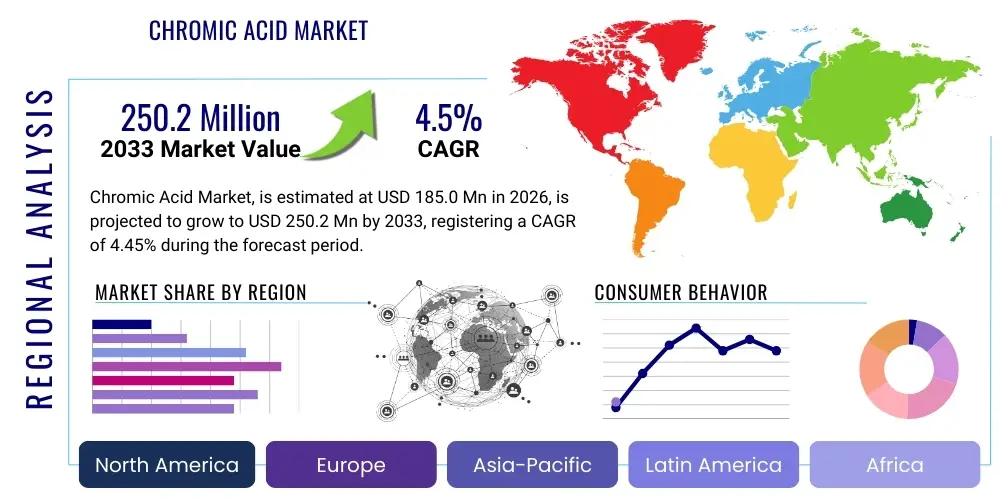

Chromic Acid Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434651 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Chromic Acid Market Size

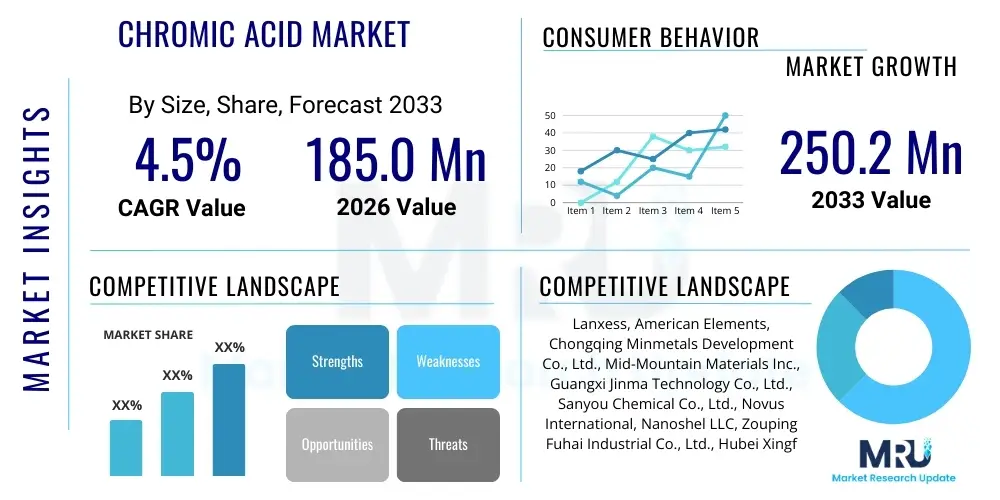

The Chromic Acid Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.45% between 2026 and 2033. The market is estimated at USD 185.0 Million in 2026 and is projected to reach USD 250.2 Million by the end of the forecast period in 2033.

Chromic Acid Market introduction

The Chromic Acid Market, fundamentally driven by industrial requirements for robust corrosion resistance and high-quality surface finishing, is a mature but critical sector within the specialized chemical industry. Chromic acid (CrO3), also universally recognized as chromium trioxide, functions as an extremely powerful oxidizing agent. Its industrial significance is predominantly anchored in the electroplating domain, specifically hard chrome plating, which is irreplaceable in demanding applications requiring exceptional surface hardness, minimal friction, and outstanding wear and tear resistance. These applications span critical components in the aerospace, heavy industrial machinery, and automotive sectors, where the longevity and reliability of parts are non-negotiable safety and operational requirements. The chemical's unparalleled ability to form a highly durable, dense, and aesthetically pleasing metallic layer ensures its continued use, despite escalating global regulatory pressures aimed at restricting hexavalent chromium compounds due to toxicity concerns. The market valuation is therefore critically linked not just to industrial output, but also to the speed and effectiveness of industry adoption of environmental mitigation technologies.

The utilization of chromic acid extends far beyond metal finishing, playing a crucial, though quantitatively smaller, role in highly specialized chemical manufacturing processes. It acts as an essential catalyst or oxidizing agent in the synthesis of various organic chemicals, including certain complex pharmaceuticals, specialized polymer resins, and essential vitamins, notably Vitamin K. In the broader metallurgical context, chromic acid is a vital component in the production of passivating films on aluminum and other non-ferrous metals, enhancing their inherent corrosion resistance before painting or further processing. This passivation step is critical in the aerospace industry, where strict weight and durability standards must be met. The complex regulatory landscape, notably the European Union’s REACH legislation listing Cr(VI) compounds as Substances of Very High Concern (SVHC), necessitates that manufacturers worldwide invest continually in closed-loop recycling technologies and robust environmental safeguards, influencing production costs and driving up the barrier to entry for new market participants. The structural demand for superior functional coatings, however, continues to secure the necessary long-term stability of the market.

The key driving factors propelling the demand for chromic acid include the resurgence in global capital expenditure within manufacturing sectors post-pandemic recovery, leading to increased demand for robust industrial machinery and equipment that require durable coatings. Specifically, the expansion of commercial aircraft fleets and the military maintenance cycle significantly boost demand in the aerospace segment. Furthermore, burgeoning infrastructure projects in developing nations require enormous quantities of treated steel and metal components resistant to atmospheric corrosion, indirectly supporting the market through robust metal finishing demands. Key benefits provided by chromic acid—superior hardness, exceptional thermal stability, and low coefficient of friction—make substitutions extremely difficult in high-performance applications. Conversely, the strict enforcement of environmental regulations and the ongoing development of viable, low-toxicity alternatives, particularly in decorative plating, act as powerful restraints, compelling the market toward specialized, high-performance functional usage rather than generalized industrial application.

Chromic Acid Market Executive Summary

The Chromic Acid Market summary indicates a structurally mature, highly concentrated industry facing significant external pressures from environmental legislation. Key business trends highlight a strategic pivot towards supply chain resilience, achieved through vertical integration or long-term contracts, ensuring the secure procurement of chromium ore and sodium dichromate, especially given geopolitical instability in key sourcing regions. Financially, major market players are dedicating increasing portions of their R&D budget towards compliance technology—specifically highly efficient ion exchange systems and waste minimization processes—to protect existing revenue streams derived from essential uses. This focus on environmental stewardship, while increasing operational expenses, effectively acts as a competitive advantage by creating a moat against smaller competitors who cannot afford such high compliance capital investment, leading to further market consolidation among large, globally compliant chemical manufacturers.

Regional trends dramatically illustrate the divergence between high-growth, lower-regulation environments and mature, regulatory-heavy markets. Asia Pacific (APAC) dominates global consumption, fueled by unprecedented growth in indigenous automotive production, high-volume electronics finishing, and massive public infrastructure investment. Nations like China and India utilize chromic acid across numerous industrial processes where the emphasis is on scale and economic output, providing the highest volume growth trajectory. Conversely, Europe, under the strict oversight of REACH, demonstrates the profound impact of regulatory constraints, with chromic acid usage increasingly limited to applications that have successfully secured authorization proving its essentiality and demonstrating stringent risk management. North America maintains a steady, technology-driven market focusing on aerospace and defense applications, adhering strictly to EPA guidelines, which drives innovation in emission control technologies, rather than pure volume growth.

Segmentation analysis confirms the irreplaceable nature of chromic acid in functional coatings; the plating and finishing segment, particularly hard chrome, maintains overwhelming revenue dominance, despite regulatory attempts to promote substitution. This functional reliance underscores the technical superiority of the Cr(VI) process for critical wear parts. The chemical synthesis segment, while smaller, represents high-value, high-purity demand, often for pharmaceutical intermediates and niche catalysts, exhibiting resilience against substitution efforts due to complex chemical pathway requirements. Grade differentiation is becoming more pronounced; purified grades command a premium due to strict requirements for catalyst purity, whereas technical grades continue to serve the general plating needs in less regulated, high-volume regions. Overall, the market remains stable but structurally transforming, shifting from a broad industrial chemical to a specialized, performance-critical chemical managed under tight environmental controls.

AI Impact Analysis on Chromic Acid Market

Common user questions regarding AI's impact on the Chromic Acid Market primarily center on two major themes: mitigating regulatory risk and optimizing resource efficiency in high-hazard operations. Users frequently ask if Machine Learning models can accurately predict deviations in chromic acid bath concentrations that lead to sub-standard plating or excessive chemical drag-out, both of which increase environmental liability and operational costs. There is strong interest in applying AI for advanced process control (APC) to manage the complex variables (temperature gradients, current density fluctuations, pH levels) inherent in maintaining hard chrome plating integrity, thereby ensuring consistent quality and minimizing the formation of hazardous byproducts. Furthermore, users are keenly interested in how AI can automate compliance documentation and provide real-time auditing capabilities for governmental reporting agencies, significantly reducing administrative burden and risk of non-compliance penalties associated with hexavalent chromium usage.

The integration of AI systems into the operational landscape of chromic acid users promises significant efficiency gains that directly address environmental concerns. By deploying sophisticated sensor networks (IoT) coupled with ML algorithms, operators can achieve levels of control previously unattainable through traditional PID control loops. For instance, AI models can analyze historical maintenance records and real-time operational data from effluent treatment plants—which are critical for minimizing Cr(VI) discharge—to predict component failure (e.g., pump seals, filter media breakdown) before catastrophic release occurs. This predictive maintenance capability is transformative in a hazardous chemical environment, improving safety, reducing unplanned downtime, and ensuring continuous regulatory adherence, directly addressing stakeholder concerns regarding environmental risk management.

Looking ahead, AI’s greatest long-term potential lies in accelerating the materials science research dedicated to finding viable Cr(VI) alternatives. Generative AI models are capable of simulating millions of molecular combinations and complex surface deposition dynamics that would be impossible through conventional lab testing. This computational power allows R&D teams to rapidly screen potential non-chromium or trivalent chromium formulations that might achieve the required performance metrics for hardness and corrosion resistance, thereby speeding up the substitution timeline where technically feasible. While the core chemical manufacturing of chromic acid itself is mature and less prone to AI disruption, the operational management, regulatory compliance, and substitutional research areas are ripe for AI-driven transformation, making the process of using the essential chemical safer, cleaner, and more economically sustainable for authorized functional uses.

- AI optimizes electroplating parameters (current, concentration, temperature) for reduced chemical consumption and waste generation, minimizing Cr(VI) drag-out.

- Predictive maintenance using AI minimizes downtime of corrosive reactors, pumps, and environmental abatement systems, enhancing safety and ensuring continuous regulatory compliance.

- Machine learning algorithms assist in modeling and testing potential lower-toxicity chromium compounds and surface characteristics, accelerating R&D efforts for substitution.

- AI-powered systems ensure real-time compliance tracking, automated generation of complex regulatory reports (e.g., REACH authorization data), and continuous environmental monitoring.

- Optimization of global supply chain logistics, forecasting specific grade demand shifts based on regional manufacturing output, especially sensitive to automotive and aerospace production cycles.

DRO & Impact Forces Of Chromic Acid Market

The fundamental drivers supporting the Chromic Acid Market are primarily rooted in engineering necessity, specifically the need for exceptional surface properties unattainable consistently or economically by alternatives. The escalating global demand for high-end capital goods, spanning complex hydraulic cylinders used in heavy construction, high-precision rollers in steel manufacturing, and critical engine components in aerospace, mandates coatings that deliver extreme hardness, low friction coefficient, and superior thermal stability. Furthermore, rapid urbanization and large-scale public infrastructure investments in Asia, Latin America, and Africa require robust anti-corrosion protection for structural steel and metallic fittings, driving continuous consumption in the general metal treatment and priming sectors. These macroeconomic drivers, tied directly to global industrial output and capital equipment investment cycles, provide the necessary foundation for sustained demand, especially for technical-grade chromic acid used in volume applications.

Conversely, the market is severely restrained by the overwhelming regulatory environment, which targets hexavalent chromium compounds as hazardous carcinogens. The European Union’s REACH regulation stands as the most influential restraint, imposing severe restrictions, high compliance costs, and deadlines for phase-out unless specific authorization for essential uses is granted. Similar stringent regulations exist under the US EPA and occupational safety bodies worldwide, pushing end-users to either abandon Cr(VI) entirely or invest heavily in complex, expensive closed-loop recycling and air emission control technologies. The economic viability of chromic acid usage is therefore consistently challenged by these escalating environmental costs, which incentivize the substitution with non-chromium or trivalent systems in lower-performance or decorative applications where the technical requirements are less demanding. This regulatory environment restricts overall volume growth and channels remaining usage into highly technical, irreplaceable niche applications.

Opportunities for market growth and sustainability reside in the successful commercialization and deployment of advanced abatement and recycling technologies that drastically reduce environmental exposure and waste generation. Investment in sophisticated ion exchange and electrolytic recovery processes allows users to meet near-zero discharge mandates, thereby securing continued operational licenses in regulated zones and mitigating the risk of future regulatory bans. Furthermore, there is a distinct opportunity in capitalizing on the performance gap where Cr(III) and other non-chrome alternatives fail to match Cr(VI) performance—specifically in functional hard chrome plating where extreme load bearing and high temperatures are involved. This focus on "essential use" niches, coupled with superior environmental management, allows the market to stabilize at a premium value point. The primary impact forces are regulatory mandates versus engineering performance requirements, with the regulatory force currently dictating geographical market structure and operational costs, pushing production and volume consumption toward regions with adaptable regulatory structures.

Segmentation Analysis

The strategic segmentation of the Chromic Acid Market underscores the chemical’s integral role in high-performance manufacturing processes globally. Analysis by Application reveals that Plating and Finishing remains the economic powerhouse, generating the majority of revenue. Within this segment, hard chrome plating, utilized for functional parts requiring extreme wear resistance (e.g., internal combustion engine cylinder liners, printing press rollers, mining equipment hydraulics), demonstrates resilience against substitution due to its technical superiority. The secondary, yet critical, application is in Chemical Synthesis, where the high oxidizing potential of chromic acid is leveraged for the production of specialized chemicals, including certain pigments, catalysts, and intermediates for pharmaceutical and agrochemical sectors, often requiring the highest purity grades.

When segmented by End-Use Industry, the Automotive sector historically represents the largest consumption base, encompassing both decorative chrome finishes (now largely transitioning away from Cr(VI) where possible) and, more importantly, functional hard chrome plating for critical components like shock absorbers, brake systems, and transmission parts. The Aerospace and Defense sector is critical not for volume, but for high-value demand, utilizing chromic acid for aluminum pre-treatment (anodizing) and specialized functional plating where military and regulatory specifications prohibit the use of unproven alternatives. The Industrial Machinery and Equipment sector provides a stable, long-term consumption base, driven by the necessary maintenance and coating of tools, dies, and heavy manufacturing equipment, whose operational life is extended substantially by chromic acid-derived coatings.

Segmentation by Grade differentiates between the two primary quality levels demanded by end-users. Technical Grade, characterized by standard purity specifications, serves the majority of the electroplating and general metal treatment industries, where slight impurities are tolerable but cost efficiency is key. Purified Grade, conversely, commands a significant price premium and is specifically required for sensitive applications in catalyst manufacturing, electronic component production, and pharmaceutical synthesis, where trace element contamination can compromise final product integrity or catalytic reaction efficiency. The demand dynamics for Purified Grade are less sensitive to industrial cycles but highly sensitive to specialized technological advancements and regulatory requirements regarding chemical purity.

- By Application:

- Plating and Finishing (Hard Chrome Plating, Decorative Chrome, Functional Plating)

- Chemical Synthesis and Catalyst Production (Oxidizing Agent, Intermediate synthesis)

- Wood Preservation (CCA Formulation, increasingly restricted)

- Metal Treatment (Aluminum Anodizing, Passivation of Metallic Substrates)

- Others (Dyeing mordants, Specialized Pigments)

- By End-Use Industry:

- Automotive (Functional and Aesthetics)

- Aerospace and Defense (Pre-treatment and Hard Plating)

- Industrial Machinery and Equipment (Hydraulics, Rollers, Tools)

- Construction and Infrastructure (Structural Steel Treatment)

- Electronics (Printed Circuit Board Manufacturing, specialized etching)

- By Grade:

- Technical Grade (General Electroplating, High Volume Industrial Use)

- Purified Grade (Catalyst Manufacturing, Sensitive Chemical Synthesis)

Value Chain Analysis For Chromic Acid Market

The upstream segment of the Chromic Acid value chain is dominated by the sourcing and beneficiation of chromite ore, the primary geological source of chromium. The global supply of chromite is geographically concentrated, mainly in South Africa, Kazakhstan, India, and Turkey, subjecting the supply chain to significant geopolitical and logistical risk. Key upstream processors convert the mined chromite into ferrochrome or, crucially for this market, sodium dichromate (Na2Cr2O7). The conversion of chromite to sodium dichromate is an energy-intensive roasting process, making energy costs and environmental permitting for these initial chemical conversion plants a major determinant of upstream cost structures. Market consolidation in this precursor stage ensures high control over raw material pricing and availability, leading to integrated operations by the largest chromic acid producers who seek to minimize reliance on external, volatile commodity markets.

The midstream phase involves the controlled reaction of sodium dichromate with sulfuric acid to produce chromium trioxide (Chromic Acid, CrO3). This stage requires specialized, corrosion-resistant equipment due to the highly reactive nature of the chemicals involved. Producers must focus heavily on yield maximization, impurity removal to meet purified grade specifications, and strict safety management. Distribution channels for chromic acid are highly specific and regulated. Direct sales are predominantly used for high-volume end-users (e.g., large aerospace MRO facilities or major plating lines) who can manage the transport, storage, and specialized handling required for corrosive and hazardous materials. Direct sales provide the supplier with greater oversight of end-use compliance and technical support delivery.

Indirect distribution relies on a global network of specialized chemical logistics providers and authorized distributors who manage the complex permitting, small-volume packaging, and regional transportation for diverse smaller industrial customers across fragmented geographies. Given the regulatory status of Cr(VI), distributors play an essential role in ensuring compliance with local storage, transport, and safety data sheet (SDS) requirements, acting as the primary compliance link to thousands of smaller plating shops and specialized manufacturers. Downstream consumption is driven by the application process itself: electroplating baths, chemical reactors, or surface preparation lines. The efficiency of the downstream user’s process, particularly their ability to implement closed-loop recycling and effective wastewater treatment, directly impacts the sustainability and overall market viability of chromic acid usage in that specific region.

Chromic Acid Market Potential Customers

The primary cohort of potential customers consists of captive and independent electroplating facilities that execute hard chrome plating for the capital goods sector. These customers—including specialized manufacturers of hydraulic piston rods, large industrial rollers, printing cylinders, and engine components—are heavily reliant on the functional benefits of Cr(VI) coatings, demanding Technical Grade chromic acid in bulk quantities. Their procurement decisions are based on consistent purity, guaranteed supply chain stability, and robust technical support concerning bath chemistry management, as downtime in their high-precision operations is extremely costly. These customers are sensitive to regulatory changes and actively seek suppliers who can demonstrate best-in-class environmental compliance technologies and certifications.

A secondary, yet highly critical, customer base includes the aerospace Maintenance, Repair, and Overhaul (MRO) industry and defense contractors. These entities require chromic acid not only for hard functional plating on landing gear and actuators but also for chemical conversion coatings and specialized aluminum anodizing (Chromic Acid Anodizing – CAA) processes, which remain standard requirements under military and FAA specifications due to their unparalleled performance in preventing corrosion fatigue. These customers require Purified Grade material and are typically less price-sensitive, prioritizing quality consistency and the supplier's ability to maintain complex regulatory authorizations necessary for specialized defense applications. Their demand cycle is less correlated with general industrial output and more aligned with government defense budgets and fleet maintenance schedules.

Finally, chemical manufacturers and catalyst producers constitute a high-value customer segment. Companies synthesizing various organic compounds, specialized pigments (e.g., chromate pigments, though declining), or catalysts used in petrochemical processes require ultra-high purity chromic acid (Purified Grade). For these buyers, even trace levels of specific metallic impurities can destroy catalyst beds or ruin complex synthesis reactions, making stringent quality control the paramount purchasing criterion. Although these customers typically purchase lower volumes than large plating operations, they represent a stable, specialized demand niche insulated from broad regulatory substitution efforts targeting general surface finishing applications.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 185.0 Million |

| Market Forecast in 2033 | USD 250.2 Million |

| Growth Rate | 4.45% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Lanxess, American Elements, Chongqing Minmetals Development Co., Ltd., Mid-Mountain Materials Inc., Guangxi Jinma Technology Co., Ltd., Sanyou Chemical Co., Ltd., Novus International, Nanoshel LLC, Zouping Fuhai Industrial Co., Ltd., Hubei Xingfa Chemicals Group Co., Ltd., Chemtura (now Lanxess), BASF SE, Solvay S.A., Merck KGaA, Dr. Paul Lohmann GmbH KG, MacDermid Enthone Industrial Solutions, Elementis plc, Vishnu Chemicals Ltd., Hunter Chemical LLC, Atotech (now MKS Instruments). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Chromic Acid Market Key Technology Landscape

The technological evolution within the Chromic Acid Market is primarily defensive, centered on maximizing the safe operational lifespan of existing hexavalent chromium processes while radically minimizing environmental output. One of the most critical technologies is the deployment of sophisticated zero-discharge systems. These include advanced electrolytic recovery cells, which utilize electrochemical principles to regenerate chromic acid from spent plating solutions, extending bath life indefinitely and reducing fresh chemical input. Coupled with this are highly selective ion exchange resin columns and reverse osmosis systems designed to scavenge residual Cr(VI) from dilute rinse waters, achieving effluent purity levels that satisfy the strictest regulatory limits, such as those imposed by the EU’s Industrial Emissions Directive (IED).

On the application front, significant technological effort is directed towards optimizing the hard chrome plating bath itself. This involves the continuous development and refinement of proprietary catalysts and additives that enhance plating efficiency (measured in current efficiency and deposition rate), reduce surface tension to suppress hazardous misting and aerosols (a major occupational health concern), and improve the uniformity and mechanical properties of the final coating. Specialized fume suppressant technologies, which are required to be non-PFOS/PFOA compliant, represent a crucial, dynamically evolving sub-segment. Furthermore, the integration of automation, utilizing programmable logic controllers (PLCs) and digital sensors, is essential for maintaining the narrow operating parameters of hard chrome baths, ensuring consistent coating quality across high-precision components used in aerospace and hydraulics.

Beyond process control, the future landscape is being shaped by research into truly viable substitution technologies. While trivalent chromium plating (Cr(III)) has successfully replaced decorative chrome, achieving the technical specifications of hard Cr(VI) plating (e.g., micro-hardness above 900 HV and exceptional crack resistance) remains a persistent technological hurdle. Therefore, significant R&D investment is dedicated to modifying Cr(III) bath chemistries, optimizing pulsed current electroplating techniques, and exploring alternative materials (like nickel-tungsten alloys or High-Velocity Oxygen Fuel (HVOF) sprayed coatings) that attempt to close the functional performance gap. The success or failure of these competing technologies will dictate the long-term volume trajectory for chromic acid, making this pursuit of parity a continuous and financially significant technological battleground within the broader surface finishing industry.

Regional Highlights

Asia Pacific (APAC) holds the unequivocal position as the epicenter of demand and the largest market for chromic acid globally. This dominance is intrinsically linked to the region's unmatched scale of industrial output, particularly in rapidly expanding economies like China, which serves as the factory of the world. The automotive sector, driven by both domestic consumption and exports, requires vast quantities of both functional and general metal treatment using chromic acid. Although environmental awareness and regulation are intensifying across APAC, the enforcement historically has been more fragmented than in Western nations, allowing for the continuation of high-volume, cost-competitive manufacturing processes that rely on technical-grade chromic acid. The region’s aggressive push for infrastructure development further ensures sustained demand for corrosion-resistant materials used in construction and heavy engineering projects.

Europe represents the most challenging and regulated market environment. Due to the strict implementation of REACH, chromic acid usage is confined to highly specialized, authorized applications where the user can demonstrate that no technically suitable alternative exists, predominantly within the aerospace MRO and critical defense equipment sectors. The market here is characterized by slow growth, premium pricing, and mandatory investment in closed-loop recycling and sophisticated risk management measures. This regulatory pressure has led to a significant contraction of general plating operations utilizing Cr(VI), pushing manufacturers to either relocate or transition to alternatives, highlighting a profound shift towards a high-compliance, low-volume market structure strictly focused on essential functional performance.

North America maintains a stable market position, primarily driven by the demanding requirements of the US aerospace, defense, and heavy machinery manufacturing base. While the EPA and OSHA impose strict standards regarding air emissions and occupational exposure, the US has focused intensely on engineering controls (e.g., maximum achievable control technology - MACT standards) rather than outright broad bans, allowing critical users to maintain operations by investing heavily in high-efficiency scrubbers, ventilation systems, and specialized waste treatment. Market growth is closely tied to capital investment cycles within these high-value industries, ensuring a steady demand for high-quality chromic acid utilized in processes like Chromic Acid Anodizing (CAA) for aircraft components, where regulatory authorization for essential uses remains strong and substitution efforts have proven insufficient.

Latin America and the Middle East and Africa (MEA) constitute emerging markets with moderate to high future potential. LATAM demand is fueled by the regional automotive assembly industry and localized manufacturing sectors, often using established technologies with less pressure for immediate substitution than in Europe. MEA consumption is heavily focused on the energy sector (oil and gas infrastructure), requiring powerful corrosion inhibitors and wear-resistant coatings for drilling equipment and pipelines operating in harsh environments. As industrialization accelerates across these regions, particularly in the construction and energy sectors, the demand for chromic acid for metal passivation and protective coatings is expected to see above-average growth rates, contingent on internal economic and political stability, and the eventual adoption of international chemical safety standards.

- Asia Pacific (APAC): Market volume leader; fastest growth due to robust automotive and electronics manufacturing; moderate, though increasing, regulatory complexity.

- North America: Stable, high-value market driven by aerospace, defense, and heavy industrial equipment; mandatory high investment in emission control (MACT) technology.

- Europe: Highly restricted and mature market; driven by strict REACH authorization for essential uses only; profound structural shift toward compliant, low-volume operation.

- Latin America & MEA: Emerging markets with growth potential tied to oil/gas infrastructure and localized manufacturing; demand relies on technical grade material for core industrial needs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Chromic Acid Market.- Lanxess

- American Elements

- Chongqing Minmetals Development Co., Ltd.

- Mid-Mountain Materials Inc.

- Guangxi Jinma Technology Co., Ltd.

- Sanyou Chemical Co., Ltd.

- Novus International

- Nanoshel LLC

- Zouping Fuhai Industrial Co., Ltd.

- Hubei Xingfa Chemicals Group Co., Ltd.

- Chemtura (now Lanxess)

- BASF SE

- Solvay S.A.

- Merck KGaA

- Dr. Paul Lohmann GmbH KG

- MacDermid Enthone Industrial Solutions

- Elementis plc

- Vishnu Chemicals Ltd.

- Hunter Chemical LLC

- Atotech (now MKS Instruments)

- Bayer AG (historic involvement)

Frequently Asked Questions

Analyze common user questions about the Chromic Acid market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor restraining the growth of the Chromic Acid Market?

The primary constraint is the stringent global regulation of hexavalent chromium (Cr(VI)) compounds, particularly through directives like REACH in the EU and severe EPA restrictions, which necessitate significant investment in compliance technology and actively promote substitution in non-essential applications.

Which application segment holds the largest share in the Chromic Acid Market?

The Plating and Finishing application segment holds the largest market share, driven by the indispensable requirement for functional hard chrome coatings to provide superior wear resistance, low friction, and anti-corrosion protection in high-stress industrial and critical transportation components.

How does the Asia Pacific region impact the global Chromic Acid Market?

APAC is the dominant and fastest-growing regional market, serving as the main global manufacturing and consumption hub. Its expansive automotive, electronics, and infrastructure sectors utilize chromic acid in large volumes, sustaining high global demand for technical-grade material.

Are there viable substitutes for chromic acid in functional hard chrome plating?

While research into trivalent chromium (Cr(III)) plating and alternative non-chromium coatings is intense, commercially available substitutes currently lack the equivalent hardness, thermal stability, and consistent performance profile of traditional hexavalent chromic acid for critical, high-stress functional applications required by aerospace and defense sectors.

How is technology being utilized to mitigate the hazards associated with chromic acid usage?

Key mitigating technologies include advanced zero-discharge systems, such as specialized electrolytic recovery cells and ion exchange units, which achieve efficient Cr(VI) recovery from effluent, minimizing environmental discharge, and sophisticated fume suppressants to ensure occupational safety and regulatory compliance.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager