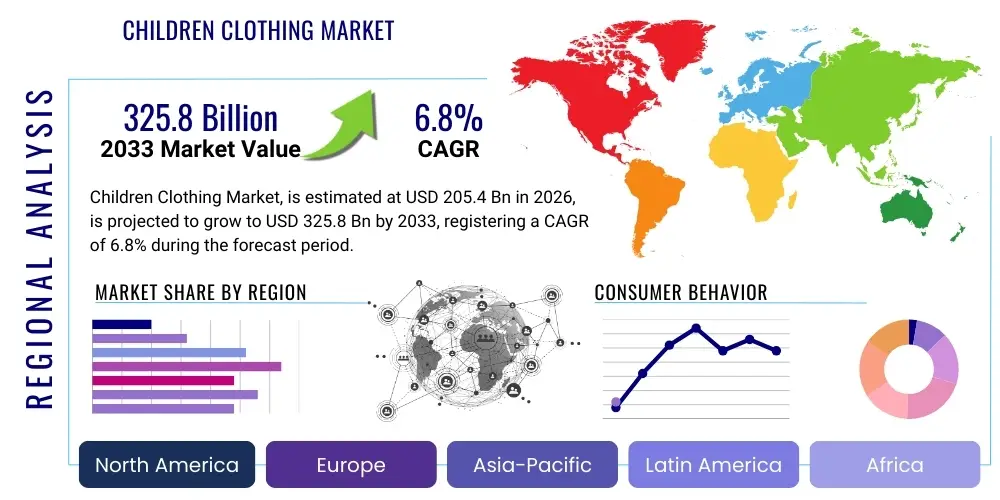

Children Clothing Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437306 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Children Clothing Market Size

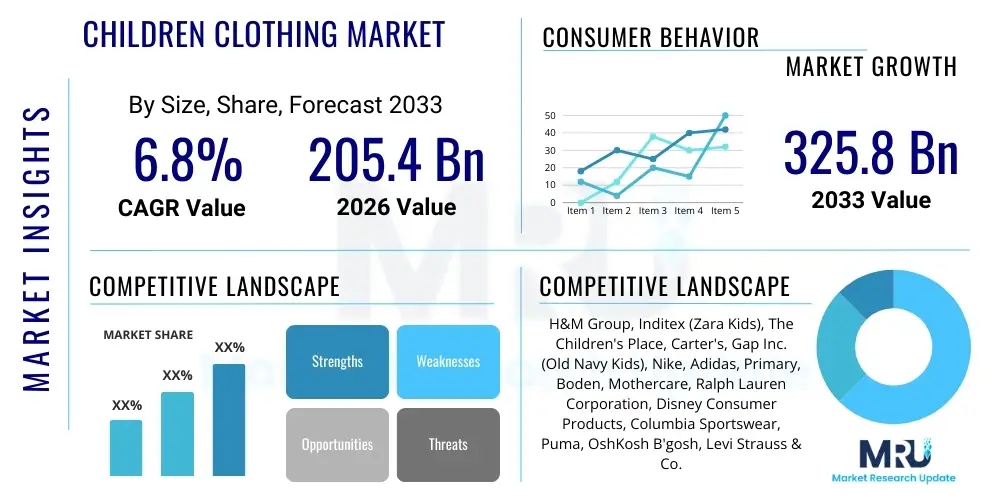

The Children Clothing Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $205.4 Billion in 2026 and is projected to reach $325.8 Billion by the end of the forecast period in 2033.

Children Clothing Market introduction

The Children Clothing Market encompasses all apparel, footwear, and accessories designed specifically for infants, toddlers, and children up to the age of 14. This market is highly dynamic, driven by birth rates, parental spending habits, and rapidly evolving fashion trends influenced by social media and celebrity culture. Products range from basic functional wear, such as sleepwear and basics, to high-end designer outfits and specialized athletic gear. The primary objective of children's clothing is to provide comfort, safety, and durability, while increasingly incorporating elements of style and sustainability demanded by modern consumers. The lifespan of these products is typically short due to the rapid growth of children, leading to consistent replacement demand, which anchors the market's stability and consistent growth trajectory globally.

Major applications of children's clothing span everyday casual wear, school uniforms, specialized sportswear, and occasion-specific formal attire. The diverse range of applications necessitates high levels of specialization in manufacturing regarding fabric choice (prioritizing hypoallergenic and organic materials), structural integrity, and adherence to stringent safety regulations, particularly regarding flammability and small parts hazards. Consumer purchasing decisions are increasingly guided by brand trust, perceived quality, and value for money, shifting focus away from purely price-driven selections towards longevity and ethical sourcing. The proliferation of specialized retail outlets and the dominance of online platforms have made a vast array of niche and global brands accessible to parents across varying socioeconomic strata.

Key driving factors supporting the market's expansion include the rising disposable income in developing economies, the growing influence of Western fashion trends globally, and technological advancements enabling faster production cycles and personalized sizing options. Furthermore, the robust growth of the e-commerce sector has dismantled geographical barriers, allowing specialized children’s fashion brands to access a global consumer base effectively. Benefits derived from the market include providing essential functional necessities for child development, enabling self-expression through style, and, from an industry perspective, fostering innovation in material science focused on durability and environmental friendliness. However, market volatility remains influenced by seasonal shifts, inventory management challenges, and intense competitive pricing pressures, particularly in the mass-market segment.

Children Clothing Market Executive Summary

The global Children Clothing Market is experiencing robust growth fueled by several macroeconomic and sociological factors. Key business trends indicate a definitive shift towards sustainable and ethically sourced apparel, with organic cotton and recycled materials gaining significant traction among middle and high-income consumers. The competitive landscape is intensely fragmented, characterized by the dual presence of global fast-fashion behemoths offering trend-driven, affordable clothing, and specialized niche brands focusing on high-quality, durable, and unique designs. Retail strategy is increasingly omnichannel, emphasizing seamless integration between physical stores, which serve as experiential centers, and powerful e-commerce platforms, which manage the majority of transactional volume. Companies are leveraging digital marketing and social media influencers to target Millennial and Gen Z parents, who prioritize convenience and brand narrative transparency.

Regional trends demonstrate that Asia Pacific (APAC), particularly China and India, is poised for the fastest growth, attributed to increasing birth rates, rapid urbanization, and significant economic growth leading to higher parental spending capacities. North America and Europe, while representing mature markets, maintain high average spending per child, focusing heavily on premiumization and technological integration, such as smart clothing features and advanced customization options. The shift in manufacturing bases, often towards Southeast Asia, influences cost structures and supply chain resilience globally. Regulatory environments, particularly in the EU and US, governing chemical safety and material standards, dictate product development and sourcing strategies for all major players operating within these regions, creating high barriers to entry for non-compliant manufacturers.

Segmentation trends highlight the dominance of the apparel segment, specifically outerwear and casual wear, driven by frequent replacement cycles. The girls’ clothing segment typically commands a slightly larger market share than boys’ due to a wider variety of style options and higher emphasis on fashion-forward designs. Crucially, the distribution channel analysis confirms the exponential growth of the online segment, accelerated significantly by recent global disruptions, offering unparalleled convenience, comparative shopping capabilities, and wider product inventories than traditional brick-and-mortar locations. However, specialized brand stores and hypermarkets remain essential for immediate purchases and for parents who prefer physically assessing fit and quality before committing to a purchase. Sustainability and gender-neutral collections are emerging as pivotal sub-segments driving future innovation and consumer interest.

AI Impact Analysis on Children Clothing Market

Common user inquiries regarding the influence of Artificial Intelligence (AI) in the children's apparel sector frequently revolve around how technology can enhance personalization, optimize inventory management to reduce waste, and improve supply chain transparency. Users are keen to understand if AI can accurately predict fast-changing seasonal trends in children’s fashion, which are often dictated by parental preferences rather than peer influence. Key themes summarize the expectation that AI should solve the inherent difficulty of predicting children’s rapid growth rates for sizing accuracy, leading to a reduction in returns. There is also significant interest in how AI tools like computer vision can automate quality control, ensuring compliance with strict international safety standards (e.g., detecting hazards in small parts or faulty stitching), thereby mitigating liability risks for manufacturers and retailers. Users anticipate that AI-driven dynamic pricing models will maximize value for money while maintaining competitive margins.

AI's primary transformative impact is centered on demand forecasting and supply chain optimization. Utilizing machine learning algorithms, companies can analyze vast datasets—including demographic data, weather patterns, social media trends, and historic sales figures—to predict specific apparel needs for different age groups and geographic regions with much higher accuracy than traditional methods. This predictive capability minimizes overstocking of obsolete inventory and reduces instances of stockouts for highly demanded items, directly combating the high waste generation typically associated with the fashion industry. Furthermore, generative AI is beginning to assist designers by suggesting novel patterns, color palettes, and garment structures specifically optimized for child comfort and movement, accelerating the product development lifecycle from concept to market.

Beyond the back-end operations, AI significantly enhances the customer experience in the children’s clothing retail space. Virtual try-on applications, powered by computer vision and augmented reality (AR), are addressing the major challenge of sizing inconsistency across brands, allowing parents to gauge the fit of clothing on their child's projected size without needing physical samples. Personalized recommendation engines utilize behavioral data to suggest outfits based on style preferences, previous purchases, and specific developmental stages (e.g., suggesting durable knee patches for toddlers starting to crawl). This hyper-personalization drives higher conversion rates and improves customer loyalty, positioning AI as a critical component in future competitive strategies within the sector.

- AI-driven Predictive Sizing: Reduces returns and improves customer satisfaction by accurately forecasting child growth and correlating with brand-specific sizing charts.

- Optimized Demand Forecasting: Utilizes machine learning to minimize inventory risk, aligning production closely with volatile fashion and seasonal requirements.

- Enhanced Quality Control (QC): Computer vision systems automate inspection processes to ensure strict adherence to international child safety regulations regarding small components and material quality.

- Hyper-Personalized Marketing: AI algorithms deliver highly targeted product recommendations and personalized styling advice to parents based on purchase history and lifestyle.

- Supply Chain Visibility: Facilitates track-and-trace capabilities, increasing transparency regarding ethical sourcing and material provenance, which is critical for compliance and marketing sustainable claims.

DRO & Impact Forces Of Children Clothing Market

The dynamics of the Children Clothing Market are shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively form the Impact Forces determining market direction and profitability. Key drivers include sustained global population growth, particularly in Asia and Africa, coupled with a notable increase in parental expenditure allocated toward premium, branded, and specialized children's items, reflecting the trend of 'kidulthood' where parents project their fashion values onto their children. This expenditure is often inelastic, as necessary replacements due to growth are unavoidable. The exponential rise of e-commerce platforms provides unparalleled distribution reach and convenience, transforming how and where parents shop, thus accelerating market accessibility. Opportunities lie in the customization trend, leveraging digital printing and on-demand manufacturing to cater to unique preferences, and the strategic adoption of circular economy models, such as rental or resale services, tapping into eco-conscious consumers and extending product lifecycle value.

Conversely, significant restraints temper the market's explosive growth potential. The most critical constraint is the high degree of price sensitivity across broad consumer segments, especially in the basic wear category, where intense competition forces manufacturers to maintain tight margins. Furthermore, the market is highly vulnerable to fluctuating raw material prices, particularly cotton and synthetic fibers, which directly impact production costs and retail pricing stability. The regulatory environment poses a continuous challenge, with strict and often divergent international safety standards requiring costly compliance audits, testing, and material adjustments. These regulatory hurdles can restrict market entry for smaller players and necessitate continuous investment in compliance monitoring for global brands. Finally, the short lifecycle of children's garments—due to rapid physical growth—creates constant inventory turnover pressure and associated waste management issues.

The impact forces currently exerting the strongest influence are technological integration and the sustainability mandate. Technology, through AI and e-commerce infrastructure, is pushing the boundaries of personalization and operational efficiency, making it easier for brands to scale while offering tailored services. Simultaneously, the consumer demand for ethical sourcing, transparency, and environmentally friendly products is fundamentally altering the value chain, shifting investment towards biodegradable materials, non-toxic dyes, and closed-loop production systems. These forces collectively compel incumbent players to either innovate rapidly to meet ethical demands or risk losing market share to agile, digitally native brands specializing in sustainable fashion. The ability of companies to manage volatile input costs while successfully communicating their sustainability credentials will be the primary determinant of long-term success.

Segmentation Analysis

The Children Clothing Market is comprehensively segmented based on product type, end-user demographics, and distribution channels, providing a granular view of consumer behavior and market penetration strategies. The primary segmentation by type covers Apparel (the largest segment, encompassing shirts, trousers, dresses, and outerwear), Footwear (ranging from casual sneakers to formal shoes), and Accessories (including headwear, socks, belts, and specialized items like mittens or bibs). This structure allows companies to specialize their R&D efforts and marketing campaigns, recognizing that purchasing drivers differ significantly between functional necessity (e.g., footwear) and fashion choice (e.g., apparel). Apparel dominates due to the necessity of seasonal changes and the high frequency of replacement required by physical wear and tear.

Segmentation by end-user demographics separates the market into Infants and Toddlers (0-3 years), characterized by stringent safety and comfort requirements, and Older Children (4-14 years), where brand recognition and fashion preferences begin to influence purchase decisions significantly. A key differentiation factor is the growth rate; infant wear is replaced much more frequently than clothing for pre-teens. The girls’ segment traditionally shows higher revenue contribution globally due to greater diversification in style and higher consumer interest in coordinated outfits and accessories. However, the boys' segment is rapidly growing, driven by specialized athletic wear and the normalization of branded streetwear for younger demographics, requiring brands to focus more on durable and performance-oriented garments for boys.

Distribution channel segmentation highlights the ongoing paradigm shift in retail. The Online Channel (e-commerce, brand websites, and third-party marketplaces) is the fastest-growing segment, offering convenience, wider sizing availability, and personalized digital experiences. Conversely, the Offline Channel, segmented into Supermarkets/Hypermarkets (value-focused, high-volume sales), Brand-Owned Stores (premium, experiential retail), and Multi-Brand Outlets, remains crucial for immediate needs, tactile quality assessment, and reinforcing brand identity. Successful market penetration strategies increasingly rely on a cohesive omnichannel approach, utilizing physical stores for returns and brand engagement while leveraging the operational scalability and data capture capabilities of digital platforms.

- By Product Type:

- Apparel (Outerwear, Bottomwear, Sleepwear, Innerwear)

- Footwear (Casual, Formal, Athletic)

- Accessories (Hats, Gloves, Socks, Ties, Bibs)

- By End-User:

- Boys

- Girls

- By Distribution Channel:

- Online (E-commerce Platforms, Direct-to-Consumer Websites)

- Offline (Specialty Stores, Supermarkets/Hypermarkets, Department Stores)

Value Chain Analysis For Children Clothing Market

The value chain of the Children Clothing Market begins with upstream activities involving raw material procurement, primarily sourcing cotton, synthetic fibers (polyester, nylon), and specialized materials like organic wool or recycled plastics. Upstream analysis focuses heavily on material certification (e.g., GOTS for organic cotton) and ensuring transparency regarding labor practices. Key players in this phase are textile manufacturers and spinning mills, which transform raw fibers into finished fabrics suitable for children’s apparel, emphasizing non-toxic dyeing and finishing processes. Due to stringent regulations regarding material safety for children, manufacturers prioritize suppliers who can guarantee compliance and provide consistent quality and hypoallergenic properties. Efficiency in this stage dictates final product cost and compliance effectiveness.

The central phase involves design, manufacturing, and assembly. Design teams must balance aesthetic trends with functional requirements, such as ease of movement, adjustable features, and durability to withstand frequent washing. Manufacturing often relies on global outsourcing to regions offering lower labor costs, such as Vietnam, Bangladesh, and Turkey, but is increasingly integrating automated cutting and sewing technologies for precision. Quality assurance is paramount in manufacturing, involving rigorous testing for seam strength, button security, and chemical residue. In the downstream segment, the process shifts to logistics, distribution, and retail. Effective logistics management is critical for handling seasonal inventory cycles and ensuring timely delivery to diverse global markets, particularly for fast-fashion cycles.

Distribution channels are categorized into direct and indirect models. Direct channels involve brand-owned physical stores and direct-to-consumer (DTC) e-commerce websites, allowing brands maximum control over pricing, brand experience, and consumer data collection. Indirect channels utilize intermediaries such as wholesalers, large department stores, specialized children’s boutiques, and mass-market hypermarkets. The most impactful shift has been the rise of online marketplaces (e.g., Amazon, Zalando, local equivalents), which function as indirect distribution channels offering wide access but often intensifying price competition. The efficiency of the distribution network determines speed-to-market and influences the overall profitability, making sophisticated inventory planning and warehousing capabilities crucial competitive advantages.

Children Clothing Market Potential Customers

The core customer base for the Children Clothing Market consists primarily of parents, followed closely by grandparents and other immediate family members who purchase gifts. Parents in the Millennial and Gen Z demographics represent the fastest-growing and most influential consumer group. These buyers are digitally native, highly informed, and increasingly prioritize values-based purchasing, focusing on sustainability, ethical labor practices, and brand transparency over simple affordability, especially in mature Western markets. They are prone to researching products extensively online, relying on peer reviews, influencer recommendations, and detailed product specifications regarding material safety and durability before making purchasing decisions.

Within the parent demographic, key behavioral segments include the 'Affluent Fashion Seeker' who invests in premium, designer, and high-quality durable brands (often favoring European labels), and the 'Value Maximizer' who prioritizes affordability and convenience, typically purchasing basic wear through large retailers or hypermarkets. The secondary end-users, the children themselves, play a growing role in the decision-making process, particularly in the 5-14 age range. Their preferences for specific colors, characters (licensed merchandise), and styles—often driven by social media trends—increasingly influence parental choices, especially concerning footwear and specific apparel items like branded sportswear or graphic tees.

Furthermore, institutions represent a significant B2B customer segment. These include schools (purchasing uniforms), specialized sports clubs (requiring custom athletic gear), and day-care facilities. These bulk buyers prioritize bulk pricing, consistency, and compliance with institutional standards regarding color, fabric composition, and logo application. The procurement cycle for institutional customers differs significantly from B2C purchases, relying on long-term contracts and strict quality control standards. Therefore, manufacturers often maintain separate sales divisions and production lines tailored to meet the specific demands and lead times associated with large institutional orders.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $205.4 Billion |

| Market Forecast in 2033 | $325.8 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | H&M Group, Inditex (Zara Kids), The Children's Place, Carter's, Gap Inc. (Old Navy Kids), Nike, Adidas, Primary, Boden, Mothercare, Ralph Lauren Corporation, Disney Consumer Products, Columbia Sportswear, Puma, OshKosh B'gosh, Levi Strauss & Co., L.L.Bean, PatPat, Mini Boden, Next Plc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Children Clothing Market Key Technology Landscape

The technological landscape in the children's clothing sector is rapidly evolving, driven by the need for better fitting, enhanced safety, and greater supply chain efficiency. A key innovation is the integration of Digital Product Creation (DPC) tools, including 3D design and virtual sampling software. These technologies allow designers to create highly realistic virtual prototypes, drastically reducing the time and material waste associated with physical sampling. By using 3D modeling, companies can test colorways, fabric drape, and fit variations across different standardized child body types before committing to production, thereby accelerating the time-to-market for new collections and facilitating rapid trend responsiveness, which is essential in this fast-moving consumer goods sector. Furthermore, the use of Product Lifecycle Management (PLM) software is becoming standard practice, enabling cohesive data management across design, sourcing, manufacturing, and regulatory compliance.

In retail and consumer interaction, the application of Augmented Reality (AR) and Artificial Intelligence (AI) is transforming the purchasing experience. AR-powered virtual try-on systems address the primary challenge of online sizing, providing parents with a confident purchase decision by visualizing how garments will fit their child based on user-provided measurements or standard growth curve data. Complementary to this, the adoption of Radio-Frequency Identification (RFID) technology is optimizing inventory accuracy both in-store and throughout the logistics pipeline. RFID tags enable real-time tracking of individual items, significantly reducing shrinkage, improving stock visibility for omnichannel fulfillment, and providing critical data points necessary for accurate demand forecasting and loss prevention strategies.

Material science innovation also constitutes a crucial part of the technology landscape. Research focuses heavily on developing sustainable, high-performance textiles. This includes fabrics made from recycled PET bottles, Tencel, and advanced organic cotton that require less water and fewer pesticides. Concurrently, the small but growing niche of "smart clothing" incorporates wearable technology, such as embedded sensors in infant wear, capable of monitoring vital signs, temperature, and even tracking location. While smart clothing remains premium, its increasing miniaturization and decreasing cost suggest potential for future mass-market adoption, particularly in safety-focused applications, offering a tangible competitive differentiation for brands specializing in infant care products.

Regional Highlights

The regional analysis of the Children Clothing Market reveals divergent growth dynamics and consumer priorities across major geographical areas. Asia Pacific (APAC) currently dominates the market in terms of volume and is projected to exhibit the highest Compound Annual Growth Rate (CAGR) throughout the forecast period. This rapid expansion is primarily attributed to densely populated countries like China and India, where rising middle-class disposable income, coupled with high birth rates and increasing exposure to global fashion trends, fuels demand for branded and high-quality children’s apparel. Furthermore, APAC serves as the primary manufacturing hub for the global industry, benefiting from lower labor costs and established textile supply chains, though increasing domestic consumption is reorienting some production capacity toward local markets.

North America and Europe represent mature markets characterized by high per-capita spending on children's apparel and a strong preference for premiumization and sustainability. In these regions, consumption is less driven by population growth and more by cyclical fashion replacement, licensed character merchandise, and investment in specialized categories like organic cotton basics and high-performance outerwear. European consumers, particularly those in Scandinavian countries and Germany, place a significant emphasis on eco-friendly certifications, non-toxic materials, and ethical sourcing, forcing brands to invest heavily in supply chain transparency and verifiable sustainability claims. E-commerce penetration is extremely high in both regions, dictating the necessity of robust omnichannel retail strategies and efficient returns processing.

Latin America (LATAM) and the Middle East and Africa (MEA) are emerging markets offering substantial growth opportunities, albeit from a smaller base. In LATAM, economic volatility can restrain market growth, yet the demand for aspirational Western brands remains strong, particularly in urban centers like Brazil and Mexico. MEA shows heterogeneous growth; while the Middle East benefits from high-income consumers seeking luxury and designer children's wear, the African market is primarily characterized by demand for functional, durable, and affordable clothing. Investment in local manufacturing and localized distribution networks is critical for market success in MEA, where reliance on informal markets often necessitates innovative distribution approaches to reach the mass consumer base effectively and competitively.

- North America: Focus on premium quality, heavy reliance on e-commerce, strong demand for specialized athletic wear and branded products. High regulatory compliance standards.

- Europe: Driven by sustainability mandates, ethical sourcing, and organic materials. Mature market emphasizing durability and circular fashion models (resale/rental).

- Asia Pacific (APAC): Highest volume and growth rate; powered by rising disposable incomes in China and India. Major manufacturing hub shifting towards domestic brand consumption.

- Latin America (LATAM): Growth concentrated in urban areas; strong brand loyalty and increasing adoption of digital retail channels, despite economic fluctuations.

- Middle East & Africa (MEA): Dual market structure with high demand for luxury brands in the GCC countries and intense focus on affordability and durability in African nations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Children Clothing Market.- H&M Group

- Inditex (Zara Kids)

- The Children's Place

- Carter's

- Gap Inc. (Old Navy Kids)

- Nike

- Adidas

- Primary

- Boden

- Mothercare

- Ralph Lauren Corporation

- Disney Consumer Products

- Columbia Sportswear

- Puma

- OshKosh B'gosh

- Levi Strauss & Co.

- L.L.Bean

- PatPat

- Mini Boden

- Next Plc.

Frequently Asked Questions

Analyze common user questions about the Children Clothing market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the growth of the Children Clothing Market?

Market growth is primarily driven by rising disposable incomes globally, rapid urbanization leading to increased parental spending on non-essential goods, and the expansion of the e-commerce sector which provides convenient access to a wide array of domestic and international brands.

How is sustainability impacting children's clothing trends?

Sustainability is a critical trend, compelling brands to adopt organic cotton, recycled materials, and non-toxic dyes. Consumers are increasingly seeking transparency regarding ethical sourcing and durability, favoring brands that support circular economy initiatives like clothing rental or resale platforms.

Which distribution channel is growing fastest in this market?

The Online Distribution Channel (e-commerce and direct-to-consumer websites) is the fastest-growing segment, propelled by consumer demand for convenience, personalized sizing solutions (like virtual try-ons), and the ability to compare prices and quality across various brands easily.

What are the primary challenges faced by the Children Clothing industry?

Key challenges include intense price competition, volatility in raw material costs (especially cotton), the short product lifecycle due to rapid child growth, and the necessity of adhering to stringent, costly international safety and flammability regulations.

How does AI affect sizing accuracy in children's apparel?

AI utilizes machine learning and growth curve data to offer predictive sizing recommendations, helping parents select the correct fit and size for a child's projected growth stage, significantly minimizing online purchase returns stemming from sizing inconsistencies.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager