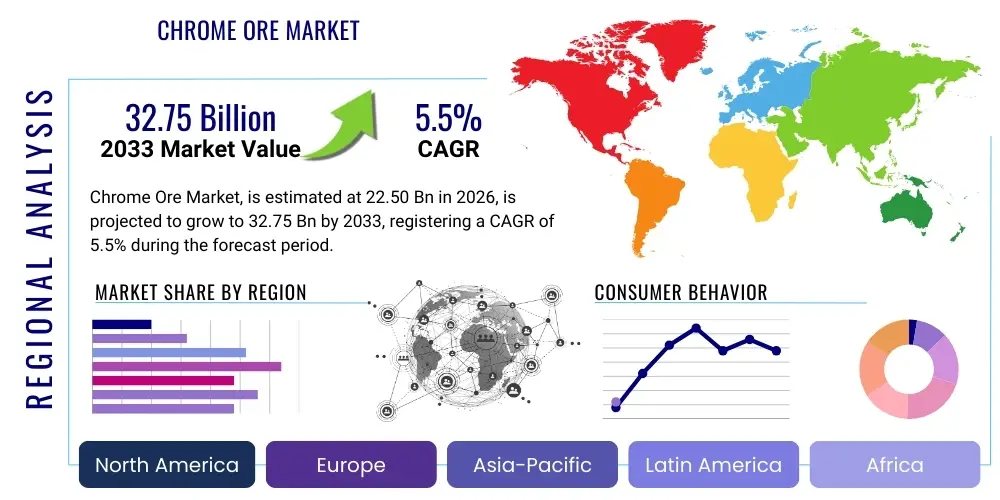

Chrome Ore Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440600 | Date : Jan, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Chrome Ore Market Size

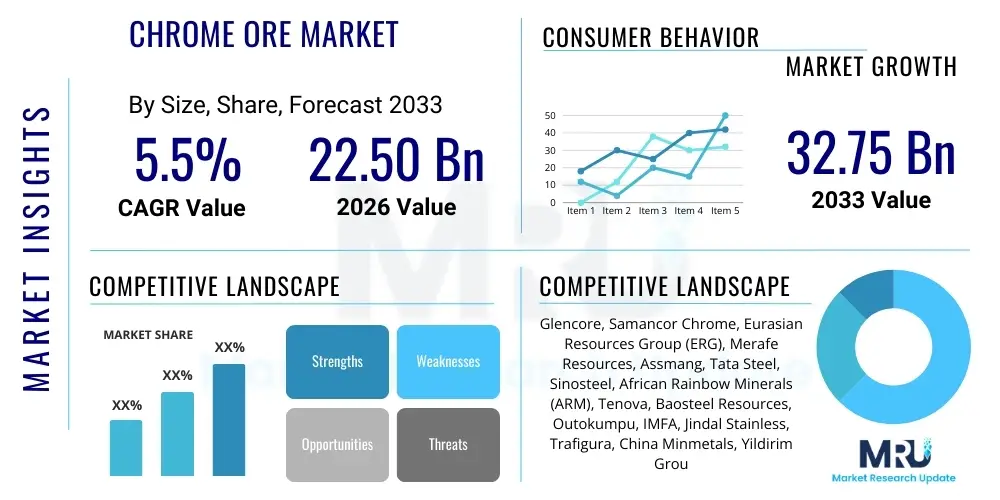

The Chrome Ore Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.5% between 2026 and 2033. The market is estimated at USD 22.50 Billion in 2026 and is projected to reach USD 32.75 Billion by the end of the forecast period in 2033.

Chrome Ore Market introduction

The global chrome ore market forms a foundational pillar for numerous industrial sectors, primarily driven by the escalating demand for stainless steel, refractories, and specialized chemicals. Chrome ore, the only economically viable source of chromium, is a critical raw material for producing ferrochrome, an alloy essential for imparting corrosion resistance, high-temperature strength, and lustrous finish to stainless steel. The market's trajectory is intimately linked with global industrialization, infrastructure development, and the expansion of the automotive and aerospace industries, all of which are significant consumers of chromium-containing products.

Product descriptions of chrome ore vary based on its chromium content, iron-to-chromium ratio, and impurities, dictating its suitability for different applications. High-grade metallurgical chrome ore is predominantly used in ferrochrome production, while medium-grade ores find application in refractory materials due to their high melting point and chemical inertness. Low-grade ores are processed for the chemical industry to produce various chromium compounds. The benefits derived from chromium, such as its exceptional hardness, wear resistance, and aesthetically pleasing finish, underpin its indispensable role across diverse manufacturing processes. Key driving factors for this market include robust growth in construction and infrastructure projects, increasing urbanization leading to greater demand for consumer goods containing stainless steel, and advancements in automotive manufacturing requiring lighter and stronger materials.

Chrome Ore Market Executive Summary

The chrome ore market's executive summary reveals a complex interplay of business trends, regional dynamics, and segment-specific growth patterns. In terms of business trends, the market is witnessing a move towards greater supply chain integration and consolidation among major mining and ferrochrome producers, aiming to mitigate price volatility and secure raw material supply. Furthermore, there is an increasing emphasis on sustainable mining practices and responsible sourcing, driven by environmental regulations and corporate social responsibility initiatives. Technological advancements in exploration and extraction are also reshaping the competitive landscape, pushing for greater operational efficiency and cost-effectiveness.

Regional trends highlight the continued dominance of the Asia Pacific region, particularly China and India, as both major consumers and processors of chrome ore, fueled by their vast steel industries and rapid industrial growth. Africa, notably South Africa and Zimbabwe, remains the primary source of high-quality chrome ore reserves, positioning it as a critical supplier to global markets. Segment trends indicate that ferrochrome production will continue to be the largest application segment, with consistent demand from the stainless steel sector. However, niche applications in specialty chemicals and advanced refractory materials are expected to demonstrate promising growth, driven by technological innovations and expanding industrial requirements for high-performance materials.

AI Impact Analysis on Chrome Ore Market

The integration of Artificial Intelligence (AI) is poised to revolutionize the chrome ore market, addressing long-standing challenges related to operational efficiency, resource management, and environmental sustainability. Common user questions revolve around how AI can optimize mining processes, enhance supply chain predictability, improve exploration success rates, and mitigate environmental impacts. Users are keen to understand AI's capability to provide data-driven insights for market forecasting, equipment maintenance, and quality control. The overarching expectation is that AI will introduce unprecedented levels of precision, automation, and strategic foresight, leading to significant cost reductions, increased productivity, and more sustainable practices across the entire chrome ore value chain.

- Predictive maintenance systems utilizing AI algorithms analyze sensor data from mining equipment to anticipate failures, thereby reducing downtime and maintenance costs.

- AI-powered geological modeling and exploration tools enhance the accuracy of identifying new chrome ore deposits, optimizing drilling patterns and resource estimation.

- Optimized mine planning and scheduling, driven by AI, maximize ore recovery and processing efficiency while minimizing waste and energy consumption.

- Real-time supply chain visibility and optimization platforms leverage AI to forecast demand, manage logistics, and mitigate disruptions, improving inventory management.

- AI-driven automated sorting and beneficiation processes improve the quality and purity of chrome ore concentrates, leading to higher-value end products.

- Advanced data analytics and machine learning models enable more accurate market price forecasting, allowing producers and consumers to make informed trading decisions.

- Deployment of autonomous mining vehicles and robotic systems increases safety, reduces labor costs, and enables continuous operations in hazardous environments.

- AI-enhanced environmental monitoring systems track air and water quality, land rehabilitation progress, and energy usage, ensuring compliance and promoting sustainable mining.

- Improved safety protocols through AI-powered monitoring of worker behavior and equipment operation, identifying potential hazards before incidents occur.

- Resource efficiency gains through AI-guided process control in smelting operations, reducing energy consumption and material waste in ferrochrome production.

DRO & Impact Forces Of Chrome Ore Market

The chrome ore market is shaped by a confluence of intricate drivers, significant restraints, evolving opportunities, and overarching impact forces. Key drivers include the relentless global demand for stainless steel, which consumes the majority of ferrochrome derived from chrome ore. Rapid urbanization and industrialization in emerging economies, particularly across Asia, fuel extensive infrastructure development and manufacturing growth, further amplifying the need for chromium-containing materials. The burgeoning automotive industry, with its increasing reliance on lighter, stronger, and more corrosion-resistant alloys, also acts as a substantial growth catalyst. Moreover, the expanding use of refractories in various high-temperature industrial applications, from steelmaking to cement production, contributes consistently to chrome ore demand.

However, the market also faces considerable restraints. Volatility in commodity prices, often influenced by geopolitical events and macroeconomic shifts, creates uncertainty for miners and processors, impacting investment decisions. High energy costs, particularly for smelting ferrochrome, represent a significant operational burden and can compress profit margins. Stringent environmental regulations related to mining, waste disposal, and emissions necessitate substantial compliance investments, sometimes limiting operational expansion. Geopolitical instability in key producing regions, coupled with potential oversupply or demand imbalances, can lead to supply chain disruptions and price fluctuations, challenging market stability. These restraints collectively mandate strategic planning and robust risk management for market participants.

Opportunities within the chrome ore market are emerging through technological advancements in exploration, mining, and processing, which promise enhanced efficiency and reduced environmental footprint. The continued industrial growth in developing countries presents untapped potential for increased consumption, as these regions modernize their manufacturing capabilities and infrastructure. Furthermore, the global drive towards a circular economy and resource efficiency opens avenues for innovation in recycling chromium-containing materials and exploring sustainable alternatives. New applications in high-tech industries, such as specialized alloys for aerospace and renewable energy components, also offer long-term growth prospects for high-purity chrome ore derivatives. These opportunities emphasize the market's potential for innovation and diversification beyond its traditional applications.

Segmentation Analysis

The chrome ore market is comprehensively segmented to provide granular insights into its diverse applications, grades, and geographical distribution. This segmentation enables a detailed understanding of market dynamics, specific demand drivers for various product types, and regional consumption patterns. The primary segmentation criteria typically include the grade of the ore, which directly influences its end-use suitability, and the application where the refined chromium or its compounds are utilized. Additionally, regional segmentation offers a crucial perspective on geopolitical influences, local industrial growth, and supply chain logistics, allowing stakeholders to identify key growth markets and strategic investment areas.

- By Grade

- High-grade (Metallurgical Grade): Characterized by a high Cr2O3 content and high Cr:Fe ratio, primarily used for ferrochrome production.

- Medium-grade (Refractory Grade): Possessing specific chemical compositions suitable for manufacturing heat-resistant materials.

- Low-grade (Chemical Grade): Lower Cr2O3 content, processed to produce chromium chemicals for various industrial applications.

- By Application

- Ferrochrome Production: The dominant application, essential for stainless steel manufacturing due to its corrosion resistance and strength.

- Refractories: Used in the production of chromite bricks and linings for high-temperature furnaces in various industries.

- Chemicals: For manufacturing chromium chemicals like chromium sulfate (leather tanning), chromic acid (electroplating), and chromium pigments.

- Foundry: As a sand additive in molds for its high thermal stability and non-wetting properties.

- Others: Including specialized applications in defense, aerospace, and advanced materials.

- By Region

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East and Africa (MEA)

Value Chain Analysis For Chrome Ore Market

The value chain for the chrome ore market encompasses a sequential series of activities, starting from geological exploration and culminating in the consumption of chromium-containing end products. The upstream segment of the value chain is characterized by intensive capital investments in exploration and mining operations, where companies identify, extract, and beneficiate chrome ore. This involves geological surveys, drilling, blasting, excavation, and then processes such as crushing, grinding, and concentration through gravity separation or flotation to increase the chromite content and prepare the ore for further processing. Efficiency and technological advancements in this stage are critical for cost-effectiveness and resource recovery, directly impacting the profitability of the entire chain.

Further along the value chain, the downstream segment primarily involves the metallurgical processing of chrome ore into ferrochrome, which is then used as a key alloying agent in stainless steel production. This also includes the manufacturing of refractory materials and various chromium chemicals. The complexity and energy intensity of these downstream processes add significant value to the raw ore. Distribution channels for chrome ore are multifaceted, involving direct sales from large mining companies to major ferrochrome producers or stainless steel mills under long-term contracts. Conversely, a substantial portion is traded indirectly through commodity brokers and trading houses, which manage logistics, warehousing, and sales to a broader range of smaller and medium-sized end-users across different geographical regions.

The interplay between direct and indirect distribution mechanisms is influenced by market size, buyer requirements, and supply security. Large-volume buyers often prefer direct relationships to ensure consistent supply and competitive pricing, fostering closer strategic alliances with miners. Indirect channels, however, provide flexibility and market access for producers to reach diverse customers globally, including those in specialty chemical or foundry applications. Understanding these intricate upstream activities, downstream processing demands, and diverse distribution pathways is crucial for stakeholders to identify bottlenecks, optimize logistics, and enhance overall market efficiency, ensuring a resilient and responsive supply of chromium to global industries.

Chrome Ore Market Potential Customers

The potential customers for chrome ore are diverse and span several industrial sectors, primarily driven by the unique properties that chromium imparts to materials. The largest segment of end-users consists of stainless steel producers, for whom ferrochrome, derived from chrome ore, is an indispensable alloying agent. These customers range from global steel giants to specialized alloy manufacturers, all requiring consistent and high-quality ferrochrome to produce various grades of stainless steel used in construction, automotive, consumer goods, and industrial machinery. Their purchasing decisions are heavily influenced by chromium content, pricing, and the reliability of supply, making long-term contracts with chrome ore miners and ferrochrome producers a common practice.

Another significant group of potential customers includes manufacturers of refractory materials. Companies specializing in refractory bricks, mortars, and castables for lining high-temperature furnaces in industries such as steel, cement, glass, and non-ferrous metals rely on refractory-grade chrome ore. These buyers prioritize the ore's high melting point, chemical inertness, and thermal shock resistance, which are crucial for extending the lifespan and efficiency of industrial furnaces. Their demand is closely tied to investment cycles in heavy industry and the operational capacities of these energy-intensive sectors, requiring a stable supply of specific chrome ore grades to meet rigorous performance standards.

Beyond metallurgy and refractories, the chemical industry represents a vital customer segment for chrome ore. Companies producing chromium chemicals utilize low-grade chrome ore as a feedstock for a wide array of products. This includes chromium sulfate for leather tanning, chromic acid for electroplating and surface finishing, and chromium pigments for paints and ceramics. Foundries also constitute potential customers, using chrome ore sand as a molding material due to its high thermal conductivity and excellent surface finish properties. The specific requirements of these diverse end-user sectors underscore the multifaceted demand for chrome ore, driving innovation in mining, processing, and product development to cater to their distinct needs.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 22.50 Billion |

| Market Forecast in 2033 | USD 32.75 Billion |

| Growth Rate | 5.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Glencore, Samancor Chrome, Eurasian Resources Group (ERG), Merafe Resources, Assmang, Tata Steel, Sinosteel, African Rainbow Minerals (ARM), Tenova, Baosteel Resources, Outokumpu, IMFA, Jindal Stainless, Trafigura, China Minmetals, Yildirim Group, Chrome International, Mineral Resources Ltd., Thrasia plc, Comilog. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Chrome Ore Market Key Technology Landscape

The chrome ore market's technological landscape is continually evolving, driven by the imperatives of efficiency, sustainability, and cost reduction across the entire value chain. In the upstream segment, advanced exploration techniques are paramount, including sophisticated geophysical and geochemical surveys that leverage remote sensing, drone technology, and AI-powered data analytics for more precise identification of potential ore bodies. Modern mining operations increasingly incorporate automation and robotics, particularly in drilling, blasting, and material handling, to enhance safety, improve productivity, and reduce operational costs. Digital twin technology is also gaining traction, allowing for real-time monitoring and simulation of mining processes to optimize performance and predict maintenance needs.

Beneficiation processes, which involve separating chrome ore from gangue minerals, are seeing advancements through more efficient crushing, grinding, and separation technologies. These include enhanced flotation cells, heavy media separation (HMS) plants, and magnetic separation techniques that can process lower-grade ores more effectively and reduce environmental waste. The pyrometallurgical processes used for ferrochrome production are also subject to continuous innovation. This encompasses the development of more energy-efficient furnaces, such as closed arc furnaces, and improved smelting techniques that minimize energy consumption and greenhouse gas emissions, aligning with global environmental regulations and sustainability goals.

Furthermore, the broader technological landscape includes the integration of the Internet of Things (IoT) sensors throughout the mining and processing stages, providing real-time data for operational control, quality assurance, and predictive analytics. Sustainable mining practices are being championed through technologies for water recycling, tailings management, and land rehabilitation, leveraging bio-mining and phytoremediation techniques. Innovations in material science are also exploring new applications for chromium, particularly in high-performance alloys for aerospace, defense, and renewable energy sectors, demanding higher purity and specialized forms of chrome ore, thus influencing the processing technologies needed to meet these stringent requirements.

Regional Highlights

The chrome ore market exhibits significant regional disparities in terms of production, consumption, and market dynamics, reflecting geological endowments, industrial development, and trade policies. Each region plays a distinct role in the global supply chain, contributing to the overall market's complexity and strategic importance. Understanding these regional highlights is crucial for market participants to identify growth opportunities, mitigate supply risks, and formulate effective business strategies, emphasizing the interconnectedness of global chrome ore flows and processing capabilities.

- Asia Pacific (APAC): Dominates both consumption and processing of chrome ore, primarily driven by China and India's massive stainless steel industries and rapid infrastructure development. Countries like Kazakhstan and Turkey are also significant producers within the broader APAC sphere. The region's high industrial output and expanding manufacturing sectors ensure a consistent, robust demand for chromium and its derivatives, making it the largest and fastest-growing market.

- Africa: Home to the world's largest chrome ore reserves, particularly in South Africa and Zimbabwe. This region is the primary global supplier of high-quality chrome ore, making it critical for the international market. Production is largely export-oriented, with significant investments in mining infrastructure and beneficiation plants. Geopolitical stability and mining policies in these countries significantly influence global supply and pricing.

- Europe: A major consumer of ferrochrome and stainless steel, particularly in Germany, Italy, and France, driven by advanced manufacturing, automotive, and construction sectors. Europe has limited indigenous chrome ore production and is heavily reliant on imports from African and Asian producers. The focus here is on value-added processing and high-end applications of stainless steel and specialty alloys.

- North America: Represents a significant market for specialized chromium products and stainless steel but has minimal domestic chrome ore production. The region relies heavily on imports to meet its industrial demands, particularly from the automotive, aerospace, and defense sectors. Investment is typically directed towards downstream processing and innovative applications, with a strong emphasis on supply chain security and efficiency.

- Latin America & Middle East and Africa (MEA): These regions represent emerging markets with growing industrial bases and potential for increased chrome ore demand. Latin America has some minor production but is primarily a consumer, while MEA (outside of South Africa) has potential for new exploration and mining projects, driven by regional development and resource monetization strategies. Their growth trajectories are linked to local industrialization efforts and global commodity prices.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Chrome Ore Market.- Glencore

- Samancor Chrome (jointly owned by Samancor Resources and Merafe Resources)

- Eurasian Resources Group (ERG)

- Merafe Resources

- Assmang (part of African Rainbow Minerals)

- Tata Steel

- Sinosteel

- African Rainbow Minerals (ARM)

- Tenova

- Baosteel Resources

- Outokumpu

- Indian Metals & Ferro Alloys Ltd (IMFA)

- Jindal Stainless

- Trafigura

- China Minmetals Corporation

- Yildirim Group

- Chrome International

- Mineral Resources Ltd.

- Tharisa plc

- Comilog (Compagnie Minière de l'Ogooué)

Frequently Asked Questions

What drives the demand for chrome ore globally?

The demand for chrome ore is primarily driven by the robust growth of the global stainless steel industry, as chrome ore is the sole commercial source for chromium, a critical alloying element imparting corrosion resistance and hardness to stainless steel. Additionally, increasing infrastructure development, particularly in emerging economies, and the expanding automotive and construction sectors further stimulate demand. The use of chrome ore in refractories for high-temperature industrial applications and in the chemical industry for various chromium compounds also contributes significantly to its market demand, reflecting its fundamental role across diverse manufacturing and industrial processes worldwide.

What are the primary applications of chrome ore?

Chrome ore's primary applications are broadly categorized into three main areas: ferrochrome production, refractories, and chemicals. Ferrochrome, the dominant application, is an essential component in stainless steel manufacturing, accounting for the largest share of chrome ore consumption. Refractories utilize refractory-grade chrome ore for manufacturing heat-resistant bricks and linings used in industrial furnaces due to its high melting point and chemical stability. In the chemical industry, chrome ore is processed to produce various chromium chemicals, including chromium sulfate for leather tanning, chromic acid for electroplating, and chromium pigments for paints and ceramics. Foundries also use chrome ore sand as a molding material for its excellent thermal properties.

Which regions are major producers and consumers of chrome ore?

Globally, the leading producers of chrome ore are predominantly concentrated in Africa, with South Africa and Zimbabwe holding the largest reserves and being the primary suppliers to international markets. Other significant producing nations include Kazakhstan, Turkey, and India, contributing substantially to the global supply. On the consumption side, the Asia Pacific region, particularly China and India, stands as the largest consumer of chrome ore, driven by their expansive stainless steel industries and rapid industrialization. Europe and North America are also major consumers, albeit with minimal domestic production, relying heavily on imports to meet their advanced manufacturing and industrial demands.

What are the main challenges facing the chrome ore market?

The chrome ore market faces several significant challenges, including price volatility influenced by global economic cycles and geopolitical events, which can impact investment decisions and profitability. High energy costs, particularly for the energy-intensive ferrochrome smelting process, pose a substantial operational burden. Stringent environmental regulations related to mining operations, waste management, and emissions necessitate significant compliance costs and can restrict expansion. Additionally, potential supply chain disruptions due to geopolitical instability in key producing regions, coupled with market imbalances between supply and demand, contribute to market uncertainty and require robust risk management strategies from all stakeholders across the value chain.

How is sustainability impacting the chrome ore industry?

Sustainability is increasingly impacting the chrome ore industry by driving shifts towards more environmentally responsible mining practices and greater resource efficiency. Regulatory pressures and growing stakeholder expectations are compelling companies to invest in technologies for reduced energy consumption, improved water management, and minimized waste generation throughout the extraction and processing phases. This includes adopting cleaner production methods in ferrochrome smelting and enhancing land rehabilitation efforts post-mining. The emphasis on responsible sourcing and ethical labor practices is also gaining prominence, influencing procurement decisions and encouraging greater transparency across the supply chain. These sustainability imperatives are reshaping operational strategies and fostering innovation within the chrome ore market.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Chromite and Chrome Ore Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Chrome Ore Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Chromite, Chromium-rich Spar, Hard Chrome Spinel), By Application (Metallurgical, Chemical & Foundry, Refractory), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager