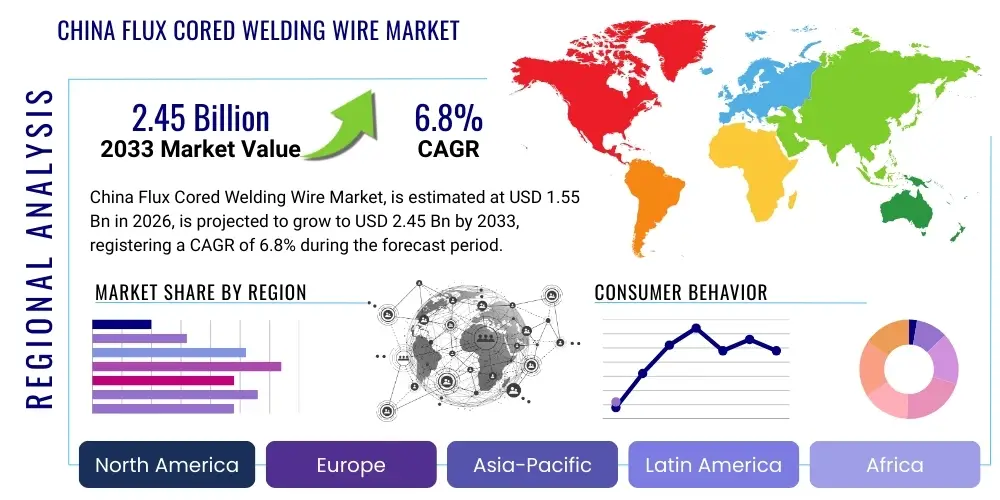

China Flux Cored Welding Wire Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434695 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

China Flux Cored Welding Wire Market Size

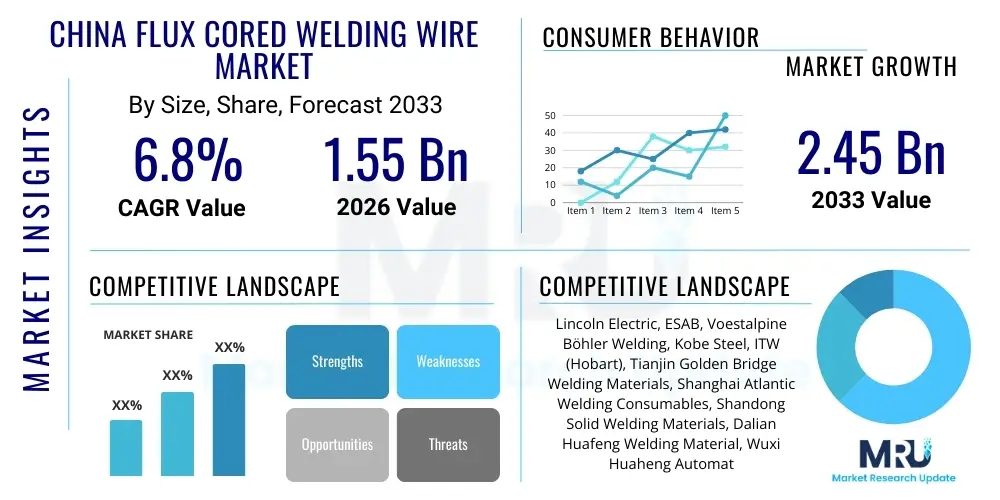

The China Flux Cored Welding Wire Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.55 Billion in 2026 and is projected to reach USD 2.45 Billion by the end of the forecast period in 2033. This steady expansion is primarily driven by significant investments in infrastructural development, robust growth in the shipbuilding and heavy fabrication sectors, and the increasing adoption of automated welding processes across diverse manufacturing industries within China.

China Flux Cored Welding Wire Market introduction

The China Flux Cored Welding Wire (FCW) Market encompasses the manufacturing, distribution, and application of tubular welding electrodes filled with flux components, specialized for high-productivity welding processes. These wires offer superior deposition rates and improved weld quality compared to traditional Solid Metal Arc Welding (SMAW) or Gas Metal Arc Welding (GMAW) processes, making them indispensable in heavy industrial applications. The core components of the wire often include alloying agents, slag formers, and deoxidizers, designed to protect the molten weld pool from atmospheric contamination while enhancing mechanical properties.

The product description spans various types, including self-shielded FCW, which eliminates the need for external shielding gas, and gas-shielded FCW, typically utilized with CO2 or argon-mixed gases for optimized performance in structural applications. Major applications driving demand include high-rise construction, energy pipelines, railway infrastructure, heavy machinery manufacturing, and, most prominently, China's massive shipbuilding industry, where high productivity and all-position welding capabilities are essential. The flexibility and speed offered by FCW technology provide significant operational benefits.

Key driving factors fueling market growth include stringent quality requirements in critical infrastructure projects, necessitating high-integrity welds; increasing labor costs, which incentivize the shift toward automated and high-deposition-rate welding methods; and supportive government policies aimed at modernizing domestic manufacturing capabilities. Furthermore, the push toward implementing advanced welding standards and enhancing worker efficiency solidifies the position of flux cored welding wire as a preferred consumables choice in demanding fabrication environments across the nation.

China Flux Cored Welding Wire Market Executive Summary

The Chinese Flux Cored Welding Wire market is characterized by intense competition among domestic and international players, rapid technological adoption focused on improving deposition efficiency, and a significant reliance on macro-economic trends in construction and heavy manufacturing. Business trends indicate a shift towards specialized, high-performance wires optimized for specific materials such as high-strength low-alloy (HSLA) steels, reflecting sophisticated end-user demand in automotive and advanced infrastructure projects. Furthermore, sustainability is becoming a minor but growing factor, with manufacturers exploring options to reduce welding fume emissions and waste.

Regional trends within China highlight strong demand concentration in the eastern coastal provinces, which host major shipbuilding yards, automotive assembly plants, and large-scale infrastructure fabrication centers (e.g., Jiangsu, Shandong, Guangdong). Western and interior regions, while traditionally slower, are showing accelerated growth due to government-led initiatives like the Belt and Road Initiative (BRI), which necessitates extensive railway, pipeline, and bridge construction, driving localized demand for welding consumables. The market structure remains fragmented, though consolidation among key domestic manufacturers is anticipated to improve supply chain efficiencies.

Segment trends demonstrate the continued dominance of the gas-shielded flux cored arc welding (FCAW-G) segment due to its superior mechanical properties and suitability for automated processes. However, self-shielded wires (FCAW-S) maintain a crucial role in outdoor or field-based applications where portability and wind resistance are advantageous. By application, the shipbuilding segment remains the largest consumer, but significant growth is expected from the general fabrication and energy sectors as China continues to expand its power generation and transportation network. This dynamic landscape necessitates continuous innovation in wire metallurgy and diameter optimization to capture market share.

AI Impact Analysis on China Flux Cored Welding Wire Market

User inquiries regarding AI's impact on the FCW market frequently revolve around how automation and machine learning can enhance weld quality consistency, optimize production line efficiency, and predict material failures. Common concerns focus on the integration cost of AI-driven robotics and the necessary skills transition for the welding workforce. Users expect AI to revolutionize quality control through sophisticated real-time monitoring of welding parameters (current, voltage, travel speed) and defect detection using advanced vision systems. The consensus highlights that AI's primary contribution will be minimizing human error and standardizing highly complex or repetitive welding tasks, thereby increasing the effective demand for consistent, high-quality flux cored wires designed for robotic feed systems.

AI's influence is transforming both the manufacturing of the wire itself and its final application. In the manufacturing stage, AI-powered systems are being deployed for predictive maintenance on wire drawing and coating machinery, optimizing throughput, and minimizing material waste. Furthermore, machine learning algorithms are used in material science to rapidly iterate and design new flux formulations that offer superior performance characteristics, such as lower spatter generation or enhanced mechanical strength, thereby accelerating product development cycles. This allows Chinese manufacturers to quickly adapt to evolving international and domestic material standards.

In the end-user market, particularly within large Chinese shipyards and heavy equipment assembly lines, AI-driven robotic welding cells are becoming standard. These robots utilize AI for path planning, adaptive welding adjustments based on gap variations, and instantaneous process optimization. This highly automated environment places a premium on consistent wire feeding, precise wire diameter, and uniform flux density, pushing FCW manufacturers to adhere to extremely tight quality tolerances, further accelerating the adoption of specialized and premium-grade FCW products in the coming years.

- AI-driven Quality Control: Real-time monitoring and analysis of welding process data to ensure defect-free welds and consistent bead profiles.

- Predictive Maintenance: Application of machine learning in wire manufacturing facilities to anticipate equipment failures, minimizing downtime and optimizing production yield.

- Robotic Integration Optimization: AI algorithms used to enhance robotic welding path planning and parameter adjustments, improving overall deposition efficiency and speed.

- Material Formulation Advancement: Utilization of AI to model and test new flux cored chemistries virtually, accelerating the development of specialized wires for new alloys.

- Demand Forecasting: AI tools employed by manufacturers to predict regional and application-specific demand fluctuations, optimizing inventory management and supply chain logistics.

DRO & Impact Forces Of China Flux Cored Welding Wire Market

The dynamics of the China Flux Cored Welding Wire market are shaped by compelling drivers, structural restraints, significant opportunities, and powerful external impact forces. The primary drivers include the accelerated pace of infrastructure modernization under the 14th Five-Year Plan, coupled with expanding requirements from China’s world-leading shipbuilding industry, which demands high-productivity welding solutions. The restraint landscape is defined by intense price competition from standard solid wires, volatile raw material costs (especially ferroalloys and steel strips), and increasing environmental scrutiny regarding welding fume emissions, pressuring manufacturers to develop low-fume alternatives. Opportunities are vast, primarily centered on niche applications in renewable energy installations (wind turbine towers, offshore platforms) and capturing higher market share through premium product innovation, leveraging China’s domestic technological capabilities.

Impact forces significantly influencing the market include global trade tensions, which can affect the import/export of steel products and welding machinery, consequently impacting domestic fabrication output. Furthermore, geopolitical shifts influence large-scale, long-term infrastructure projects (such as those under BRI), which directly generate colossal demand for welding consumables. The pace of technological obsolescence is also a strong impact force; as advanced welding techniques (like laser-hybrid welding) gain traction, FCW manufacturers must continuously innovate to maintain relevance and competitive advantage. The interplay between stringent domestic safety regulations and the inherent demands for high-efficiency production creates a complex operational environment for market players.

Overall, the market exhibits a robust underlying growth trajectory, primarily shielded by massive domestic consumption, but is acutely sensitive to global commodity pricing and domestic regulatory shifts. The successful navigation of environmental standards while maintaining cost efficiency will be the defining challenge for market participants. The demand elasticity in relation to macroeconomic investment in heavy industry dictates short-term revenue performance, whereas long-term success hinges on technological differentiation, particularly in developing wires suitable for automated processes and high-stress applications.

Segmentation Analysis

The China Flux Cored Welding Wire market is extensively segmented based on the critical characteristics that dictate product performance and application suitability. These primary segmentation criteria include the specific shielding method employed (gas-shielded versus self-shielded), the flux type utilized within the core (such as Rutile, Basic, or Metal-cored), and the material structure they are designed to weld (carbon steel, stainless steel, or low alloy steel). Understanding these divisions is crucial for manufacturers tailoring their product portfolios to meet the varied demands of industries like petrochemical, power generation, and automotive manufacturing.

The largest segment by far is the Gas-Shielded Flux Cored Arc Welding (FCAW-G) wire, dominating consumption due to its widespread use in automated systems requiring high deposition rates and superior mechanical properties, particularly in shipbuilding and structural construction where regulatory compliance is strict. The self-shielded variant (FCAW-S), though smaller, holds significant importance for non-critical, outdoor, or field applications where external gas supply is impractical. Within flux chemistry, Rutile-based wires are favored for their excellent operability and appearance in general fabrication, while Basic flux wires are reserved for critical, high-integrity welds requiring maximum toughness.

The market analysis reveals that the fastest-growing segment is likely the low alloy steel wire segment, driven by increasing construction of high-pressure vessels, pipelines, and specialized heavy machinery that requires materials with enhanced strength-to-weight ratios. Furthermore, the rising demand for metal-cored wires, which offer higher deposition rates and better gap bridging than traditional flux-cored wires, represents a nascent but powerful trend, positioning it as a key focus area for technological investment and market penetration strategies over the forecast period.

- By Type:

- Gas Shielded Flux Cored Arc Welding (FCAW-G) Wire

- Self-Shielded Flux Cored Arc Welding (FCAW-S) Wire

- By Flux Composition:

- Rutile Flux Cored Wire

- Basic Flux Cored Wire

- Metal Cored Wire

- Other (e.g., Chromium-rich, Nickel-based)

- By Material Welded:

- Carbon Steel Flux Cored Wire

- Stainless Steel Flux Cored Wire

- Low Alloy Steel Flux Cored Wire

- Hardfacing Flux Cored Wire

- By End-User Industry:

- Shipbuilding

- Construction and Infrastructure

- Heavy Equipment and Machinery

- Automotive and Transportation

- Oil and Gas/Energy

- General Fabrication

Value Chain Analysis For China Flux Cored Welding Wire Market

The value chain of the China Flux Cored Welding Wire market begins with the upstream procurement of essential raw materials, primarily steel strip (usually cold-rolled), ferroalloys (such as ferrosilicon, ferromanganese), mineral powders (like rutile, fluorite, and limestone), and specialized chemical components necessary for the flux mixture. Upstream analysis focuses heavily on global commodity pricing and the stability of domestic Chinese steel production, as these factors determine manufacturing costs and price volatility. Manufacturers must maintain robust supply chain relationships to ensure the consistent quality and availability of low-carbon steel strips, which form the outer shell of the wire, ensuring proper drawing and forming processes.

The midstream involves the core manufacturing process: strip forming, flux filling, drawing, and precise copper coating or surface preparation. Key activities at this stage include quality control of the flux mixture composition and achieving optimal wire diameter consistency, which is crucial for reliable automated feeding. Distribution channels are varied, involving both direct sales to large, strategic end-users (e.g., major state-owned shipyards or pipeline companies) and indirect distribution through a complex network of authorized distributors, local welding supply houses, and large industrial trading companies. The indirect channel serves the vast number of small-to-medium enterprises (SMEs) engaged in general fabrication and regional construction projects.

Downstream analysis highlights the final consumption points, dominated by heavy fabrication industries. Direct distribution minimizes costs and enhances technical support for key accounts, ensuring product specifications meet critical industry standards (e.g., certification by classification societies like CCS or ABS for shipbuilding). Conversely, the indirect channel requires strong logistical support and extensive inventory management to cater to varied regional demands and immediate needs. The efficiency of this downstream network, coupled with high-quality technical service provision, is critical for brand loyalty and market penetration across China’s vast geography.

China Flux Cored Welding Wire Market Potential Customers

The primary customers for flux cored welding wire in China are large-scale industrial consumers requiring high productivity, consistent quality, and materials suitable for automated or semi-automated welding processes. End-users span critical sectors responsible for China’s physical and economic infrastructure, focusing on applications where high integrity and robust mechanical properties of the weld joint are paramount. This customer base is highly price-sensitive but simultaneously demands certified products conforming to both national (GB) and international standards (AWS, ISO).

The largest customer cohort is centered in the shipbuilding and offshore fabrication industries, where FCW is utilized for hull assembly, block construction, and pipe welding due to its high deposition rate in overhead and vertical positions. Another significant segment includes heavy equipment manufacturers, particularly those producing construction machinery (excavators, cranes) and mining equipment, which require hardfacing wires and low-alloy wires for wear resistance and structural strength. The energy sector, including pipeline construction for oil and gas transmission and the assembly of power generation infrastructure (boilers, wind turbine towers), constitutes another critical customer segment demanding specialized wires for high-pressure and high-temperature environments.

Furthermore, the general fabrication sector, encompassing structural steel fabrication for commercial buildings and general metalworking shops, forms a diffuse yet substantial customer group, typically served through the indirect distribution network. These customers prioritize versatility and ease of use (often preferring Rutile flux types). The continued governmental focus on railway expansion and high-speed rail projects also positions railway component manufacturers as consistently high-value consumers, particularly for specialized wires used in track maintenance and rolling stock manufacturing, solidifying the breadth of the customer landscape.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.55 Billion |

| Market Forecast in 2033 | USD 2.45 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Lincoln Electric, ESAB, Voestalpine Böhler Welding, Kobe Steel, ITW (Hobart), Tianjin Golden Bridge Welding Materials, Shanghai Atlantic Welding Consumables, Shandong Solid Welding Materials, Dalian Huafeng Welding Material, Wuxi Huaheng Automation Technology, Beijing Time Golden Bridge, Jiangsu Yangzi River Welding Material, Shandong Aode Welding Material, Changzhou Huarui Welding Wire, Hefei Mecha Tooling & Welding Material, KISWEL, Hyundai Welding. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

China Flux Cored Welding Wire Market Key Technology Landscape

The technology landscape in the China Flux Cored Welding Wire market is rapidly evolving, driven by the need to meet higher standards of structural integrity, increase productivity rates, and comply with environmental mandates. A key area of innovation focuses on advanced flux formulation metallurgy, specifically the development of low-fume and low-spatter wires. These new compositions utilize optimized ratios of slag-forming agents and stabilizers to improve arc stability, reducing clean-up time and enhancing worker safety, thereby appealing directly to large manufacturers invested in workforce health and safety protocols.

Another prominent technological shift involves the refinement of wire manufacturing processes, moving towards extremely tight dimensional tolerances and superior surface finishes. This is critical because modern high-speed robotic welding systems are highly sensitive to variations in wire diameter, affecting feedability and arc stability. Manufacturers are investing in high-precision drawing and coating equipment, often incorporating in-line laser sensors and computerized control systems, to ensure the consistent quality required for reliable automation integration across Chinese manufacturing lines, particularly in the automotive and heavy machinery sectors where consistent weld quality is non-negotiable.

Furthermore, there is a distinct technology trend towards specialized wires designed for specific high-performance applications, such as wires for high-strength low-alloy (HSLA) steels or hardfacing wires for wear resistance in mining and earthmoving equipment. The increased adoption of Metal-Cored Wires (MCW), which offer exceptional deposition rates and minimal slag, represents a significant technological leap. Although MCW technically differ from traditional FCW, they compete directly for the high-productivity welding segment and are increasingly being manufactured and promoted by FCW leaders due to their superior suitability for advanced mechanized welding.

Regional Highlights

The analysis of the China Flux Cored Welding Wire Market must be viewed through the lens of key consumption hubs and major industrial clusters. While the report focuses on China, understanding the internal provincial dynamics provides necessary granular detail for market entry and distribution strategies. The eastern and southern coastal regions remain the primary drivers of demand, leveraging established industrial ecosystems and proximity to export routes.

- East China (Jiangsu, Zhejiang, Shanghai): This region is the undisputed powerhouse for shipbuilding, offshore engineering, and advanced manufacturing. It exhibits the highest consumption of high-specification, gas-shielded FCW (FCAW-G) for critical applications. Demand is characterized by large volume procurement and stringent quality requirements mandated by international classification societies.

- South China (Guangdong, Fujian): Dominated by automotive, light manufacturing, and construction industries. This area drives demand for medium-grade FCW products suitable for high-volume general fabrication, alongside specialized wires required for the regional automotive supply chain and bridge construction.

- North China (Hebei, Tianjin, Shandong): A major hub for heavy equipment, steel production, and petrochemical processing. Consumption here is robust, focusing heavily on basic flux cored wires for high-integrity structural applications, as well as hardfacing wires necessary for steel mill maintenance and mining equipment refurbishment.

- Central and Western China (Sichuan, Hubei, Shaanxi): Although smaller in market size compared to the coastal areas, these regions represent high-growth potential driven by significant government investment in internal infrastructure (railways, pipelines, dam projects) and the relocation of manufacturing capacity inland, necessitating field-based, self-shielded FCW (FCAW-S) and high-quality structural wires.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the China Flux Cored Welding Wire Market.- Tianjin Golden Bridge Welding Materials Group Co Ltd

- Shanghai Atlantic Welding Consumables Co Ltd (SAW)

- Shandong Solid Welding Materials Co Ltd

- Lincoln Electric Holdings Inc

- ESAB (Colfax Corporation)

- Kobe Steel Ltd

- Voestalpine Böhler Welding GmbH

- Illinois Tool Works Inc (ITW) - Hobart

- Dalian Huafeng Welding Material Co Ltd

- Wuxi Huaheng Automation Technology Co Ltd

- Beijing Time Golden Bridge Welding Co Ltd

- Jiangsu Yangzi River Welding Material Co Ltd

- Shandong Aode Welding Material Co Ltd

- Changzhou Huarui Welding Wire Co Ltd

- KISWEL Co Ltd

- Hyundai Welding Co Ltd

- Shenzhen Xinqiang Welding Consumables Co Ltd

- Jinan Dayang Welding Material Co Ltd

- Guangzhou Solid Welding Materials Co Ltd

- Hangzhou Oxygen Equipment Group Co Ltd

Frequently Asked Questions

Analyze common user questions about the China Flux Cored Welding Wire market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the long-term growth of the Flux Cored Welding Wire market in China?

Long-term growth is driven primarily by China's sustained capital investment in heavy infrastructure, including high-speed rail and utility projects, coupled with the mandatory requirement for high-productivity welding solutions in the world’s largest shipbuilding industry, necessitating consistent adoption of FCW over traditional stick electrodes.

How do environmental regulations impact the manufacturing of FCW in China?

Increasingly stringent environmental regulations, particularly concerning welding fume emissions and factory waste water discharge, are forcing Chinese manufacturers to invest in developing low-fume wire formulations and modernizing production facilities to comply with stricter national standards, driving product innovation towards premium, cleaner alternatives.

Which segment holds the largest market share by product type in China?

The Gas Shielded Flux Cored Arc Welding (FCAW-G) Wire segment currently holds the largest market share due to its superior mechanical properties, efficiency, and suitability for high-speed, automated welding processes widely utilized in major structural and industrial fabrication projects across the country.

What role does the shipbuilding industry play in China's FCW market demand?

The shipbuilding industry is the single largest end-user segment for FCW in China, demanding massive volumes of certified wires for rapid and high-integrity construction of vessels and offshore structures. The sector’s focus on automation and vertical welding productivity makes FCW an essential consumable.

Are Chinese manufacturers competitive against international FCW brands?

Yes, major Chinese domestic manufacturers are highly competitive, especially in the mid-to-high quality segments. They leverage cost advantages, extensive distribution networks, and rapidly improving technological capabilities to challenge international brands, particularly in general fabrication and large domestic infrastructure contracts.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager