CINV Existing and Pipeline Drugs Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434047 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

CINV Existing and Pipeline Drugs Market Size

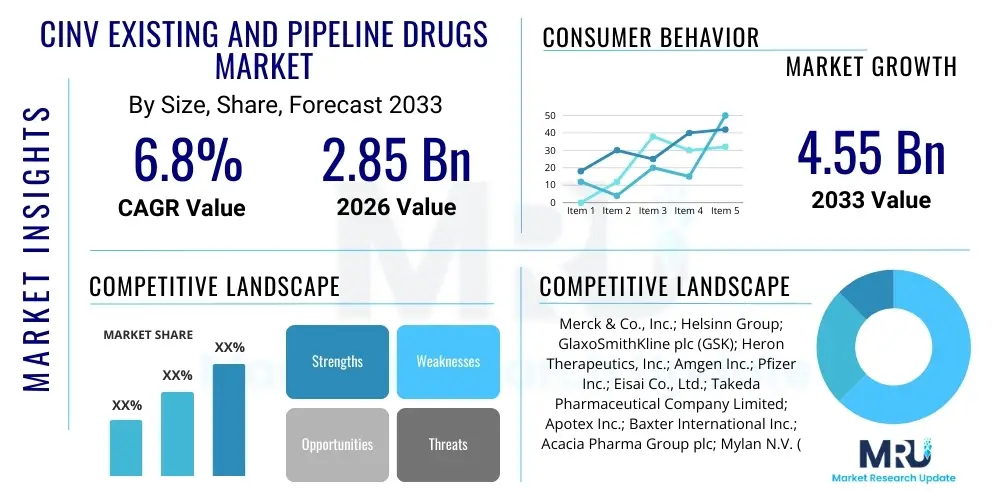

The CINV Existing and Pipeline Drugs Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $2.85 Billion in 2026 and is projected to reach $4.55 Billion by the end of the forecast period in 2033.

CINV Existing and Pipeline Drugs Market introduction

The Chemotherapy-Induced Nausea and Vomiting (CINV) Existing and Pipeline Drugs Market encompasses a crucial segment within supportive cancer care, focusing on pharmacological agents designed to prevent and treat one of the most debilitating side effects of chemotherapy. CINV severity dictates patient compliance with oncology protocols and significantly impacts their quality of life. The market is defined by established antiemetic classes, primarily 5-HT3 receptor antagonists, Neurokinin-1 (NK1) receptor antagonists, and corticosteroids, alongside emerging combination therapies and novel formulations targeting delayed-onset CINV, which remains a substantial unmet clinical need. The goal of these therapeutic interventions is to achieve complete protection from nausea and vomiting, thereby enabling patients to maintain treatment schedules and improve overall clinical outcomes.

Major applications of CINV drugs span prophylaxis and rescue treatment across the spectrum of emetogenic chemotherapy regimens, categorized as highly emetogenic chemotherapy (HEC), moderately emetogenic chemotherapy (MEC), and low emetogenic chemotherapy (LEC). The established benefits of effective CINV management include increased patient adherence to complex chemotherapy cycles, reduced requirement for unplanned hospitalizations, and decreased healthcare resource utilization associated with dehydration and electrolyte imbalance. Furthermore, the psychological burden on patients is substantially lessened, facilitating a better overall prognosis and enhancing their functional status during intensive cancer treatment. The continuous evolution of clinical guidelines, such as those published by MASCC/ESMO and ASCO, mandates specific multi-drug regimens, reinforcing the demand for current and pipeline antiemetics.

Driving factors in this market are intrinsically linked to the increasing global incidence of cancer, leading to a rising patient pool undergoing chemotherapy. Technological advancements in drug delivery systems, particularly those enabling sustained release or extended action (e.g., long-acting NK1 antagonists), provide therapeutic advantages and drive market uptake. Moreover, heightened awareness among healthcare professionals regarding the critical importance of prophylactic CINV management is fostering better prescribing practices. The shift towards guideline-concordant care, combined with aggressive research focusing on CINV refractory to current standard treatments, particularly in pediatric and highly sensitive patient populations, ensures sustained investment and commercial viability for both existing and innovative pipeline products.

CINV Existing and Pipeline Drugs Market Executive Summary

The CINV Existing and Pipeline Drugs Market demonstrates robust growth driven by the rising global cancer burden and continuous advancements in supportive care protocols. Business trends highlight a strategic focus on developing fixed-dose combination (FDC) therapies that simplify administration and improve adherence. Key players are investing heavily in research targeting novel mechanisms of action beyond the conventional NK1/5-HT3 pathways, including the repurposing of drugs like olanzapine for refractory CINV management. A significant business challenge involves navigating the increased generic competition for established 5-HT3 antagonists and first-generation NK1 inhibitors, compelling innovators to prioritize sustained-release or novel formulation platforms to secure intellectual property protection and maintain market share. Licensing agreements and strategic partnerships between large pharmaceutical companies and specialized biotech firms focusing on oncology support care are accelerating the market penetration of pipeline assets.

Regional trends indicate North America and Europe maintaining dominant market shares due to high cancer prevalence, sophisticated healthcare infrastructure, and favorable reimbursement policies for antiemetic prophylaxis. However, the Asia Pacific (APAC) region is projected to exhibit the fastest growth rate, fueled by expanding access to advanced cancer treatment, increasing healthcare expenditure, and the modernization of oncology centers. In developing economies, the implementation of international clinical guidelines is improving the standard of care, driving the adoption of guideline-recommended triple and quadruple therapy regimens. Conversely, market access in certain Latin American and Middle Eastern markets remains constrained by pricing pressures and reliance on generic alternatives, requiring companies to tailor market entry strategies to local economic realities and regulatory pathways.

Segmentation trends reveal that NK1 receptor antagonists continue to be the cornerstone of highly emetogenic chemotherapy (HEC) regimens, experiencing strong revenue generation, particularly the extended-release formulations. The injectable route of administration segment is valued highly due to its utility in acute care settings and assurance of drug delivery in severely ill patients. From an application perspective, the HEC segment commands the largest market share, but the MEC segment shows promising expansion as clinicians increasingly recognize the need for aggressive prophylaxis even in moderately emetogenic settings. Pipeline innovation is heavily geared towards addressing the psychological and anticipatory component of CINV, alongside pharmacological solutions for breakthrough CINV, ensuring comprehensive coverage across the emesis timeline (acute, delayed, and anticipatory phases).

AI Impact Analysis on CINV Existing and Pipeline Drugs Market

Users frequently inquire about how Artificial Intelligence (AI) can refine CINV drug development and optimize clinical application, often focusing on questions like: "Can AI predict which patients will develop severe CINV?", "How does machine learning assist in identifying novel drug targets for refractory nausea?", and "Will AI integration improve adherence to complex antiemetic protocols?". The consensus theme centers on AI's potential to revolutionize personalized supportive care. AI and machine learning algorithms are anticipated to play a critical role in predicting individual patient risk profiles for CINV based on demographic data, chemotherapy type, genetic markers, and previous treatment responses. This predictive capability enables highly precise, preemptive antiemetic selection, moving beyond standardized guidelines towards truly personalized medicine. Furthermore, AI tools are accelerating the discovery process by analyzing vast datasets of receptor interactions and adverse event profiles, streamlining the development of next-generation antiemetics that minimize side effects and enhance efficacy against complex CINV mechanisms.

- AI-driven Predictive Analytics: Utilizing patient-specific data, including genomics and concomitant medications, to forecast the likelihood and severity of acute and delayed CINV, allowing for risk-stratified treatment planning.

- Optimized Clinical Trial Design: Machine learning models assist in identifying optimal patient cohorts for clinical trials of pipeline CINV drugs, increasing trial efficiency and reducing development timelines.

- Drug Repurposing Identification: AI algorithms analyze molecular pathways and drug-target interactions to identify existing non-antiemetic drugs (e.g., psychotropics) that might be effectively repurposed for treating refractory CINV, such as those resistant to NK1 antagonists.

- Personalized Dosing Recommendations: Employing real-time patient monitoring (via wearable technology) combined with AI analysis to adjust antiemetic dosing dynamically, minimizing toxicity while maximizing prophylactic effect.

- Enhanced Patient Monitoring and Adherence: AI-powered digital health platforms facilitate symptom tracking, medication reminders, and automatic communication with care teams when breakthrough CINV occurs, improving adherence to complex at-home drug regimens.

- Accelerated Target Identification: High-throughput screening combined with AI image recognition and data analytics helps isolate novel molecular targets implicated in the complex central and peripheral nervous system pathways leading to emesis.

DRO & Impact Forces Of CINV Existing and Pipeline Drugs Market

The dynamics of the CINV market are governed by a complex interplay of clinical necessity (Drivers), commercial challenges (Restraints), therapeutic potential (Opportunities), and external market pressures (Impact Forces). The primary driver is the unavoidable increase in cancer incidence globally, necessitating systemic chemotherapy and, consequently, antiemetic prophylaxis. This is coupled with continually evolving clinical guidelines that strongly advocate for comprehensive, multi-drug regimens, increasing per-patient drug expenditure. Restraints include the significant generic erosion impacting older drug classes, particularly 5-HT3 antagonists, which necessitates rapid innovation to maintain premium pricing. Additionally, challenges related to managing delayed-onset CINV and breakthrough nausea remain substantial clinical hurdles, requiring high-cost, multi-day treatment protocols. Opportunities lie in developing advanced formulations, such as transdermal patches or subcutaneous long-acting injectables, which promise improved patient compliance and sustained efficacy, particularly in the challenging delayed phase. The impact forces include stringent regulatory pathways for new combination therapies and intense patent litigation that defines market entry and exclusivity periods for novel pipeline assets.

Key drivers center on clinical advances and patient advocacy. The recognition that inadequate CINV management leads to treatment failure, reduced survival, and poor quality of life has institutionalized strict adherence to preventative guidelines. This has led to the widespread adoption of NK1 antagonists, which are the most significant revenue driver in the branded market. The increasing prevalence of complex, dose-dense chemotherapy regimens (e.g., those using anthracyclines, cisplatin, and cyclophosphamide) ensures a steady demand for high-efficacy antiemetics. Furthermore, the pharmaceutical industry’s commitment to patient-centric care is manifesting in the development of formulations that are easier to administer, such as single-day regimens covering multiple days of CINV risk.

The market faces significant restraints related to cost-effectiveness and accessibility. Payers and health systems increasingly demand head-to-head clinical data demonstrating superior outcomes of newer branded combination drugs over existing generic standards. The lack of consistently effective solutions for anticipatory nausea and vomiting (ANV) remains an area of high unmet need that current pharmacological agents have difficulty addressing, limiting market potential in that specific indication. However, this restraint simultaneously fuels the Opportunity for psychotropic agents and behavioral interventions that could be integrated into the CINV management protocol. The overarching opportunity resides in successfully commercializing pipeline drugs that offer genuine differentiation, such as those targeting alternative molecular pathways (e.g., GABA or Cannabinoid receptors for refractory patients) or those offering significantly improved convenience through innovative delivery technologies, ultimately reshaping the treatment landscape for delayed and breakthrough CINV.

Segmentation Analysis

The CINV market is segmented based on the mechanism of action of the drugs, the route by which they are administered, the severity of the chemotherapy regimen being used, and the distribution channel through which the products reach the end-user. This layered segmentation allows for a detailed analysis of market dynamics, revealing where innovation is concentrated and which product categories are facing the highest degree of generic competition. Understanding the application segments (HEC, MEC, LEC) is vital, as clinical guidelines mandate distinct antiemetic combinations for each level of emetogenicity, directly influencing market volume and revenue distribution across drug classes. The market is increasingly defined by multi-segment use, where combination products featuring antagonists from different classes dominate therapeutic choices, particularly in the hospital setting.

- By Drug Class

- NK1 Receptor Antagonists (e.g., Aprepitant, Fosaprepitant, Rolapitant, Netupitant)

- 5-HT3 Receptor Antagonists (e.g., Ondansetron, Granisetron, Palonosetron)

- Corticosteroids (e.g., Dexamethasone)

- Dopamine Receptor Antagonists (e.g., Olanzapine, Metoclopramide)

- Combination Drugs (e.g., Netupitant/Palonosetron FDC)

- Others (e.g., Cannabinoids)

- By Route of Administration

- Oral

- Injectable (Intravenous, Subcutaneous)

- Transdermal

- By Application (Emetogenicity Level)

- Highly Emetogenic Chemotherapy (HEC)

- Moderately Emetogenic Chemotherapy (MEC)

- Low Emetogenic Chemotherapy (LEC)

- By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

- Oncology Clinics

Value Chain Analysis For CINV Existing and Pipeline Drugs Market

The value chain for CINV drugs begins with upstream activities focused on active pharmaceutical ingredient (API) synthesis and formulation development, requiring high levels of specialized chemical engineering and clinical research, particularly for complex molecules like NK1 antagonists and sustained-release formulations. Upstream activities are characterized by rigorous R&D investment, patent enforcement, and regulatory filings (NDA/BLA) to secure market exclusivity. Key participants at this stage include specialized chemical manufacturers and large pharmaceutical companies holding proprietary drug patents. Efficiency in API sourcing and manufacturing scalability directly impacts the final cost structure and profitability, especially when considering the rapid transition to high-volume manufacturing required upon regulatory approval.

The midstream segment of the value chain involves pharmaceutical manufacturing, quality control, packaging, and logistics. Due to the high sensitivity and sterility requirements of injectable CINV products, manufacturing processes are subject to stringent Good Manufacturing Practice (GMP) standards. Distribution channels form a critical link, encompassing wholesalers, third-party logistics (3PL) providers, and specialized pharmaceutical distributors who manage the inventory flow from manufacturers to end-users. Direct distribution is common for high-cost, specialized injectable drugs primarily used in hospital settings and oncology clinics, allowing manufacturers greater control over pricing and inventory management, while indirect channels utilize national and regional distributors for broader reach into retail and compounding pharmacies.

Downstream activities center on product dispensing, prescription management, and patient utilization, where the main entities are hospital pharmacies, retail outlets, and oncology infusion centers. The decision-making process at the downstream level is heavily influenced by physician prescribing habits, adherence to established clinical guidelines (MASCC, ASCO), and institutional formulary acceptance. Potential customers (end-users) are primarily oncology patients receiving chemotherapy. The final link in the chain involves market access and reimbursement, where manufacturers negotiate pricing and coverage with payers, managed care organizations (MCOs), and government health programs to ensure affordable access to these essential supportive care medications. Effective market access strategies are crucial for maximizing the reach of branded, high-value CINV drugs.

CINV Existing and Pipeline Drugs Market Potential Customers

The primary consumers and prescribing influencers in the CINV Existing and Pipeline Drugs Market are oncology professionals and institutional healthcare providers. Oncologists (medical, pediatric, and radiation), hematologists, and oncology nurses serve as the key prescribers, relying on clinical guidelines and institutional protocols to select appropriate prophylactic and rescue antiemetic regimens based on the patient's chemotherapy protocol (HEC, MEC, LEC). These professionals prioritize drug efficacy, safety profile, ease of administration, and proven effectiveness against delayed CINV. Institutional buyers, such as hospital pharmacy committees and integrated delivery networks (IDNs), are critical potential customers as they make formulary decisions that determine which drugs are stocked and available, often balancing clinical outcomes with cost-effectiveness and generic availability.

Another major group of potential customers comprises specialized oncology infusion centers and outpatient clinics, which administer the majority of injectable CINV drugs concurrently with chemotherapy. These centers require reliable supply chains, adequate inventory management, and formulations that simplify the administration process, such as single-dose, extended-release injectables that reduce nursing time. For oral CINV drugs prescribed for home use (primarily for delayed CINV prophylaxis), retail pharmacies, including both traditional brick-and-mortar stores and growing online pharmacies, represent the direct dispensing channel to the ultimate end-user, the cancer patient.

The ultimate beneficiaries and final consumers are adult and pediatric patients undergoing highly emetogenic chemotherapy. Their purchasing behavior, while mediated by prescriptions and insurance coverage, indirectly drives demand for user-friendly formulations that minimize side effects and complexity. Patient advocacy groups and professional organizations influence the market by raising awareness about the need for optimal CINV control, putting pressure on both prescribers and payers to adopt the most effective, guideline-recommended antiemetic agents, including novel pipeline products that promise better control of breakthrough and delayed symptoms, particularly for high-risk patients who have failed standard therapies.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $2.85 Billion |

| Market Forecast in 2033 | $4.55 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Merck & Co., Inc.; Helsinn Group; GlaxoSmithKline plc (GSK); Heron Therapeutics, Inc.; Amgen Inc.; Pfizer Inc.; Eisai Co., Ltd.; Takeda Pharmaceutical Company Limited; Apotex Inc.; Baxter International Inc.; Acacia Pharma Group plc; Mylan N.V. (Viatris); Sandoz (Novartis); Kyowa Hakko Kirin Co., Ltd.; Teva Pharmaceutical Industries Ltd.; Sun Pharmaceutical Industries Ltd.; Dr. Reddy's Laboratories Ltd.; Fresenius Kabi AG; ANI Pharmaceuticals, Inc.; Cipla Limited |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

CINV Existing and Pipeline Drugs Market Key Technology Landscape

The technological landscape of the CINV market is defined less by radical new drug classes and more by significant advancements in drug formulation and delivery systems designed to enhance patient compliance, bioavailability, and duration of action. A crucial technological focus is the development of long-acting release mechanisms for established antiemetics, particularly the NK1 receptor antagonists. Technologies such as microsphere encapsulation or liposomal delivery systems are being leveraged to enable single-dose intravenous administration that maintains therapeutic plasma concentrations over the critical 3-to-5-day period post-chemotherapy, effectively addressing the challenges of delayed CINV prophylaxis without requiring daily patient adherence to oral regimens. This sustained-release technology provides a significant commercial edge over generic immediate-release formulations.

Another pivotal technological development involves the successful creation and stabilization of Fixed-Dose Combination (FDC) products, exemplified by the combination of an NK1 antagonist (e.g., Netupitant) and a 5-HT3 antagonist (e.g., Palonosetron). FDC technology simplifies the complex multi-drug regimens recommended by guidelines, reducing the pill burden for patients and minimizing medication errors in clinical settings. The co-formulation must ensure chemical compatibility and synchronized release kinetics of the active ingredients. Furthermore, the integration of non-invasive drug delivery systems, such as transdermal patches (utilized for specific 5-HT3 antagonists like granisetron), represents a breakthrough technology for patients who experience difficulty swallowing or severe anticipatory nausea, offering stable drug input across the skin barrier for several days.

The intersection of pharmaceuticals and digital health is also shaping the technological environment. This includes the development of mobile health applications and wearable biosensors that monitor physiological indicators potentially linked to nausea onset (e.g., changes in gastric motility or heart rate variability). While not direct drug technologies, these tools represent advanced supportive technologies used in conjunction with CINV drugs to provide real-time feedback to oncologists, allowing for timely intervention against breakthrough emesis. Furthermore, ongoing research focuses on identifying and synthesizing non-conventional agents, such as highly selective GABA agonists or specific Cannabinoid receptor modulators, utilizing advanced computational chemistry and high-throughput screening to identify novel, non-dopaminergic pathways for patients refractory to standard triplet therapy.

Regional Highlights

North America, particularly the United States, holds the largest market share in the CINV Existing and Pipeline Drugs Market. This dominance is attributable to the high prevalence of cancer, the rapid adoption of proprietary branded antiemetics, high per-capita healthcare spending, and sophisticated clinical infrastructures that strictly adhere to international CINV prophylaxis guidelines (ASCO/NCCN). The region benefits from substantial investments in pharmaceutical R&D, strong patent protection, and prompt regulatory review processes (FDA), facilitating the rapid market entry of novel combination therapies and long-acting injectable formulations. Favorable and broad reimbursement coverage by private and public payers for high-cost prophylactic regimens further solidifies North America’s leading position in terms of revenue generation and early adoption rates.

Europe represents the second-largest market, characterized by mature healthcare systems and stringent regulatory frameworks (EMA). Western European countries (Germany, France, UK) are key contributors, driven by high cancer incidence and established reimbursement mechanisms. However, market fragmentation across national health systems results in varying levels of uptake for high-cost branded antiemetics compared to the U.S. There is a strong emphasis on cost-effectiveness analysis in European markets, often leading to more aggressive price negotiations and greater reliance on high-quality generic equivalents once exclusivity expires. The region is seeing increased focus on optimizing combination therapies to meet the specific guidelines of European oncology societies (ESMO).

The Asia Pacific (APAC) region is forecasted to be the fastest-growing market due to demographic shifts, increasing investments in healthcare infrastructure, and a growing patient population receiving chemotherapy, particularly in emerging economies like China and India. The rapid economic development in key APAC nations is increasing the affordability of and access to branded antiemetics, moving away from older, less effective single-agent therapies. While generic penetration is exceptionally high, the demand for novel, effective antiemetics capable of managing delayed CINV is spurring the adoption of premium NK1-based regimens in major metropolitan oncology centers. Latin America and the Middle East & Africa (MEA) offer substantial growth potential, contingent upon improving healthcare access and navigating highly localized regulatory and procurement challenges, often prioritizing lower-cost generic alternatives where available.

- North America (U.S., Canada): Market leader; driven by high adoption of branded NK1 antagonists, sophisticated reimbursement systems, and advanced clinical guideline adherence.

- Europe (Germany, UK, France): Second largest market; characterized by strong regulatory compliance but facing increasing pressure for cost-effectiveness and generic penetration.

- Asia Pacific (China, Japan, India): Fastest-growing region; fueled by rising cancer prevalence, expanding healthcare infrastructure, and modernization of oncology treatment protocols.

- Latin America (Brazil, Mexico): Emerging market; growth constrained by economic instability and prioritization of essential medicines, but showing high potential in private sector oncology care.

- Middle East & Africa: Focus on building specialized oncology centers; reliance on imports; limited access to newer generation drugs outside of major, well-funded tertiary care hospitals.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the CINV Existing and Pipeline Drugs Market.- Merck & Co., Inc.

- Helsinn Group

- GlaxoSmithKline plc (GSK)

- Heron Therapeutics, Inc.

- Amgen Inc.

- Pfizer Inc.

- Eisai Co., Ltd.

- Takeda Pharmaceutical Company Limited

- Apotex Inc.

- Baxter International Inc.

- Acacia Pharma Group plc

- Mylan N.V. (Viatris)

- Sandoz (Novartis)

- Kyowa Hakko Kirin Co., Ltd.

- Teva Pharmaceutical Industries Ltd.

- Sun Pharmaceutical Industries Ltd.

- Dr. Reddy's Laboratories Ltd.

- Fresenius Kabi AG

- ANI Pharmaceuticals, Inc.

- Cipla Limited

Frequently Asked Questions

Analyze common user questions about the CINV Existing and Pipeline Drugs market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the most significant growth driver for the CINV Existing and Pipeline Drugs Market?

The most significant growth driver is the continuous global rise in cancer incidence, directly correlating with an increased patient population undergoing systemic chemotherapy, which necessitates mandatory prophylactic antiemetic treatment. Furthermore, the mandatory adherence to increasingly comprehensive international clinical guidelines, advocating for expensive, multi-drug combination regimens (especially involving NK1 antagonists), drives therapeutic expenditure and market expansion.

How are pipeline drugs addressing the current unmet needs in CINV management?

Pipeline drugs are primarily focused on addressing delayed-onset CINV (occurring 24 to 120 hours post-chemotherapy) and breakthrough nausea refractory to standard care. Technological solutions include long-acting injectable formulations of NK1 antagonists and novel combination therapies that incorporate drugs like olanzapine, moving towards single-dose, multi-day coverage to improve compliance and comprehensive protection across all emesis phases.

Which drug class dominates the CINV market in terms of revenue generation?

The Neurokinin-1 (NK1) Receptor Antagonists class, including proprietary drugs like aprepitant and netupitant combinations, currently dominates the high-revenue segment of the CINV market. This dominance stems from their essential role in guideline-recommended triple and quadruple therapy regimens for Highly Emetogenic Chemotherapy (HEC) and the premium pricing associated with their extended-release and fixed-dose combination (FDC) formulations.

What is the primary restraint affecting the profitability of the established CINV drug manufacturers?

The primary restraint is severe generic erosion, particularly within the 5-HT3 Receptor Antagonists class (e.g., ondansetron and generic palonosetron), and older NK1 antagonists. This widespread availability of low-cost generic alternatives forces branded manufacturers to accelerate innovation in novel delivery systems and FDCs to justify premium pricing and maintain intellectual property advantages against intense price competition from generic drug producers.

In the context of CINV, how does Answer Engine Optimization (AEO) affect content strategy?

AEO requires content providers to structure market insights clearly and concisely, directly answering high-intent user queries about drug efficacy, clinical guidelines, and market growth drivers. For CINV, AEO-optimized content focuses on specific drug classes (NK1 vs. 5-HT3), emetogenicity levels (HEC vs. MEC), and addressing critical concerns like delayed nausea management, ensuring the content is easily digestible and highly relevant for search and generative AI engines.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager