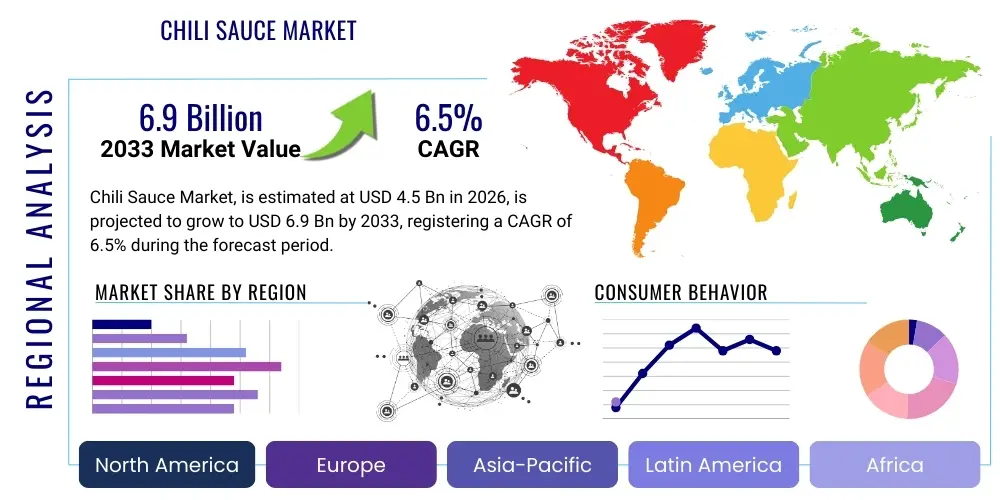

Chili Sauce Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437321 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Chili Sauce Market Size

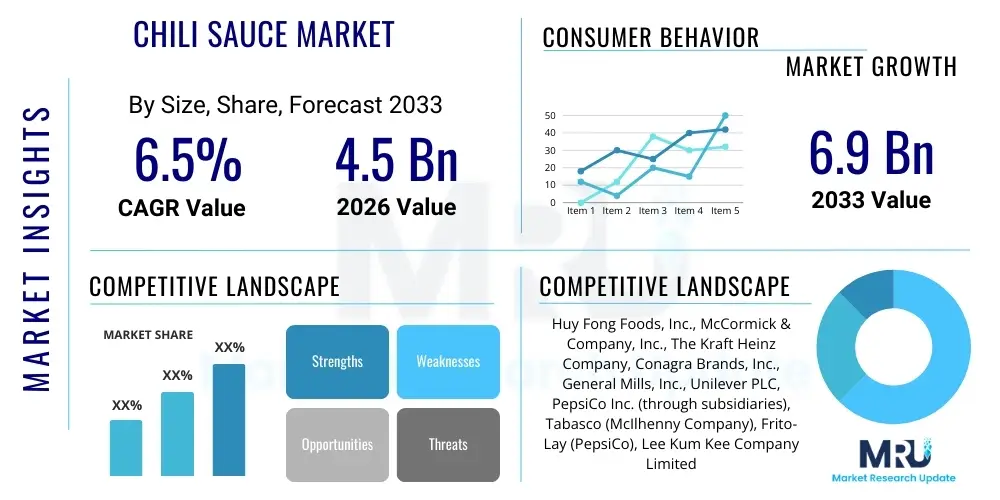

The Chili Sauce Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 6.9 Billion by the end of the forecast period in 2033.

Chili Sauce Market introduction

The Chili Sauce Market is characterized by robust expansion driven primarily by shifting consumer preferences towards ethnic cuisines, increased globalization of food consumption, and the rising demand for convenient, ready-to-use flavor enhancers. Chili sauce, ranging from mild to intensely hot, serves as a fundamental condiment, ingredient, and dip across diverse culinary traditions globally. Its versatility allows integration into packaged foods, restaurant meals, and household cooking, significantly boosting its market penetration across all socio-economic groups. The product itself is a liquid condiment composed primarily of chili peppers, vinegar, sugar, salt, and various spices, processed to achieve specific flavor profiles and heat levels, measured often by the Scoville Heat Unit (SHU) scale. This foundational demand ensures continuous innovation in flavor and format, catering to a sophisticated global palate that seeks authenticity and intensity in food experiences. The manufacturing process often involves fermentation or blending, depending on the desired outcome, ensuring a wide array of textures and shelf-stable products.

Major applications of chili sauce span the entire food service industry, retail sectors, and the packaged food manufacturing space. In the food service context, chili sauce is essential for Asian, Mexican, and fusion restaurants, serving as a signature ingredient that defines regional authenticity. Retail applications include table sauces sold directly to consumers for home use, often segmented by origin (e.g., Sriracha, Tabasco, Gochujang) or by specialty attributes (e.g., organic, gluten-free). Furthermore, industrial applications involve the bulk supply of chili sauces or paste extracts used as flavorings in savory snacks, ready meals, marinades, and specialized processed meats. The core benefit of chili sauce is its capacity to impart complex, pungent flavors and heat, transforming simple dishes and appealing directly to the increasingly adventurous palate of modern consumers who prioritize flavor customization and culinary exploration in their daily routines.

Key driving factors fueling market expansion include rapid urbanization in emerging economies, which correlates with higher consumption of prepared foods and packaged condiments due to time constraints. The proliferation of international fast-food chains incorporating spicy menu items also plays a critical role in normalizing and popularizing specific chili sauce flavors globally. Moreover, manufacturers are actively introducing organic, low-sodium, and clean-label chili sauces, responding directly to heightened health consciousness and dietary trends. These innovations, coupled with aggressive marketing strategies targeting millennials and Gen Z consumers seeking bold flavors, solidify the market's positive trajectory, making flavor complexity, perceived authenticity, and ingredient traceability primary purchasing criteria across the global consumer base. Investment in sustainable packaging and ethical sourcing practices further enhances brand appeal and marketability in premium segments.

Chili Sauce Market Executive Summary

The Chili Sauce Market exhibits strong positive business trends, fundamentally supported by advancements in processing technology that allow for better flavor preservation and increased shelf stability for natural, preservative-free products. Business growth is notably concentrated in product premiumization, where niche, artisanal, and small-batch chili sauces, often featuring exotic pepper varieties, command higher prices, appealing to consumers seeking authenticity and superior ingredient quality. Furthermore, the market is undergoing strategic consolidation, as large multinational food corporations acquire successful regional brands to quickly expand their flavor portfolio and geographic footprint, simultaneously streamlining supply chains and achieving economies of scale in sourcing raw chili material and specialized packaging. This proactive strategic activity indicates high confidence in sustained future consumer demand driven by cross-cultural food exploration.

Regionally, Asia Pacific maintains its dominance due to deep cultural integration of chili and spicy condiments in daily cooking, led by major consumption hubs such as China, Thailand, and India. However, North America and Europe are exhibiting the fastest growth rates, driven by demographic shifts, increasing exposure to diverse international cuisines, and the widespread "heat-seeking" trend among younger consumers who view heat tolerance as a culinary adventure. European markets, in particular, show a strong inclination towards sustainably sourced ingredients and traceability in their condiments, pushing manufacturers to invest significantly in transparent labeling and ethical supply chain management systems. Latin America is also rapidly emerging as a significant market, capitalizing on its rich indigenous pepper varieties and traditions, increasingly exporting premium, origin-certified sauces globally through modernized processing facilities.

Segment trends highlight the significant growth of the specialty/gourmet segment, overshadowing conventional mass-market offerings in terms of percentage growth, although mass-market volume remains dominant. Within the ingredients segmentation, the demand for natural, non-GMO, and fermentation-based components is paramount, reflecting a consumer desire for traditional preparation methods and cleaner labels. Consumer preferences are rapidly shifting towards specific, high-profile pepper varieties (e.g., Habanero, Ghost Pepper, Carolina Reaper, Peri-Peri) rather than generic ‘hot sauce,’ indicating a move towards ingredient-specific sophistication and flavor connoisseurship. Distribution channels show robust growth in e-commerce, allowing specialty producers to bypass traditional retail barriers and reach niche audiences directly, enhancing personalized marketing efforts and significantly speeding up the cycle for new product introductions and limited-edition releases.

AI Impact Analysis on Chili Sauce Market

Users commonly inquire about how Artificial Intelligence (AI) can enhance chili pepper cultivation efficiency, optimize complex flavor profiles, and revolutionize supply chain transparency in the Chili Sauce Market. Key concerns revolve around AI's role in predictive market demand forecasting, preventing food fraud related to origin and ingredient substitution, and managing the inherent variability in natural agricultural products like chili peppers, whose heat and flavor characteristics can change drastically based on weather, soil conditions, and specific harvest timing. Industry stakeholders and consumers expect AI to primarily deliver more consistent product quality, highly personalized flavor recommendations based on vast data sets, and significant reductions in production waste through optimized resource allocation, ensuring sustainability objectives are met throughout the entire value chain from farm to table.

AI's influence is rapidly transforming several critical aspects of chili sauce production, from initial agricultural output to final consumer engagement and loyalty programs. In the agricultural phase, machine learning algorithms analyze satellite imagery, hyper-local weather data, soil nutrient metrics, and historical crop performance to optimize irrigation schedules, predict potential yield fluctuations, and precisely determine the optimal harvest window to maximize capsaicin content and achieve ideal flavor intensity. This precision farming approach not only reduces input costs (water, fertilizer) but also dramatically improves the consistency of raw materials, which is absolutely crucial for achieving brand standardization and reliability across large-scale manufacturing operations globally.

In the R&D, manufacturing, and consumer-facing segments, AI facilitates rapid flavor development, quality control, and personalization at scale. Generative algorithms can analyze massive datasets of flavor compounds, existing product sales data, and granular consumer preference data (gleaned from social media trends, purchase histories, and taste tests) to suggest novel ingredient combinations or adjust existing formulations to match regional or demographic tastes more precisely and quickly than traditional taste panels. For instance, AI can accurately simulate the outcome of lengthy processes like fermentation or aging, drastically cutting down the typical R&D cycle time. This capability for rapid iteration allows manufacturers to proactively respond to fast-evolving consumer demands for innovative and complex flavor experiences, improving the time-to-market for seasonal, limited-edition, and highly premium product offerings, ensuring maximum competitive advantage.

- AI-driven precision agriculture optimizes chili pepper yield and raw material consistency by analyzing soil and weather patterns.

- Machine learning algorithms predict optimal flavor profiles, ingredient ratios, and ideal fermentation times based on real-time consumer trend analysis.

- Predictive analytics enhance complex demand forecasting across multiple geographies, minimizing expensive inventory holding costs and significantly reducing product spoilage.

- AI sensors and automated systems monitor fermentation and aging processes for superior quality control, ensuring consistent heat (SHU) and complex flavor profiles batch after batch.

- Advanced computer vision and image recognition systems verify raw material quality and detect contaminants or substandard peppers during high-speed sorting and processing.

- Chatbots and personalized recommendation engines utilizing AI improve direct-to-consumer (DTC) e-commerce experiences by suggesting customized product pairings and recipes.

- Blockchain integration, verified and monitored by AI, ensures absolute supply chain transparency regarding chili source, ethical farming practices, and certification validity.

DRO & Impact Forces Of Chili Sauce Market

The Chili Sauce Market is fundamentally shaped by a dynamic interplay of Drivers, Restraints, and Opportunities (DRO), which collectively form the impact forces steering its evolution and defining competitive strategies. The primary drivers are the increasing global appreciation for spicy and ethnic foods, fueled significantly by cultural exchange, migration, and the proliferation of international media, alongside the rising consumer demand for versatile, convenient cooking aids that deliver high impact flavor. Manufacturers capitalize on these strong drivers by aggressively offering wider varieties of heat levels, regional specialties, and international flavor profiles. However, the market faces significant restraints, chiefly the inherent volatility in the price and supply of key raw materials, primarily fresh chili peppers, which are highly susceptible to unpredictable climate changes, agricultural pests, and geopolitical disruptions in major growing regions, leading to inconsistent manufacturing costs, product shortages, and intense pressure on profit margins across the industry.

Opportunities for sustained market growth are substantial and primarily centered around product innovation within the rapidly expanding health and wellness categories. The targeted development of low-sugar, low-sodium, organic, and functional chili sauces (e.g., incorporating prebiotics for gut health or adaptogens for stress reduction) directly addresses the modern consumer's pursuit of healthier eating without compromising the desired intensity of flavor. Moreover, strategic expansion into rapidly emerging markets in Africa, Eastern Europe, and Southeast Asia, coupled with the sophisticated utilization of digital marketing and e-commerce platforms, presents unprecedented pathways for achieving deep and rapid market penetration globally. The opportunity to leverage sustainable packaging solutions (biodegradable, high post-consumer recycled content, or reduced plastic use) also provides a crucial competitive advantage in environmentally conscious consumer segments, driving brand loyalty and premium pricing capacity.

The impact forces exerted by these DRO elements dictate complex, multifaceted market strategies. Strong, consumer-driven preferences compel constant product line extensions and rapid flavor portfolio rotations, ensuring retail shelves are perpetually stocked with new, trending flavors, thereby forcing competitors into high levels of research and development (R&D) spending. Restraints related to agricultural consistency necessitate substantial investment in robust, multi-regional sourcing contracts, advanced vertical integration strategies, or the costly adoption of Controlled Environment Agriculture (CEA) for securing the supply of high-value and sensitive pepper varieties. The overarching impact on the industry is a highly competitive landscape where sustainability, supply chain traceability, flavor authenticity, and verifiable health claims are no longer optional features but mandatory entry requirements, profoundly influencing investment decisions, particularly concerning automated, flexible production lines and sophisticated inventory management systems designed to absorb agricultural supply shocks and manage product consistency across diverse supply origins.

Segmentation Analysis

The Chili Sauce Market segmentation analysis provides a granular view of market dynamics based on source, type, packaging, distribution channel, and application. Understanding these diverse segments is crucial for strategic business planning, enabling manufacturers to precisely tailor their product offerings, marketing campaigns, and pricing strategies to specific consumer groups and end-use industries. The market exhibits significant diversity across these parameters, reflecting the truly global and culturally specific nature of chili sauce consumption, where localized flavor profiles and regional taste preferences heavily influence product composition and preferred delivery formats, ensuring that the market structure remains highly complex and regionally fragmented.

Key segmentation by type—ranging from conventional sweet chili sauce, globally recognized hot sauce brands, concentrated pepper paste (like Gochujang or Harissa), and unique specialty sauces—demonstrates highly disparate growth rates, with the hot sauce and specialty sauce segments currently enjoying the highest momentum. This acceleration reflects the dominant consumer trend towards exploring higher heat levels and seeking authentic, regionally derived ethnic flavors that enhance culinary experimentation. Furthermore, packaging segmentation, covering recyclable glass bottles, lightweight plastic bottles, single-serving sachets, and industrial bulk containers, reveals shifting patterns driven by concurrent demands for convenience, sustainability goals, and cost efficiency. Smaller, hygienic, single-serving sachets are dominant in the high-volume food service and travel sectors, while aesthetically pleasing, recyclable glass bottles remain the packaging choice for the premium retail consumer segment concerned with quality perception and environmental responsibility.

Distribution segmentation is critically important, distinguishing effectively between the massive retail sector (supermarkets, hypermarkets, convenience stores), the high-volume food service sector (restaurants, catering, institutional use), and the industrial sector (food manufacturing). While traditional retail channels still account for the majority of volume sales globally, the transformative rise of specialized e-commerce platforms is significantly disrupting traditional models. Online retail provides crucial direct access for specialty producers and craft brands to bypass historical retail gatekeepers and reach specific, highly engaged niche audiences directly. This market fragmentation necessitates complex, data-driven omnichannel strategies from established market players, requiring them to focus equally on maximizing physical shelf visibility and executing sophisticated digital marketing campaigns to capture market share across all consumer touchpoints, ensuring that real-time product availability perfectly matches dynamic consumption patterns.

- By Type:

- Hot Sauce (High Scoville Rating, focus on specific pepper varietals)

- Sweet Chili Sauce (Appealing heavily to Asian and fusion cuisine consumers)

- Pepper Paste/Pulp (e.g., Gochujang, Sambal Oelek, fundamental cooking ingredients)

- Barbeque and Specialty Sauce Hybrids (e.g., Smokey Chipotle, Spicy Mayo blends)

- By Source:

- Natural/Organic (Driving premium pricing and health-focused purchases)

- Conventional (Mass-market volume production)

- By Packaging:

- Glass Bottles (Preferred for premium retail and better perceived quality)

- Plastic Bottles (PET, favored for high-volume family sizes and safety)

- Pouches and Sachets (Crucial for food service and travel segments, ensuring portability)

- Bulk Containers (Industrial Use, necessary for large-scale food manufacturing integration)

- By Distribution Channel:

- Supermarkets and Hypermarkets (Largest volume retail channel)

- Convenience Stores (Important for immediate consumption and impulse buys)

- Online Retail/E-commerce (Fastest growth, essential for niche and artisanal brands)

- Food Service (Horeca - Hotels, Restaurants, Cafes)

- By Application/End-Use:

- Household/Retail Consumption (Daily table use)

- Commercial/Food Processing Industry (Ingredient for snacks, ready meals, frozen foods)

- Restaurants and Catering (Bulk use and specialized customer requirements)

Value Chain Analysis For Chili Sauce Market

The Value Chain of the Chili Sauce Market is highly complex and fragmented, starting with the intensive upstream sourcing of agricultural commodities and culminating in the final consumer purchase, with numerous quality and safety checkpoints in between. Upstream analysis focuses intensely on securing high-quality, consistent, and sustainable supplies of chili peppers (e.g., specific varietals such as cayenne, jalapeno, tabasco, or ghost pepper), which invariably represents the highest variable cost and primary risk exposure for manufacturers due to agricultural volatility. This stage involves developing complex, often long-term relationships with contract growers, sometimes requiring the manufacturer's direct investment in agricultural extension services to ensure strict compliance with quality standards such as specific capsaicinoid levels, pesticide residue limits, and organic certifications necessary for premium products. Secondary upstream inputs include essential ingredients like vinegar, salt, sugars, and specialized packaging materials, all of which are subject to global commodity price fluctuations, necessitating the deployment of advanced procurement risk management and hedging strategies.

The midstream process involves highly sophisticated manufacturing, which includes raw material preparation (washing, quality inspection, destemming), controlled fermentation (critical for flavor complexity in traditional sauces), blending, precision cooking, high-temperature pasteurization or HPP, and automated packaging. Direct operations involve in-house, state-of-the-art facilities where stringent quality control protocols (e.g., continuous SHU testing, pH balance checks, viscosity measurement) are paramount to maintain absolute brand consistency and microbial safety across every batch. Indirectly, many established producers strategically rely on co-packers or Contract Manufacturing Organizations (CMOs) to manage sudden production volume surges, rapidly enter new geographical markets without substantial direct capital expenditure, or produce specialized, low-volume product lines. Achieving operational efficiency in this stage, particularly through the use of high-speed automation in blending, filling, and labeling, significantly influences the final unit cost and overall margin structure, addressing the high-volume requirements of a competitive global distribution network.

The downstream segment encompasses the intricate network of distribution channels, ranging from highly efficient direct sales models to multi-tiered retail and food service supply chains. Direct-to-Consumer (DTC) distribution via e-commerce provides manufacturers with higher margins and direct consumer data access but requires significant investment in fulfillment logistics, warehousing, and delivery infrastructure. Indirect distribution relies heavily on established third-party logistics (3PL) providers, specialized food wholesalers, and national/international distributors to reliably reach the vast network of supermarkets, hypermarkets, and institutional restaurants globally. Effective, digitally-enabled supply chain management, supported by optimized inventory placement strategies and rigorous cold chain integrity maintenance (where relevant for fresh sauces), is absolutely essential to minimize product spoilage and maximize overall shelf life. The consumer feedback loop, increasingly powered by digital data analytics and social listening, critically closes the value chain, informing future R&D cycles and necessary product adjustments based on real-time consumption patterns and satisfaction metrics.

Chili Sauce Market Potential Customers

The potential customer base for the Chili Sauce Market is exceptionally broad, spanning multiple socio-economic demographics, geographic segments, and large industry verticals globally, positioning the product as a true cross-category staple. Primary end-users include individual households that purchase table sauces and cooking condiments for daily culinary use, which represents the single largest volume segment of the market. Within this core household segment, consumers are intricately segmented based on their preference for specific heat levels (mild, medium, extreme hot), distinct flavor profiles (acidic, smoky, fruity, fermented), and adherence to specific dietary requirements (vegan, organic, gluten-free, low-sodium), necessitating manufacturers to maintain a highly diversified and continually refreshed product portfolio to capture all key sub-segments effectively.

A second major and highly influential customer category is the extensive commercial food service sector, encompassing quick-service restaurants (QSRs), formal full-service dining establishments, institutional catering operations (hospitals, schools, corporate cafeterias), and specialty food retailers. These commercial customers typically demand specific product attributes, including bulk packaging formats, absolute quality consistency across large batches, and often require customized, proprietary formulations tailored precisely to complement their specific signature menu items or preparation methods, thereby generating large and stable order volumes. The accelerating global trend towards fusion and international cuisine in restaurants drives robust demand for specific, authentic, regional chili sauces (e.g., Peruvian Aji Amarillo, North African Harissa), requiring sophisticated suppliers to maintain authentic, high-fidelity sourcing and blending processes to satisfy these professional culinary standards.

The third critical segment comprises food manufacturers and processors, classified as industrial users. These high-volume customers utilize chili sauce or highly concentrated chili extracts as foundational ingredients in the production of numerous secondary products such as savory snack foods (flavored chips, crackers), highly profitable marinades, chilled and frozen ready-to-eat meals, instant noodle flavorings, and various processed meats and plant-based alternatives. Their purchasing decisions are primarily governed by price stability, quality standardization, concentration level (measurable SHU index), ease of integration into continuous, large-scale production lines, and guaranteed long-term supply agreements. As the global savory snack and convenience food markets continue their aggressive expansion, the industrial demand for standardized, high-volume chili inputs is accelerating, driven by the desire to add complex, trending flavor notes that appeal directly to the evolving mass market consumer base.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 6.9 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Huy Fong Foods, Inc., McCormick & Company, Inc., The Kraft Heinz Company, Conagra Brands, Inc., General Mills, Inc., Unilever PLC, PepsiCo Inc. (through subsidiaries), Tabasco (McIlhenny Company), Frito-Lay (PepsiCo), Lee Kum Kee Company Limited, Cholula Food Company (McCormick), TW Garner Food Co. (Texas Pete), Kikkoman Corporation, Nestle S.A., Thai Pride Food Industry Co. Ltd., Burns Philp & Co. Ltd. (Frank's RedHot), Baumer Foods, Inc. (Crystal Hot Sauce), Goya Foods, Inc., Walkerswood Caribbean Foods, Sriraja Panich, Reese Group (Trappey's Fine Foods). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Chili Sauce Market Key Technology Landscape

The technological landscape of the Chili Sauce Market is constantly evolving, with primary objectives focused on improving process efficiency, ensuring absolute product safety, and achieving minute flavor precision required for premiumization. A core technological focus is on advanced, non-thermal processing methods, particularly High-Pressure Processing (HPP) and sophisticated aseptic packaging technologies. HPP allows manufacturers to significantly extend the refrigerated shelf life of chili sauces—sometimes up to 90 days—while rigorously maintaining the product's fresh flavor, natural texture, and vital nutritional integrity without resorting to traditional, high-temperature thermal pasteurization, which can compromise the subtle volatile flavor compounds inherent in premium chili varieties. The successful application of HPP specifically caters directly to the expanding premium, clean-label trend, satisfying demanding consumer expectations for minimally processed, additive-free ingredients.

In manufacturing operations, advanced automation, robotics, and precise sensor technology are paramount for scaling production while mitigating risks. Modern blending tanks employ highly sensitive inline sensors (e.g., refractometers for Brix levels, precise pH meters for acidity, sophisticated viscosity sensors for texture, and specialized Spectrophotometers for color intensity and consistency) that provide real-time data to interconnected Automated Process Control (APC) systems. These critical systems utilize complex algorithms to automatically adjust ingredient flow, mixing speeds, and processing temperatures, ensuring that every large production batch meets exact, predetermined specifications regarding flavor, heat level (often verified via High-Performance Liquid Chromatography—HPLC—for capsaicinoids), and final product thickness. This stringent technological approach dramatically reduces human error and batch-to-batch variability, which is crucial for maintaining uncompromising brand loyalty, especially in the high-end specialty market where consistency and authenticity are primary differentiators. Furthermore, advancements in specialized milling and supercritical fluid extraction technologies allow for the highly precise separation and utilization of different chemical components of the chili pepper, enabling tailored product formulations, such as extracting specific capsaicinoids for controlled heat delivery or isolating natural carotenoids for visual appeal without adding preservatives.

Beyond the core manufacturing floor, digital technologies govern traceability, inventory optimization, and consumer engagement, forming the indispensable foundation of modern, resilient supply chain management. The growing integration of blockchain technology is increasingly utilized to record and verify the immutable journey of the chili pepper from the original farm field to the final bottled sauce on the shelf, providing irrefutable proof of origin, organic status, and ethical sourcing claims, which directly addresses the heightened consumer demand for verifiable transparency and sustainability guarantees. On the consumer side, interactive labeling technology, such as dynamic QR codes linked to detailed provenance data, engaging production videos, and highly personalized recipe suggestions tailored by AI, significantly enhances product engagement and builds deep brand trust. Furthermore, advanced predictive analytics are used not only for highly accurate demand forecasting across complex supply chains but also to model precise consumer reactions to new flavor combinations before expensive large-scale commercial trials, thereby rigorously optimizing the success rate of New Product Introductions (NPIs) in a highly saturated and intensely fast-moving market where differentiation is increasingly dependent on subtle flavor novelty and documented authenticity.

Regional Highlights

The global Chili Sauce Market exhibits distinct consumption patterns, cultural integration levels, and robust growth dynamics across its primary operational regions. Asia Pacific (APAC) stands out unequivocally as the historical and current global market leader, commanding the largest share due to the deep, intrinsic cultural reliance on chili condiments and spices in daily diets across highly populated countries like China, Thailand, Vietnam, and India. The regional market in APAC is characterized by a highly fragmented landscape dominated by numerous small, traditional, regional manufacturers operating alongside large, quality-driven international players. Growth in APAC is powerfully fueled by rapid urbanization, significant increases in disposable incomes, and the continuous innovation in local flavors, often incorporating complex fermented chili pastes and sauces specific to micro-regions, such as Gochujang in Korea or various distinct Sambal types across Indonesia and Malaysia. The sheer scale of the population and the deeply embedded culinary traditions ensure that APAC remains the foundational market for raw material sourcing and consumption, necessitating highly efficient, localized distribution networks optimized for high-frequency, smaller-volume purchasing habits common in the region.

North America is categorized by exceptionally high per capita consumption, intense brand competition, and rapid, trend-setting innovation, primarily driven by the dynamic market of the United States. The region shows an intense and growing interest in extreme heat sauces (often featuring exotic super-hot varieties exceeding 1 million SHU) and premium, clean-label, craft/artisanal sauces, often successfully sold direct-to-consumer (DTC) to bypass traditional retail barriers. The rapidly growing multi-cultural demographic heavily influences demand, aggressively driving the popularity of global flavors such as high-quality Sriracha, Peri-Peri, and various African and Caribbean chili sauces, pushing American manufacturers to drastically broaden their flavor offerings beyond traditional staples. Marketing success in this hyper-competitive region relies heavily on authentic brand storytelling, influential social media campaigns, and competitive heat level differentiation, leading to significant investment in digital content and lucrative influencer partnerships. Furthermore, the strong and reliable presence of major national and international fast-food chains provides massive opportunities for custom-formulated sauces, requiring high-volume manufacturing capabilities that must meet exceptionally stringent safety and supply consistency standards.

Europe demonstrates stable, consistent growth, with demand heavily concentrated primarily in mature Western European countries like the UK, Germany, and France, significantly driven by the increasing popularity and acceptance of Tex-Mex, diverse Asian, and vibrant Mediterranean cuisines. European consumers exhibit a notably stronger preference for sauces marketed with clear, verifiable health benefits (e.g., organic certification, non-GMO status, sustainably sourced ingredients) and uncompromising transparency regarding ingredient origin. The extensive regulatory frameworks in the EU regarding food additives, food safety, and allergen labeling are among the strictest globally, posing compliance challenges but concurrently fostering strong consumer trust and favoring manufacturers with verifiable quality control systems. The Middle East and Africa (MEA) and Latin America (LATAM) collectively represent high-potential, rapidly emerging markets experiencing structural growth. LATAM's growth is inherently tied to its rich tradition of indigenous pepper cultivation (e.g., Aji, Habanero) and traditional recipe modernization, increasingly upgrading production processes for international export. Meanwhile, MEA expansion is driven by robust youth population growth, the rapid expansion of food service infrastructure, and the continuous influx of Western and Asian food chains demanding specific heat levels and flavor profiles to cater to diverse local tastes and the expatriate population. Investment in resilient cold chain logistics is often critical for maintaining product quality and ensuring long shelf life in high-temperature MEA markets, posing a specialized technological hurdle.

- Asia Pacific (APAC): Dominates the market share; characterized by high volume consumption across household and food service sectors; rapid urbanization strongly supports increased demand for convenient ready-to-use condiments. Focus on deep-rooted traditional fermented pastes (Gochujang, Sambal) and regional varietals ensures immense market diversity. Key countries include China, Thailand, and India, where highly localized flavor profiles often dictate market success over generic global brands.

- North America: Fastest growing region globally, characterized by intense demand for gourmet, super-hot, and specialized craft chili sauces; high adoption rates of novel globalized flavor profiles and innovative, premium packaging. The dynamic US market dictates global trends in specialty hot sauce, often linking consumption to competitive eating challenges and viral social media trends, demanding specialized heat measurement and assertive, distinctive branding.

- Europe: Growth is stable and quality-driven, fueled by stringent clean-label demands and the popularity of international fusion cuisines; regulatory focus on food safety and verifiable ingredient sourcing is stringent, heavily favoring organic and ethically produced sauces. Major consumption is concentrated in Western Europe (UK, Germany), with smaller, promising markets emerging in Eastern Europe focused on regional chili preparations.

- Latin America (LATAM): Represents high long-term market potential rooted in abundant indigenous pepper varieties (e.g., Aji, Rocoto) and rich traditional recipes; there is increasing industrial use of chili derivatives in processed snacks and ready meals targeted at both local and international export markets. Brazil and Mexico are primary growth engines, leveraging strong agricultural bases and developing sophisticated domestic manufacturing capabilities for both powdered and liquid chili formats.

- Middle East and Africa (MEA): An emerging market driven primarily by youth population growth, expanding access to international food trends, and increasing disposable incomes; local production capacity is steadily expanding, but imports of specialized premium sauces remain high, often targeting affluent consumer segments. Logistical challenges related to extreme temperature control and ensuring optimal shelf stability in arid climates necessitate specialized packaging science and resilient distribution protocols.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Chili Sauce Market.- Huy Fong Foods, Inc.

- McCormick & Company, Inc.

- The Kraft Heinz Company

- Conagra Brands, Inc.

- General Mills, Inc.

- Unilever PLC

- PepsiCo Inc. (through subsidiaries like Frito-Lay and Taco Bell)

- Tabasco (McIlhenny Company)

- Lee Kum Kee Company Limited

- Cholula Food Company (Acquired by McCormick)

- TW Garner Food Co. (Texas Pete)

- Kikkoman Corporation

- Nestle S.A.

- Thai Pride Food Industry Co. Ltd.

- Burns Philp & Co. Ltd. (Frank's RedHot)

- Baumer Foods, Inc. (Crystal Hot Sauce)

- Goya Foods, Inc.

- Walkerswood Caribbean Foods

- Sriraja Panich

- Reese Group (Trappey's Fine Foods)

- Ajinomoto Co., Inc.

- Fujian Kenbishi Food Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Chili Sauce market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Chili Sauce Market?

The Chili Sauce Market is anticipated to demonstrate robust annual growth, registering a Compound Annual Growth Rate (CAGR) of 6.5% during the forecast period spanning 2026 to 2033. This growth is primarily fueled by rising global consumer demand for ethnic and high-impact spicy flavors across all food consumption sectors.

Which product segment is currently driving the highest revenue in the chili sauce industry?

The conventional Hot Sauce type segment, characterized by wide market penetration and varying Scoville ratings, along with the Supermarkets and Hypermarkets distribution channel, currently accounts for the largest share of overall market revenue due to exceptionally high consumer volume and widespread product accessibility globally.

How does the volatility of raw material supply affect the chili sauce market?

The substantial supply volatility of fresh chili peppers, highly susceptible to unpredictable climate change, agricultural diseases, and logistical disruptions, acts as a primary market restraint, leading directly to fluctuating raw material costs, potential inconsistencies in product heat levels, and increased operational risk for all global manufacturers.

Which geographical region is expected to experience the fastest market growth?

North America, specifically driven by the United States market, is projected to exhibit the fastest percentage growth rate, fueled by strong, sustained demand for highly differentiated gourmet and artisanal hot sauces, driven by continuous product diversification and adventurous, flavor-seeking consumer preferences.

What major technological advancement is impacting chili sauce preservation and quality?

High-Pressure Processing (HPP) technology is a pivotal advancement, allowing manufacturers to significantly extend the safe shelf life and ensure the microbial safety of chili sauces while crucially retaining the superior fresh flavor, vibrant color, and nutritional characteristics, offering a clean-label alternative to traditional high-heat pasteurization.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager