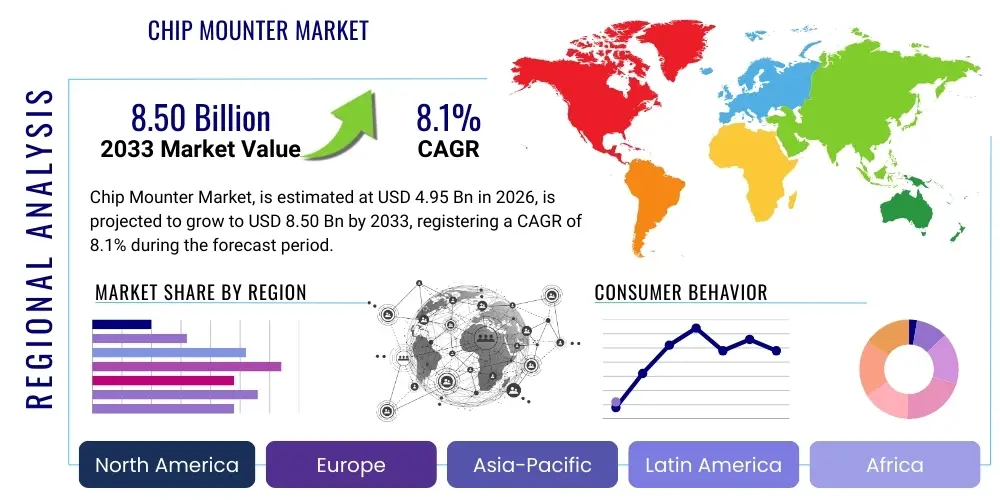

Chip Mounter Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436883 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Chip Mounter Market Size

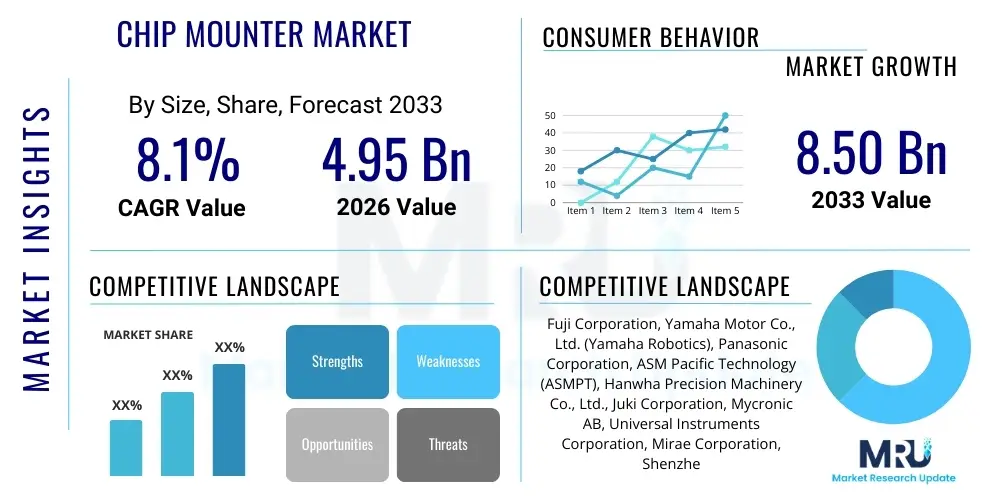

The Chip Mounter Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.1% between 2026 and 2033. The market is estimated at USD 4.95 Billion in 2026 and is projected to reach USD 8.50 Billion by the end of the forecast period in 2033.

Chip Mounter Market introduction

The Chip Mounter Market encompasses equipment used for placing surface-mount devices (SMDs) onto printed circuit boards (PCBs) with high precision and speed. These highly automated systems are fundamental to the electronics manufacturing industry, driving the production of everything from complex consumer electronics to automotive control units and industrial machinery. The core product categories include high-speed mounters, multi-functional mounters, and dispensing equipment, each tailored to specific production volume and component complexity requirements. The efficiency and accuracy of these machines are critical determiners of product quality and manufacturing throughput, positioning chip mounters as indispensable assets in modern electronics assembly lines.

Major applications of chip mounters span across telecommunications, automotive electronics, consumer electronics (smartphones, tablets, wearables), industrial electronics, and medical devices. The relentless miniaturization of electronic components, coupled with the increasing demand for high-density interconnects (HDIs), necessitates continuous technological advancements in mounter technology, including enhanced vision systems, precise placement mechanisms, and advanced software optimization for production planning. The market benefits significantly from the global expansion of 5G infrastructure, the electrification of vehicles, and the proliferation of IoT devices, all of which require vast quantities of complex PCBs.

Key driving factors accelerating market growth include the robust expansion of electronics manufacturing in Asia Pacific, particularly in China, South Korea, and Taiwan, which serve as global manufacturing hubs. Furthermore, the transition toward Industry 4.0 paradigms, emphasizing automation, integration, and predictive maintenance within production environments, fuels the demand for sophisticated, high-throughput chip mounters equipped with smart features. The necessity for shorter product development cycles and increasing component diversity also mandates flexible, multi-functional placement solutions, solidifying the market's trajectory toward substantial growth.

Chip Mounter Market Executive Summary

The Chip Mounter Market is characterized by intense technological competition, driven by the persistent industry need for higher component placement speeds (up to 200,000 CPH or more), greater placement accuracy (sub-micron levels), and flexibility to handle diverse component sizes, ranging from 01005 (0.4mm x 0.2mm) microchips to large connectors. Business trends indicate a strong shift towards modular and scalable solutions that allow manufacturers to adapt quickly to changing production demands and component mixes. Strategic collaborations between mounter manufacturers and semiconductor producers are becoming crucial for developing solutions capable of handling advanced packaging technologies like System-in-Package (SiP) and heterogeneous integration, ensuring future compatibility with next-generation electronics.

Regionally, Asia Pacific maintains its undisputed dominance, accounting for the largest share of the global market due to the concentration of major Electronic Manufacturing Service (EMS) providers and Original Equipment Manufacturers (OEMs). However, North America and Europe are exhibiting significant growth in specialized, high-value segments, such as automotive electronics and medical devices, where reliability and traceability are paramount, leading to investments in highly automated, precision-focused mounters. Emerging markets in Southeast Asia (Vietnam, Thailand) are increasingly becoming secondary manufacturing hubs, attracting capacity expansion and driving demand for mid-range, cost-effective placement systems, balancing regional dynamics.

Segment trends reveal a pronounced preference for high-speed, modular mounters (often rotating head or turret types) for mass production of consumer devices, maximizing throughput. Conversely, multi-functional mounters, which offer versatility in handling large, irregularly shaped, or delicate components, are seeing increased uptake in industrial and automotive sectors. Furthermore, the software and integration segment, including Manufacturing Execution Systems (MES) compatibility and advanced placement optimization algorithms, is growing faster than the hardware segment itself, underscoring the value placed on smart factory integration and efficiency gains derived from optimized machine utilization rather than sheer speed alone.

AI Impact Analysis on Chip Mounter Market

User queries regarding AI's influence on the Chip Mounter Market frequently center on automation enhancement, predictive maintenance capabilities, and yield optimization through deep learning. Key themes revolve around how Artificial Intelligence can transcend traditional machine vision limitations, enabling dynamic self-correction and higher precision in handling increasingly complex and minute components. Users are concerned with the practical implementation costs of integrating AI vision systems versus the quantifiable improvements in first-pass yield and reduction in material waste. Expectations are high concerning AI’s ability to optimize production scheduling in real-time across multiple mounter lines and autonomously diagnose complex machine faults before catastrophic failure, moving production environments towards fully autonomous operation and minimal human intervention.

- AI-driven placement optimization: Utilizing machine learning algorithms to analyze component characteristics and PCB layouts, dynamically adjusting placement parameters (force, speed, nozzle type) for maximizing accuracy and minimizing stress on fragile components, leading to higher first-pass yield rates.

- Predictive Maintenance (PdM): AI models analyze vibration, temperature, and cycle time data from machine sensors to predict component wear, such as feeder mechanisms or placement heads, scheduling maintenance proactively and dramatically reducing unexpected downtime (mean time between failures - MTBF).

- Enhanced Machine Vision and Inspection: Deep learning models significantly improve the accuracy of solder paste inspection (SPI) and Automated Optical Inspection (AOI) systems, better distinguishing between true defects and acceptable variances, especially for complex micro-components like 01005 and wafer-level chip scale packages (WLCSPs).

- Autonomous Process Control: AI facilitates real-time monitoring and adjustment of reflow oven profiles and component feeding processes based on environmental fluctuations and material properties, maintaining consistent quality across long production runs.

- Smart Factory Integration: AI acts as the central intelligence orchestrator, seamlessly integrating data flow between chip mounters, component inventory systems, MES, and enterprise resource planning (ERP) systems, optimizing overall factory throughput and material logistics.

DRO & Impact Forces Of Chip Mounter Market

The Chip Mounter Market is strongly driven by the proliferation of advanced electronics, restrained by high capital expenditure requirements, and poised for opportunities through autonomous manufacturing adoption. The core driving force remains the increasing density and complexity of PCBs required for 5G, electric vehicles, and sophisticated medical devices, which mandates high-precision placement technology. However, the substantial initial investment cost and the complexity associated with integrating and operating state-of-the-art mounters, coupled with the shortage of highly skilled maintenance technicians, act as primary restraints, especially for small and medium-sized EMS providers. Opportunities lie in the shift towards modular machine architectures and the integration of AI, which enhances flexibility and reduces reliance on constant manual fine-tuning.

Impact forces within the market are predominantly technological and competitive. The rapid pace of component miniaturization (driving the move towards 0201 and 01005 components) necessitates continuous R&D investment by mounter manufacturers to maintain relevance, placing pressure on older equipment. Competition is fierce, particularly among major Japanese and European vendors, who differentiate their offerings based on CPH (components per hour) speed, accuracy (CpK values), and software integration capabilities. The regulatory landscape, specifically around environmental standards and energy consumption (ESG factors), also exerts pressure, forcing companies to innovate toward more energy-efficient and sustainable manufacturing processes.

The synergy between component manufacturers and equipment providers defines the supply side, ensuring that mounter technology evolves in lockstep with new component packaging formats. Downstream, the demand is highly inelastic, driven by essential macro trends such as urbanization and digitization. The combined impact of these forces ensures a persistent requirement for faster, more accurate, and smarter chip placement systems, solidifying the market's trajectory towards automation and data-driven efficiency, despite intermittent economic cycles that may briefly slow capital investment decisions.

Segmentation Analysis

The Chip Mounter Market is comprehensively segmented based on machine type, component placement speed, application sector, and end-user profile, reflecting the diverse requirements of the electronics manufacturing ecosystem. Segmentation by machine type primarily distinguishes between high-speed mounters (optimized for speed and mass production) and multi-functional mounters (optimized for flexibility and handling large, odd-shaped components), catering to different manufacturing priorities. The segmentation analysis provides a granular view of market dynamics, revealing specific growth pockets driven by technological shifts, such as the increasing demand for ultra-high-speed models that are essential for the production of advanced consumer electronics and data center infrastructure components.

Analyzing the market by application reveals differential growth rates across key sectors. The automotive electronics segment is experiencing exponential growth, fueled by ADAS (Advanced Driver-Assistance Systems) and battery management systems (BMS) for electric vehicles, demanding high-reliability, high-temperature capable placement systems. Conversely, while consumer electronics remain the largest volume consumer, the segment is susceptible to fluctuating demand cycles and intense price competition, driving demand for cost-effective, high-throughput solutions. Understanding these application-specific requirements is critical for manufacturers to tailor their R&D and sales strategies effectively, ensuring their product portfolio aligns with high-growth end-markets requiring stringent quality control.

Further segmentation by placement speed, measured in Components Per Hour (CPH), allows for clear distinction between entry-level systems, mid-range flexible mounters, and premium ultra-high-speed models. This metric is a fundamental purchasing consideration, directly correlating with production capacity. Given the global push toward localized and resilient supply chains, many regional manufacturers are investing heavily in these diverse machine types simultaneously—using high-speed mounters for core logic boards and multi-functional mounters for peripheral assemblies—thus ensuring operational resilience and maximum efficiency across heterogeneous product lines.

- By Type: High-Speed Mounters, Multi-Functional Mounters, Medium-Speed Mounters, Other Specialized Mounters (Die Bonders, Flip Chip Attachers)

- By Speed: Below 50,000 CPH, 50,000 – 100,000 CPH, Above 100,000 CPH (Ultra-High Speed)

- By Application: Consumer Electronics, Automotive Electronics, Telecommunications and IT Hardware, Industrial Electronics, Healthcare and Medical Devices, Aerospace and Defense

- By End-User: Electronic Manufacturing Services (EMS) Providers, Original Equipment Manufacturers (OEMs), Original Design Manufacturers (ODMs)

- By Region: North America, Europe, Asia Pacific (APAC), Latin America (LATAM), Middle East and Africa (MEA)

Value Chain Analysis For Chip Mounter Market

The value chain for the Chip Mounter Market begins with the upstream suppliers of critical components and materials, including high-precision mechanical parts (motors, linear scales, bearings), sophisticated optical systems (cameras, lasers, vision processing units), and specialized software and control systems. Key upstream actors, primarily focused in Japan, Germany, and Switzerland, provide the advanced robotics and precision engineering necessary for high-accuracy placement. Maintaining robust relationships with these specialized component suppliers is vital for chip mounter manufacturers to ensure the performance metrics (speed and accuracy) of their final machines are competitive and reliable.

The midstream involves the core activities of the chip mounter OEMs (Original Equipment Manufacturers), who are responsible for machine design, integration, proprietary software development, and global assembly. These OEMs invest heavily in R&D to improve nozzle technology, feeder systems, and machine vision capabilities. Distribution channels are typically a mix of direct sales teams for large, strategic accounts (major EMS providers) and indirect sales through specialized regional distributors or system integrators who provide local technical support, installation, and essential training. The complexity and high cost of these machines necessitate a robust, highly skilled support network throughout the sales and deployment process.

Downstream activities include the end-users—EMS providers, OEMs, and ODMs—who utilize the chip mounters for mass production and specialized manufacturing. The downstream segment is characterized by service and support requirements, including maintenance contracts, software updates, and consumables (nozzles, feeders). The increasing demand for automation and data integration means that downstream value is increasingly generated through the optimization of the production line (OEE - Overall Equipment Effectiveness) rather than just the machine's speed. Direct channels are crucial for high-volume, multi-unit purchases where technical consulting and custom integration are required, while indirect channels serve smaller manufacturers and specialized niche markets effectively.

Chip Mounter Market Potential Customers

Potential customers for chip mounter equipment are primarily businesses engaged in high-volume, precision electronics assembly across various industrial sectors. The largest customer base consists of Electronic Manufacturing Services (EMS) providers, such as Foxconn, Flextronics, and Jabil, who require highly scalable, flexible, and reliable chip mounters to service diverse contracts for global brands. These companies typically invest in large fleets of machines, often standardizing on specific vendors to minimize training and maintenance complexity, making them crucial targets for high-volume sales and service contracts.

Original Equipment Manufacturers (OEMs) who maintain captive manufacturing facilities also represent significant potential customers, especially those in high-reliability segments like automotive (Tier 1 suppliers), medical device manufacturing, and industrial automation. For these OEMs, the focus is less on sheer speed and more on traceability, quality control, and longevity, often requiring specialized multi-functional mounters capable of handling unique component packages and rigorous environmental requirements. The rising trend of reshoring manufacturing capabilities in North America and Europe is expanding the OEM customer base in these regions.

Furthermore, specialized Original Design Manufacturers (ODMs) and smaller, niche contract manufacturers serving prototyping or low-volume, high-mix production are also key customers. These entities often prioritize machine flexibility, quick setup times (NPI - New Product Introduction), and advanced software tools that facilitate rapid changeovers. As the IoT and customized hardware market expands, the need for these agile, small-to-mid-sized manufacturers to upgrade their placement technology to handle miniaturized components ensures sustained demand across all customer tiers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.95 Billion |

| Market Forecast in 2033 | USD 8.50 Billion |

| Growth Rate | 8.1% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Fuji Corporation, Yamaha Motor Co., Ltd. (Yamaha Robotics), Panasonic Corporation, ASM Pacific Technology (ASMPT), Hanwha Precision Machinery Co., Ltd., Juki Corporation, Mycronic AB, Universal Instruments Corporation, Mirae Corporation, Shenzhen JT Automation Equipment Co., Ltd., Europlacer, Assembleon (now part of K&S), Autotronik SMT GmbH, Speedprint Technology, DDM Novastar |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Chip Mounter Market Key Technology Landscape

The Chip Mounter Market's technological landscape is defined by continuous innovation aimed at increasing CPH rates while simultaneously improving placement accuracy to handle increasingly smaller, more fragile components. Core technologies include advanced linear motor drives and high-resolution vision systems, which together minimize mechanical vibration and ensure sub-micron level repeatability. Modern mounters leverage sophisticated non-contact recognition technology to inspect components in motion, accelerating the production process without sacrificing quality. Furthermore, flexible gantry systems and modular head designs are becoming standard, allowing machines to swiftly switch between high-speed component placement and handling large, irregular parts on the same production line, maximizing versatility.

A major focus area is the development of next-generation feeder technology, moving beyond traditional mechanical feeders toward smart, electric, and software-controlled feeders that offer real-time inventory tracking and automatic component verification, significantly reducing setup time and the risk of component misplacement. Integration with advanced production floor management software (like MES) utilizing standardized communication protocols (e.g., CFX or IPC-SMEMA) is paramount, enabling comprehensive data collection for process monitoring, predictive maintenance, and closed-loop feedback systems. This data infrastructure is essential for realizing the full potential of smart factories and achieving Industry 4.0 objectives.

Additionally, specialized technologies are emerging to address high-value segments. For advanced semiconductor packaging (e.g., Fan-Out Wafer Level Packaging), specialized flip-chip bonders and die attach equipment (often categorized as highly specialized mounters) utilizing thermo-compression bonding techniques are gaining traction. The drive for sustainability is also influencing technology, leading to mounters with optimized power consumption and mechanisms designed for minimizing material waste during the setup and operation phases. The convergence of hardware precision and intelligent software optimization remains the central pillar of technological advancement in this critical manufacturing sector.

Regional Highlights

- Asia Pacific (APAC): APAC is the dominant market leader, driven by its established role as the global manufacturing epicenter for consumer electronics, IT hardware, and telecommunications equipment. Countries like China, South Korea, Taiwan, and Japan host the world's largest EMS providers and semiconductor fabrication plants, leading to sustained, high-volume demand for high-speed, high-throughput chip mounters. Rapid industrialization and government initiatives supporting local electronics production further consolidate the region's position, though competition among local suppliers is intensifying.

- North America: North America demonstrates robust demand, particularly in high-reliability segments such as aerospace, defense, medical devices, and high-end automotive electronics. The focus here is less on sheer volume and more on precision, advanced traceability, and handling complex, specialized PCBs for mission-critical applications. Recent geopolitical shifts encouraging supply chain resilience are driving investments in sophisticated, flexible mounters for advanced domestic manufacturing capabilities.

- Europe: Europe is characterized by strong investment in industrial electronics, automotive manufacturing (especially EVs), and specialized automation equipment. European manufacturers prioritize quality, longevity, and adherence to strict environmental and industrial standards. The region is seeing significant uptake of highly automated, integrated mounter solutions that can function seamlessly within advanced smart factory environments, particularly in Germany, Italy, and Eastern European manufacturing hubs.

- Latin America (LATAM): LATAM remains a smaller, yet growing market, primarily centered in countries like Mexico (serving the North American automotive and consumer electronics assembly market) and Brazil. Demand is often concentrated in mid-range, cost-effective mounters, with growth tied directly to foreign investment in regional assembly plants and the expanding domestic consumption of electronics.

- Middle East and Africa (MEA): This region is in an nascent stage regarding high-end electronics manufacturing. Demand for chip mounters is highly localized and often project-specific, tied mainly to developing infrastructure projects, telecommunications expansion (5G rollouts), and limited domestic industrial electronics production, requiring basic to medium-speed flexible mounters.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Chip Mounter Market.- Fuji Corporation

- Yamaha Motor Co., Ltd. (Yamaha Robotics)

- Panasonic Corporation

- ASM Pacific Technology (ASMPT)

- Hanwha Precision Machinery Co., Ltd.

- Juki Corporation

- Mycronic AB

- Universal Instruments Corporation

- Mirae Corporation

- Shenzhen JT Automation Equipment Co., Ltd.

- Europlacer

- Assembleon (now part of K&S)

- Autotronik SMT GmbH

- Speedprint Technology

- DDM Novastar

- Orbotech (KLA Corporation)

- Heller Industries

- ITW EAE

- Nordson Corporation (SELECT Equipment)

Frequently Asked Questions

Analyze common user questions about the Chip Mounter market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driving factor for the Chip Mounter Market growth?

The primary driver is the pervasive trend of component miniaturization combined with explosive demand across key high-tech segments, notably 5G infrastructure deployment, the rapid electrification of the automotive industry (EVs), and the proliferation of high-density IoT devices, all requiring extremely precise, high-speed PCB assembly.

How is AI specifically impacting the operational efficiency of chip mounters?

AI integration enhances operational efficiency primarily through predictive maintenance, significantly reducing unplanned downtime, and optimizing placement routines (AI-driven vision and pathfinding) for components as small as 01005, which boosts first-pass yield and overall equipment effectiveness (OEE).

Which region dominates the global Chip Mounter Market, and why?

Asia Pacific (APAC) dominates the market due to the high concentration of major global Electronic Manufacturing Services (EMS) providers, Original Equipment Manufacturers (OEMs), and semiconductor manufacturing facilities located in countries such as China, South Korea, and Taiwan, driving massive capital investment in assembly equipment.

What are the key technical differences between High-Speed and Multi-Functional mounters?

High-Speed mounters (e.g., turret heads) are optimized for maximizing Components Per Hour (CPH) for small, standard chips, focusing on speed. Multi-Functional mounters (e.g., gantry heads) are designed for flexibility and accuracy, handling a wider range of large, odd-shaped, or delicate components required for complex assemblies like automotive PCBs or server boards.

What is the greatest challenge facing manufacturers adopting new chip mounter technology?

The greatest challenge is the extremely high initial capital expenditure required for sophisticated, ultra-precision machines and the subsequent difficulty in sourcing and retaining highly skilled technical personnel needed to program, maintain, and optimize these complex integrated automation systems.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager