Chromatographic Packing Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438696 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Chromatographic Packing Market Size

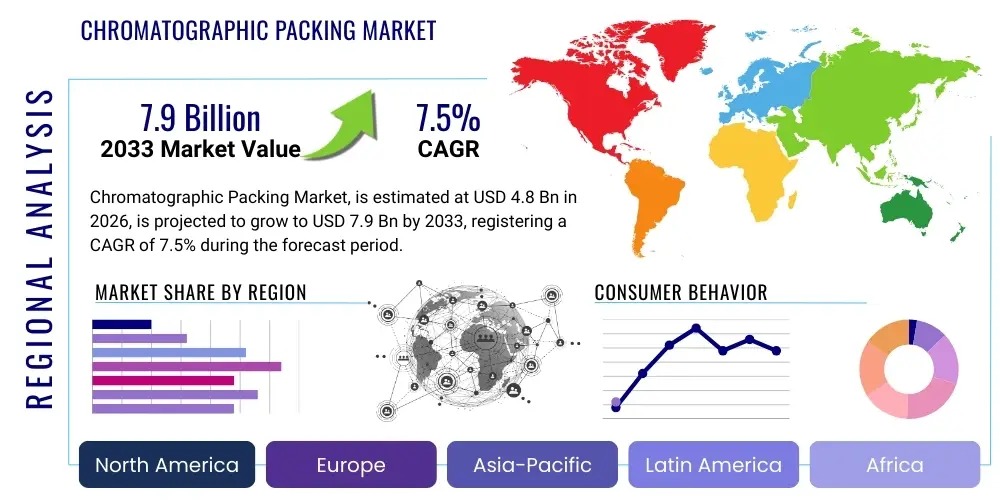

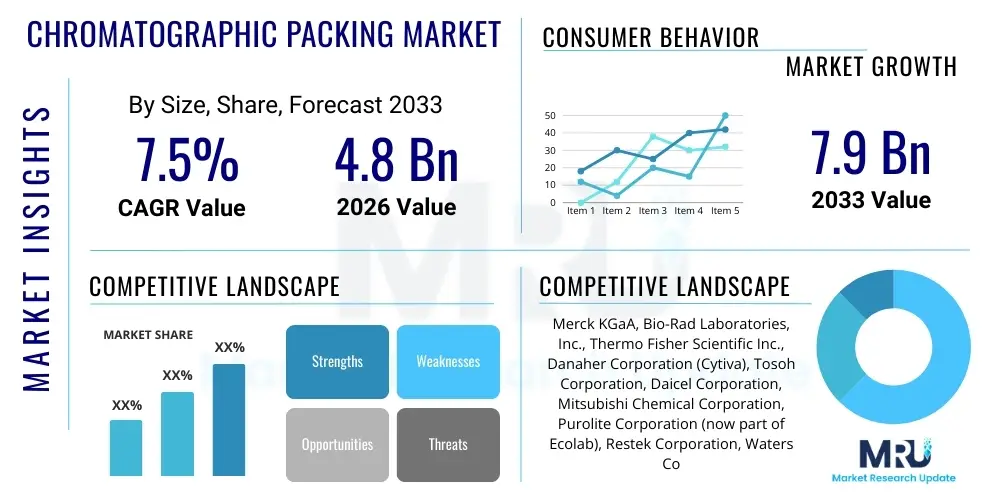

The Chromatographic Packing Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 7.9 Billion by the end of the forecast period in 2033.

Chromatographic Packing Market introduction

The Chromatographic Packing Market encompasses the supply of stationary phase materials, which are the fundamental components used in chromatography columns essential for separating complex mixtures in analytical and preparative applications. These sophisticated materials, often based on silica, polymers, or specialized resins, are crucial for achieving high resolution, selectivity, and efficiency in separation processes across various platforms, including High-Performance Liquid Chromatography (HPLC), Ultra-High-Performance Liquid Chromatography (UHPLC), and large-scale preparative chromatography utilized predominantly in biopharmaceutical manufacturing. The continuous drive toward faster, more accurate, and high-throughput separation techniques fuels the demand for innovative packing materials such as superficially porous particles (SPP) and monolithic supports, which offer superior performance characteristics compared to traditional porous particles. The effectiveness of chromatographic separation, which relies heavily on the quality and physicochemical properties of the packing material, directly impacts the purity and yield of therapeutic agents, making this market a critical enabler of the biotechnology and pharmaceutical industries.

Major applications for chromatographic packing materials span quality control, drug discovery, clinical diagnostics, environmental testing, and, most significantly, the downstream processing of biotherapeutics, including monoclonal antibodies (mAbs), peptides, and vaccines. The intrinsic benefits derived from high-quality packing materials include enhanced column lifetime, reduced solvent consumption, minimized analysis time, and significantly improved reproducibility of results, which are mandatory requirements under stringent regulatory guidelines, particularly those enforced by agencies like the FDA and EMA. The market is segmented primarily by material type (silica-based, polymer-based), format (pre-packed columns, bulk media), and application scale (analytical, preparative, process). This specialization addresses the diverse needs ranging from micron-scale analytical assays requiring ultra-high resolution to large-scale purification requiring high binding capacity and robustness.

Key driving factors propelling the expansion of the Chromatographic Packing Market include the burgeoning global demand for biopharmaceuticals, particularly biosimilars and novel protein therapies, which necessitate efficient and scalable purification methods. Furthermore, technological advancements leading to the development of smaller, more uniform particles, such as sub-2-micron porous and sub-3-micron SPP materials, are expanding the capabilities of analytical laboratories. The increasing complexity of drug molecules requires specialized packing materials, such as chiral stationary phases for enantiomeric separation, and affinity chromatography media for highly selective binding. Regulatory mandates for rigorous testing of impurities and contaminants in food, water, and drugs further solidify the essential role of chromatographic methods, thereby ensuring sustained investment in advanced packing media research and development by manufacturers worldwide.

Chromatographic Packing Market Executive Summary

The Chromatographic Packing Market is experiencing robust acceleration driven primarily by the biopharmaceutical sector’s unprecedented demand for efficient downstream purification solutions. Business trends indicate a strong move towards strategic mergers and acquisitions among established chemical and life science companies to integrate specialized packing media technologies, particularly in the realm of ion exchange and affinity chromatography, crucial for monoclonal antibody production. Furthermore, there is an observable shift in market dynamics toward manufacturers providing comprehensive solutions, integrating column hardware design with optimized packing protocols, rather than just supplying bulk media. Pricing strategies are becoming increasingly competitive in the mature analytical segment, pushing innovation towards high-end, proprietary materials like superficially porous particles (SPP) where performance gains justify premium costs, while the preparative segment focuses intensely on cost-per-batch efficiency and media reusability, essential for operational expenditure control in large-scale manufacturing environments.

Regionally, North America maintains its dominance, primarily due to the established presence of global pharmaceutical and biotechnology giants, substantial R&D expenditure, and a well-defined regulatory framework that mandates advanced separation techniques for drug approval. However, the Asia Pacific (APAC) region is projected to register the highest growth rate, fueled by rapid expansion in generics manufacturing, increasing governmental investment in life sciences infrastructure, and the relocation of bioprocessing activities to countries like China and India. European market growth is stable, underpinned by strong academic research in separation science and the presence of major analytical instrumentation manufacturers, focusing heavily on environmental and food safety applications alongside pharmaceutical quality control. Investment flows are concentrated on developing localized supply chains in APAC to mitigate geopolitical risks and optimize logistics associated with high-value chromatographic media.

Segment trends reveal that the Polymer-based Media segment, particularly agarose and polystyrene divinylbenzene (PS-DVB), is witnessing rapid adoption for large-scale bioprocessing due to superior chemical stability and high binding capacity under caustic cleaning conditions, crucial for sanitation protocols. Within the application landscape, biopharmaceutical purification remains the most lucrative segment, demanding high-capacity media for capturing and polishing therapeutic proteins. The format segmentation shows strong growth in pre-packed columns, driven by laboratory demand for ease-of-use, reproducibility, and minimal human error during column preparation, accelerating turnaround times in clinical and analytical settings. The trend is clear: standardization and scalability are paramount, pushing vendors to certify their media for cGMP compliance and long-term supply assurance, addressing the industry’s central focus on supply chain resilience.

AI Impact Analysis on Chromatographic Packing Market

User queries regarding the intersection of Artificial Intelligence (AI) and the Chromatographic Packing Market primarily revolve around how machine learning can optimize separation methods, predict column performance, and accelerate the discovery of novel stationary phases. Users are particularly concerned with AI's ability to handle the complexity of multivariate data generated during chromatographic runs, including parameters such as particle size distribution, pore structure, binding kinetics, and mobile phase composition. Key themes emerging from this analysis include the potential for AI-driven method development to significantly reduce the time and resource expenditure currently associated with trial-and-error optimization, which is particularly laborious for complex large-molecule separation or chiral purification. Furthermore, users anticipate AI models capable of predictive maintenance and real-time process monitoring, ensuring optimal utilization and longevity of high-cost packing media in industrial bioprocessing columns. There is also significant interest in the application of deep learning algorithms to correlate the synthesis parameters of novel packing materials (e.g., polymer crosslinking density or silica surface modification) directly with separation efficiency and selectivity, thereby streamlining R&D pipelines for next-generation media.

The strategic deployment of AI in the chromatographic workflow transforms the packing market from a purely materials-supply domain to an integrated service and solution offering. Manufacturers are beginning to leverage AI to model the intricate fluid dynamics within packed beds, allowing for better quality control during the packing process itself, which directly correlates with column efficiency and reproducibility. This predictive modeling capability helps in standardizing column packing procedures globally, a critical factor for highly regulated industries. Moreover, AI is poised to enhance the utility of existing media by maximizing operational windows; for example, machine learning can determine the optimal flow rate, buffer composition, and loading capacity for a specific target molecule on a given packing medium, extending the media’s effective lifespan and improving downstream yields without necessitating costly hardware upgrades. This shift towards smart chromatography systems validates the value proposition of premium, high-fidelity packing materials, as their superior performance characteristics are fully realized and exploited through optimized, AI-driven protocols.

The primary concern amongst potential users and consumers of chromatographic packing material relates to the integration complexity of AI software with existing legacy analytical instruments and process control systems prevalent in older manufacturing facilities. Standardization of data formats and the creation of robust, labeled datasets from historical runs are prerequisites for effective AI implementation. Despite these challenges, the overarching expectation is that AI will democratize high-level chromatographic expertise, allowing less specialized operators to achieve expert-level separation results. This capability, coupled with the potential for in-silico material screening, is expected to accelerate the adoption of high-resolution packing media and stimulate incremental demand by making complex separations more economically and practically feasible across a wider spectrum of laboratory and manufacturing environments. The future competitiveness of packing material suppliers may increasingly rely on their ability to provide integrated software platforms that leverage AI for application support.

- AI optimizes method development, reducing reliance on lengthy empirical optimization cycles in HPLC and UHPLC.

- Predictive modeling ensures optimal column packing density, maximizing the efficiency and reproducibility of separation columns.

- Machine learning algorithms correlate physicochemical properties of packing materials (e.g., porosity, ligand density) with target molecule selectivity.

- AI enables real-time monitoring and predictive maintenance in large-scale preparative chromatography, preventing media failure and maximizing column lifetime.

- Enhanced data analysis facilitates faster identification of contaminants and impurities using complex separation profiles generated by advanced packing media.

DRO & Impact Forces Of Chromatographic Packing Market

The Chromatographic Packing Market is fundamentally driven by the escalating demand for advanced biotherapeutics, including monoclonal antibodies (mAbs), cell and gene therapies, and recombinant proteins, all of which require highly efficient and scalable purification methods that rely directly on specialized packing media. Technological drivers, such as the introduction of superficially porous particles (SPP) and sub-2-micron fully porous materials, offer significant resolution enhancements and shorter analysis times, fueling replacement cycles in analytical laboratories. The stringent regulatory requirements across pharmaceuticals and food safety necessitate validated, high-quality separation techniques, guaranteeing sustained investment in premium packing materials. Counterbalancing these drivers are significant restraints, including the extremely high initial capital cost associated with large-scale preparative chromatography columns and the media itself, posing a barrier to entry for smaller biotechnology firms. Furthermore, the inherent susceptibility of certain organic-based packing materials to degradation from harsh cleaning-in-place (CIP) protocols in bioprocessing environments increases operational expenditure and limits media reusability, a significant economic constraint.

Key opportunities exist in addressing the unique separation challenges presented by emerging modalities, particularly the purification of viral vectors for gene therapies and large nucleic acids, which require novel, non-traditional separation mechanisms like monolithic columns or specialized membrane adsorbers to maintain biological activity. The rapid expansion of the biosimilars market globally presents a significant opportunity, as these manufacturers require cost-effective, high-throughput media that can match the purity profiles of originator drugs. The potential for innovation lies in developing continuous chromatography systems, where smaller, more efficient columns packed with specialized media can significantly reduce the manufacturing footprint and media consumption compared to traditional batch chromatography. This shift necessitates packing materials optimized for rapid cycling and robust performance under dynamic conditions, creating a fertile ground for novel material science developments aimed at reducing the overall cost of purification per gram of therapeutic product.

The market impact forces are categorized by supply-side innovations and demand-side pressure. On the supply side, competitive intensity focuses on proprietary ligand chemistries for affinity and ion exchange media, where performance differentiation is achieved through superior selectivity and binding capacity. The threat of substitution remains moderate, as alternative separation techniques (e.g., crystallization, ultracentrifugation) are generally not adequate replacements for high-resolution chromatography in complex biomolecule purification, solidifying chromatography's central role. However, continuous process intensification methodologies, potentially reducing the required media volume, serve as a negative impact force on overall volume demand. The dominant positive force is the continued acceleration of drug pipelines, especially in oncology and immunology, ensuring an expanding base of target molecules requiring high-purity chromatographic separation throughout the forecast period.

Segmentation Analysis

The Chromatographic Packing Market is analyzed based on a multi-dimensional segmentation strategy, providing granular insight into the material, format, application, and end-user landscapes. This segmentation reflects the highly specialized nature of chromatography, where the required packing material properties—such as pore size, particle shape, surface chemistry, and mechanical stability—vary dramatically depending on whether the process is high-resolution analytical testing or large-volume industrial purification. The primary segmentation by material type, focusing on silica-based and polymer-based media, distinguishes between materials used predominantly in small-molecule analysis (silica) and those favored for large-scale bioseparations (polymers) due to their chemical robustness and suitability for high pH cleaning regimes. Segmentation by format, including bulk media and pre-packed columns, captures the shift towards convenience and reproducibility in laboratory settings versus the cost-efficiency required for process-scale operations.

Application segmentation reveals the dominance of the biopharmaceutical sector, which necessitates specialized chromatography modes like size exclusion, hydrophobic interaction, and particularly affinity chromatography (e.g., Protein A media for mAbs). Conversely, the food and beverage testing segment, along with environmental analysis, drives demand for specific materials optimized for trace contaminant analysis and complex mixture resolution using techniques like reversed-phase HPLC. The analytical segment, defined by column internal diameters typically under 10mm, is highly sensitive to improvements in particle technology (SPP, sub-2µm), aiming for speed and efficiency. In contrast, the preparative and process scale segments, utilizing significantly larger columns, prioritize media capacity, physical resilience, and cost-effectiveness over ultra-high resolution, although efficiency remains critical for maintaining product quality specifications and maximizing yield per run.

Understanding these segments allows market participants to tailor their product development and commercial strategies effectively. For instance, companies targeting the analytical market invest heavily in particle manufacturing precision and bonding chemistries, emphasizing reproducibility and longevity. Suppliers focusing on the bioprocess market invest in cGMP manufacturing standards, scalable production capacity, and validation services to meet the strict regulatory needs of pharmaceutical clients. The continuous evolution of drug discovery platforms, including the increasing use of high-throughput screening and automation, further drives the demand for specialized packing materials that are stable under diverse and aggressive operational parameters, reinforcing the market's trajectory towards high-value, differentiated products.

- By Material Type:

- Silica-based Media (Fully Porous, Superficially Porous Particles (SPP), Hybrid)

- Polymer-based Media (PS-DVB, Polyacrylamide, Hydroxyapatite)

- Others (Alumina, Zirconia, Carbon, specialized Resins)

- By Format:

- Bulk Media (Used for Self-Packing, Primarily Process Scale)

- Pre-packed Columns (Analytical Columns, Flash Columns, Cartridges)

- By Application:

- Biopharmaceutical Purification (Monoclonal Antibodies, Recombinant Proteins, Vaccines, Oligonucleotides)

- Clinical Diagnostics and Forensics

- Food and Beverage Testing

- Environmental Analysis

- Academics and Research

- By Separation Mode:

- Affinity Chromatography

- Ion Exchange Chromatography (IEX)

- Reversed-Phase Chromatography (RPC)

- Size Exclusion Chromatography (SEC)

- Hydrophobic Interaction Chromatography (HIC)

- Chiral Chromatography

- By End-User:

- Pharmaceutical and Biotechnology Companies

- Contract Manufacturing Organizations (CMOs) and Contract Research Organizations (CROs)

- Academic and Government Research Institutes

- Hospitals and Clinical Laboratories

Value Chain Analysis For Chromatographic Packing Market

The value chain for the Chromatographic Packing Market begins with the upstream sourcing and synthesis of raw materials, primarily high-purity chemical precursors like silanes, high-grade polymers (e.g., polystyrene divinylbenzene, agarose), and specialized ligands for functionalization. This phase demands rigorous quality control, as the purity and consistency of these foundational materials directly dictate the chromatographic performance, mechanical strength, and chemical stability of the final packing media. Key upstream processes involve precision synthesis of spherical silica or polymer base particles, followed by intricate surface modification through bonding chemistry to attach functional groups, such as C18, ion-exchange ligands, or specialized affinity agents (e.g., Protein A). Companies in this stage, often highly specialized chemical manufacturers, must possess proprietary expertise in controlling particle morphology, pore structure uniformity, and ligand density, establishing a significant barrier to entry due to the technical complexity involved in achieving chromatographic grade quality.

The midstream stage involves the core manufacturing process: packing media production, quality assurance, and packaging. Bulk media producers focus on large-volume, cGMP-compliant manufacturing capacity, especially for bioprocess media, requiring sophisticated fluidization and sieving techniques to ensure tight particle size distribution. Manufacturers of pre-packed columns take this bulk media and load it into high-precision column hardware using proprietary dynamic axial compression or slurry packing methods to create a homogeneous, stable packed bed, which is critical for achieving high resolution and reproducibility in analytical and small-scale preparative applications. Regulatory compliance and extensive validation documentation are critical components of value addition at this stage, particularly for pharmaceutical applications where media stability data, extractables and leachables testing, and regulatory filings are mandatory requirements provided to the downstream users.

Downstream analysis focuses on distribution channels and end-user consumption. Direct distribution is favored for large bioprocessing contracts, enabling direct technical support, custom media formulations, and long-term supply agreements between the manufacturer and the pharmaceutical company or CMO. Indirect channels, involving specialized scientific distributors and regional dealers, handle the majority of analytical column sales and smaller-volume bulk media orders for research and academic labs. The ultimate end-users are pharmaceutical companies, which utilize the media for drug purification and quality control, and CROs/CMOs, which utilize the materials to provide outsourced purification and analytical services. The value realization at the downstream level is measured by enhanced yield, purity of therapeutic products, reduced operational costs achieved through media longevity, and faster time-to-market enabled by rapid, high-resolution analytical separation techniques, solidifying the packing material as a critical, high-value consumable in the biotechnology workflow.

Chromatographic Packing Market Potential Customers

The primary and most lucrative customer base for the Chromatographic Packing Market consists of Pharmaceutical and Biotechnology companies, particularly those involved in the research, development, and large-scale manufacturing of biopharmaceuticals, small molecule drugs, and generic pharmaceuticals. These entities are reliant on chromatographic packing media at every stage of the drug lifecycle: from initial high-throughput screening and analytical method development (requiring high-resolution SPP and sub-2µm media) to large-scale purification of APIs (requiring high-capacity ion exchange and affinity media). Biopharma companies, driven by multi-billion dollar antibody pipelines, represent the largest consumers of high-cost, specialized process media, necessitating long-term supply partnerships and media designed for rigorous regulatory environments and cyclic stability under harsh cleaning regimens. Their purchasing decisions are heavily influenced by media performance metrics such as dynamic binding capacity, flow rate characteristics, and regulatory compliance standards.

A rapidly growing segment of potential customers includes Contract Manufacturing Organizations (CMOs) and Contract Research Organizations (CROs). As pharmaceutical companies increasingly outsource non-core manufacturing and analytical testing functions, CMOs and CROs become centralized purchasers of chromatographic consumables. These organizations often operate under tight deadlines and require flexible, high-throughput methodologies, driving demand for ready-to-use pre-packed columns, standardized method kits, and bulk media that can be quickly scaled up or down based on client projects. Their purchasing criteria often prioritize vendor reliability, ability to handle diverse chromatographic modes (e.g., chiral, reversed-phase, HIC), and competitive unit pricing for high-volume consumption. The trend towards biopharma outsourcing, particularly in Asia Pacific, has significantly amplified the purchasing power and strategic importance of CMOs within the value chain.

Beyond the core drug development industry, significant customer segments include academic research institutions, government laboratories focused on public health and environmental monitoring, and industries involved in highly regulated testing, such as food safety and clinical diagnostics. Academic labs utilize various media formats for fundamental research in separation science and compound identification, typically purchasing smaller quantities of highly specialized or novel media. Environmental and food testing labs require robust, highly reproducible media for the trace analysis of pesticides, toxins, and contaminants, adhering strictly to official methods (e.g., EPA, USP). These diverse customer bases ensure market resilience, with specialized niche media catering to precise analytical challenges, while the dominant demand for volume remains anchored in the highly regulated, high-value production processes of the biopharmaceutical manufacturing sector globally.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 7.9 Billion |

| Growth Rate | CAGR 7.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Merck KGaA, Bio-Rad Laboratories, Inc., Thermo Fisher Scientific Inc., Danaher Corporation (Cytiva), Tosoh Corporation, Daicel Corporation, Mitsubishi Chemical Corporation, Purolite Corporation (now part of Ecolab), Restek Corporation, Waters Corporation, Sepax Technologies, Inc., W. R. Grace & Co., SiliCycle Inc., YMC Co., Ltd., Agilent Technologies, Inc., Shimadzu Corporation, Regis Technologies, Inc., JSR Corporation, Sun Analytical Instruments, Kaneka Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Chromatographic Packing Market Key Technology Landscape

The contemporary chromatographic packing market is defined by a landscape of advanced materials engineered for superior kinetics and mass transfer efficiency, moving beyond traditional fully porous, large-particle media. A central technological development is the widespread adoption of Superficially Porous Particles (SPP), often termed core-shell particles, which feature a solid, non-porous core surrounded by a thin, porous shell. This architecture significantly reduces the diffusion path length for analytes, resulting in much faster analysis times and higher efficiency compared to fully porous particles of similar size, thereby driving their dominance in Ultra-High-Performance Liquid Chromatography (UHPLC) applications. Complementary advancements include the production of ultra-pure silica with narrow particle size distributions (sub-2µm), which are mandatory for achieving the ultra-high resolution required in complex analytical separations, particularly proteomics and metabolomics research. Furthermore, hybrid particle technologies, which combine organic polymers and inorganic silica, are gaining traction by offering enhanced chemical stability across a wider pH range than traditional silica, thus extending column life and operational flexibility, especially in demanding quality control environments.

In the bioprocessing sector, technological innovation is centered on maximizing dynamic binding capacity (DBC) and improving the chemical robustness of large-scale media. Monolithic columns, characterized by a continuous porous bed structure rather than discrete particles, offer extremely fast flow rates at low back pressures, making them highly suitable for the rapid purification of large biomolecules like plasmids and viral vectors where convective mass transfer is preferred over diffusion. Parallel innovation focuses on specialized surface chemistries; for instance, the development of highly specific affinity ligands that provide greater selectivity and yield for target proteins beyond standard Protein A chromatography. These modern media often incorporate optimized pore architecture (e.g., through-pore technology) to improve the accessibility of large molecules to the internal surface area, effectively boosting the overall productivity of the purification step. The integration of advanced polymer chemistry allows for media regeneration under highly caustic conditions, addressing the critical industry need for robust cleaning-in-place (CIP) protocols mandated by regulatory bodies to ensure product safety.

Looking forward, the technology landscape is converging towards multimodal and continuous chromatography optimization. Multimodal ligands, which incorporate multiple interaction mechanisms (e.g., ion exchange and hydrophobic interaction), allow for streamlined purification processes by achieving high separation power in a single step, reducing the overall number of required purification stages. This approach significantly lowers material consumption and processing time. Concurrently, the rise of continuous chromatography techniques, such as simulated moving bed (SMB) and periodic counter-current chromatography (PCC), necessitates the development of highly resilient media optimized for repeated, rapid loading and elution cycles. Manufacturers are investing heavily in characterizing the mechanical stability and kinetic performance of media under high cyclic stress to meet the demanding requirements of these intensified continuous biomanufacturing platforms. This focus on process intensification and higher operational stability is a key technological differentiator shaping future product development in the process-scale packing market.

Regional Highlights

North America, particularly the United States, holds the largest market share in the Chromatographic Packing Market, a dominance attributed to several deeply embedded factors. The region boasts the highest concentration of leading pharmaceutical and biotechnology companies globally, coupled with substantial, consistent expenditure on biopharmaceutical research and development. This robust R&D ecosystem drives continuous demand for advanced analytical and preparative chromatography media for drug discovery, clinical trials, and commercial manufacturing, especially for complex large molecules like monoclonal antibodies and emerging cell and gene therapies. Furthermore, the presence of major analytical instrument manufacturers and key opinion leaders in separation science ensures early and rapid adoption of cutting-edge packing technologies, such as UHPLC columns utilizing sub-2µm and SPP materials. The highly stringent regulatory environment enforced by the FDA mandates the use of validated, high-purity separation techniques, reinforcing the need for premium, consistently manufactured packing media and creating a stable, high-value market characterized by robust long-term contracts and technology leadership.

The European market represents the second-largest regional segment, characterized by strong governmental support for academic research and a powerful pharmaceutical industry centered in Germany, Switzerland, and the UK. The European market exhibits strong demand for high-performance packing materials driven by rigorous quality control in both pharmaceutical manufacturing and environmental analysis, where EU directives often set global benchmarks for contaminant testing. European companies are leaders in certain niche areas, such as chiral chromatography media and specialized polymer-based resins for industrial applications. While growth rates are generally steady and slightly lower than in Asia, the emphasis on quality, environmental standards, and compliance with the European Medicines Agency (EMA) regulations sustains the demand for high-specification chromatographic media. Collaborative R&D efforts between academic institutions and industry across the continent further contribute to the steady uptake of new separation technologies, particularly those focused on process efficiency and green chemistry principles, minimizing solvent usage.

Asia Pacific (APAC) is projected to be the fastest-growing region throughout the forecast period. This rapid growth is propelled by significant macroeconomic shifts, including expanding healthcare spending, increasing populations requiring access to pharmaceuticals, and government initiatives promoting domestic biomanufacturing capabilities in countries like China, India, and South Korea. China, in particular, is witnessing explosive growth in its generics and biosimilars sectors, requiring massive investment in large-scale purification infrastructure, consequently boosting demand for high-capacity, cost-effective bulk chromatography media. The establishment of Contract Manufacturing Organizations (CMOs) and Contract Development and Manufacturing Organizations (CDMOs) across the region is also rapidly accelerating demand, as these firms acquire modern analytical and process equipment to meet global quality standards. While pricing competition is intense in the mass-market generic space, the high growth trajectory and expanding biotechnology sector ensure APAC will be the primary engine of volume expansion for the chromatographic packing market in the coming decade, creating lucrative opportunities for both domestic and international media suppliers to localize manufacturing and distribution.

- North America: Dominant market share fueled by high R&D spending, established biopharma industry, and stringent FDA regulatory requirements driving premium media adoption.

- Europe: Stable growth, strong academic base, focus on environmental analysis, and high adoption rates of niche separation media (e.g., chiral and SFC packing).

- Asia Pacific (APAC): Highest CAGR due to rapid expansion of generics and biosimilars manufacturing, government investment in life sciences, and increasing CMO/CDMO capacity in China and India.

- Latin America and MEA: Emerging markets exhibiting gradual growth, driven primarily by infrastructure modernization, increasing access to pharmaceuticals, and demand for basic analytical consumables, often relying on imported pre-packed columns and media.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Chromatographic Packing Market.- Merck KGaA

- Bio-Rad Laboratories, Inc.

- Thermo Fisher Scientific Inc.

- Danaher Corporation (Cytiva)

- Tosoh Corporation

- Daicel Corporation

- Mitsubishi Chemical Corporation

- Purolite Corporation (now part of Ecolab)

- Restek Corporation

- Waters Corporation

- Sepax Technologies, Inc.

- W. R. Grace & Co.

- SiliCycle Inc.

- YMC Co., Ltd.

- Agilent Technologies, Inc.

- Shimadzu Corporation

- Regis Technologies, Inc.

- JSR Corporation

- Sun Analytical Instruments

- Kaneka Corporation

Frequently Asked Questions

Analyze common user questions about the Chromatographic Packing market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for specialized chromatographic packing media?

The increasing global demand for complex biopharmaceuticals, particularly monoclonal antibodies, vaccines, and gene therapy vectors, is the primary driver, necessitating high-resolution, scalable, and robust purification media (like high-capacity affinity and ion exchange media) to meet purity and yield requirements in downstream processing.

How do Superficially Porous Particles (SPP) enhance analytical chromatography performance?

SPP, or core-shell particles, minimize the diffusion distance for analytes by featuring a thin porous shell around a solid core. This architecture results in superior mass transfer kinetics, allowing for significantly higher column efficiency and faster analysis times compared to fully porous particles of similar size, which is critical for UHPLC applications.

What are the main constraints impacting the growth of the process-scale packing market?

Key constraints include the high initial capital investment required for large-volume chromatography columns and the media itself, coupled with the instability of certain polymer-based media under the aggressive cleaning-in-place (CIP) chemicals required by regulatory standards, leading to elevated operational costs due to media replacement.

Which geographical region is expected to exhibit the fastest growth rate in the market?

The Asia Pacific (APAC) region is forecasted to achieve the highest Compound Annual Growth Rate (CAGR). This acceleration is driven by the rapid expansion of generics and biosimilars manufacturing bases, significant government investment in biotechnology infrastructure, and the growing outsourcing activities performed by Contract Manufacturing Organizations (CMOs) in countries like China and India.

How is Artificial Intelligence (AI) expected to transform chromatographic method development?

AI is expected to transform method development by utilizing machine learning to analyze complex data sets, predict optimal separation conditions (mobile phase, temperature, flow rate), and model particle interactions, significantly reducing the time-consuming, empirical trial-and-error process currently required to optimize complex large-molecule and chiral separations.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager