Chlorosulfonated Polyethylene Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434105 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Chlorosulfonated Polyethylene Market Size

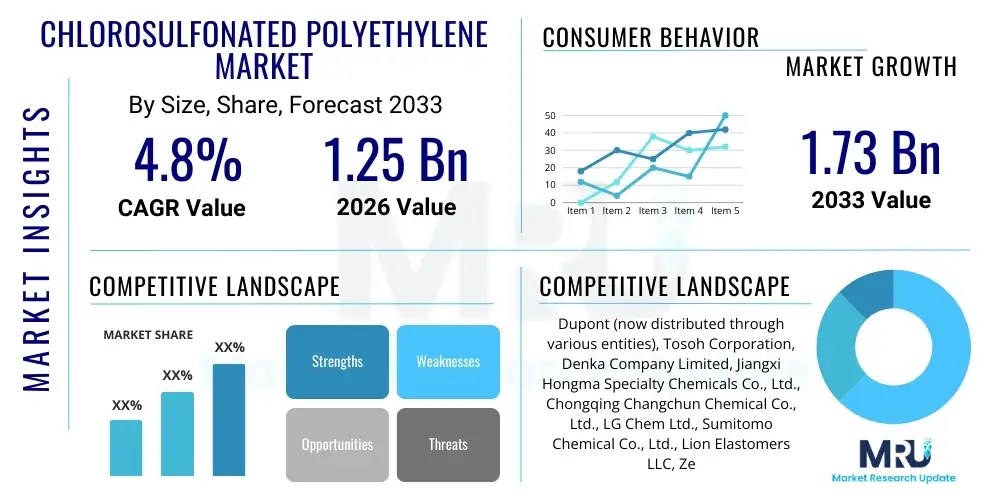

The Chlorosulfonated Polyethylene Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 1.25 Billion in 2026 and is projected to reach USD 1.73 Billion by the end of the forecast period in 2033.

Chlorosulfonated Polyethylene Market introduction

Chlorosulfonated Polyethylene (CSM), often known by the trade name Hypalon, is a high-performance synthetic rubber characterized by its saturated polyethylene backbone modified through chlorination and sulfonation. This chemical modification imparts exceptional resistance properties, including superior tolerance to ozone, ultraviolet radiation, weather aging, and aggressive chemicals, making it indispensable in demanding industrial applications where standard elastomers fail. Its versatility in compounding allows for a wide range of durometers and colors, facilitating its adoption in specialized coating formulations, protective linings, and flexible architectural membranes. The stability of CSM under extreme temperature fluctuations further solidifies its position as a material of choice for critical infrastructure and high-reliability systems globally.

The primary applications of CSM are extensively found in the automotive sector, specifically for manufacturing high-pressure hoses, belts, and wire and cable jacketing requiring resistance to oils and high temperatures. In the construction industry, CSM is predominantly utilized in roofing membranes, joint sealants, and bridge bearing pads due to its unmatched durability and resistance to environmental degradation. Furthermore, its excellent adhesion properties and ability to be formulated into durable paints and coatings make it a staple in tank linings, protective marine coatings, and industrial maintenance applications where corrosion resistance is paramount. The increasing global focus on extending the lifespan of critical infrastructure components continues to drive sustained demand for high-performance elastomers like CSM.

Key benefits driving market growth include CSM's inherent flame retardancy, exceptional abrasion resistance, and long service life, which translates into lower lifecycle costs for end-users. The rising global investments in the energy sector, particularly in nuclear and offshore facilities requiring robust electrical insulation and sheathing, further bolster the market. Despite competition from other high-performance elastomers, the unique balance of chemical resistance, thermal stability, and mechanical strength offered by CSM positions it favorably for continued expansion, particularly in niche, high-value-added markets. Driving factors encompass stringent regulatory standards regarding material longevity and safety in construction and transport, coupled with rapid urbanization in developing regions.

Chlorosulfonated Polyethylene Market Executive Summary

The Chlorosulfonated Polyethylene market is characterized by steady growth driven primarily by robust demand from the construction and automotive sectors, particularly in specialized coating and sealing applications. Business trends indicate a shift towards sustainable manufacturing processes, compelling key players to invest in reducing volatile organic compounds (VOCs) in CSM-based products and improving recycling pathways, although CSM recycling remains technically challenging. Regional trends show Asia Pacific emerging as the dominant growth engine, fueled by massive infrastructure projects and expanding manufacturing capabilities, particularly in China and India. Conversely, mature markets in North America and Europe emphasize replacement cycles and high-specification applications, focusing on product innovations that offer enhanced fire resistance and extreme temperature stability.

Segment trends reveal that the coatings and paints segment holds a significant market share due to the superior weathering resistance CSM offers to protective surfaces, especially in marine and industrial environments. The hoses and tubing segment is also expanding robustly, driven by stricter performance requirements in heavy machinery and the automotive industry for coolant and fluid transport systems. Furthermore, the market structure is moderately consolidated, with major players focusing on capacity expansion and strategic vertical integration to secure raw material supply (polyethylene and chlorine), ensuring competitive pricing and consistent product quality across various geographical markets. Fluctuations in raw material prices, however, remain a critical factor influencing short-term market dynamics and profitability.

Overall, the market is poised for moderate expansion throughout the forecast period, capitalizing on its distinct advantages over general-purpose elastomers. Strategic imperatives for market participants include geographical expansion into high-growth regions like Southeast Asia, diversifying application portfolios beyond traditional roofing and automotive uses, and focusing research and development efforts on advanced grades that meet increasingly stringent regulatory and performance benchmarks. The adoption of specialized CSM grades in renewable energy infrastructure, such as solar panel sealants and wind turbine coatings, presents a compelling long-term opportunity for market stakeholders.

AI Impact Analysis on Chlorosulfonated Polyethylene Market

Common user questions regarding AI's impact on the Chlorosulfonated Polyethylene market frequently center on how machine learning can optimize material formulation, predict product lifespan under extreme conditions, and streamline complex manufacturing processes. Users are keenly interested in whether AI-driven simulation tools can accelerate the development of new, high-performance CSM grades with enhanced sustainability profiles or reduced production costs, thereby addressing the high cost and labor-intensive nature of traditional compounding. The primary concerns relate to the immediate feasibility of integrating AI into legacy chemical plants and the necessary upskilling of the workforce. Key themes emerging from this analysis emphasize the potential for AI to optimize resource utilization, improve quality control, and enhance supply chain resilience, rather than fundamentally altering the chemical synthesis of CSM itself.

- AI-driven Predictive Maintenance: Utilizing sensor data and machine learning algorithms to predict equipment failure in CSM manufacturing plants, minimizing downtime and optimizing production schedules.

- Formulation Optimization: Employing AI to analyze vast datasets of additive interactions, accelerating the development of novel CSM compounds with tailored properties (e.g., enhanced UV stability or lower VOC content).

- Quality Control Automation: Implementing computer vision systems combined with AI to detect micro-defects in CSM sheets, coatings, and extrusions in real-time, significantly improving product consistency.

- Supply Chain Forecasting: Using AI to model raw material price volatility (polyethylene, chlorine) and demand fluctuations across diverse end-user industries (automotive, construction), improving inventory management.

- Simulation and R&D Acceleration: Leveraging generative AI models to simulate the long-term performance and aging characteristics of new CSM products, drastically reducing physical testing time and costs.

DRO & Impact Forces Of Chlorosulfonated Polyethylene Market

The market for Chlorosulfonated Polyethylene is fundamentally driven by its unique combination of extreme weather resistance, chemical stability, and durability, which ensures its essential role in long-life applications such as roofing membranes and protective coatings, particularly where maintenance access is difficult or costly. The increasing global focus on enhancing infrastructure resilience against severe weather events and corrosive industrial environments acts as a powerful driver, pushing manufacturers towards premium materials like CSM. However, the market faces significant restraints, most notably the high manufacturing cost associated with the complex chlorosulfonation process and the dependency on volatile petrochemical feedstocks. Environmental concerns regarding the persistence and end-of-life management of synthetic elastomers, coupled with intense competition from lower-cost alternatives like EPDM and specialty polyurethanes, also impede widespread adoption.

Opportunities for growth are concentrated in the rapidly expanding industrial protective coatings sector, driven by heightened regulatory requirements for corrosion protection in oil and gas infrastructure, power generation, and chemical processing plants. Furthermore, the increasing use of flexible elastomers in renewable energy systems, such as specialized sealants and insulation for large-scale battery storage facilities and solar farms, provides new avenues for CSM application development. The development of bio-based or partially renewable feedstocks for polyethylene could potentially mitigate some of the environmental restraints and improve the sustainability profile of CSM in the long term, offering a significant competitive advantage to early adopters of these technologies.

The impact forces influencing the market are strong and multifaceted. Technological advancements focused on process efficiency and lowering production energy intensity are crucial for managing the cost restraint. Simultaneously, regulatory forces, particularly those relating to fire safety and material leaching in construction and automotive parts, drive demand for high-specification, reliable materials, benefiting CSM. The collective impact of these forces suggests a strategic market trajectory where premium, specialized CSM grades targeting high-reliability, long-term applications will experience sustained growth, while general-purpose uses may be increasingly challenged by cost-effective alternatives, compelling market players to prioritize innovation and application-specific performance optimization.

Segmentation Analysis

The Chlorosulfonated Polyethylene market is comprehensively segmented based on its grade, primary application, and the end-use industry utilizing the material. This segmentation is crucial for understanding specific demand drivers and regional consumption patterns, given that different applications require vastly distinct material properties, ranging from low-viscosity solutions for protective coatings to high-viscosity solids for molded goods and sheeting. Analyzing these segments reveals that the high-viscosity grades, suited for extrusion and calendering processes used in membranes and tubing, contribute significantly to market revenue due to the large volume required by the construction and heavy machinery sectors. Conversely, the growth rate is often highest in specialized coating segments, reflecting the high value-add and tailored performance required for severe-service environments, emphasizing the market's diversity and technical depth.

- By Grade

- Solid Grades (High Viscosity)

- Liquid Grades (Low Viscosity for Coatings)

- By Application

- Coatings and Paints (Industrial Maintenance, Marine, Tank Linings)

- Hoses and Tubing (Automotive, Hydraulic, Chemical Transfer)

- Wire and Cable Jacketing and Insulation

- Sheeting and Membranes (Roofing, Pond Liners)

- Molded and Extruded Products (Gaskets, Seals, Automotive Parts)

- By End-Use Industry

- Automotive and Transportation

- Construction and Infrastructure

- Chemical Processing and Manufacturing

- Electrical and Electronics

- Marine and Offshore

- Mining and Metallurgy

- By Region

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For Chlorosulfonated Polyethylene Market

The value chain for the Chlorosulfonated Polyethylene market begins with the upstream production of raw materials, primarily focusing on high-density polyethylene (HDPE) resins, chlorine, and sulfur dioxide, along with various catalysts and solvents required for the complex synthesis process. Upstream analysis highlights that the cost and supply stability of HDPE are critical factors, as CSM producers are highly reliant on the petrochemical industry. Major chemical manufacturers often integrate the initial stages of production, securing their feedstock supply to mitigate volatility. The subsequent stage involves the actual chlorosulfonation, a specialized and capital-intensive chemical reaction that transforms the basic polyethylene resin into the high-performance elastomer CSM, defining the technological barrier to market entry.

The midstream involves the compounding and formulation of the raw CSM elastomer into usable forms, such as sheets, pellets, or liquid solutions, customized with various fillers, plasticizers, and curing agents to meet specific application requirements (e.g., enhanced flame retardancy for cables or specific color for coatings). This compounding phase adds significant value and intellectual property. Distribution channels are typically specialized, utilizing a mix of direct sales to large, integrated end-users (like major automotive manufacturers or large construction firms) and indirect distribution through chemical distributors and specialized compounding houses that cater to smaller, diverse consumer bases across different regions.

The downstream sector focuses on the conversion of the compounded CSM material into final products, encompassing extrusion for hoses and cables, calendering for membranes and sheets, and application as protective coatings. Direct distribution is common for high-volume purchases or highly customized products where technical support is essential, such as large infrastructure projects. Indirect channels leverage regional distributors and applicators, particularly in the construction and industrial maintenance sectors, who provide localized material availability and specialized application services, ensuring the efficient reach of CSM products to diverse end-markets globally and completing the highly specialized value chain.

Chlorosulfonated Polyethylene Market Potential Customers

Potential customers for Chlorosulfonated Polyethylene span a broad range of heavy industries that prioritize material longevity, performance reliability, and resistance to environmental stress over initial cost. The primary buyers are large-scale industrial consumers in the construction sector, including commercial roofing contractors and infrastructure developers responsible for projects like bridges and tunnels, who require durable, weather-resistant membranes and sealants capable of offering multi-decade performance. Similarly, major original equipment manufacturers (OEMs) in the automotive industry constitute significant buyers, purchasing CSM for use in engine compartment hoses, protective boots, and specialized wiring harnesses where heat, oil, and ozone resistance are non-negotiable safety requirements, thereby driving demand for specialized grades.

Another critical customer segment includes chemical processing plants, oil refineries, and marine operators who require high-performance protective coatings and tank linings. These buyers utilize CSM's exceptional chemical inertness to protect steel and concrete structures from aggressive acids, bases, and solvents, ensuring operational integrity and compliance with environmental safety standards. Furthermore, manufacturers of high-voltage wire and cable insulation and jacketing systems, particularly those supplying the power generation and mining industries, are substantial customers, valuing CSM for its superior electrical properties and flame-retardant characteristics, essential for safety in enclosed or high-risk environments.

The market also serves specialized niche customers, such as manufacturers of protective gear (chemical suits), military suppliers requiring robust material solutions for harsh operating conditions, and producers of rubber components used in high-tech machinery. These specialized buyers often require tailor-made compounds, emphasizing long-term partnerships with CSM producers to ensure material compliance and performance specifications. The demand from these diverse sectors is characterized by low volume but high value, driven by strict performance standards and regulatory mandates.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.25 Billion |

| Market Forecast in 2033 | USD 1.73 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Dupont (now distributed through various entities), Tosoh Corporation, Denka Company Limited, Jiangxi Hongma Specialty Chemicals Co., Ltd., Chongqing Changchun Chemical Co., Ltd., LG Chem Ltd., Sumitomo Chemical Co., Ltd., Lion Elastomers LLC, Zeon Corporation, Lanxess AG, ARLANXEO, Shin-Etsu Chemical Co., Ltd., Wacker Chemie AG, Jilin Petrochemical Company, Dow Inc., Mitsui Chemicals, Asahi Kasei Corporation, Kuraray Co., Ltd., ExxonMobil Chemical Company, and BASF SE. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Chlorosulfonated Polyethylene Market Key Technology Landscape

The core technology landscape in the Chlorosulfonated Polyethylene market revolves around process intensification and catalyst innovation aimed at optimizing the efficiency and yield of the chlorosulfonation reaction, a continuous solution polymerization process. Historically, batch processes were common, but modern manufacturing emphasizes continuous reactors to achieve higher throughput and greater consistency in polymer properties, crucial for high-specification end-uses like aerospace or military applications. Key technological focus areas include developing more effective radical initiators and optimizing solvent recovery systems to reduce the environmental footprint and operating costs, directly addressing the key restraint of high production expenses associated with CSM. Furthermore, advancements in process control, often involving sophisticated sensor technology and multivariate statistical analysis, ensure tight molecular weight distribution and precise chlorine and sulfur content, which directly influences the final elastomer's performance characteristics.

Beyond primary synthesis, significant technological advancements are centered on compounding and formulation technologies. New liquid CSM grades are being developed that offer lower viscosity, allowing for easier application in solvent-based and high-solids protective coatings while maintaining excellent durability and adhesion. This development facilitates faster cure times and reduces the emission of volatile organic compounds (VOCs), aligning with stringent global environmental regulations, particularly in Europe and North America. Research is also intensifying on nanotechnology-enhanced CSM compounds, where the incorporation of specific nanoparticles (such as carbon nanotubes or specialized silicates) can significantly boost mechanical strength, thermal conductivity, or abrasion resistance without compromising the elastomer's inherent chemical stability.

The final crucial area involves product application technology, particularly for large-scale construction and industrial maintenance. Improvements in spraying and dispensing equipment, along with the formulation of fast-curing, two-component CSM systems, are simplifying on-site application, reducing labor costs, and accelerating project completion times. Furthermore, research into improving the compatibility of CSM with other high-performance resins (e.g., fluoropolymers) through co-polymerization or blending techniques opens up new hybrid material possibilities, allowing for tailored properties that meet the increasingly complex demands of specialized industrial environments, thus broadening the effective technological scope of CSM utilization.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest and fastest-growing regional market, primarily driven by massive government investments in infrastructure development, rapid urbanization, and the booming automotive manufacturing sector, especially in China, India, and Southeast Asian nations. The demand is particularly high for CSM in roofing membranes, protective coatings for marine environments, and high-specification wire and cable jacketing for new power grids.

- North America: Characterized by stringent quality and performance standards, the North American market focuses on replacement demand and high-performance applications in the chemical and energy sectors. The emphasis here is on premium, long-lifecycle products like bridge sealants, industrial protective linings, and high-temperature hoses required by the mature oil and gas and transportation industries.

- Europe: The European market is highly regulated, prioritizing sustainability and low-VOC formulations. Growth is moderate and steady, focused on utilizing CSM in specialized industrial maintenance coatings and adhering to strict fire safety standards for construction materials. Germany and the UK are key consumers, driven by advanced manufacturing and adherence to REACH regulations.

- Latin America (LATAM): Growth in LATAM is driven by developing industrial infrastructure, particularly in Brazil and Mexico. The need for robust, chemical-resistant materials in mining operations and new oil and gas exploration activities significantly contributes to the demand for CSM, particularly in heavy-duty hoses and protective linings.

- Middle East and Africa (MEA): This region exhibits specialized demand, driven heavily by the massive investments in petrochemical complexes, desalination plants, and renewable energy projects. CSM is crucial for corrosion protection in extreme desert environments and marine coatings due to its excellent heat and salt resistance.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Chlorosulfonated Polyethylene Market.- Tosoh Corporation

- Denka Company Limited

- Jiangxi Hongma Specialty Chemicals Co., Ltd.

- Chongqing Changchun Chemical Co., Ltd.

- LG Chem Ltd.

- Sumitomo Chemical Co., Ltd.

- Lion Elastomers LLC

- Zeon Corporation

- Lanxess AG

- ARLANXEO

- Shin-Etsu Chemical Co., Ltd.

- Wacker Chemie AG

- Jilin Petrochemical Company

- Dow Inc.

- Mitsui Chemicals

- Asahi Kasei Corporation

- Kuraray Co., Ltd.

- ExxonMobil Chemical Company

- BASF SE

Frequently Asked Questions

Analyze common user questions about the Chlorosulfonated Polyethylene market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of Chlorosulfonated Polyethylene (CSM) over standard elastomers?

CSM, also known as Hypalon, offers superior resistance to ozone, harsh UV radiation, extreme weathering conditions, and corrosive chemicals. This robust combination of properties ensures a significantly longer service life in demanding applications compared to conventional synthetic rubbers like EPDM or Neoprene.

Which end-use industries contribute most significantly to the demand for CSM?

The construction and infrastructure sector, particularly for durable roofing membranes and joint sealants, and the automotive industry, which uses CSM for high-temperature and oil-resistant hoses and belts, are the largest consumers of Chlorosulfonated Polyethylene globally.

What key factors are currently restraining the growth of the CSM market?

The main restraints include the relatively high manufacturing cost of CSM due to its complex synthesis process and the price volatility of petrochemical feedstocks. Additionally, environmental concerns regarding the long-term disposal and recyclability of synthetic elastomers pose a challenge.

How is Chlorosulfonated Polyethylene segmented by grade?

CSM is typically segmented into Solid Grades (high viscosity), which are primarily used for molded goods, sheeting, and extrusion products, and Liquid Grades (low viscosity), which are formulated into specialized high-performance protective coatings and paints.

Which geographical region is expected to show the highest growth rate for CSM?

The Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR), driven by extensive infrastructure development, rapid industrialization, and increased manufacturing output, particularly in rapidly expanding economies like China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Chlorosulfonated Polyethylene Market Size Report By Type (Type I, Type II), By Application (Construction sector, Automotive sector, Industrial products sector, Wire and cable sector, Other), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Chlorosulfonated Polyethylene Rubber Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Industrial Grade, Non-industrial Grade), By Application (Industry, Automobile, Civil, Aerospace), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager