Chromium Oxide Green Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435501 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Chromium Oxide Green Market Size

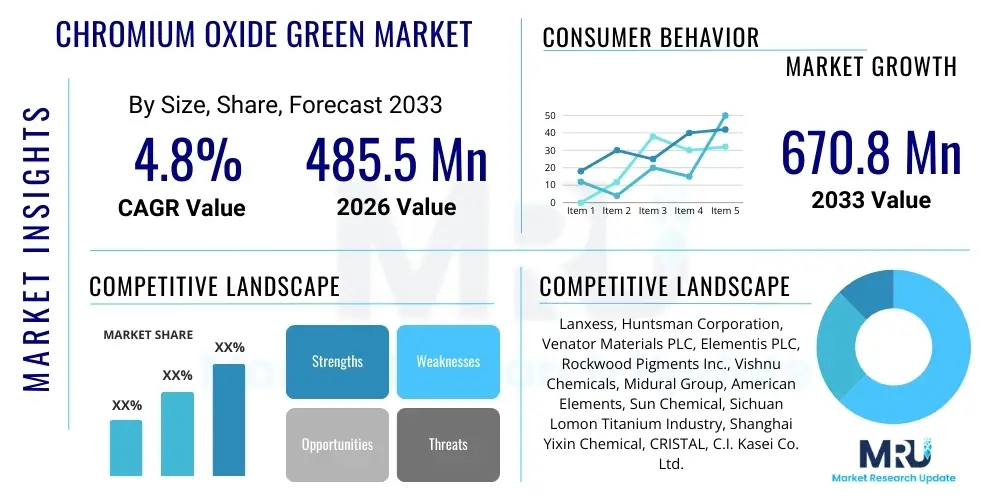

The Chromium Oxide Green Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 485.5 Million in 2026 and is projected to reach USD 670.8 Million by the end of the forecast period in 2033. This consistent growth trajectory is primarily driven by robust demand from the metallurgical sector, particularly in the production of high-performance alloys and refractory materials essential for industrial furnaces and high-temperature applications. The inherent chemical stability and refractory properties of chromium oxide green ensure its continued relevance across diverse heavy industries globally.

Chromium Oxide Green Market introduction

Chromium Oxide Green (Cr2O3) is an inorganic chemical compound characterized by its brilliant green color, high stability, and insolubility in water and acids. It serves predominantly as a high-performance pigment known for its exceptional light fastness, heat resistance, and chemical inertness. Its unique properties position it as a critical material in applications requiring durability and stability under harsh conditions, distinguishing it from conventional organic pigments. The versatility of Chromium Oxide Green spans multiple industrial sectors, making it a foundational component in modern manufacturing processes where color integrity and material performance are paramount. This widespread utility drives market dynamics globally.

Major applications of Chromium Oxide Green include its use in camouflage paints due to its near-infrared reflectance properties, as a raw material in the synthesis of specialized chromium chemicals, and extensively in the formulation of high-temperature refractory linings for steel and glass manufacturing. Furthermore, its abrasive qualities are leveraged in polishing compounds, specifically for stainless steel and precision optical surfaces. The primary benefit of using Cr2O3 is its superior environmental stability; it does not fade or degrade when exposed to extreme weather, UV radiation, or corrosive chemical environments, ensuring product longevity and reliability. This high-performance profile is crucial for segments like automotive coatings and construction materials.

The market is predominantly driven by escalating infrastructure development and industrialization across emerging economies, particularly within the Asia Pacific region. Increased investments in the steel and glass industries, coupled with rising global demand for durable protective coatings and specialized ceramic tiles, significantly bolster the consumption of Chromium Oxide Green. The shift towards higher-specification, longer-lasting construction and industrial products compels manufacturers to incorporate high-quality, stable pigments and refractory fillers, solidifying Cr2O3’s market position as an indispensable chemical additive.

Chromium Oxide Green Market Executive Summary

The Chromium Oxide Green market is experiencing substantial growth, underpinned by resilient demand from the metallurgy and ceramics sectors, which utilize its high melting point and chemical inertia for refractory applications. Key business trends indicate a critical focus on improving production efficiency and developing cleaner manufacturing processes to address rising environmental scrutiny related to chromium compounds. Leading companies are investing in backward integration, securing stable access to chromite ore, and expanding capacity to meet the sustained consumption from emerging industrial hubs, ensuring supply chain stability and competitive advantage in a volatile raw materials landscape.

Regionally, the Asia Pacific (APAC) dominates the consumption landscape, primarily fueled by massive infrastructure projects, burgeoning automotive production, and expanding ceramic tile manufacturing in China and India. North America and Europe, while mature, demonstrate steady demand driven by strict regulatory standards demanding high-quality, non-fading pigments in architectural coatings and military applications. Segment trends confirm that the Pigment Grade segment holds the largest market share due to its widespread use in paints, inks, and building materials, while the Technical Grade segment is poised for the highest growth rate, propelled by its application in the crucial aerospace and specialized alloy manufacturing industries where performance standards are exceptionally high.

Overall, the market remains moderately consolidated, with strong competition focused on product purity and consistency. Strategic objectives for market players include geographical expansion into high-growth potential regions like Southeast Asia and Latin America, alongside technological upgrades aimed at reducing energy consumption during the calcination process. The executive outlook suggests stable long-term growth, contingent upon mitigating potential regulatory hurdles related to chromium usage and the successful commercialization of sustainable, low-waste production techniques, thereby ensuring the longevity and social license to operate for major manufacturers.

AI Impact Analysis on Chromium Oxide Green Market

Common user questions regarding AI's impact on the Chromium Oxide Green market revolve around supply chain optimization, predictive maintenance of large kilns and reactors, and the potential for AI-driven materials discovery to identify sustainable alternatives or enhance existing Cr2O3 properties. Users are keen to understand if AI can significantly reduce manufacturing costs, particularly energy consumption during the calcination phase, and improve quality control by detecting minute impurities in pigment grades. The primary concerns center on the initial investment required for AI infrastructure implementation and the specialized skill gap needed to manage AI-integrated chemical production facilities. Key expectations include faster reaction optimization, reduced operational downtime, and enhanced compliance tracking related to waste management and emissions, leveraging AI's ability to process vast sensor data in real-time.

- AI-driven Predictive Maintenance: Utilizing machine learning algorithms to forecast equipment failure in high-temperature kilns, reducing unexpected downtime and maintenance costs in production facilities.

- Optimized Synthesis Processes: Employing AI to analyze complex reaction parameters (temperature, pressure, raw material ratios) to optimize calcination yield, purity, and energy efficiency of Chromium Oxide Green production.

- Supply Chain Forecasting: Integrating AI for more accurate demand forecasting in end-use sectors (e.g., refractory, construction), leading to optimized inventory management and minimized obsolescence risks for raw materials.

- Enhanced Quality Control: Implementing computer vision and AI analytics for real-time spectral analysis of pigment batches, ensuring precise color consistency and particle size distribution.

- Sustainability Monitoring: Using AI platforms to monitor and optimize energy usage and waste generation, aiding manufacturers in meeting stringent environmental, social, and governance (ESG) targets.

- Materials Informatics: Applying machine learning to explore new, cost-effective precursors or novel chemical pathways for Cr2O3 synthesis, potentially bypassing traditional high-cost methods.

DRO & Impact Forces Of Chromium Oxide Green Market

The Chromium Oxide Green market is significantly influenced by a dynamic interplay of driving factors, regulatory constraints, and emerging technological opportunities. The primary market driver is the sustained growth in global infrastructure and construction sectors, particularly in developing nations, necessitating high volumes of durable pigments and specialized refractory ceramics. Concurrently, the increasing military expenditure globally ensures continuous demand for camouflage coatings requiring the unique near-infrared reflectance properties of Cr2O3. These drivers are tempered by significant restraints, predominantly concerns surrounding the toxicity associated with hexavalent chromium compounds, which, although not present in the final Cr2O3 product, are often used or generated as intermediates in certain manufacturing processes, leading to stringent governmental regulations and disposal challenges.

Despite these restraints, substantial market opportunities exist, particularly in the adoption of cleaner production technologies, such as the direct reduction of chromite ore, which minimizes the formation of undesirable intermediates. Furthermore, the burgeoning demand for high-end polishers and lapping compounds in the electronics and precision machinery industries offers a niche, high-value application growth avenue. The market's overall trajectory is thus heavily dependent on the industry's success in demonstrating and implementing environmentally sound production practices that comply with evolving global chemical regulations, particularly REACH in Europe and similar acts in Asia, securing the long-term viability of the product.

Impact forces shape the competitive landscape and market resilience. Porter's five forces analysis indicates moderate bargaining power of suppliers, driven by the concentrated nature of chromite ore mining, but low threat of substitutes due to the unparalleled performance of Cr2O3 in high-heat and chemical stability applications. Buyer power is moderate, influenced by the large volumes purchased by key refractory and pigment manufacturers. Overall, the market remains competitive, with growth primarily dictated by industrial output and technological advancements that enhance product purity while simultaneously mitigating environmental risks associated with its production chain, ensuring a balance between industrial necessity and ecological responsibility.

Segmentation Analysis

The Chromium Oxide Green market segmentation provides a comprehensive view of consumption patterns, differentiating the market based on the product’s grade, which dictates its purity and intended use, and its application across various end-user industries. The segmentation by grade is critical as it directly correlates with the selling price and regulatory requirements; for instance, Pharmaceutical Grade demands the highest purity and adherence to strict standards, commanding a premium price, whereas Pigment Grade is mass-produced for lower-tolerance applications like colored cement and standard coatings. Understanding these grade differentials is essential for strategic planning and optimizing manufacturing output to align with specific market needs and regulatory frameworks globally.

Segmentation by application reveals the core consumption drivers. The Ceramics & Refractories segment dominates in terms of volume due to the necessity of Cr2O3 as a refractory filler in bricks and linings used in high-temperature industrial environments such as cement kilns and glass furnaces, capitalizing on its exceptional melting point. However, the Coatings & Pigments segment, particularly for specialized architectural and protective coatings requiring extreme durability and weather fastness, contributes significantly to market value. These segments demonstrate divergent growth rates, with advanced metallurgical applications likely to experience faster growth due to rising demand for specialized alloys and high-performance metal processing tools globally.

This detailed segmentation allows market players to tailor their production, marketing, and distribution strategies effectively. Companies focused on Technical Grade production will prioritize partnerships with metallurgical and aerospace industries, emphasizing purity and technical specifications. Conversely, manufacturers targeting the Pigment Grade segment will concentrate on large-scale, cost-efficient production and robust distribution networks catering to construction material suppliers and paint manufacturers, ensuring they capture market share across different profitability and volume thresholds.

- By Grade:

- Technical Grade

- Pharmaceutical Grade

- Pigment Grade

- By Application:

- Metallurgy (e.g., Ferrochrome, Specialty Alloys)

- Ceramics & Refractories (e.g., Magnesia-Chrome Bricks, Kiln Linings)

- Coatings & Pigments (e.g., Industrial Paints, Camouflage Coatings, Concrete Colorants)

- Chemicals (e.g., Catalyst Preparation, Chromium Salts Synthesis)

- Polishing & Abrasives (e.g., Lapping Compounds)

Value Chain Analysis For Chromium Oxide Green Market

The value chain for the Chromium Oxide Green market begins with the upstream sourcing of chromite ore, the primary raw material, which is mined and processed in concentrated regions, predominantly South Africa, Kazakhstan, and India. This upstream segment is characterized by relatively high consolidation and significant capital investment in mining operations, which dictates the cost and stability of supply for intermediate producers. The subsequent processing phase involves converting chromite ore into high-purity sodium dichromate or other chromium intermediates, followed by reduction and calcination to yield the final Cr2O3 product. Efficiency in this manufacturing step, particularly energy management and waste minimization, is critical for competitive pricing and regulatory compliance.

The midstream phase involves manufacturing and formulation, where the crude Chromium Oxide Green powder is refined, milled, and standardized according to the required grade (Technical, Pigment, or Pharmaceutical). Product quality control, focusing on particle size distribution, tinting strength, and chemical purity, is paramount here. Distribution channels are twofold: direct sales and indirect sales. Direct distribution is favored for large-volume buyers, such as major refractory producers or specialized chemical manufacturers, allowing for customized specifications and stronger B2B relationships. Indirect distribution utilizes a network of chemical distributors and specialty pigment agents, particularly for smaller orders and regional paint manufacturers, providing wider market access and localized inventory management.

The downstream analysis focuses on the end-user markets, where the material is incorporated into finished goods. The bulk of the demand originates from heavy industries (metallurgy, construction, ceramics). The final consumer (the buyer) is typically a corporate entity utilizing Cr2O3 as an essential ingredient, rather than an individual consumer. The efficiency of the value chain is increasingly judged by its adherence to circular economy principles and sustainable sourcing, as downstream users often demand transparency regarding the environmental impact of their inputs. Optimizing logistics and managing regulatory burdens across different geographical markets are ongoing challenges in this segment, requiring sophisticated global supply chain management.

Chromium Oxide Green Market Potential Customers

Potential customers for Chromium Oxide Green are highly diverse, encompassing multinational corporations across several heavy industries that rely on its specific chemical and physical properties. The largest volume consumers are industrial manufacturers in the refractory and ceramics sectors. These companies use Technical Grade Cr2O3 to produce high-performance, heat-resistant bricks, mortar, and specialized kiln furniture essential for lining furnaces used in steel, cement, and glass production, where temperatures routinely exceed 1500°C. Their buying criteria prioritize thermal stability, consistency, and particle morphology, making them repeat, high-volume purchasers who often negotiate long-term supply contracts directly with major manufacturers.

Another major customer segment includes global pigment and coatings manufacturers. These buyers procure Pigment Grade Cr2O3 for use in specialized industrial paints, architectural coatings, and concrete colorants. Their requirement is centered on color fastness, tinting strength, and resistance to UV degradation and harsh chemical exposure. This segment often demands detailed certification regarding heavy metal content and regulatory compliance, particularly for coatings used in consumer-facing or highly regulated environments, such as aerospace or marine applications. Furthermore, military contractors represent a specialized, recurring customer base, utilizing the material for standardized camouflage coatings requiring specific infrared spectral properties for stealth applications.

Finally, chemical processors and precision engineering firms form the high-value, niche customer base. Chemical companies use Cr2O3 as a precursor for synthesizing other chromium compounds or as a catalyst in various industrial chemical reactions, demanding the highest level of purity (Pharmaceutical or Ultra-Pure Technical Grade). Precision engineering and electronics manufacturers are consumers in the polishing segment, using Chromium Oxide Green in fine abrasive lapping compounds to achieve ultra-smooth surfaces on optics, hard drives, and specialty metallic components. These buyers are highly sensitive to product consistency and micron size, often leading to specialized, customized production orders from suppliers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 485.5 Million |

| Market Forecast in 2033 | USD 670.8 Million |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Lanxess, Huntsman Corporation, Venator Materials PLC, Elementis PLC, Rockwood Pigments Inc., Vishnu Chemicals, Midural Group, American Elements, Sun Chemical, Sichuan Lomon Titanium Industry, Shanghai Yixin Chemical, CRISTAL, C.I. Kasei Co. Ltd., Cathay Industries, BASF SE, KRONOS Worldwide, Merck KGaA, Ferro Corporation, J.H. Calo Company, Chromox Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Chromium Oxide Green Market Key Technology Landscape

The core technology for Chromium Oxide Green production traditionally involves the thermal reduction of sodium dichromate or similar chromium intermediates. However, the technological landscape is rapidly evolving, driven by the necessity to comply with stricter environmental regulations and improve energy efficiency. A critical technological focus is the optimization of the calcination process, which involves heating the precursor materials in high-temperature kilns. Advanced kiln designs, incorporating superior heat recovery systems and precise temperature control mechanisms, are being implemented to minimize energy usage and ensure homogeneous particle growth, which is vital for achieving consistent color and strength in pigment grades.

Furthermore, significant research and development efforts are concentrated on alternative, cleaner synthesis methods that bypass the formation of hexavalent chromium (Cr VI) intermediates entirely or allow for their immediate, safe reduction. One promising area is the direct reduction of chromite ore, often utilizing solid-state reactions or specialized plasma torch technology. Although these methods require high initial capital investment, they offer a sustainable long-term solution by drastically reducing toxic waste generation and regulatory burden. Manufacturers are also exploring micro-encapsulation techniques to enhance the dispersibility and compatibility of Cr2O3 pigments within complex resin systems, thereby improving performance in advanced coatings.

In terms of quality enhancement, modern production facilities are adopting advanced analytical techniques. This includes utilizing sophisticated instruments like X-ray diffraction (XRD) and scanning electron microscopy (SEM) for real-time analysis of crystalline structure, particle size, and morphology. Automation and digitalization of process control systems are becoming standard practice, allowing for the precise management of complex synthesis parameters, leading to superior batch-to-batch consistency—a critical factor for high-end applications like precision polishing and certified camouflage paints. This continuous technological refinement ensures the sustained high quality and competitive edge of modern Chromium Oxide Green products.

Regional Highlights

- Asia Pacific (APAC): APAC is the dominant market in both production and consumption, characterized by rapid industrial expansion, particularly in China, India, and Southeast Asia. The region’s colossal infrastructure and construction sectors, coupled with heavy investments in metallurgical and ceramic industries, drive overwhelming demand for both refractory and pigment grades. Local manufacturers benefit from comparatively lower production costs and proximity to major chromite ore sources, although environmental compliance is becoming increasingly stringent, necessitating technological upgrades.

- North America: This region represents a mature, high-value market where demand is steady, driven primarily by specialized applications such as high-performance industrial coatings, aerospace components, and military procurement. Strict environmental regulations necessitate the import of high-purity, environmentally compliant products. Growth is focused on niche markets like advanced polishing compounds and specialized technical ceramics, emphasizing product quality over sheer volume.

- Europe: Europe is characterized by stringent chemical regulations, notably REACH, which places immense pressure on manufacturers regarding the use and disposal of chromium-related substances. Consumption here is stable, largely driven by the premium architectural paint sector and the high-end refractory industry. Market players focus heavily on sustainable supply chain management and verifiable environmental certifications to maintain market access and comply with regional directives.

- Latin America (LATAM): LATAM is an emerging high-growth market, spurred by recovering construction sectors and domestic industrial output, especially in Brazil and Mexico. The demand for Chromium Oxide Green is growing for use in cement coloring and foundational infrastructure coatings. Market growth is sensitive to macroeconomic stability and foreign direct investment in manufacturing capabilities, presenting significant future opportunities for global suppliers.

- Middle East and Africa (MEA): MEA is a region of mixed dynamics. The Middle East drives demand through large-scale petrochemical and construction projects, requiring extensive protective coatings and refractory materials for high-heat environments. South Africa, a major source of chromite ore, plays a critical role in the upstream supply chain. Consumption is gradually increasing, tied directly to national development plans and industrial diversification efforts.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Chromium Oxide Green Market.- Lanxess

- Huntsman Corporation

- Venator Materials PLC

- Elementis PLC

- Rockwood Pigments Inc.

- Vishnu Chemicals

- Midural Group

- American Elements

- Sun Chemical

- Sichuan Lomon Titanium Industry

- Shanghai Yixin Chemical

- CRISTAL

- C.I. Kasei Co. Ltd.

- Cathay Industries

- BASF SE

- KRONOS Worldwide

- Merck KGaA

- Ferro Corporation

- J.H. Calo Company

- Chromox Ltd.

Frequently Asked Questions

Analyze common user questions about the Chromium Oxide Green market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary application driving the demand for Technical Grade Chromium Oxide Green?

The primary application driving demand for Technical Grade Chromium Oxide Green is its use in the Ceramics and Refractories industry, particularly in manufacturing magnesia-chrome bricks and kiln linings necessary for high-temperature metallurgical furnaces and cement production due to its exceptional thermal stability.

How do regulatory restraints, such as REACH, impact the Chromium Oxide Green market?

Regulations like REACH significantly impact the market by imposing strict controls on the manufacturing process, particularly regarding the handling and generation of hexavalent chromium (Cr VI) intermediates, compelling producers to adopt cleaner, more sustainable synthesis technologies and ensure the final Cr2O3 product is compliant and free of harmful residues.

Which geographical region dominates the consumption of Chromium Oxide Green, and why?

The Asia Pacific (APAC) region dominates the global consumption, primarily driven by massive, ongoing infrastructure projects, rapid industrialization, high production volumes in the steel and glass sectors, and expanding automotive manufacturing in countries like China and India.

Is Chromium Oxide Green considered a sustainable material, given its chemical origin?

While the final product, Cr2O3, is non-toxic and highly durable, sustainability concerns often arise from the upstream manufacturing processes that may involve toxic chromium intermediates. Industry focus is shifting toward implementing environmentally friendly production methods, such as direct reduction, to enhance the product's overall sustainability profile.

What are the expected growth sectors for Chromium Oxide Green in the next five years?

Key growth sectors include high-end Polishing and Abrasives for electronics and optics, specialized protective and camouflage Coatings requiring high-performance durability, and emerging metallurgical applications involving the production of advanced, specialty chromium alloys.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Chromium Oxide Green Market Statistics 2025 Analysis By Application (Coating, Ceramics, Rubber, Metallurgy), By Type (Pigment Grade, Metallurgical Grade, Refractory Grade), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Chromium Oxide Green Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Pigment Grade, Metallurgical Grade, Refractory Grade, Others), By Application (Coating, Ceramics, Rubber, Metallurgy, Other), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager