Chronic Lymphocytic Leukemia Treatment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435510 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Chronic Lymphocytic Leukemia Treatment Market Size

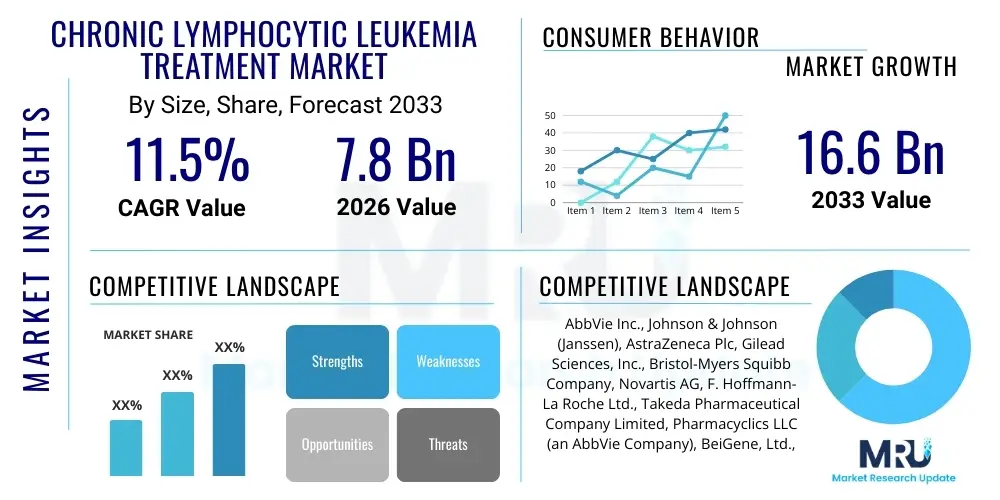

The Chronic Lymphocytic Leukemia Treatment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at USD 7.8 Billion in 2026 and is projected to reach USD 16.6 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the rising global prevalence of CLL, particularly within aging populations across major economies, coupled with significant advancements in targeted therapies that offer superior efficacy and reduced toxicity compared to traditional chemotherapies. The increasing approval and uptake of novel oral agents, such as Bruton's Tyrosine Kinase (BTK) inhibitors and BCL-2 inhibitors, are redefining treatment standards and expanding market valuation.

Chronic Lymphocytic Leukemia Treatment Market introduction

The Chronic Lymphocytic Leukemia (CLL) Treatment Market encompasses pharmaceuticals, therapeutic procedures, and supportive care technologies utilized in managing the most common type of leukemia in adults. CLL is characterized by the slow, uncontrolled proliferation of B lymphocytes in the bone marrow and blood. The product description spans a complex portfolio, including small-molecule targeted drugs, traditional chemotherapy agents, monoclonal antibodies, and emerging cellular therapies. Targeted therapies, particularly those inhibiting crucial signaling pathways vital for CLL cell survival, represent the primary driver of current market dynamics. These treatments offer substantial clinical benefits, including extended progression-free survival and improved quality of life for patients ineligible for intensive chemotherapy or stem cell transplant.

Major applications of CLL treatments include first-line therapy for newly diagnosed patients, management of relapsed or refractory (R/R) disease, and palliative care. The shift away from chemoimmunotherapy towards novel oral agents (e.g., Ibrutinib, Acalabrutinib, Venetoclax) has revolutionized the treatment landscape, especially for high-risk genetic subsets (e.g., 17p deletion, TP53 mutation). Benefits derived from these newer classes include oral administration convenience, high response rates, and sustained disease control, translating into improved long-term outcomes for a chronic condition. Furthermore, the market benefits from diagnostic advancements, such as sophisticated cytogenetics and next-generation sequencing, which enable personalized treatment selection based on molecular markers.

Driving factors propelling market growth include the rising geriatric demographic globally, as CLL incidence increases sharply with age. Substantial investment in oncology research by major pharmaceutical companies focuses heavily on developing combination regimens involving novel targeted agents to overcome resistance mechanisms and improve depth of response. Furthermore, favorable regulatory environments, particularly in North America and Europe, accelerate the approval process for breakthrough therapies, ensuring rapid market accessibility. Increased patient awareness and improved diagnostic capabilities in developing economies also contribute significantly to the expanding patient pool receiving appropriate treatment.

Chronic Lymphocytic Leukemia Treatment Market Executive Summary

The Chronic Lymphocytic Leukemia Treatment Market is experiencing robust growth fueled primarily by the paradigm shift from intravenous chemotherapy to oral targeted therapy. Business trends indicate a strong focus on licensing, collaborations, and mergers among pharmaceutical companies seeking to consolidate intellectual property related to BTK and BCL-2 inhibitors, as well as novel agents targeting Bruton's Tyrosine Kinase C481S mutations. The market is highly competitive, characterized by continuous pipeline innovation aimed at developing therapies for patients refractory to initial targeted treatments. Key strategic initiatives involve exploring fixed-duration combination regimens (e.g., Venetoclax plus Obinutuzumab) that minimize the duration of continuous treatment exposure while maintaining deep remission, addressing both efficacy and patient compliance concerns.

Regionally, North America maintains market dominance due to high healthcare expenditure, established reimbursement policies, and the early adoption of high-cost innovative drugs. However, the Asia Pacific region is projected to register the fastest growth rate, attributed to improving healthcare infrastructure, increasing awareness regarding blood cancers, and a burgeoning patient population accessing specialized oncology care. Europe follows closely, driven by centralized regulatory approvals (EMA) and strong governmental focus on oncology R&D, although pricing pressures and HTA (Health Technology Assessment) requirements often introduce market access challenges compared to the US market. The global trend emphasizes moving treatment into the community setting, capitalizing on the oral nature of newer therapies.

Segment trends highlight the dominance of targeted therapy drugs over traditional chemotherapy and monoclonal antibodies, although combinations remain critical. Specifically, the BTK inhibitor class commands the largest revenue share, but the BCL-2 inhibitor class is rapidly gaining momentum, particularly in combination settings and specific patient populations where BTK resistance is a concern. In terms of distribution, hospital pharmacies currently lead due to the initial administration and monitoring requirements, but specialty pharmacies are becoming increasingly important for dispensing oral, outpatient maintenance therapies. Furthermore, the increasing use of companion diagnostics to confirm specific molecular targets (e.g., IGHV mutational status, specific chromosomal abnormalities) drives growth in the diagnostics segment related to CLL treatment selection.

AI Impact Analysis on Chronic Lymphocytic Leukemia Treatment Market

User queries regarding the application of Artificial Intelligence (AI) in CLL treatment heavily center on personalized medicine, predictive diagnostics, and optimizing clinical trial design. Users are concerned about how AI can accurately predict patient response to specific targeted agents (e.g., resistance to Ibrutinib) based on complex genomic profiles and clinical features. Key themes involve the expectation that AI and Machine Learning (ML) algorithms will streamline the classification of high-risk CLL subtypes, enabling earlier and more aggressive intervention. Furthermore, there is significant interest in using AI for drug discovery, accelerating the identification of novel small molecules that inhibit difficult-to-target pathways or bypass current resistance mechanisms. These technologies are anticipated to improve trial efficiency, enhance monitoring through remote data analysis, and ultimately reduce the cost of delivering personalized CLL care, though regulatory hurdles for AI-driven diagnostic tools remain a notable concern.

- AI algorithms significantly enhance prognostic accuracy by analyzing multimodal data (genomic, clinical, pathological).

- Machine learning models predict patient response and toxicity profiles for specific targeted therapies (e.g., BTK inhibitors).

- AI accelerates novel drug target identification and lead optimization in the preclinical phase of CLL drug development.

- Natural Language Processing (NLP) is used to extract insights from vast amounts of electronic health records (EHRs) for real-world evidence generation in CLL.

- AI optimizes clinical trial matching, rapidly identifying eligible CLL patients based on complex inclusion/exclusion criteria.

- Advanced image analysis using deep learning supports the precise assessment of lymph node and spleen size changes post-treatment.

- Predictive maintenance and quality control in complex cellular therapy manufacturing (e.g., CAR T-cell therapy) benefit from AI applications.

DRO & Impact Forces Of Chronic Lymphocytic Leukemia Treatment Market

The Chronic Lymphocytic Leukemia Treatment Market is significantly influenced by a dynamic interplay of Drivers (D), Restraints (R), and Opportunities (O), which collectively shape the competitive landscape and growth trajectory. The primary driver is the demonstrable clinical superiority of targeted oral agents over conventional chemoimmunotherapy, offering substantial improvements in overall survival and progression-free survival. Restraints largely center on the extremely high cost of these innovative targeted therapies, leading to significant economic burdens on healthcare systems and patients, coupled with complex intellectual property (IP) landscapes and the potential for treatment resistance requiring subsequent line therapies. Opportunities are abundant, including the potential for curative combination therapies, the development of next-generation inhibitors that overcome specific resistance mutations (e.g., non-covalent BTK inhibitors), and the expansion of market access into emerging economies.

Impact forces currently favoring market expansion include the rapid advancements in genomic medicine, allowing for refined risk stratification and personalized treatment protocols. The global aging population continues to act as a fundamental demand driver, ensuring a constant influx of newly diagnosed CLL cases. Conversely, restraints related to competition from biosimilars (expected for older monoclonal antibodies and potentially targeted agents post-patent expiry) and payer scrutiny over drug pricing exert downward pressure. The need for continuous patient monitoring and management of specific adverse events associated with targeted drugs (e.g., cardiac issues with first-generation BTK inhibitors) necessitates robust healthcare infrastructure, posing challenges in resource-constrained regions.

The strategic opportunities involve capitalizing on the shift towards minimal residual disease (MRD) guided treatment, where therapies are utilized to achieve the deepest possible remission, potentially enabling treatment discontinuation for fixed periods. This paradigm shift offers commercial advantages for therapies proving efficacy in achieving undetectable MRD status. Furthermore, the market benefits from increasing research into novel cellular therapies and bispecific antibodies specifically tailored for B-cell malignancies. Successfully navigating the complex pricing and reimbursement negotiations, especially in European and APAC markets, is crucial for sustained commercial success in this high-value therapeutic area.

Segmentation Analysis

The Chronic Lymphocytic Leukemia Treatment Market is systematically segmented based on treatment type, drug class, route of administration, and distribution channel, providing a granular view of market dynamics and revenue generation streams. Treatment type segments differentiate between targeted therapy, chemotherapy, immunotherapies (monoclonal antibodies), and stem cell transplantation. The pharmaceutical sector, driven by small-molecule targeted agents, represents the dominant and fastest-growing segment. The classification by drug class allows for specific analysis of the impact of novel mechanisms of action, such as inhibitors targeting the B-cell receptor signaling pathway and those modulating apoptosis pathways. The shift towards oral administration has dramatically influenced patient preference and adherence, highlighting its importance in market modeling.

Further analysis reveals critical distinctions within the drug class segmentation. The BTK inhibitor class, which includes covalent and non-covalent agents, holds the largest market share due to its efficacy in both frontline and R/R settings. However, the BCL-2 inhibitor class, represented primarily by Venetoclax, is essential for combination regimens, fixed-duration strategies, and treating specific high-risk cohorts. Monoclonal antibodies, predominantly CD20-targeting agents like Rituximab and Obinutuzumab, often serve as backbone components in chemoimmunotherapy or combination targeted regimens. Understanding these nested classifications is vital for strategic planning, especially as pipelines focus increasingly on synergistic combinations of these agents to overcome tumor heterogeneity and enhance treatment depth.

The distribution channel segment underscores the complex supply chain dynamics. Due to the high cost and specialized handling required for most oncology therapeutics, hospital pharmacies and specialized oncology centers remain crucial points of dispensing. Nevertheless, the prevalence of oral targeted therapies is expanding the role of specialty and retail pharmacies, requiring sophisticated cold chain logistics and extensive patient education services to ensure compliance and monitor adverse events. The segmentation structure comprehensively captures the therapeutic landscape's evolution, demonstrating a clear pivot towards patient-centric, high-efficacy pharmaceutical interventions.

- Treatment Type:

- Targeted Therapy

- Chemotherapy

- Immunotherapy (Monoclonal Antibodies)

- Stem Cell Transplantation

- Radiation Therapy

- Drug Class:

- Bruton's Tyrosine Kinase (BTK) Inhibitors (Covalent and Non-covalent)

- B-cell Lymphoma 2 (BCL-2) Inhibitors

- Phosphoinositide 3-Kinase (PI3K) Inhibitors

- CD20 Inhibitors

- Alkylating Agents

- Purine Analogs

- Route of Administration:

- Oral

- Intravenous (IV)

- Distribution Channel:

- Hospital Pharmacies

- Specialty Pharmacies

- Retail Pharmacies

- Oncology Centers

Value Chain Analysis For Chronic Lymphocytic Leukemia Treatment Market

The value chain for the CLL treatment market is intricate, beginning with upstream activities focused on active pharmaceutical ingredient (API) synthesis and clinical research. Upstream analysis involves highly specialized biotech and pharmaceutical firms engaged in target identification (e.g., identifying novel kinases or apoptosis regulators), lead optimization, and rigorous preclinical testing. The complexity of synthesizing small-molecule inhibitors and manufacturing high-quality monoclonal antibodies requires significant capital investment and highly skilled expertise. Licensing agreements and research collaborations between academic institutions and large biopharma companies are integral at this stage, driving innovation and securing future intellectual property rights crucial for market sustainability.

Midstream activities encompass large-scale manufacturing, formulation into finished dosage forms (primarily oral tablets/capsules and IV infusions), and packaging. Stringent Good Manufacturing Practices (GMP) regulations, particularly for oncology drugs, govern this phase. Downstream analysis focuses on market access, distribution, and patient delivery. The distribution channel structure relies heavily on a specialized network, often involving cold chain logistics, managed by wholesalers and distributors who move the product from the manufacturing site to healthcare providers. Direct sales forces and specialized oncology account managers are critical for educating prescribers and negotiating formulary placement with payers.

The distribution segment is further bifurcated into direct and indirect channels. Direct distribution involves manufacturers supplying large hospital systems or oncology centers, often through closed-loop distribution agreements to ensure accountability and control over high-value products. Indirect channels utilize specialty distributors and third-party logistics (3PL) providers to reach smaller clinics and specialty pharmacies. Given the high cost of CLL therapeutics, reimbursement management and patient support programs (PSP) are essential elements of the downstream value chain, facilitating patient access and maximizing adherence. The efficiency of this value chain determines both the commercial success and the speed at which life-saving innovations reach the patient population.

Chronic Lymphocytic Leukemia Treatment Market Potential Customers

The primary customers and end-users of Chronic Lymphocytic Leukemia treatments are specialized healthcare institutions and individual patients diagnosed with CLL across various stages of the disease. Specialized oncology centers and teaching hospitals represent critical purchasing entities due to their capability to initiate complex, resource-intensive therapies, including stem cell transplants, advanced monoclonal antibody infusions, and management of specialized targeted oral agents. These institutions are the core buyers of the full spectrum of CLL treatment products, requiring robust supply chains that can handle high-cost inventory and precise dispensing protocols. Community oncology clinics are also significant customers, particularly for oral therapies, as treatment management increasingly shifts to outpatient settings.

Institutional buyers, such as national healthcare systems (e.g., NHS in the UK, centralized procurement agencies in Europe), payer organizations, and Health Maintenance Organizations (HMOs) in the US, act as indirect but highly influential customers. Their decisions regarding formulary inclusion, pricing negotiation, and reimbursement policies dictate which drugs are accessible to the patient population, effectively controlling significant market volume. These entities prioritize value-based purchasing, focusing on therapies demonstrating superior cost-effectiveness ratios and long-term survival benefits, often requiring extensive real-world evidence to justify the high price points of novel agents.

Ultimately, the final recipient is the CLL patient, typically an older adult (average diagnosis age is 70). Patient characteristics, including comorbidities, genetic risk factors, and prior treatment history, determine the specific therapeutic regime purchased and utilized. The increasing prevalence of oral administration means that specialty pharmacies and patients themselves, managed through complex adherence programs, become crucial endpoints in the distribution channel. Therefore, customer segmentation ranges from sophisticated institutional purchasers demanding clinical data and volume discounts to individual patients requiring support services and accessible dispensing mechanisms.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 7.8 Billion |

| Market Forecast in 2033 | USD 16.6 Billion |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | AbbVie Inc., Johnson & Johnson (Janssen), AstraZeneca Plc, Gilead Sciences, Inc., Bristol-Myers Squibb Company, Novartis AG, F. Hoffmann-La Roche Ltd., Takeda Pharmaceutical Company Limited, Pharmacyclics LLC (an AbbVie Company), BeiGene, Ltd., TG Therapeutics, Inc., Merck & Co., Inc., Celgene Corporation (now part of BMS), Pfizer Inc., Genentech (Roche), Meiji Seika Pharma Co., Ltd., Incyte Corporation, Hutchison China MediTech Limited (Chi-Med), Sandoz (Novartis division), Teva Pharmaceutical Industries Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Chronic Lymphocytic Leukemia Treatment Market Key Technology Landscape

The technology landscape governing the CLL treatment market is highly dynamic and centers predominantly on molecular oncology and advanced drug development methodologies. Key technologies include small-molecule kinase inhibition design, particularly focused on creating highly selective and potent Bruton's Tyrosine Kinase (BTK) inhibitors. The evolution from first-generation covalent inhibitors (like Ibrutinib) to second-generation covalent inhibitors (like Acalabrutinib and Zanubrutinib) emphasizes improved selectivity, reduced off-target effects, and enhanced safety profiles. Furthermore, the burgeoning technology surrounding non-covalent BTK inhibitors (e.g., Pirtobrutinib) represents a critical technological advancement aimed specifically at overcoming the C481S resistance mutation, which renders earlier generations ineffective. This continuous chemical optimization ensures market longevity for the BTK class.

Beyond small molecules, monoclonal antibody technology remains foundational. Continuous innovation focuses on optimizing antibody-dependent cell-mediated cytotoxicity (ADCC) and complement-dependent cytotoxicity (CDC) functions. Advances in bioengineering have led to the development of enhanced CD20 antibodies (like Obinutuzumab) that show superior efficacy compared to their predecessors. Crucially, the rise of cellular therapies, particularly CAR T-cell technology, represents the bleeding edge of the landscape, though its application in CLL is still maturing compared to other B-cell lymphomas. Technological challenges here involve optimizing T-cell persistence and reducing cytokine release syndrome (CRS) risk in an elderly patient population typically associated with CLL.

Diagnostic technology plays an equally pivotal role. Fluorescent In Situ Hybridization (FISH) for detecting chromosomal aberrations (e.g., 17p deletion), Next-Generation Sequencing (NGS) for assessing TP53 and IGHV mutational status, and multi-parameter flow cytometry for accurate minimal residual disease (MRD) assessment are essential companion technologies. These diagnostic tools are indispensable for guiding the use of targeted drugs, as regulatory approvals often hinge on the presence or absence of specific high-risk molecular markers. The integration of high-throughput screening and computational biology tools further supports the rapid identification and development of novel targeted agents, solidifying the market's dependence on cutting-edge biotechnological innovations.

Regional Highlights

- North America (United States and Canada): North America commands the dominant share of the CLL Treatment Market, primarily due to the highest per capita healthcare spending globally and exceptionally strong regulatory support for novel oncology drugs, leading to rapid market entry and uptake. The US market benefits from robust reimbursement mechanisms, widespread adoption of premium-priced targeted agents (BTK and BCL-2 inhibitors), and a high concentration of leading pharmaceutical companies and specialized cancer treatment centers. Clinical research and development activities are intensely focused in this region, setting global standards for CLL management.

- Europe (Germany, France, UK, Italy, Spain): Europe is the second-largest market, characterized by varying national pricing and reimbursement policies influenced by Health Technology Assessment (HTA) bodies. Western European nations, especially Germany and the UK, are key contributors, driven by aging populations and standardized oncology guidelines. While drug prices are often lower than in the US due to governmental negotiation, high patient volumes and a commitment to utilizing evidence-based medicine sustain significant market value.

- Asia Pacific (APAC - China, Japan, India, South Korea): APAC is projected to be the fastest-growing region, benefiting from rapidly improving healthcare infrastructure, increasing awareness of blood malignancies, and significant growth in the middle-class demographic accessing specialized oncology care. Japan and Australia are early adopters of innovative targeted therapies, while emerging giants like China and India present vast, untapped markets, often driven by local pharmaceutical manufacturing capabilities and increasing foreign direct investment in healthcare.

- Latin America (LATAM): The LATAM region shows moderate growth, primarily concentrated in countries like Brazil and Mexico. Market penetration is often hindered by economic volatility, limited healthcare budgets, and challenges in establishing comprehensive reimbursement for expensive targeted oral therapies, often leading to slower adoption rates compared to North America and Europe. Focus remains predominantly on established, lower-cost chemoimmunotherapy regimens, though access to BTK inhibitors is slowly expanding.

- Middle East and Africa (MEA): This region represents the smallest market share but offers opportunities in high-income Gulf Cooperation Council (GCC) countries (UAE, Saudi Arabia) which possess sophisticated healthcare systems capable of adopting cutting-edge treatments. However, the majority of the African continent faces substantial barriers related to infrastructure, diagnosis rates, and affordability, limiting widespread access to modern CLL therapeutics.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Chronic Lymphocytic Leukemia Treatment Market.- AbbVie Inc. (Key product: Venclexta/Venclyxto (Venetoclax))

- Johnson & Johnson (Janssen Biotech, Inc.) (Key product: Imbruvica (Ibrutinib))

- AstraZeneca Plc (Key product: Calquence (Acalabrutinib))

- Gilead Sciences, Inc. (Focus on PI3K inhibitors and pipeline agents)

- Bristol-Myers Squibb Company (BMS) (Offers legacy and pipeline agents following Celgene acquisition)

- Novartis AG (Involved in research and development of novel targeted therapies)

- F. Hoffmann-La Roche Ltd. (Key product: Gazyva (Obinutuzumab), Rituxan/MabThera (Rituximab))

- Takeda Pharmaceutical Company Limited (Involved in oncology pipeline)

- Pharmacyclics LLC (An AbbVie Company, focused on Imbruvica development)

- BeiGene, Ltd. (Key product: Brukinsa (Zanubrutinib))

- TG Therapeutics, Inc. (Focus on Ublituximab and UKONIQ (umbralisib), though latter withdrawn)

- Merck & Co., Inc. (Involved in supportive care and combination research)

- Pfizer Inc. (Pipeline compounds and supportive treatments)

- Genentech (A member of the Roche Group, involved in immunotherapy)

- Incyte Corporation (Focused on hematology and oncology therapeutics)

- Kyowa Kirin Co., Ltd. (Involved in hematology research)

- Teva Pharmaceutical Industries Ltd. (Focus on generic versions and supportive care)

- Sun Pharmaceutical Industries Ltd. (Growing presence in oncology generics)

- Celltrion Healthcare Co., Ltd. (Developing biosimilars for monoclonal antibodies)

- Eli Lilly and Company (Pipeline compounds in oncology)

Frequently Asked Questions

Analyze common user questions about the Chronic Lymphocytic Leukemia Treatment market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the most innovative targeted therapies currently driving the CLL Treatment Market?

The market is primarily driven by small-molecule targeted therapies, specifically Bruton's Tyrosine Kinase (BTK) inhibitors such as Ibrutinib, Acalabrutinib, and Zanubrutinib, and BCL-2 inhibitors like Venetoclax. These agents offer high response rates, oral administration, and significantly improved progression-free survival compared to traditional chemotherapy, particularly in high-risk patient subgroups, forming the backbone of modern CLL management.

How significant is the shift from chemoimmunotherapy to oral targeted agents in CLL treatment?

The shift is highly significant, representing a paradigm change where chemoimmunotherapy is increasingly reserved for specific low-risk cases or is being phased out entirely in favor of targeted agents, especially for elderly and frail patients. Oral targeted therapies provide convenience, reduce the need for hospital visits, and achieve deeper, more durable responses, leading to superior clinical outcomes and driving market revenue growth.

What major restraints impede the widespread adoption of advanced CLL treatments?

The primary restraint is the exorbitant cost of novel targeted therapeutics (BTK and BCL-2 inhibitors), posing significant affordability and reimbursement challenges for healthcare systems globally. Additionally, the development of treatment resistance, particularly mutations like C481S to first-generation BTK inhibitors, necessitates continuous development of next-generation agents, adding complexity and cost.

What role does Minimal Residual Disease (MRD) assessment play in commercial strategies for CLL drugs?

MRD assessment is crucial as it measures the depth of remission. Commercial strategies increasingly focus on achieving undetectable MRD status, particularly with fixed-duration combination regimens (e.g., Venetoclax combinations). Therapies demonstrating high rates of MRD negativity are positioned as superior value propositions, influencing clinical guidelines, payer negotiations, and ultimately, market share.

Which geographic region presents the most significant future growth opportunity for CLL therapeutics?

The Asia Pacific (APAC) region, specifically emerging economies like China and India, is poised for the fastest growth. This acceleration is driven by expanding access to advanced healthcare, rising awareness, and a growing investment in oncology infrastructure, enabling the greater adoption of premium-priced targeted therapies previously restricted to North American and European markets.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager