Chilled Soup Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432308 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Chilled Soup Market Size

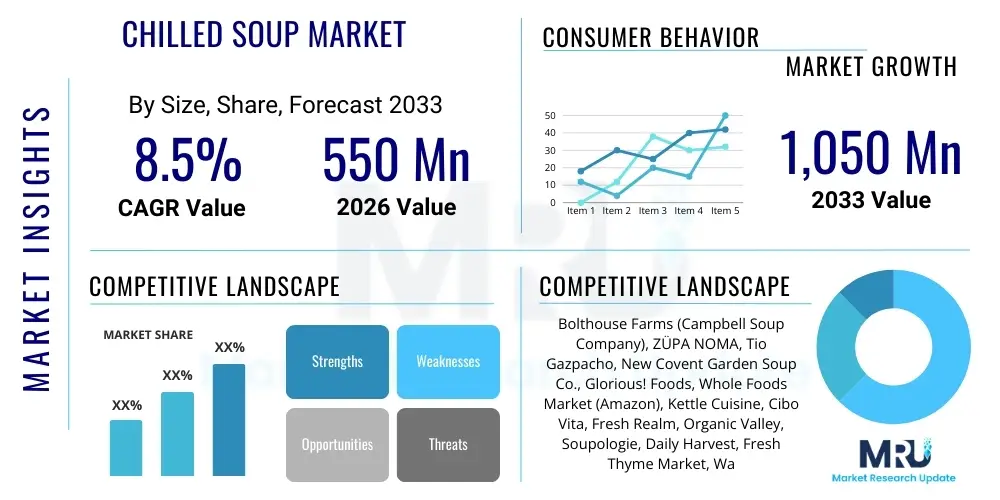

The Chilled Soup Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at $550 Million in 2026 and is projected to reach $1,050 Million by the end of the forecast period in 2033. This robust expansion is primarily fueled by shifting consumer preferences towards fresh, convenient, and minimally processed food options, particularly within high-income Western markets.

Chilled Soup Market introduction

The Chilled Soup Market encompasses ready-to-eat liquid food products that are formulated and packaged specifically for refrigeration and consumption without the need for heating. These products, ranging from traditional vegetable-based recipes like gazpacho and vichyssoise to innovative fruit and hybrid nutrient-dense formulas, are positioned as premium alternatives to conventional canned or dehydrated soups. The core appeal of chilled soups lies in their perceived freshness, higher nutritional retention compared to thermally processed counterparts, and unparalleled convenience for busy consumers seeking healthy meal or snack solutions.

Product descriptions typically emphasize clean labels, natural ingredients, and absence of artificial preservatives, aligning with macro consumer trends focusing on health and wellness. Major applications for chilled soups include quick lunch replacements, dietary supplements (especially green detox soups), and high-end appetizer offerings in the foodservice sector. The sophistication of packaging, often using sustainable materials like recyclable PET bottles or carton packs, further enhances the marketability of these products, appealing to environmentally conscious demographics seeking transparency in their food sourcing.

Driving factors for this market expansion include the increasing urbanization globally, which heightens the demand for convenient ready meals, coupled with rising disposable incomes that allow consumers to afford premium refrigerated options. Furthermore, continuous product innovation, incorporating exotic flavors, functional ingredients (like probiotics or high fiber content), and plant-based protein sources, ensures sustained consumer interest and expands the consumption occasions beyond traditional soup seasons. The emphasis on cold-chain integrity and advanced processing techniques like High-Pressure Processing (HPP) secures product quality and safety, underpinning market confidence.

- Product Description: Ready-to-eat liquid foods stored and consumed chilled, offering fresh flavor profiles and high nutritional content.

- Major Applications: Quick lunch/dinner, healthy snack replacement, detox/cleanse programs, and specialized foodservice offerings.

- Key Benefits: Convenience, perceived freshness, high retention of vitamins and nutrients, and suitability for clean-label diets.

- Driving Factors: Rising consumer demand for convenience, increasing focus on health and wellness, and continuous innovation in plant-based and functional ingredients.

Chilled Soup Market Executive Summary

The Chilled Soup Market is characterized by robust business trends centered on premiumization and customization. Key market players are investing heavily in cold chain logistics to expand their geographic reach while maintaining product integrity. There is a discernible shift towards incorporating globally inspired flavors and functional ingredients, such as turmeric, ginger, and various superfoods, directly addressing the health consciousness of modern consumers. Strategic partnerships between producers and major retail chains, focusing on optimal shelf placement in high-traffic refrigerated sections, are vital for maintaining competitive advantage and driving impulse purchases, particularly in mature markets like North America and Western Europe.

Regional trends indicate that Europe, especially the UK, France, and Spain, holds a dominant position, largely due to the established culinary tradition of cold soups (e.g., gazpacho). However, North America is exhibiting the fastest growth, propelled by strong demand for healthy, quick meal alternatives and the effectiveness of e-commerce platforms in distributing short shelf-life items. The Asia Pacific region, though currently small, presents substantial long-term opportunity as urbanization accelerates and Western dietary habits are increasingly adopted among affluent urban populations, leading to increased demand for convenient, ready-to-eat formats.

Segment trends reveal that the Vegetable-Based segment dominates the market, specifically focusing on classic options like tomato, cucumber, and blended greens, often marketed as natural detox aids. Packaging segmentation shows a strong preference for portable, single-serving containers (cups and small bottles), reflecting the on-the-go consumption culture. Within distribution, supermarkets and hypermarkets remain the primary sales channel, but the Online Retail segment is rapidly gaining momentum, offering greater convenience and personalized subscription services for regular consumers.

AI Impact Analysis on Chilled Soup Market

Users frequently inquire how AI can enhance the supply chain efficiency, flavor innovation, and demand forecasting within the perishable Chilled Soup Market. Key themes revolve around leveraging machine learning for predictive inventory management to minimize spoilage—a critical concern given the short shelf life—and utilizing AI-driven consumer data analytics to identify emerging flavor trends (e.g., combinations of spices, specific ingredient pairings) that drive new product development. Furthermore, consumers and industry professionals are keen on understanding how AI can optimize manufacturing processes, such as ingredient blending and temperature control during HPP, ensuring consistent, high-quality output while reducing waste and optimizing cost structures in this premium sector.

- AI optimizes cold chain logistics by predicting potential delays and temperature deviations.

- Machine learning algorithms enhance demand forecasting, reducing inventory holding costs and minimizing product spoilage.

- AI-driven flavor profiling analyzes consumer feedback and social media trends to accelerate novel recipe development and ingredient blending.

- Robotics and computer vision, enabled by AI, improve quality control during packaging and high-pressure processing (HPP) stages.

- Predictive maintenance schedules for refrigeration equipment are generated, ensuring operational continuity critical for temperature-sensitive products.

DRO & Impact Forces Of Chilled Soup Market

The Chilled Soup Market is primarily driven by the escalating consumer demand for convenient, healthy food options that align with busy lifestyles, coupled with a growing preference for minimally processed foods perceived as having superior nutritional value and fresher taste profiles. Restraints predominantly involve the inherent challenges associated with distributing and storing perishable goods, necessitating expensive cold chain logistics and resulting in a significantly shorter shelf life compared to traditional shelf-stable soups, which translates into higher retail prices and increased risk of inventory loss. However, opportunities abound in emerging markets where health awareness is rising and through strategic expansion into functional food categories, such as incorporating immune-boosting ingredients or utilizing advanced non-thermal preservation technologies like HPP to moderately extend shelf life.

Impact forces within this market are shaped by both economic and technological factors. On the demand side, macroeconomic growth and rising disposable incomes globally increase the affordability of premium, refrigerated products. Technologically, innovations in food processing and packaging, specifically HPP, act as a crucial enabling force, allowing manufacturers to maintain the product's nutritional and sensory qualities without relying on heat or artificial preservatives. Regulatory scrutiny concerning clean labeling and food safety standards also impacts the market, favoring manufacturers capable of demonstrating stringent quality control and ingredient transparency.

The balance between the need for product freshness (a driver) and the logistical complexity required to maintain that freshness (a restraint) dictates market dynamics. Manufacturers that successfully navigate this complexity by optimizing their supply chain using advanced monitoring technologies will capture greater market share. The opportunity to cater to specific dietary needs—vegan, gluten-free, low-carb—is substantial, allowing brands to segment the market and achieve premium pricing, reinforcing the market's high-value trajectory despite the existing operational challenges inherent to perishable goods.

Segmentation Analysis

The Chilled Soup Market is systematically segmented based on composition, packaging type, and distribution channel, providing a clear map of consumer preferences and market reach. Analysis of these segments is crucial for strategic business planning, allowing companies to tailor product development and marketing efforts towards the most lucrative demographic niches. The dominant segmentation by type reflects the broad spectrum of ingredients used, catering to diverse palates and dietary requirements, while packaging segmentation emphasizes the growing demand for portability and single-serving convenience suitable for modern, on-the-go consumption patterns. Distribution channel analysis highlights the persistent importance of physical retail spaces, alongside the rapidly expanding potential of direct-to-consumer online platforms.

- By Type:

- Vegetable-Based (Gazpacho, Tomato, Beetroot, Cucumber)

- Fruit-Based (Berry, Peach, Melon)

- Blended/Hybrid (Incorporating grains, legumes, or dairy alternatives)

- By Packaging:

- Bottles (PET, Glass)

- Cartons/Tetra Paks

- Cups/Bowls (Single-serving containers)

- By Distribution Channel:

- Supermarkets & Hypermarkets

- Convenience Stores

- Online Retail

- Specialty Food Stores

Value Chain Analysis For Chilled Soup Market

The value chain for the Chilled Soup Market begins with the upstream segment, encompassing the sourcing and procurement of high-quality, often organic or locally sourced, fresh ingredients, including premium vegetables, fruits, and spices. Since product freshness is the primary differentiator, the efficiency and quality control at the raw material stage are paramount. Key upstream activities involve detailed supplier audits, ensuring compliance with strict agricultural standards, and managing highly seasonal inputs. The reliance on advanced agricultural practices and fast transportation to the processing facility significantly influences the final product cost and quality, making vertical integration or strong supplier partnerships highly advantageous.

The midstream process involves manufacturing, which is highly specialized due to the requirement for non-thermal processing methods, primarily High-Pressure Processing (HPP), to ensure microbial safety while retaining nutrient integrity. This stage also includes blending, flavoring, and critical quality testing, followed by aseptic or modified atmosphere packaging in dedicated facilities. The distribution channel forms the critical downstream segment. Due to the requirement for continuous refrigeration (cold chain), logistics costs are significantly higher than those for shelf-stable goods. Direct and indirect channels are both employed, with indirect channels leveraging third-party logistics (3PL) providers specializing in refrigerated transport.

Direct distribution often occurs when manufacturers supply large national supermarket chains or specialty food retailers with centralized temperature-controlled warehouses, allowing for tighter inventory control. Indirect distribution, frequently utilized for small, specialized organic retailers or through e-commerce fulfillment centers, requires robust partnership agreements to ensure the cold chain is never broken, impacting the final consumer experience and product safety. The efficiency of the distribution network, particularly the "last mile" delivery in urban areas, is a key determinant of success and market penetration in this sensitive product category.

Chilled Soup Market Potential Customers

The primary potential customers for the Chilled Soup Market are health-conscious consumers aged 25 to 55 residing in urban and suburban areas, characterized by high disposable incomes and demanding schedules. These end-users, often professionals or parents, prioritize convenience without compromising on nutrition or taste, making ready-to-eat chilled options highly appealing. They are typically educated about dietary trends, actively seek products with clean labels (minimal ingredients, no artificial additives), and show a strong preference for ingredients that support specific health goals, such as enhanced immunity, gut health, or weight management. This demographic values premiumization and is willing to pay a higher price for perceived quality and wellness benefits.

Another significant customer segment includes the growing population of vegans, vegetarians, and flexitarians. Chilled soups are inherently versatile and can easily be formulated to be plant-based, gluten-free, or dairy-free, catering perfectly to these specialized dietary requirements. Manufacturers target this group by prominently featuring certifications and ingredient transparency on their packaging. Furthermore, the rising demand for meal replacements in corporate environments and among older adults who seek easily digestible and nutritious foods also positions them as key buyers. The trend of using chilled soups as part of "detox" or "cleansing" programs also drives periodic, high-volume purchases by consumers focused on short-term dietary resets.

Beyond individual consumers, the foodservice sector, including high-end cafes, corporate cafeterias, and airlines, represents a vital institutional customer base. These commercial buyers utilize chilled soups for portion control, minimizing preparation time, and maintaining consistent quality across multiple locations. The appeal here is operational efficiency and reliability, ensuring they can offer fresh, high-quality, seasonal items quickly without extensive in-house kitchen labor. Customized bulk packaging and specialized delivery schedules are often required to service this specific group of end-users.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $550 Million |

| Market Forecast in 2033 | $1,050 Million |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bolthouse Farms (Campbell Soup Company), ZÜPA NOMA, Tio Gazpacho, New Covent Garden Soup Co., Glorious! Foods, Whole Foods Market (Amazon), Kettle Cuisine, Cibo Vita, Fresh Realm, Organic Valley, Soupologie, Daily Harvest, Fresh Thyme Market, Wawa, Soupergirl, Trader Joe's, Waitrose, Tabatchnick Fine Foods, Good & Gather (Target), Dr. McDougall's Right Foods |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Chilled Soup Market Key Technology Landscape

The technological landscape of the Chilled Soup Market is dominated by advancements in non-thermal preservation and sophisticated cold chain management systems, which are essential for maintaining the product's premium quality and safety without resorting to traditional heat sterilization. High-Pressure Processing (HPP) stands out as the most crucial technology; it uses intense water pressure to inactivate pathogens and spoilage organisms, significantly extending the refrigerated shelf life from a few days up to several weeks, while preserving the fresh taste, color, and thermosensitive nutrients. The adoption of HPP dictates the feasibility of large-scale market penetration for premium chilled soups, directly affecting production costs and geographical distribution capabilities. Investments in HPP machinery and associated infrastructure are a core strategic priority for market leaders.

Beyond preservation, advanced packaging technology plays a vital role in the segment's success. This includes the use of oxygen barrier materials (like multi-layer PET or specific films for cups) to prevent oxidation, which can quickly degrade flavor and nutritional content. Additionally, smart packaging solutions, such as temperature monitoring indicators or QR codes linked to detailed ingredient sourcing information, are increasingly integrated to enhance consumer trust and verify cold chain integrity. These innovations support the clean label movement by minimizing the need for chemical preservatives and providing consumers with necessary transparency regarding product handling and freshness status.

Logistics technology, encompassing advanced refrigeration units, real-time temperature tracking via IoT sensors, and optimized routing algorithms, forms the backbone of successful market operations. These systems minimize thermal abuse during transit and storage, which is critical for preventing rapid spoilage. Furthermore, automated blending and filling systems ensure production consistency, reduce human error, and increase throughput efficiency. The synergistic deployment of HPP, barrier packaging, and smart cold chain monitoring defines the competitive advantage in delivering consistently fresh and safe chilled soup products to a widely dispersed consumer base, facilitating market growth and reducing operational wastage.

Regional Highlights

Europe currently represents the largest market share for chilled soups, driven by strong culinary traditions, particularly in Southern European countries like Spain (gazpacho) and Italy, and high demand in the UK and France for convenient, high-quality ready meals. The European consumer base is mature, highly aware of provenance, and places a strong emphasis on organic and locally sourced ingredients. Regulatory standards regarding food safety and labeling in the European Union also push manufacturers to maintain exceptional quality control, further cementing the region's position as a trendsetter in premium refrigerated goods.

North America is projected to exhibit the highest Compound Annual Growth Rate (CAGR) throughout the forecast period. This rapid growth is propelled by the pervasive culture of convenience, busy lifestyles, and increasing health consciousness among the U.S. and Canadian populations. The market here is characterized by aggressive flavor innovation and the integration of chilled soups into mainstream grocery diets, often marketed as nutrient-dense meal replacements rather than just appetizers. Strong e-commerce infrastructure, particularly through major grocery retailers and meal kit delivery services, facilitates seamless distribution of short shelf-life items across vast geographies.

The Asia Pacific (APAC) region remains an emerging market but holds substantial future potential. Growth is concentrated in rapidly urbanizing economies such as China, Japan, and Australia, where Western dietary influences and the demand for easy, ready-to-eat meals are escalating. Challenges include establishing adequate cold chain infrastructure across developing areas and adapting Western recipes to local palates. However, rising disposable income and the growing sophistication of retail environments are creating fertile ground for market expansion, particularly targeting affluent, health-aware young professionals seeking premium imported or high-quality local chilled options.

- North America: Fastest growing region; high consumer demand for convenience; strong adoption of HPP technology; dominant market for meal replacement soups.

- Europe: Largest market share; established consumer base; strong emphasis on natural, organic, and traditional recipes (Gazpacho, Vichyssoise); robust regulatory standards.

- Asia Pacific (APAC): High growth potential fueled by urbanization and rising disposable incomes; focus on establishing reliable cold chain logistics; key markets include Australia and urban centers in China.

- Latin America & MEA: Nascent markets with niche growth, primarily focused on affluent urban centers; high potential for localized flavor adaptation and expansion of cold chain capabilities in the long term.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Chilled Soup Market.- Bolthouse Farms (Campbell Soup Company)

- ZÜPA NOMA

- Tio Gazpacho

- New Covent Garden Soup Co.

- Glorious! Foods

- Whole Foods Market (Amazon)

- Kettle Cuisine

- Cibo Vita

- Fresh Realm

- Organic Valley

- Soupologie

- Daily Harvest

- Fresh Thyme Market

- Wawa

- Soupergirl

- Trader Joe's

- Waitrose

- Tabatchnick Fine Foods

- Good & Gather (Target)

- Dr. McDougall's Right Foods

- Koia (Functional beverages and soups)

- Blue Apron (Offering chilled soup as meal kit component)

- Plenish Cleanse

Frequently Asked Questions

Analyze common user questions about the Chilled Soup market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is High-Pressure Processing (HPP) and why is it important for chilled soup?

HPP is a non-thermal preservation technique utilizing intense pressure to eliminate harmful bacteria and spoilage organisms. It is vital for chilled soup as it significantly extends refrigerated shelf life while preserving the product’s fresh flavor, natural texture, and heat-sensitive nutrients without needing chemical additives.

Which region dominates the global Chilled Soup Market share?

Europe currently holds the largest market share, driven by strong consumer demand for convenient, high-quality prepared foods and deeply rooted culinary traditions involving cold soups, notably in Mediterranean countries like Spain and Italy.

Are chilled soups considered healthier than canned or shelf-stable soups?

Generally, yes. Chilled soups often undergo minimal or no thermal processing, which helps retain a higher content of vitamins and antioxidants. They are also typically formulated with fewer artificial preservatives, meeting the consumer preference for clean-label products.

What are the main distribution channels used for Chilled Soup products?

The primary distribution channels are Supermarkets and Hypermarkets, owing to their extensive refrigerated display capacities. However, Online Retail is rapidly growing in importance, offering subscription models and facilitating the reliable delivery of temperature-sensitive items directly to consumers.

What is the biggest operational challenge faced by manufacturers in this market?

The greatest operational challenge is maintaining the strict cold chain integrity throughout the supply network. The short shelf life of chilled soups necessitates highly efficient, temperature-controlled logistics and inventory management to prevent spoilage and financial loss.

The market analysis presented herein confirms the accelerated trajectory of the Chilled Soup Market, underlining its status as a key growth segment within the broader convenient and healthy ready-to-eat food sector. The convergence of technological advancements, particularly HPP adoption, and evolving consumer health priorities ensures sustained investment and product diversification across all major geographies, with particular focus on integrating functional ingredients and sustainable packaging solutions. Industry participants must strategically manage the complexities of cold chain logistics and inventory optimization to capitalize fully on the premiumization trend that defines this dynamic market segment. Detailed data analysis, focusing on localized flavor preferences and demographic purchasing behavior, will be paramount for competitive differentiation and successful new product launches in the coming forecast period spanning 2026 to 2033, ensuring long-term profitability and enhanced market penetration globally.

Further elaborations on the segmentation and regional analysis reveal nuanced market opportunities. Within the Vegetable-Based segment, there is increasing differentiation based on ingredient sourcing, with consumers seeking certified organic or non-GMO vegetables, driving up the average unit price. Manufacturers are focusing on ethnic flavors, such as Japanese miso-based cold soups or South American ceviche-style blends, broadening the appeal beyond traditional Western tastes. The shift toward smaller, more frequent grocery trips also favors the convenience store distribution channel, where quick, healthy options capture impulse purchases effectively. This necessitates tailored packaging designs optimized for visibility and grab-and-go convenience, reflecting the high mobility of the target consumer base and their need for immediate consumption solutions, reinforcing the premium value proposition of the chilled format.

In terms of competitive landscape, market leaders are increasingly focusing on strategic acquisitions of smaller, specialized brands known for innovative flavor profiles or unique HPP application methods, thereby consolidating technological advantages and expanding product portfolios rapidly. This M&A activity is expected to intensify, particularly in North America, as established players seek to secure market share in the high-growth functional soup categories (e.g., soups fortified with collagen or high-fiber blends). Regulatory changes, particularly those relating to waste reduction and packaging recyclability, will continue to influence material choices, favoring sustainable carton packaging over traditional plastics where feasible, aligning with global environmental governance trends and catering to the eco-conscious consumer segment, thereby enhancing brand reputation and long-term viability in key international markets.

The role of digital platforms extends beyond simple distribution. E-commerce channels are evolving into personalized consultation platforms, offering tailored soup recommendations based on user health goals, dietary restrictions, or meal planning schedules. This enhanced digital engagement allows for unprecedented levels of customer loyalty and provides manufacturers with direct, granular data on consumption patterns, enabling highly precise iterative product development cycles and inventory adjustments. The integration of AI in inventory management, as detailed previously, is crucial for matching fluctuating online demand with a highly perishable supply, minimizing stockouts during peak periods while drastically cutting down on waste—a major operational metric for modern food supply chains. This technological integration represents a fundamental shift in managing perishable goods logistics, setting chilled soups apart from conventional food categories in terms of operational sophistication and required capital investment in advanced infrastructure. The long-term success hinges on mastery of this sophisticated cold chain management.

Considering the strong influence of nutritional science, future innovation in the Chilled Soup Market will likely center on 'active' ingredients. We anticipate increased incorporation of ingredients marketed for specific health outcomes, such as adaptogens (Rhodiola, Ashwagandha) for stress reduction, specialized protein peptides for muscle recovery, and prebiotics/probiotics for enhanced gut biome support. These formulations elevate chilled soups from simple convenience food to genuine functional wellness products, commanding higher price points and attracting specialized consumer segments focused on preventative health maintenance. Furthermore, advancements in natural preservation techniques beyond HPP, such as novel antimicrobial extracts derived from plants or fruits, are continuously being explored to find cost-effective ways to extend shelf life without compromising the clean label promise. This relentless pursuit of both convenience and superior nutritional integrity ensures the chilled soup category maintains its premium positioning and continued rapid growth in the global food landscape, appealing specifically to urban consumers who equate quality food with minimal processing and maximum nutrient delivery capabilities in a ready-to-eat format.

The emphasis on clean label production requires significant investment in traceability systems. Blockchain technology is emerging as a critical tool, allowing consumers and manufacturers alike to track ingredients from farm to factory and final refrigerated shelf, providing an immutable record of quality and handling. This level of transparency is becoming non-negotiable for premium brands operating in the chilled goods sector, particularly those sourcing ingredients globally where ethical and environmental compliance is a major consumer concern. The integration of such sophisticated tracking mechanisms increases operational costs initially but serves as a powerful differentiator in marketing materials, establishing the brand as a leader in integrity and quality assurance. This focus on traceability is particularly strong in markets like Germany and Scandinavia, where consumer expectations for sustainable and ethical food production are among the highest globally, driving best practices throughout the supply chain and influencing global manufacturing standards.

Finally, the competitive strategy involves not just product innovation but also efficient shelf space management. Given the high cost of refrigerated display space in retail environments, manufacturers must demonstrate rapid inventory turnover. This requires robust promotional strategies, effective in-store merchandising designed to maximize visibility, and data-driven agreements with retailers regarding optimal product assortment. Brands that can prove their high velocity of sales are granted better placement and greater opportunity for seasonal product rotations. The logistical efficiency gained through AI and HPP technology directly translates into higher inventory turnover, thus reducing slotting fees and maximizing profit margins, forming a virtuous cycle that favors technologically advanced and strategically nimble players in the intensely competitive refrigerated grocery aisle environment.

The detailed market size projections underpin a confidence in sustained consumer adoption. The forecasted $1,050 Million market value by 2033 reflects a strong market reception to innovation in flavor and format, and the continued willingness of consumers to invest in health-oriented convenience items. This valuation is conservative, considering potential breakthroughs in shelf life extension technologies that could dramatically reduce distribution costs and unlock access to currently underserved rural or developing markets where cold chain infrastructure is nascent. The 8.5% CAGR signifies that chilled soup is outpacing many traditional CPG (Consumer Packaged Goods) categories, confirming its status as a high-value growth engine within the food and beverage industry, attracting significant venture capital and strategic corporate interest globally.

Further analysis of the regulatory environment shows divergence across regions, particularly concerning the use of non-thermal processing methods. While the FDA and EFSA have broadly approved HPP, localized regulations concerning labeling of "minimally processed" foods and ingredient origin claims require careful navigation. Companies operating across multiple jurisdictions must maintain distinct packaging and labeling protocols to ensure compliance, adding complexity to international expansion efforts. This complexity contributes to the barrier to entry for smaller or less established players, inadvertently favoring large multinational corporations with extensive regulatory and legal departments capable of managing disparate global standards effectively, thereby influencing the market structure toward consolidation over time, particularly in highly regulated Western markets.

The impact of seasonality on the Chilled Soup Market is also evolving. Traditionally, cold soups were strong summer items, but innovation has led to year-round consumption. Manufacturers now introduce 'hybrid' soups that can be consumed chilled or gently warmed, blurring the seasonal lines and creating stable demand throughout the calendar year. Examples include chilled vegetable broths or specialized functional soups marketed for recovery or hydration, making them relevant post-workout or during periods of illness, regardless of external temperature. This adaptation strategy is critical for evening out production schedules and ensuring consistent utilization of expensive HPP and cold storage assets, maximizing operational efficiency throughout the entire annual cycle.

Finally, social responsibility drives market perception. Consumers increasingly support brands that minimize food waste—a major concern in the perishable sector. Brands that actively partner with food banks or use surplus/ugly produce in their formulations gain a powerful ethical marketing advantage. This focus on circular economy principles and waste reduction is particularly strong among younger generations (Millennials and Gen Z), who are disproportionately high consumers of refrigerated, healthy convenience foods. Thus, sustainability metrics, alongside ingredient quality and nutritional value, form the third pillar of competitive excellence in the Chilled Soup Market, influencing purchasing decisions and brand loyalty in key consumer segments.

The strategic differentiation for new entrants often focuses on highly specialized niches, such as ketogenic, paleo, or autoimmune protocol (AIP) compliant chilled soups, which cater to extremely specific dietary communities. These niche products often bypass traditional supermarket distribution initially, relying heavily on direct-to-consumer e-commerce platforms and specialty health food stores to reach their targeted audience effectively. While these segments represent smaller volumes, they command exceptionally high margins due to the specialized nature of the ingredients and the precise formulation required. Success in these micro-segments can serve as a proving ground for broader market expansion, demonstrating the brand's commitment to quality and dietary specificity before entering mainstream channels. The flexibility offered by smaller batch production, enabled by modular HPP units, is key to exploiting these specialized market opportunities profitably.

Further economic pressures stemming from global inflation impact the raw material costs for premium fresh produce, which is a significant factor in the Chilled Soup Market. Unlike shelf-stable soups that rely on less expensive dehydrated or canned ingredients, chilled soups are highly susceptible to fluctuations in agricultural commodity prices, labor costs for harvesting, and energy costs associated with maintaining the cold chain. These cost pressures necessitate efficient pricing strategies that balance consumer price sensitivity with the need to maintain premium brand positioning. Manufacturers must continually seek efficiency gains through automation and supply chain optimization to absorb these escalating input costs without alienating their core customer base, ensuring that the final retail price remains justifiable relative to the perceived superior freshness and nutritional content offered by the chilled format.

In terms of technology scouting, the industry is closely monitoring advancements in edible coatings and natural preservative sprays that could further enhance the microbiological stability of the ingredients before processing, offering an additional layer of safety and potentially allowing for even milder HPP treatments. Furthermore, the development of localized, decentralized HPP hubs, where processing occurs closer to the point of consumption or agricultural sourcing, promises to revolutionize cold chain management by cutting down long-haul transportation of unprocessed or highly perishable goods. This geographical optimization could significantly lower carbon footprints and reduce logistics overhead, aligning operational sustainability with economic efficiency—a dual benefit highly valued by modern industrial leaders in this high-growth sector.

The shift towards plant-based diets continues to exert a profound influence on product development. Even traditional cream-based chilled soups (like vichyssoise) are being reformulated using non-dairy alternatives, such as oat, almond, or coconut milk, to appeal to lactose-intolerant consumers and the growing vegan population. This reformulation effort is technically challenging as plant-based substitutes must deliver the same creamy mouthfeel and stability under refrigeration as their dairy counterparts, requiring careful selection of stabilizers and emulsifiers—while still adhering to stringent clean label requirements. Successful navigation of these formulation hurdles provides a significant competitive edge, allowing brands to access the dominant health-conscious market segments driving the overall market expansion.

Finally, the growing adoption of smart refrigeration technology at the retail level is indirectly supporting market growth. Retailers are installing sophisticated display units that provide real-time temperature monitoring and alerts, minimizing the risk of thermal abuse on the shelf and protecting product quality for the consumer. This increased reliability in the retail environment encourages both manufacturers to expand their chilled product lines and consumers to trust the integrity of the product upon purchase, creating a more robust and dependable final link in the highly sensitive chilled supply chain. This technological investment by retailers is a fundamental prerequisite for sustained high-volume sales in the premium ready-to-eat chilled soup category.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager