Chromatography Columns Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433045 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Chromatography Columns Market Size

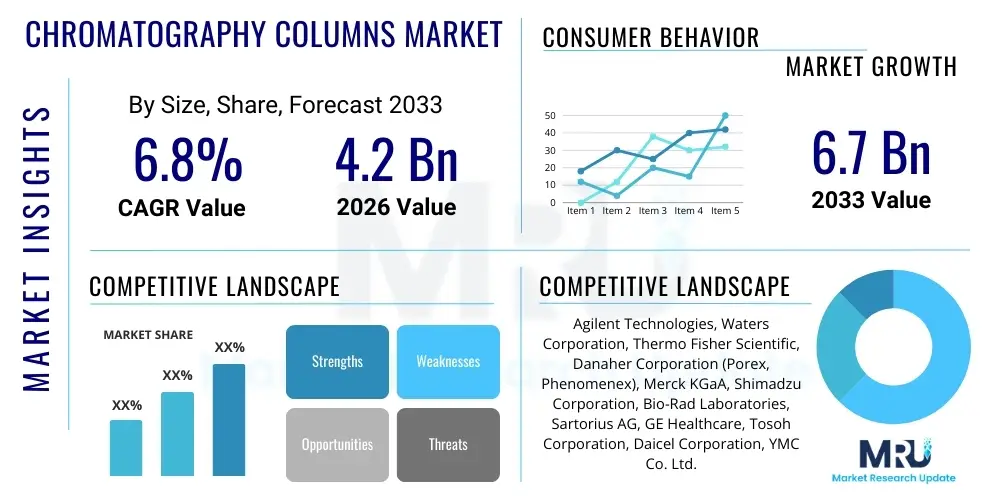

The Chromatography Columns Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 4.2 billion in 2026 and is projected to reach USD 6.7 billion by the end of the forecast period in 2033.

Chromatography Columns Market introduction

The Chromatography Columns Market encompasses essential consumable components utilized in separation science, primarily serving to separate complex mixtures into their individual constituents for analysis or purification. These columns, which vary significantly in size, material, and stationary phase composition, are critical for achieving high-resolution separation based on differential partitioning between a mobile phase and a stationary phase. They form the core functional element across various chromatographic techniques including High-Performance Liquid Chromatography (HPLC), Ultra-High-Performance Liquid Chromatography (UHPLC), Gas Chromatography (GC), and affinity chromatography, driving accuracy and efficacy in modern analytical laboratories and large-scale manufacturing environments.

The core product description spans several types, including analytical columns (focused on identification and quantification), preparative columns (focused on purifying large quantities of substances), and specialty columns tailored for specific matrices like chiral separation or size exclusion. Major applications predominantly lie within the pharmaceutical and biotechnology sectors, where they are indispensable for drug discovery, quality control, impurity profiling, and large-scale purification of biologics, such as monoclonal antibodies and vaccines. Beyond healthcare, these columns are heavily employed in environmental testing, food safety analysis, and forensic toxicology, reflecting their pervasive utility in chemical and biological analysis.

Key benefits derived from advanced chromatography columns include enhanced separation efficiency, higher throughput, reduced solvent consumption (particularly with UHPLC systems), and improved reproducibility, which is vital for regulatory compliance. Driving factors fueling market expansion include the rapid proliferation of biosimilars and generics, demanding stringent quality assessment tools, substantial growth in global R&D spending on life sciences, and the continuous technological evolution leading to smaller particle sizes and novel stationary phase chemistries, which significantly boost analytical capabilities and separation speed. The need for precise and validated analytical methods in an increasingly regulated landscape ensures sustained demand for high-quality chromatography columns across global markets.

Chromatography Columns Market Executive Summary

The global Chromatography Columns Market is characterized by robust growth, primarily propelled by escalating demand from the biopharmaceutical industry for high-purity therapeutics and stringent global regulatory environments necessitating sophisticated separation techniques. Business trends highlight a pronounced shift towards miniaturization and high-throughput screening technologies, specifically the adoption of Ultra-High-Performance Liquid Chromatography (UHPLC) columns, which offer superior resolution and faster run times compared to traditional HPLC. Manufacturers are heavily investing in developing specialized media, such as sub-2-micron particles and monolithic supports, to address the complexity of modern biological molecules. Furthermore, strategic collaborations and mergers among technology providers are consolidating market expertise and facilitating the integration of automation and data management solutions into chromatographic workflows, thereby optimizing laboratory efficiency and reducing operational costs for end-users.

Regionally, North America maintains its dominance due to high concentration of major pharmaceutical and biotechnological companies, coupled with significant governmental and private funding for life sciences research and development. However, the Asia Pacific (APAC) region is demonstrating the highest growth trajectory, driven by massive expansion in generic drug manufacturing, burgeoning contract research and manufacturing organizations (CROs/CMOs), and improving healthcare infrastructure, particularly in countries like China and India. European markets remain mature, characterized by rigorous regulatory standards (e.g., EMA guidelines) that mandate continuous investment in high-quality separation equipment and consumables for quality assurance and control (QA/QC) processes, particularly concerning novel advanced therapeutic medicinal products (ATMPs).

Segment trends indicate that the preparatory chromatography column segment is witnessing significant traction due to the increased requirement for large-scale purification of bulk pharmaceuticals and complex biomolecules like insulin and therapeutic proteins. By stationary phase, the silica-based media segment holds the largest market share owing to its versatility and established use, but polymer-based and specialized affinity media are rapidly gaining ground, especially for purifying delicate biologics where surface interactions are critical. Applications within drug discovery and development consistently generate the highest revenue, fueled by the continuous introduction of new drug candidates into preclinical and clinical pipelines, requiring extensive separation and validation stages throughout the development lifecycle.

AI Impact Analysis on Chromatography Columns Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Chromatography Columns Market frequently center on how AI can accelerate chromatographic method development, predict column performance and lifetime, and enhance data interpretation from complex separation runs. Users are concerned with optimizing mobile phase selection, stationary phase compatibility, and temperature parameters faster than traditional trial-and-error methods. There is strong interest in using machine learning to handle large datasets generated by UHPLC systems, ensuring accurate peak integration, impurity detection, and predictive maintenance scheduling for high-value columns. The core expectations revolve around AI reducing variability, improving robustness, and minimizing human error in complex multi-dimensional chromatography processes, leading to cost savings and faster product release.

The integration of AI algorithms, particularly machine learning and deep learning models, is poised to fundamentally transform how chromatography is performed and utilized. AI tools are being developed to analyze historical data concerning separation parameters, sample matrices, and column characteristics to recommend optimal starting conditions for new purification tasks, thereby drastically shortening method development time from weeks to hours. Furthermore, AI contributes to predictive modeling of column degradation and packing uniformity, allowing labs to schedule replacements proactively, minimizing unexpected downtime and ensuring consistent analytical quality throughout lengthy campaigns, a major cost factor in biomanufacturing.

While AI does not directly replace the physical chromatography column, it significantly elevates the efficiency and effectiveness of the separation process. The ability of AI-driven software to automate data processing, flag subtle shifts in peak shape or retention time indicative of column issues, and facilitate "digital twins" of separation processes means that column utilization is optimized. This optimization translates directly into higher throughput, lower solvent consumption, and greater confidence in the analytical results, reinforcing the value proposition of high-performance column hardware and media, especially those compatible with the high data generation rates characteristic of advanced systems like two-dimensional liquid chromatography (2D-LC).

- AI optimizes chromatographic method development by predicting optimal gradient elution profiles and solvent mixtures.

- Machine learning models enhance data processing for complex chromatograms, improving peak integration accuracy and impurity detection in real- time.

- AI algorithms predict the remaining useful life and performance degradation of expensive chromatography columns, enabling predictive maintenance.

- Automation driven by AI reduces human intervention and variability, improving the robustness and reproducibility of analytical separation workflows.

- AI facilitates the creation of digital twins for simulating and validating scale-up from analytical to preparative chromatography, minimizing experimental work.

DRO & Impact Forces Of Chromatography Columns Market

The Chromatography Columns Market dynamics are shaped by a complex interplay of Drivers, Restraints, Opportunities, and inherent Impact Forces that influence investment and adoption. A primary Driver is the rigorous regulatory environment set by bodies like the FDA and EMA, which mandates precise identification and quantification of impurities in drug products, thereby sustaining demand for high-resolution columns. Concurrently, the booming biotechnology sector, specifically the development of biosimilars and advanced cell and gene therapies, relies heavily on sophisticated chromatography for purification and quality control (QC), necessitating continuous innovation in column technology. These drivers create a foundational demand floor that ensures continuous market expansion, especially for premium, high-efficiency columns.

Conversely, significant Restraints hinder market growth, most notably the high initial cost of advanced chromatographic systems (UHPLC/SFC) and the associated consumable costs, particularly high-purity stationary phase media. The technical expertise required for method development, column packing, and maintenance of specialized columns also acts as a barrier to entry for smaller laboratories or those in developing regions. Furthermore, the longevity and chemical stability of the stationary phase media under harsh purification conditions remain a challenge, leading to frequent replacement cycles that add to operational expenditure, requiring manufacturers to focus resources on enhancing media durability and reducing material costs without compromising performance.

Opportunities for significant market growth emerge from the continued push towards continuous chromatography and process intensification in biomanufacturing, allowing for smaller facility footprints and more efficient large-scale purification. Miniaturization and the development of specialized columns for niche applications, such as microfluidics-based separation and portable analysis devices, open new application areas beyond traditional laboratory settings. The critical Impact Forces acting on the market include the need for pharmaceutical companies to accelerate time-to-market for new drugs (pushing demand for faster UHPLC systems) and the unwavering external pressure for increased sustainability in chemical processes, driving the adoption of techniques like Supercritical Fluid Chromatography (SFC) which use less toxic solvents, influencing purchasing decisions across the industry.

Segmentation Analysis

The Chromatography Columns Market is highly diversified, segmented comprehensively based on column type, separation technique, stationary phase material, and primary application areas, reflecting the broad range of analytical and preparative needs across industries. This detailed segmentation allows manufacturers to tailor product development specifically towards high-growth niches, such as the rapid purification demands of the biologics sector or the stringent QA/QC requirements in food and environmental testing. The market primarily bifurcates between analytical columns, optimized for resolution and sensitivity in small-scale samples, and preparative columns, designed for high loading capacity and bulk purification, with ongoing innovation focusing on blurring the lines through high-efficiency preparative methods.

Segmentation by technology reveals the dominance of Liquid Chromatography (LC) columns, encompassing HPLC and UHPLC, which are the backbone of pharmaceutical and chemical analysis, followed by Gas Chromatography (GC) columns crucial for analyzing volatile compounds. Within LC, the ongoing shift towards UHPLC columns (featuring smaller particle sizes, typically sub-2µm) is a defining trend, offering superior peak capacity and faster separation, though demanding higher pressure instrumentation. Furthermore, specialty techniques like Size Exclusion Chromatography (SEC), Ion Exchange Chromatography (IEX), and Affinity Chromatography contribute substantially, particularly in the separation of high molecular weight biopharmaceuticals and large proteins, requiring unique packing materials and surface chemistries tailored to molecular interaction.

The critical factor in column performance is the stationary phase material. Silica-based columns remain the conventional choice due to their mechanical stability and broad chemical applicability, while polymer-based columns are essential for separations under extreme pH conditions, common in industrial processes. The stationary phase segment is rapidly evolving with the development of porous shell particles (core-shell technology) that enhance kinetic performance without excessive back pressure, and monolithic columns, which offer faster mass transfer kinetics, demonstrating the continuous commitment of market players to innovation aimed at maximizing separation efficiency and minimizing run times across all major end-user industries.

- By Column Type:

- Analytical Columns

- Preparative Columns

- Process Columns

- By Stationary Phase:

- Silica-based Columns

- Polymer-based Columns

- Alumina-based Columns

- Other Specialized Media (e.g., Affinity, Monolithic)

- By Separation Technique:

- Liquid Chromatography (HPLC, UHPLC, LPLC)

- Gas Chromatography (GC)

- Supercritical Fluid Chromatography (SFC)

- Ion Exchange Chromatography (IEX)

- Size Exclusion Chromatography (SEC)

- Affinity Chromatography

- By Application:

- Pharmaceutical and Biotechnology Industry (Drug Discovery, QA/QC, Biologics Purification)

- Food and Beverage Testing

- Environmental Testing

- Academic Research and Government Laboratories

- Cosmetics and Chemical Industries

Value Chain Analysis For Chromatography Columns Market

The value chain for the Chromatography Columns Market begins with the upstream procurement of high-purity raw materials, primarily specialized silica gels, high-grade polymers, and metallic housing components (stainless steel or PEEK). The quality and consistency of the stationary phase material, which dictates column performance, are paramount, making the supplier base for ultra-pure silica and high-end monomers a critical and concentrated point in the value chain. Manufacturers of chromatography columns invest heavily in proprietary surface modification techniques and precise column packing technologies, transforming raw media into high-performance consumables. This manufacturing stage involves stringent quality checks to ensure column-to-column reproducibility, a critical requirement for regulatory acceptance in pharmaceutical applications.

The downstream analysis reveals two primary distribution channels: direct sales and indirect sales. Direct sales are often preferred for high-value process chromatography columns or complex analytical systems, allowing manufacturers to provide specialized technical support, validation services, and customized solutions directly to major pharmaceutical and biotech firms. This channel fosters strong customer relationships and is crucial for capturing process optimization feedback. Indirect sales, relying on global distributors, specialized scientific equipment suppliers, and e-commerce platforms, are vital for reaching academic laboratories, smaller analytical labs, and international markets where local presence of the manufacturer is limited, ensuring broad market accessibility for standard analytical columns and consumables.

The power within the value chain is increasingly shifting towards sophisticated end-users, particularly large biopharmaceutical companies who demand not only the product but also the holistic solution—including certified reference materials, application methods, and integration support. This demand pressures manufacturers to maintain robust inventory levels and rapid delivery systems (logistics), as any disruption in the supply of critical columns can halt multi-million dollar manufacturing processes. Furthermore, the distribution channel must adhere to complex global shipping regulations, especially for pre-packed columns, which are sensitive to handling and storage conditions, adding complexity to the final delivery step and necessitating certified logistics partners to ensure product integrity up to the point of use.

Chromatography Columns Market Potential Customers

The primary and largest segment of end-users for the Chromatography Columns Market consists of organizations within the biopharmaceutical and life sciences industries. These customers, including major pharmaceutical companies, biotechnology firms, and specialized Contract Research Organizations (CROs) and Contract Manufacturing Organizations (CMOs), rely on chromatography columns for every stage of drug development, from initial synthesis and impurity profiling (analytical columns) to large-scale purification of therapeutic proteins (preparative and process columns). The increasing pipeline of complex biologics, such as monoclonal antibodies (mAbs) and recombinant proteins, drives significant investment in advanced affinity and ion exchange columns specifically designed for large biomolecular separation with high yield and purity.

Another substantial customer base encompasses academic and research institutions, along with government laboratories involved in fundamental scientific investigation, clinical diagnostics, and forensic analysis. These users require a wide variety of columns, often smaller or specialized, to support diverse research projects ranging from proteomics and metabolomics to environmental analysis of pollutants. While individual purchases may be smaller than industrial procurement, the sheer number of institutions and the continuous demand for consumables for new experiments make this a stable and high-volume segment, often influenced by public funding cycles and university research grants. Furthermore, these entities frequently serve as early adopters for cutting-edge chromatographic technologies and new column chemistries.

The third major customer segment includes industries requiring stringent quality control and safety testing, such as the food and beverage industry, environmental monitoring agencies, and the chemical manufacturing sector. Food testing labs utilize columns to detect contaminants, residues (pesticides, antibiotics), and nutritional components. Environmental labs rely on them for water and soil sample analysis (e.g., volatile organic compounds). These industries demand robust, reliable, and standardized columns capable of handling complex matrices and adhering to specific national and international testing protocols (e.g., EPA or ISO methods), ensuring consistent recurring revenue for manufacturers focusing on application-specific validated methods.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.2 billion |

| Market Forecast in 2033 | USD 6.7 billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Agilent Technologies, Waters Corporation, Thermo Fisher Scientific, Danaher Corporation (Porex, Phenomenex), Merck KGaA, Shimadzu Corporation, Bio-Rad Laboratories, Sartorius AG, GE Healthcare, Tosoh Corporation, Daicel Corporation, YMC Co. Ltd., Mitsubishi Chemical Holdings Corporation, W. R. Grace & Co., PerkinElmer Inc., Regis Technologies, Dr. Maisch GmbH, Jasco Corporation, Sun SRI. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Chromatography Columns Market Key Technology Landscape

The technological landscape of the Chromatography Columns Market is defined by relentless innovation aimed at improving separation efficiency, increasing throughput, and reducing solvent consumption. The most significant advancement over the last decade has been the widespread adoption of Ultra-High-Performance Liquid Chromatography (UHPLC) column technology. UHPLC columns utilize stationary phase particles smaller than 2 micrometers, demanding sophisticated hardware capable of operating at pressures exceeding 15,000 psi. This technology dramatically reduces analysis time and increases peak capacity, making it indispensable for rapid screening and complex matrix analysis in pharmaceutical development, although it necessitates columns manufactured with extremely tight tolerances and highly uniform packing techniques to handle the high pressures without bed collapse.

Another major technological focal point is the development of core-shell (superficially porous particle) technology. Core-shell columns feature a solid, impermeable inner core surrounded by a thin, porous layer of stationary phase. This architecture significantly improves mass transfer kinetics by shortening the diffusion path, leading to higher efficiency and resolution compared to fully porous particles of the same size, without generating the extremely high back pressures associated with sub-2µm fully porous particles. This innovation has democratized high efficiency, allowing near-UHPLC performance on standard HPLC systems, driving substantial market penetration across mid-tier laboratories and those not yet ready for full UHPLC system investment.

Furthermore, specialized column technologies cater to niche, high-value separations. Monolithic columns, which feature a continuous porous rod structure rather than packed particles, are gaining traction, especially for the analysis of large biomolecules (like large proteins or viruses) due to their convective flow characteristics, which provide rapid separations at very low back pressure. Preparative chromatography, particularly in biomanufacturing, is seeing a shift towards multi-column systems (e.g., Simulated Moving Bed, SMB) and continuous chromatography approaches, which require robust process columns capable of repeatable and high-yield purification under industrial conditions. These advanced systems demand optimized column dimensions and media particle sizes, often utilizing polymer-based or specialized affinity ligands engineered for specific targets, solidifying the market’s reliance on highly engineered, application-specific separation tools.

Regional Highlights

- North America: North America, led by the United States, holds the largest market share in the Chromatography Columns Market. This dominance is attributable to the region's strong presence of global pharmaceutical and biotechnology giants, significant investments in R&D, and early adoption of advanced separation technologies like UHPLC and advanced continuous chromatography systems. The stringent regulatory framework imposed by the FDA, coupled with high awareness and penetration of sophisticated analytical instruments in academia and clinical research, ensures sustained high demand for premium, high-resolution columns and specialized media used in complex biological molecule analysis and process validation.

- Europe: Europe represents a mature and highly competitive market, characterized by strict quality control standards mandated by the European Medicines Agency (EMA) and a strong focus on environmental analysis and food safety (e.g., REACH regulations). Countries such as Germany, the UK, and France are major contributors, driven by a robust chemical industry base and leading academic research. The market here emphasizes robust, validated methods and sustainable practices, leading to steady demand for highly durable columns and environmentally friendly chromatographic approaches like Supercritical Fluid Chromatography (SFC) columns.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region during the forecast period. This accelerated growth is primarily fueled by rapid expansion in generic drug manufacturing, massive government investment in healthcare infrastructure (especially in China and India), and the emergence of numerous Contract Research Organizations (CROs) and Contract Manufacturing Organizations (CMOs). While cost sensitivity remains a factor, the rising quality mandates and increasing focus on biosimilar development are driving the transition from traditional HPLC to more efficient UHPLC and preparative columns to meet the demands of large-scale, high-quality production.

- Latin America (LATAM): The LATAM region, while smaller, presents significant potential opportunities, driven by increasing foreign direct investment in localized pharmaceutical manufacturing and improving regulatory standards, particularly in Brazil and Mexico. Market growth is often dependent on successful technology transfer and adoption rates, with demand focused on essential analytical columns for quality assurance and control of imported and locally produced drugs and food products.

- Middle East and Africa (MEA): The MEA market is gradually expanding, primarily driven by substantial investments in healthcare diversification and petrochemical analysis. Countries like Saudi Arabia and the UAE are enhancing their laboratory infrastructure, creating niche demand for columns used in specialized areas such as oil and gas analysis, alongside growing requirements for pharmaceutical quality testing to ensure local drug safety and efficacy.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Chromatography Columns Market.- Agilent Technologies

- Waters Corporation

- Thermo Fisher Scientific

- Danaher Corporation (including Phenomenex and PALL Corporation)

- Merck KGaA

- Shimadzu Corporation

- Bio-Rad Laboratories

- Sartorius AG

- Tosoh Corporation

- Daicel Corporation

- YMC Co. Ltd.

- Mitsubishi Chemical Holdings Corporation

- W. R. Grace & Co.

- PerkinElmer Inc.

- Regis Technologies

- Dr. Maisch GmbH

- Jasco Corporation

- Sun SRI

- Sepax Technologies, Inc.

- Kromasil (Nouryon)

Frequently Asked Questions

Analyze common user questions about the Chromatography Columns market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Chromatography Columns Market?

The market growth is primarily driven by escalating R&D spending in the biopharmaceutical sector, the rapid global proliferation of biosimilars and generic drugs requiring strict purity checks, and the increasing adoption of highly efficient separation technologies like UHPLC in quality control and process scale-up across multiple industries.

How does Ultra-High-Performance Liquid Chromatography (UHPLC) technology influence column demand?

UHPLC significantly increases demand for specialized columns utilizing sub-2-micron or core-shell particles. These columns enable faster analysis, higher resolution, and increased throughput compared to traditional HPLC, positioning them as essential consumables for modern, high-volume analytical laboratories.

Which column segment holds the largest share in terms of revenue, and why?

Analytical chromatography columns, specifically those used in HPLC and UHPLC, typically hold the largest revenue share. This is due to their pervasive use in routine quality control (QC), method validation, and impurity analysis across virtually all chemical, pharmaceutical, and food safety laboratories globally, making them high-volume consumables.

What is the role of continuous chromatography (e.g., SMB) in the market?

Continuous chromatography techniques, such as Simulated Moving Bed (SMB), are vital for large-scale preparative and process purification, particularly for high-value biopharmaceuticals. These methods demand specialized, robust process columns designed for extended lifetime and efficient solvent usage, driving demand in the industrial purification segment.

How is AI impacting the efficiency and use of chromatography columns?

AI algorithms are optimizing column usage by accelerating method development through predictive modeling, enhancing data analysis for better impurity detection, and enabling predictive maintenance schedules. This reduces variability and maximizes the performance lifespan of high-cost columns in complex analytical and preparative workflows.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager