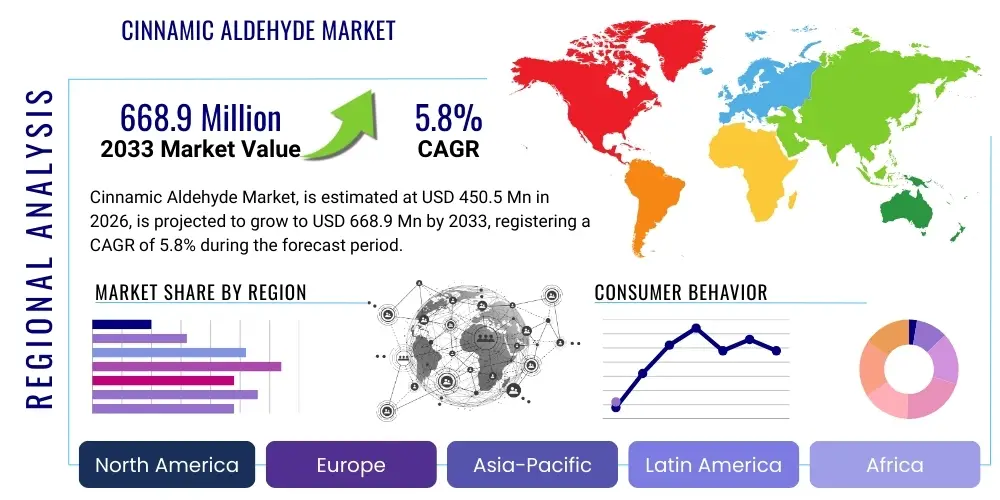

Cinnamic Aldehyde Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436180 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Cinnamic Aldehyde Market Size

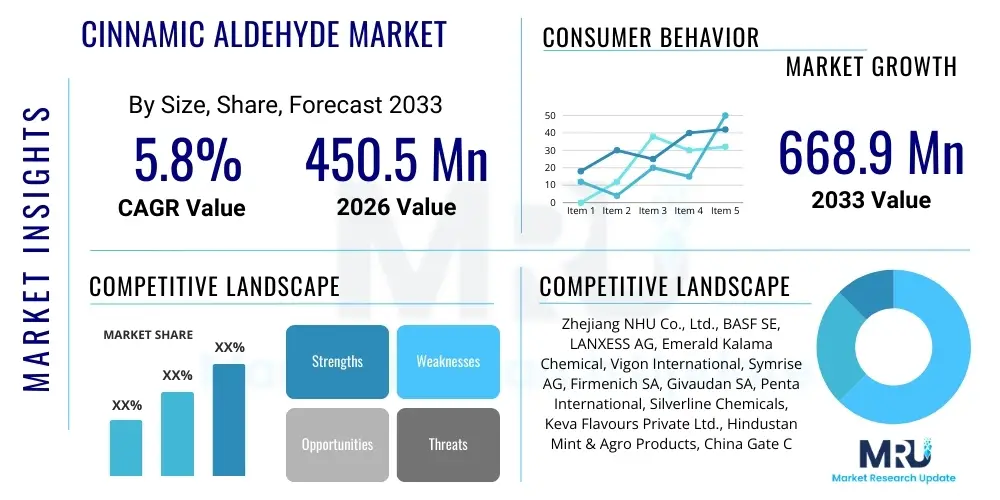

The Cinnamic Aldehyde Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 450.5 Million in 2026 and is projected to reach USD 668.9 Million by the end of the forecast period in 2033.

Cinnamic Aldehyde Market introduction

Cinnamic aldehyde, chemically known as 3-phenylprop-2-enal, is an organic compound responsible for the flavor and odor of cinnamon. This pale yellow, viscous liquid is primarily derived from the bark of Cinnamomum species, though it is also widely synthesized chemically. Its characteristic sweet and warm aroma makes it indispensable across numerous industries, most notably in the fragrance and flavor sector, where it serves as a key ingredient in perfumes, colognes, and food flavorings. Furthermore, its inherent antimicrobial and antifungal properties have amplified its utility in functional applications such as pharmaceuticals, agricultural chemicals, and personal care products, driving steady market demand globally.

The market expansion for cinnamic aldehyde is intricately linked to the burgeoning global demand for natural and nature-identical ingredients. While the natural form extracted from cinnamon oil commands a premium, the synthetic variant offers cost-effectiveness and scalability, catering to high-volume industrial requirements. The product’s versatility extends beyond simple flavoring; it acts as a crucial intermediate in the synthesis of various high-value fine chemicals, contributing significantly to sectors like paints, coatings, and specialized polymers. Regulatory considerations regarding food safety and cosmetic ingredients, particularly in mature markets like North America and Europe, mandate high purity standards, influencing production methods and market dynamics.

Key driving factors for market growth include the robust expansion of the cosmetics industry, coupled with increasing consumer preference for spicy and exotic flavor profiles in processed foods and beverages. Its efficacy as a sustainable and less toxic alternative to traditional preservatives is also gaining traction, especially within the feed and agricultural sectors. However, the market must navigate challenges related to price volatility of natural cinnamon oil and increasingly stringent regulations concerning allergenicity and skin sensitization associated with high concentrations of cinnamic aldehyde, necessitating continuous innovation in formulation and delivery systems.

Cinnamic Aldehyde Market Executive Summary

The global Cinnamic Aldehyde market is characterized by stable growth driven primarily by its extensive use in the flavor and fragrance industry and the growing recognition of its biological activities, specifically its role as a natural preservative and antimicrobial agent. Business trends indicate a strong shift towards synthetic production due to superior cost efficiency and stable supply, though the premium natural segment retains strong footing in high-end cosmetic and food applications. Strategic expansion into emerging economies, particularly across the Asia Pacific region, is observed, where rapid urbanization and increasing disposable incomes fuel demand for packaged goods and sophisticated personal care products. Key industry players are focusing on backward integration to secure raw material supply and forward integration into advanced derivative production to enhance value realization across the supply chain.

Regional trends highlight Asia Pacific (APAC) as the fastest-growing market, supported by massive industrial output, particularly in China and India, which are major centers for chemical synthesis and downstream processing. North America and Europe, while mature, remain dominant in terms of high-value application consumption, dictated by stringent regulatory frameworks that favor high-purity synthetic and naturally derived grades. Furthermore, innovation in delivery technology, such as microencapsulation of cinnamic aldehyde, is a critical regional trend, aimed at improving stability, shelf life, and controlled release in sensitive formulations like pharmaceuticals and specialized food additives.

Segmentation trends reveal that the synthetic cinnamic aldehyde segment dominates the market volume due to its cost advantage and suitability for industrial use, particularly in agrochemicals and commodity flavors. Conversely, the natural segment, derived predominantly from cinnamon oil, leads in terms of value, commanding higher prices in the premium fragrance and functional food sectors. Application-wise, the Flavor & Fragrance segment continues to hold the largest market share, though the Pharmaceutical and Agrochemical segments are exhibiting the highest growth rates, driven by novel uses such as effective fungicides, insecticides, and therapeutic agents targeting metabolic health and infections. This diversification signals a shift from purely sensory application to functional ingredient usage.

AI Impact Analysis on Cinnamic Aldehyde Market

User inquiries regarding the influence of Artificial Intelligence (AI) on the Cinnamic Aldehyde market frequently revolve around questions of optimized synthesis routes, predictive modeling for demand forecasting based on consumer trends, and AI-driven quality control in complex distillation and purification processes. Key themes emerging from this analysis include the potential for AI algorithms to drastically reduce the cost of synthetic production by identifying more efficient catalysts and reaction conditions, thereby lowering energy consumption and waste generation. Users are also concerned with how machine learning can accelerate the discovery of novel cinnamic aldehyde derivatives with enhanced functional properties (e.g., lower allergenicity or higher targeted antimicrobial efficacy) for pharmaceutical and cosmetic applications. Expectations center on AI streamlining the highly variable supply chain dynamics of natural sourcing and improving regulatory compliance through automated data analysis and risk assessment.

- AI optimizes chemical synthesis parameters, potentially lowering production costs and improving yield efficiency of synthetic cinnamic aldehyde.

- Machine learning algorithms enhance demand forecasting, stabilizing price volatility and optimizing inventory management for major consumers.

- AI facilitates rapid screening and development of novel cinnamic aldehyde derivatives with targeted functional characteristics for high-end applications.

- Predictive modeling improves supply chain resilience, especially for natural sourcing, by forecasting weather impacts and harvest yields.

- AI-enabled Spectroscopic analysis ensures real-time quality control and purity assessment, critical for regulatory compliance in food and pharmaceutical grades.

- Automated systems enhance safety protocols in chemical manufacturing plants by identifying potential reaction hazards before they occur.

DRO & Impact Forces Of Cinnamic Aldehyde Market

The Cinnamic Aldehyde market is significantly influenced by a favorable confluence of drivers, including expanding applications in feed additives as a natural growth promoter and preservative, and the perpetual growth of the global flavor industry seeking authentic and stable aroma profiles. However, the market faces considerable restraints, particularly the regulatory limitations imposed by various jurisdictions (e.g., EU regulations on fragrance allergens) that restrict the concentration of cinnamic aldehyde in certain end-products, necessitating constant reformulation and labeling adjustments by manufacturers. Opportunities abound in developing controlled-release formulations for agrochemicals, where its fungicidal properties can be maximized, and in targeted pharmaceutical research exploiting its anti-inflammatory and anti-diabetic potential. These forces collectively dictate the market trajectory, compelling producers to focus on high-purity, low-allergen products while strategically leveraging emerging functional applications.

Drivers: The increasing consumer desire for natural food ingredients and preservatives, coupled with the rapid growth of the livestock industry utilizing cinnamic aldehyde as a gut health modulator, provides substantial market momentum. Its demonstrated effectiveness against various microbial and fungal pathogens positions it strongly as a sustainable alternative to synthetic pesticides and preservatives, appealing to environmentally conscious industries. Additionally, the urbanization trends in developing regions drive higher consumption of packaged and flavored goods, guaranteeing a stable baseline demand for both natural and synthetic variants of this crucial chemical intermediate. Furthermore, technological advancements in synthetic routes, such as improved catalytic processes, are enhancing the economic viability of bulk production, making it accessible for industrial-scale applications.

Restraints: Significant restraints include the volatile pricing and inconsistent supply of natural cinnamon bark and oil, which directly impacts the natural cinnamic aldehyde segment. Furthermore, the compound’s classification as an allergen or sensitizer in cosmetic and dermatological products by major regulatory bodies necessitates extensive warning labeling and dosage restrictions, complicating its use in personal care formulations. Competition from substitute flavorants and aroma chemicals that offer similar sensory profiles without the associated regulatory baggage or allergen concerns also poses a perpetual restraint. The high cost associated with achieving the extremely high purity levels required for pharmaceutical and certain food contact applications adds complexity and limits smaller players.

Opportunities: Major market opportunities lie in the continuous development of novel derivatives and encapsulated forms that minimize skin sensitization while retaining functional efficacy, opening doors in highly sensitive consumer segments. The untapped potential in specialty chemicals, particularly in the synthesis of polymers and resins where cinnamic aldehyde can serve as a monomer or cross-linking agent, presents a profitable diversification pathway. Furthermore, the rising need for eco-friendly and biodegradable pesticides in agriculture, where cinnamic aldehyde’s natural fungicidal properties are highly valued, creates a robust opportunity for market penetration in specialty crop protection solutions globally.

Impact Forces: Impact forces, such as fluctuating crude oil prices, heavily influence the cost structure of synthetic cinnamic aldehyde production, given that key precursors are petrochemically derived. Regulatory mandates, specifically stricter allergen labeling rules in regions like the EU (REACH) and North America (FDA), directly impact market access and formulation practices, acting as a powerful external constraint. Consumer health trends favoring natural and clean-label products provide a major supportive force for the naturally derived segment. The pace of research and development into novel medical uses, such as treatments for neurodegenerative diseases or metabolic syndrome, could generate high-value, albeit niche, market segments, fundamentally altering the market landscape. Global geopolitical stability also affects the import/export dynamics of natural cinnamon source materials from Southeast Asia.

Segmentation Analysis

The Cinnamic Aldehyde market is broadly segmented based on Type (Natural and Synthetic), Application (Flavor & Fragrance, Pharmaceuticals, Agrochemicals, Personal Care & Cosmetics, and Others), and Grade (Food Grade, Industrial Grade, and Pharmaceutical Grade). This structured segmentation allows for a detailed analysis of market dynamics, revealing that the Synthetic segment dominates in terms of volume due to cost-effectiveness and supply consistency, while the Natural segment commands a significantly higher average selling price (ASP). Application analysis shows the traditional Flavor and Fragrance industry as the largest revenue generator, although specialized functional uses in Agrochemicals and Pharmaceuticals are experiencing accelerated adoption rates due to new scientific discoveries validating cinnamic aldehyde’s efficacy as a potent bio-active compound.

The distinction between grades is critical for manufacturers, as the requirements for Pharmaceutical Grade Cinnamic Aldehyde, demanding ultra-high purity (>99.5%) and minimal heavy metal contamination, necessitate specialized purification technologies, leading to higher production costs. Conversely, Industrial Grade is utilized in bulk applications such as paint additives, where purity requirements are less stringent. Geographic segmentation indicates that production is heavily concentrated in Asia Pacific, particularly China, which leverages its cost advantage in chemical synthesis, whereas consumption is more globally dispersed, with high-value consumption centered in North America and Europe, driven by stringent regulatory demand for quality and traceability in consumer products.

- By Type:

- Natural Cinnamic Aldehyde

- Synthetic Cinnamic Aldehyde

- By Application:

- Flavor & Fragrance (F&F)

- Pharmaceuticals and Nutraceuticals

- Agrochemicals (Fungicides, Insecticides)

- Personal Care and Cosmetics

- Industrial Chemicals (Paints, Coatings, Polymers)

- Feed Additives

- By Grade:

- Food Grade

- Industrial Grade

- Pharmaceutical Grade

- By Region:

- North America (U.S., Canada, Mexico)

- Europe (Germany, UK, France, Italy, Spain)

- Asia Pacific (China, Japan, India, South Korea)

- Latin America (Brazil, Argentina)

- Middle East & Africa (MEA)

Value Chain Analysis For Cinnamic Aldehyde Market

The value chain for Cinnamic Aldehyde starts with the procurement of raw materials, which differs significantly between the natural and synthetic routes. Upstream analysis for the natural route involves the cultivation and harvesting of cinnamon bark (primarily from Cinnamomum cassia and Cinnamomum zeylanicum), extraction via steam distillation, and preliminary purification. For the synthetic route, the process involves procuring petrochemical derivatives such as benzaldehyde and acetaldehyde or acetone, which are then condensed using a specialized base-catalyzed reaction (aldol condensation). Securing stable and quality-controlled sourcing—both agricultural and petrochemical—is paramount, as fluctuations in either supply chain directly impact the cost of the final product. Manufacturers often employ stringent quality checks at this stage to ensure precursor purity meets subsequent processing demands.

The midstream segment involves the core manufacturing and processing activities, including reaction, separation, purification (often involving fractional distillation and crystallization), and standardization. Key strategic differentiators in this segment include proprietary catalytic systems that enhance yield and minimize byproducts, especially for the high-purity pharmaceutical grades. Distribution channels are varied: direct sales dominate for large-volume industrial buyers and specialized pharmaceutical companies requiring strict quality assurance, while indirect channels, utilizing regional chemical distributors and specialized flavor and fragrance houses, cater to smaller or geographically dispersed end-users. The efficiency of the logistics network, particularly cold chain management for sensitive natural oils, is crucial for preserving product quality across borders.

Downstream analysis focuses on the application sectors, where cinnamic aldehyde is formulated into end-products. Major downstream players include multinational flavor and fragrance corporations, pharmaceutical giants, and large agrochemical formulators. The final value added occurs through formulation expertise, such as microencapsulation to improve stability and controlled release properties, tailoring the ingredient for specific consumer safety or performance requirements. The downstream segment generates significant value due to brand recognition and regulatory compliance expertise. The interplay between direct and indirect distribution channels ensures global reach, with indirect channels offering crucial logistical support for highly regulated cross-border chemical trade.

Cinnamic Aldehyde Market Potential Customers

The potential customers for Cinnamic Aldehyde span diverse industrial sectors, with the primary end-users concentrated in companies specializing in sensory ingredients, human and animal health products, and crop protection. Large multinational Flavor and Fragrance (F&F) houses are major buyers, utilizing cinnamic aldehyde as a foundational element in complex aroma compositions, often demanding technical or natural grades for authenticity and regulatory acceptance in final consumer products like perfumes, soaps, and air fresheners. The Food and Beverage industry, including major confectionary, bakery, and beverage producers, represents another critical customer base, requiring high-purity, food-grade synthetic or natural variants to impart cinnamon flavor and provide natural preservative functions in shelf-stable products.

A rapidly growing segment of end-users is the Pharmaceutical and Nutraceutical sector. These companies purchase pharmaceutical-grade cinnamic aldehyde for its documented anti-inflammatory, anti-microbial, and potential anti-diabetic properties, formulating it into dietary supplements, over-the-counter medications, and specialized drug excipients. The Agrochemical industry, focusing on pesticides and fungicides, constitutes a crucial industrial buyer, valuing the compound for its low toxicity profile compared to synthetic alternatives, using it in organic farming solutions. Furthermore, livestock feed producers are increasingly incorporating technical grade cinnamic aldehyde into animal feed to enhance gut health and improve feed conversion ratios, representing a high-volume, albeit price-sensitive, customer segment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Million |

| Market Forecast in 2033 | USD 668.9 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Zhejiang NHU Co., Ltd., BASF SE, LANXESS AG, Emerald Kalama Chemical, Vigon International, Symrise AG, Firmenich SA, Givaudan SA, Penta International, Silverline Chemicals, Keva Flavours Private Ltd., Hindustan Mint & Agro Products, China Gate Chemical, Kunshan Huahong Chemicals, F&F Chemicals, Shaanxi Pioneer Biotech, Natural Sourcing LLC, Aurochemicals, Aromatic & Allied Chemicals, Millennium Chemicals. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cinnamic Aldehyde Market Key Technology Landscape

The Cinnamic Aldehyde market is characterized by mature, yet evolving, synthetic and extraction technologies aimed at achieving higher purity and better yield while minimizing environmental impact. The dominant synthetic route relies on the Aldol Condensation reaction between benzaldehyde and acetaldehyde, typically catalyzed by bases. Key technological advancements in this area focus on developing heterogeneous catalysts, such as solid base catalysts (e.g., modified zeolites or metal oxides), which offer easier separation, recyclability, and reduced wastewater generation compared to traditional homogeneous catalysts. Furthermore, continuous flow chemistry techniques are being adopted by large-scale manufacturers to replace batch processes, significantly improving efficiency, safety, and product consistency, especially crucial for meeting stringent industrial and pharmaceutical specifications.

In the realm of natural extraction, advancements focus on maximizing the yield and preserving the integrity of the natural essential oil. Supercritical Fluid Extraction (SFE) using CO2 is gaining traction as a greener, solvent-free alternative to traditional steam distillation, resulting in essential oils with a cleaner profile, higher concentration of cinnamic aldehyde, and fewer thermally degraded artifacts. Coupled with advanced analytical technologies like High-Performance Liquid Chromatography (HPLC) and Gas Chromatography-Mass Spectrometry (GC-MS), these extraction techniques ensure superior quality control and help verify the authenticity and traceability of natural Cinnamic Aldehyde, which is critical for premium segments susceptible to adulteration.

A crucial technological trend across both production methods is the development of microencapsulation and controlled-release systems. Technologies such as spray drying, coacervation, and liposomal encapsulation are employed to stabilize cinnamic aldehyde, which is sensitive to light, heat, and oxidation. This encapsulation extends its shelf life, masks its pungent aroma when necessary, and, most importantly, reduces its skin sensitizing properties in cosmetic and personal care applications. These specialized delivery technologies are opening new high-value markets in functional foods and advanced dermal health products, demonstrating the market’s reliance on innovation beyond basic chemical synthesis.

Regional Highlights

- Asia Pacific (APAC): APAC dominates the global production capacity for synthetic Cinnamic Aldehyde, primarily driven by China and India, which benefit from low manufacturing costs, readily available precursor chemicals, and less stringent environmental regulations compared to Western counterparts. This region is also a major consumer, fueled by rapidly expanding economies, a massive manufacturing base for personal care products, and increasing domestic demand for processed foods and fragrances. The growing adoption of modern agricultural practices and expansion of the animal feed industry further solidifies APAC’s position as the fastest-growing market in both volume and value terms, though regulatory harmonization remains a persistent challenge.

- North America: North America represents a mature, high-value consumption market, characterized by strict quality and safety regulations enforced by bodies like the FDA and EPA. Demand is concentrated in the premium Flavor & Fragrance sector and specialized applications in functional food ingredients and pharmaceuticals. The region is a key hub for research into novel pharmaceutical applications of cinnamic aldehyde, focusing heavily on naturally derived or high-purity synthetic grades. High consumer awareness regarding ingredient sourcing and clean labeling drives demand for traceable and sustainably produced materials.

- Europe: Europe is defined by some of the most stringent regulatory frameworks globally, particularly REACH and EU cosmetic directives concerning allergens. This regulatory environment restricts the usage levels of cinnamic aldehyde in personal care products but simultaneously drives innovation in low-allergen derivatives and encapsulated delivery systems. The market here is robust, anchored by a powerful flavor and fragrance industry (centered in France, Germany, and Switzerland) and a strong demand for natural fungicides in the agricultural sector, where organic farming is highly prioritized.

- Latin America (LATAM): The LATAM market is poised for significant growth, driven by expanding middle-class populations and increased foreign direct investment in manufacturing capabilities, particularly in Brazil and Mexico. Demand is escalating across the food, beverage, and personal care segments. While still reliant on imports for specialized grades, local industrial production is increasing, positioning LATAM as a critical emerging consumer market with a focus on cost-effective, high-volume synthetic solutions for local industrial consumption.

- Middle East & Africa (MEA): The MEA region offers niche growth opportunities, particularly in the Middle East, driven by high per capita spending on luxury perfumes and cosmetics, which are heavy users of fragrance ingredients. African markets, while developing, show potential in the animal feed additive segment, utilizing cinnamic aldehyde to improve livestock health. Market entry here is often complex, requiring navigation of disparate national regulatory standards and relying heavily on established international distribution networks.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cinnamic Aldehyde Market.- Zhejiang NHU Co., Ltd.

- BASF SE

- LANXESS AG

- Emerald Kalama Chemical

- Vigon International

- Symrise AG

- Firmenich SA

- Givaudan SA

- Penta International

- Silverline Chemicals

- Keva Flavours Private Ltd.

- Hindustan Mint & Agro Products

- China Gate Chemical

- Kunshan Huahong Chemicals

- F&F Chemicals

- Shaanxi Pioneer Biotech

- Natural Sourcing LLC

- Aurochemicals

- Aromatic & Allied Chemicals

- Millennium Chemicals

Frequently Asked Questions

Analyze common user questions about the Cinnamic Aldehyde market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary applications of Cinnamic Aldehyde?

Cinnamic Aldehyde is predominantly used as a key flavoring and fragrance agent in the food, beverage, and cosmetic industries. It is also increasingly utilized in agrochemicals as an effective fungicide and in feed additives for promoting animal gut health, owing to its potent antimicrobial properties.

What is the main difference between natural and synthetic Cinnamic Aldehyde?

Natural Cinnamic Aldehyde is extracted directly from cinnamon oil, offering higher purity and demanding a premium price, typically used in high-end products. Synthetic Cinnamic Aldehyde is chemically synthesized (usually via Aldol condensation) and is preferred for high-volume industrial applications due to its stable supply and lower production cost.

Is Cinnamic Aldehyde regulated as an allergen?

Yes, Cinnamic Aldehyde is recognized as a potential skin sensitizer and is subject to strict regulatory limits and labeling requirements in many regions, particularly in the European Union (EU), which restricts its concentration in leave-on cosmetic and personal care products.

Which geographical region dominates the production of Cinnamic Aldehyde?

Asia Pacific (APAC), specifically China, dominates the global production of synthetic Cinnamic Aldehyde, leveraging significant cost advantages in chemical synthesis, while also being a major source region for natural cinnamon extraction.

How is technological innovation affecting the Cinnamic Aldehyde market?

Technological innovation is focused on improving synthesis efficiency through heterogeneous catalysis and developing controlled-release mechanisms, such as microencapsulation, to mitigate allergenicity, improve stability, and open doors for specialized functional applications in pharmaceuticals and advanced consumer goods.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager