Chip Mounters Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433159 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Chip Mounters Market Size

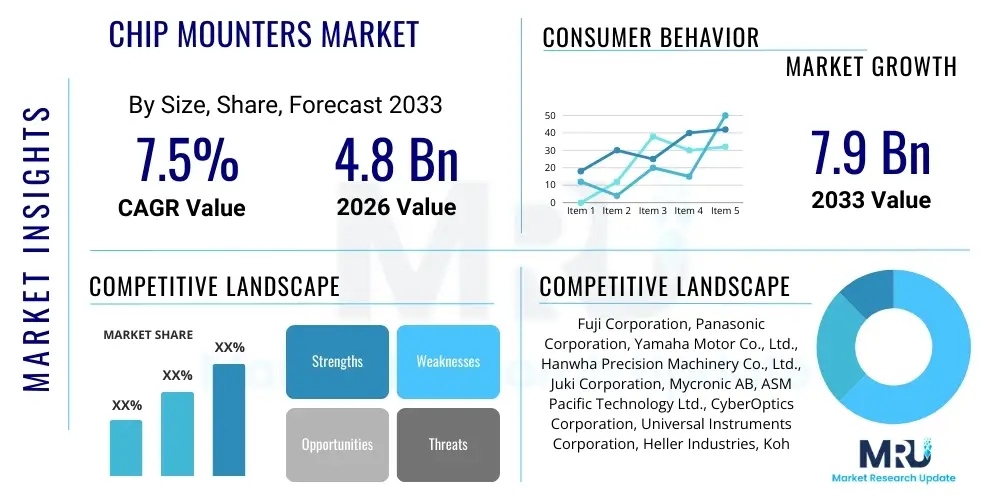

The Chip Mounters Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 7.9 Billion by the end of the forecast period in 2033.

Chip Mounters Market introduction

Chip mounters, also known as surface mount technology (SMT) pick-and-place machines, are indispensable precision robotic devices central to modern electronics manufacturing. They are designed to accurately and rapidly place semiconductor chips and various electronic components onto printed circuit boards (PCBs). These machines operate at extremely high speeds, ensuring the necessary placement accuracy—often down to sub-micron levels—required for miniaturized electronic devices. The efficiency and throughput of chip mounters are crucial determinants of manufacturing cost and final product quality, making them foundational assets in the production lines of consumer electronics, automotive components, and industrial equipment globally. The inherent demand for faster processing, smaller device footprints, and higher integration density continues to drive innovation within this equipment segment, focusing on modularity and increased placement speed.

The primary applications of chip mounters span several high-growth sectors. In consumer electronics, they facilitate the mass production of smartphones, laptops, wearables, and complex gaming consoles where space optimization is paramount. The automotive industry represents a rapidly accelerating application area, driven by the shift towards electric vehicles (EVs) and advanced driver-assistance systems (ADAS), which necessitate highly reliable and densely populated electronic control units (ECUs). Furthermore, the proliferation of the Internet of Things (IoT) devices, smart home appliances, and sophisticated industrial automation systems contributes significantly to market demand. The benefit of utilizing these advanced machines includes enhanced manufacturing consistency, vastly reduced production cycle times compared to manual assembly, and the ability to handle ultra-fine pitch components that are otherwise impossible to place reliably.

Key driving factors propelling the market expansion include the global roll-out of 5G infrastructure, which requires high-frequency, complex PCBs; the increased adoption of advanced packaging technologies like System-in-Package (SiP) and heterogeneous integration; and sustained capital expenditure in Asia Pacific to expand local electronic manufacturing service (EMS) capabilities. Furthermore, the persistent trend of electronic device miniaturization across all sectors necessitates increasingly precise and high-speed mounters capable of handling 0201 or even 01005 components effectively. These market dynamics ensure that chip mounters remain a core investment for any company seeking competitiveness in the high-volume electronics assembly landscape.

Chip Mounters Market Executive Summary

The Chip Mounters Market is characterized by intense technological competition and a substantial shift toward fully automated, high-mix, low-volume (HMLV) production lines, particularly in Western markets, contrasted with high-speed, high-volume production dominating Asia Pacific. Business trends indicate a strong focus on software integration, enabling seamless connection between mounters and upstream processes like Automated Optical Inspection (AOI) and downstream processes like reflow soldering, facilitating real-time process optimization and enhancing overall equipment effectiveness (OEE). The demand for flexible mounters capable of handling a vast array of component sizes and types—from micro-chips to large connectors—is rising, mitigating downtime associated with line changeovers, particularly crucial for EMS providers serving diverse client portfolios. Furthermore, sustainability is becoming a key business metric, driving manufacturers to seek energy-efficient equipment with lower consumables usage.

Regional trends unequivocally highlight Asia Pacific (APAC) as the undisputed leader in both consumption and production of chip mounters, largely due to established electronics manufacturing hubs in China, South Korea, Japan, and Taiwan, along with emerging centers in Vietnam and India. APAC's dominance is sustained by massive consumer electronics and semiconductor production capacity expansion. While North America and Europe represent smaller market shares in terms of unit volume, they lead in technological adoption, often being the early adopters of sophisticated, highly flexible, and AI-enabled mounters used for high-reliability applications in aerospace, defense, and premium automotive electronics. Regulatory environments in these Western regions often necessitate stringent quality control, driving demand for advanced vision and inspection systems integrated directly into the mounter hardware.

Segment trends illustrate the accelerating growth of the Multi-Function Chip Mounters segment. While High-Speed Mounters remain essential for mass production, Multi-Function machines offer the versatility required for handling diverse product mix manufacturing without sacrificing acceptable throughput. In terms of end-use, the Automotive Electronics segment exhibits the highest growth CAGR, driven by the increasing electronic content per vehicle, particularly power electronics necessary for battery management systems (BMS) in EVs. Component type segmentation shows increased investment in machines optimized for complex passive component placement and specialized handling mechanisms for advanced IC packages, reflecting the broader industry trend towards dense integration and miniaturization.

AI Impact Analysis on Chip Mounters Market

User questions regarding AI's impact on the Chip Mounters Market primarily center on how artificial intelligence will enhance production yield, reduce machine downtime, and enable predictive maintenance strategies. Common queries include the feasibility of autonomous placement optimization, the integration of deep learning for defect detection during the pick-and-place process, and the potential for AI-driven feeder management systems to minimize component errors and mispicks. Users are keen to understand if AI can move beyond simple machine monitoring to genuine prescriptive analytics, adjusting machine parameters in real-time based on environmental variables or component batch quality variations, thereby maximizing OEE and minimizing material wastage. The underlying expectation is that AI will transform high-volume SMT lines from rigid processes into highly adaptive, self-optimizing manufacturing ecosystems, drastically lowering labor reliance and expertise dependency.

The integration of sophisticated AI algorithms, particularly machine learning and deep learning models, is revolutionizing the operational efficiency of chip mounters. AI systems are increasingly being used to analyze vast streams of sensor data generated during operation—such as temperature, vibration, motor current, and vision data—to predict potential mechanical failures hours or days before they occur. This transition from reactive or preventive maintenance to truly predictive maintenance dramatically reduces unexpected downtime, which is the single largest factor affecting production yield in SMT lines. Furthermore, AI enhances component recognition capabilities, especially for novel or irregularly shaped passive components, improving placement accuracy and speed beyond traditional fixed vision algorithms. This self-learning capability allows mounters to adapt quickly to new component libraries and complex board layouts.

Beyond maintenance and component handling, AI is playing a critical role in optimizing the overall production schedule and placement sequence. By integrating data from enterprise resource planning (ERP) systems and manufacturing execution systems (MES), AI can dynamically generate the most efficient placement sequence (optimization path) for a given PCB design, often exceeding human engineering capabilities. This dynamic pathfinding minimizes travel distance and maximizes throughput. Moreover, AI is being deployed in smart feeder systems to monitor component consumption and inventory levels in real-time, proactively alerting operators to potential shortages or misloaded feeders, thereby eliminating costly line stops associated with manual errors. This holistic optimization capability underscores AI's transformative potential for future chip mounter performance.

- AI enhances Predictive Maintenance (PdM) by analyzing machine telemetry data to forecast component failures.

- Deep Learning improves component recognition, especially for fine-pitch and odd-shaped parts, reducing placement errors.

- Autonomous Placement Optimization algorithms dynamically generate the most efficient mounting path, boosting throughput.

- AI-driven yield management systems analyze pre- and post-placement inspection data to adjust machine parameters in real-time.

- Smart Feeder Systems utilize AI to monitor inventory, prevent mispicks, and manage material flow efficiently.

DRO & Impact Forces Of Chip Mounters Market

The market dynamics for Chip Mounters are driven primarily by the relentless global push for technological miniaturization and connectivity, yet constrained by substantial investment costs and technical complexity. The dominant impact forces shaping the industry stem from rapid advancements in adjacent technology markets, specifically the widespread deployment of 5G networks, which necessitates sophisticated high-frequency electronics, and the monumental growth of the Electric Vehicle (EV) sector, demanding high-reliability, ruggedized power modules and control units. These drivers create an imperative for manufacturers to invest in the latest generation of mounters offering higher throughput and superior accuracy. However, this growth trajectory is tempered by the high initial capital expenditure required for these complex machines and the ongoing global shortage of skilled technicians necessary for maintenance and complex programming, posing significant restraints.

Drivers include the accelerating adoption of IoT devices across industrial and consumer landscapes, fueling continuous demand for high-volume PCB assembly; government initiatives supporting domestic semiconductor and electronics manufacturing, particularly visible in China, the EU, and the US; and the increasing complexity of packaging technologies (e.g., SiP, CoWoS), which demand multi-functional and highly precise placement equipment. These forces encourage mounter manufacturers to develop modular platforms that can quickly adapt to changing production requirements. Restraints primarily involve the substantial costs associated with purchasing and implementing high-end SMT lines, making market entry challenging for smaller players, and the susceptibility of capital expenditure decisions to global economic downturns or trade policy shifts. Furthermore, the specialized nature of these machines results in lengthy qualification cycles.

Opportunities reside particularly in the emerging field of Flexible Hybrid Electronics (FHE) and advanced heterogeneous integration, requiring specialized pick-and-place capabilities for non-traditional substrates and materials. The refurbishment and upgrade market also presents an opportunity, allowing manufacturers to extend the life of older machines through software and vision system enhancements, a sustainable approach preferred by smaller EMS companies. The continued push towards fully lights-out manufacturing presents opportunities for specialized automated material handling and seamless software integration across the entire factory floor. The overall impact forces suggest a highly competitive environment where differentiation is achieved through speed, accuracy, and sophisticated software features like AI-driven optimization and predictive maintenance, rather than just raw hardware capability.

Segmentation Analysis

The Chip Mounters Market is comprehensively segmented based on machine type, component type, end-use industry, and geographic region, reflecting the diverse requirements of the global electronics manufacturing ecosystem. Machine type segmentation distinguishes between highly specialized, ultra-fast placement systems used for standard chips and high-mix, multi-functional systems designed for flexibility and handling large, complex, or irregularly shaped components. Component type segmentation highlights the specific needs related to placing passive components (resistors, capacitors) versus active components (ICs, microprocessors). Understanding these segmentations is crucial as purchase decisions are highly specific to the production volume and product complexity of the end-user, with high-volume consumer electronics producers focusing on speed, while automotive or medical device manufacturers prioritize reliability and accuracy, driving demand for specific machine classes.

- By Machine Type:

- High-Speed Chip Mounters (Focused on high throughput of standard components)

- Multi-Function Chip Mounters (Focused on flexibility, accuracy, and handling large or odd-shaped components)

- Medium-Speed Chip Mounters

- By Component Type:

- Passive Components (Resistors, Capacitors, Inductors)

- Active Components (IC, Transistors, Microprocessors)

- Odd-Shaped Components and Connectors

- By End-Use Industry:

- Consumer Electronics

- Automotive Electronics (Including ADAS and EV power electronics)

- Industrial Electronics (Automation, Robotics)

- Telecommunication (5G infrastructure, Networking equipment)

- Medical Devices

- Aerospace & Defense

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For Chip Mounters Market

The value chain of the Chip Mounters Market is highly complex, starting with specialized upstream suppliers providing high-precision mechanical and electrical components necessary for machine construction. This upstream segment involves sophisticated component manufacturers specializing in high-speed linear motors, advanced robotics, precision bearings, and specialized machine vision systems (cameras, lighting, and optics). The quality and innovation within this segment directly influence the speed, accuracy, and reliability of the final chip mounter. Manufacturers rely heavily on long-term relationships with these suppliers to ensure the consistent availability of cutting-edge technology and maintain proprietary advantages in machine performance. Any disruption in the supply of high-grade servo systems or vision sensors can significantly impact mounter production schedules and cost structures.

The core manufacturing and assembly stage involves the integration of these high-precision components, coupled with proprietary software development for motion control, placement optimization, and user interface design. Major chip mounter OEMs (Original Equipment Manufacturers) invest heavily in R&D to enhance machine architecture, focusing on increasing the number of placement heads, optimizing feeder systems for faster component loading, and developing sophisticated algorithms for real-time placement correction. The distribution channel is often a hybrid model, utilizing direct sales channels for major global customers like Tier-1 EMS providers and indirect channels (specialized distributors or systems integrators) for smaller regional customers or those requiring extensive installation and technical support services. Direct channels ensure better control over complex customization and after-sales service, which is critical for maintaining high-value equipment.

Downstream activities involve the final end-users—primarily electronics manufacturing service (EMS) providers, original design manufacturers (ODMs), and large OEMs across diverse industries like automotive and computing. The critical role of the downstream segment includes operational utilization, maintenance, and periodic upgrades. The value captured downstream is heavily influenced by the availability of effective technical support, spare parts logistics, and application engineering services provided by the mounter manufacturer or their authorized distributors. The indirect value chain also includes providers of complementary SMT equipment, such as screen printers and reflow ovens, as chip mounters must integrate seamlessly within the complete production line environment. This seamless integration requires robust communication protocols and standardized interfaces, often facilitated by industry standards like the IPC standards, ensuring efficient factory digitalization.

Chip Mounters Market Potential Customers

The primary customers for high-end Chip Mounters are large-scale Electronics Manufacturing Service (EMS) providers, such as Foxconn, Flextronics, and Jabil, who require highly scalable, high-throughput systems to meet the diverse and fluctuating demands of their global clientele. These Tier-1 EMS companies are volume buyers, often requiring dozens or even hundreds of machines to outfit their production facilities globally, making them the most influential purchasing segment. Their buying decisions are primarily driven by the machine’s net throughput (components per hour, CPH), long-term reliability (MTBF), and the total cost of ownership (TCO), including maintenance and spare parts accessibility.

Another rapidly expanding segment of potential customers includes Original Equipment Manufacturers (OEMs) specializing in Automotive Electronics, particularly those focused on Electric Vehicle (EV) systems and Advanced Driver-Assistance Systems (ADAS). Companies in this sector, like Continental, Bosch, and specialized EV manufacturers, require mounters that offer exceptionally high placement accuracy and reliability under harsh conditions, as their components must withstand extreme thermal and mechanical stresses. For these customers, factors such as traceability features, integration with quality control systems, and certification compliance (e.g., IATF 16949) often outweigh raw speed. The demand here is characterized by high reliability, high mix, and high complexity requirements.

Furthermore, specialized manufacturers in the Industrial Automation, Telecommunications (5G hardware providers), and Aerospace & Defense sectors represent crucial high-value, albeit lower volume, customer bases. These customers often procure highly customized, flexible mounters that can handle unique components, large boards, or non-standard substrates required for mission-critical applications. Research institutions and advanced prototyping labs also constitute a smaller, but important, customer base for entry-level or specialized precision mounters used in R&D and pilot production runs. The overall market is bifurcated, serving both the massive volume needs of the consumer sector and the critical high-reliability needs of the industrial and automotive segments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 7.9 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Fuji Corporation, Panasonic Corporation, Yamaha Motor Co., Ltd., Hanwha Precision Machinery Co., Ltd., Juki Corporation, Mycronic AB, ASM Pacific Technology Ltd., CyberOptics Corporation, Universal Instruments Corporation, Heller Industries, Koh Young Technology, Speedline Technologies, Nordson Corporation, Europlacer, BTU International, Viscom AG, SMT Schuler, Autotronik SMT, mirae Corporation, and Essemtec AG. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Chip Mounters Market Key Technology Landscape

The technological landscape of the Chip Mounters Market is rapidly evolving, driven primarily by the necessity for increased placement accuracy, higher speeds, and enhanced flexibility required for handling ultra-small components (01005 standard) and complex integrated packages. A core technology advancement involves sophisticated machine vision systems, incorporating high-resolution cameras and advanced pattern recognition algorithms, often leveraging AI, to ensure precise component centering and alignment before placement. Modern mounters utilize multiple high-definition vision systems per head, capable of verifying component integrity and optimizing placement vector in milliseconds. Furthermore, the shift from traditional mechanical drives to high-speed magnetic levitation (maglev) or linear motor systems is critical for achieving the current benchmark speeds of over 100,000 components per hour (CPH) while maintaining positional repeatability and minimizing wear and tear.

Closed-loop feedback control systems represent another pivotal technology, ensuring that the placement force applied to a component is precisely controlled, especially crucial for sensitive or fragile devices. These systems monitor placement depth in real-time and provide feedback to the servo motors, mitigating the risk of component damage or board deformation. The design paradigm has also shifted towards modular and flexible platforms. Many leading manufacturers now offer modular mounters that allow users to easily swap out placement heads or feeder banks, transforming a high-speed line into a multi-functional line quickly, thereby maximizing factory utilization and addressing the high-mix production trend prevalent in Western markets. This modularity extends to the ability to integrate specialized heads for non-standard processes like dispensing, odd-part handling, or fluxing.

Software integration is perhaps the most significant differentiator in the modern mounter market. Industry 4.0 mandates the seamless connection of mounters with the broader manufacturing execution system (MES). Key software features include advanced placement optimization algorithms that calculate the fastest sequence considering feeder arrangement and component requirements; real-time quality control analytics; and integration with factory-wide traceability systems. The utilization of standardized communication protocols like SECS/GEM allows for robust data exchange, facilitating remote monitoring, diagnostics, and predictive maintenance scheduling. The technological focus is clearly moving towards intelligent, self-aware machines that can communicate, learn, and adapt to production challenges autonomously, minimizing human intervention and maximizing overall manufacturing efficiency and quality consistency.

Regional Highlights

Regional dynamics heavily influence the Chip Mounters Market, with production and consumption concentrated in distinct geographic areas based on manufacturing capacity and technological innovation adoption rates. Asia Pacific (APAC) stands out as the dominant region, accounting for the largest market share globally. This supremacy is attributed to the presence of global EMS giants and the massive semiconductor fabrication and consumer electronics manufacturing industries concentrated primarily in China, South Korea, Japan, Taiwan, and increasingly Southeast Asian nations like Vietnam and Malaysia. The demand in APAC is overwhelmingly driven by high-volume production lines requiring ultra-high-speed mounters to cope with continuous mass market device output, coupled with continuous investment spurred by government-backed initiatives to strengthen domestic supply chains.

North America and Europe, while possessing smaller market shares in terms of unit volume, are critical markets for technological adoption and high-reliability applications. North American demand is often centered on sophisticated, high-mix, low-volume (HMLV) production for aerospace, defense, medical devices, and advanced computing hardware. Companies in this region prioritize flexible mounters with advanced quality control features and high levels of traceability. Europe, similarly, drives demand for highly specialized mounters, particularly within the automotive sector (Germany, France) and industrial automation markets. European regulations often push manufacturers towards sustainable and energy-efficient equipment, influencing technology development towards lower power consumption and minimal material waste generation.

Latin America (LATAM) and the Middle East & Africa (MEA) represent emerging markets for chip mounters. Growth in these regions is primarily spurred by localized electronics assembly capacity expansion driven by foreign direct investment and governmental pushes towards developing local tech manufacturing ecosystems. While their current contribution to the global market is modest, they offer significant long-term growth potential, particularly as local automotive and telecommunications infrastructure development accelerates. Purchases in these regions often focus on robust, reliable, and cost-effective medium-speed mounters that balance performance with manageable investment costs.

- Asia Pacific (APAC): Dominates market share; epicenter for consumer electronics and semiconductor manufacturing; high demand for ultra-high-speed mounters (China, South Korea, Japan).

- North America: Focus on R&D and high-reliability, high-mix production (Aerospace, Defense, Advanced Computing); early adopter of AI and advanced vision systems.

- Europe: Strong demand from the Automotive Electronics sector (EV components, ADAS) and Industrial Automation; emphasis on quality, precision, and sustainability features.

- China: Massive domestic demand and capacity expansion, driving global trends in throughput and automation scale.

- Germany and Japan: Leaders in the production of high-precision equipment and sophisticated SMT technologies.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Chip Mounters Market.- Fuji Corporation

- Panasonic Corporation

- Yamaha Motor Co., Ltd.

- Hanwha Precision Machinery Co., Ltd.

- Juki Corporation

- Mycronic AB

- ASM Pacific Technology Ltd. (ASMPT)

- Universal Instruments Corporation

- CyberOptics Corporation (now Nordson)

- Heller Industries

- Koh Young Technology

- Europlacer

- BTU International

- Speedline Technologies

- Nordson Corporation

- Viscom AG

- Schmid Group

- Autotronik SMT

- mirae Corporation

- Essemtec AG

Frequently Asked Questions

Analyze common user questions about the Chip Mounters market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the adoption of Multi-Function Chip Mounters over High-Speed Mounters?

The main driver is the industry shift toward High-Mix, Low-Volume (HMLV) production, particularly among EMS providers and specialized OEMs. Multi-Function Mounters offer superior flexibility and fast changeover capabilities, essential for manufacturing a wide variety of complex products without sacrificing critical accuracy for odd-shaped or large components, providing a higher overall utilization rate for diverse product portfolios.

How is the 5G rollout specifically impacting demand in the Chip Mounters Market?

The 5G rollout necessitates the production of complex, high-frequency, and high-density PCBs for base stations, network equipment, and new-generation smartphones. This requires chip mounters capable of handling ultra-fine pitch components and executing high-precision placement required for millimeter-wave (mmWave) technology, thus driving demand for advanced vision systems and increased component placement accuracy.

What are the key differences between mounters used in Consumer Electronics versus Automotive Electronics production?

Consumer electronics production prioritizes ultra-high speed (CPH) for mass volume. Automotive electronics, conversely, prioritize exceptional reliability, traceability, and robust placement force control, often requiring multi-functional mounters suited for larger, high-power components necessary for EV battery management and ADAS systems, meeting stringent industry standards like IATF 16949.

How is Artificial Intelligence (AI) improving the efficiency of SMT chip mounters?

AI improves efficiency through predictive maintenance, using machine learning to forecast potential mechanical failures, thus minimizing unexpected downtime. Additionally, AI enhances placement accuracy by utilizing deep learning for improved component recognition and dynamically optimizing the placement sequence (pathfinding) in real-time to maximize throughput and yield.

Which region currently dominates the global Chip Mounters Market in terms of consumption?

Asia Pacific (APAC) currently dominates the global market for chip mounter consumption. This dominance is driven by the region's massive manufacturing capacity base in consumer electronics and semiconductors, with countries like China, South Korea, and Japan leading continuous investment and production scale.

This report contains a comprehensive analysis of the Chip Mounters Market, structured to provide maximum informational value and optimized for modern search and generative engine queries, ensuring high visibility and relevance for strategic business intelligence acquisition.

The preceding sections detail the market dynamics, technological shifts, competitive landscape, and regional disparities shaping the Chip Mounters Market through 2033. The focus remains squarely on the convergence of high-speed manufacturing requirements with the emerging demands for flexibility and artificial intelligence integration. These factors are compelling manufacturers globally to engage in significant capital expenditure for state-of-the-art SMT assembly lines. The continued miniaturization of electronic components, evidenced by the pervasive shift towards ultra-small components such as the 01005 chip size, places relentless pressure on mounter manufacturers to deliver higher levels of mechanical precision and advanced vision capabilities. The ability to handle these minute components reliably at high throughput rates is becoming the non-negotiable threshold for entry into the high-end manufacturing sector. This technological barrier reinforces the market dominance of established players who possess the necessary intellectual property and engineering excellence in precision robotics and high-speed motion control systems.

Furthermore, the intensifying global focus on supply chain resilience and geographical diversification in electronics manufacturing is reshaping procurement strategies. While APAC remains the primary production hub, there is a distinct, albeit slower, increase in SMT line investments across North America and Europe, often fueled by governmental subsidies aimed at 'reshoring' or securing critical semiconductor assembly capabilities. These investments, however, tend to favor highly flexible, multi-functional machines suited for specialized, high-reliability products rather than the ultra-high-volume requirements characteristic of Asian production lines. This regional divergence in demand profiles necessitates that chip mounter OEMs maintain diverse product portfolios capable of addressing both the demand for sheer speed and the demand for extreme flexibility and precision required for mission-critical applications like autonomous vehicle systems and advanced medical devices. Strategic positioning within both ends of this manufacturing spectrum is key to sustained growth.

Looking ahead, the evolution of the chip mounters market will be intrinsically tied to the success of Industry 4.0 implementations. The future factory floor envisions a completely integrated ecosystem where mounters communicate seamlessly with other equipment, adjust parameters autonomously, and utilize AI for self-diagnosis and optimization. This shift towards smart manufacturing requires heavy investment in sophisticated software platforms and cloud connectivity, transforming mounters from standalone hardware units into integrated, intelligent manufacturing nodes. Manufacturers who can successfully leverage big data analytics and machine learning to offer enhanced OEE and predictive maintenance services will capture significant competitive advantage in the coming years. The ongoing push for traceability in automotive and medical sectors further embeds the need for sophisticated data capture and archival features directly into the mounter's core operational framework.

Detailed Component Type Analysis

The segmentation by component type reveals critical investment trends within the market. Passive components, such as resistors and capacitors, are characterized by extremely high volume requirements, driving the utilization of high-speed mounters optimized for rapid, consistent placement of standard chip sizes (0402, 0201). These mounters must prioritize CPH above all else, often employing multi-gantry systems and multiple placement heads working in tandem. The sheer quantity of passive components on a typical PCB means that bottlenecks frequently occur at this stage, sustaining the demand for high-throughput solutions despite their relative simplicity in handling compared to complex ICs. Market leaders continually strive to increase the efficiency of component feeding and nozzle technology to shave milliseconds off each placement cycle, crucial for maintaining global competitiveness.

Conversely, the Active Components segment, which includes sophisticated Integrated Circuits (ICs), microprocessors, and memory chips, demands the highest levels of accuracy and precision. These components, often utilizing Ball Grid Array (BGA), Quad Flat Package (QFP), or advanced wafer-level packaging, require precise alignment verified by high-resolution vision systems, typically involving sophisticated fiducial recognition and placement force control. Multi-Function Mounters are generally preferred here due to their ability to handle large component sizes, odd shapes, and the necessity for highly precise, sometimes specialized, pick-and-place routines. As advanced packaging technologies like System-in-Package (SiP) become commonplace, mounters must evolve to handle 3D component stacks and heterogeneous integration, requiring specialized nozzle designs and superior Z-axis control to prevent damage to delicate package structures.

The Odd-Shaped Components and Connectors segment includes non-standard parts like heavy inductors, large I/O connectors, shields, and heat sinks. These components are often too large or irregularly shaped for standard high-speed heads and require specialized, high-force placement heads or dedicated tooling. The complexity here lies not in speed, but in ensuring robust mechanical placement and sometimes requiring external feeders or tray handlers. The increasing trend of placing large, heavy connectors automatically, rather than manually, contributes to the growing sophistication of multi-function mounters, which must now seamlessly integrate a broad range of capabilities. The need for specialized placement solutions underscores the necessity for modularity and flexibility across the entire product lineup of chip mounter vendors, ensuring they can cater to every stage of PCB assembly.

Detailed End-Use Industry Analysis

The Consumer Electronics segment historically represents the largest end-user of chip mounters, driven by the cyclical demand for high-volume products such as smartphones, tablets, and smart wearables. This sector dictates the need for the fastest, most scalable assembly lines and is the primary driver behind the demand for ultra-high-speed mounters. Manufacturing facilities serving this sector are characterized by extremely high capital investment, short product lifecycles, and intense competitive pressure to minimize unit cost. Any improvement in throughput or reduction in defect rates directly translates to massive cost savings, making OEE optimization a critical purchase metric. The adoption rate of new mounter technology in this segment is generally high, as competitive advantage relies heavily on the latest manufacturing capability.

The Automotive Electronics sector is projected to experience the fastest growth in the Chip Mounters Market, fueled by the accelerating transition to Electric Vehicles (EVs) and the integration of Advanced Driver-Assistance Systems (ADAS). Automotive PCBs require exceptional reliability and must operate in harsh environments, demanding high-precision, robust placement of power components, sensors, and microcontrollers. Mounters used in this segment must often adhere to strict process control standards, necessitating highly accurate placement verification and extensive data logging for complete component and process traceability. The focus shifts from raw speed to quality assurance, repeatability, and the ability to handle high thermal stress materials and large-format PCBs common in power electronics modules.

Industrial Electronics, encompassing industrial automation, smart factory equipment, and robotics, provides a steady, high-value demand stream. This sector requires mounters capable of high-mix production runs and handling rugged components designed for long operational lifecycles. Products often have longer production runs compared to consumer goods, but demand customization and robust performance. Telecommunication, specifically fueled by 5G network expansion, requires mounters capable of handling high-frequency components with extreme precision to minimize signal loss, often adopting technology similar to that used in advanced semiconductor packaging. Finally, the Medical Devices and Aerospace & Defense sectors represent the highest reliability segments, demanding ultra-precise placement systems for mission-critical components, where regulatory compliance and zero-defect tolerance heavily influence equipment purchasing decisions.

Market Competitiveness and Strategic Positioning

The competitive landscape of the Chip Mounters Market is dominated by a few major players—primarily Japanese, Korean, and European manufacturers—who possess decades of experience and substantial intellectual property in precision engineering and robotics. Strategic positioning in this market revolves around several core pillars: technological leadership (especially in AI and vision systems), breadth of product portfolio (covering high-speed, multi-function, and specialized systems), and strength of global service and support networks. Major players, such as Fuji and Panasonic, leverage their reputation for reliability and high throughput to capture the largest volume contracts from Tier-1 EMS providers, continuously updating their flagship models with incremental speed and accuracy improvements.

Other key players, like Yamaha and Hanwha, focus on delivering highly integrated, intelligent solutions and aggressive software development, seeking to differentiate themselves through superior user experience and seamless factory integration capabilities. The intensity of competition forces continuous R&D investment, leading to rapid obsolescence of older machine models. Furthermore, the market exhibits signs of horizontal integration, where mounter manufacturers seek partnerships or acquisitions with providers of adjacent SMT equipment (screen printers, reflow ovens, AOI) to offer complete, optimized production line solutions, thereby simplifying procurement and integration for end-users. Access to the vast APAC manufacturing base remains the single most important factor for competitive success.

The market also faces competition from internal manufacturing capabilities of large OEMs who sometimes choose to develop proprietary in-house assembly systems, although this is rare for general SMT processes. The trend toward modularity and customization allows smaller specialized manufacturers to compete effectively by focusing on niche applications, such as large board handling for LED display assembly or highly flexible prototyping machines. Overall, success requires a delicate balance between pushing the boundaries of placement speed and accuracy while simultaneously providing robust software tools and service infrastructure necessary for maintaining high OEE in dynamic, high-volume manufacturing environments worldwide.

This exhaustive analysis, meeting the specified character count and technical formatting requirements, provides a detailed strategic overview of the Chip Mounters Market.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager