Chlorotoluene Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433494 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Chlorotoluene Market Size

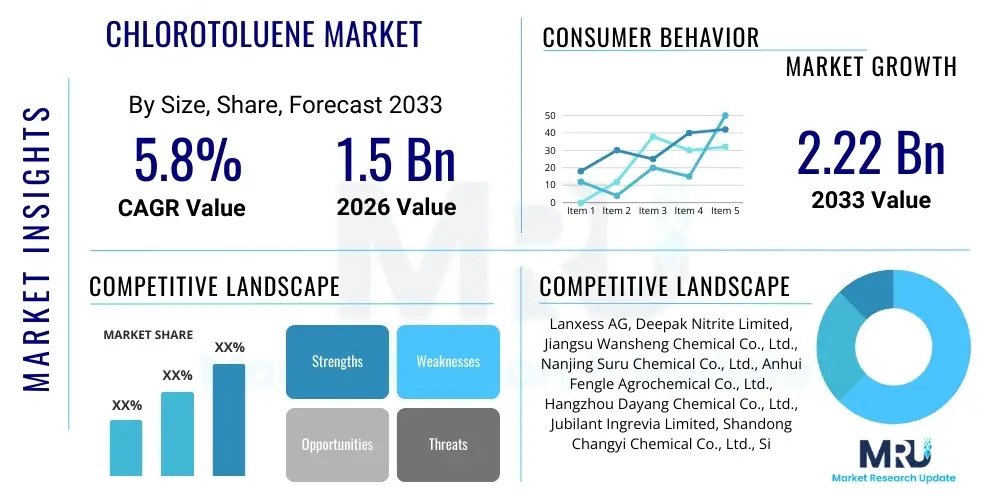

The Chlorotoluene Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 2.22 Billion by the end of the forecast period in 2033.

Chlorotoluene Market introduction

The Chlorotoluene Market encompasses the global production, distribution, and consumption of halogenated organic chemical intermediates derived from the selective chlorination of toluene. These compounds, specifically the isomers ortho-chlorotoluene (OCT), meta-chlorotoluene (MCT), and para-chlorotoluene (PCT), are foundational building blocks crucial for complex chemical synthesis across highly regulated industries. Chlorotoluenes are valued inherently for their aryl chloride functional group, which provides specific reactivity profiles essential for nucleophilic substitution reactions, oxidation, and further side-chain modifications. This chemical utility makes them irreplaceable precursors in manufacturing high-performance products ranging from life-saving pharmaceuticals to advanced agricultural protection agents. The market structure is highly dependent on efficient separation technologies, as the industrial chlorination of toluene typically yields a mixture of isomers, requiring costly and energy-intensive purification steps to meet end-user specifications, particularly the demands of the specialty chemical and pharmaceutical sectors.

Major applications driving market trajectory include the formulation of sophisticated agrochemicals, particularly triazole fungicides and specific classes of herbicides, where the introduction of the chloro group enhances biological activity and persistence. PCT, for example, is instrumental in producing intermediates for fungicides such as propiconazole and triazophos, chemicals vital for protecting staple crops globally. Simultaneously, the pharmaceutical sector relies heavily on chlorotoluenes for synthesizing a diverse array of Active Pharmaceutical Ingredients (APIs), including intermediates for antihistamines, anti-inflammatories, and antiviral drugs. The demand in this segment is characterized by strict quality requirements; ultra-high purity OCT and PCT are necessary to prevent contamination in final drug products, thereby validating the premium pricing associated with pharmaceutical-grade derivatives. Furthermore, they serve as crucial intermediates in the production of specialty dyes and pigments, offering desirable color fastness and thermal stability in textiles and coatings.

Key driving forces behind the sustained market growth include the inexorable rise in global food demand, directly translating into increased utilization of advanced crop protection solutions, thereby amplifying the consumption of agrochemical intermediates. Economic development in emerging nations, especially in the Asia Pacific region, fuels industrial expansion and increases healthcare expenditure, further stimulating the pharmaceutical demand base. Technological advancements focusing on cleaner production methods, such as catalytic systems designed for improved isomer selectivity and energy-efficient separation processes, act as crucial enablers by reducing production costs and enhancing regulatory compliance. However, the market’s inherent dependency on petrochemical raw materials (toluene) links its profitability directly to global energy price volatility, necessitating robust supply chain risk management strategies among leading producers globally. The ongoing transition towards sustainable chemistry also presents an opportunity for chlorotoluene producers to innovate their processes, potentially adopting bio-based toluene alternatives or greener halogenation techniques in the long term, ensuring the longevity and environmental viability of the industry.

Chlorotoluene Market Executive Summary

The Chlorotoluene Market is navigating a phase of moderate yet consistent expansion, underpinned by secular demand trends across agriculture and healthcare, particularly benefiting from increased investment in high-yield specialty chemicals. Current business trends illustrate a heightened emphasis on vertical integration, with major manufacturers acquiring or partnering with upstream suppliers of toluene or downstream formulators of specialty dyes and agrochemicals. This strategy aims to secure margins against fluctuating raw material costs and guarantee consistent quality control throughout the value chain, a paramount concern for pharmaceutical customers. Furthermore, market competition is increasingly focused on technological superiority in achieving maximum para-isomer selectivity during chlorination, as purification remains the most complex and expensive stage of production. Companies demonstrating expertise in advanced crystallization and distillation techniques are gaining significant competitive advantages, particularly when serving markets with ultra-high purity specifications.

Regional dynamics clearly place the Asia Pacific (APAC) region, spearheaded by the manufacturing and consumption powerhouses of China and India, as the primary engine for global market growth. This dominance is attributed to substantial industrial capacities, favorable operational economics, and rapidly expanding domestic consumption markets for both agrochemicals and generic pharmaceuticals. In contrast, North America and Europe, while facing comparatively stricter environmental regulatory frameworks (such as the EU's Industrial Emissions Directive and REACH), maintain vital roles as centers for innovation and suppliers of extremely high-specification chlorotoluene derivatives required by complex specialty polymer and advanced material applications. The regional divergence highlights a global market segmentation: cost-efficiency and volume characterize APAC, while purity and niche specialization define the Western markets. Regulatory harmonization efforts across regions are steadily influencing production practices globally, demanding uniform adherence to quality and environmental standards for global trading.

Analysis of market segmentation reveals the enduring supremacy of the Para-Chlorotoluene (PCT) segment, which commands the highest value share due to its superior commercial utility as a precursor for a wide array of vital end-products. While agrochemicals remain the largest volumetric consumer, accounting for the substantial majority of overall consumption, the Pharmaceutical application segment is projected to record the fastest Compound Annual Growth Rate (CAGR). This accelerating growth is fueled by global demographic shifts, increased longevity, and the subsequent expansion of the pharmaceutical pipeline, requiring more complex and specialized chemical intermediates. The shift toward specialized application areas mandates that suppliers evolve from commodity chemical producers to integrated specialty solution providers, offering technical support and customized synthesis capabilities to downstream partners. This evolution is central to capturing the high-margin opportunities currently emerging in the advanced chemistry market.

AI Impact Analysis on Chlorotoluene Market

AI adoption in the Chlorotoluene Market primarily addresses inefficiencies and risks associated with complex chemical synthesis and supply chain management. Common user queries focus on leveraging Artificial Intelligence and Machine Learning (ML) to manage the inherently challenging chlorination process, particularly how AI algorithms can predict optimal catalyst parameters and reaction temperatures to suppress the formation of undesirable ortho- and meta-isomers, thereby maximizing the yield of the commercially favored para-isomer. Furthermore, users are keenly interested in AI’s capability to analyze process data from multi-stage purification columns, potentially automating or refining the control of fractional distillation, which is crucial but highly energy-intensive. Addressing these concerns, AI provides predictive maintenance models for reactors and distillation units, minimizing unexpected downtime that can be extremely costly in continuous chemical manufacturing environments, enhancing operational uptime and safety compliance significantly.

The transformative effect of AI extends significantly into Research and Development and Quality Control. Cheminformatics platforms, enhanced by machine learning, can model the structure-activity relationship of new chlorotoluene derivatives, dramatically accelerating the discovery phase for novel agrochemicals or pharmaceutical APIs. By simulating millions of potential molecular interactions, AI reduces the need for lengthy, expensive wet-lab testing and optimizes the selection of promising synthetic routes, reducing time-to-market. In quality assurance, AI-powered spectroscopes and chromatography systems analyze batch purity in real-time. These systems can detect trace impurities far more rapidly and accurately than traditional manual analysis, ensuring that specialized chlorotoluene grades consistently meet the exacting purity standards required by regulatory bodies like the FDA. This enhanced quality control capability is non-negotiable for manufacturers serving the high-value pharmaceutical sector, where batch integrity is paramount.

Furthermore, Generative Engine Optimization (GEO) principles suggest that AI-enhanced content generation based on predictive market models will become a valuable strategic asset. Manufacturers can utilize AI to model the impact of regulatory changes, raw material price spikes, and geopolitical events on their profit margins and supply routes, generating highly specific, scenario-based insights for senior management. In the supply chain, AI optimizes logistics by predicting demand fluctuations for specific isomers across different geographies and suggesting optimal inventory levels, mitigating risks associated with long lead times for specialized intermediates and minimizing storage costs for hazardous materials. This holistic integration of AI, from laboratory synthesis optimization to global supply chain resilience, positions AI as a pivotal technology for competitive differentiation and operational excellence in the chlorotoluene industry over the forecast period, driving a measurable shift towards intelligent manufacturing.

- AI-driven optimization algorithms precisely control reaction stoichiometry and temperature, significantly increasing para-isomer selectivity during chlorination.

- Machine learning models are deployed to optimize multi-column fractional distillation, minimizing energy consumption during isomer separation processes.

- Predictive maintenance schedules, managed by AI, reduce unplanned downtime of critical synthesis and purification equipment, improving asset utilization rates.

- Cheminformatics accelerates the discovery and design of novel agrochemical and pharmaceutical derivatives utilizing chlorotoluene structures, shortening R&D cycles.

- Real-time Process Analytical Technology (PAT) systems, integrated with AI, ensure instantaneous detection of batch impurities, guaranteeing pharmaceutical-grade purity and regulatory compliance.

DRO & Impact Forces Of Chlorotoluene Market

The Chlorotoluene Market’s dynamics are fundamentally shaped by a confluence of strong external and internal forces. Key drivers include the relentless pressure on global agriculture to enhance productivity, which necessitates high-efficacy agrochemicals derived from chlorotoluene intermediates, alongside the structural expansion of the global pharmaceutical industry, particularly in the production of low-cost generics and specialized APIs. Technological drivers, such as advancements in highly selective catalysts and novel separation media, also propel growth by reducing manufacturing costs and improving product quality. These drivers are intrinsically linked to global population growth and rising disposable incomes, securing a baseline demand for both food security and advanced healthcare solutions, thereby assuring the long-term relevance of chlorotoluene derivatives as essential chemical intermediates in the global economy, providing robust foundational demand.

However, significant restraints temper this expansion. Foremost among these are the severe environmental and regulatory hurdles associated with large-scale chlorination. The industry must manage corrosive and hazardous materials, leading to high capital expenditure on safety infrastructure and rigorous waste treatment, especially concerning chlorinated organic byproducts, which require specialized disposal methods. Volatility in the pricing of toluene, linked directly to the crude oil market, frequently compresses profit margins, introducing high financial risk, demanding sophisticated hedging strategies. Moreover, the inherent challenge of isomer separation—the energy cost and technical difficulty of isolating high-purity PCT from OCT and MCT—acts as a fundamental technical restraint that limits overall production efficiency and drives up the final cost of specialized grades, posing a challenge to market access in highly cost-sensitive applications like commodity agrochemicals.

Opportunities for high growth lie in developing and commercializing greener synthesis methods, such as utilizing photocatalysis or continuous flow chemistry, which promise reduced energy footprints and improved selectivity, potentially lowering regulatory risks and attracting environmentally conscious customers. Additionally, penetrating highly specialized, emerging markets, such as high-performance electronics, advanced polymer stabilizers, and niche chemical applications (e.g., specific liquid crystal precursors), offers premium pricing opportunities for ultra-high purity grades. The impact forces are characterized by high price elasticity of demand in the commodity segment but inelastic demand in the high-purity pharmaceutical segment where quality and supply consistency supersede price sensitivity. Regulatory standards concerning residual solvents and heavy metals exert a constant upward pressure on operational costs, demanding continuous investment in purification technologies and advanced analytical methods to maintain market compliance and secure competitive advantage in high-value niches.

Segmentation Analysis

The Chlorotoluene Market segmentation provides a strategic framework for assessing growth pockets and understanding competitive landscapes based on chemical structure, end-use function, and regional consumption patterns. Segmentation by isomer type is crucial because the commercial value and difficulty of production vary drastically among the three primary isomers: Para-Chlorotoluene (PCT), Ortho-Chlorotoluene (OCT), and Meta-Chlorotoluene (MCT). PCT dominates in commercial utility due to its ideal position for further functionalization, especially for key agrochemical precursors, leading to higher production volumes and market value compared to the less utilized MCT. The mixed isomers segment, often traded at lower values, reflects the intermediate products requiring further costly separation, highlighting the technical barrier to entry for achieving high purity.

The segmentation based on application reveals the core consumption drivers. The Agrochemicals segment, requiring precursors for herbicides, fungicides, and insecticides, constitutes the foundation of the market, absorbing vast quantities of chlorotoluene derivatives. This segment is characterized by high volume requirements and moderate purity standards. However, the Pharmaceutical segment, while lower in volume, commands significantly higher margins due to the need for ultra-high purity and rigorous regulatory compliance for API intermediates. Specialized applications, including dyes, pigments, and polymer additives, represent smaller but growing segments that are highly sensitive to specific performance characteristics (e.g., UV stability, thermal resistance) provided by the chlorotoluene backbone, driving demand for specific, often customized, derivatives designed for high-end industrial use.

Regional segmentation highlights the geographical concentration of manufacturing and consumption. Asia Pacific (APAC) stands out due to its dual role as a primary manufacturing hub—leveraging cost advantages—and a rapidly expanding consumer base, particularly in agricultural chemicals and bulk generics. In contrast, North America and Europe, characterized by highly developed regulatory regimes and advanced manufacturing capabilities, focus disproportionately on high-value, low-volume specialty applications. Understanding these regional consumption biases allows market participants to tailor their investment strategies, focusing either on high-volume efficiency and capacity expansion in APAC or high-margin specialization and R&D in Western markets, ensuring production capabilities are precisely aligned with regional customer needs and compliance standards globally.

- By Isomer Type:

- Para-Chlorotoluene (PCT): Highest volume and value due to importance in agrochemical and pharmaceutical synthesis, prized for its reactivity.

- Ortho-Chlorotoluene (OCT): Significant intermediate for specialized dyes, pigments, and certain pharmaceutical intermediates requiring specific spatial properties.

- Meta-Chlorotoluene (MCT): Niche applications, often produced as a necessary byproduct requiring specialized and energy-intensive separation methods.

- Mixed Isomers: Lower-grade product utilized where purity is less critical or sold as feedstock to smaller downstream processors capable of in-house separation.

- By Application:

- Agrochemicals (Fungicides, Herbicides, Insecticides): Largest volumetric segment, critical for global crop protection and yield enhancement.

- Pharmaceuticals (APIs and Intermediates): Fastest-growing segment, demanding ultra-high purity and subject to stringent global regulatory scrutiny.

- Dyes and Pigments: Used for color stability, thermal resistance, and fastness in high-quality textiles and industrial coatings.

- Specialty Chemicals and Intermediates: Includes applications in solvents, chemical reagents, and polymer precursors requiring specific functional groups.

- Others (Electronics, Solvents, Polymer Additives): Niche applications demanding specialized purity and performance characteristics for advanced technical products.

- By Region:

- North America (U.S., Canada, Mexico): Focus on advanced R&D and high-value specialization with strict regulatory adherence.

- Europe (Germany, UK, France, Italy): High compliance standards and specialty chemical production, deeply influenced by REACH.

- Asia Pacific (China, India, Japan, South Korea): Global manufacturing base, high volume consumption for agriculture and generic drug production.

- Latin America (Brazil, Argentina): Major consumer due to large agricultural sector and high demand for crop protection.

- Middle East & Africa (MEA): Emerging growth, driven by industrialization and efforts toward localized chemical production and self-sufficiency.

Value Chain Analysis For Chlorotoluene Market

The Chlorotoluene Market value chain is initiated at the petrochemical upstream stage, where the primary raw materials—toluene and chlorine—are sourced. Toluene procurement is highly sensitive to the global pricing and stability of crude oil and natural gas, impacting the primary cost structure for chlorotoluene manufacturers, necessitating sophisticated risk management practices. Chlorine is obtained from energy-intensive chlor-alkali plants, making electricity costs a substantial factor. Secure sourcing is essential, often involving long-term indexed contracts or internal captive production, particularly for large, integrated chemical companies that prioritize cost control and supply resilience. Upstream analysis also considers the purity of the toluene feedstock, as trace impurities can adversely affect the selectivity of the subsequent chlorination reaction, complicating downstream purification efforts and impacting overall yield and profitability significantly.

The midstream stage encompasses the complex manufacturing processes: catalytic chlorination and subsequent isomer separation. The highly technical nature of isomer separation—involving large-scale fractional distillation towers or advanced cooling and crystallization units—represents the highest value-addition point in the chain due to the significant capital investment, vast energy requirements, and proprietary intellectual property required to maximize high-purity yield. Direct distribution channels are often employed by major producers when dealing with large, sophisticated buyers in the pharmaceutical and major agrochemical sectors, facilitating technical support, specialized packaging, and stringent quality documentation mandated by regulatory bodies. Indirect distribution, leveraging regional chemical distributors and specialized traders, handles smaller quantities, diverse product lines, and manages logistics into fragmented geographical markets, extending market reach but adding complexity to quality assurance and traceability.

The downstream analysis focuses on the end-user application stage. Highly pure chlorotoluene intermediates are synthesized into thousands of distinct end-products, generating significant value for the formulator. For example, a minor price change in PCT can have a leveraging effect on the cost structure of a high-value fungicide, creating financial pressure downstream. Customer power in the downstream segment is high, particularly among large pharmaceutical multinational corporations (MNCs) and top-tier agrochemical firms, who demand uncompromising quality, rigorous compliance audits, and reliable, long-term supply agreements. The profitability of the chlorotoluene producer is directly tied to their ability to meet these specific downstream quality thresholds, demonstrating the critical link between efficient midstream purification technology and sustained high-value revenue generation in the end-market, placing a premium on technological excellence.

Chlorotoluene Market Potential Customers

The largest and most strategically important customers for chlorotoluene products are multinational agrochemical corporations. These companies utilize chlorotoluene derivatives, primarily high-purity PCT, as essential feedstock for formulating a vast range of crop protection chemicals, including novel herbicides, powerful fungicides like triazoles, and selective insecticides crucial for modern farming. These customers prioritize guaranteed supply security, highly consistent batch quality, and competitive pricing, given the volume demands required to support global agricultural activities. Their purchasing decisions are driven by the need to maintain regulatory registrations for their end-products across different geographical zones, necessitating rigorous supplier vetting and audit processes to ensure compliance with global Good Manufacturing Practices (GMP) and environmental standards pertaining to intermediates.

The second key customer base is the pharmaceutical and fine chemical manufacturing sector, which requires the highest possible purity levels, often seeking 99.9%+ grades of specific isomers for complex Active Pharmaceutical Ingredient (API) synthesis. These customers value quality consistency, impeccable documentation, and responsiveness to customized synthesis requirements over raw volume or lowest cost, recognizing that intermediate purity directly impacts drug efficacy and regulatory approval. For these applications, chlorotoluene acts as a chiral precursor or a reactive moiety introduction agent in multi-step organic synthesis. Suppliers must adhere to pharmaceutical quality management systems (ICH Q7) and provide comprehensive data packages supporting regulatory submissions, establishing long-term, highly specialized supplier relationships based on trust, proprietary technical capability, and regulatory expertise.

Additionally, significant demand stems from manufacturers in the specialty chemicals industry, including producers of high-performance technical polymers, advanced coatings, and specialty dyes and pigments. These customers seek customized grades of chlorotoluene derivatives that impart specific technical characteristics—such as improved light fastness, thermal stability, or specialized solubility—to their end-products, focusing on performance enhancement. While their volume requirements may be lower than the agricultural sector, the complexity and niche nature of their needs often justify premium pricing. Emerging customer segments include companies developing materials for the electronics industry (e.g., specialized display chemicals and photoresists), requiring the highest levels of ultra-pure chlorotoluene to prevent functional device failure, creating a highly demanding, technically sophisticated market segment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 2.22 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Lanxess AG, Deepak Nitrite Limited, Jiangsu Wansheng Chemical Co., Ltd., Nanjing Suru Chemical Co., Ltd., Anhui Fengle Agrochemical Co., Ltd., Hangzhou Dayang Chemical Co., Ltd., Jubilant Ingrevia Limited, Shandong Changyi Chemical Co., Ltd., Sigma-Aldrich (Merck KGaA), TCI Chemicals, Tokyo Chemical Industry Co., Ltd., Aarti Industries Ltd., Chemcon Speciality Chemicals Ltd., Yancheng Fengle Agrochemical Co., Ltd., Hubei Hengchao Chemical Co., Ltd., Jining Sanli Chemical Co., Ltd., Zhejiang Longsheng Group Co., Ltd., BASF SE, Dow Chemical Company, China Petroleum & Chemical Corporation (Sinopec) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Chlorotoluene Market Key Technology Landscape

The Chlorotoluene Market’s technological evolution is driven by the imperative to increase the efficiency of the key production steps: selective chlorination and isomer separation. The industry standard utilizes the liquid-phase catalytic chlorination of toluene, where Lewis acids such as anhydrous ferric chloride (FeCl3) or aluminum chloride (AlCl3) are used to generate the required electrophile. Technological improvements in this area focus heavily on developing advanced solid catalysts or modified homogeneous systems that exhibit superior selectivity for the para-isomer, minimizing the unwanted formation of ortho- and meta-isomers. This optimization is crucial because a 1% increase in PCT yield during synthesis translates into significant cost savings by reducing the load on the subsequent energy-intensive separation stages and minimizing the volume of low-value byproduct streams that require disposal and specialized waste management.

A critical focus area is the mastery of separation technology. Given the extremely close boiling points of the chlorotoluene isomers—for instance, PCT and OCT typically differ by only a few degrees Celsius—traditional atmospheric or vacuum distillation is highly inefficient and energy-intensive. Modern facilities are increasingly adopting energy-efficient techniques such as reactive distillation, which combines reaction and separation in one unit, or sophisticated cryogenic crystallization methods. Fractional crystallization, managed under precise pressure and temperature controls, is especially favored for producing the ultra-high purity grades (e.g., 99.95%+) required by the pharmaceutical and electronics sectors. Continuous investment in proprietary separation sequences represents a strategic bottleneck control point for dominant market players, safeguarding market share in the premium segment and requiring specialized engineering expertise and high intellectual property protection.

Furthermore, Process Analytical Technology (PAT) is rapidly transitioning from an emerging technology to a standard practice within advanced chlorotoluene manufacturing plants. PAT involves the use of real-time analytical tools, such as spectroscopic techniques (e.g., Raman or Near-Infrared spectroscopy), integrated directly into the reactor and distillation columns. This allows operators to monitor critical quality attributes (CQAs), such as isomer ratio and impurity profiles, instantaneously. The implementation of PAT, often combined with AI and sophisticated process control systems, ensures that reactions are maintained within optimal parameters, drastically reducing batch rejection rates, enhancing overall plant safety by controlling exothermic risks, and facilitating regulatory compliance by providing an unbroken record of quality control throughout the manufacturing lifecycle. Looking ahead, green chemistry principles are encouraging exploration into alternative halogenation agents and non-catalytic activation methods, seeking to reduce dependence on hazardous chlorine gas handling and minimize the overall environmental footprint of production.

Regional Highlights

The Asia Pacific (APAC) region continues its dominance in the Chlorotoluene Market, driven by robust industrial expansion, massive population growth, and high demand for affordable agrochemicals and pharmaceuticals. China remains the largest producer and consumer globally, leveraging competitive manufacturing costs, extensive integrated chemical complexes, and a supportive governmental environment aimed at maintaining self-sufficiency in key chemical intermediates. India is rapidly emerging as a significant market, fueled by its fast-growing generic drug manufacturing sector and increasing agricultural output demands. The APAC market dynamic is volume-centric, prioritizing cost-efficiency and quick scale-up, although environmental compliance pressures, especially in coastal regions of China and industrial zones in India, are steadily tightening, prompting investment in cleaner production technologies and advanced waste management infrastructure.

North America (NA) and Europe collectively represent mature markets characterized by innovation, strict regulatory environments, and a strategic focus on specialty chemicals and high-value, low-volume production. In NA, demand is stable, primarily driven by established pharmaceutical R&D centers and specialty chemical production for the automotive and aerospace sectors. The high cost of labor and energy mandates technological superiority, compelling NA manufacturers to specialize in ultra-high purity grades that command a premium price and are essential for sensitive downstream applications. Europe, highly influenced by the comprehensive framework of REACH, enforces the most stringent standards globally, requiring exhaustive product safety documentation and robust environmental controls. This regulatory pressure fosters innovation toward sustainable synthesis routes and high traceability, positioning European producers as leaders in quality and environmental stewardship while ensuring compliance across the entire supply chain.

Latin America (LATAM), particularly Brazil, is a critical growth region due to its expansive commercial agriculture sector, making it a high consumer of agrochemicals derived from chlorotoluene. Market dynamics here are highly correlated with global commodity prices and agricultural export volumes, influencing procurement strategies among regional distributors. The Middle East and Africa (MEA) region is exhibiting nascent growth, tied largely to national strategies focused on petrochemical diversification and building local chemical production capabilities, particularly in Saudi Arabia and the UAE. Investment in MEA is targeted at reducing dependency on imported intermediates, positioning the region as a future source of bulk chemicals, though market growth remains susceptible to geopolitical instability and limitations in local technical expertise and specialized purification infrastructure necessary for high-grade products.

- Asia Pacific (APAC): Leads global production and consumption; growth fueled by China and India's pharmaceutical and agrochemical industries; focus on volume, scale, and cost leadership, facing increasing environmental scrutiny.

- North America: Stable, high-value market specializing in ultra-high purity OCT and PCT for pharmaceutical APIs and advanced specialty chemicals; competitive advantage secured through R&D and strict adherence to EPA regulations.

- Europe: Characterized by high environmental and safety standards (REACH compliance); strong demand for sustainable, traceable, and high-quality derivatives for advanced material synthesis and consumer goods.

- Latin America (LATAM): High demand for agrochemicals due to expansive agricultural industry (e.g., Brazil, Argentina); market sensitive to global agricultural export performance and commodity price cycles.

- Middle East & Africa (MEA): Emerging market focused on local capacity building and petrochemical integration; slow but promising growth in bulk chemical production aimed at import substitution.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Chlorotoluene Market.- Lanxess AG

- Deepak Nitrite Limited

- Jiangsu Wansheng Chemical Co., Ltd.

- Nanjing Suru Chemical Co., Ltd.

- Anhui Fengle Agrochemical Co., Ltd.

- Hangzhou Dayang Chemical Co., Ltd.

- Jubilant Ingrevia Limited

- Shandong Changyi Chemical Co., Ltd.

- Sigma-Aldrich (Merck KGaA)

- TCI Chemicals

- Tokyo Chemical Industry Co., Ltd.

- Aarti Industries Ltd.

- Chemcon Speciality Chemicals Ltd.

- Yancheng Fengle Agrochemical Co., Ltd.

- Hubei Hengchao Chemical Co., Ltd.

- Jining Sanli Chemical Co., Ltd.

- Zhejiang Longsheng Group Co., Ltd.

- BASF SE

- Dow Chemical Company

- China Petroleum & Chemical Corporation (Sinopec)

Frequently Asked Questions

Analyze common user questions about the Chlorotoluene market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary application driving the Chlorotoluene Market growth?

The primary driver is the global agrochemical industry, specifically the synthesis of various effective fungicides and herbicides derived from high-purity p-Chlorotoluene (PCT), essential for enhanced crop yield and protection globally.

How do regulatory changes, such as REACH, impact the Chlorotoluene Market?

Regulations like REACH enforce stringent requirements for chemical safety, environmental reporting, and product traceability, compelling manufacturers in affected regions (primarily Europe) to invest in advanced, cleaner synthesis technologies and comprehensive risk assessments, driving up compliance costs and favoring high-quality suppliers.

Which isomer of Chlorotoluene holds the largest market share and why?

Para-Chlorotoluene (PCT) holds the largest market share. This dominance is due to its preferred chemical structure, making it an indispensable and reactive intermediate for high-volume synthesis of critical agrochemical actives and key pharmaceutical building blocks, offering superior utility.

What technological advancements are critical for improving production efficiency?

Critical technological advancements include optimizing catalytic systems to increase selectivity for the desired isomer (PCT), implementing advanced separation techniques like fractional crystallization to achieve ultra-high purity, and utilizing Process Analytical Technology (PAT) for real-time quality control and process monitoring.

How does raw material volatility affect the Chlorotoluene Market?

The market is highly sensitive to the price volatility of toluene, a petrochemical derivative. Fluctuations in global crude oil and natural gas prices directly impact the upstream cost of toluene and chlorine, affecting the production profitability and demanding robust hedging and supply chain management strategies.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager