Chicken Sausage Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433146 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Chicken Sausage Market Size

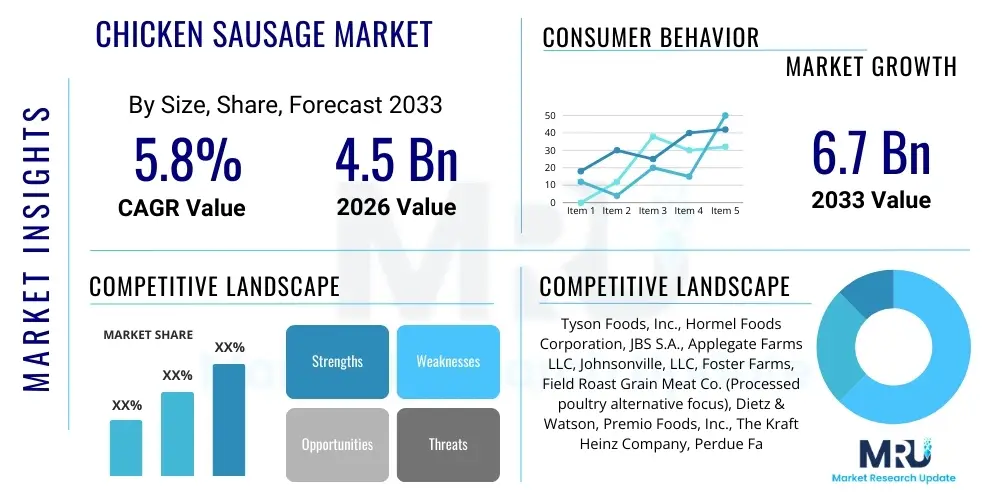

The Chicken Sausage Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. This robust growth is primarily fueled by shifting consumer preferences towards leaner protein sources and the increasing demand for convenient, ready-to-eat meal options globally. Health consciousness among middle-income populations, particularly in developed regions like North America and Europe, acts as a significant catalyst for market expansion, positioning chicken sausage as a favorable alternative to traditional pork or beef sausages.

The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 6.7 Billion by the end of the forecast period in 2033. This valuation reflects the substantial investments made by key industry players in flavor innovation, shelf-life extension technologies, and sustainable sourcing practices. Furthermore, the growing penetration of organized retail and e-commerce platforms has significantly improved product visibility and accessibility, supporting consistent revenue growth throughout the forecast timeframe.

Geographically, while North America holds a dominant share due to high consumption rates of processed poultry, the Asia Pacific region is anticipated to exhibit the fastest growth, driven by rapid urbanization, changing dietary habits, and the expansion of quick-service restaurants (QSRs) and fast-food chains incorporating chicken sausage products into their core offerings. Market competition remains intense, necessitating continuous product diversification and aggressive marketing strategies focusing on nutritional benefits and ingredient transparency.

Chicken Sausage Market introduction

The Chicken Sausage Market encompasses the global production, distribution, and consumption of processed meat products made primarily from chicken meat, blended with various spices, binders, and flavorings, encased in natural or synthetic casings. Chicken sausage serves as a popular, health-conscious alternative to traditional red meat sausages, appealing to consumers seeking lower fat and cholesterol content without sacrificing flavor or convenience. The product category is highly diverse, including fresh, pre-cooked, smoked, and frozen varieties, catering to breakfast, lunch, and dinner applications across household and food service sectors globally.

Major applications of chicken sausage include ready meals, appetizers, pizza toppings, and main course components. The versatility of the product allows for easy integration into diverse culinary traditions, ranging from grilling and pan-frying to use in stews and casseroles. Key benefits driving consumer adoption include the perceived health halo associated with white meat, high protein content, and the convenience offered by pre-cooked options which minimize preparation time for busy consumers. This aligns perfectly with modern lifestyle trends demanding quick, nutritious meal solutions, making chicken sausage a staple in both developed and emerging markets.

Driving factors propelling this market forward involve technological advancements in processing and packaging that ensure extended shelf life and maintain product quality. Furthermore, increasing investments in product innovation, such as the introduction of organic, antibiotic-free, and plant-based adjacent chicken sausage products, widen the consumer base. Supportive factors also include robust marketing campaigns emphasizing taste, nutritional advantages, and the ethical sourcing of poultry, effectively countering potential consumer skepticism regarding processed food consumption.

Chicken Sausage Market Executive Summary

The Chicken Sausage Market is characterized by robust growth underpinned by strong consumer demand for healthy, convenient protein sources, significantly influencing global business trends. Key business trends include the vertical integration of poultry processing companies to ensure supply chain efficiency and quality control, along with an increasing focus on clean label ingredients and reduced sodium formulations to meet evolving regulatory and consumer health standards. Strategic mergers and acquisitions are common as companies seek to expand their product portfolios and geographical reach, particularly targeting high-growth segments such as gluten-free and allergen-friendly chicken sausage variants, thereby consolidating market presence.

Regionally, North America maintains its leadership position due to high discretionary spending and established consumption patterns, although Europe shows accelerated growth driven by stringent quality standards and a strong market for premium, artisanal chicken sausage. The Asia Pacific region, especially India and China, represents the most dynamic growth frontier, benefiting from rapid urbanization, westernization of diets, and the proliferation of organized retail infrastructure. Regional trends also highlight localized flavor customization, where manufacturers adapt spice profiles and ingredients to align with specific local tastes, ensuring broader market acceptance across diverse cultures.

Segment trends indicate that the pre-cooked chicken sausage segment dominates the market due to unparalleled convenience, appealing directly to time-constrained urban consumers. Concurrently, the online retail distribution channel is exhibiting the fastest CAGR, reflecting the sustained shift towards digital commerce, accelerated by global events that normalized online grocery shopping. Furthermore, the rising awareness regarding environmental impact is subtly pushing the market towards sustainable packaging solutions and highlighting ethically sourced poultry, influencing consumer choices within all product types.

AI Impact Analysis on Chicken Sausage Market

Common user questions regarding AI's impact on the Chicken Sausage Market frequently revolve around supply chain optimization, predictive quality control, and personalized product development. Users are keen to understand how AI can enhance efficiency in poultry farming (e.g., feed optimization, disease prediction) and processing plants (e.g., automated sorting, yield maximization) to reduce operational costs. A primary concern is also the role of AI in food safety, specifically using machine learning algorithms to identify contaminants or spoilage indicators earlier than traditional methods. Key expectations center on using AI-driven consumer data analytics to predict flavor trends, optimize inventory management based on real-time sales data, and create highly customized flavor profiles tailored to localized demographic preferences, thus minimizing waste and maximizing profitability in a highly competitive processed food sector.

- AI-powered predictive analytics optimizes raw material sourcing and inventory levels, reducing procurement costs for chicken meat and spices.

- Implementation of machine vision systems in processing lines ensures consistent size, texture, and quality control of sausage links, enhancing product uniformity.

- Machine learning algorithms analyze vast consumer purchasing data to forecast demand fluctuations accurately, minimizing stock-outs and reducing food waste throughout the distribution chain.

- AI enhances food safety by employing sensor data and computer vision to detect foreign objects or microbiological contamination risks in real-time during production.

- Generative AI models assist R&D teams in simulating and formulating novel chicken sausage flavor combinations, accelerating new product development cycles.

- Automated packaging systems utilizing AI reduce labor costs and increase throughput while ensuring compliance with labeling and weight standards.

DRO & Impact Forces Of Chicken Sausage Market

The Chicken Sausage Market's dynamics are shaped by powerful Drivers, inherent Restraints, strategic Opportunities, and overarching Impact Forces that influence its trajectory over the forecast period. The primary Drivers include the surging global demand for convenient, protein-rich foods, coupled with consumer migration away from red meats due to health perceptions. This is strongly supported by innovations in flavor profiles and textural improvements, making chicken sausage a highly palatable and versatile meal component. Conversely, Restraints principally involve the rising cost volatility of poultry feed and raw chicken meat, which pressures profit margins for manufacturers. Additionally, negative consumer perceptions regarding the health risks associated with nitrates, nitrites, and sodium content in processed meats pose significant marketing challenges, requiring extensive efforts in clean label formulation.

Opportunities for growth are abundant, notably through geographical expansion into untapped emerging markets in Southeast Asia and Latin America, where cold chain infrastructure is rapidly improving. There is also a substantial opportunity in developing premium product lines, such as organic, non-GMO, and artisanal chicken sausages, targeting high-end consumers willing to pay a premium for ethical sourcing and superior quality. Furthermore, leveraging e-commerce and direct-to-consumer models offers manufacturers a chance to bypass traditional retail bottlenecks and engage directly with their consumer base, fostering brand loyalty and capturing valuable purchase data.

The key Impact Forces governing the market include stringent governmental regulations concerning meat processing, labeling accuracy, and food safety standards, which necessitate continuous investment in compliance and quality assurance technologies. Economic instability or inflationary pressures can impact consumer willingness to purchase premium processed items, shifting demand towards value-based offerings. Sociocultural shifts, such as increased focus on flexitarian or poultry-inclusive diets, positively reinforce market expansion, while environmental sustainability pressures compel manufacturers to adopt eco-friendly packaging and reduce their overall carbon footprint across the supply chain, affecting long-term operational strategies.

Segmentation Analysis

The Chicken Sausage Market is comprehensively segmented based on product type, distribution channel, flavor profile, and end-use, allowing for precise market analysis and targeted strategic planning. This segmentation reflects the diversity of consumer demand, ranging from highly convenient pre-cooked formats for quick meals to specialty flavors targeting gourmet preferences. Analyzing these distinct segments helps manufacturers identify niche markets, optimize product mix, and tailor marketing efforts to specific consumer demographics, maximizing penetration and revenue growth across varied geographical regions. The dominance of certain segments, such as pre-cooked options and supermarket distribution, underscores the current market focus on convenience and broad retail access.

- By Product Type: Fresh Chicken Sausage, Pre-cooked Chicken Sausage, Smoked Chicken Sausage, Frozen Chicken Sausage.

- By Distribution Channel: Supermarkets/Hypermarkets, Convenience Stores, Online Retail (E-commerce), Traditional Butcher Shops.

- By Flavor/Ingredient: Plain/Traditional, Spiced/Herbed (e.g., Italian Style, Cajun), Cheese/Vegetable Infused, Breakfast Style (e.g., Maple, Apple).

- By End-Use: Food Service (HORECA - Hotels, Restaurants, Cafes), Retail Consumers (Household Consumption).

Value Chain Analysis For Chicken Sausage Market

The value chain for the Chicken Sausage Market commences with the upstream segment involving poultry farming, feed production, and primary slaughtering and processing. Efficiency in this stage is critical, focusing on optimized breeding programs, disease management, and minimizing live weight loss to ensure a cost-effective supply of high-quality chicken meat, the core raw material. Key upstream risks include commodity price volatility, particularly feed costs (soy and corn), and outbreaks of avian diseases, which can severely disrupt supply and elevate input expenses for sausage manufacturers. Manufacturers often engage in long-term contracts or backward integration to mitigate these supply risks and ensure consistent quality parameters.

The central manufacturing stage includes formulation (blending meat, fat, spices, and binders), emulsification, stuffing into casings, smoking/cooking, and final packaging. This stage heavily relies on sophisticated machinery and adherence to stringent food safety regulations (e.g., HACCP, USDA standards). Downstream analysis focuses on the distribution channels, encompassing warehousing, cold chain logistics, and final sale points. Effective cold chain management is paramount to maintaining the integrity and shelf life of refrigerated and frozen chicken sausage products, influencing market access and product quality perception by the end consumer.

Distribution channels are multifaceted, ranging from direct sales to large institutional buyers (food service) to indirect sales through complex retail networks. Supermarkets and hypermarkets serve as the dominant indirect channel, offering high visibility and volume sales. However, the rapidly expanding online retail segment (e-commerce) is reshaping the traditional distribution landscape, offering direct access and personalized delivery options, particularly appealing to younger, tech-savvy consumers. Traditional butcher shops maintain relevance in premium and artisanal segments. Success in the downstream sector relies heavily on strategic partnerships with reliable logistics providers and robust retail relationships to ensure optimal shelf placement and consumer accessibility.

Chicken Sausage Market Potential Customers

The primary end-users and buyers of chicken sausage products are broadly categorized into the retail consumer segment and the commercial food service sector (HORECA). Retail consumers represent a diverse group, including health-conscious individuals seeking leaner protein alternatives to pork or beef, busy professionals and families prioritizing convenience and quick preparation times, and those adhering to poultry-only diets for religious or personal reasons. These customers are primarily reached through supermarkets, convenience stores, and rapidly growing online grocery platforms. The focus for this segment is on packaging size variety, ease of cooking instructions, and perceived health benefits.

The food service segment includes hotels, full-service restaurants, quick-service restaurants (QSRs), institutional caterers (schools, hospitals), and corporate cafeterias. These commercial buyers require large volumes, consistent quality specifications, and specific product formats, such as pre-sliced or bulk-packaged links, often under private labels. QSRs, in particular, are significant consumers of breakfast and specialty chicken sausage products, driven by the need for speed, standardization, and cost-efficiency in their operations. Manufacturers often develop bespoke formulations and supply chain solutions tailored specifically to the high-volume needs and operational constraints of these food service clients.

Emerging potential customer groups also include consumers globally interested in globalized cuisine, driving demand for ethnic and fusion-flavored chicken sausages. Furthermore, the growing segment of consumers prioritizing sustainability and ethical sourcing provides a key opportunity for premium brands, focusing on welfare standards (e.g., pasture-raised, free-range) and sustainable packaging. Targeting these niche groups requires specialized marketing focused on transparency and ethical storytelling, differentiating products beyond basic nutritional claims.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 6.7 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Tyson Foods, Inc., Hormel Foods Corporation, JBS S.A., Applegate Farms LLC, Johnsonville, LLC, Foster Farms, Field Roast Grain Meat Co. (Processed poultry alternative focus), Dietz & Watson, Premio Foods, Inc., The Kraft Heinz Company, Perdue Farms, Hillshire Brands (Tyson subsidiary), Al Safi Foods, Gold&C&H Foods, Zwanenberg Food Group B.V., Klement's Sausage Co., Olymel S.E.C. (S.E.N.C.), Maple Leaf Foods Inc., BRF S.A., Conagra Brands. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Chicken Sausage Market Key Technology Landscape

The technological landscape of the Chicken Sausage Market is defined by innovations aimed at enhancing food safety, extending shelf life, and improving product consistency. Critical technologies include advanced high-pressure processing (HPP) techniques, which are increasingly adopted as a non-thermal method for pathogen inactivation, significantly extending the refrigerated shelf life of fresh and pre-cooked chicken sausages without compromising flavor or nutritional value. Furthermore, the integration of advanced automation and robotic systems in stuffing, linking, and packaging processes ensures high throughput, minimizes human contact, and maintains precise portion control, crucial for optimizing operational costs and meeting large-scale retail demands.

The market also heavily utilizes modified atmosphere packaging (MAP) technologies, employing specific gas mixtures (e.g., nitrogen and carbon dioxide) within the packaging to slow down oxidation and microbial growth, preserving the fresh color and texture of the sausage for longer periods. Alongside these physical processing technologies, manufacturers are employing sophisticated flavor encapsulation methods. This technology ensures the volatile aromatic compounds of spices and herbs are released gradually during cooking, providing a superior and more consistent consumer experience, which is vital for premium product differentiation and consumer loyalty in highly competitive segments.

Digital technologies are also gaining prominence, particularly in traceability and quality assurance. Blockchain technology is emerging as a critical tool for providing end-to-end transparency, allowing consumers and regulators to track the chicken from farm to fork, verifying ethical sourcing claims and safety parameters. Moreover, analytical instrumentation, such as near-infrared (NIR) spectroscopy, is used in real-time quality control to measure fat, protein, and moisture content accurately and instantly during blending, ensuring every batch of chicken sausage meets precise formulation specifications before final processing.

Regional Highlights

- North America: Dominates the global market share, driven by high per capita consumption of processed poultry products and strong demand for convenient, pre-cooked breakfast and dinner options. The U.S. and Canada are innovation hubs for clean label and organic chicken sausage variants.

- Europe: Characterized by mature markets in Western Europe (Germany, UK, France) where consumer focus is strongly biased towards premium quality, artisanal processing, and strict regulatory adherence to animal welfare and additive limitations. Central and Eastern Europe present opportunities for volume growth.

- Asia Pacific (APAC): Expected to register the fastest CAGR due to rapid economic growth, rising disposable incomes, and increasing Western influence on dietary habits. Key growth markets include China, India, and Southeast Asian nations, spurred by the expansion of modern retail chains and QSRs.

- Latin America (LATAM): Growth is steady, primarily driven by urbanization and rising middle-class populations in Brazil and Mexico. The market here favors economical, value-based processed meat products, though premiumization trends are slowly emerging.

- Middle East and Africa (MEA): Growth is primarily fueled by the demographic rise and demand for certified Halal poultry products. The market benefits from imports and increasing local manufacturing capabilities focused on meeting specific religious and cultural dietary requirements.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Chicken Sausage Market.- Tyson Foods, Inc.

- Hormel Foods Corporation

- JBS S.A.

- Applegate Farms LLC

- Johnsonville, LLC

- Foster Farms

- Field Roast Grain Meat Co. (Processed poultry alternative focus)

- Dietz & Watson

- Premio Foods, Inc.

- The Kraft Heinz Company

- Perdue Farms

- Hillshire Brands (Tyson subsidiary)

- Al Safi Foods

- Gold&C&H Foods

- Zwanenberg Food Group B.V.

- Klement's Sausage Co.

- Olymel S.E.C. (S.E.N.C.)

- Maple Leaf Foods Inc.

- BRF S.A.

- Conagra Brands

Frequently Asked Questions

Analyze common user questions about the Chicken Sausage market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Chicken Sausage Market?

The market growth is primarily driven by increasing consumer awareness regarding health and wellness, leading to a preference for leaner protein sources over red meat. Additionally, the rising demand for convenient, ready-to-eat, and ready-to-cook meal solutions significantly propels the sales of chicken sausages globally, supported by flavor innovation and wide retail accessibility.

Which geographical region holds the largest market share for Chicken Sausage?

North America currently holds the largest market share, attributed to high consumption rates of processed poultry products, well-established retail distribution networks, and a strong preference for breakfast and dinner sausages. However, the Asia Pacific region is forecast to exhibit the fastest growth over the projected period.

How does the clean label trend impact chicken sausage manufacturing?

The clean label trend mandates manufacturers to focus on minimal processing and the removal of artificial ingredients, synthetic preservatives, and high levels of sodium or nitrates. This leads to increased demand for natural casings, recognizable ingredient lists, and alternative preservation methods like high-pressure processing (HPP) to meet consumer demands for healthier, transparent food products.

What is the projected Compound Annual Growth Rate (CAGR) for the Chicken Sausage Market?

The Chicken Sausage Market is projected to exhibit a steady Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. This consistent growth rate reflects sustained consumer demand and continuous product diversification across various segments and emerging geographies, confirming robust market stability.

What role does technology play in ensuring the quality and safety of chicken sausages?

Technology plays a crucial role through the implementation of advanced cold chain logistics, modified atmosphere packaging (MAP) to extend shelf life, and the use of machine learning algorithms for real-time quality assurance and predictive contaminant detection in processing plants. Blockchain technology is also being adopted for enhanced supply chain traceability and transparency.

Chicken Sausage Market Overview 2026-2033

The strategic outlook for the Chicken Sausage Market from 2026 to 2033 remains highly optimistic, driven by fundamental shifts in global consumption patterns favoring poultry and convenient meal formats. The market is consolidating, with major international players leveraging economies of scale and advanced processing technologies to maintain competitive pricing while simultaneously investing heavily in premiumization strategies. This dichotomy allows manufacturers to cater effectively to both the price-sensitive volume market and the niche health-conscious consumer segments. Emerging market penetration, particularly in urban centers of developing nations, represents a key growth strategy, where modern retail is facilitating unprecedented access to packaged meat products, altering traditional food habits rapidly.

Sustainability and ethical sourcing are transitioning from niche concerns to mainstream requirements, influencing procurement and marketing strategies across the industry. Consumer scrutiny over animal welfare and environmental impact compels manufacturers to adopt certified sourcing practices and invest in eco-friendly packaging materials, such as compostable films and recycled plastics, to maintain brand relevance and consumer trust. Regulatory environments, especially concerning ingredient transparency and food safety standards, continue to tighten globally, serving as a barrier to entry for smaller, less compliant players and pushing the larger market incumbents towards proactive compliance and continuous quality management system upgrades.

Furthermore, digital transformation, particularly in sales and marketing, is reshaping consumer engagement. E-commerce platforms are not just distribution channels; they are critical touchpoints for data collection, personalized marketing, and direct consumer feedback loops. Companies are increasingly utilizing data analytics to understand consumer preferences instantaneously, allowing for agile product modifications and localized promotions. This strategic pivot towards data-driven operations ensures that market offerings remain aligned with rapidly changing demographic and behavioral trends, securing long-term revenue streams and competitive advantage in the highly saturated packaged foods landscape.

Competitive Landscape Analysis

The competitive landscape of the Chicken Sausage Market is moderately fragmented but dominated by a few integrated global food processing giants who possess significant production capacity and extensive distribution networks. Competition is fierce, primarily revolving around product innovation, pricing strategies, and brand recognition. Key players like Tyson Foods and Hormel Foods utilize their robust supply chains to achieve cost efficiency, while smaller, regional players often compete by specializing in artisanal, organic, or unique regional flavor profiles, thereby carving out valuable niche markets. The intensity of competition forces continuous investment in R&D to introduce new flavors, reduce fat/sodium content, and improve textural characteristics.

Strategic maneuvering within the market often involves capacity expansion and synergistic acquisitions aimed at broadening geographical footprint or acquiring specialized technological capabilities (e.g., non-GMO or plant-based processing expertise). Marketing efforts are heavily concentrated on emphasizing the health benefits of chicken over red meat, often utilizing digital and social media campaigns to reach younger, health-aware demographics. Private label brands, offered by large supermarket chains, also exert significant competitive pressure, often competing aggressively on price and demanding high production standards from their suppliers, thereby keeping overall market margins optimized but constrained.

To differentiate themselves, manufacturers are increasingly focusing on vertical integration, controlling the entire poultry production cycle from farm to final packaging. This ensures consistent raw material quality and traceability, mitigating risks associated with external sourcing. Moreover, partnerships with food service providers (QSRs and major restaurant chains) for custom formulations represent a crucial battleground for market share, offering stable, high-volume contracts. Success in this competitive environment hinges on the ability to balance high-quality, safe production with aggressive cost management and rapid adaptation to evolving consumer trends, especially the demand for transparency and sustainability.

Product Type Deep Dive: Pre-cooked vs. Fresh

The segmentation of the Chicken Sausage Market by product type—Fresh, Pre-cooked, Smoked, and Frozen—reveals distinct consumption patterns and growth drivers. Pre-cooked chicken sausage is the dominant segment, accounting for the largest market share due to its unparalleled convenience. These products require minimal preparation time, making them highly attractive to time-constrained urban consumers and the commercial food service industry. The growth in this segment is strongly tied to the rising popularity of ready-to-eat and heat-and-eat meals, where quick meal assembly is paramount. Advancements in packaging technology, which maintain texture and flavor after reheating, further solidify the dominance of the pre-cooked segment, particularly in North America and Europe.

Conversely, the Fresh Chicken Sausage segment, while smaller, maintains a steady growth trajectory driven by consumers who prioritize perceived freshness, control over ingredients, and a belief that fresh products offer superior flavor. This segment appeals heavily to the home cook demographic and is often associated with premium, locally sourced, or artisanal offerings found in butcher shops and specialty grocery stores. The operational challenge for the fresh segment lies in its shorter shelf life, demanding extremely efficient cold chain logistics and inventory management to prevent spoilage and waste at the retail level, requiring substantial investment in infrastructure.

Smoked and Frozen chicken sausages represent critical supplementary segments. Smoked varieties appeal to specific flavor preferences and offer excellent stability, often used in grilling and specific ethnic cuisines. The Frozen segment is vital for institutional buyers and consumers seeking extended storage capabilities, mitigating the need for frequent grocery trips. The proliferation of large chest freezers in households globally supports the robust growth of the frozen segment, where bulk purchasing is common. Manufacturers must manage the potential for freezer burn and ensure the product maintains integrity upon thawing and cooking, demanding specific freezing and packaging technologies for optimal consumer acceptance.

Distribution Channel Deep Dive: Online Retail Momentum

Distribution channels for chicken sausage are bifurcated into traditional brick-and-mortar retail (supermarkets, convenience stores, butcher shops) and the rapidly expanding online retail (e-commerce) sector. Supermarkets and hypermarkets remain the primary distribution channel globally, benefiting from high foot traffic, extensive refrigerated shelf space, and the ability to offer a wide variety of brands and price points. The success of this channel relies heavily on favorable cold chain infrastructure within the store and sophisticated inventory rotation practices to manage the perishable nature of the product, ensuring consistent availability of fresh and pre-cooked stock.

The online retail segment is poised for the highest growth rate during the forecast period. The acceleration of online grocery shopping, amplified by global shifts towards contactless shopping, has made e-commerce a crucial avenue for chicken sausage distribution. Online platforms offer unparalleled convenience, allowing consumers to easily compare nutritional information, read reviews, and manage scheduled deliveries. For manufacturers, the challenge lies in ensuring last-mile cold chain integrity, often requiring specialized insulated packaging and rapid delivery mechanisms to prevent temperature abuse and maintain product quality throughout the final stages of the supply chain.

Convenience stores and traditional butcher shops play supporting, yet important, roles. Convenience stores cater to immediate consumption needs or impulse purchases, stocking smaller pack sizes and popular pre-cooked varieties. Butcher shops, although declining in volume, retain importance for premium and locally sourced chicken sausages, serving consumers who value personalized service and expert product knowledge. Manufacturers must adopt a multi-channel strategy, optimizing different packaging formats and pricing tiers for each distribution channel to maximize market penetration and satisfy diverse consumer purchasing habits.

Sustainability and Ethical Sourcing Trends

Sustainability has emerged as a critical non-negotiable factor influencing purchasing decisions in the Chicken Sausage Market. Consumers, particularly in developed economies, are increasingly demanding transparency regarding the environmental footprint of their food, leading to a strong push for manufacturers to adopt circular economy principles. This includes initiatives focused on reducing water usage in processing, optimizing energy consumption in cold storage and distribution, and minimizing food waste across the value chain, from farm management to retail display. Companies are actively setting public targets for carbon footprint reduction and aligning their operations with global sustainable development goals, recognizing that poor performance in this area can significantly damage brand reputation and erode consumer trust.

Ethical sourcing, specifically concerning animal welfare, is deeply integrated into sustainability efforts. Consumers are scrutinizing the welfare standards under which the chicken is raised, driving demand for products certified as free-range, antibiotic-free (ABF), and humanely raised. This pressure encourages manufacturers to establish verifiable supplier certification programs and invest in third-party auditing to validate their ethical claims. Premium pricing is often justified by these high-welfare claims, creating a distinct market segment that caters to environmentally and socially conscious consumers, requiring specialized processing lines and dedicated marketing campaigns to convey the added value effectively.

Packaging innovation forms the third pillar of sustainability within the market. There is a concerted industry shift away from non-recyclable plastic films towards mono-materials, compostable polymers, and materials with high recycled content. The challenge remains in finding sustainable alternatives that can effectively handle the stringent requirements of modified atmosphere packaging (MAP) and maintain optimal barrier properties necessary for preserving the highly perishable nature of chicken sausage. Success in sustainable packaging not only reduces environmental impact but also serves as a strong point of differentiation on crowded retail shelves, appealing directly to a growing segment of environmentally aware buyers.

Regulatory Landscape and Food Safety Standards

The Chicken Sausage Market operates under a strict and complex global regulatory environment designed to ensure food safety, public health, and fair trade practices. Key regulatory bodies, such as the USDA in the United States, EFSA in Europe, and national food safety agencies across APAC, impose detailed standards on everything from raw material inspection and processing hygiene to ingredient usage (especially nitrates, nitrites, and artificial colorings) and labeling accuracy. Compliance with these standards necessitates continuous investment in hazard analysis and critical control points (HACCP) systems and sophisticated microbiological testing protocols within processing facilities, requiring specialized labor and technological infrastructure.

Labeling regulations are a particularly dynamic area, driven by consumer demand for transparency and government mandates. Manufacturers must accurately declare nutritional content, allergen warnings, and origin claims (e.g., country of origin, claims regarding antibiotic use or organic status). Mislabeling or failure to comply with additive limitations can result in significant product recalls, hefty fines, and catastrophic brand damage. The trend towards clean label products often preempts regulatory requirements, as companies proactively reduce additives to maintain consumer appeal, preparing for potential future restrictions on ingredients commonly perceived as unhealthy.

International trade of chicken sausage is further complicated by varying sanitary and phytosanitary (SPS) measures between countries. Exporters must secure certifications that meet the specific import requirements of target countries, which often include rigorous inspection regimes and documentation confirming animal health status and processing standards. Navigating this multi-layered regulatory environment is crucial for global market expansion, driving manufacturers to standardize their core production processes to meet the highest common international benchmarks, thereby facilitating easier access to diverse global markets and minimizing regulatory trade friction.

Flavor and Innovation Trends

Flavor innovation remains a cornerstone of growth and differentiation in the Chicken Sausage Market, moving beyond traditional sage and pepper profiles to embrace global culinary trends and regional preferences. Manufacturers are successfully integrating exotic and ethnic flavors, such as Korean BBQ, Thai Curry, or Mediterranean herb blends, catering to the increasingly adventurous palates of modern consumers who seek unique and authentic gastronomic experiences. This trend of 'flavor fusion' is particularly strong in younger demographics and helps position chicken sausage as a versatile ingredient for diverse international meals, rather than just a traditional breakfast item.

In addition to exotic profiles, there is a significant focus on functional and health-aligned flavors. This includes incorporating ingredients that offer perceived health benefits, such as turmeric, ginger, and various superfoods, alongside reduced-sodium and natural seasoning alternatives. The breakfast segment is seeing renewed innovation with sweet and savory combinations like maple syrup and apple or cranberry infusions, broadening the product's applicability and moving it beyond conventional use cases. These innovations are critical for capturing consumer attention in crowded retail aisles and encouraging trial purchases among competing protein sources.

Furthermore, technology plays a vital role in flavor consistency. Advances in seasoning encapsulation and mixing technologies ensure that the chosen flavor profile is evenly distributed throughout the sausage matrix and is maintained both during the cooking process and throughout the product’s shelf life. Consumer testing and AI-driven predictive modeling are increasingly used to identify burgeoning flavor trends before they hit the mass market, allowing key players to launch relevant, timely products. This rapid innovation cycle is essential to maintain competitive edge and capture market share from traditional meat sausage competitors.

Future Outlook and Key Investment Opportunities

The future outlook for the Chicken Sausage Market is marked by continued expansion, especially driven by the convergence of health, convenience, and technology. Key investment opportunities lie in expanding manufacturing capabilities in the Asia Pacific region to capitalize on rapid demand growth and establishing localized supply chains that can efficiently manage the required cold chain logistics. Furthermore, investment in sustainable poultry farming practices and vertical integration is crucial to secure raw material supply, enhance traceability, and meet ethical consumer demands, thereby securing long-term operational resilience against potential supply chain shocks.

Technological investment offers significant returns, specifically in automating processing lines to improve yield and consistency, and integrating advanced data analytics platforms for precise demand forecasting and real-time inventory optimization. The development of next-generation packaging solutions that are both sustainable and highly functional (e.g., active packaging that extends shelf life or intelligent packaging that monitors temperature) presents a high-growth investment area. These technologies help mitigate food safety risks while simultaneously addressing pressing environmental concerns, positioning the investing company as a market leader in responsible innovation.

Strategic acquisitions targeting specialty processors focused on high-margin segments—such as organic, non-GMO, or ethnic specialty flavors—provide established players with a rapid avenue to diversify their portfolio and appeal to niche markets without prolonged internal R&D cycles. Finally, focusing on product formats that cater to the evolving work-from-home and single-person household trends, such as smaller portion sizes and multi-packs for various meal occasions, ensures that manufacturers remain relevant to the changing dynamics of modern consumer life, sustaining the market's positive growth trajectory through 2033 and beyond.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager