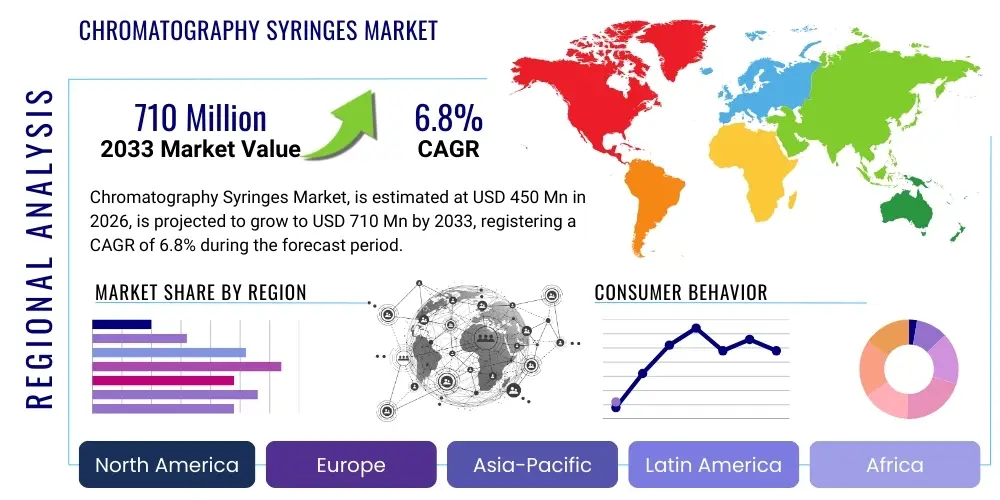

Chromatography Syringes Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435173 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Chromatography Syringes Market Size

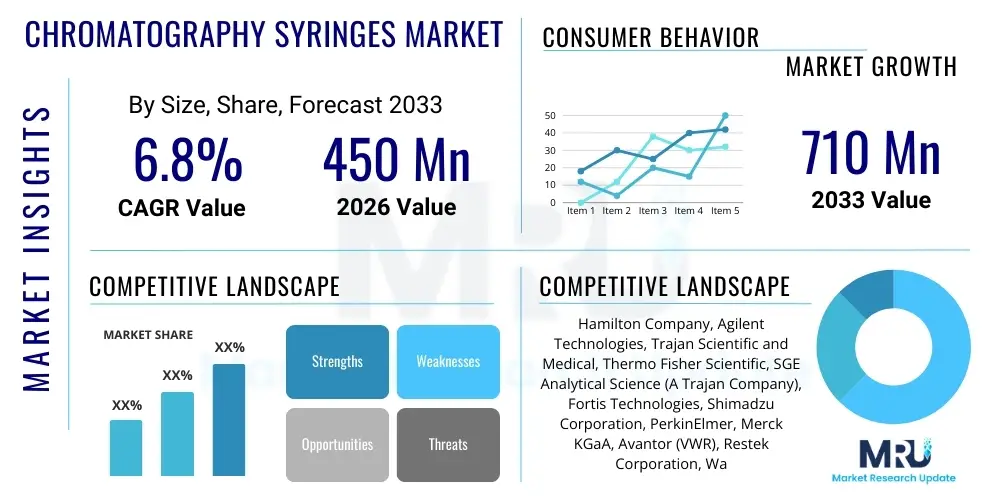

The Chromatography Syringes Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 710 Million by the end of the forecast period in 2033.

Chromatography Syringes Market introduction

The Chromatography Syringes Market encompasses specialized precision instruments vital for sample introduction in analytical chemistry techniques such as Gas Chromatography (GC), Liquid Chromatography (LC), and Thin Layer Chromatography (TLC). These syringes are engineered to deliver micro-volumes of liquid or gas samples with exceptional accuracy and repeatability, ensuring the integrity of the subsequent chromatographic separation and analysis. The precision required is paramount, as measurement errors during injection can severely compromise the analytical results, especially in sensitive applications like pharmacokinetics and trace contaminant detection. The design of these syringes, including inert material construction (such as borosilicate glass and PTFE plungers), minimizes sample degradation and cross-contamination, making them indispensable tools across regulated industries.

Product descriptions vary significantly based on the intended chromatographic technique and level of automation. Standard microliter syringes are commonly used for manual injections in conventional HPLC, while specialized fixed-needle, autosampler, and high-pressure syringes are designed to withstand the stringent demands of UHPLC (Ultra-High Performance Liquid Chromatography) and automated GC systems. Major applications span drug discovery and development, quality control in the food and beverage industry, environmental monitoring, and clinical diagnostics, driven by the increasing global emphasis on product safety and regulatory compliance.

The primary benefits of utilizing high-quality chromatography syringes include enhanced analytical accuracy, reduced sample waste, and compatibility with high-throughput laboratory automation systems. Key driving factors accelerating market growth include the robust expansion of the pharmaceutical and biotechnology sectors, particularly the development of biologics and personalized medicine, which rely heavily on precise quantitative analysis. Furthermore, continuous technological advancements focusing on reducing dead volume, improving pressure resistance, and integrating automation capabilities are solidifying the market's upward trajectory.

Chromatography Syringes Market Executive Summary

The global Chromatography Syringes Market is characterized by intense focus on precision engineering and automation compatibility, driven by evolving regulatory landscapes and the accelerating pace of drug discovery. Business trends indicate a strong shift toward high-throughput screening and the adoption of UHPLC, necessitating syringes capable of enduring high pressures and offering maximum inertness. This demand is fostering innovation in specialized syringe types, including automated liquid handling syringes designed for robotic platforms. Strategic alliances between syringe manufacturers and instrument vendors (e.g., autosampler providers) are crucial for ensuring seamless integration and optimized performance in modern analytical laboratories, consolidating the market toward offering comprehensive system solutions rather than isolated components.

Regionally, North America maintains its dominance due to high investment in pharmaceutical R&D, advanced laboratory infrastructure, and the stringent regulatory environment necessitating highly accurate testing procedures. However, the Asia Pacific (APAC) region is projected to exhibit the fastest growth, propelled by the rapid establishment of contract research organizations (CROs), expanding manufacturing bases for generic drugs, and increasing governmental spending on quality control and environmental analysis in countries like China and India. Europe remains a steady market, characterized by mature pharmaceutical markets and a strong presence of key technology providers.

Segment trends reveal that the Liquid Chromatography (LC) application segment, particularly UHPLC, holds the largest market share and is expected to grow robustly due to its superior efficiency and speed. By product type, autosampler syringes are gaining prominence as labs increasingly prioritize workflow automation to improve efficiency and minimize human error. End-user analysis highlights pharmaceutical and biotechnology companies as the primary revenue generators, driven by the continuous requirement for method validation, impurity profiling, and quality assurance testing throughout the drug lifecycle. The emphasis across all segments is on achieving higher sensitivity and reproducibility for demanding analytical protocols.

AI Impact Analysis on Chromatography Syringes Market

Common user questions regarding AI's influence on the Chromatography Syringes Market frequently revolve around how artificial intelligence and machine learning (ML) can improve injection accuracy, minimize analyst variability, and optimize automated liquid handling workflows. Users inquire about AI’s role in predicting syringe lifespan, identifying degradation patterns, and fine-tuning injection parameters to achieve optimal chromatographic resolution without manual intervention. The prevailing themes underscore a desire for predictive maintenance, enhanced quality assurance for large-scale clinical trials, and leveraging AI-driven systems to handle complex, heterogeneous sample matrices that require non-linear calibration or dynamic injection volume adjustments. The key expectation is that AI integration will shift the analytical focus from the manual precision of injection to high-level data interpretation and streamlined laboratory operations.

- AI algorithms optimize autosampler programming, dynamically adjusting injection speeds and draw cycles to maximize precision and reduce carryover, thereby improving overall chromatographic data quality.

- Machine learning models analyze historical chromatography data to predict the optimal maintenance schedule for syringes and autosampler components, minimizing downtime and unexpected failures related to plunger sticking or needle blockage.

- Advanced image recognition and deep learning are employed in automated systems to verify proper seating and alignment of fixed-needle syringes, ensuring leak-free high-pressure injections in UHPLC environments.

- AI-driven software assists in quality control (QC) validation by rapidly identifying anomalous injection profiles or inconsistencies that might indicate syringe malfunction or user error, surpassing traditional statistical process control limitations.

- Integration with Laboratory Information Management Systems (LIMS) allows AI to track the usage history and performance metrics of individual syringes, providing traceable compliance records and informed decisions regarding replacement cycles.

DRO & Impact Forces Of Chromatography Syringes Market

The Chromatography Syringes Market growth is primarily driven by the exponential expansion of the biopharmaceutical industry, increased regulatory scrutiny requiring precise analytical data, and the widespread adoption of high-resolution separation techniques like UHPLC and 2D-LC. These drivers are compelling laboratories to invest in high-precision, robust sample introduction tools. However, restraints such as the relatively high cost of specialty, high-pressure, and inert material syringes, alongside the mandatory requirement for skilled technicians to ensure proper handling and maintenance, slightly impede market expansion, particularly in budget-constrained academic settings or emerging markets. Opportunities abound in developing specialized syringes for automated microfluidic and point-of-care testing devices, coupled with market penetration into environmental monitoring and complex forensic toxicology where trace analysis demands the highest level of injection accuracy. These forces collectively shape a competitive landscape focused on innovation in materials science and automation compatibility.

Segmentation Analysis

The Chromatography Syringes Market is highly fragmented and segmented based on multiple technical parameters crucial for analytical performance, including the type of needle fixation, injection volume capacity, the specific chromatographic application, and the end-user industry utilizing the technology. Detailed segmentation is essential for understanding the diverse demands of modern laboratories, ranging from large-scale pharmaceutical quality control facilities needing automated solutions to small university labs requiring robust, low-cost manual options. The differentiation based on application (GC vs. LC) is particularly significant, as GC syringes often require gas-tight seals and precise temperature compatibility, while LC syringes emphasize high-pressure resistance and minimal dead volume for improved resolution. The ongoing evolution of chromatographic instrumentation directly influences the development and commercial viability of new syringe segments, particularly those compatible with ultra-high performance requirements.

- By Type:

- Standard Syringes (Manual Injection)

- Autosampler Syringes (Needle Removable, Fixed Needle)

- High-Pressure Syringes (UHPLC Compatible)

- Gas-Tight Syringes (For GC Applications)

- Specialty Syringes (e.g., Headspace, Purge and Trap)

- By Volume:

- Microliter Syringes (0.5 µL to 100 µL)

- Mid-Volume Syringes (100 µL to 500 µL)

- Larger Volume Syringes (Above 500 µL)

- By Application:

- Liquid Chromatography (LC/HPLC/UHPLC)

- Gas Chromatography (GC)

- Thin Layer Chromatography (TLC)

- Others (e.g., Spectrometry, Elemental Analysis)

- By End-User:

- Pharmaceutical and Biotechnology Companies

- Academic and Research Institutes

- Food and Beverage Industry

- Environmental Testing Laboratories

- Hospitals and Clinical Laboratories

Value Chain Analysis For Chromatography Syringes Market

The value chain for the Chromatography Syringes Market begins with the upstream analysis involving specialized raw material suppliers. These suppliers provide high-grade, chemically inert materials, primarily borosilicate glass, precise stainless steel alloys for needles, and advanced polymers like PTFE (Polytetrafluoroethylene) for plungers and seals. Quality control at this stage is critical, as any material impurity or structural imperfection directly impacts the syringe's precision and inertness. Manufacturers then focus on high-precision engineering and assembly, utilizing highly automated cleanroom facilities to ensure microliter accuracy and geometric uniformity. Syringe manufacturing is a niche, technically demanding process that involves glass blowing, needle sharpening, and meticulous plunger fitting to prevent leaks and maximize repeatability.

The midstream involves the distribution channel, which is typically bifurcated into direct sales channels and indirect distribution through specialized scientific equipment suppliers and third-party distributors (e.g., VWR, Fisher Scientific). Direct channels are often utilized by major manufacturers for large-volume contracts with key pharmaceutical accounts, allowing for better customer service and technical support. Indirect channels, however, provide broader geographical reach and inventory access, particularly for standard syringes and consumables, catering to smaller laboratories and academic institutions globally. Effective logistics and inventory management are paramount to ensure distributors can rapidly meet the consumable needs of high-throughput laboratories.

Downstream analysis focuses on the end-users—pharmaceutical R&D labs, QC units, environmental testing centers, and forensic labs. Customer purchasing decisions are heavily influenced by factors such as system compatibility (especially with popular autosamplers like Agilent, Waters, and Thermo Fisher), guaranteed accuracy (often certified), and the availability of specialized, certified-clean products. Post-sale technical support, application notes, and ease of re-ordering are crucial factors that influence customer loyalty. The entire value chain is characterized by stringent quality assurance checkpoints, driven by ISO standards and Good Laboratory Practice (GLP) requirements, reinforcing the market’s focus on reliability and traceability.

Chromatography Syringes Market Potential Customers

The primary consumers and end-users of chromatography syringes are organizations operating within highly regulated analytical environments where sample integrity and measurement accuracy are non-negotiable. Pharmaceutical and biotechnology companies represent the largest customer base, utilizing these precision tools extensively throughout the drug development lifecycle, from initial compound screening and impurity profiling to final quality control and stability testing. Their demand is specifically concentrated on autosampler syringes compatible with high-pressure LC systems and specialty gas-tight syringes for residual solvent analysis in GC. The need for traceable, certified, and compliant consumables drives their purchasing behavior.

Academic and governmental research institutes constitute another significant segment, requiring syringes for fundamental research in chemistry, materials science, and biochemistry. While often more price-sensitive than the commercial sector, these institutions demand versatility and durability for diverse experimental setups. Furthermore, the burgeoning field of clinical diagnostics, especially those involving therapeutic drug monitoring (TDM) and toxicology screening, necessitates the use of ultra-precise microliter syringes to handle biological fluids with limited sample volume. Environmental and food safety testing laboratories represent rapidly growing customer groups, utilizing syringes for trace analysis of pesticides, contaminants, and additives, adhering to strict governmental regulations such as those imposed by the EPA and FDA, thereby relying heavily on standard and gas-tight syringes for robustness and reliability.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 710 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Hamilton Company, Agilent Technologies, Trajan Scientific and Medical, Thermo Fisher Scientific, SGE Analytical Science (A Trajan Company), Fortis Technologies, Shimadzu Corporation, PerkinElmer, Merck KGaA, Avantor (VWR), Restek Corporation, Waters Corporation, GL Sciences, Tecan, Eppendorf, Cole-Parmer, Kimble Chase, Jiangsu Victor Instrument, Chengdu K-E-L Instruments. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Chromatography Syringes Market Key Technology Landscape

The technological evolution in the chromatography syringes market is centered on achieving higher pressure resistance, minimizing mechanical wear, and ensuring maximum sample integrity, directly responding to the demands of miniaturized and high-speed separation techniques. A critical development is the specialization of syringes for Ultra-High Performance Liquid Chromatography (UHPLC), which operate at pressures exceeding 15,000 psi. This necessitates syringes constructed with robust, often proprietary, metal plungers and advanced inert internal coatings (e.g., diamond-like carbon or specific ceramics) to maintain leak integrity and prevent needle blockage under intense conditions. The focus is on seamless compatibility with advanced autosamplers, requiring standardized, yet robust, mechanical interfaces.

Another significant technological advancement is the widespread adoption of automated liquid handling (ALH) systems, demanding syringes designed specifically for robotic arm manipulation. These automated syringes feature reinforced hubs, precise mechanical tolerances, and integrated sensor compatibility, allowing the system to verify successful sample loading and injection. Furthermore, material science innovation continues to be a cornerstone, with manufacturers exploring new glass treatments and inert polymer seals, such as specialized versions of PTFE or FEP, to drastically reduce surface adsorption and chemical interaction, which is vital when analyzing highly concentrated or chemically sensitive biological samples.

For Gas Chromatography (GC), advancements focus on improved gas-tight sealing mechanisms and heated zone compatibility. Gas-tight syringes often incorporate plunger tips made of highly durable, low-friction materials to maintain vacuum integrity over numerous cycles. Moreover, manufacturers are increasingly integrating technologies to improve needle durability, such as specialized electro-polishing and beveling techniques, which enhance piercing capability for septa while prolonging syringe lifespan, thereby reducing operational costs and improving workflow continuity in high-volume laboratories. The overall trend points toward smarter, more durable, and increasingly integrated sample introduction tools that minimize the "human factor" variability.

Regional Highlights

- North America: This region dominates the global chromatography syringes market, primarily driven by substantial R&D expenditure by major pharmaceutical and biotechnology companies located in the United States and Canada. The stringent regulatory environment imposed by the FDA mandates high levels of analytical precision, fostering strong demand for specialized, high-accuracy, and certified syringes, particularly those utilized in complex clinical and quality control assays. The region is a key early adopter of cutting-edge chromatographic instruments (UHPLC, 2D-LC) and automated liquid handling systems, ensuring sustained demand for high-pressure and autosampler-compatible syringes.

- Europe: Europe represents a mature and stable market, bolstered by the presence of large generic drug manufacturers and established academic research centers, particularly in Germany, the UK, and Switzerland. The region benefits from robust regulatory oversight (EMA) and a strong history of instrumental analysis. The market here shows high demand for specialized environmental testing syringes and general-purpose HPLC consumables, although growth is steadier compared to the dynamic APAC region.

- Asia Pacific (APAC): APAC is anticipated to be the fastest-growing market during the forecast period. This accelerated growth is attributed to the rapid expansion of generic drug manufacturing, the establishment of numerous contract research organizations (CROs) in China and India, and increasing government investments in food safety and environmental quality monitoring infrastructure. While price competition is intense, the sheer volume of new laboratories being established drives substantial demand, often for both basic manual syringes and increasingly, automated systems required for global export compliance.

- Latin America (LATAM): The LATAM market, while smaller, is growing steadily, driven by improvements in local healthcare infrastructure and increased foreign investment in biotechnology. Key markets like Brazil and Mexico are increasing their adoption of modern chromatography techniques in pharmaceutical manufacturing and agricultural testing, leading to moderate but consistent demand for chromatography consumables.

- Middle East and Africa (MEA): This region is an emerging market characterized by gradual infrastructure development in clinical diagnostics and petrochemical analysis. Demand is concentrated in technologically advanced nations like Saudi Arabia and the UAE, where investment in sophisticated analytical equipment for oil and gas research, and environmental monitoring, necessitates the purchase of precision chromatography syringes.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Chromatography Syringes Market.- Hamilton Company

- Agilent Technologies

- Trajan Scientific and Medical

- Thermo Fisher Scientific

- SGE Analytical Science (A Trajan Company)

- Fortis Technologies

- Shimadzu Corporation

- PerkinElmer

- Merck KGaA (MilliporeSigma)

- Avantor (VWR)

- Restek Corporation

- Waters Corporation

- GL Sciences

- Tecan

- Eppendorf

- Cole-Parmer

- Kimble Chase

- Jiangsu Victor Instrument

- Chengdu K-E-L Instruments

- Gilson, Inc.

Frequently Asked Questions

Analyze common user questions about the Chromatography Syringes market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between fixed-needle and removable-needle chromatography syringes?

Fixed-needle syringes offer maximum precision and zero dead volume, making them ideal for high-accuracy manual injections and automated systems where needle replacement is not required. Removable-needle syringes allow for needle sterilization or replacement, offering greater flexibility and cost-efficiency for routine laboratory use or when dealing with highly viscous samples.

How does the adoption of UHPLC systems impact the demand for specialized syringes?

UHPLC operates at extremely high pressures (up to 20,000 psi), necessitating specialized chromatography syringes designed with reinforced construction, often incorporating thicker glass barrels, robust plunger materials, and specific hub designs to withstand high back-pressure and prevent leaks during injection, driving demand for premium, high-pressure models.

Which end-user segment drives the highest revenue in the Chromatography Syringes Market?

The Pharmaceutical and Biotechnology segment is the largest revenue contributor. Their continuous need for highly accurate sample introduction in drug discovery, quality control, stability testing, and regulatory compliance protocols ensures sustained high-volume demand for certified, high-precision autosampler syringes.

What materials are essential for manufacturing gas-tight chromatography syringes?

Gas-tight syringes typically utilize borosilicate glass barrels for chemical inertness and stainless steel needles. Crucially, they employ precision-machined PTFE (Polytetrafluoroethylene) or specialized polymer plunger tips to create a perfect seal against the glass, preventing gas leakage and ensuring accurate injection of volatile samples in Gas Chromatography (GC).

What are the key driving factors for market growth in the Asia Pacific region?

Growth in APAC is primarily driven by the expansion of contract research and manufacturing organizations (CROs/CMOs), increasing investment in regional generic drug production, and stricter governmental regulations regarding food safety and environmental testing, rapidly escalating the need for analytical precision tools across China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager