating processes to enhance stability and mask undesirable flavors. Quality control is paramount, involving rigorous testing for potency, dissolution, microbial contamination, and heavy metals. The complexity of manufacturing chewables, which must balance nutrient load, palatability, and stability, drives significant operational costs. Manufacturers must adhere to Good Manufacturing Practices (GMP) and often navigate diverse regulatory requirements based on the target distribution geography. Innovation in this stage focuses on sugar reduction technologies and heat-stable encapsulation methods, which are vital for maintaining product integrity and consumer appeal.

The downstream distribution channel involves both direct and indirect paths to market. Indirect distribution relies heavily on large retail chains, including supermarkets, hypermarkets, and mass merchant stores, which provide high visibility and volume sales. Pharmacies and drug stores offer consumers expert consultation and are preferred for specialized therapeutic supplements. Direct distribution via e-commerce and brand websites is experiencing exponential growth, offering manufacturers higher margins and direct consumer data access. Successful downstream strategy requires seamless integration of logistics, effective shelf placement strategies, and robust digital marketing campaigns that leverage influencer endorsements and performance marketing to capture consumer attention in a crowded digital space.

Chewable Vitamins and Supplements Market Potential Customers

The potential customer base for the Chewable Vitamins and Supplements Market is segmented into several distinct, high-growth demographic groups, all sharing a common need for convenient, non-invasive nutritional delivery. The primary and most receptive customer segment is parents purchasing for the Pediatric Population (ages 2-12). These customers are primarily concerned with ensuring their children receive essential nutrients (such as Vitamin D, Vitamin C, and Calcium) in a format that promotes compliance, often prioritizing low-sugar, natural-flavor, and allergen-free options. Marketing to this group emphasizes developmental benefits, immune support, and the ease of incorporating the supplement into a child's daily routine, often focusing on aesthetic appeal and flavor profiles that mimic popular candies.

The second major segment, and the fastest growing, is the Geriatric Population (age 60+). This segment requires chewable formats due to age-related conditions such as dysphagia, reduced appetite, and the necessity of managing multiple medications (polypharmacy). They seek supplements focused on cognitive function, bone health (Calcium, Magnesium), and chronic disease management. For this group, the primary selling points are safety, ease of ingestion, clinically supported efficacy, and formulations that minimize potential drug interactions. Packaging accessibility and clear labeling are crucial factors influencing purchase decisions within this demographic, often accessed through pharmacy channels or specialized healthcare providers.

The third significant customer segment includes Adults with Active Lifestyles and Specific Dietary Needs, such as vegans, vegetarians, and individuals with restrictive diets or gastrointestinal sensitivities. This group values specialty chewables, including high-dose B-complex, specialty probiotics, and plant-based Omega-3 gummies, often seeking clean-label certifications and transparency regarding ingredient sourcing. Furthermore, adults who simply dislike swallowing pills constitute a substantial subset of this market. Marketing strategies targeting this segment emphasize premium ingredients, sustainability, and the convenience of on-the-go consumption, often utilizing subscription services and direct-to-consumer models for personalized product delivery based on specific lifestyle goals.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 6.2 Billion |

| Market Forecast in 2033 | USD 11.1 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Church & Dwight Co. Inc., Pfizer Inc., Bayer AG, The Nature's Bounty Co., Glanbia PLC, Amway Corp., Abbott Laboratories, Nature's Way Products LLC, GNC Holdings, Inc., Rainbow Light Nutritional Systems, SmartyPants Vitamins, Hero Nutritionals, Zarbee's Naturals, Garden of Life (Nestlé Health Science), Nordic Naturals, Nature Made (Pharmavite LLC), Olly Public Benefit Corporation, New Chapter (Procter & Gamble), MegaFood, and NOW Foods. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Chewable Vitamins and Supplements Market Key Technology Landscape

The technological landscape of the Chewable Vitamins and Supplements Market is rapidly evolving, driven by the need to enhance nutrient bioavailability, improve shelf stability, and meet consumer demand for healthier, lower-sugar formulations. One critical area of innovation is Advanced Encapsulation Technologies, such as microencapsulation and nanoencapsulation. These techniques protect sensitive ingredients, like Omega-3 fatty acids and certain probiotics, from degradation due to heat, light, and moisture during manufacturing and storage. Microencapsulation not only extends the shelf life but also effectively masks unpleasant tastes and odors inherent to specific vitamins and oils, which is a common challenge in palatable chewable formulations, thereby directly addressing key consumer satisfaction metrics.

Another pivotal technology is the development of Clean Label Gelling and Sweetening Systems. Historically, many gummies relied heavily on gelatin and high-fructose corn syrup, which are increasingly rejected by health-conscious consumers. The shift towards plant-based alternatives like pectin, tapioca syrup, and specific types of fiber-based gelling agents (like agar or carrageenan) requires sophisticated formulation science to maintain the desired chewy texture and heat resistance. Concurrently, the utilization of natural, low-glycemic sweeteners such as stevia, monk fruit, and erythritol, often paired with flavor potentiators, necessitates precise manufacturing controls to ensure homogenous mixing and prevent crystallization or texture breakdown over time. This technological focus directly supports the clean-label trend and broadens market access to vegan and diabetic consumers.

Furthermore, Continuous Manufacturing Processes and High-Speed Depositing Equipment are streamlining production, improving efficiency, and ensuring batch-to-batch consistency. Unlike traditional batch processing, continuous manufacturing reduces human error, minimizes exposure to contaminants, and allows for faster scale-up of successful formulations. Specialized gummy depositors utilizing vacuum or cold-press technology are also gaining traction, particularly for sensitive ingredients, as they operate at lower temperatures, minimizing thermal degradation of vitamins and active components. These advancements, coupled with robust, integrated Quality by Design (QbD) systems, ensure that the final chewable product not only tastes appealing but also delivers the intended therapeutic dose with verifiable stability throughout its claimed shelf life.

Regional Highlights

Regional dynamics play a crucial role in shaping the global Chewable Vitamins and Supplements market, reflecting varying regulatory environments, consumer purchasing power, and cultural attitudes toward dietary supplementation. North America (NA) currently dominates the market share, attributed to high levels of consumer awareness regarding wellness, substantial discretionary spending on supplements, and a highly competitive, innovation-driven industry landscape. The U.S. market, in particular, is saturated with product offerings, driving manufacturers to constantly innovate in areas like personalization, specialized condition-specific formulations (e.g., stress and sleep), and sustainability, including recyclable or compostable packaging for chewables.

The Asia Pacific (APAC) region is forecasted to be the fastest-growing market, propelled by demographic shifts, including a large and increasingly affluent middle class in countries like China and India, and a rapid increase in parental concern for children's nutritional intake. Government health initiatives aimed at tackling vitamin deficiencies, coupled with the increasing digitalization of health education, are accelerating market adoption. While regulatory landscapes are fragmented across APAC nations, the sheer market size and demand for convenient, enjoyable formats promise exceptional long-term growth for chewable products, particularly those focused on immunity and general child health.

Europe represents a mature but highly regulated market. Growth here is steady, driven by an aging population seeking easy-to-consume supplements and a strong consumer preference for natural, organic, and locally sourced ingredients. Strict EU regulations on health claims and ingredient maximum levels necessitate focused research and development efforts, often leading to premium product offerings. Latin America (LATAM) and the Middle East & Africa (MEA) represent emerging markets where lower penetration rates offer significant untapped potential. Market expansion in these regions is heavily reliant on increasing consumer education, improving distribution infrastructure, and offering products at accessible price points, often focusing on core multivitamins and essential minerals.

- North America (NA): Market leader; driven by high consumer awareness, strong e-commerce penetration, and continuous innovation in low-sugar, functional gummies.

- Asia Pacific (APAC): Fastest-growing region; powered by rising disposable income, large pediatric population base, and increasing focus on preventative health in major economies like China and India.

- Europe: Mature market; characterized by stringent regulatory standards, strong demand from the aging population, and preference for clean-label, certified organic ingredients.

- Latin America (LATAM): High growth potential; driven by increasing urbanization and the need to address common nutritional deficiencies, focusing on affordability and accessibility.

- Middle East & Africa (MEA): Emerging market; growth tied to health awareness campaigns, improvement in retail infrastructure, and increasing influence of Western health trends.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Chewable Vitamins and Supplements Market.- Church & Dwight Co. Inc.

- Pfizer Inc.

- Bayer AG

- The Nature's Bounty Co.

- Glanbia PLC

- Amway Corp.

- Abbott Laboratories

- Nature's Way Products LLC

- GNC Holdings, Inc.

- Rainbow Light Nutritional Systems

- SmartyPants Vitamins

- Hero Nutritionals

- Zarbee's Naturals (Johnson & Johnson)

- Garden of Life (Nestlé Health Science)

- Nordic Naturals

- Nature Made (Pharmavite LLC)

- Olly Public Benefit Corporation (Unilever)

- New Chapter (Procter & Gamble)

- MegaFood

- NOW Foods

- Vitafusion (Church & Dwight)

- Centrum (GSK Consumer Healthcare)

- Honest Kids (The Honest Company)

- Jamieson Wellness Inc.

- Pure Encapsulations (Nestlé Health Science)

Frequently Asked Questions

Analyze common user questions about the Chewable Vitamins and Supplements market and generate a concise list of summarized FAQs reflecting key topics and concerns.What factors are driving the shift from traditional tablets to chewable vitamins?

The primary driver is consumer preference for convenience and enhanced palatability, which significantly improves adherence, particularly among pediatric and geriatric consumers who often experience difficulty swallowing (dysphagia). Chewable formats, especially gummies, minimize 'pill fatigue' and are often perceived as a more enjoyable means of nutrient intake.

Are chewable vitamins as effective as traditional pill or capsule supplements?

The effectiveness largely depends on the formulation's stability and bioavailability. While traditional pills often allow for higher nutrient density, modern chewable supplements use advanced microencapsulation technologies to protect active ingredients, ensuring comparable absorption rates and potency retention throughout the product's shelf life, provided they are formulated and manufactured correctly.

What are the main regulatory challenges faced by manufacturers of chewable supplements?

Manufacturers primarily face challenges related to substantiating health claims and ensuring stability of vitamins within the chewable matrix, especially regarding sugar content limitations and natural flavoring authenticity. Regulatory bodies require rigorous testing to confirm the label-claimed potency remains consistent until the expiration date, which is technically difficult for moisture-sensitive ingredients in gummy formats.

How is the clean-label trend influencing chewable vitamin formulations?

The clean-label trend is strongly influencing formulations by driving demand for non-GMO ingredients, natural colorants derived from fruits and vegetables, and the elimination of artificial sweeteners and high-fructose corn syrup. This shift has necessitated significant R&D investment in plant-based gelling agents (like pectin) and low-glycemic natural sweeteners to maintain the desired texture and taste profiles.

Which geographical region shows the greatest potential for future market expansion?

The Asia Pacific (APAC) region, specifically emerging economies within it, exhibits the greatest potential for future expansion. This growth is fueled by an expanding middle class, increasing parental investment in child health, and rising awareness of specific nutritional deficiencies, leading to rapid adoption of convenient, palatable supplement formats.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager