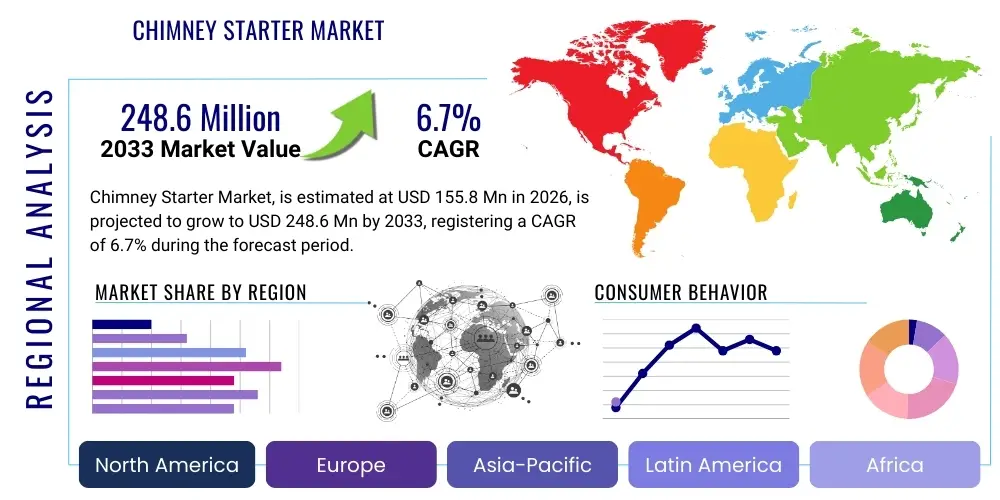

Chimney Starter Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436250 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Chimney Starter Market Size

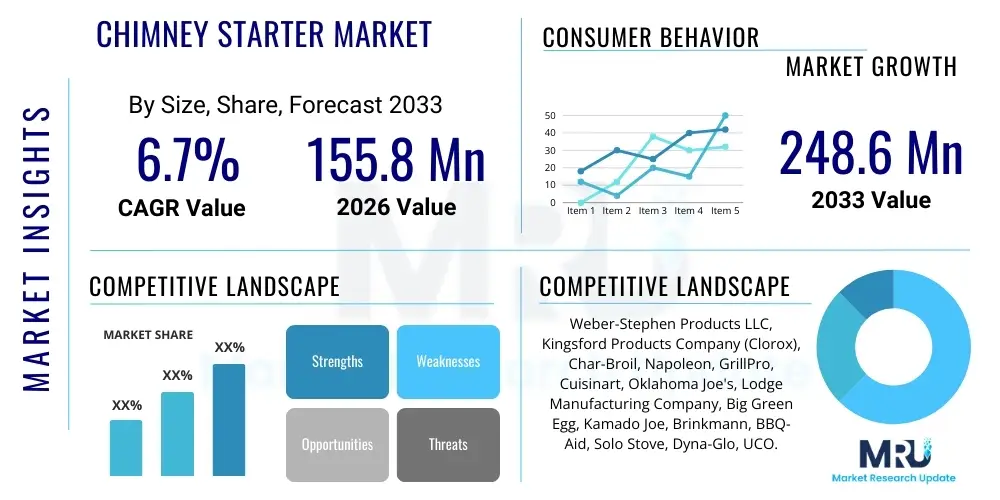

The Chimney Starter Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.7% between 2026 and 2033. The market is estimated at USD 155.8 Million in 2026 and is projected to reach USD 248.6 Million by the end of the forecast period in 2033. This growth trajectory is fundamentally supported by the sustained global interest in outdoor cooking, specifically the traditional and flavor-rich experience offered by charcoal grilling. The convenience and efficiency provided by chimney starters, significantly reducing the time and reliance on lighter fluid for charcoal preparation, are key adoption factors across residential and commercial sectors. Furthermore, product innovation focusing on durable materials, enhanced heat transfer efficiency, and safety features is driving consumer willingness to upgrade existing grilling tools.

The market expansion is also geographically diverse, with strong uptake noted in established markets like North America and Europe, which possess high rates of home ownership and established grilling cultures. Emerging economies, particularly in Asia Pacific, are witnessing increased demand driven by rising disposable incomes and the Westernization of leisure activities, including backyard barbecuing. The shift toward sustainable practices in grilling, where chimney starters eliminate the need for chemical fire starters, further validates the robust financial outlook for this specialized segment of the grilling accessories industry. Market participants are increasingly focusing on robust supply chain management and leveraging digital platforms to reach a wider global consumer base, contributing significantly to the anticipated revenue growth.

Chimney Starter Market introduction

The Chimney Starter Market encompasses the global trade of cylindrical metal containers designed to rapidly and safely ignite charcoal briquettes or lump charcoal for grilling purposes. These devices operate on the principle of convection, drawing heat upward through the charcoal load, enabling quick, uniform ignition without the need for flammable liquids, thereby enhancing both safety and flavor profile in outdoor cooking. Product offerings range from basic galvanized steel models to premium stainless steel versions featuring heat-resistant handles and collapsible designs for portability. Major applications span residential backyard grilling, professional catering, camping, and outdoor recreational activities. The primary benefits include accelerated charcoal preparation (often cutting ignition time in half), consistency in heat generation, and the elimination of chemical residue often associated with lighter fluids, contributing to better-tasting food and a cleaner burn.

Driving factors propelling market growth include the enduring global popularity of charcoal grilling, especially among gourmet enthusiasts who prioritize flavor over convenience offered by gas grills. The increasing frequency of outdoor leisure activities, coupled with urbanization leading to smaller but dedicated outdoor spaces, boosts demand for efficient, compact grilling accessories. Furthermore, growing consumer awareness regarding the health and environmental risks associated with chemical fire starters positions the chimney starter as a responsible and necessary tool. Manufacturers are capitalizing on these trends by introducing innovative designs, such as models compatible with specialized grilling inserts and those utilizing recycled or sustainable materials, ensuring continued relevance in a competitive culinary tools market. The convergence of safety, efficiency, and environmental consciousness underpins the market's positive trajectory.

Chimney Starter Market Executive Summary

The Chimney Starter Market is characterized by stable growth, primarily fueled by strong business trends focusing on material science advancements and direct-to-consumer (DTC) digital sales channels. Key business trends involve the segmentation of products based on material durability (stainless steel commanding a premium) and size suitability (small for camping, large for commercial use). Companies are heavily investing in marketing the product as an essential safety and flavor-enhancing tool, rather than a mere accessory. The competitive landscape is fragmented, with established grilling brands vying against niche, e-commerce-focused manufacturers that leverage optimized supply chains from Asia Pacific production hubs. Profitability remains healthy due to the relatively low manufacturing complexity offset by high consumer perceived value.

Regionally, North America and Europe remain the dominant revenue generators, driven by high per capita spending on outdoor leisure goods and well-entrenched barbecue traditions. However, the Asia Pacific region, particularly countries like Australia, China, and India, is registering the fastest growth rate, attributable to increasing disposable incomes, modernization of consumer habits, and rising popularity of Western-style grilling culture. Segments trends show that the stainless steel material category is experiencing higher revenue growth compared to traditional galvanized steel, owing to consumer preference for longevity and resistance to corrosion. Furthermore, the large capacity segment (accommodating 50+ briquettes) is showing significant adoption among frequent users and professional outdoor cooks, signaling a maturity in usage patterns where efficiency is prioritized over initial cost.

AI Impact Analysis on Chimney Starter Market

User inquiries regarding the impact of Artificial Intelligence on the Chimney Starter Market typically center on supply chain optimization, smart inventory management, and personalized marketing strategies, rather than direct product application, as the chimney starter is a mechanical, non-electronic device. Common questions include: "How can AI predict demand spikes for grilling season accessories?", "Can AI models optimize the logistics of bulky metal products?", and "Are there AI-driven marketing techniques targeting specific grilling demographics?" The analysis reveals key themes focusing on efficiency gains: reducing waste in manufacturing, predicting optimal stock levels across geographically dispersed distribution centers, and tailoring advertising content (e.g., video tutorials) based on regional grilling preferences and weather forecasts. Users expect AI to streamline the backend operations of chimney starter manufacturers, making products more accessible and competitively priced, while improving the shopping experience through better recommendation engines.

- AI-driven demand forecasting optimizes production schedules, minimizing overstock and obsolescence related to seasonal demand shifts.

- Predictive maintenance analytics applied to manufacturing machinery enhances output quality and reduces downtime in metal forming and stamping processes.

- AI-powered e-commerce recommendation engines personalize accessory bundles (e.g., matching a chimney starter with specific charcoal types or grills) increasing average order value.

- Optimized logistics routing and warehousing, informed by AI, reduce shipping costs for bulky items, benefiting both manufacturers and end-users.

- Chatbots and natural language processing (NLP) improve customer service handling queries related to product usage, troubleshooting, and material specifications.

DRO & Impact Forces Of Chimney Starter Market

The market dynamics are significantly influenced by a blend of persistent drivers, notable restraints, and compelling opportunities that shape competitive strategies and consumer adoption rates. Key drivers include the global enduring trend towards authentic charcoal flavor in food preparation, the inherent safety and convenience offered by chimney starters compared to traditional methods, and increasing disposable income dedicated to leisure and outdoor living products. These positive forces establish a solid foundational demand across most developed and rapidly developing economies. However, the market faces restraints such as intense competition from alternative, non-charcoal grilling methods (gas and electric grills), the perception of the chimney starter as a non-essential accessory rather than a mandatory purchase, and price volatility in raw materials, particularly steel and aluminum, which directly impacts manufacturing costs and retail pricing.

Opportunities for expansion lie primarily in product differentiation through advanced material innovation, such as utilizing corrosion-resistant alloys or developing sustainable, eco-friendly variants. The expansion of e-commerce channels, particularly in previously underserved rural or international markets, represents a major untapped sales avenue. Furthermore, strategic partnerships with barbecue associations, culinary schools, and major retailers can significantly enhance brand visibility and consumer education regarding the benefits of the product. The impact forces indicate a market characterized by high substitution threat (due to alternative ignition methods) but moderate entry barriers for specialized manufacturers. The purchasing power of consumers is high, especially for premium, durable goods, necessitating a focus on quality assurance and extended product warranties to capture discerning market segments.

Segmentation Analysis

The Chimney Starter Market is segmented across multiple dimensions, primarily based on the material used in manufacturing, the capacity (size) of the device, and the primary application or end-user category. This segmentation is crucial for manufacturers to tailor their product lines and marketing strategies to specific consumer needs, ranging from the occasional backyard griller to the dedicated barbecue enthusiast or commercial caterer. Material segmentation highlights the trade-off between cost and durability, while capacity segmentation addresses varying requirements for meal sizes and frequency of grilling. Understanding these distinct segments allows market players to optimize pricing strategies and distribution channels, ensuring product availability where demand is most concentrated, such as specialized grilling stores or mass-market home improvement retailers.

The complexity within segmentation also reflects evolving consumer demands for convenience and specialization. For instance, the demand for collapsible or portable chimney starters within the camping and outdoor recreation segment contrasts sharply with the large-capacity, stationary requirements of commercial food service. Moreover, the segmentation by end-user (Residential vs. Commercial) dictates the required material thickness, handle robustness, and longevity specifications. This granular approach ensures that products meet the rigorous quality standards expected by professional users while remaining affordable and user-friendly for the vast residential consumer base, thereby maximizing market penetration and revenue potential across all key user demographics.

- By Material:

- Galvanized Steel

- Stainless Steel

- Aluminum/Other Alloys

- By Capacity:

- Small (Up to 40 Briquettes)

- Medium (40-75 Briquettes)

- Large (Over 75 Briquettes)

- By End-User:

- Residential

- Commercial (Restaurants, Catering, Events)

- By Distribution Channel:

- Online Retail (E-commerce, Company Websites)

- Offline Retail (Supermarkets, Hypermarkets, Specialty Stores, Hardware Stores)

Value Chain Analysis For Chimney Starter Market

The value chain for the Chimney Starter Market begins with the Upstream Analysis, which focuses on the sourcing and processing of core raw materials, predominantly steel (galvanized or stainless) and, to a lesser extent, aluminum, along with heat-resistant plastics or wood for handle components. Key upstream activities involve sheet metal procurement, quality testing, and transport logistics. Cost efficiencies achieved at this stage, particularly through bulk purchasing of steel coils, are critical determinants of the final product profitability. Manufacturing follows, involving sheet metal cutting, stamping, rolling, welding, and assembly, which are often concentrated in specialized manufacturing hubs in Asia Pacific to leverage lower labor and energy costs. Optimization of manufacturing throughput and minimizing scrap rate are central to enhancing operational efficiency within the value chain.

The Downstream Analysis involves the crucial activities of distribution, marketing, and sales. Distribution channels are bifurcated into Direct and Indirect methods. Direct sales primarily occur via brand-owned e-commerce platforms or large retailer partnerships (e.g., exclusive store brands). Indirect distribution utilizes wholesalers, specialized distributors of grilling equipment, and major online marketplaces like Amazon, which offer unparalleled global reach. Effective marketing—focused on demonstrating product utility, safety, and superior grilling outcomes—is essential for converting consumers who might otherwise rely on lighter fluid. Post-sale services, including warranty claims and user support, though minimal for a simple product like a chimney starter, contribute to brand loyalty and reputation management.

The interplay between manufacturing location and distribution strategy defines success. Companies that manage to optimize the flow of bulky, low-margin metal goods from production sites to diverse consumer endpoints—whether through efficient container shipping or localized distribution centers—gain a significant competitive edge. The shift towards e-commerce necessitates robust digital fulfillment capabilities, including efficient packaging to prevent transit damage, which is a unique logistical challenge for this product category given its sharp edges and size. This continuous push for supply chain transparency and responsiveness is essential for meeting seasonal spikes in consumer demand effectively.

Chimney Starter Market Potential Customers

The primary end-users and potential customers of chimney starters are broadly categorized into residential consumers who enjoy backyard grilling and commercial entities requiring reliable, high-volume charcoal ignition. Residential users constitute the largest volume segment, spanning casual weekend grillers, barbecue hobbyists, and dedicated pitmasters. These consumers seek convenience, safety, and a superior flavor experience that avoids the chemical taint of lighter fluid. Within the residential segment, there is a distinct sub-group of eco-conscious consumers who prioritize the elimination of chemical fire starters, making the chimney starter an environmentally responsible choice for their outdoor cooking needs.

The commercial segment includes restaurants specializing in smoked and grilled cuisine, professional catering services, and large event organizers. These entities require large-capacity, heavy-duty chimney starters made from materials like thick stainless steel to withstand continuous, high-heat usage. Reliability and speed are paramount in this sector, as charcoal preparation must integrate seamlessly into high-pressure kitchen or event timelines. Further potential customers include outdoor recreation enthusiasts, such as campers and hikers, who utilize smaller, more portable, often collapsible chimney starter designs to facilitate safe, quick fire starting in various outdoor environments. Targeting these distinct user profiles requires tailored product sizing, material specification, and appropriate distribution channels, emphasizing specialty stores for the high-end user and mass-market retail for the casual consumer.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 155.8 Million |

| Market Forecast in 2033 | USD 248.6 Million |

| Growth Rate | CAGR 6.7% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Weber-Stephen Products LLC, Kingsford Products Company (Clorox), Char-Broil, Napoleon, GrillPro, Cuisinart, Oklahoma Joe's, Lodge Manufacturing Company, Big Green Egg, Kamado Joe, Brinkmann, BBQ-Aid, Solo Stove, Dyna-Glo, UCO. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Chimney Starter Market Key Technology Landscape

The technology landscape for the Chimney Starter Market, while seemingly simple due to the product's mechanical nature, revolves heavily around advanced material science, ergonomic design engineering, and efficient manufacturing techniques. Core technology involves optimizing the airflow dynamics within the cylinder to maximize the Venturi effect, ensuring rapid and even heat distribution for quick charcoal ignition. This requires precise calculation of the diameter-to-height ratio and the geometry of the air intake holes at the base. Recent technological advancements focus on using higher-grade stainless steel alloys (such as 304 stainless steel) that offer superior resistance to thermal fatigue and corrosion, significantly extending product lifespan compared to traditional galvanized steel models which are prone to rust and degradation over repeated, high-temperature cycles.

Manufacturing technology plays a critical role in cost and quality control. Automated deep drawing and metal stamping processes ensure uniformity and structural integrity, crucial for safety and durability. Furthermore, the integration of heat-resistant, high-temperature polymer materials for handles and safety guards represents a key ergonomic technology trend, replacing traditional wood or poorly insulated metal. These polymer components must adhere to strict fire safety standards, providing insulation for the user while maintaining structural integrity near intense heat sources. Innovations also include integrated starter mechanisms or quick-release bottom grates designed to make the transfer of lit charcoal safer and more convenient, addressing common user pain points related to handling hot fuels.

Sustainability and product engineering convergence mark another important technological domain. Manufacturers are increasingly exploring the use of recycled stainless steel and designing products for easy disassembly and end-of-life recycling. The emphasis on compact and folding designs employs advanced hinge and locking mechanism engineering, catering to the growing portable and camping market segment without compromising structural stability when fully loaded with hot charcoal. Overall, while the core function remains convection-based, the technological focus is on enhancing user safety, maximizing product longevity, and improving manufacturing scalability and material efficiency, ensuring the chimney starter remains a reliable and competitive ignition tool.

Regional Highlights

- North America: This region holds the largest market share, driven by a deeply ingrained barbecue culture, high rates of home ownership with outdoor spaces, and high consumer spending on grilling accessories. The US and Canada are major markets, with consumers showing a strong preference for large-capacity, durable chimney starters, often purchasing premium products from established brands like Weber and Char-Broil.

- Europe: Europe represents a mature market with steady growth, led by Germany, the UK, and France. Grilling popularity is significant, particularly during summer months. Demand is characterized by a balance between conventional galvanized steel models for cost-consciousness and specialized stainless steel units, particularly driven by high standards for quality and environmental sustainability.

- Asia Pacific (APAC): APAC is the fastest-growing market, although starting from a lower base. Growth is propelled by urbanization, increasing disposable incomes, and the adoption of Western culinary and leisure habits in countries like China, Australia, and India. This region is also a key manufacturing hub, which influences global pricing and supply chain dynamics.

- Latin America: This region shows moderate growth, heavily influenced by local barbecue traditions (such as Churrasco in Brazil). Demand is primarily focused on functional, medium-capacity chimney starters. Economic volatility in some countries poses a constraint, leading consumers to often favor cost-effective or locally manufactured options.

- Middle East and Africa (MEA): The MEA market is still nascent but shows potential, especially in Gulf Cooperation Council (GCC) countries where outdoor entertaining is common during cooler seasons. Market penetration is limited by local grilling preferences and cultural factors, but increasing tourism and expatriate populations are driving niche demand for standard grilling accessories.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Chimney Starter Market.- Weber-Stephen Products LLC

- Kingsford Products Company (Clorox)

- Char-Broil

- Napoleon

- GrillPro

- Cuisinart

- Oklahoma Joe's

- Lodge Manufacturing Company

- Big Green Egg

- Kamado Joe

- Brinkmann

- BBQ-Aid

- Solo Stove

- Dyna-Glo

- UCO

- Steven Raichlen Best of Barbecue

- Outset

- FOGO Charcoal

- Backyard Grill (Walmart)

- Grizzly Gear

Frequently Asked Questions

Analyze common user questions about the Chimney Starter market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Chimney Starter Market?

The Chimney Starter Market is projected to exhibit a Compound Annual Growth Rate (CAGR) of 6.7% over the forecast period from 2026 to 2033, driven by sustained interest in charcoal grilling and product convenience.

Which material segment holds the largest market share in the Chimney Starter industry?

Galvanized steel historically accounts for the largest volume share due to cost-effectiveness, though the stainless steel segment is demonstrating faster revenue growth due to superior durability and corrosion resistance preferred by premium consumers.

How do chimney starters contribute to safer grilling practices?

Chimney starters significantly enhance grilling safety by eliminating the need for volatile chemical lighter fluids, reducing the risk of accidental flare-ups and minimizing dangerous handling of flammable liquids near fire.

Which geographical region is expected to show the fastest market growth?

The Asia Pacific (APAC) region is forecasted to display the fastest market growth, primarily fueled by rising disposable incomes, rapid urbanization, and the increasing adoption of Western outdoor cooking traditions in key emerging economies.

What are the primary factors restraining the growth of the Chimney Starter Market?

Market growth is primarily restrained by intense competition from alternative grilling methods, such as efficient gas and electric grills, and price volatility in raw materials like steel, which affects manufacturing costs and retail prices.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager